Aurania Confirms Significant Amounts Of High-Tech Metals In Tiria-Shimpia Samples

Toronto, Ontario, May 25, 2021 – Aurania Resources Ltd. (TSXV: ARU) (OTCQB: AUIAF) (Frankfurt: 20Q) (“Aurania” or the “Company”) reports that laboratory assays have confirmed the presence of the high-tech metals, gallium (“Ga”) and indium (“In”) in significant amounts in rock-chip samples from the Tiria-Shimpia target in the Company’s Lost Cities – Cutucu Project (“Project”) in southeastern Ecuador.

Gallium and indium are known to substitute for zinc in the structure of sphalerite (zinc sulphide mineral), and sulphidic zinc ores are a major source of these by-product metals. Because of the growing usage in certain high-tech applications such as smartphones and solar cells, they are rapidly becoming economically important, and supply security-related concerns are reflected in their identification as critical raw materials. Gallium is used in gallium arsenide (“GaAs”) semiconductor chips, and its unique properties enable electrons to pass through faster than in conventional silicon chips. It is used to support 5G technologies.

Next generation GaAs semiconductors promise to bring a huge market, not totally replacing the existing semiconductor market, but ultimately making a huge dent in it. The ability to replace silicon semiconductors, a market that is $500 billion dollars in 2020 makes one sit up and take notice. The existing silicon semiconductor market is a pretty good size for a market that barely existed in 1975. Next generation GaAs support the signal speed that is needed to implement 5G. (Business Wire, March 4, 2020).

It has been well-publicized that there is currently a worldwide shortage of GaAs semiconductor chips. Partly this is due to shutdown of bauxite mining operations in Shanxi province in China in 2019, due to environmental concerns, where gallium is produced as a by-product of alumina. Bauxite from outside of China typically does not contain recoverable levels of gallium: https://roskill.com/news/gallium-price-floor-set-to-rise-in-2021. Whatever the situation, it would appear that gallium supply is inelastic.

So far, sampling at Tiria-Shimpia has produced maximum values of 163 parts per million (“ppm”) for gallium and 39 ppm for indium. These high values are associated with high silver and zinc grades in rock-chip samples (Table 1). According to Kitco Metals (https://www.kitco.com/strategic-metals/), the gallium price has ranged between approximately US$200 to US$534 per kilogram (“kg”) over the past five years. The Indium price is reported by Kitco Metals to US$290 to US$490 per kg over the past five years.

It should be made clear that the Company has not performed any metallurgical testing to date to determine the extent to which these metals are recoverable in any quantity, if at all.

About the Area

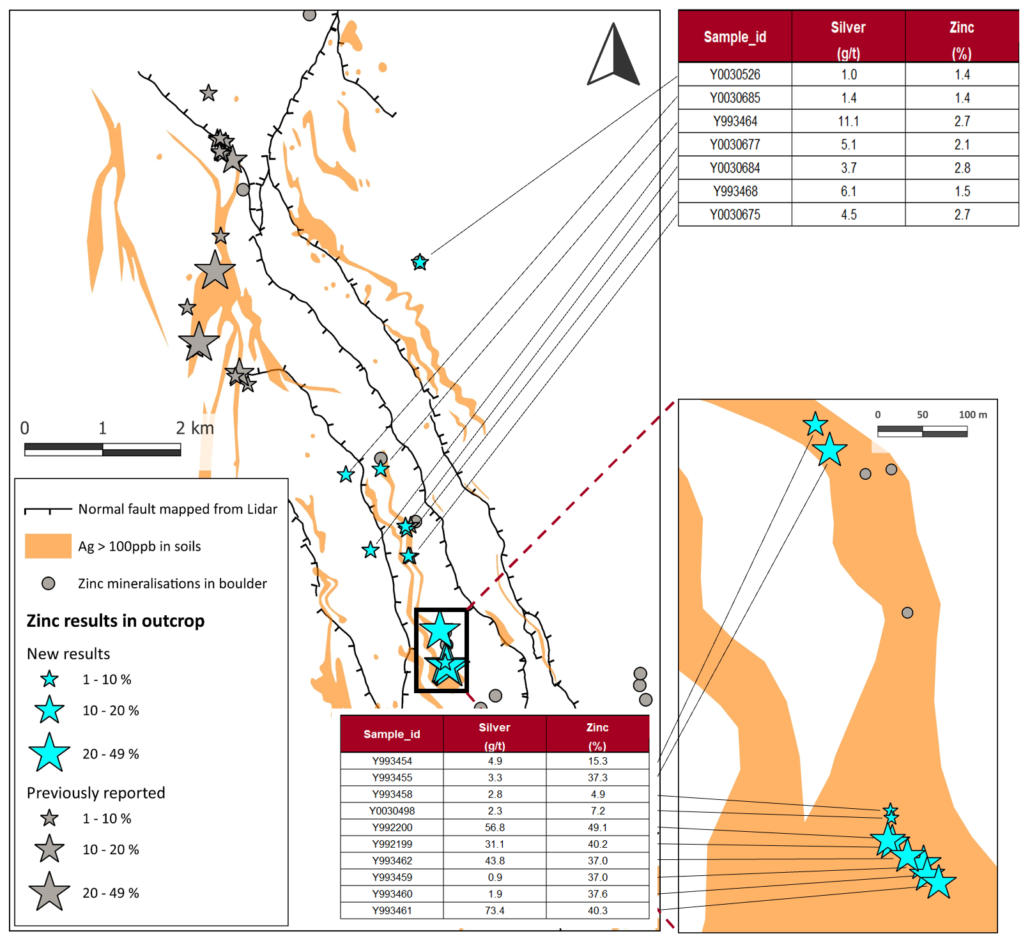

Gallium and indium values are concentrated in the central part of the Tiria-Shimpia target in an area approximately 500 metres long, that remains open to the south. Elevated gallium and indium are found in crackle-brecciated limestone that contains veins of sphalerite and barite, associated with high values in silver and zinc reported in prior press releases dated May 21, 2021.

Table 1. Summary of rock-chip samples from the Shimpia central area.

| Sample Number | Gallium | Indium | Silver | Zinc |

| (g/t) | (g/t) | (g/t) | (%) | |

| Y993462 | 163 | 9.6 | 43.8 | 37.0 |

| E797971 | 160 | 38.6 | 6.3 | 25.9 |

| Y992200 | 154 | 14.9 | 56.8 | 49.1 |

| Y993461 | 132 | 33.7 | 73.4 | 40.3 |

| Y992199 | 109 | 0.9 | 31.1 | 40.2 |

| Y993454 | 31 | 5.9 | 4.9 | 15.2 |

Sample Analysis & Quality Assurance / Quality Control (“QAQC”)

Laboratories: The rock samples were prepared for analysis at MS Analytical (“MSA”) in Cuenca, Ecuador, and the analyses were done in Vancouver, Canada.

Sample preparation: The rock samples were jaw-crushed to 10 mesh (crushed material passes through a mesh with apertures of 2 millimetres (“mm”)), from which a one-kilogram sub-sample was taken. The sub-sample was crushed to a grain size of 0.075mm and a 200 gram (“g”) split was set aside for analysis.

Analytical procedure: Approximately 0.25g of rock pulp underwent four-acid digestion and analysis for 48 elements by ICP-MS. For the over-limit samples, those that had a grade of greater than 1% copper and 100g/t silver, 0.4 grams of pulp underwent digestion in four acids and the resulting liquid was diluted and analyzed by ICP-MS.

QAQC: Aurania personnel inserted a certified standard pulp sample, alternating with a field blank, at approximate 20 sample intervals in all sample batches. Aurania’s analysis of results from its independent QAQC samples showed the batches reported on above, lie within acceptable limits. In addition, the labs reported that the analyses had passed their internal QAQC tests.

Qualified Person

The geological information contained in this news release has been verified and approved by Jean-Paul Pallier, MSc. Mr. Pallier is a designated EurGeol by the European Federation of Geologists and a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators.

About Aurania

Aurania is a mineral exploration company engaged in the identification, evaluation, acquisition and exploration of mineral property interests, with a focus on precious metals and copper in South America. Its flagship asset, The Lost Cities – Cutucu Project, is located in the Jurassic Metallogenic Belt in the eastern foothills of the Andes mountain range of southeastern Ecuador.

Information on Aurania and technical reports are available at www.aurania.com and www.sedar.com, as well as on Facebook at https://www.facebook.com/auranialtd/, Twitter at https://twitter.com/auranialtd, and LinkedIn at https://www.linkedin.com/company/aurania-resources-ltd-.

For further information, please contact:

| Carolyn Muir

VP Investor Relations Aurania Resources Ltd. (416) 367-3200 |

Dr. Richard Spencer

President Aurania Resources Ltd. (416) 367-3200 |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain forward-looking information that involves substantial known and unknown risks and uncertainties, most of which are beyond the control of Aurania. Forward-looking statements include estimates and statements that describe Aurania’s future plans, objectives or goals, including words to the effect that Aurania or its management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to Aurania, Aurania provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to Aurania’s objectives, goals or future plans, statements, exploration results, potential mineralization, the corporation’s portfolio, treasury, management team and enhanced capital markets profile, the estimation of mineral resources, exploration, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, regulatory, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, the effects of COVID-19 on the business of the Company including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restrictions on labour and international travel and supply chains, and those risks set out in Aurania’s public documents filed on SEDAR. Although Aurania believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Aurania disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

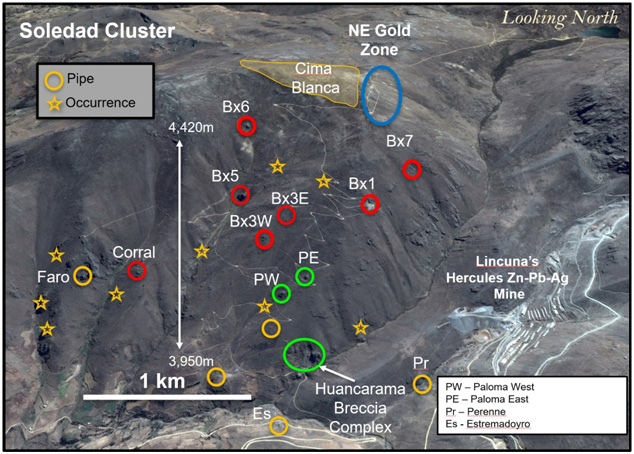

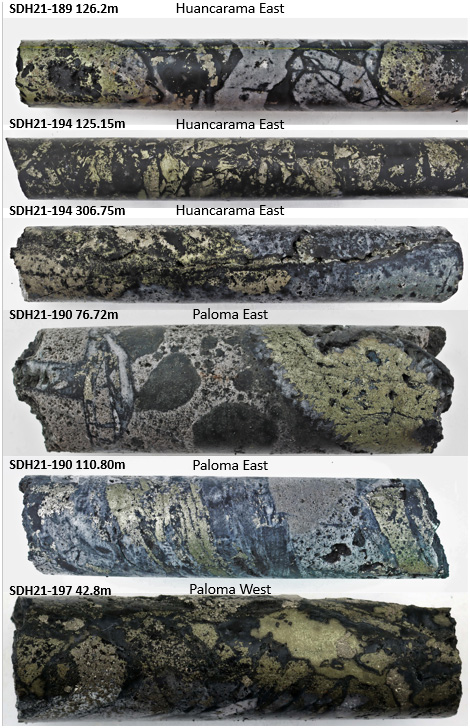

Figure 4 – Select core photos from Huancarama, Paloma East, and Paloma West reported in this release: SDH21-189 (126.2m) mosaic and jigsaw tourmaline breccia with sulfide cement; SDH21-194 (125.15m) mosaic breccia with selective clast replacement by chalcopyrite and pyrite; SDH21-194 306.75m tourmaline breccia with late chalcopyrite replacement along vein; SDH21-190 (76.72m) tourmaline breccia with chalcopyrite filling open space; SDG21-190 (110.80) shingle breccia with selective chalcopyrite replacement of shingle clasts; SDH21-197 (42.8m) mosaic tourmaline breccia with selective clast replacement and open space filling by chalcopyrite and pyrite. Core diameter is 6.35cm (HQ) in all instances.

Figure 4 – Select core photos from Huancarama, Paloma East, and Paloma West reported in this release: SDH21-189 (126.2m) mosaic and jigsaw tourmaline breccia with sulfide cement; SDH21-194 (125.15m) mosaic breccia with selective clast replacement by chalcopyrite and pyrite; SDH21-194 306.75m tourmaline breccia with late chalcopyrite replacement along vein; SDH21-190 (76.72m) tourmaline breccia with chalcopyrite filling open space; SDG21-190 (110.80) shingle breccia with selective chalcopyrite replacement of shingle clasts; SDH21-197 (42.8m) mosaic tourmaline breccia with selective clast replacement and open space filling by chalcopyrite and pyrite. Core diameter is 6.35cm (HQ) in all instances.