Comstock Mining Announces Positive Nine-months Earnings of $0.63 Per Share: Recognizes $18.3 Million Gain on Lucerne Sale

Virginia City, NV (November 17, 2020) Comstock Mining Inc. (the “Company”) (NYSE American: LODE) announced financial updates (unaudited) and strategic highlights for the third quarter and year to date:

Selected Strategic Highlights

- Completed the sale of the Lucerne mine to Tonogold Resources Inc. (“Tonogold”) for total cash, stock and debt consideration of approximately $18.8 million, plus Tonogold’s assumption of certain current and future obligations, and recognized a gain on the sale of approximately $18.3 million;

- Retained Investment in Tonogold share securities valued at $9.7 million at September 30, 2020;

- Retained Receivable in Tonogold secured note valued at $6.4 million at September 30, 2020;

- Extinguished its $4.8 million Senior Secured Debenture that was due later this year via a combination of cash proceeds from the Lucerne mine sale and unsecured promissory notes with favorable, extended terms;

- Installed and commenced the Mercury Clean Up LLC (“MCU”) Comstock mercury remediation pilot;

- Shipped and landed through MCU Philippines Inc. (“MCU-P”), the first landmark Philippines mercury remediation system, working together with our joint venture partner Clean Ore Solutions OPC;

- Completed an airborne geophysical survey of the Dayton-Spring Valley exploration complex;

- Expanded the airborne geophysical survey over all of the Company’s Comstock District properties;

- Contracted to lease, with an option to sell, the Daney Ranch for $2.7 million to a drilling company; and

- Extended the $10.1 million sale of Comstock’s two Silver Springs, NV properties until December 31, 2020.

Unaudited Third Quarter and Year To Date 2020 Selected Financial Highlights

- Costs applicable to mining decreased $296,023 during the three months ended September 30, 2020, as compared to the same period in 2019, as a result of certain assets becoming fully depreciated. These costs consist solely of depreciation expense on temporarily idled processing equipment;

- Real estate operating costs increased $690,306 during the three months ended September 30, 2020, as compared to the same period in 2019, almost solely due to depreciation recorded during the third quarter that would have been charged for previous periods, on the Gold Hill Hotel and Daney Ranch properties;

- Exploration and pre-development costs increased $152,978 during the three months ended September 30, 2020, as compared to the same period in 2019, primarily due to the costs of conducting an airborne geophysical survey of the Company’s resource areas and exploration targets;

- Interest expense decreased $15,140 during the three months ended September 30, 2020, as compared to the same period in 2019, as a result of lower average debt outstanding, including the retirement of the remaining Senior Secured Debenture in August 2020;

- Net income was $17.3 million, or $0.54 per share for the three months ended September 30, 2020, as compared to $0.4 million, or $0.02 per share in the prior comparable period, driven by transaction gains;

- Net income was $18.3 million, or $0.63 per share for the nine months ended September 30, 2020, as compared to a net loss of $3.5 million, or ($0.20) per share in the prior comparable period, driven by transaction and investment gains;

- Invested $1.9 million (in cash and stock) to date in MCU, as of September 30, 2020;

- Invested $1.0 million (in cash) to date in MCU-P, as of September 30, 2020;

- Total assets were $48.2 million, including current assets of $26.0 million, at September 30, 2020;

- Debt obligations totaled $4.8 million at September 30, 2020; reduced to $2.5 million by October 10; and

- Cash and cash equivalents at September 30, 2020, were $1.7 million.

Mr. Corrado De Gasperis, Executive Chairman and CEO stated, “Our successful sale of Lucerne has eliminated substantially all of our debt and recorded an $18 plus million gain and expectations of full-year profit for 2020, all while reducing our operating expenses and positioning our balance sheet for growth. We believe that our resource-based technology, properties, plant and equipment, and existing gold and silver mineral properties are undervalued. Our strategic plan includes establishing and growing the value of our existing mineral and royalty properties, commercializing and growing a global, ESG-compliant, profitable mercury remediation business, while still monetizing over $25 million in assets over the next fifteen months, for funding that growth.”

Comstock Mining’s Corporate Growth

The Company’s goal is to grow per-share value by commercializing environment-enhancing, precious and strategic-metal-based products and processes that generate a rate of predictable cash flow (throughput) and increase the long-term enterprise value of our northern Nevada based platform. The next three years are dedicated to delivering that value by achieving the performance objectives listed below:

Establish and grow the value of our mineral properties:

- Establish the Dayton Resource area’s maiden, stand-alone mineral resource estimate;

- Expand the Dayton-Spring Valley Complex through exploration drilling and geophysical modelling;

- Develop the expanded Dayton-SV Complex toward full economic feasibility, supporting a decision to mine;

- Entitle the Dayton-SV Complex with geotechnical, metallurgical, environmental studies and permitting; and

- Validate the Comstock NSR Royalty portfolio (Lucerne Mine, Occidental Lode, Comstock Lode, etc.).

Commercialize a global, ESG-compliant, profitable, mercury remediation system:

- Establish the technical efficacy of MCU’s Comstock Mercury System, and protect the intellectual property;

- Initiate and operate the first international mercury remediation project by deploying MCU’s second and third mercury remediation systems into the Philippines; and

- Identify, evaluate and prioritize a pipeline of potential mercury remediation projects; then deploy the third and fourth mercury remediation projects, producing extended, superior cash flow returns.

Monetize non-strategic assets and build a quality organization:

- Monetize our third-party, junior mining securities responsibly, for $12.5 million or more;

- Monetize our non-mining assets for $12.5 million, excluding the Gold Hill Hotel;

- Grow the value of our Opportunity Zone investments to over $30 million; and

- Deploy a systemic organization, capable of accelerating growth and handling complexity.

The strategic plan is designed to deliver per-share value over the next three years, while positioning the Company for continued growth beyond 2023.

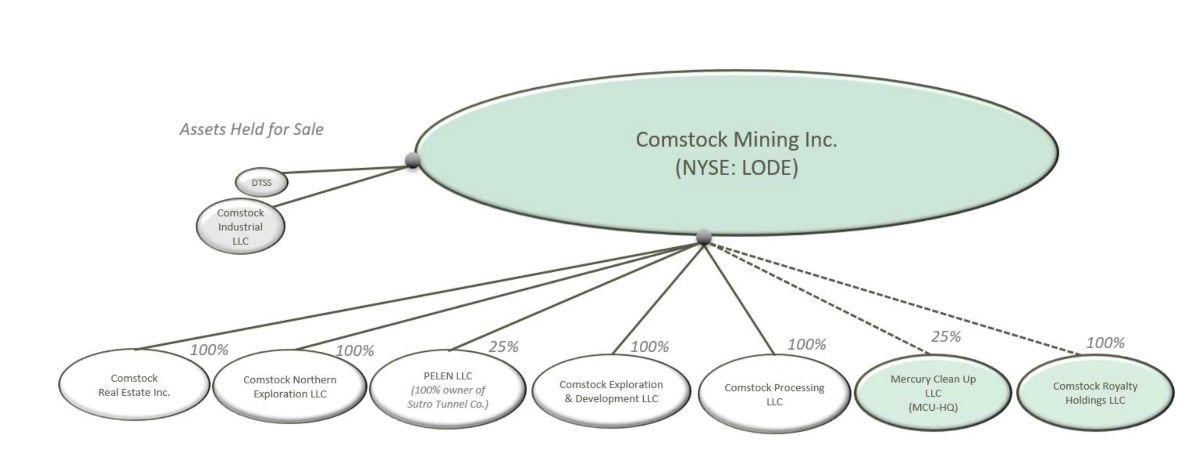

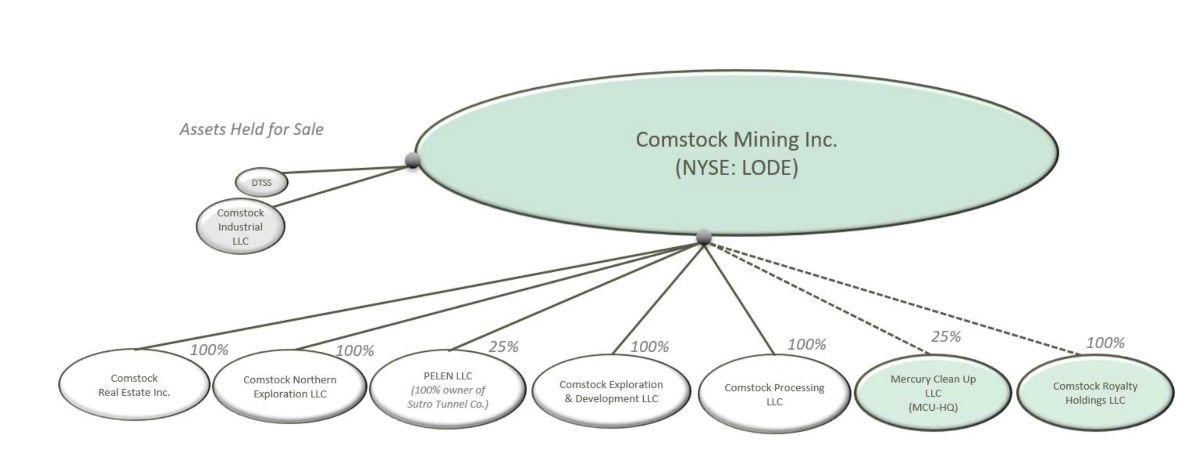

Comstock Mining’s Corporate Realignment

Comstock Mining Inc. is the parent company that wholly owns the realigned subsidiaries and is expanding its mineral resources, mercury remediation operations and royalty portfolios.

Mr. De Gasperis continued, “The realignment enables partnerships and transactions that increase value-creating opportunities and accelerate our precious and strategic-metal-based products and process growth. Our goal is to deliver over $500 million of value, or at least $12 per share, from our existing assets and the commercialization of these environmentally friendly metal processing and mining technologies, partnerships and ventures.”

Comstock Exploration and Development

Our district-wide exploration and development plans contemplate three specific, geological areas that the Company has organized into wholly-owned subsidiaries called Comstock Exploration and Development LLC, Comstock Northern Exploration LLC, and Comstock Mining LLC. Comstock Exploration and Development LLC includes the Dayton and Spring Valley areas. Comstock Northern Exploration LLC includes the Occidental and Gold Hill exploration targets now leased to Tonogold, and Comstock Mining LLC, recently acquired by Tonogold, includes the Lucerne properties. These exploration targets represent over 7 miles of mineralized strike length, with current and historical grades of gold and silver, and significant historical mine production.

Comstock Processing LLC

Comstock Processing LLC (“CPL”), owns all of the property, plant, equipment, and permits for the crushing, agglomerating, leaching, Merrill Crowe processing, mercury retort, refining, and metallurgical operations located at 1200 American Flat Road, Virginia City, Nevada. The facilities represent a fully permitted platform, best positioned for implementing our Strategic Focus on high-value, cash-generating, precious and strategic metal-based activities.

To date, Comstock Processing has entered into two strategic ventures that leverage its platform for nearer-term cash generation; first with Tonogold for the Lease-Option Agreement to lease and operate the facilities and second, with Mercury Clean Up LLC (“MCU”) for the commercial pilot of the MCU mercury remediation system.

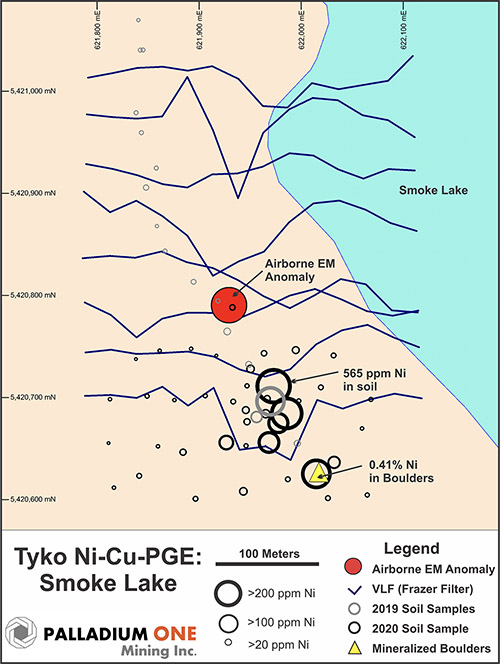

Dayton Resource and Spring Valley Exploration Areas

During the third quarter of 2020, the Company engaged Geotech Ltd (“Geotech”) of Aurora, Canada, to conduct an airborne geophysical survey of the Dayton resource area, Spring Valley exploration targets, and the rest of the Company’s Comstock district properties. The survey included both magnetic and Geotech’s proprietary Versatile Time-Domain Electromagnetic (“VTEM”) surveys.

The survey was flown from September 19, through October 3, 2020, with 1,161 line-kilometers. The interpreted, three-dimensional results have been recently delivered to the Company and our geological team is just now assessing a deep trove of geophysical and geological data. The results will greatly increase the Company’s understanding of the Dayton resource area, the Spring Valley resource expansion potential, and the rest of the Company’s Comstock district properties.

The Company’s technical staff is currently compiling a detailed structural interpretation of the Dayton resource area, which will provide the framework for a completely new resource model. The detailed interpretation is leading to a list of highly prospective drill targets to further define and expand the mineral resource.

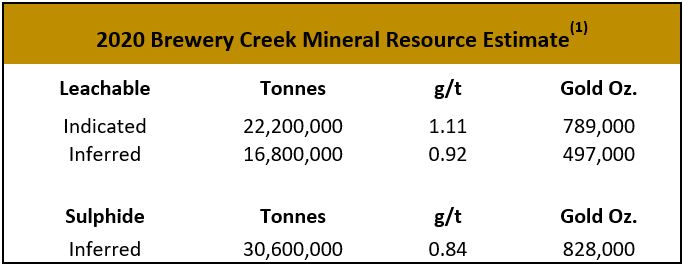

The Company is proceeding to publish a separate S-K 1300 compliant, Initial Assessment technical report for the Dayton resource area to validate a mineral resource estimate. The new technical report will provide not only a new resource estimate, but also a phased drilling plan for further defining and expanding the resource for sustainable, profitable mining. The Company plans to continually advance the Dayton to full feasibility, towards a production ready mine plan. Mining on lands 100% privately held by the Company should shorten the permitting cycle.

Corporate

During 2019, the Company received $6.1 million in Tonogold convertible preferred stock (“CPS”). The CPS became convertible into common shares on May 22, 2020. On May 22, 2020, and September 29, 2020, the Company elected to convert $1.1 million and $2.8 million of CPS, respectively, at $0.18 per common share, for a total of 21,777,778 common shares. Through November 13, 2020, the Company has sold 5,057,894 common shares at an average price of $0.40 per share for proceeds of over $2 million and still holds 16,719,884 shares.

On October 2, 2020, Tonogold redeemed the remaining $2.2 million of CPS for $2.6 million in cash, representing 120% of the CPS face value. The Company promptly reduced its debt from approximately $4.8 million at September 30, 2020, to approximately $2.5 million in early October.

The Company is also owed $4.5 million, in the form of a 12% note receivable, due and payable by Tonogold on September 20, 2021, plus Tonogold’s assumption of $6.7 million in future lease and reclamation obligations, that together represent a permanent reduction of annual operating expenses of approximately $1 million.

Cash and cash equivalents at September 30, 2020, were $1.7 million, total common shares outstanding at both September 30, 2020, and November 17, 2020, were 34,440,766 shares.

Outlook

The Company expects to monetize its non-mining assets over the next fifteen months, for over $22 million, net of debt. The Company expects to close on the sale of certain properties and senior water rights in Silver Springs, Nevada, to Sierra Springs Enterprises Inc., for total proceeds of approximately $10 million. The Company also expects to monetize the remaining $9.7 million in Tonogold securities over the next fifteen months and collect on the $4.5 million in notes receivable in the next 10 months. The Company will use the proceeds to extinguish the outstanding $2.5 million in debt obligations, plus accrued interest, and fund the Company’s growth initiatives.

The Company’s fourth quarter 2020 plans also include updating the Dayton’s current resource estimate and continuing southerly into Spring Valley with incremental exploration programs that include recently completed geophysical surveys, surface exploration and definition drilling of targets identified by the geophysical surveys, surface mapping, prior drilling and deeper geological interpretations that all lead to publishing a new, S-K 1300 compliant, mineral resource estimate.

The Company’s remaining 2020 plans include advancing the investment in and the commercialization of MCU’s mercury remediation processing technologies. The Company expects to close on the MCU transaction during the fourth quarter of 2020, meaning it will then own 15% of MCU and expects to close on the MCU Philippines transaction in the first quarter of 2021, meaning it will then own 25% of MCU and 50% of its first joint venture in the Philippines. Oro Industries Inc. has delivered the 25-ton-per-hour mercury recovery plant and is testing and preparing the system for its pilot operations on the Comstock, including a 200 gallon-per-minute dissolved air flotation water treatment plant. These pilot trial operations will continue throughout 2021, at the Company’s American Flat processing facility, to validate and fine-tune the mercury extraction and remediation process, with the objective of reclaiming and remediating the Company’s existing properties, enhancing the values of, and evaluating the potential economic feasibility for, these properties, and creating new global growth opportunities in mercury remediation by demonstrating MCU’s technological and operational effectiveness, efficiency, and feasibility.

MCU-P has delivered its first international system to the Philippines and plans to commence reclamation operations during the fourth quarter 2020. MCU-P will operate under a joint venture agreement with Clean Ore Solutions, a Philippine Company, for mercury extraction and remediation of Mount Diwalwal and the Naboc River, one of the most mercury polluted, gold mining regions in the world. This represents the first real international opportunity for large-scale mercury remediation and environmental reclamations, using MCU’s systems, and establishing MCU as a leader in mercury remediation projects, and in particular, contamination caused by artisanal and small-scale miners.

Conference Call

The Company will host a conference call today, November 17, 2020, at 8:00 a.m. Pacific Time/11:00 a.m. Eastern Time. The live call will include a moderated Q&A, after the prepared comments by the Company. Please join the event 5-10 minutes prior to scheduled start time. When prompted, provide the confirmation code. The dial-in telephone numbers for the live audio are as follows:

Toll Free: 1-800-367-2403

Direct: 1-334-777-6978

Confirmation Code: 2739116

The audio will be available, usually within 24 hours of the call, on the Company’s new website:

http://www.comstockmining.com/investors/investor-library

About Comstock Mining Inc.

Comstock Mining Inc. is a Nevada-based, precious and strategic metal-based exploration, economic resource development, mineral production and metal processing business with a strategic focus on high-value, cash-generating, environmentally friendly, and economically enhancing mining and processing technologies and businesses. The Company has extensive, contiguous property in the historic Comstock and Silver City mining districts (collectively, the “Comstock District”) and is an emerging leader in sustainable, responsible mining and processing, and is currently commercializing environment-enhancing, metal-based technologies, products, and processes for precious and strategic metals recovery.

Forward-Looking Statements

This press release and any related calls or discussions may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, are forward-looking statements. The words “believe,” “expect,” “anticipate,” “estimate,” “project,” “plan,” “should,” “intend,” “may,” “will,” “would,” “potential” and similar expressions identify forward-looking statements, but are not the exclusive means of doing so. Forward-looking statements include statements about matters such as: consummation of all pending transactions; project, asset or Company valuations; future industry market conditions; future explorations, acquisitions, investments and asset sales; future performance of and closings under various agreements; future changes in our exploration activities; future estimated mineral resources; future prices and sales of, and demand for, our products; future impacts of land entitlements and uses; future permitting activities and needs therefor; future production capacity and operations; future operating and overhead costs; future capital expenditures and their impact on us; future impacts of operational and management changes (including changes in the board of directors); future changes in business strategies, planning and tactics and impacts of recent or future changes; future employment and contributions of personnel, including consultants; future land sales, investments, acquisitions, joint ventures, strategic alliances, business combinations, operational, tax, financial and restructuring initiatives; the nature and timing of and accounting for restructuring charges and derivative liabilities and the impact thereof; contingencies; future environmental compliance and changes in the regulatory environment; future offerings of equity or debt securities; the possible redemption of debentures and associated costs; future working capital, costs, revenues, business opportunities, debt levels, cash flows, margins, earnings and growth.

These statements are based on assumptions and assessments made by our management in light of their experience and their perception of historical and current trends, current conditions, possible future developments and other factors they believe to be appropriate. Forward-looking statements are not guarantees, representations or warranties and are subject to risks and uncertainties, many of which are unforeseeable and beyond our control and could cause actual results, developments and business decisions to differ materially from those contemplated by such forward-looking statements. Some of those risks and uncertainties include the risk factors set forth in our filings with the SEC and the following: counterparty risks; capital markets’ valuation and pricing risks; adverse effects of climate changes or natural disasters; global economic and capital market uncertainties; the speculative nature of gold or mineral exploration, including risks of diminishing quantities or grades of qualified resources; operational or technical difficulties in connection with exploration or mining activities; contests over title to properties; potential dilution to our stockholders from our stock issuances and recapitalization and balance sheet restructuring activities; potential inability to comply with applicable government regulations or law; adoption of or changes in legislation or regulations adversely affecting businesses; permitting constraints or delays; decisions regarding business opportunities that may be presented to, or pursued by, us or others; the impact of, or the non-performance by parties under agreements relating to, acquisitions, joint ventures, strategic alliances, business combinations, asset sales, leases, options and investments to which we may be party; changes in the United States or other monetary or fiscal policies or regulations; interruptions in production capabilities due to capital constraints; equipment failures; fluctuation of prices for gold or certain other commodities (such as silver, zinc, cyanide, water, diesel fuel and electricity); changes in generally accepted accounting principles; adverse effects of terrorism and geopolitical events; potential inability to implement business strategies; potential inability to grow revenues; potential inability to attract and retain key personnel; interruptions in delivery of critical supplies, equipment and raw materials due to credit or other limitations imposed by vendors or others; assertion of claims, lawsuits and proceedings; potential inability to satisfy debt and lease obligations; potential inability to maintain an effective system of internal controls over financial reporting; potential inability or failure to timely file periodic reports with the SEC; potential inability to list our securities on any securities exchange or market; inability to maintain the listing of our securities; and work stoppages or other labor difficulties. Occurrence of such events or circumstances could have a material adverse effect on our business, financial condition, results of operations or cash flows or the market price of our securities. All subsequent written and oral forward-looking statements by or attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. Except as may be required by securities or other law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Neither this press release nor any related calls or discussions constitutes an offer to sell, the solicitation of an offer to buy or a recommendation with respect to any securities of the Company, the fund or any other issuer.

Contact information

Comstock Mining Inc.

1200 American Flat Rd

PO Box 1118

Virginia City, NV 89440

http://www.comstockmining.com

Corrado De Gasperis

Executive Chairman & CEO

Tel (775) 847-4755

degasperis@comstockmining.com

Zach Spencer

Director of External Relations

Tel (775) 847-5272 ext.151

questions@comstockmining.com