Garibaldi Mobilizes Exploration Crews

Vancouver, British Columbia, June 1, 2021 – Garibaldi Resources (TSXV: GGI) (the “Company” or “Garibaldi”) is pleased to announce that exploration personnel have been deployed to the Company’s camp at km 45 on the Eskay Creek road. The flagship E&L nickel-copper-cobalt massive sulphide project remains the primary focus, followed by volcanogenic-massive-sulphide (VMS) precious-metal targets within the Hazelton Group. Geophysical surveys over Nickel Mountain and the VMS prospective Palm Springs claims, are now underway.

The first stage includes two specialized airborne surveys. ZTEM, a deep penetrating electro-magnetic (EM) airborne sensor to track conductive high-grade E&L intrusions. SkyTEM, designed to identify structures with prospective stratigraphy for the discovery of Eskay Creek style VMS precious-metal mineralization. Data from both surveys will be processed rapidly to aid interpretation for exploration (See news release dated May 6, 2021).

Garibaldi’s planned diamond drill program will focus on extending the E&L mineralized gabbro along trend, for new massive sulphide discoveries. Beyond Nickel Mountain, crews will sample geophysical and geochemical VMS target areas over the remainder of Garibaldi’s claims for base and precious metals. This includes alteration zones and outcrops identified by World view3 satellite remote sensing. Significant VMS targets at various stages include the following prospects:

VMS Gold Targets

- Casper, Four shallow diamond drill holes tested the quartz vein discovery in 2020, each hole intercepted gold mineralization. The polymetallic quartz vein with select channel sample assays of up to 249 g/t (8. oz) gold, is at low elevation, within 1.4 km from roads and hydroelectric facilities. The mineralized system’s strike length is over 500 meters and open along strike. (see news releases Feb.12, 2021, Nov.16, Sept.29, Sept.22, Feb 28, 2020)

- Palm Springs, Previous work has identified VMS potential at Palm Springs, where a significant portion of the claims are mapped as Eskay Creek facies. The geochemical profile includes elevated arsenic, antimony, mercury, gold, zinc and copper, with realgar and orpiment within a major quartz breccia zone. The rhyolitic volcanics appear to be underlain by black siltstones and volcanoclastics. In addition, two separate geophysical VTEM anomalies one km apart makes this area a high priority VMS exploration target.

- Triple Faults, The Harrymel-Unuk (H-U) fault is a dominant feature bisecting the Palm Springs claims. Exploration will focus along a projected 6 km wide VMS trend, extending 3km on either side of the H-U fault. A clastic sequence within 2 km of a large-scale fault is a key prospective feature observed by Kyba-Nelson of the B.C. Geological Survey in their 2015 Red-line paper on NW B.C. deposits. Coupled with new stratigraphic interpretation of the district, VMS target areas will undergo detailed evaluation programs.

- Eskay North, The claims border the historic Eskay Creek mine which is 2,500 meters southwest from Garibaldi’s claim boundary. The high-grade Eskay Creek 21 zones strike northeast towards Eskay North which is covered by the Bowser Lake Group, of unknown thickness. Garibaldi’s ZTEM survey will provide deep penetration of the Bowser and search beneath for the projected Hazelton group which hosts the mineralization at the Eskay Creek Mine. (Minfile 104 B 008 Eskay Creek)

Battery Metals & Gold

Garibaldi’s 100% owned Eskay claim Group is 180 sq. kms of highly prospective claims, resulting from the consolidation of Nickel Mountain, Palm Springs and Eskay North in 2016. The battery-metal rich E&L magmatic nickel-copper-cobalt massive sulphide discovery is a high value proposition surrounded by a multitude of base and precious-metal outcrops of nickel-copper-zinc-gold-silver and platinum group metals. The escalating global green revolution will require all these metals to feed rising demand from new battery technology for electric vehicles.

While Garibaldi’s primary focus is the foundational E&L nickel-copper-cobalt massive sulphide project, the Company’s Eskay Claim Group is centered within the Eskay gold camp, encircled by numerous recent precious metal rich discoveries by neighboring operators. Advanced structural, stratigraphic and remote sensing interpretation of Eskay district geology indicates strong potential for VMS related Eskay Creek style mineralization on Garibaldi’s Palm Springs claim block to the north of Nickel Mountain. Garibaldi’s abundant VMS precious metals potential offers an added bonus to shareholders, as rising inflation pressures gold and silver prices higher.

Steve Regoci, Garibaldi CEO, stated: “We’re anxious to receive the ZTEM and SkyTEM survey results as we prepare for drilling. Our top priority is to explore deeper and along trend at E&L, but we also have large numbers of exciting new nickel-copper and VMS gold targets to explore as well.

The growing demand for critical metal sources required to drive the new green economy, and precious metals to protect against increasing inflation, was the compelling vision for our entire pipeline of district scale projects. The advancing Eskay claim group ranks high for potential to deliver new discoveries as metal prices trend higher.”

Qualified Person

Jeremy Hanson, P.Geo., VP Exploration Canada for the Company and a qualified person as defined by NI- 43-101, has supervised the preparation of and reviewed and approved of the disclosure of information in this news release.

About Garibaldi

Garibaldi Resources Corp. is an active Canadian-based junior exploration company focused on creating shareholder value through discoveries and strategic development of its assets in some of the most prolific mining regions in British Columbia and Mexico.

We seek safe harbor.

GARIBALDI RESOURCES CORP.

Per: “Steve Regoci”

Steve Regoci, President

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or the accuracy of this release.

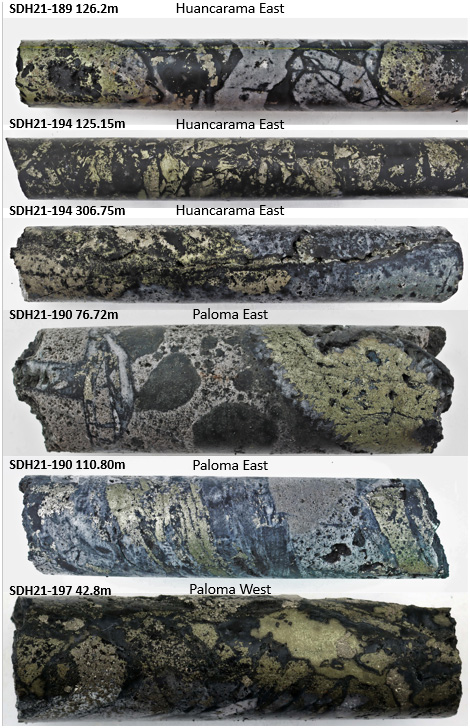

Figure 4 – Select core photos from Huancarama, Paloma East, and Paloma West reported in this release: SDH21-189 (126.2m) mosaic and jigsaw tourmaline breccia with sulfide cement; SDH21-194 (125.15m) mosaic breccia with selective clast replacement by chalcopyrite and pyrite; SDH21-194 306.75m tourmaline breccia with late chalcopyrite replacement along vein; SDH21-190 (76.72m) tourmaline breccia with chalcopyrite filling open space; SDG21-190 (110.80) shingle breccia with selective chalcopyrite replacement of shingle clasts; SDH21-197 (42.8m) mosaic tourmaline breccia with selective clast replacement and open space filling by chalcopyrite and pyrite. Core diameter is 6.35cm (HQ) in all instances.

Figure 4 – Select core photos from Huancarama, Paloma East, and Paloma West reported in this release: SDH21-189 (126.2m) mosaic and jigsaw tourmaline breccia with sulfide cement; SDH21-194 (125.15m) mosaic breccia with selective clast replacement by chalcopyrite and pyrite; SDH21-194 306.75m tourmaline breccia with late chalcopyrite replacement along vein; SDH21-190 (76.72m) tourmaline breccia with chalcopyrite filling open space; SDG21-190 (110.80) shingle breccia with selective chalcopyrite replacement of shingle clasts; SDH21-197 (42.8m) mosaic tourmaline breccia with selective clast replacement and open space filling by chalcopyrite and pyrite. Core diameter is 6.35cm (HQ) in all instances.