Palladium One Discovery Indicates Significant Mineralization Potential at the Disraeli PGE Project

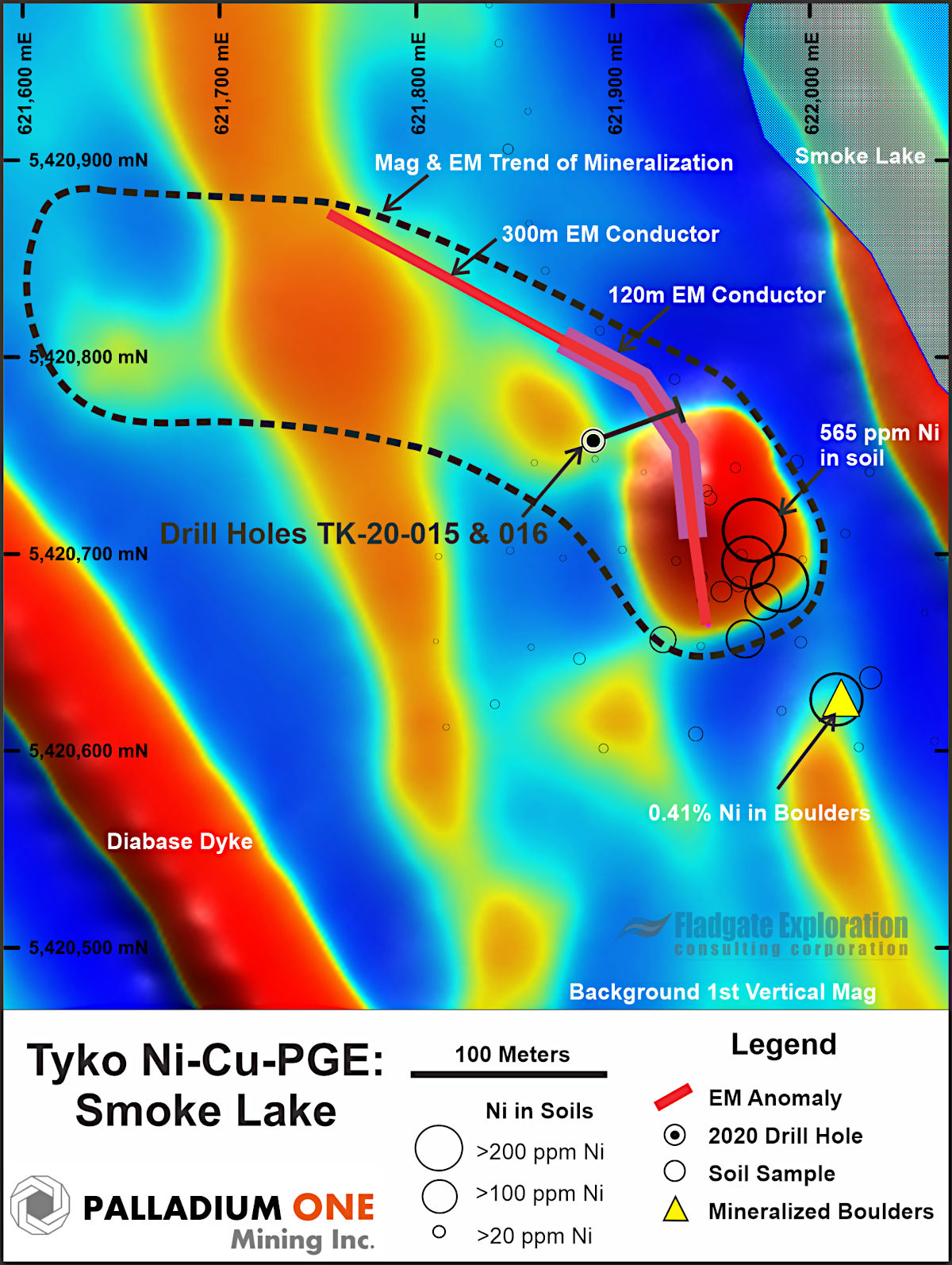

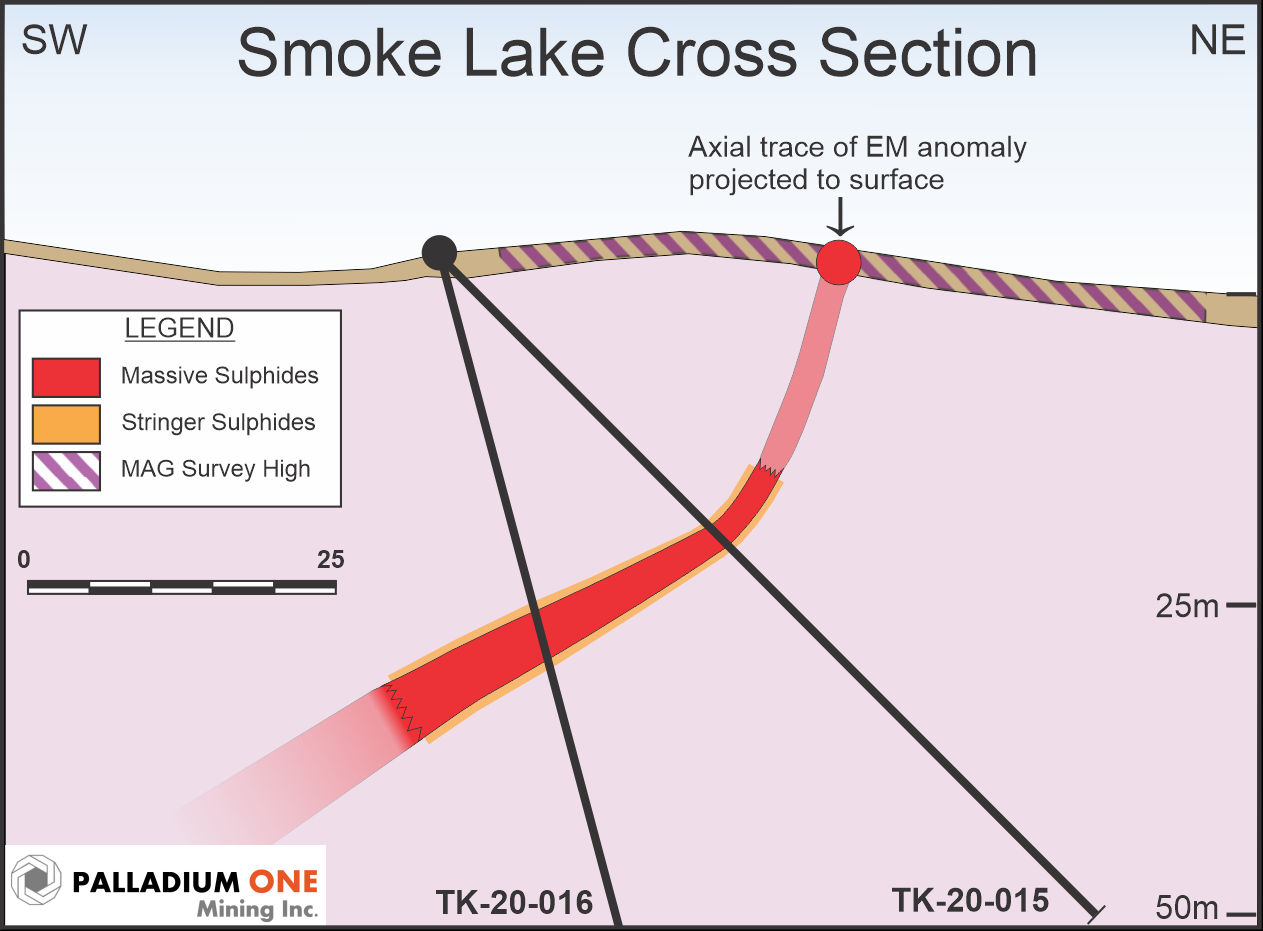

December 9, 2020 – Toronto, Ontario – A new high-resolution drone magnetic survey discovery has outlined a significant magnetic signature, a key indicator of mineralization in the Mid-Continental Rift (“MCR”), where the Disraeli PGE Project is located, in Ontario, Canada said Palladium One Mining Inc. (TSX-V: PDM, FRA: 7N11, OTC: NKORF) (the “Company” or “Palladium One”) today. The magnetic survey (“Mag”) outlined a large, reversely polarized, magnetic body coincident with AeroTEM electromagnetic (“EM”) anomalies.

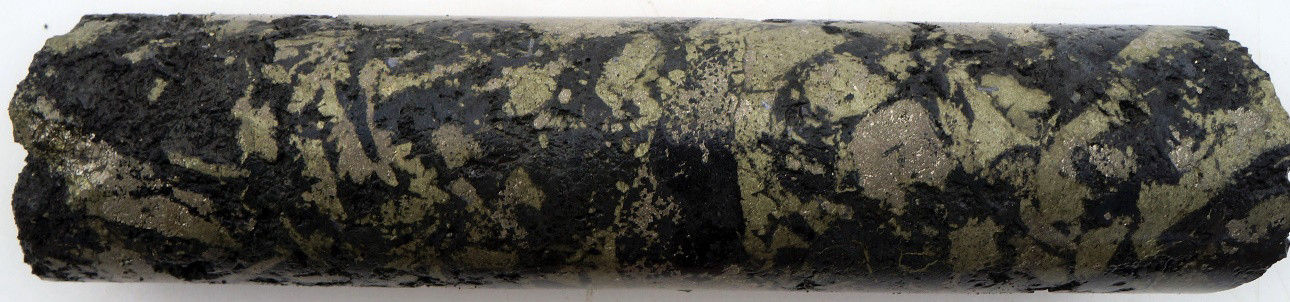

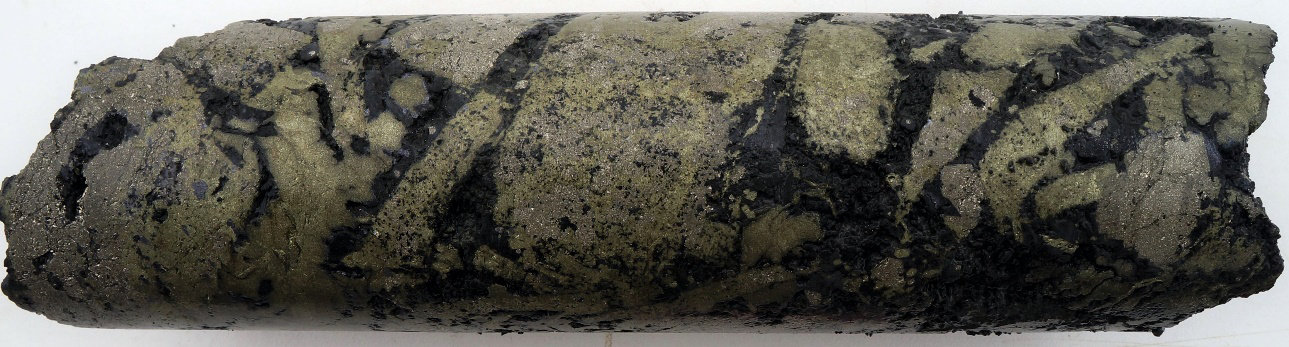

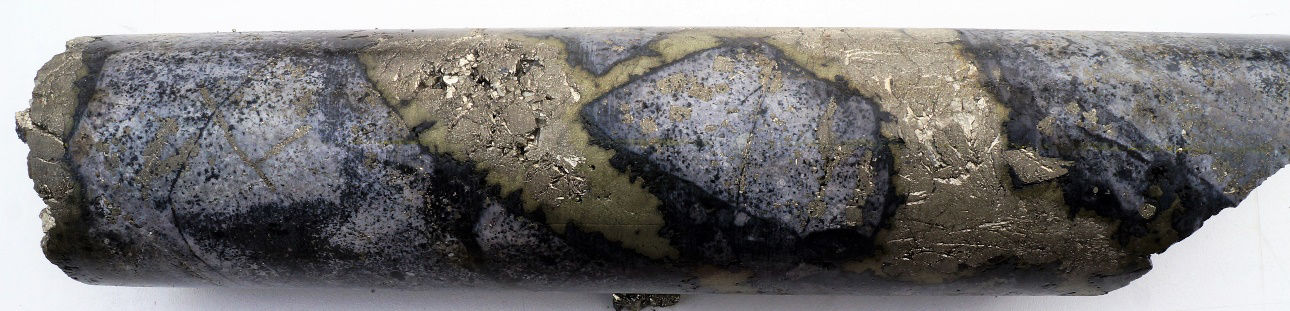

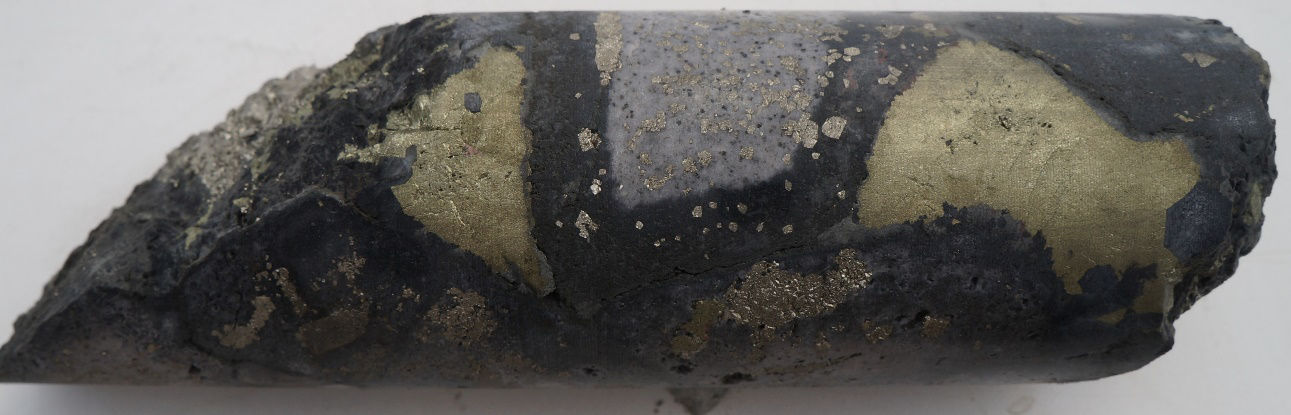

“Reversely polarized magnetic bodies are very important indicators of mineralization within the Mid-Continental Rift as demonstrated by nearby palladium-platinum-nickel-copper mineral deposits and mines, which are in part, reversely polarized. The target is high-grade PGE-rich nickel-copper mineralization located within magma conduits similar to Clean Air Metals Inc.’s Thunder Bay North (“TBN”) and Escape Lake deposits.” said Derrick Weyrauch, President and CEO.

“Disraeli’s Hook Bay zone is clearly a more primitive portion of the greater Disraeli intrusion. The presence of airborne EM conductors coincident with a reversely polarized magnetic body, something that does not occur at TBN, suggests the potential for semi or even massive sulphides. Rare massive sulphide intercepts at TBN have returned impressive grades such 98 g/t PGE (52.8 g/t Pd, 41.5 g/t Pd, 3.9 g/t Au), 3.3% Ni, and 11.6% Cu over 2.6 meters in hole BL10- 197 (see Magma Metals Limited News Release February 15, 2010). These grades reflect the very high metal tenor of the sulphides, which is the hallmark of the PGE-rich mineralization in the Nipigon Plate portion of the Mid-Continent Rift.” commented Weyrauch.

An exploration drill permit has been received and the Company plans to drill Disraeli in February 2021, pending winter ice conditions.

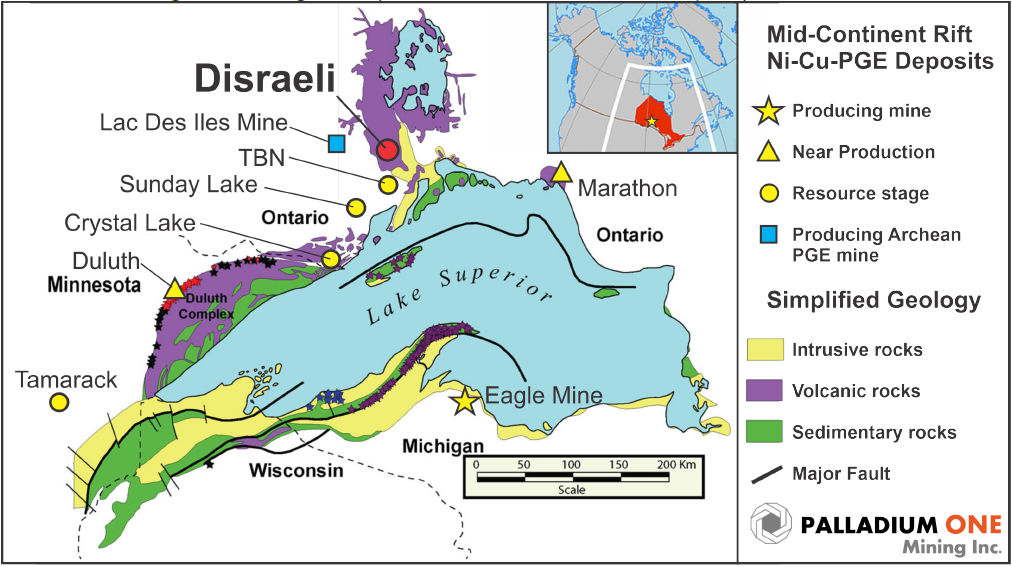

Disraeli is located 40 kilometers north of Clean Air Metals Inc’s TBN project and only 50 kilometers east from Impala Platinum Holdings Ltd’s (“Implats”) Lac Des Iles palladium Mine (Figure 1 and 2)

Figure 1. Illustration of Proterozoic Mid-Continent Rift and select associated copper-nickel-palladium-platinum deposits. The Eagle Mine operated by Lundin Mining hosts a Measured and Indicated Resource of 4.6 million tonnes grading 3.7% Ni, 3.1% Cu, 0.9 g/t Pt, 0.7 g/t Pd (2017 Lundin NI 43-101 report).

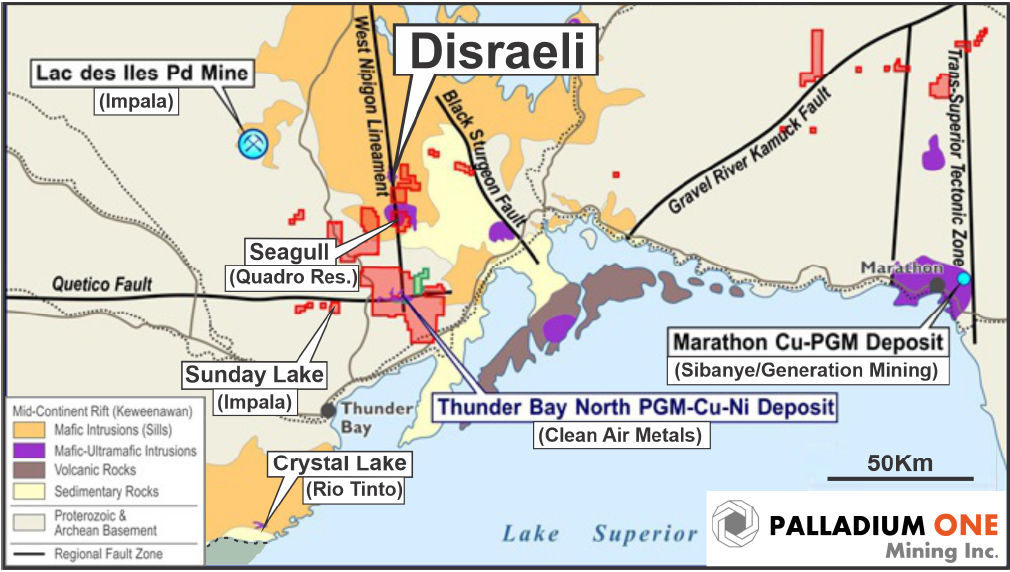

Figure 2. Illustrating the Nipigon Plate portion of the Proterozoic Mid-Continent Rift showing the West Nipigon Lineament which connects the Disraeli, Seagull and TBN intrusions. The Archean aged, Lac des Iles Palladium mine, located 50 kilometers west of Disraeli is also shown.

Preliminary Analysis:

- The West Nipigon Lineament (Figure 2), is believed to be a control structure for the emplacement of the TBN (Clean Air Metals Inc.), Seagull (Quadro Resources Ltd.), and Disraeli intrusions and is prospective for additional magma conduits such as those found at TBN and Escape Lake.

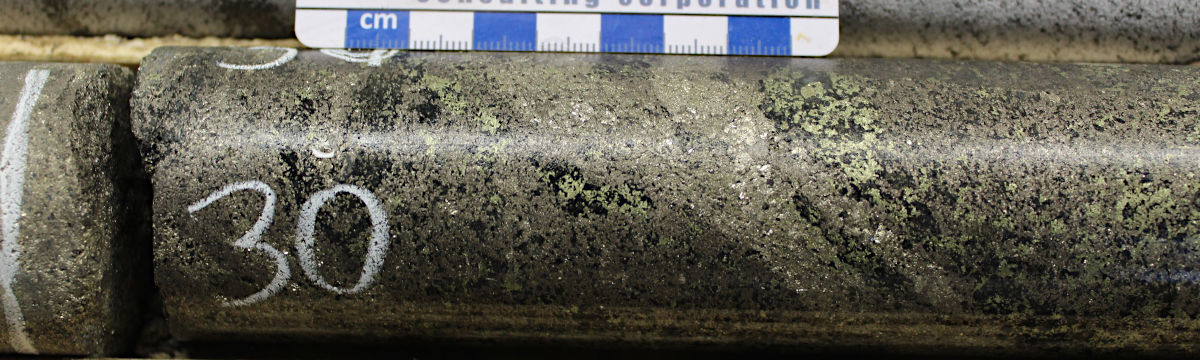

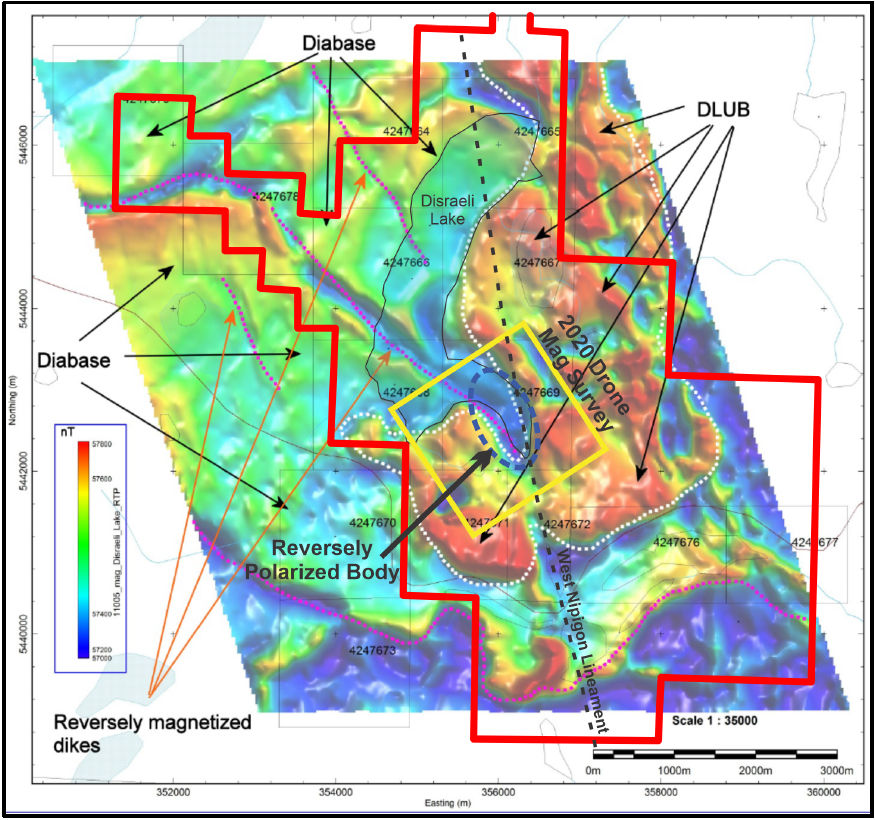

- The high-resolution drone magnetic survey identified a very strong, reversely polarized magnetic body beneath the southeast bay (Hook Bay) of Disraeli Lake. (Figure 3 and 4).

- Reversely Polarized rocks are a key indicator for early mafic-ultramafic intrusives associated with PGE-Ni-Cu mineralization in the Mid-Continent Rift. Portions of the nearby TBN, Escape Lake, Sunday Lake (Implats), and Marathon (Generation Mining) deposits are also reversely polarized.

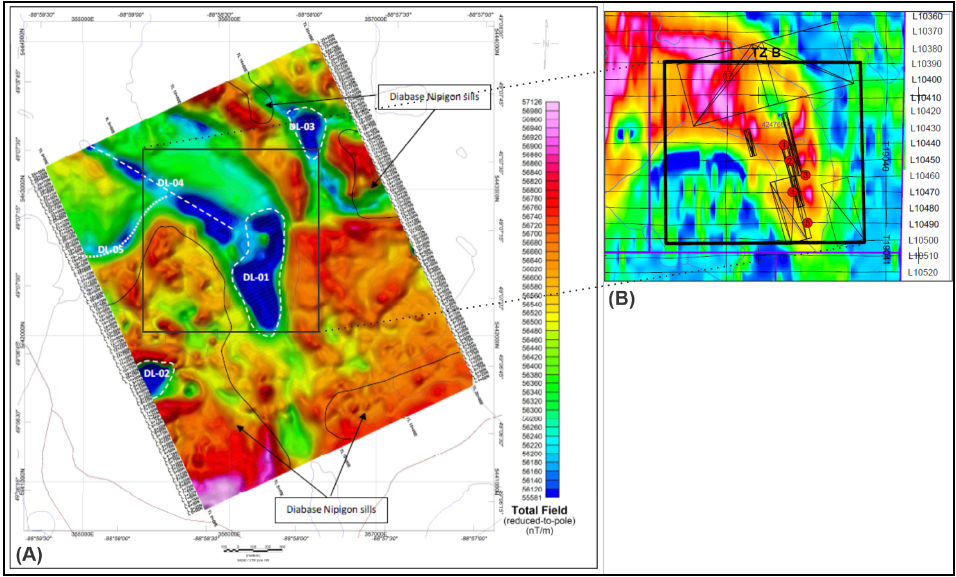

- The reversely polarized Hook Bay magnetic body is coincident with several AeroTEM EM anomalies that were outlined by a previous operator in 2011 and 2014 but were never drill tested (Figure 4 and 5).

- The presence of airborne AeroTEM EM anomalies suggest the possibility of not only disseminated mineralization but also semi massive or even massive sulphides.

- A lake sediment survey conducted in 2020 has shown a consistently greater ultramafic signature beneath Hook Bay compared to the rest of the Disraeli Lake. Ultramafic rocks were also observed along the western shore of Hook Bay. All of which point to this area being a much more primitive part of the Disraeli intrusion, and hence potentially close to the magma conduit which fed the intrusion.

- The Disraeli intrusion has seen much less exploration than adjacent intrusions in the Nipigon Plate, only 8 holes have been drilled on the property, and none have tested beneath Disraeli Lake. There is a precedent for magma conduits being located beneath lakes. Both TBN and Escape Lake magma conduits occur beneath the Current and Steepledge lakes, respectively.

Target Model:

- High-grade PGE-rich Ni-Cu mineralization located within magma conduits similar to Clean Air Metals Inc.’s Thunder Bay North and Escape Lake deposits.

Figure 3. 2011, 100-meter spaced AeroTEM survey, total magnetic field reduced to the pole (TMI-RTP) with 2014 Condor Geophysics interpretation highlighting the Disraeli ultramafic body (DLUB). Note the reversely polarised body in the southeast bay (Hook Bay) of Disraeli Lake. The Disraeli property boundary shown in red, 2020 detailed drone survey area outlined in yellow, and the Hook Bay reversely polarized body shown by dashed blue line.

Figure 4. Image (A) is the 2020 drone based, 25-meter spaced survey, TMI-RTP mag, target DL-01 is the Hook Bay strongly magnetic reversely polarized body. Image (B) are EM anomaly picks and Maxwell plates models by Condor Consulting in 2014 from the 2011 AreoTEM survey. The background image is a 60-meter conductivity depth slice.

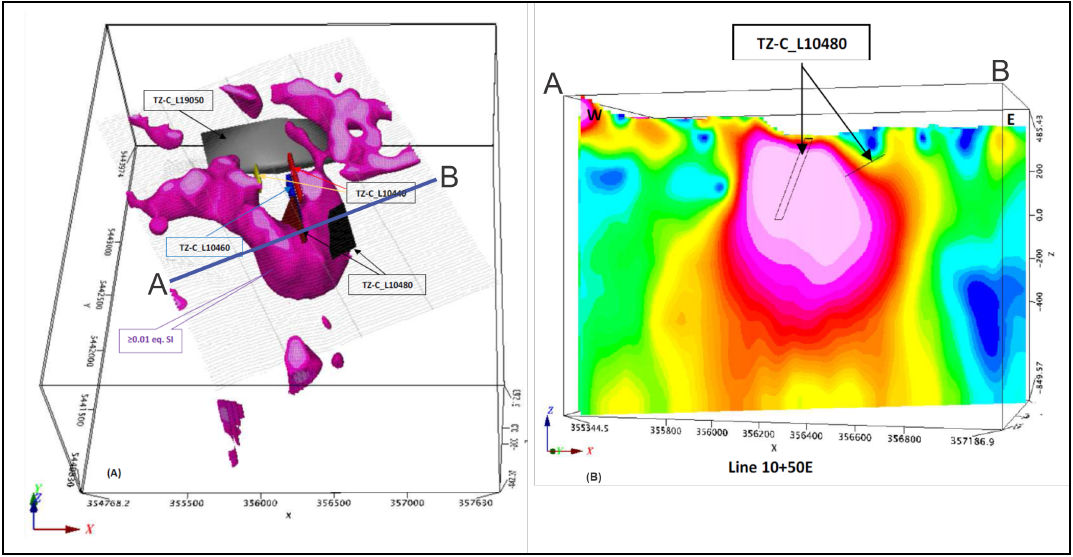

Figure 5. Image (A) is an isometric view of the Hook Bay highly magnetic body looking north. Image (A) was generated by Abitibi Geophysics using VOXI Magnetization Vector Inversion technology (MVI) magnetic susceptibility model plotted as an isosurface using the 2020 drone magnetic survey data, MVI is considered a better technique for modelling overall magnetic susceptibility in areas like Disraeli where both positively and reversely polarized rocks occur. Image (B) is a cross section along Line A-B through the MVI magnetic susceptibility model looking north. Both images include Maxwell plate EM picks from Condor Consulting 2014 interpretation of the 2011 AeroTEM survey.

Qualified Person

The technical information in this release has been reviewed and verified by Neil Pettigrew, M.Sc., P. Geo., Vice President of Exploration and a director of the Company and the Qualified Person as defined by National Instrument 43- 101.

About Palladium One

Palladium One Mining Inc. is an exploration company targeting district scale, platinum-group-element (PGE)-coppernickel deposits in Finland and Canada. Its flagship project is the Läntinen Koillismaa or LK Project, a palladiumdominant platinum group element-copper-nickel project in north-central Finland, ranked by the Fraser Institute as one of the world’s top countries for mineral exploration and development. Exploration at LK is focused on targeting disseminated sulfides along 38 kilometers of favorable basal contact and building on an established NI 43-101 open pit resource.

ON BEHALF OF THE BOARD

“Derrick Weyrauch”

President & CEO, Director

For further information contact:

Derrick Weyrauch, President & CEO

Email:

info@palladiumoneinc.com

Neither the TSX Venture Exchange nor its Market Regulator (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release is not an offer or a solicitation of an offer of securities for sale in the United States of America. The common shares of Palladium One Mining Inc. have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration.

Information set forth in this press release may contain forward-looking statements. Forward-looking statements are statements that relate to future, not past events. In this context, forward-looking statements often address a company’s expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, or other similar expressions. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; fluctuations in palladium and other commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the absence of dividends; competition; dilution; the volatility of our common share price and volume; and tax consequences to Canadian and U.S. Shareholders. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Investors are cautioned against attributing undue certainty to forward-looking statements.

Source: Palladium One Mining Inc.