Travelzoo Reports Third Quarter 2020 Results

NEW YORK, October 21, 2020 – Travelzoo® (NASDAQ: TZOO):

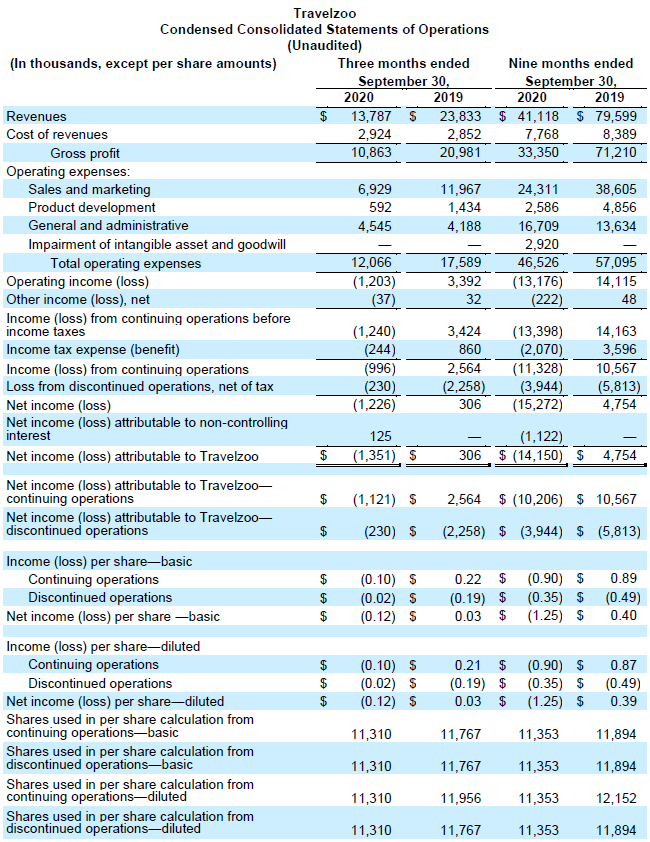

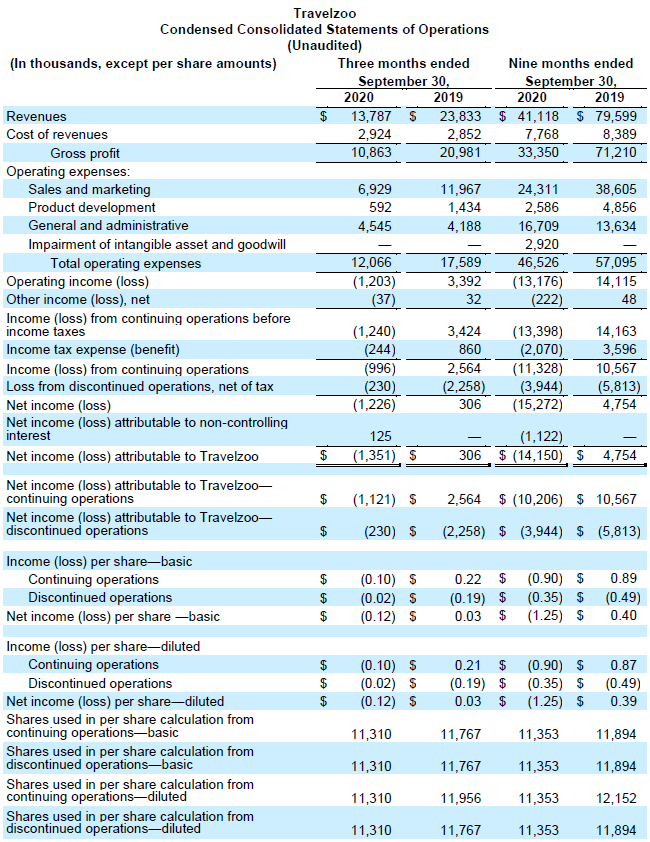

- Consolidated revenue of $13.8 million, down 42% from $23.8 million year-over-year

- Net loss of $1.2 million

- Non-GAAP consolidated operating profit of $1.2 million

- Earnings per share (EPS) of ($0.10) attributable to Travelzoo from continuing operations

Travelzoo, a global Internet media company that publishes exclusive offers and experiences for members, today announced financial results for the third quarter ended September 30, 2020. Consolidated revenue was $13.8 million, down 42% from $23.8 million year-over-year. Revenue increased by 97% from $7.0 million in Q2 2020. Reported revenue excludes revenue from discontinued operations in Asia Pacific. Travelzoo’s reported revenue consists of advertising revenues and commissions, derived from and generated in connection with purchases made by Travelzoo members.

The reported net loss attributable to Travelzoo from continuing operations was $1.1 million for Q3 2020. At the consolidated level, including minority interests, the reported net loss from continuing operations was $1.2 million. EPS from continuing operations was ($0.10), down from $0.21 in the prior-year period.

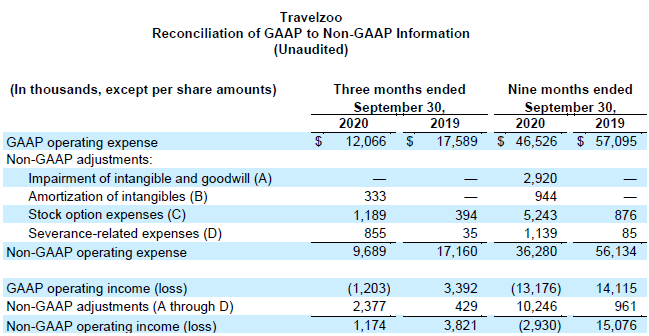

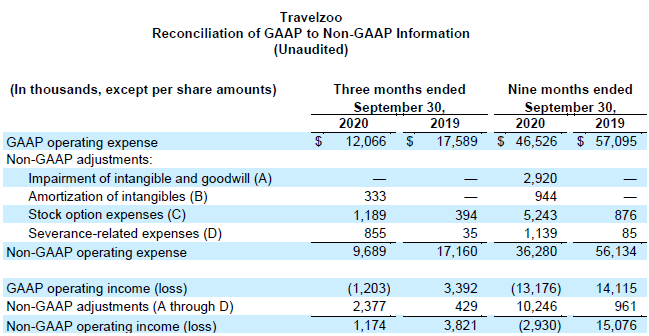

Non-GAAP operating profit was $1.2 million. The calculation of non-GAAP operating profit excludes amortization of intangibles ($0.3 million), stock option expenses ($1.2 million), and severance-related expenses ($0.9 million). See section “Non-GAAP Financial Measures” below.

“A strong improvement in our business is evident compared to Q2. We are seeing irresistibly priced deals coming to the market, and Travelzoo, as the most trusted media brand publishing and recommending travel deals, is telling its members about the very best deals”, said Holger Bartel, Global CEO.

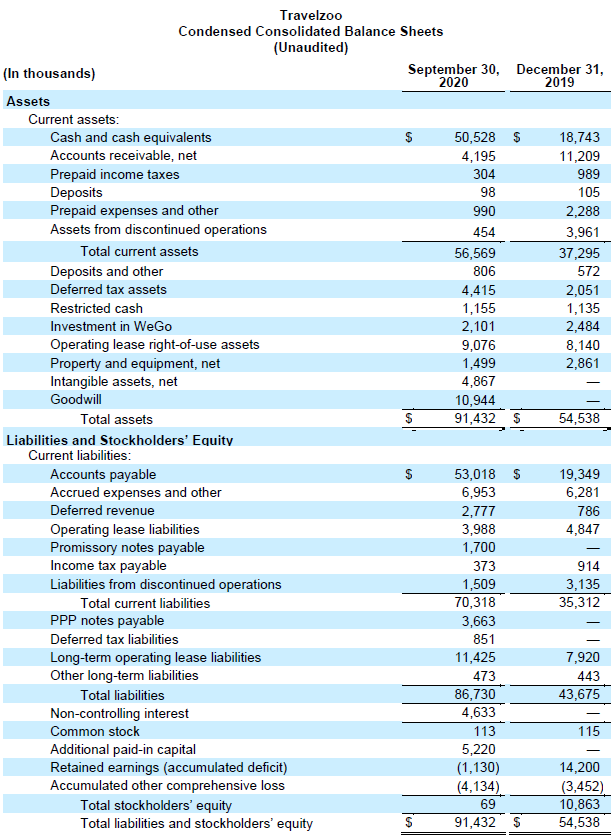

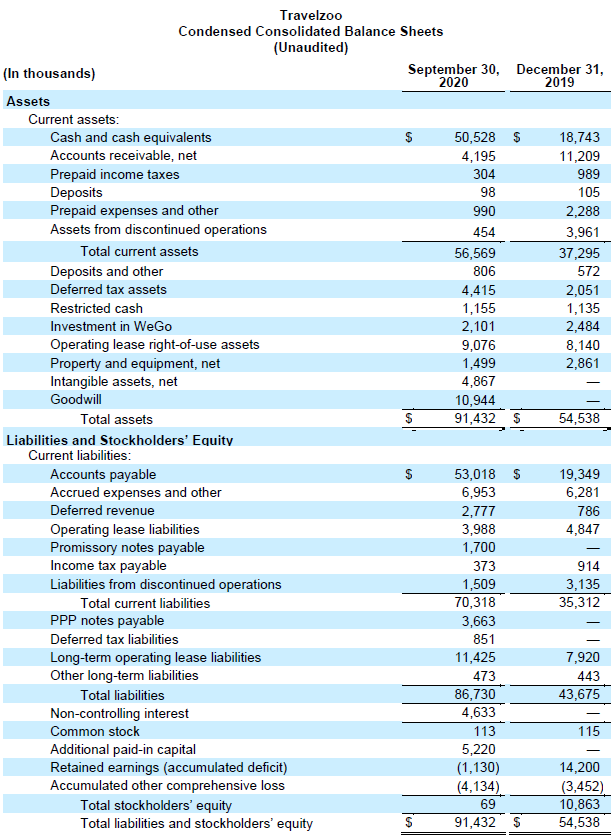

Cash Position

As of September 30, 2020, consolidated cash, cash equivalents and restricted cash were $51.7 million. In April 2020 and May 2020, Travelzoo received low-interest government loans under the Paycheck Protection Program (PPP) of $3.1 million and $535,000, respectively. No further applications for loans have been made since then and the company does not anticipate requiring any further loans.

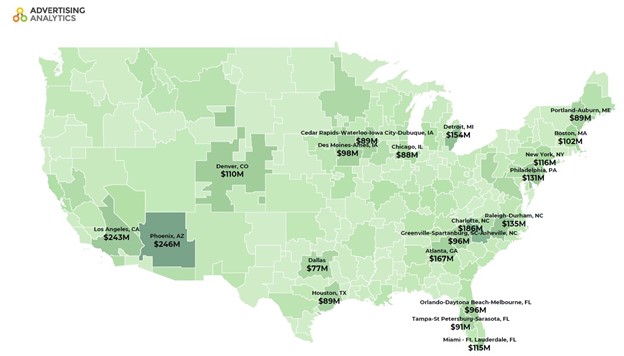

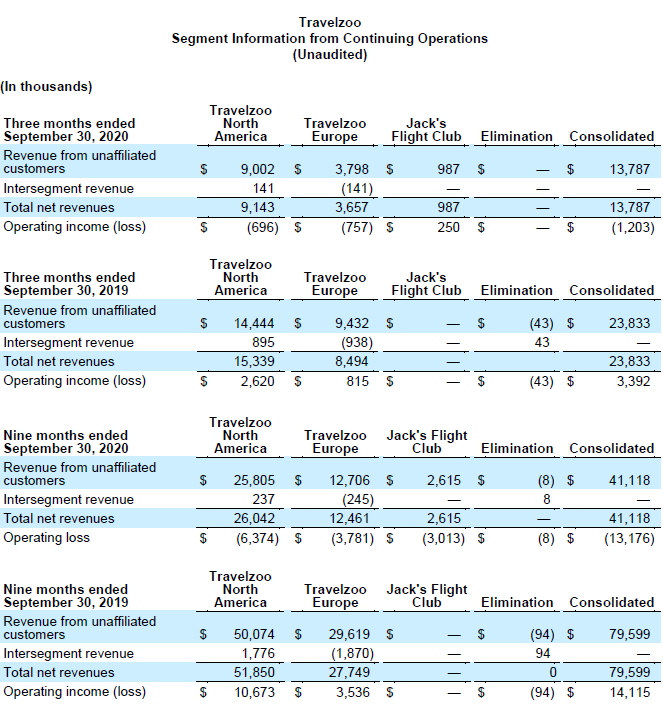

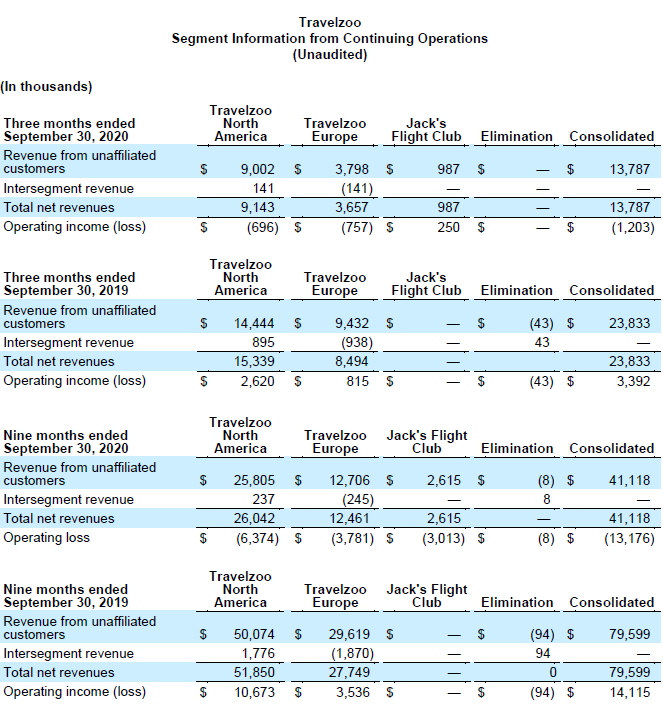

Travelzoo North America

North America business segment revenue decreased 40% year-over-year to $9.1 million. North America business segment revenue increased by 118% from $4.2 million in Q2 2020. Operating loss for Q3 was $696,000, or (8%) of revenue, compared to an operating profit of $2.6 million, or 17% of revenue in the prior-year period.

Travelzoo Europe

Europe business segment revenue decreased 57% year-over-year to $3.7 million. In constant currencies, revenue decreased 62% year-over-year. Europe business segment revenue increased by 97% from $1.9 million in Q2 2020. Operating loss for Q3 was $757,000, or (21%) of revenue, compared to an operating profit of $815,000, or 10% of revenue in the prior-year period.

Jack’s Flight Club

On January 13, 2020, Travelzoo acquired 60% of Jack’s Flight Club, a subscription service. In Q3 2020, the Jack’s Flight Club business segment generated $1.1 million in revenue from subscriptions with operating profit of $731,000. After consolidation with Travelzoo, Jack’s Flight Club’s net income was $312,000, with $187,000 attributable to Travelzoo as a result of recording $333,000 of amortization of intangible assets related to the acquisition and a haircut of revenue (derived from deferred revenue sold prior to acquisition) of $148,000 due to purchase accounting in accordance with U.S. GAAP.

Members and Subscribers

As of September 30, 2020, we had 30.5 million members worldwide. In Europe, the unduplicated number of Travelzoo members was 8.9 million as of September 30, 2020, down 3% from September 30, 2019. In North America, the unduplicated number of Travelzoo members was 16.5 million as of September 30, 2020, down 7% from September 30, 2019. Jack’s Flight Club had 1.7 million subscribers as of September 30, 2020, up 9% from September 30, 2019. In June 2020, Travelzoo sold its subsidiary in Japan, Travelzoo Japan K.K., to Mr. Hajime Suzuki. In connection with the sale, Travelzoo and Travelzoo Japan K.K. entered into a royalty-bearing licensing agreement for the exclusive use of Travelzoo members in Japan. In August 2020, Travelzoo sold its Singapore subsidiary to Mr. Julian Rembrandt and entered into a royalty-bearing licensing agreement for, among other things, the exclusive use of Travelzoo’s members in Australia, New Zealand and Singapore. Under the licensing agreements, Travelzoo’s existing members in Australia, Japan, New Zealand, and Singapore will continue to be owned by Travelzoo as the licensor.

Discontinued Operations

As announced in a press release on March 10, 2020, Travelzoo decided to exit its Asia Pacific business which in 2019 reduced EPS by $0.60. The Asia Pacific business was classified as discontinued operations at March 31, 2020. Prior periods have been reclassified to conform with the current presentation. Certain reclassifications have been made for current and prior periods between the continued operations and the discontinued operations in accordance with U.S. GAAP.

Income Taxes

Income tax benefit was $244,000 in Q3 2020, compared to an income tax expense of $860,000 in the prior-year period.

Non-GAAP Financial Measures

Management calculates non-GAAP operating income when evaluating the financial performance of the business. Travelzoo’s calculation of non-GAAP operating income, also called “non-GAAP operating profit” in this press release and today’s earnings conference call, excludes the following items: impairment of intangibles and goodwill, amortization of intangibles, stock option expenses, severance-related expenses. This press release includes a table which reconciles GAAP operating income to the calculation of non-GAAP operating income. Non-GAAP operating income is not required by, or presented in accordance with, generally accepted accounting principles in the United States of America (“GAAP”). This information should be considered as supplemental in nature and should not be considered in isolation or as a substitute for the financial information prepared in accordance with GAAP. In addition, these non-GAAP financial measures may not be the same as similarly titled measures reported by other companies.

Looking Ahead

We currently see a trend of recovery of our revenue. We have been able to reduce our operating expenses significantly. As a result of recovery of revenue and substantially lower operating expenses, we currently expect to achieve for Q4 a result close to break-even or a profit.

Conference Call

Travelzoo will host a conference call to discuss third quarter results today at 11:00 a.m. ET. Please visit http://ir.travelzoo.com/events-presentations to

- download the management presentation (PDF format) to be discussed in the conference call; and year-over-year

- access the webcast.

About Travelzoo

Travelzoo® provides our 30 million members insider deals and one-of-a-kind experiences personally reviewed by one of our deal experts around the globe. We have our finger on the pulse of outstanding travel, entertainment, and lifestyle experiences. For over 20 years we have worked in partnership with more than 5,000 top travel suppliers—our long-standing relationships give Travelzoo members access to irresistible deals.

Certain statements contained in this press release that are not historical facts may be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities and Exchange Act of 1934. These forward-looking statements may include, but are not limited to, statements about our plans, objectives, expectations, prospects and intentions, markets in which we participate and other statements contained in this press release that are not historical facts. When used in this press release, the words “expect”, “predict”, “project”, “anticipate”, “believe”, “estimate”, “intend”, “plan”, “seek” and similar expressions are generally intended to identify forward-looking statements. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements, including changes in our plans, objectives, expectations, prospects and intentions and other factors discussed in our filings with the SEC. We cannot guarantee any future levels of activity, performance or achievements. Travelzoo undertakes no obligation to update forward-looking statements to reflect events or circumstances occurring after the date of this press release.

Travelzoo and Top 20 are registered trademarks of Travelzoo.

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you