Palladium One Major Discovery Increases Kaukua South Mineralized Strike Length Six-Fold From 600 M to 4 Km

Key highlights:

- 11 successful discovery holes were drilled on the Kaukua South extension—each contain magmatic sulphide mineralization, and rush assay results are pending.

- Major discovery increases mineralized strike length from 600 m to 4 km at Kaukua South.

- Drilling validates potential to significantly increase existing NI 43-101 pit constrained resources and confirms the Kaukua South Induced Polarization (“IP”) chargeability anomaly is the result of magmatic sulfides.

- Due to near surface mineralization, more holes than planned were drilled, enabling modelling of potential tonnages across the four-kilometer mineralized strike length of Kaukua South.

- The width (drilled core length) of mineralized intercepts ranges from 15 m to 100 m.

- Palladium is more valuable than gold and has a range-bound price approximately US$400 per ounce higher than gold.

September 29, 2020 – Vancouver, British Columbia – Palladium One Mining Inc. (TSX-V:

PDM, FRA: 7N11, OTC: NKORF) (the “Company” or “Palladium One”). Initial visual results from the resumed diamond drill exploration program at the LK Project in Finland demonstrate that Kaukua South is comprised of the same host rocks and indicates that it is the fault displaced extension of the Kaukua Deposit.

Multiple discoveries of magmatic sulfide mineralization have been outlined, and preliminary indications are that Kaukua South could be several times the size of the NI 43-101 Kaukua Open Pit Resource. That resource currently has 526,000 ounces of palladium equivalent ounces at 1.8 g/t in the indicated category and 636,000 ounces of palladium equivalent ounces at 1.5 g/t in the inferred category.

“We are very excited to report this major new discovery, and are

processing assays on a rush basis,” said Derrick Weyrauch, President and Chief Executive Officer.

”The Kaukua South strike extension is exceptionally significant

because it has shallow disseminated sulfide mineralization the same as Kaukua

and points to the footprint of a large-scale mineral system,” said Dr. Peter C.

Lightfoot, one of Palladium One Mining’s directors and a globally recognized

expert in magmatic precious metal and nickel-copper-cobalt sulphide ore

deposits. Dr. Lightfoot also stated, “LK is shaping up to potentially be the

largest palladium dominant open pit project in a best in class mining

jurisdiction, globally.”

“Advanced planning for a Phase II resource definition drill

program is underway, we will drill on a 100-meter spaced grid along the

four-kilometer mineralized strike extent of Kaukua South.” stated Derrick Weyrauch

Investor Update Webinar

Please join Derrick Weyrauch, CEO, and Neil Pettigrew, Vice President Exploration on October 1, 2020 at 10:00 AM Eastern Time (US and Canada), 4:00 PM (GMT+2) to discuss the interim results from the Company’s Phase I exploration drilling program in the Greater Kaukua Area.

Date: October 1, 2020

Time: 10:00 AM Eastern Time (US and Canada), 4:00 PM (GMT+2)

Registration link: https://primetime.bluejeans.com/a2m/register/gfryyqah

After registering, you will receive a confirmation email containing information about joining the webinar. Questions may be asked during the webinar orally or via the webinar chat function. A replay will be made available on the Palladium One Mining Inc. website at http://www.palladiumoneinc.com

Summary:

- Drilling has extended magmatic sulfide mineralization in Kaukua South more than 3 km east of hole LK20-006 which returned 63.4 m at 1.88 g/t palladium equivalent (Pd_Eq)*, within 166.7m @ 1.16 g/t Pd_Eq (see news release dated August 11, 2020 ). Historic drilling returned 33 m at 1.9 g/t Pd_Eq (KAU-08-035) 600 m west of LK20-006, thereby demonstrating a

mineralized strike length of approximately 4 km (Figure 1). - 11 holes were drilled on the Kaukua South IP chargeability anomaly (see news release dated August 10, 2020) during the resumed drill program, all of which intersected magmatic sulfide mineralization (Figures 1, 2, 3, 4, and 5).

- Step out drilling, consisting of five sections

with at least two holes per section, indicates Kaukua South shallows

and comes to surface, along the three-kilometer extension. - Disseminated to blebby (1-5%) magmatic sulfides consisting of chalcopyrite and pyrrhotite with local veins of remobilized massive sulfide occur within intercepts ranging from 15 m to

100 m (drilled core length). - Sulphide mineralization and variable- to chaotic-textured mafic-ultramafic rock types are the same as the host rocks at the Kaukua Open Pit NI 43-101 deposit. Kaukua South is now interpreted to be the fault displaced extension of the Kaukua Deposit. The average true-width mineralized core at Kaukua is approximately 30 m, and preliminary indications suggest that similar core mineralized true-widths also occur in Kaukua South.

* Palladium equivalent

Palladium equivalent is calculated using US$1,100 per ounce for palladium, US$950 per ounce for platinum, US$1,300 per ounce for gold, US$6,614 per tonne for copper, and US$15,4332 per tonne for nickel.

Phase 1 Drill Program Update

The Company continues to log and sample the drill core from the recently completed drilling program. Fourteen holes totalling 2,566 m were completed during the resumed program in August and September, bringing the total Phase I exploration drilling program to 26 holes totalling 4,490 m. First assay results are expected with in the next few weeks and will be released as they are received.

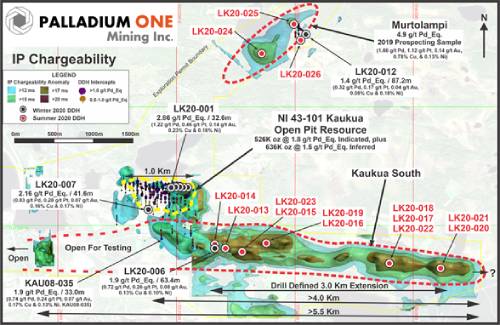

Figure 1

This figure shows the greater Kaukua Area, the NI 43-101 compliant Kaukua Open Pit deposit, Murtolampi and Kaukua South zones. The new drill defined three-kilometer eastern extension of the Kaukua South zone is shown with the resumed Phase I drill holes labelled in red.

Figure 2

Kaukua South extension chalcopyrite-rich magmatic sulfide from 6 different holes from the resumed Phase I exploration drill program. Pictures A, B, C & D are typical Kaukua-type disseminated to blebby chalcopyrite-pyrrhotite magmatic sulfides, ranging from 1-5% averaging around 2%, hosted in gabbroic and pyroxenitic rocks. Pictures D and E are remobilized magmatic sulfides, which can occur as massive chalcopyrite-rich veins.

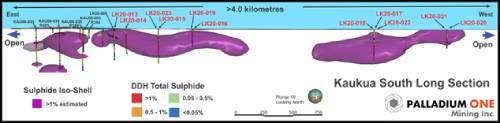

Figure 3

Kaukua South Long section showing the greater than 1% magmatic sulphide isoshell derived from visual inspection of down hole percent sulfide from drill logs. Resumed Phase I diamond drill holes are labelled in red.

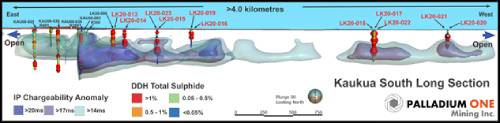

Figure 4

Kaukua South Long section showing IP Chargeability isoshells and down hole logged sulfide percentages, resumed Phase I drill holes labelled in red.

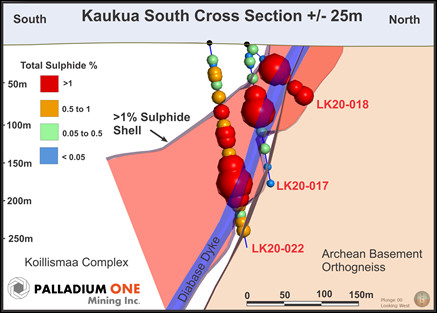

Figure 5

Kaukua South cross section, looking west showing holes LK20-017, 18 and 22 with down hole visual sulfide percentages.

QA/QC

The Phase I drilling program was carried out under the supervision of Neil Pettigrew, M.Sc., P. Geo., Vice President of Exploration and a director of the Company.

Drill core samples were split using a rock saw by Company staff, with half retained in the core box and stored indoors in a secure facility, in Taivalkoski, Finland. The drill core samples were transported by courier from the Company’s core handling facility in Taivalkoski, Finland, to ALS Global (“ALS”) laboratory in Outokumpu, Finland. ALS, is an accredited lab and are ISO compliant (ISO 9001:2008, ISO/IEC 17025:2005). PGE analysis was performed using a 30 grams fire assay with an ICP-MS or ICP-AES finish. Multi-element analyses, including copper and nickel were analysed by four acid digestion using 0.25 grams with an ICP-AES finish.

Certified standards, blanks and crushed duplicates are placed in the sample stream at a rate of one QA/QC sample per 10 core samples. Results are analyzed for acceptance at the time of import. All standards associated with the results in this press release were determined to be acceptable within the defined limits of the standard used

Qualified Person

The technical information in this release has been reviewed and verified by Neil Pettigrew, M.Sc., P. Geo., Vice President of Exploration and a director of the Company and the Qualified Person as defined by National Instrument 43-101.

About Palladium One

Palladium One Mining Inc. is an exploration and development company targeting district scale, platinum-group-element-copper-nickel deposits in Finland and Canada. Its flagship project is the Läntinen Koillismaa or LK Project, a palladium-dominant platinum group element-copper-nickel project in north central Finland, ranked by the Fraser Institute as one of the world’s top countries for mineral exploration and development. Exploration at LK is focused on targeting disseminated sulfides along 38 kilometers of favorable basal contact and building on an established NI 43-101 open pit resource.

ON BEHALF OF THE BOARD

“Derrick Weyrauch”

President & CEO, Director

For further information contact:

Derrick Weyrauch, President & CEO

Email: info@palladiumoneinc.com

Neither the TSX Venture Exchange nor its Market Regulator (as

that term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

This press release is not an offer or a solicitation of an offer of securities for sale in the United States of America. The common shares of Palladium One Mining Inc. have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration.

Information set forth in this press release may contain forward-looking statements. Forward-looking statements are statements that relate to future, not past events. In this context, forward-looking statements often address a company’s expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, or other similar expressions. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; fluctuations in palladium and other commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the absence of dividends; competition; dilution; the volatility of our common share price and volume; and tax consequences to Canadian and U.S. Shareholders. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Investors are cautioned against attributing undue certainty to forward-looking statements

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 online investors. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 online investors. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you