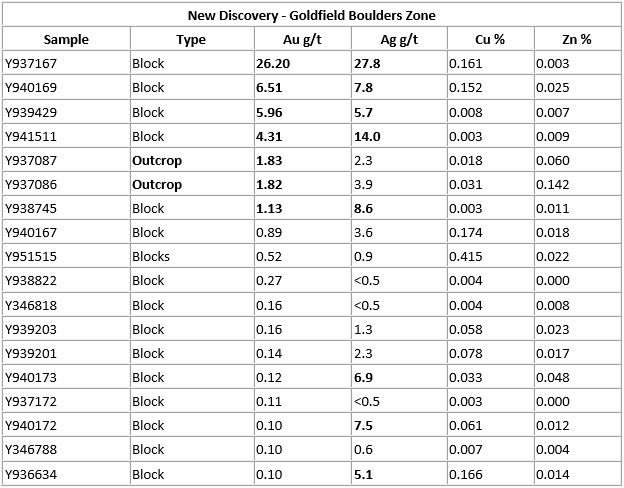

Troilus Discovers New Goldfield Boulder Zone 36 Km from Troilus Mine with Samples up to 26.2 g/t Gold and 27.8 g/t Silver

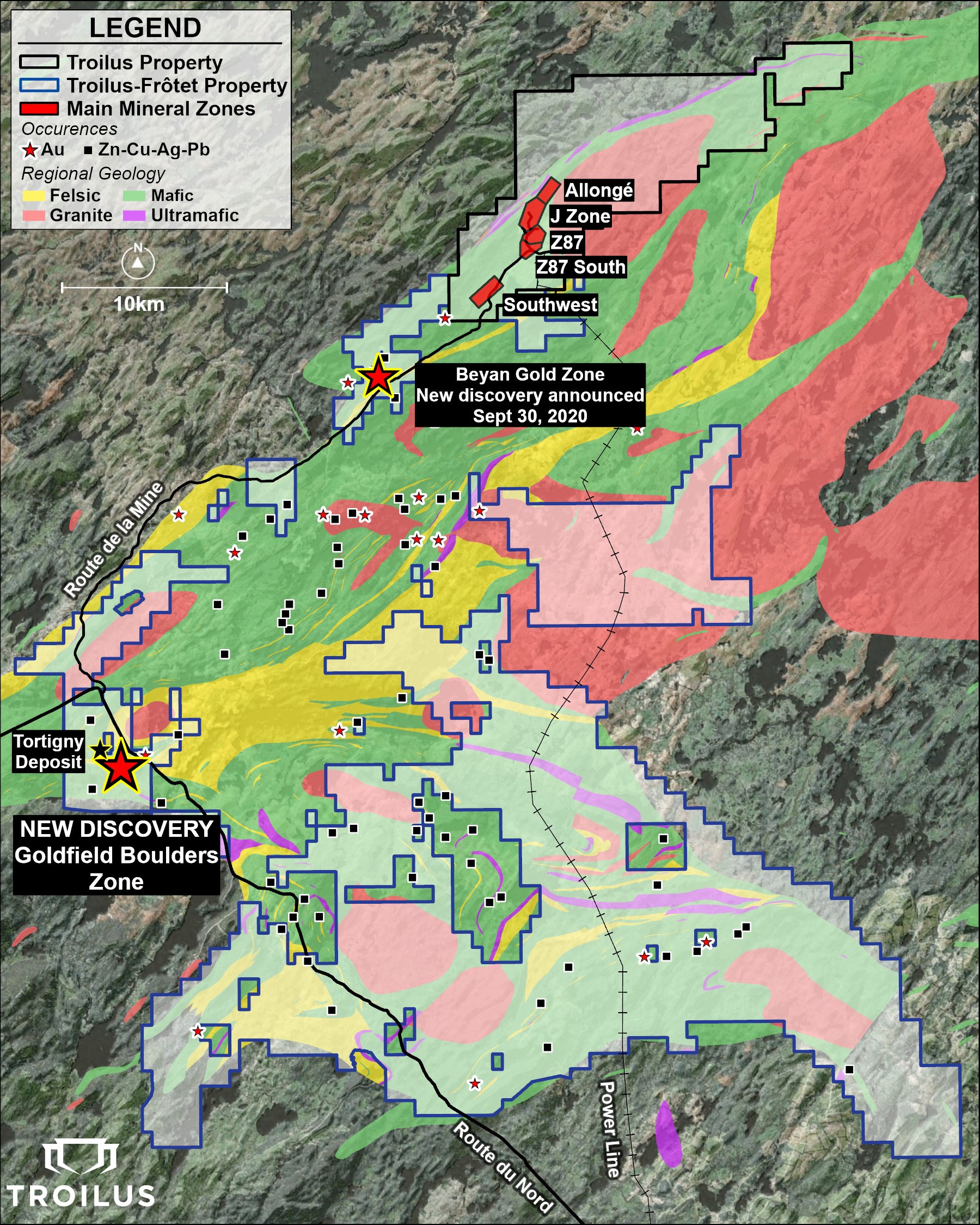

October 8, 2020, Toronto, Ontario – Troilus Gold Corp. (TSX: TLG) (OTCQB: CHXMF) (“Troilus” or the “Company”) is pleased to announce the latest results from its summer 2020 regional exploration program on its 100%-owned Troilus Project, located within the Frôtet-Evans Greenstone Belt of northern Quebec. The program focused on identifying high priority targets within the extensive land package Troilus acquired and staked earlier in the year (the “Troilus-Frôtet Property”) (see press releases dated April 28, 2020 and July 21, 2020). Initial results collected 28 km southwest of the recently announced Beyan Gold Zone Discovery (see press release dated September 30, 2020), have outlined another new zone of mineralization: the Goldfield Boulder Zone (“Goldfield”). Gold bearing boulders and outcrop can be traced and defined in situ over a minimum strike length of 4 km. Goldfield is accessible from the Route du Nord highway.

Highlights from the New Goldfield Zone:

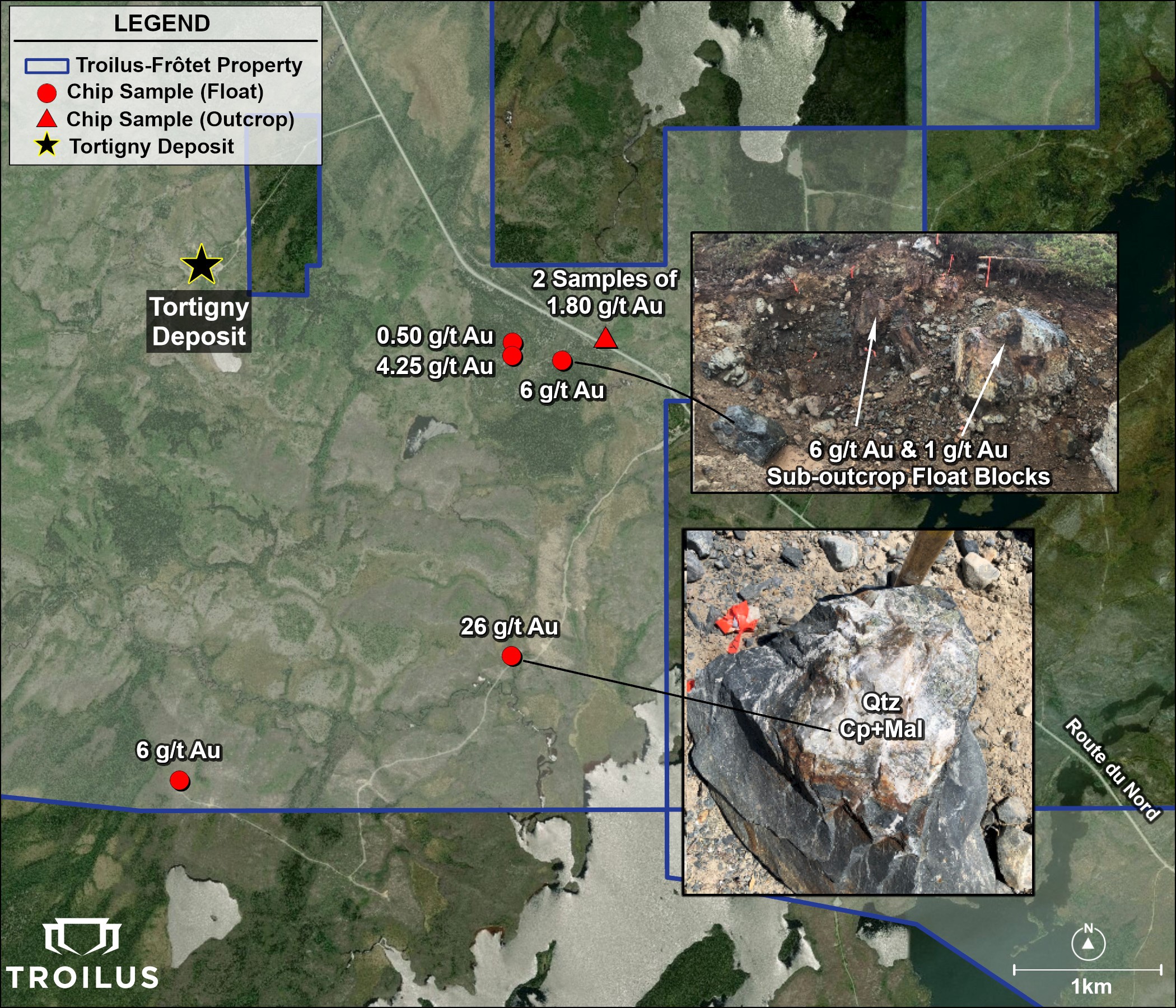

- Grab samples returned up to 26.2 g/t gold and 27.8 g/t silver in outcrop

- Other sample highlights include: 6.51 g/t Au, 5.96 g/t Au, 4.31 g/t Au; 14.0 g/t Ag, 8.6 g/t Ag (see full results in Table 1)

- Many geological characteristics linking Goldfield to the main mineralized zones over 36 km away

“The discovery of the Goldfield Zone this summer marks an exciting moment for Troilus,” said Justin Reid, CEO of Troilus. “Earlier this year we had the opportunity to significantly increase our land holdings through a combination of acquisition and staking. The addition of the Troilus-Frôtet Property increased our land holdings from 16,000 hectares to over 107,000 hectares. Our evolving geologic model, developed over the last couple of years through drilling and exploration around the main ore bodies of Z87, the J Zones and more recently the Southwest Zone, led us to believe that the region could have district scale potential and we believed that expanding our claim area had the potential to add significant value for shareholders via discovery. The Goldfield Zone, located on the western side of the Troilus-Frôtet Property, marks the furthest afield exploration conducted to date. We are thrilled to report newly discovered, near-surface gold occurrences with samples ranging up to 26.2 g/t gold and 27.8 g/t silver, 36 km from the main mineralized zones at the Troilus property. The Goldfield Zone results, combined with the recent Beyan Zone results, suggest that gold mineralization within the Frôtet-Evans Greenstone Belt is prolific and not constrained geographically as historically thought. We await further results from locations across the Troilus-Frotêt Property collected during the summer and believe that these showings could just be the beginning of what the district could host.”

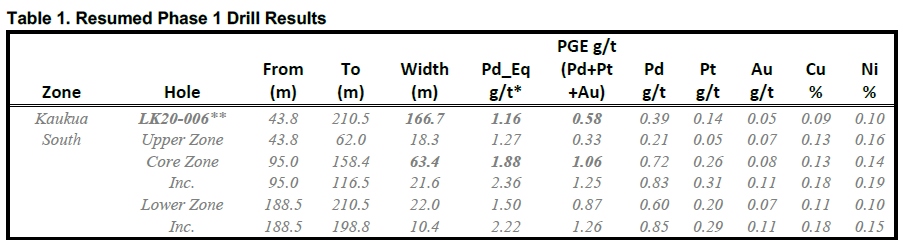

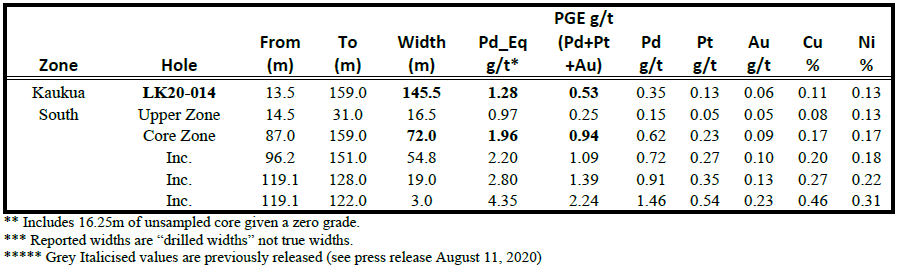

During this initial bedrock mapping and boulder tracing, the Troilus Geological team located several mineralized boulders on the main Tortigny block assaying up to 26 g/t Au with the best results highighted in the Table 1 below. The Tortigny deposit (see Figure 2), now 100% owned by Troilus, was discovered by Noranda in 1994 with an initial mineral resource estimate prepared in 1997. The latest NI 43-101 compliant mineral resource completed by Beaufield Resources in 2014, estimates measured and indicated resources of 1.1 million tonnes grading 1.8% Cu, 3.65% Zn, 48.51 g/t Ag and 0.35 g/t Au and inferred mineral resources of 99,000 tonnes grading 1.19% Cu, 1.23% Zn, 12.45 g/t Ag and <0.1 g/t Au. The Tortigny mineral resource includes 135 drill holes (34,581 metres) and covers a distance of approximately 600 metres. (The Technical Report for the Tortigny deposit titled: “TECHNICAL REPORT FOR THE TORTIGNY POLYMETALLIC PROJECT SOUTHERN JAMES BAY MUNICIPALITY QUEBEC, CANADA” and effective June 2, 2014, was completed by Micon International Limited and can be found on Beaufield Resources SEDAR profile at www.sedar.com). A qualified person has not done sufficient work to classify the historical estimates as a current mineral resource estimate. Troilus is not treating the historical estimates as current estimates and the historical estimates should not be relied upon as current mineral resource estimates. Further drilling would be required to verify the historical estimate.

Several of these boulders are large (up to 3m in length) and sub-angular, indicating a possible nearby source. These blocks were collected over a distance of 4 km from north to south. There is denser vegetation in this area so outcrops are not as exposed. Nevertheless, one nearby outcrop, located 200m north of the Goldfield Zone ran 1.8 g/t Au, suggesting further exploration is warranted beyond the current boundaries of this new zone. Mafic intrusive and felsic volcanic rocks are the main lithologies hosting these gold and silver gold showings. These units are strongly deformed and altered.

Results for approximately 85 samples are still pending from a total 440 samples that were collected in the vicinity of the Goldfield showing. The Troilus Geological team shipped over 1000 soil samples (B-Horizon) to the lab and results for these are also pending.

Troilus remains underexplored and highly prospective. Extensive field exploration work undertaken this summer across the +107,000 hectare Troilus property is currently being compiled to identify new prospective targets. Further assays of samples collected in the field are pending and will be updated in due course.

Figure 1 – Troilus Property, Regional Geology and Location of the New Goldfield Zone

Figure 2 – Close-up of the Goldfield Boulder Zone

Table 1 – New Beyan Gold Zone Initial Surface Sample Results

Quality Assurance and Control

All grab and ship samples were collected by hand and were located by hand-held GPS, bagged and sealed, and sent for assaying at ALS Laboratory, a certified commercial laboratory. Every sample was processed with standard crushing to 85% passing 75 microns on 500 g splits. Samples were assayed by one-AT (30 g) fire assay with an AA finish and if results were higher than 3.5 g/t Au, assays were redone with a gravimetric finish. In addition to gold, ALS carried out multi-element analysis for ME-ICP61 analysis of 33 elements four acid ICP-AES.

Qualified Person

All technical and scientific information, in this press release has been reviewed and approved by Bertrand Brassard, M.Sc., P.Geo., Chief Geologist, who is a Qualified Person as defined by NI 43-101. Mr. Brassard is an employee of Troilus and is not independent of the Company under NI 43-101.

About Troilus Gold Corp.

Troilus is a Toronto-based, Quebec focused, advanced stage exploration and early-development company focused on the mineral expansion and potential mine re-start of the former gold and copper Troilus mine. The 107,326 hectare Troilus property is located within the Frotêt-Evans Greenstone Belt in Quebec, Canada. From 1996 to 2010, Inmet Mining Corporation operated the Troilus project as an open pit mine, producing more than 2,000,000 ounces of gold and nearly 70,000 tonnes of copper.

For more information:

Justin Reid

Chief Executive Officer

+1 (647) 276-0050 x 1305

Justin.reid@troilusgold.com

Paul Pint

President

+1 (416) 602-1050

paul.pint@troilusgold.com

Cautionary Note Regarding Forward-Looking Statements and Information

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability; the estimate of Mineral Resources in the updated Mineral Resource statement may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. There is no certainty that the Indicated Mineral Resources will be converted to the Probable Mineral Reserve category, and there is no certainty that the updated Mineral Resource statement will be realized.

This press release contains “forward-looking statements” within the meaning of applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements regarding the impact of the planned drill program and results on the Company, the reliability of historical estimates and the likelihood that they will be updated to current mineral resource estimates, the possible economics of the project, the Company’s understanding of the project; the development potential and timetable of the project; the estimation of mineral resources; realization of mineral resource estimates; the timing and amount of estimated future exploration; the anticipated results of the Company’s 2020 drill program and their possible impact on the potential size of the mineral resource estimate; the impact of the novel coronavirus (COVID-19) and the considerable uncertainties about the geographic, social and economic impact on the Company of its continuing global spread costs of future activities; capital and operating expenditures; success of exploration activities; the anticipated ability of investors to continue benefiting from the Company’s low discovery costs, technical expertise and support from local communities.. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “continue”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “will”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking statements are made based upon certain assumptions and other important facts that, if untrue, could cause the actual results, performances or achievements of Troilus to be materially different from future results, performances or achievements expressed or implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which Troilus will operate in the future. Certain important factors that could cause actual results, performances or achievements to differ materially from those in the forward-looking statements include, amongst others, currency fluctuations, the global economic climate, dilution, share price volatility and competition. Forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause the actual results, level of activity, performance or achievements of Troilus to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: the impact the COVID 19 pandemic may have on the Company’s activities (including without limitation on its employees and suppliers) and the economy in general; the impact of the recovery post COVID 19 pandemic and its impact on gold and other metals; there being no assurance that the exploration program or programs of the Company will result in expanded mineral resources; risks and uncertainties inherent to mineral resource estimates; the high degree of uncertainties inherent to preliminary economic assessments and other mining and economic studies which are based to a significant extent on various assumptions; variations in gold prices and other precious metals, exchange rate fluctuations; variations in cost of supplies and labour; receipt of necessary approvals; general business, economic, competitive, political and social uncertainties; future gold and other metal prices; accidents, labour disputes and shortages; environmental and other risks of the mining industry, including without limitation, risks and uncertainties discussed in the Technical Report to be filed and in other continuous disclosure documents of the Company available under the Company’s profile at www.sedar.com. Although Troilus has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Troilus does not undertake to update any forward-looking statements, except in accordance with applicable securities laws.

Troilus Gold Corp.

36 Lombard Street, Floor 4

Toronto, Ontario

M5C 2X3

Canada

Tel: +1 647.276.0050

Email: info@troilusgold.com

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you