U.S. Gold Corp. Announces Maggie Creek Exploration Update

- High potential Nevada exploration project on the Carlin Trend

- Project has similar geological features as and in close proximity to Newmont’s Gold Quarry mine

ELKO, Nev., Oct. 28, 2020 /PRNewswire/ — U.S. Gold Corp. (Nasdaq: USAU) (the “Company”) a gold exploration and development company, is pleased to announce its potential future Maggie Creek exploration plans for the project on the Carlin Trend in Nevada.

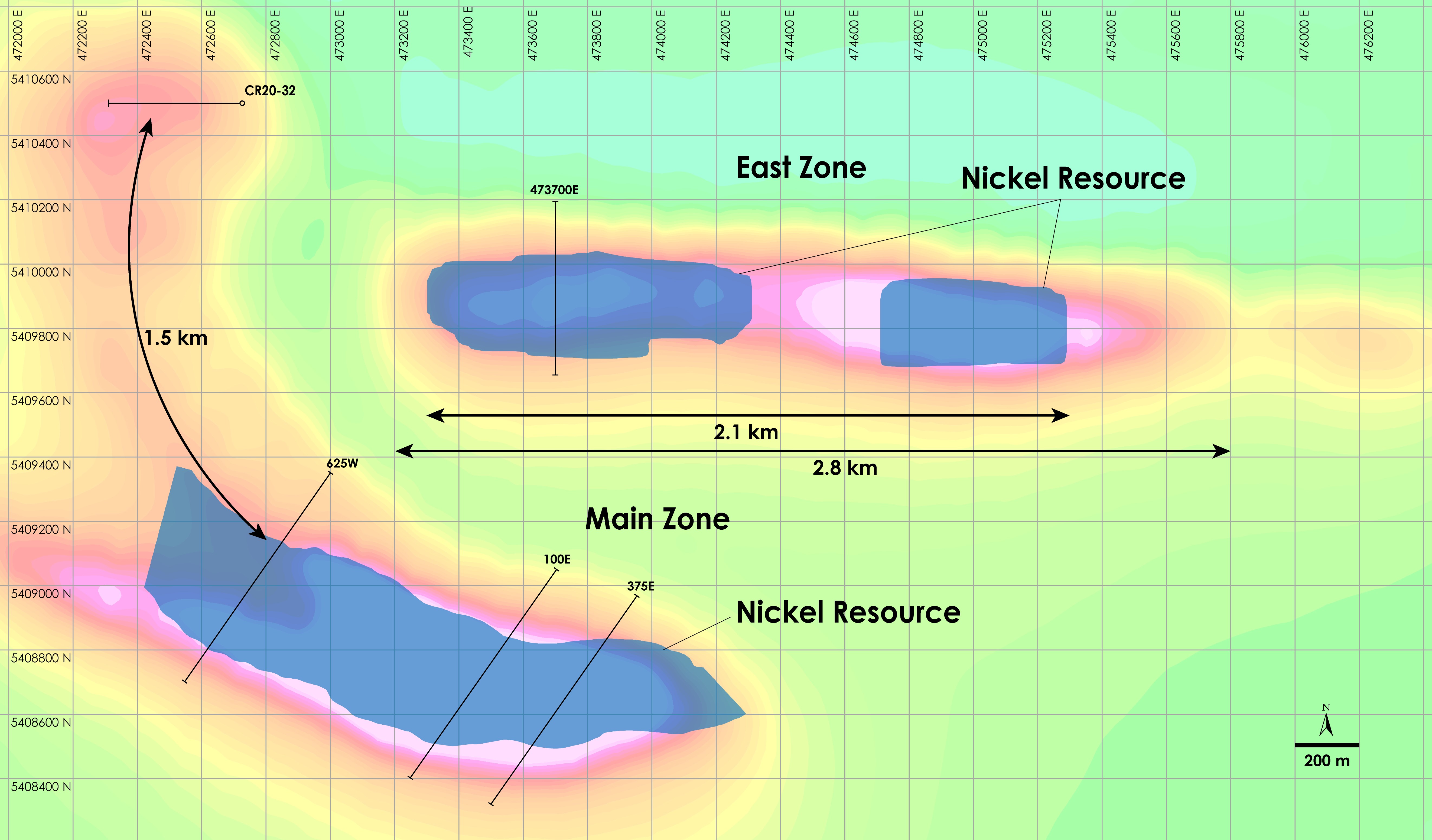

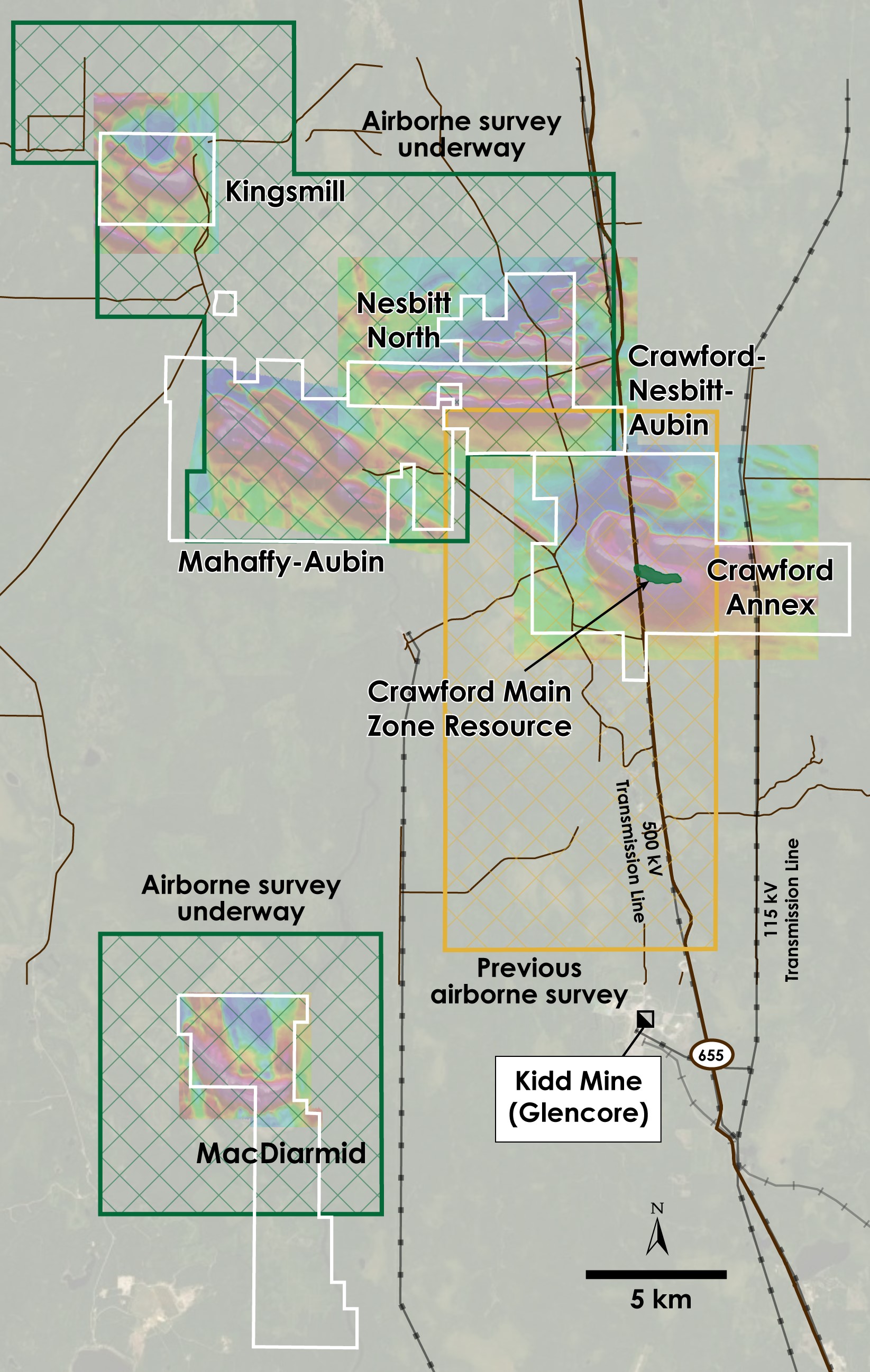

The Maggie Creek Project is located in the heart of the Carlin Trend, immediately adjacent to Newmont’s (NYSE: NEM) 26-million-ounce Gold Quarry mine. The Project occurs along the northeast projection of the Gold Quarry fault zone, which is an important mineralizing control at the Gold Quarry mine, indicating the potential to discover Carlin style gold deposits. The recent discoveries at Carlin (Leeville) and Gold Quarry (Chukar) demonstrate the potential for high-grade deposits at depth, which are mostly untested at Maggie Creek. Newmont’s Rainbow deposit occurs immediately south of the Maggie Creek project boundary. U.S. Gold Corp. has an option to earn up to 70% of the Maggie Creek project from Orogen Royalties, Inc. (TSX.V: OGN).

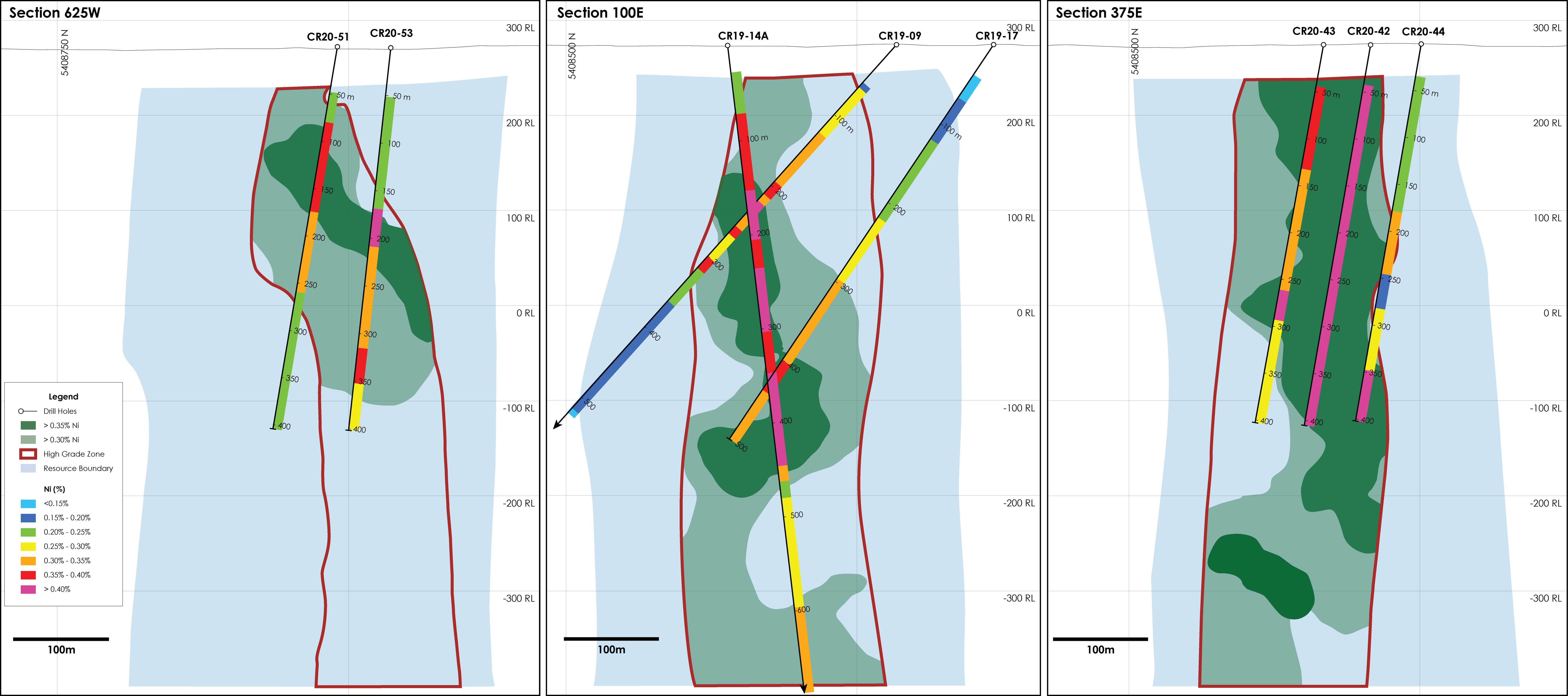

The Company believes Maggie Creek has significant discovery potential and its exploration team and leading consultants are continuously interpreting all the historical drilling and exploration work previously done in the area. Results of a district-wide gravity survey on the Maggie Creek claims were previously announced on May 13, 2020. This new geological information, synthesized with historical district information, has been incorporated in the Company’s future exploration plans. The Maggie Creek exploration program in the future is expected to initially test mineralized gold horizons exposed at surface that are projected to down dip into district-scale structures. Historical drilling at Maggie Creek has been relatively shallow, with a mean depth of just 300 feet. The numerous gold showings within classical stratigraphy and structure that hosts the majority of gold ounces in the Carlin Trend are evident. The same host rocks and fault structures associated with the Gold Quarry Mine, including the Chukar-Alunite Fault Zone, that partly drive the high-grade mineralization at Gold Quarry potentially extend onto the Maggie Creek property. The projection of the Chukar-Alunite fault zone into the Maggie Creek Property where it intersects a strong NW structural corridor presents high priority potential drill targets.

Since acquiring the Maggie Creek option, U.S. Gold Corp. has been busy analyzing historical project data, conducting additional geophysical surveys and planning future exploration efforts. Ken Coleman – the Company’s Senior Project Geologist, has been out on the Maggie Creek claims, seeking to verify historical drill collars and conducting surface geological surveys and reviews. Future geophysical surveys and soil sampling are being designed and are planned for future exploration seasons. In addition, preliminary drilling plans are being formulated using existing and newly generated data.

The Company also engaged Nevada exploration expert Mr. John Norby to conduct a thorough, high-level geological-technical review of the Maggie Creek project. Mr. Norby’s Maggie Creek technical presentation can be viewed at:

www.usgoldcorp.gold/properties/maggie-creek/technical-ppt

Specific drill targets have emerged as a result of Mr. Norby’s work. Of the 241 historic drill holes at Maggie Creek, only 21 were drilled to depths of 1,000 feet or greater. Deeper underground targets in the district are largely untested. There are four initial target areas that will be considered as the focus of the Company’s initial Maggie Creek exploration efforts. These include:

The NE Soap Creek Target:

Local gold intercepts on the Maggie Creek claims may be a distal expression of larger gold concentrations along the Soap Creek fault. There is also potential for stratiform gold layers on the claims in the target area, as several historical drill holes were not drilled deep enough into projected favorable horizons or end in gold mineralization.

The Far North Rainbow Target:

This target is a down-dip continuation of drilled gold mineralization within decalcified upper-plate rocks at the footwall of the Cress fault. There is also potential in the hanging wall of the Cress fault for gold discoveries in similar lithologies.

The North Rainbow at Cress Fault Target:

Historically drilled gold mineralization is present in the Roberts Mountain Formation in the footwall of the Cress Fault. The upper-plate limey units in the hanging wall of the Cress Fault are also a target.

The North Rainbow Target:

This target is a down-dip continuation of drilled gold mineralization in the upper Roberts Mountain Formation, intersecting a mineralized, steeply dipping dike trend and possible sills.

Further updates about U.S. Gold Corp.’s future Maggie Creek exploration plans will be forthcoming.

About U.S. Gold Corp.

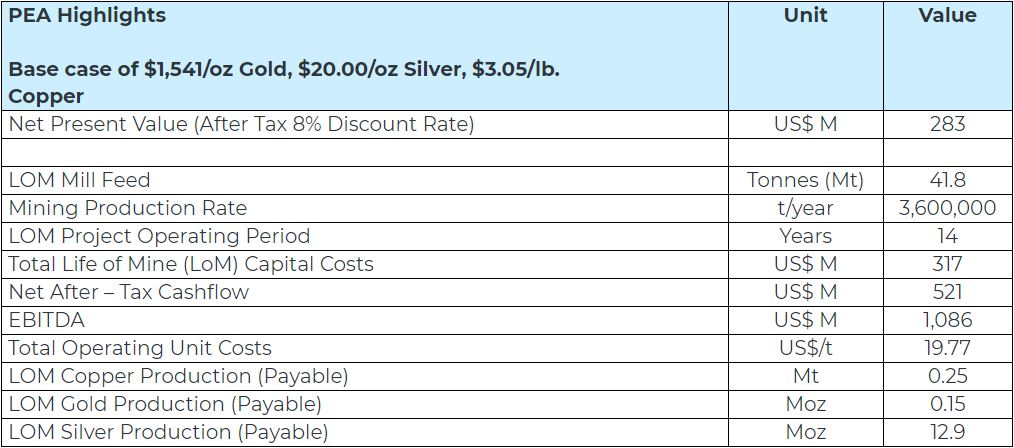

U.S. Gold Corp. is a publicly traded, U.S. focused gold exploration and development company. U.S. Gold Corp. has a portfolio of exploration properties. Copper King, now the CK Gold Project, is located in Southeast Wyoming and has a Preliminary Economic Assessment (PEA) technical report, which was completed by Mine Development Associates. Keystone and Maggie Creek are exploration properties on the Cortez and Carlin Trends in Nevada. The Challis Gold Project is located in Idaho. For more information about U.S. Gold Corp., please visit www.usgoldcorp.gold

Safe Harbor

Certain statements in this press release are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may be identified by the use of forward-looking words such as “anticipate,” “believe,” “forecast,” “estimated,” and “intend,” among others. These forward-looking statements are based on U.S. Gold Corp.’s current expectations, and actual results could differ materially from such statements. There are a number of factors that could cause actual events to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, risks arising from: the prevailing market conditions for metal prices and mining industry cost inputs, environmental and regulatory risks, risks faced by junior companies generally engaged in exploration activities, whether U.S. Gold Corp. will be able to raise sufficient capital to implement future exploration programs, COVID-19 uncertainties, and other factors described in the Company’s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the Securities and Exchange Commission, which can be reviewed at www.sec.gov. The Company has based these forward-looking statements on its current expectations and assumptions about future events. While management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory, and other risks, contingencies, and uncertainties, most of which are difficult to predict and many of which are beyond the Company’s control. The Company makes no representation or warranty that the information contained herein is complete and accurate and we have no duty to correct or update any information contained herein.

For additional information, please contact:

U.S. Gold Corp. Investor Relations: +1 800 557 4550

ir@usgoldcorp.gold

www.usgoldcorp.gold

SOURCE U.S. Gold Corp.