|

|

|

Cumulus Media (CMLS) CFO Frank Lopez-Balboa at NobleCon17 – Noble Capital Markets 17th Annual Small & Microcap Investor Conference – January 2021. Following the formal presentation, Noble Capital Markets Senior Research Analyst Michael Kupinski joins Frank to moderate a Q&A session. NobleCon 17 Complete Rebroadcast

|

Category: Media and Marketing

Industry Report – Digital, Media and Entertainment Industry – Are We There Yet?

Tuesday, January 12, 2020

Digital, Media & Entertainment Industry Report

Are We There Yet?

Michael Kupinski, DOR, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to end of report for Analyst Certification & Disclosures

Overview. Optimism grows as core advertising, which excludes Political advertising, seems stronger than what many analysts anticipated for the fourth quarter. We believe that analysts are getting ahead of their skis. 2021 will be a long and somewhat bumpy ride. In our view, there is a lot of noise around core advertising given the unprecedented amount of Political advertising. As such, we are not as sanguine as many about the advertising recovery. In our view, core advertising is not expected to recover to 2019 levels until 2022.

Television: Did the M&A market open earlier than expected? We believe that the TV stocks will be buoyed by the M&A market. But, we anticipate that 2021 will be bumpy. As the year 2021 closes, investors likely will focus on 2022 and the prospect of another banner Political year. Our favorite picks for 2021 focuses on two companies that have the financial flexibility to pursue acquisition fueled growth.

Radio: Why this is among our favorite sectors for 2021? Based on our estimates, the industry appears poised to outperform revenue growth across most media sectors in 2021. Furthermore, the average Radio stock is trading at roughly 9 times enterprise value to depressed 2021 cash flow estimates. While the multiple may appear high based on most recent trading multiples over the past five years (excluding 2020), the valuations appear to be compelling considering the strong double digit cash flow growth that is expected in an advertising recovery.

Publishing: Will there be fewer public publishers? Publishing stocks increased a strong 42.3% in the fourth quarter, outperforming the general market The takeover offer for Tribune came in on New Year’s Eve and, as such, the recent rise in the stock price was not reflective in the Q4 performance for the group.

Digital: The Pandemic had a varying impact. Surprising was the rapidity with which Digital advertising declined in 2Q and how quickly it recovered in 3Q (and into 4Q). In addition, there was a notable acceleration in the move toward ecommerce. We highlight one of our favorites, 1800FLOWERS.com. In addition, the esports industry went mainstream as broadcast networks sought content. We highlight one of recent recommendations, eSports Entertainment.

Overview

Are We There Yet?

Most investors are happy to see 2020 in the rearview mirror. The pandemic hit the industry hard, both in terms of fundamentals and stock prices. In terms of fundamentals, the media industry performed slightly better in the second half than the dire predictions made in the midst of the pandemic. Revenues rebounded from the disastrous second quarter, fueled by record breaking Political advertising. Many companies raised revenue and cash flow guidance in the third and fourth quarters due to the heavy Political advertising spend. But, even factoring out the huge influx of Political, advertising trends seemed to have improved. We caution investors, however, not to get over their skis on optimism. Political advertising, especially the level at which Political came in, created a substantial amount of noise around core advertising. The perceived momentum currently may not be as robust into 2021. The general economy is still reeling from store and restaurant closures and other restrictions. While a vaccine offers hope that there will be a return to “normalcy”, we remain cautious about the issues that will need to be addressed post pandemic. As such, investors who are optimistic that 2021 advertising returns to 2019 levels, may be like children on a long road trip asking “are we there yet?”

For instance, there appears to be a large number of potential bank foreclosures and forced evictions as Covid restrictions on evictions are relaxed. In addition, there appears to be little Congressional interest in additional financial support to families. This could disrupt consumer behavior in coming months. Furthermore, while everyone is hopeful of returning to 2019 revenue levels, we believe that a large number of businesses are not likely to return quickly and many may be permanently closed. Finally, there is a looming issue of what the government will do to help pay for the increased Pandemic-related expenses, implying tax hikes may be coming. There is a 96% correlation to advertising and discretionary spending. As such, tax hikes could potentially cut into consumer’s appetite to spend and, subsequently, advertising. While we anticipate continued improved revenue trends, we are not as sanguine about the advertising recovery in 2021, which we discuss later in this report.

On the stock front, for investors that were fortunate enough to buy media stocks during the midst of the pandemic, the returns were very strong. In the fourth quarter, particularly, media stocks increased on average 40%. Even with the strong performance in the second half of the year, most media stocks did not overcome the shortfall earlier in the year as Figure #1 illustrates. For the most part, media stocks are down modestly in the single digit percentages for the year, except for the Radio industry. There, despite the 33.5% increase in stock prices for the fourth quarter, the Radio stocks are still down a whopping 37%. Within the traditional media sectors, the publishing stocks performed the best, up nearly 34% for the year. This group benefited from the larger cap stocks in the industry, New York Times and News Corp. Both benefited from strong digital audience growth and digital revenue growth.

As we look forward toward 2021, Radio stocks appear to offer the best value and the most upside appreciation potential, assuming a continued advertising recovery. But, this industry is not without risks. Many of the Radio companies have heavy debt burdens, which may be tricky if the advertising recovery does not continue. For investors looking for a balance of leveraged returns in a return toward “normalcy”, our favorites are Gray Television, Entravision, and Travelzoo. For more risk tolerant investors, we encourage investors to take a look at eSports Entertainment, one of the few compelling growth segments of the media industry, focused on the gaming space.

Figure #1

Television Broadcast

Will M&A Buoy The Group In 2021?

The fundamentals of the television industry substantially improved in the fourth quarter, fueled by an extraordinary and unprecedented influx of Political advertising. Many companies raised Q4 guidance to reflect the strong Political advertising. To put the Political advertising numbers into perspective, for most broadcasters, Political advertising accounted for nearly 30% of total Q4 broadcast revenues. Comparatively, in 2016, Political advertising accounted for roughly 11% of total Q4 broadcast revenue. What makes the numbers so extraordinary is that Retransmission revenues in Q4 2016 were roughly 25% of total broadcast revenues and in Q4 2020 represented about 32%. In total, Political and Retransmission revenue accounted for roughly 62% of total television broadcast revenue. Cash flow margins, as measured by adjusted EBITDA, is expected to average in the high 30s percent range. The robust margins are expected to reflect the high margin Political advertising and the significant cost reduction efforts by companies striving to maintain cash flow during the Pandemic.

Some investors and analysts appear to be sanguine about the outlook for the TV fundamentals heading into 2021. We are not as optimistic. Some analysts point to the relatively healthy advertising environment, excluding Political. Given the large influx of Political, we believe that there is a lot of noise in the those core advertising numbers. We believe that key advertising categories, such as Auto, appear to be recovering nicely, with some broadcasters indicating that it was down a modest 3% to 8% in the fourth quarter. To put this into perspective, Auto was down as much as 75% in the second quarter. But, some large local advertising categories, such as restaurants, travel, and retail will take longer to return to 2019 levels, in our view. In addition, as we look forward toward the first quarter 2021, there will be some tough year earlier comps from the large influx of Political advertising from the Democratic primaries. Recall the unprecedented amount the Michael Bloomberg spent on the primaries? In January 2020, it was reported that he spent $300 million and $500 million in February.

Q1 and full year 2021 outlook

Consensus revenue estimates for the first quarter anticipate TV industry revenues falling 3.6% on average, which we believe to be optimistic. In our view, the estimates do not appear to fully reflect the absence of Political advertising, nor the lingering local economic impact from the pandemic. Our revenue estimate anticipates that the average TV company will report revenue declines in the range of 9.2%. The second quarter should reflect much stronger revenue trends given the easy comparable a year earlier, the midst of the economic shutdowns from the Covid pandemic. While we anticipate strong second quarter revenue, we do not believe that the recovering core advertising trends will be enough to offset the absence of Political advertising. As such, we anticipate that full year television advertising revenue on average will decline 7.3%. Our estimate is below that of consensus estimates that anticipate modest full year 2021 revenue decline on average 1%.

The deal market opens.

While television fundamentals appear to be still affected by the economic fallout from the Covid pandemic, the deal activity in the industry has picked up. This follows the surprising offer from E.W. Scripps to buy Ion Media on September 24. Ion Media was on the market prior to the development of the Covid pandemic early in 2020, but was pulled when economies were closed and Covid mitigation efforts unfolded. Scripps made a gutsy move to buy Ion in the midst of the pandemic and in spite of the lack of visibility on the economic and advertising recovery. More recently, the M&A environment seems to remain healthy given that Quincy Broadcasting and Meredith announced plans to sell TV stations. Investors turn their attention to the likely buyers, Gray Television and private equity firm, Apollo Capital. In our view, the sale of television stations will support public market valuations in the TV group.

Where do TV stocks go from here?

The Television stocks outperformed the general market in the fourth quarter with the Noble TV index up 39%, significantly outpacing that of the general market, as measured by the S&P 500 Index, up 10.8%. Unfortunately, the strong year end performance did not offset the weak performance earlier in the year. For the year, TV stocks are down 8.7% versus a 15.4% gain for the general market. The only stock that outperformed the group in both the fourth quarter and full year performance was Entravision. The EVC shares were up a significant 82.9% in the fourth quarter and 6.1% for the full year.

Despite challenges with the anticipated pace of the advertising recovery and the tough year earlier comparisons, we remain constructive on the television stocks. We believe that the TV stocks will be buoyed by the M&A market. But, we anticipate that 2021 will be bumpy. As the year 2021 closes, we believe that investors will once again focus on 2022 and the prospect of another banner Political year. The TV stocks typically do better the year prior to an election year, up an average 22%. Although, this was not the case in the last two elections. While many TV companies will focus on debt reduction given recent acquisitions, we believe that those with flexible balance sheets will turn toward M&A to enhance longer term growth potential. As Figure #2 illustrates, there are several companies with relatively low leverage, including Gray Television and Entravision that appear poised for accelerated growth through acquisitions. As such, our current favorites are Entravision and Gray Television.

Figure #2

Radio Broadcast

Why this is one of our favorite sectors for 2021?

Based on consensus estimates, fourth quarter revenues are expected to show substantial sequential quarterly improvement from the third quarter, down roughly 12% versus an average 22% decline in the third quarter. The improvement is expected to reflect a sizable boost from Political advertising, although Television gets the lion share of Political dollars. Broadcasters that have digital, podcasting, and diversified operations, likely will perform better than those industry averages. Digital, which for many radio broadcasters includes podcasting, appears to be growing revenues in the double digits. Overall, the industry revenue decline for 2020 is likely to be among the weakest in the media space. The stock prices likely reflect this reality (which is discussed later in this report).

Looking forward toward 2021, Radio may have one of the best revenue recoveries in the media space. This is largely due to the fact that the industry does not have as difficult Political comps as others. Even though Political was at record levels for Radio in 2020, it still accounted for only 4% of total 2020 Radio revenues. While this is up from roughly 3% in the past, it is not a large nut to overcome given the prospects of a rebound in advertising. To put this into perspective, Political advertising for Television accounted for as much as 30% of total revenues. We do believe that consensus revenue estimates for 2021 may be a little high. The average consensus revenue growth is expected to be 13.5%, a revenue growth estimate that does not anticipate that the industry revenue in 2021 achieves that of 2019. Our 2021 Radio revenue estimate is 7.3%. Nonetheless, we believe that the revenue trends appear favorable. But, revenue will be lumpy. The strongest revenue growth quarter will be the second quarter, which will be up against the easy comps from the year earlier depth of the pandemic. Q2 2020 revenues were down in the range of 55% to 65%.

The improving revenue and, subsequently, cash flow trends will be a welcome relief to many Radio companies with stretched balance sheets. 2021 cash flow is expected to have strong double digit growth, in excess of 20%. As Figure #3 illustrates, the average debt to trailing cash flow for the industry is an historically high 11.1 times. Many companies managed through the pandemic either with government loans or concessions on debt covenants. Yet, there were some Radio companies that were able to manage through without tripping covenants. We believe that most companies will be able to quickly pare down debt and debt to cash flow levels will drop to be an average 6 times by the end of 2022. The industry has managed with the relatively high 6 times handle before.

Will Radio stocks recover?

As Figure #5 illustrates, the Radio stocks had a strong rebound in the fourth quarter, up 33.5%, as measured by the Noble Radio Index. But this strong performance was below that of many media sectors including TV, up 39%, and Publishing, up 42.3%. Nonetheless, some of the strongest performers in the industry in the fourth quarter were the larger radio groups including Cumulus Media, up 62.9%; iHeart Media, up 57.5%; and, Entercom, up 52.2%. Townsquare Media increased a strong 43.1%. These companies outperformed the Radio Index and many companies across the media spectrum. The remaining publicly traded stocks traded below the Noble Radio Index.

As illustrated in our Radio comp table, the average Radio stock is trading at roughly 9 times enterprise value to depressed 2021 cash flow estimates. While the multiple may appear high based on most recent trading multiples over the past five years (excluding 2020), the valuations appear to be compelling considering the strong double digit cash flow growth that is expected in an advertising recovery. As such, the Radio stocks represent among our favorite sector for 2021.

Figure #3

Publishing

Will there be fewer public Publishers?

The fundamentals of the Publishing industry varies by company and depends upon which side of the Digital divide the company is on. Some companies, like The New York Times, have transitioned well toward a Digital driven model. Nonetheless, the Publishing industry’s transition toward Digital accelerated during the Pandemic. Unique visitors and Digital subscriptions accelerated as travel-restricted consumers sought news and information about Covid and the Presidential elections. Despite the double digit revenue growth for Digital advertising and subscriptions for some Publishers, total revenues are expected to decline in the range of 20%. National publishers, however, may see modest single digit declines in revenues.

Importantly, many in the industry are reengineering cost structures. While the Pandemic caught many media companies flatfooted without cost mitigation strategies to maintain cash flow, many Publishing companies simply accelerated cost reduction plans already in place. The Pandemic allowed many companies to reduce the office footprint or renegotiate office leases at much lower rates. As a result, many Publishers have actually exceeded cash flow expectations. Tribune Publishing is a good example of this. The company recently raised fourth quarter and full year 2021 cash flow guidance. As we look toward 2021, we anticipate that revenue trends will significantly moderate, especially since Digital revenues represent almost 50% of revenues for many Publishers. Cash flow for the industry should improve as cost mitigation efforts flow through to a full year of operations.

Investors are focused on the recent offer by the Alden Group for the remaining 68% of the shares of Tribune Publishing that it does not own. The $14.25 per share offer follows the company’s closing on the sale of BestReviews, which bolstered the company’s already strong cash position. Based on our estimates, Tribune is expected to end 2020 with as much as $220 million in cash and virtually no debt. We wonder how serious the Alden Group is about acquiring Tribune. We believe that it is likely that independent board members will reject the low ball offer. The question will be whether the Alden Group will increase its offer to levels that reflect the intrinsic value of the company. Given that the company raised cash flow expectations, we have raised our price target to $20.75. In our view, a value representing a 10% to 15% discount to our price target would be a reasonable take-out valuation.

The takeover offer for Tribune came in on New Year’s Eve and, as such, the recent rise in the stock price was not reflective in the Q4 performance for the group. Nonetheless, Publishing stocks increased a strong 42.3% in the fourth quarter, boosted by a 145.4% increase in the stock price of Gannett in the quarter. The GCI shares began the upward trend following the company’s 10Q filing on November 2, as investors concerns over the company’s high debt leverage were assuaged. In addition, the company significantly reduced headcount through a large employee buyout in November.

As we look forward toward 2021, we view the shares of Tribune as among our favorite plays. In our view, the company has a large cash position to fund accretive acquisitions. We place the probability of the Alden Group raising its offer to a range we believe would be reasonable as low. The TPCO shares currently trade at less than 3 times Enterprise Value to cash flow, as measured by adjusted EBITDA. This valuation varies from the multiple listed in Figure #4, a valuation that reflects only EBITDA. We believe that the TPCO shares stand on its own with significant cash flow and a large cash position.

Figure #4

Figure #5

Digital Media & Technology

Digital Advertising Recovers Quickly; Gaming and Podcast M&A Ramp Up

A year ago we wrote that over the previous decade online advertising as a share of all advertising had more than tripled to 50%, up from just 15% of advertising at the start of the decade. Our expectation was that this trend would continue. What we could not foresee then was that a global pandemic that would redefine how we went about our everyday life. Businesses were required to close offices and shut down brick and mortar outlets and find ways to conduct business virtually. The pandemic forced people to work from home and businesses to accelerate their digital transformation. Ecommerce provided a much needed source of revenues to offset the loss of in-store sales, and, after a 2Q pause in online advertising, businesses increased their use of digital media to promote and drive traffic to their own ecommerce operations.

If 2020 surprised us in two ways, it was 1) the rapidity with which advertising declined in 2Q, and 2) how quickly it recovered in 3Q (and into 4Q). While traditional advertising mediums such as TV (-35%), radio (-48%), outdoor (-37%) and newspaper (-44%) advertising really struggled in 2Q 2020 (just after the pandemic started), online advertising (-3%) held up remarkably well. Within online advertising, it was a bifurcated market: Advertising revenues at Google (-8%) and Facebook’s (+11%) decreased by 2% on a combined basis while revenues from all other publicly traded online advertising companies decreased by a combined 16%. Advertising results in 3Q were encouraging, particularly as those trends continued into 4Q. At traditional media companies, revenues moderated substantially, while at online advertising companies, revenues returned to mid-teens growth (+13%). Again, the online advertising marketplace was bifurcated, with online advertising at Google (+10%) and Facebook (+22%) growing a combined +14%, while online advertising from all others increased by 7%. If there is a silver lining to the advertising struggles of 2020, it is that we foresee the “mother of all easy comparisons” in 2Q 2021 combined with the benefits of vaccine distribution which should enable the beginnings of an economic recovery.

Two Trends to Watch in 2021: Connected TV Advertising and Retail Media

The pandemic accelerated a number of technology trends, from the use of online groceries to the consumption of multiplatform gaming services to increased viewing on streaming services. Viewing habits have been evolving for years, but online video platforms greatly benefited from work at home requirements. Over the last 4 years, nearly 19 million fewer homes now receive pay television services, according to Leichtmann Research Group, which tracks quarterly changes to subscriber counts. The biggest declines have come from satellite TV providers (11.9 million fewer homes). These declines have been offset somewhat by virtual MVPDs (multi-channel video providers) such as Hulu, Sling TV, and FuboTV.

Connected TV (CTV): Forced to stay at home, consumers have migrated to subscription video on demand (SVOD) platforms such as Netflix and Disney+. Fortunately for advertisers, advertising on demand (AVOD) services have also benefited from a migration of consumers to their platforms. AVOD combines the premium viewing environment of television with data-driven targeting of online advertising. AVOD service providers include TubiTV, PlutoTV, Vudu, Crackle, Peacock, as well as connected TV device makers such as Roku and Samsung. AVOD doesn’t begin to replace linear TV viewing and advertising, but it acts as a strong complement by providing incremental reach as linear TV’s reach continues to erode.

Connected TV (or CTV) advertising is relatively small, but its future is bright. During its third quarter conference call, The Trade Desk (TTD) noted that “our CTV spend grew more than 100% year-over-year in the third quarter as advertisers follow consumers to streaming platforms. eMarketer forecasts that connected TV advertising grew by 27% to $8.1 billion in 2020 and will grow by another 40% to $11.4 billion in 2021.

Retail Media: The pandemic related surge in ecommerce sales has also led to accelerated growth in retail media (also known as ecommerce channel advertising). Retail media is display or search ads that appear on retailer platforms and direct users to products available for purchase there. Amazon is the best situated company in this sector and is the main supplier of retailer media outside of China (where retailer media is already well established).

Following in the footsteps of Amazon’s fast growing advertising business are retailers like Walmart, Target, eBay and Kroger, all of whom are looking outside their core business for growth and have found it in digital advertising. Each of these companies has the requisite scale to compete for advertising dollars, as well as first-party customer data. Most are now building the technology in-house to further expand profit margins in this sector. Sponsored product advertising is the most prevalent form of retail media advertising, and it is estimated that Amazon has a 75% share of this market.

eMarketer projects that marketers will spend $17.4 billion on advertising on ecommerce sites in 2020, a 38% increase over 2019. While this type of advertising benefited from the pandemic, it is also being driven by the “cookie-less” online advertising future in which it becomes harder to track users. Ecommerce sites have the advantage of first party shopping and intent data plus attribution capabilities for measurement and optimization. Expect to hear more from this sector in the future.

Another Year of Strong Stock Price Returns in the Internet and Digital Media Sectors

Earlier we noted the upcoming easy comparisons in 2Q 2021, which could help explain why advertising related stocks continued to bounce back in the fourth quarter. All three segments of Noble’s Internet and Digital Media sectors, where advertising is the primary revenue stream, performed well in 4Q 2020. Noble’s Ad Tech (+63%) and Digital Media (+18%) significantly outperformed the S&P 500 (+12%), while Social Media (+9%) performed slightly below. Only the non-advertising related stocks, those in the MarTech space, underperformed (+0%).

One of the companies that we follow,1800FLOWERS.com, significantly benefited from the surge in ecommerce and gifting in the midst of the pandemic. In its fiscal first quarter end September, revenues surged 51.6%. In our view, the spike in activity will be long lasting as it has significantly enhanced the company’s customer acquisition. The FLWS shares increased 5.6% in the fourth quarter, contributing to 12 month performance of an astonishing 84.5% gain. While revenue and earnings comparisons will be difficult against the Pandemic spurred growth, we believe that contributions from its recent acquisition of Personalizationmall.com will enhance the company’s long term growth. In addition, the strong fundamentals over the past several quarters have significantly improved its financial position, which should allow the company to make future revenue growth investments. We continue to view the FLWS shares among our favorites in the ecommerce space.

On the opposite end of the spectrum, Travelzoo was negatively affected by the Pandemic and the subsequent travel restrictions. TZOO is a online media company that offers entertainment and travel deals. The company’s swift decision to focus on travel vouchers allowed it to significantly improve its financial position and avert a devastating travel marketplace. The vouchers allow the consumer to cancel or change travel plans without fees and were a big hit. As a result, the company’s cash position has surged and could be as much as $70 million, or nearly $5 per share, at year end December 2020. We believe that there is pent up demand for consumers to travel post Pandemic and Travelzoo appears well positioned to capitalize on that prospect. The TZOO shares are down modestly for the year. But, for investors fortunate enough to buy the shares during the depths of the travel restrictions in March 2020, the shares have nearly tripled from a low of $3.65. We view the TZOO shares as a compelling play on a return toward “normalcy” as the Covid vaccines open economies and travel restrictions are lessened. In addition, as Figure #6 illustrates, the company compares favorably on Enterprise Value to Revenue relative to its peers.

Yet another beneficiary of travel restrictions and stay at home mandates was the esports industry. The industry gained mainstream attention as traditional sports content was constrained during the economic shutdown. As such, broadcast networks turned toward esports to fill the programming void. Viewers of esports platforms tend to stay on the platform for longer periods than traditional sports or other computer applications making the sites ripe for advertising revenues. Furthermore, we believe that the esports will follow the trajectory of traditional sports into sports betting. The GMBL shares increased a strong 55% since our initiation on October 28th. The company recently made a series of acquisitions and announcements that strengthen its ability to be one of the leading companies in this space. As such, we view GMBL as among our favorites in 2021.

Finally, one of our favorites for 2021 is a marketing services company, Harte Hanks (HRTH). The company is in a turnaround mode and should swing toward significant cash flow generation in 2021. As Figure #7 illustrates, the company compares favorably to its Marketing Services peer group on the basis of Enterprise Value to Revenues and EV to EBITDA.

Figure #6

Figure #7

Companies mentioned in this report:

Harte Hanks (view report)

1800FLOWERS.COM (view report)

eSports Entertainment (view report)

Entravision Communications (view report)

The E.W. Scripps Company (view report)

Gray Television (view report)

Salem Media Group (view report)

Travelzoo (view report)

Tribune Publishing (view report)

Cumulus Media (view report)

GENERAL DISCLAIMERS

All statements or opinions contained herein that include the words “we”, “us”, or “our” are solely the responsibility of Noble Capital Markets, Inc.(“Noble”) and do not necessarily reflect statements or opinions expressed by any person or party affiliated with the company mentioned in this report. Any opinions expressed herein are subject to change without notice. All information provided herein is based on public and non-public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed. No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio. The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on its own appraisal of the implications and risks of such decision.

This publication is intended for information purposes only and shall not constitute an offer to buy/sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile. This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice. Past performance is not indicative of future results. Noble accepts no liability for loss arising from the use of the material in this report, except that this exclusion of liability does not apply to the extent that such liability arises under specific statutes or regulations applicable to Noble. This report is not to be relied upon as a substitute for the exercising of independent judgement. Noble may have published, and may in the future publish, other research reports that are inconsistent with, and reach different conclusions from, the information provided in this report. Noble is under no obligation to bring to the attention of any recipient of this report, any past or future reports. Investors should only consider this report as single factor in making an investment decision.

IMPORTANT DISCLOSURES

This publication is confidential for the information of the addressee only and may not be reproduced in whole or in part, copies circulated, or discussed to another party, without the written consent of Noble Capital Markets, Inc. (“Noble”). Noble seeks to update its research as appropriate, but may be unable to do so based upon various regulatory constraints. Research reports are not published at regular intervals; publication times and dates are based upon the analyst’s judgement. Noble professionals including traders, salespeople and investment bankers may provide written or oral market commentary, or discuss trading strategies to Noble clients and the Noble proprietary trading desk that reflect opinions that are contrary to the opinions expressed in this research report.

The majority of companies that Noble follows are emerging growth companies. Securities in these companies involve a higher degree of risk and more volatility than the securities of more established companies. The securities discussed in Noble research reports may not be suitable for some investors and as such, investors must take extra care and make their own determination of the appropriateness of an investment based upon risk tolerance, investment objectives and financial status.

Company Specific Disclosures

The following disclosures relate to relationships between Noble and the company (the “Company”) covered by the Noble Research Division and referred to in this research report.

Noble is not a market maker in any of the companies mentioned in this report. Noble intends to seek compensation for investment banking services and non-investment banking services (securities and non-securities related) with any or all of the companies mentioned in this report within the next 3 months

ANALYST CREDENTIALS, PROFESSIONAL DESIGNATIONS, AND EXPERIENCE

Senior Equity Analyst focusing on Basic Materials & Mining. 20 years of experience in equity research. BA in Business Administration from Westminster College. MBA with a Finance concentration from the University of Missouri. MA in International Affairs from Washington University in St. Louis.

Named WSJ ‘Best on the Street’ Analyst and Forbes/StarMine’s “Best Brokerage Analyst.”

FINRA licenses 7, 24, 63, 87

WARNING

This report is intended to provide general securities advice, and does not purport to make any recommendation that any securities transaction is appropriate for any recipient particular investment objectives, financial situation or particular needs. Prior to making any investment decision, recipients should assess, or seek advice from their advisors, on whether any relevant part of this report is appropriate to their individual circumstances. If a recipient was referred to Noble Capital Markets, Inc. by an investment advisor, that advisor may receive a benefit in respect of

transactions effected on the recipients behalf, details of which will be available on request in regard to a transaction that involves a personalized securities recommendation. Additional risks associated with the security mentioned in this report that might impede achievement of the target can be found in its initial report issued by Noble Capital Markets, Inc.. This report may not be reproduced, distributed or published for any purpose unless authorized by Noble Capital Markets, Inc..

RESEARCH ANALYST CERTIFICATION

Independence Of View

All views expressed in this report accurately reflect my personal views about the subject securities or issuers.

Receipt of Compensation

No part of my compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed in the public

appearance and/or research report.

Ownership and Material Conflicts of Interest

Neither I nor anybody in my household has a financial interest in the securities of the subject company or any other company mentioned in this report.

| NOBLE RATINGS DEFINITIONS | % OF SECURITIES COVERED | % IB CLIENTS |

| Outperform: potential return is >15% above the current price | 78% | 33% |

| Market Perform: potential return is -15% to 15% of the current price | 5% | 1% |

| Underperform: potential return is >15% below the current price | 0% | 0% |

NOTE: On August 20, 2018, Noble Capital Markets, Inc. changed the terminology of its ratings (as shown above) from “Buy” to “Outperform”, from “Hold” to “Market Perform” and from “Sell” to “Underperform.” The percentage relationships, as compared to current price (definitions), have remained the same. Additional information is available upon request. Any recipient of this report that wishes further information regarding the subject company or the disclosure information mentioned herein, should contact Noble Capital Markets, Inc. by mail or phone.

Noble Capital Markets, Inc.

225 NE Mizner Blvd. Suite 150

Boca Raton, FL 33432

561-994-1191

Noble Capital Markets, Inc. is a FINRA (Financial Industry Regulatory Authority) registered broker/dealer.

Noble Capital Markets, Inc. is an MSRB (Municipal Securities Rulemaking Board) registered broker/dealer.

Member – SIPC (Securities Investor Protection Corporation)

Report ID: 11744

Playboy Scheduled To Present at NobleCon17

|

|

|

|

|

Join Playboy CEO Ben Kohn at NobleCon17 – Noble Capital Markets 17th Annual Small & Microcap Investor Conference – January 19&20, 2021. Following a formal presentation, a seasoned Wall Street research analyst will join Ben to moderate a LIVE Q&A session. If you want to be added to the roster of presenters… or if you would like to join the virtual audience of investors, at no cost, go to nobleconference.com. NobleCon 17 Complete Presenting Company Schedule

|

Esports Entertainment Group (GMBL) Scheduled To Present at NobleCon17

|

|

|

|

|

Join Esports Entertainment Group (GMBL) CEO Grant Johnson at NobleCon17 – Noble Capital Markets 17th Annual Small & Microcap Investor Conference – January 19&20, 2021. Following a formal presentation, a seasoned Wall Street research analyst will join Grant to moderate a LIVE Q&A session. If you want to be added to the roster of presenters… or if you would like to join the virtual audience of investors, at no cost, go to nobleconference.com. NobleCon 17 Complete Presenting Company Schedule

|

Tribune Publishing Company (TPCO) – Are You Serious?

Monday, January 04, 2021

Tribune Publishing Company (TPCO)

Are You Serious?

Tribune Publishing Co is a print and online media company that publishes various newspapers and websites. It creates and distribute content across its media portfolio, offering integrated marketing, media, and business services to consumers and advertisers, including digital solutions and advertising opportunities. The company manages its business as two distinct segments, M and X. Segment M is comprised of the company’s media groups excluding their digital revenues and related digital expenses, except digital subscription revenues when bundled with a print subscription. Segment X includes the company’s digital revenues and related digital expenses from local Tribune websites, third party websites, mobile applications, digital only subscriptions, Tribune Content Agency and BestReviews.

Michael Kupinski, Director of Research, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Large influx of cash. The company closed on the sale of BestReviews for a total price of $160 million. Tribune owns 60% of the company and we estimate that net proceeds from the transaction will be roughly $88 million. In total, the company is expected to have roughly $230 million in cash, including $30 million of restricted cash, or over $6 per share. We are raising our financial assessment from 3.5 to 4.0, which is above average.

Surprising upside guidance. Management guided 2021 adjusted EBITDA between $105 million and $113 million, well above our back of the envelop estimate of $79 million upon the sale of BestReviews. In fact, the guidance exceeds our original estimate of $99.2 million, which included BestReviews …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Salem Media (SALM) Scheduled To Present at NobleCon17

|

|

|

|

|

Join Salem Media (SALM) CFO Evan Masyr at NobleCon17 – Noble Capital Markets 17th Annual Small & Microcap Investor Conference – January 19&20, 2021. Following a formal presentation, a seasoned Wall Street research analyst will join Evan to moderate a LIVE Q&A session. If you want to be added to the roster of presenters… or if you would like to join the virtual audience of investors, at no cost, go to nobleconference.com. NobleCon 17 Complete Presenting Company Schedule

|

Tribune Publishing Company (TPCO) – Building A Large Cash Hoard

Thursday, December 17, 2020

Tribune Publishing Company (TPCO)

Building A Large Cash Hoard

Tribune Publishing Co is a print and online media company that publishes various newspapers and websites. It creates and distribute content across its media portfolio, offering integrated marketing, media, and business services to consumers and advertisers, including digital solutions and advertising opportunities. The company manages its business as two distinct segments, M and X. Segment M is comprised of the company’s media groups excluding their digital revenues and related digital expenses, except digital subscription revenues when bundled with a print subscription. Segment X includes the company’s digital revenues and related digital expenses from local Tribune websites, third party websites, mobile applications, digital only subscriptions, Tribune Content Agency and BestReviews.

Michael Kupinski, Director of Research, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Announces sale of its interest in BestReviews. The company plans to sell BestReviews to Nexstar Broadcasting for a total of $160 million. Tribune’s 60% interest would be worth roughly $100 million, less taxes and fees. The transaction is expected to close by year end.

Sale viewed favorably. Tribune purchased its 60% interest in BestReviews three years earlier for $66 million, with a tax basis estimated to be roughly $60 million. As such, the sale of its interest for $100 million represents a substantial return on its investment, with net proceeds from the sale estimated to be roughly $89 million, or $2.40 per share …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Gray Television Inc. (GTN) – A Peachy Political Outlook

Thursday, December 17, 2020

Gray Television Inc. (GTN)

A Peachy Political Outlook

Gray Television, Inc. operates as a television broadcast company in the United States. As of April 6, 2010, it operated 36 television stations in 30 markets, including 17 affiliated with CBS Inc.; 10 affiliated with the National Broadcasting Company, Inc.; 8 affiliated with the American Broadcasting Company (ABC); and 1 affiliated with FOX Entertainment Group, Inc. (FOX). The company also operated 39 digital second channels comprising 1 affiliated with ABC, 4 affiliated with FOX, 7 affiliated with CW Network, LLC, 18 affiliated with Twentieth Television, Inc., 2 affiliated with Universal Sports Network, and 7 local news/weather channels. Gray Television, Inc. was founded in 1897 and is headquartered in Atlanta, Georgia.

Michael Kupinski, Director of Research, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Updates Political Estimate. Management indicated that Political advertising will be a strong $400 million plus for the full year 2020. The company crossed the $400 million mark yesterday, and Political continues to pour in. This implies that the fourth quarter will have a record breaking $215 million plus in Political.

Georgia on its mind. The updated forecast is the result of an influx of Political advertising from the Senate run-offs in Georgia, which has gained National attention as the election holds the outcome of the balance of power in the U.S. Senate. The company’s stations cover Augusta, Albany, Columbus, Savannah, and Thomasville, Georgia. Notably, the company picked up WALB in Albany, WTOC-Savannah …

This research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Esports Entertainment Group, Inc. (GMBL) – Acquisition Improves Its Hand

Thursday, December 17, 2020

Esports Entertainment Group, Inc. (GMBL)

Acquisition Improves Its Hand

Esports Entertainment Group Inc is a development-stage online gambling company focused purely on esports. The company’s principal business operations include design, develop and test wagering systems.

Michael Kupinski, Director of Research, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Plans to acquire online casino operator. The company announced plans to acquire Lucky Dino, an online casino operator, for roughly $30 million. The acquisition fills in the hole for its gambling operations, which will now offer casino, sportsbook betting, and esports betting. The acquisition will be funded by $30 million in debt and is expected to close early next year. We view the acquisition favorably as it broadens the company’s gambling platform and strengthens its financial viability.

Accretive acquisition. Lucky Dino is expected to generate $24 million in revenues in fiscal 2021 and $29 million in fiscal 2022, with cash flow of $5 million and $6.5 million, respectively …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Townsquare Media Inc (TSQ) – Why We Are Raising Estimates And Price Target?

Wednesday, December 16, 2020

Townsquare Media Inc (TSQ)

Why We Are Raising Estimates And Price Target?

Townsquare Media Inc is an entertainment and media company offering digital marketing solutions in the United States and Canada. It owns and operates radio stations, social media properties focusing the small and mid-cap companies. Services offered to the clients include live events, local advertising, digital advertising, e-commerce offerings, few others. The segments through which the company operates its businesses are classified into Local marketing solutions and Entertainment segments. Revenues are generated from commercials through broadcasts and sale of internet based advertisements.

Michael Kupinski, Director of Research, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Provides preliminary Q4 results. Q4 revenues are expected to nicely exceed guidance, now expected to be down a more modest 2.7% to 4.5% versus previous expectations of down 7.5%. Cash flow, as measured by adjusted EBITDA, is expected to be between $27 million to $28 million, versus the previous expectations of roughly $25 million.

Favorable revenue trends. We believe that the favorable preliminary Q4 results is in large part due moderating broadcast advertising trends, excluding Political, which is encouraging as the company cycles toward easing comps in 2021 …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Release -Sierra Metals Inc. (SMT:CA)(SMTS) – Announces Positive Preliminary Economic Assessment Results Its Cusi Mine

Sierra Metals Announces Positive Preliminary Economic Assessment Results For A Doubling Of Output At Its Cusi Mine In Mexico To 2,400 Tonnes Per Day, Including An After-Tax Npv Of US$81 Million

TORONTO–(BUSINESS WIRE)– Sierra Metals Inc. (TSX: SMT) (BVL: SMT) (NYSE AMERICAN: SMTS) (“Sierra Metals” or “the Company”) is pleased to report the results of a Preliminary Economic Assessment (“PEA”) regarding the Company’s Cusi Mine, located in Chihuahua State, Mexico.

This press release features multimedia. View the full release here.

This PEA report was prepared as a National Instrument 43-101 Technical Report for Sierra Metals Inc. (“Sierra Metals”) by SRK Consulting (Canada) Inc. (“SRK”). The full technical report will be filed on SEDAR within 45 days of this news release.

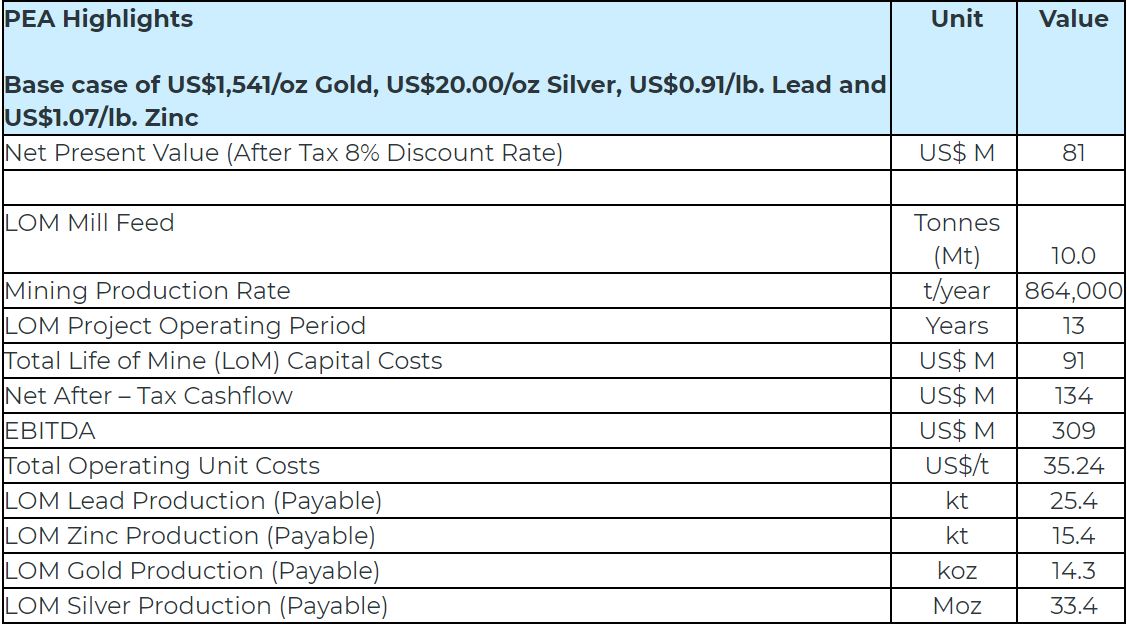

Highlights of the PEA include:

- After-tax Net Present Value (NPV): US$81 Million at an 8% discount rate assuming a long term silver price of US$20/oz

- Incremental benefit of increasing the production to 2,400 TPD from 1,200 TPD is estimated to have an after tax NPV (@8%) of US$28.1 million, and IRR of 46.8%

- Net After-tax Cash Flow: US$134 Million

- Life of Mine & Sustaining Capital Cost: US$91 Million

- Total Operating Unit Cost: US$35.24/tonne and US$8.83/oz silver equivalent

- Plant Processing Rate after expansion: 2,400 tonnes per day (TPD)

- Average LOM Grades for Silver 127.2 g/t (4.1 oz/t), Gold 0.12 g/t, Zinc 0.48% and Lead 0.34%

- Mine Life: 13 years based on existing Mineral Resource Estimate

- Life of Mine Silver Payable Production: 33.4 million ounces

Luis Marchese, CEO of Sierra Metals commented: “I am very encouraged by the results of this PEA which support the Company’s organic growth strategy and plan to profitably develop and expand the Cusi Mine production rate to 2,400 TPD from today’s capacity of 1,200 TPD, based on current analyst consensus silver metal price estimates of US$20 per oz long-term. The Company plans to continue with its disciplined approach of profitable growth and now plans to proceed with the next step of the completion of a prefeasibility study to further de-risk the plan and determine the best path forward.”

He continued “The PEA study compared the value of the current operations at Cusi at 1,200 TPD against several output expansion alternatives from 2,400 to 3,500 TPD and determined 2,400 TPD as the optimum production level based on our current mineral resource base.”

He concluded, “Cusi is the smallest of our three mining operations, however, its silver resources which include 31.3 million ounces of Measured and Indicated plus 23 million ounces of Inferred provide Sierra Metals with economic leverage to the improving silver market fundamentals. We are continuing with our strategy to increase the value of the Company on a per share basis. This builds upon the demonstrated success we have shown with increasing our current mineral resource base and improving the throughput at all mines.”

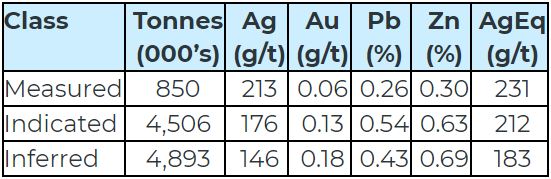

Mineral Resource Estimate

The Property is in the Cusihuarachi District of Chihuahua State, Mexico, approximately 135 km southwest of Chihuahua City. Epithermal mineralization has been mined in the area since its discovery in the early 1800’s. Mineralization is bound between regionally significant northwest trending faults; eight mineralized zones are recognized at the property, mineralized zones are up to 10 meters across and include silicified faults, veins, and breccias. Seven epithermal veins are recognized at the property, veins typically range between 0.5 and 2.0 meters wide, dip steeply, extend 100 to 200 meters along strike, and extend up to 400 meters depth. Vein orientations range between northeast and northwest.

This PEA considers depleted Measured, Indicated, and Inferred resources reported in 2020 by SRK and effective as of August 31, 2020. The results of this PEA shown in Table 1-1 are indicative of conceptual potential and are not definitive.

Table 1-1: Summary of Mineral Resources estimate as reported by SRK,2020(EffectiveAugust 31, 2020)

Source: SRK, 2020

(1) Mineral resources are reported inclusive of ore reserves. Mineral resources are not ore reserves and do not have demonstrated economic viability. All figures rounded to reflect the relative accuracy of the estimates. Gold, silver, lead and zinc assays were capped where appropriate.

(2) Mineral resources are reported at a single cut-off grade of 95 g/t AgEq based on metal price assumptions*, metallurgical recovery assumptions, personnel costs (US$10.56/t), mine operation, transport and maintenance costs (US$24.86.41/t), processing operation and maintenance (US$11.86/t), and general and administrative and other costs (US$3.20/t).

* Metal price assumptions considered for the calculation of the cut-off grade and equivalency are: Silver: (US$/oz 20.0), Lead (US$/lb. 0.91), Zinc (US$/lb. 1.07) and Gold (US$/oz 1,541.00). Source: CIBC Global Mining Group, Consensus Forecast, September 30, 2020

The resources were estimated by SRK. Giovanny Ortiz, B.Sc., PGeo, FAusIMM #304612 of SRK, a Qualified Person, performed the resource calculations for the Cusi Mine.

** Based on the historical production information of Cusi, the metallurgical recovery assumptions are: 87% Ag, 57% Au, 86% Pb, 51% Zn.

Mining Methodology

Bench and fill mining method is currently used in the main areas of the mine and to a lesser extent, room and pillar mining is also used. The mining method used varies depending on geotechnical constraints, mineralization trends, dimensions, and mine production targets.

Using the updated Mineral Resource estimate, Sierra Metals performed an expansion analysis to determine how the Cusi mine could achieve higher sustainable production rates. The analysis indicated that higher production rates are achievable through the massification of the bench and fill mining method in the new production areas, which will allow the sustainability of the operation.

Mineral Processing

The Mal Paso Plant, located approximately 50 kilometers from the Cusi Mine, uses a conventional crushing-milling-flotation circuit to recover mineral and to produce commercial quality Lead/Silver and Zinc concentrates. Mineral is delivered from the mine to the plant in 20-tonne trucks.

Mineral processing and the recovery of the mineral is demonstrated, and silver recoveries are established at 87%.

The Mal Paso Plant increased throughput from 450 TPD at the beginning of 2018 to 1,200 TPD currently. In line with proposed increases in mine output, the processing capacity at Mal Paso will increase to 2,400 TPD in 2024.

Economic Analysis

This PEA indicates an after tax NPV of US$81 million (using a discount rate of 8%) at 2,400 TPD (in 2024). Total operating cost for the life of mine is US$352 million, equating to a total operating cost of US$35.24 per tonne milled and US$8.83 per silver equivalent ounce. Highlights of the PEA are provided in Table 1-2.

Table 1-2: PEA Highlights

Quality Control

All technical data contained in this news release has been reviewed and approved by:

Americo Zuzunaga, FAusIMM CP (Mining Engineer) and Vice President of Corporate Planning is a Qualified Person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Augusto Chung, FAusIMM CP (Metallurgist) and Vice President of Metallurgy and Projects to Sierra Metals is a Qualified Person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Sierra Metals

Sierra Metals Inc. is a diversified Canadian mining company focused on the production and development of precious and base metals from its polymetallic Yauricocha Mine in Peru, and Bolivar and Cusi Mines in Mexico. The Company is focused on increasing production volume and growing mineral resources. Sierra Metals has recently had several new key discoveries and still has many more exciting brownfield exploration opportunities at all three Mines in Peru and Mexico that are within close proximity to the existing mines. Additionally, the Company also has large land packages at all three mines with several prospective regional targets providing longer-term exploration upside and mineral resource growth potential.

The Company’s Common Shares trade on the Bolsa de Valores de Lima and on the Toronto Stock Exchange under the symbol “SMT” and on the NYSE American Exchange under the symbol “SMTS”.

For further information regarding Sierra Metals, please visit www.sierrametals.com or contact:

Continue to Follow, Like and Watch our progress:

Web: www.sierrametals.com | Twitter: sierrametals | Facebook: SierraMetalsInc | LinkedIn: Sierra Metals Inc

Forward-Looking Statements

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of Canadian and U.S. securities laws (collectively, “forward-looking information”). Forward-looking information includes, but is not limited to, statements with respect to the date of the 2020 Shareholders’ Meeting and the anticipated filing of the Compensation Disclosure. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives”, “potential” or variations thereof, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking information.

Forward-looking information is subject to a variety of risks and uncertainties, which could cause actual events or results to differ from those reflected in the forward-looking information, including, without limitation, the risks described under the heading “Risk Factors” in the Company’s annual information form dated March 30, 2020 for its fiscal year ended December 31, 2019 and other risks identified in the Company’s filings with Canadian securities regulators and the United States Securities and Exchange Commission, which filings are available at www.sedar.com and www.sec.gov, respectively.

The risk factors referred to above are not an exhaustive list of the factors that may affect any of the Company’s forward-looking information. Forward-looking information includes statements about the future and is inherently uncertain, and the Company’s actual achievements or other future events or conditions may differ materially from those reflected in the forward-looking information due to a variety of risks, uncertainties and other factors. The Company’s statements containing forward-looking information are based on the beliefs, expectations and opinions of management on the date the statements are made, and the Company does not assume any obligation to update such forward-looking information if circumstances or management’s beliefs, expectations or opinions should change, other than as required by applicable law. For the reasons set forth above, one should not place undue reliance on forward-looking information.

Mike McAllister

Vice President, Investor Relations

Sierra Metals Inc.

Tel: +1 (416) 366-7777

Email: info@sierrametals.com

Americo Zuzunaga

Vice President of Corporate Planning

Sierra Metals Inc.

Tel: +1 (416) 366-7777

Luis Marchese

CEO

Sierra Metals Inc.

Tel: +1 (416) 366-7777

Source: Sierra Metals Inc.

Palladium Prices Are Expected to Remain Strong

Palladium Is the Most Valuable of the Four Precious Metals

The global transportation market is undergoing rapid change. Efforts to reduce global warming are resulting in more stringent emissions standards to reduce near-term greenhouse gas emissions, coupled with a longer-dated push toward electric vehicle adoption. Beneficiaries include mining companies that produce clean-air metals, including platinum and palladium for catalytic converters, and producers of battery metals, including copper, lithium, nickel, and cobalt. While the increasing need for metals used for EV batteries has been well-chronicled, investors may be unaware of the severe palladium supply deficit that has been driving high palladium prices. As a result, palladium is the most expensive of the four precious metals (gold, silver, palladium, and platinum).

What are Platinum Group Metals?

Palladium is one of six platinum-group metals, along with ruthenium, rhodium, osmium, iridium, and platinum. About 84%, or 9.6 million ounces of palladium ends up in the exhaust systems in cars to reduce toxic pollutants. The metal is mined primarily in Russia and South Africa, and mostly extracted as a by-product from mining other metals, including platinum and nickel. As a result, producers have not been able to quickly respond to higher prices due to limited dedicated production. Demand has increased due to stricter auto emissions standards and a move away from diesel power vehicles which use platinum for the auto catalysts. As a result, new sources of palladium supply are needed to meet demand and help achieve stricter air quality standards.

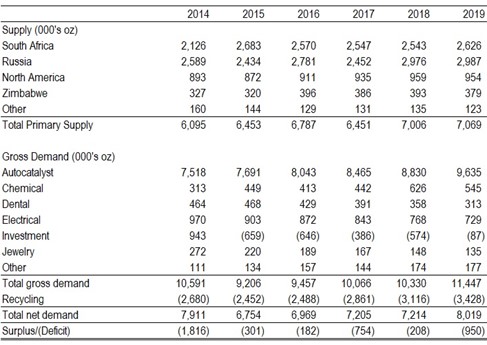

The figure below summarizes palladium supply and demand during the period 2009 through 2019.

Palladium Supply and Demand

Source: Johnson Matthey Market Report, May 2020

Will Automakers Switch to Platinum?

Most notably, palladium prices have benefited from a multi-year supply deficit driven by limited new supply sources and increasing environmental regulations that has increased demand. As a result, the price of palladium surpassed gold in 2019. Year-to-date through December 4, 2020, palladium futures prices increased 23.2% to $2,355 per ounce, compared with gold’s rise of 18.7% to $1,840 per ounce. While platinum is a substitute metal in catalytic converters, its price increased only 10.2% to $1,071 per ounce during the same period. While automakers originally switched from platinum to palladium in the 2000s to take advantage of palladium’s lower price, they have been reluctant to switch back due to potential disruptions to existing supply and manufacturing configurations, compliance with existing standards, the limited impact such a change would have on overall vehicle cost, and automakers’ focus on next generation technologies. According to the Financial Times, Nornickel, one of the largest producers of palladium, believes automakers have little appetite for changes in the catalyst chemistry as their engineering resources are focused on meeting new tighter emission legislation and carmakers are too busy transitioning to EV technologies and do not want to devote resources to new auto catalyst technologies. Most platinum group element mining companies produce both platinum and palladium so partial substitution, while not fully eliminating the palladium supply deficit, would likely provide a lift for platinum prices.

What about Electric Vehicles?

While widespread adoption of electric vehicles could meaningfully impact the supply and demand fundamentals for both platinum and palladium, it will likely take many years for electric vehicles to have a significant impact. First, auto catalyst demand for palladium is significant and supplies have been in a multi-year deficit that will take time to correct. Second, hybrid vehicles are expected to bridge the transition from internal combustion engines to battery powered vehicles. Hybrid electric vehicles also require palladium to reduce emissions and support growth in palladium demand. Perhaps the holy grail for investors is to identify mining companies that can capitalize on trends in both the clean air and battery metals markets with a diversified base of resources.

Suggested Reading:

Tyko Nickel Project Drilling Program Yields Success

When Does OPEC Expect Oil Demand to Plateau?

Exploration and Production: 2020-3Q Review and Outlook

Virtual Road Show Series – Thursday December 10 @ 1pm EST

Join Palladium One Mining President & CEO, Derrick Weyrauch for this exclusive corporate presentation, followed by a Q & A session moderated by Mark Reichman, Noble’s senior research analyst, featuring questions taken from the audience. Registration is free, but attendance is limited to 100. Register Now | View All Upcoming Road Shows

Sources:

Why Palladium is Suddenly a More Precious Metal: QuickTake, Bloomberg, Eddie van der Walt and Ranjeetha Pakiam, January 20, 2021

PGM Market Report, Johnson Matthey, Alison Cowley, May 2020.

Palladium Surges Again but the Focus Will Soon Shift to Platinum, Forbes, Tim Treadgold, January 19, 2020.

Platinum, Palladium Prices Diverge as Car Makers See Uneven Recovery, Wall Street Journal, Will Horner, September 18, 2020.

BASF Aims to Cut Cost of Gasoline Catalysts with Switch from Palladium to Platinum, Automotive News Europe, Elena Mazneva and Justina Vasquez, March 11, 2020.

Russia’s Norilsk Says Carmakers Will Not Switch from Palladium, Financial Times, Henry Sanderson, February 26, 2020.

Another Reason to be Bullish on Palladium: The Hybrid Car Boom, Bloomberg, Yuliya Fedorina and Rupert Rowling, December 28, 2018

Salem Media (SALM) – A Nice Political Boost; Raising Estimates

Friday, November 13, 2020

Salem Media (SALM)

A Nice Political Boost; Raising Estimates

Salem Media Group is America’s leading radio broadcaster, Internet content provider, and magazine and book publisher targeting audiences interested in Christian and family-themed content and conservative values. In addition to its radio properties, Salem owns Salem Radio Network, which syndicates talk, news and music programming to approximately 2700 affiliates; Salem Radio Representatives, a national radio advertising sales force; Salem Web Network, a leading Internet provider of Christian content and online streaming; and Salem Publishing, a leading publisher of Christian themed magazines. Salem owns and operates 115 radio stations, with 73 stations in the nation’s top 25 top markets – and 25 in the top 10. Each of our radio properties has a full portfolio of broadcast and digital marketing opportunities.

Michael Kupinski, Director of Research, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

A solid quarter. The company exceeded both revenue and cash flow expectations in its third quarter results, driven in part by strong Political advertising. Total company revenues were $60.6 million, 6% better than our $57.1 million estimate. Cash flow, as measured by adjusted EBITDA, was $9.6 million, a strong 25% above our $7.7 million estimate.

A Political boost. The latest results benefited from extraordinary Political advertising, which was $1.9 million. Political was well ahead of the mid term elections in Q3 2018 at $1.2 million and the last general election in Q3 2016 of $1.5 million. Management indicated that Q4 Political advertising will be north of $2 million, which will likely get another boost from the run-off Senate elections …

This research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.