Chakana Copper Intersects 101.5m of 0.61 g/t Au, 0.91% Cu, and 19.8 g/t Ag (2.26 g/t Au-Eq) from 32m at Paloma West, Soledad Project, Peru

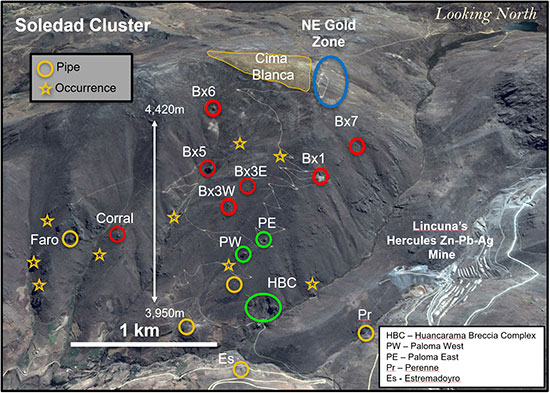

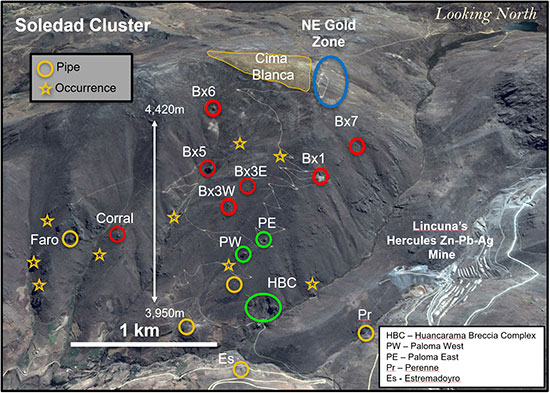

Vancouver, B.C., December 16, 2020 – Chakana Copper Corp. (TSX-V: PERU; OTCQB: CHKKF; FRA: 1ZX) (the “Company” or “Chakana”), is pleased to release new drill results from four holes at its high-grade copper-gold-silver Paloma West discovery at the expanded Soledad Project in Ancash, Peru. These results are part of the ongoing Phase 3 drill program, a fully funded 15,000 metre drill program that started August 15, 2020. Phase 3 is testing a cluster of high-grade, gold-enriched tourmaline breccia pipe targets within the Paloma and Huancarama breccia complexes (Fig. 1). Twenty holes have now been reported from the two Paloma targets for a total of 3,630 metres. Drilling is currently underway at Huancarama where thirteen holes have been completed thus far.

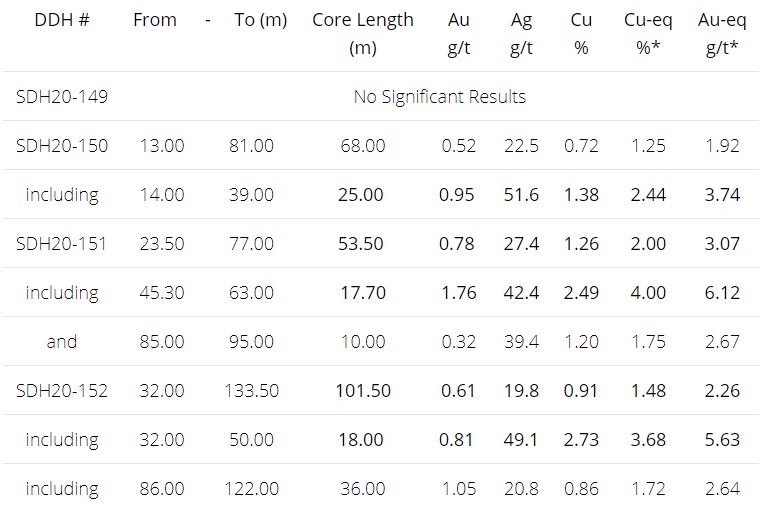

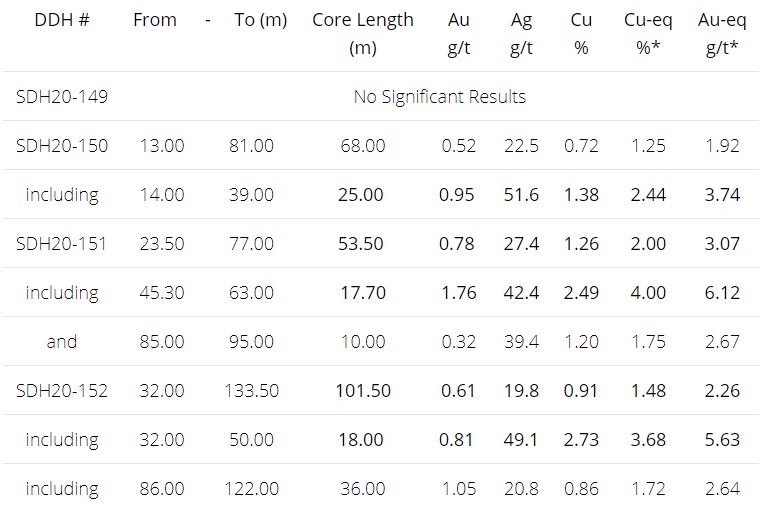

Mineralized intervals from these four holes at Paloma West include:

* Cu_eq and Au_eq values were calculated using copper, gold, and silver. Metal prices utilized for the calculations are Cu – US$2.90/lb, Au – US$1,300/oz, and Ag – US$17/oz. No adjustments were made for recovery as the project is an early stage exploration project and metallurgical data to allow for estimation of recoveries are not yet available. The formulas utilized to calculate equivalent values are Cu_eq (%) = Cu% + (Au g/t * 0.6556) + (Ag g/t * 0.00857) and Au_eq (g/t) = Au g/t + (Cu% * 1.5296) + (Ag g/t * 0.01307).

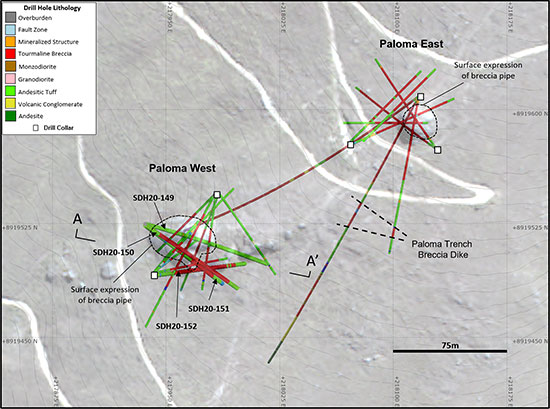

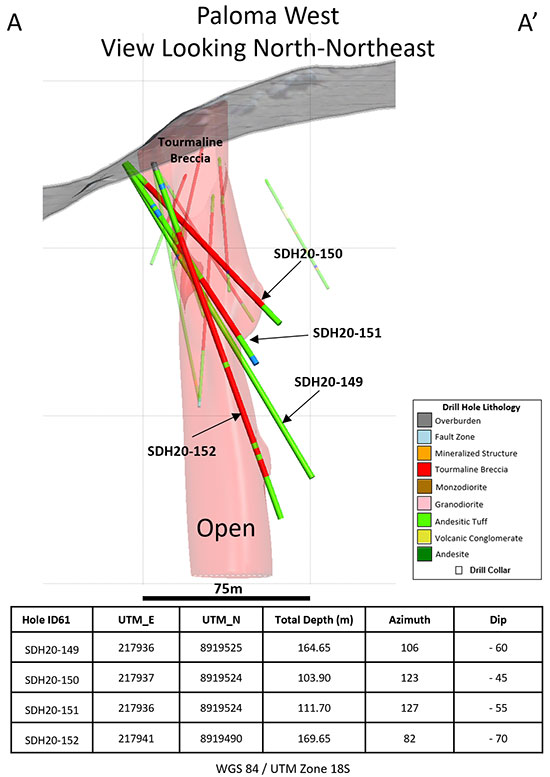

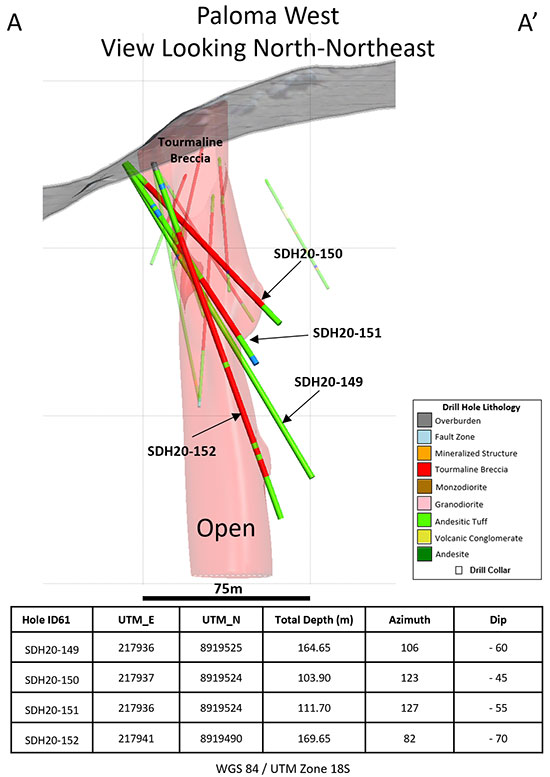

Summary information for results reported in this release; holes SDH20-149 to SDH20-151 were drilled from the northwest side of the exposed breccia pipe, and SDH20-152 was drilling from the southwest side of the breccia pipe (Figs. 2-3):

- SDH20-149 was drilled to the east-southeast and failed to intersect breccia, which is plunging southwest in the uppermost 70 metres of the breccia body.

- SDH20-150 and SDH20-151 were drilled towards the southeast from the same platform at -45 and -55 inclinations, respectively. Both holes intersected strongly mineralized breccia including 25m of 0.95 g/t Au, 1.38% Cu, and 51.6 g/t Ag starting at 14m in SDH20-150; and 17.7m with 1.76 g/t Au, 2.49% Cu, and 42.4 g/t Ag starting at 45.3m. Both intercepts occur within longer intervals of mineralized breccia.

- SDH20-152 was drilled towards the east at -70 inclination and intersected 101.5m of mineralized breccia with 0.61 g/t Au, 0.91% Cu, and 19.8 g/t Ag starting at 32m. A higher-grade margin zone within this occurs over 18m with 0.81 g/t Au, 2.73% Cu, and 49.1 g/t Ag starting at 32m.

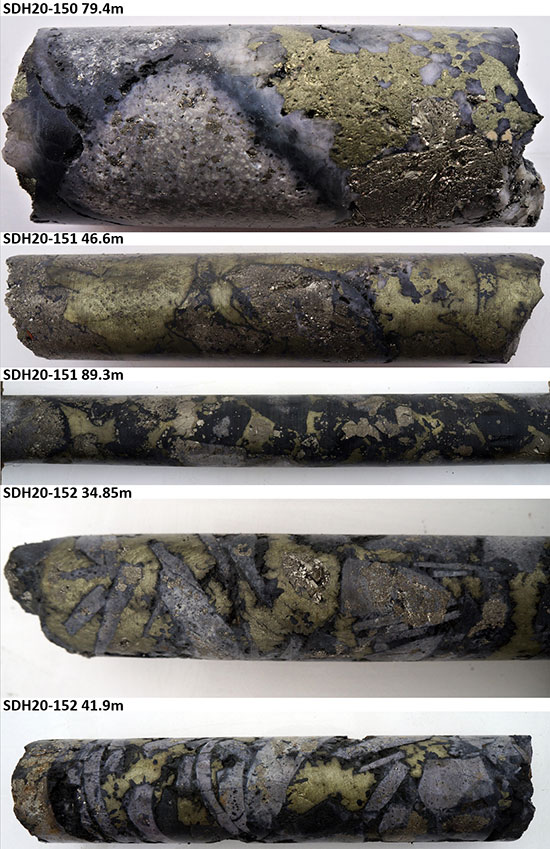

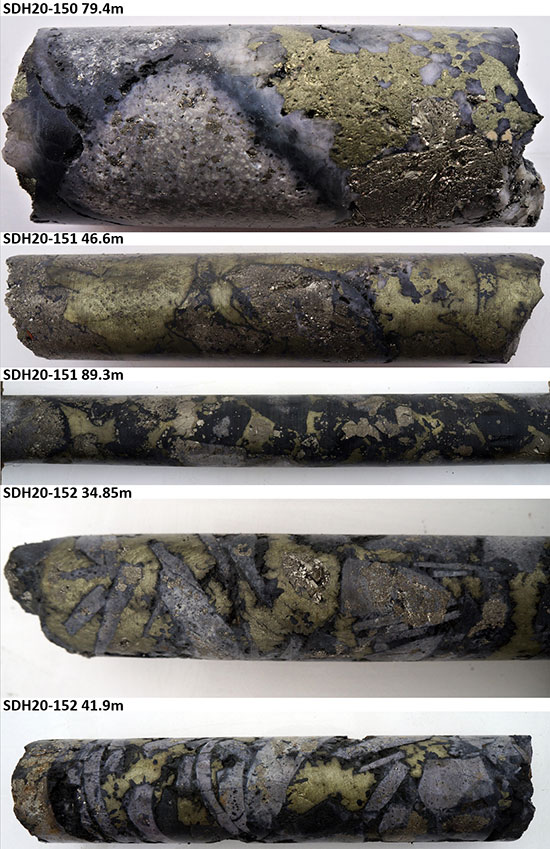

Examples of mineralized drill core from these holes are shown in Figure 4.

David Kelley, President and CEO commented, “these results are a successful conclusion to the scout drilling program at Paloma East and Paloma West, defining a breccia system much larger than anticipated with some of the highest grades ever seen on the project. The three holes that intersect breccia have high grade sections within longer intervals of mineralization. Hole SDH20-152 significantly extends mineralization to approximately 165m below surface and is open at depth. Additional in-fill drilling will be conducted at Paloma East and Paloma West to be included in an initial resource estimate. We look forward to reporting drill results from the Huancarama Breccia Complex early in the new year.”

Paloma Target Area

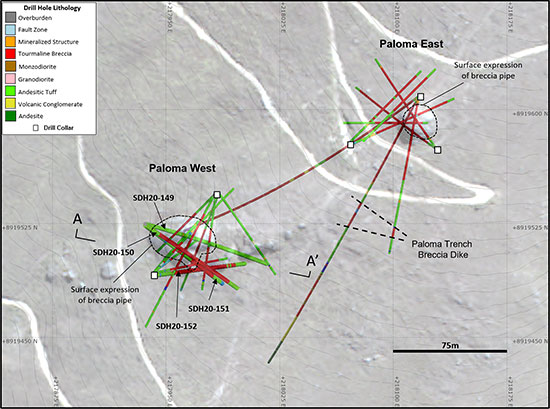

The Paloma target area consists of two mapped outcropping breccia pipes, Paloma East and Paloma West (Fig. 2) and at least one breccia dike. First-pass surface sampling encountered strongly anomalous gold at both Paloma breccia pipes as well as within several scattered small exposures of breccia and vein-like structures in the Paloma area. A strong time-domain electromagnetic geophysical anomaly is also coincident with Paloma.

Huancarama Target Area

The Huancarama Breccia Complex is located 300 metres south of and 400 metres lower than the deepest breccia intercept at Paloma. Within the complex there are five principal breccia bodies exposed at surface over approximately 200 metres (Fig. 5). There is a distinctive feature believed to be a collapse zone with dimensions of 50 metres by 30 metres. Unverified reports suggest that this may be a mine collapse, but it may also be a natural feature. The largest breccia body in the complex is H1 (approximately 60 metres in diameter). Two historic adits are in the complex, one trending north-northeast for 170 metres along the western side of H1, and a second shorter adit of 21 metres at H2. Surface sampling from the breccia bodies and channel sampling of the adits yield strongly anomalous gold results (see news release dated November 19, 2019). In addition to several targets within the complex, numerous targets exist between Huancarama and Paloma.

About Chakana Copper

Chakana Copper Corp is a Canadian-based minerals exploration company that is currently advancing the high-grade gold-copper-silver Soledad Project located in the Ancash region of Peru, a highly favorable mining jurisdiction with supportive communities. The Soledad Project consists of high-grade gold-copper-silver mineralization hosted in tourmaline breccia pipes. A total of 33,353 metres of drilling has been completed to-date, testing nine (9) of twenty-three (23) confirmed breccia pipes with more than 92 total targets. Chakana’s investors are uniquely positioned as the Soledad Project provides exposure to several metals including copper, gold, and silver. For more information on the Soledad project, please visit the website a www.chakanacopper.com.

Sampling and Analytical Procedures

Chakana follows rigorous sampling and analytical protocols that meet or exceed industry standards. Core samples are stored in a secured area until transport in batches to the ALS facility in Callao, Lima, Peru. Sample batches include certified reference materials, blank, and duplicate samples that are then processed under the control of ALS. All samples are analyzed using the ME-MS41 (ICP technique that provides a comprehensive multi-element overview of the rock geochemistry), while gold is analyzed by AA24 and GRA22 when values exceed 10 g/t by AA24. Over limit silver, copper, lead and zinc are analyzed using the OG-46 procedure. Soil samples are analyzed by 4-acid (ME-MS61) and for gold by Fire Assay on a 30g sample (Au-ICP21).

Results of previous drilling and additional information concerning the Project, including a technical report prepared in accordance with National Instrument 43-101, are made available on Chakana’s SEDAR profile at www.sedar.com.

Qualified Person

David Kelley, an officer and a director of Chakana, and a Qualified Person as defined by NI 43-101, reviewed and approved the technical information in this news release.

ON BEHALF OF THE BOARD

(signed) “David Kelley”

David Kelley

President and CEO

For further information contact:

Joanne Jobin, Investor Relations Officer

Phone: 647 964 0292

Email: jjobin@chakanacopper.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking Statement Advisory: This release may contain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of Chakana to be materially different from any future results, performance, or achievements expressed or implied by the forward looking statements. Forward looking statements or information relates to, among other things, the interpretation of the nature of the mineralization at the Soledad copper-gold-silver project (the “Project”), the potential to expand the mineralization, and to develop and grow a resource within the Project, the planning for further exploration work, the ability to de-risk the potential exploration targets, and our belief in the potential for mineralization within unexplored parts of the Project. These forward-looking statements are based on management’s current expectations and beliefs but given the uncertainties, assumptions and risks, readers are cautioned not to place undue reliance on such forward- looking statements or information. The Company disclaims any obligation to update, or to publicly announce, any such statements, events or developments except as required by law.

Figure 1 – View looking north showing breccia pipes and occurrences within the northern Soledad cluster. Pipes that have been drilled in previous campaigns are shown in red. Targets shown in green are the focus on this 15,000m drill campaign. Other pipes and occurrences remain to be tested by drilling. Additional breccia pipes occur on the south half of the property and are not shown here.

Figure 2 – Map showing location of outcropping Paloma East and Paloma West breccia pipes and drill hole lithology in holes completed to date. Red represents tourmaline breccia. Location of section line for Figure 3 indicated.

Figure 3 – Section looking north-northeast highlighting the drill holes at Paloma West reported in this release. Light red 3D shape shows approximate shape of breccia based on the first thirteen holes.

Figure 4 – Detailed core photos from Paloma West: SDH20-150 (79.4m) quartz-chalcopyrite-pyrite-tourmaline cemented breccia; SDH20-151 (46.6m) mosaic breccia replaced by chalcopyrite-pyrite; SDH20-151 (89.3m) mosaic breccia with chalcopyrite-pyrite cement and late euhedral pyrite replacement; SDH20-152 (34.85m) chaotic shingle breccia with chalcopyrite-pyrite cement; F) SDH20-152 (41.9m) shingle breccia with chalcopyrite-pyrite cement.

Figure 5 – Drone image looking northeast at the Huancarama Breccia Complex showing the five principal tourmaline breccia bodies exposed at surface (H1-H5), historic adit portal, and drill platforms. Note drill rig in center of image.

SOURCE: Chakana Copper