Wednesday, October 13, 2021

Digital, Media & Entertainment Industry

The Supply Chain Stuff Is Really Tricky

Michael Kupinski, DOR, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to end of report for Analyst Certification & Disclosures

Overview. We believe that media companies are beginning to see the ripple effect of the supply issues and inflation pressures that is affecting the general market. The lack of truck drivers in some ports are creating a bottle neck to move product, labor shortages, and chip shortages are beginning to take its toll, particularly in the larger markets where the economy is largely felt. Will these issues adversely affect the advertising rebound? How will the stocks react?

Digital Media: Facebook Faces The Music. One of the weak performers in the quarter was Noble’s Social Media Index, down nearly 2%, with most of the stocks in the index down for the quarter, including Facebook, down 2.4%. The star performer in the quarter was a Noble closely followed stock in the Marketing Tech sector, Harte Hanks, up 34.5%.

Esports and iGaming: Have the stocks bottomed? The Esport stock performance in Q3 was disappointing given that there has been a significant amount of deal activity and investment in the space. A small, but notable investment was made by a TV broadcaster, E.W. Scripps, into Misfits Gaming Group (MGG), a global esports and entertainment company. Investors should take note.

Television Broadcasting: A Content Push. The shares of Entravision bucked the poor performance of the TV stocks, up 6% versus a decline of 2.9% for the industry. The company transformed itself into a Digital Media company with compelling growth prospects. Other broadcasters have made investments outside of broadcasting in the quarter as well.

Radio Broadcasting: Hitting The Refresh Button. In the latest quarter, Cumulus Media followed the trend to re-brand itself as an “audio-first, multi-platform” company. The move follows other radio companies including Audacy and Townsquare Media. The move is viewed favorably and allows the industry to court investors with a focus on its growth businesses.

Overview

Elon Musk, the CEO of Tesla and SpaceX, once said that “The supply chain stuff is really tricky.” This certainly describes the current environment. We believe that media companies are beginning to see the ripple effect of the supply issues and inflation pressures that is affecting the general market. The lack of truck drivers in some ports are creating a bottle neck to move product. There are chip shortages, which appear to be limiting the supply of new cars. In addition to supply issues, there are labor shortages in many sectors that appear to be limiting services and product, contributing to inflationary pressures. The fall-out from these issues may be hitting some larger markets where the economy is largely felt. The question is whether or not these issues will have a direct affect on the advertising recovery? We believe it is and it may become evident in the upcoming third quarter results. Given product shortages, companies may not advertise products that consumers have difficulty finding.

Advertising has a direct correlation to discretionary income. If consumers do not have the discretionary income to purchase, then there is no need to advertise. As such, companies may cut back on advertising given the prospect that consumers have less discretionary income in an inflationary environment. While we raised the inflation concern in our previous quarterly report, the Fed and the government indicated at that time inflationary pressures would subside in the second half. This was based on the prospect that the economic rebound would moderate, easing inflationary pressures. Now, the Fed has indicated that it will begin raising interest rates, which was different than the prospect of keeping interest rates low for an extended period of time. Such a prospect of rising interest rates, given the already tight supply issues, could stall the economic recovery, leading to “stagflation”. Stagflation refers to a period of persistent high inflation with high unemployment and stagnant demand in the economy. What is worrisome is that this is a cost-push inflation environment, disrupted by the ability to bring the goods to the market. Media fundamentals tend not to do well in this economic scenario, which decreases advertising price elasticity. Media stocks tend to have issues as well. There tends to be a contraction in media stock valuation multiples.

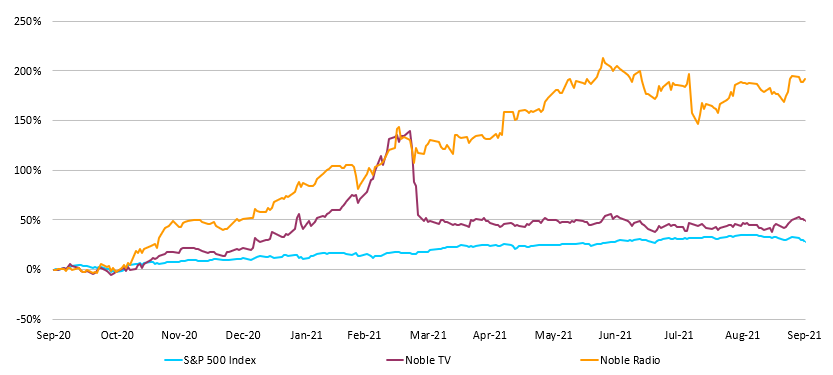

Surprisingly, most traditional media stocks have held up well over the past year, particularly the larger cap media stocks. Figure #1 Traditional Media 12 Month Performance highlights that both Radio and Television stocks are ahead of the general market, as measured by the S&P 500 Index, on a trailing 12 month basis, up 191.6%. 49.1% and 28.1%, respectively, Notably, the traditional media stocks outperformed many other media sectors, described later in this report. But, could there be trouble on the horizon? In the latest quarter, the traditional media stocks modestly under performed the general market. Radio stocks were down 2.9%, with Television stocks down 1.7%, compared with a 0.2% advance for the general market.

We are cautiously optimistic that the fundamental environment leans favorably. Furthermore, media stock valuations appear reasonable to favorable. Investors should be selective, however, favoring companies with a growth element and those with a bent toward smaller markets, such as our favorites in the traditional media space as Entravision, E.W. Scripps, Townsquare Media, and Salem Media. We believe that the sell-off in Digital Media and esports industries appear to be overdone. There appears to be a cycle rotation toward larger cap stocks, which offer liquidity. But, valuations appear compelling, particularly in the esports & iGaming segment, offering a favorable risk reward relationship. Our favorites and current coverage include eSports Entertainment, Engine Media and Motorsport Games.

Figure #1 Traditional Media 12 Month Performance

Digital Media

Facebook Faces The Music

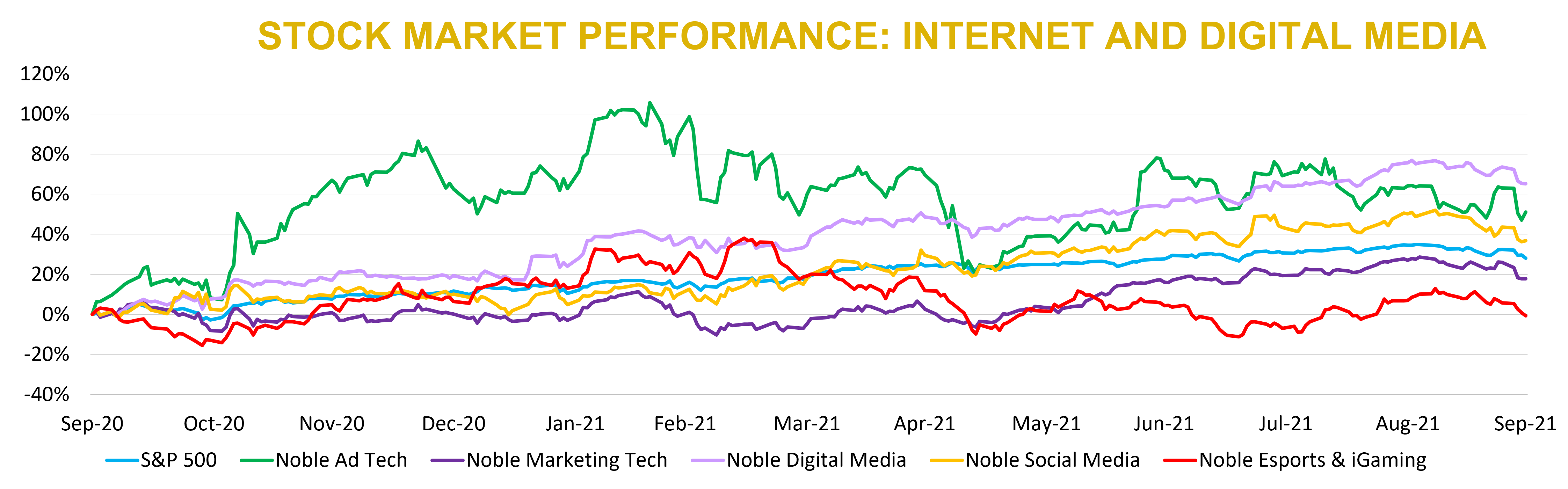

As Figure #2 Digital Media Trailing 12 Month Performance illustrates, the Digital Media stocks in general performed well, but there were some disappointing sectors, including one of our current favorites, esports & igaming. The Noble Esports and iGaming Index was down 4.5%. The Esports and iGaming sector is discussed in another section of this report. Notably, the Noble Digital Media Index was up a strong 7.3% and the Noble Marketing Tech Index climbed 1.6%, outperforming the 0.2% gain in the general market.

One of the weak performers in the quarter was Noble’s Social Media Index, down nearly 2%, with most of the stocks in the index down for the quarter, including Facebook, down 2.4%. Facebook was hit on several issues in the quarter, including privacy and on testimony in front of a Senate subcommittee from a whistleblower, Frances Haugen, a former data scientist at Facebook. First, Apple stepped up privacy by allowing users to opt out of tracking across every app on its service. Notably, there were a large number of customers that chose to opt out. As a result, Facebook is not able to track user behavior, limiting conversion data for the ads run on its platform. One traditional advertising company executive exclaimed that the lack of conversion data for Facebook now puts it on par with traditional media companies that must use attribution data to determine success of advertising. Thus far, media companies have not been able to capitalize on the current Facebook conversion data issue.

We believe that the conversion data is potentially more troubling for the company than the testimony from the whistleblower, which largely portrayed Facebook as a greedy company that knows its services are detrimental to children. While Congress seems keen on regulating the company, there does not appear to be a consensus on how to rein it in.

Figure #2 Digital Media Trailing 12 Month Performance

Helping to drive stock performance in the Digital Media sector was a robust M&A environment. Noble tracked 137 deals worth $46.4 billion in the Internet & Digital Media sector vs. 116 deals worth $29.1 billion in 3Q 2020. The number of deals increased 18% year-over-year, while the value of deals increased by 60% over 2Q 2021. On a sequential basis, the number of deals decreased by 6% while the value of deals increased by 55%. Year-to-date, the number of deals has increased by 24% (to 462 deals this year vs. 374 deals last year) and the value of deals has increased by 121% to $109.2 billion from $49.5 billion in 2020.

For the third quarter in a row, the most active sectors were Digital Content, with 47 transactions, followed by Marketing Technology transactions (32). The Agency & Analytics (20), Ad Tech (16) and Information (14) sectors also remained active.

From a deal value perspective, MarTech deals led with $23.3 billion in transaction value, followed by the Digital Content segment with $8.6 billion in deal value, followed by Information services with $8.2 billion in deal value. Driving deal value in the MarTech sector was Intuit’s $12 billion acquisition of email marketer MailChimp, and Thoma Bravo’s $6.5 billion acquisition of customer experience software provider Medallia.

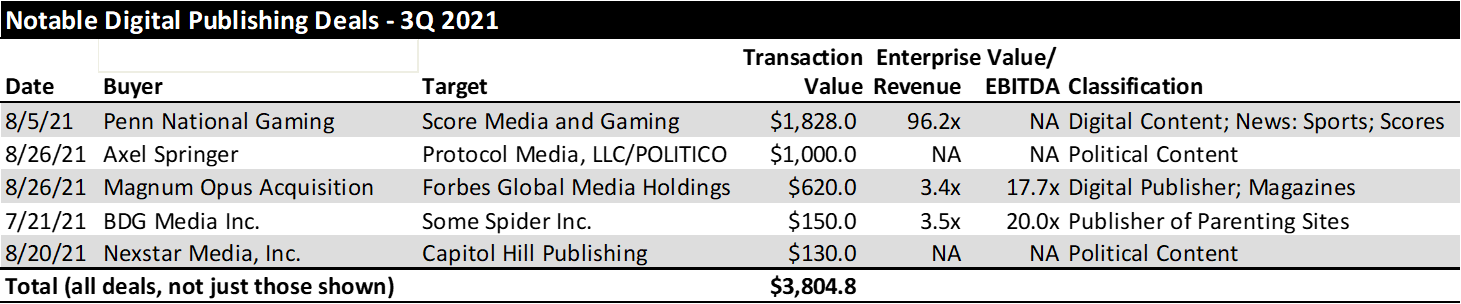

Within the digital media sector, there were several subsectors that were active. Last quarter saw a pickup in M&A activity in the digital publishing sector, with BuzzFeed selling to a SPAC, BuzzFeed acquiring Complex Media, and Graham Holdings acquiring The Leaf Group. The third quarter saw a continuation of elevated M&A activity as owners seek scale to better compete with the “walled gardens” of Facebook, Google, Amazon and other social media platforms.

One of the notable stock performances in the Marketing Tech sector was Harte Hanks. The shares advanced 34.5% in the latest quarter and reflected a strong 183.6% gain year to date. In our view, the shares reflect a strong revenue and cash flow turnaround at the company. Furthermore, on October 4, the company submitted a listing application to uplist to NASDAQ Global Market. Such a move would allow the company to attract a potentially larger investor pool. We continue to view the HRTH shares as among our favorites in the Marketing Tech sector. As Figure #3 Marketing Technology Comparables illustrates, the HRTH shares trade well below its Marketing Tech peers.

Figure #3 Marketing Technology Comparables

Market Data as of 10/11/2021

Esports & iGaming

Have the stocks bottomed?

As illustrated in Figure #4 Q3 Stock Performance, the Noble’s Esports Index underperformed the general market in the third quarter, down 4.5% compared with a modest 0.2% increase for general market. During the latest third quarter, only 5 esports stocks out of 16 were in positive territory and only 7 are up for the year. On a trailing twelve-month basis, the Index lost 0.7% compared with the general market’s 28.1% gain. Importantly, the Esport index performance is sequentially better than the previous quarter, which declined 12.7%, providing a glimmer of hope that the stocks may be near bottom.

Figure #4 Q3 Stock Performance

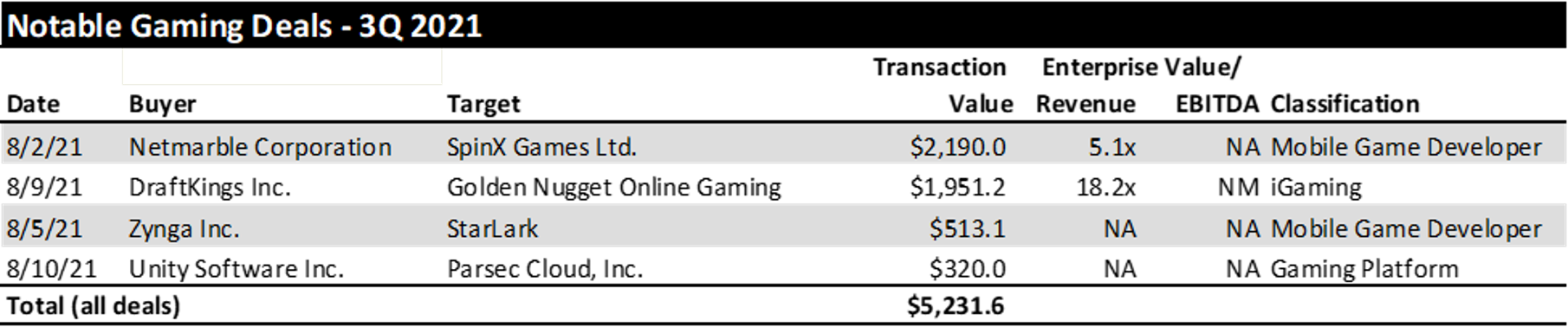

The Esport stock performance is disappointing given that there has been a significant amount of deal activity and investment in the space. The video gaming and game developer sector had the largest number of transactions (20) and accounted for $5.2 billion in M&A during the quarter, slightly down from 20 deals accounting for $7.8 billion in 2Q 2021. Notable deals include Netmarble’s $2.2 billion acquisition of mobile game developer SpinX Games, and DraftKings’ (Nasdaq: DKNG) $2.0 billion acquisition of Golden Nugget Online Gaming (GNOG). Golden Nugget operates online casino games, but also owns an igaming betting platform. There were also two gaming platform deals during the quarter: Unity Software’s $320 million acquisition of Parsec Cloud, and Roblox’s $90 million acquisition of gaming platform Guilded.

And, finally, there was a $10 million investment by a traditional media company, E.W. Scripps, into Misfits Gaming Group (MGG), a global esports and entertainment company. MGG owns three esports teams, content creators, and a full service, in house media team. While the dollar amount is somewhat small, it is noteworthy given that yet another traditional media company has put its toe in the esports pool.

We find it interesting that the weak stock performance does not reflect the current fundamentals for the industry. According to Limelight Networks, video gamers spent an average of 8 hours and 27 minutes each week playing video games in 2021, an increase of 14% over 2020. This is an increase from the depths of the Covid stay at home mandates in 2020. Many investors believed that the time consuming video games could not go higher. It did.

Notably, if video games were rated like TV stations, there would be more people gaming than watching some popular TV shows. Not surprising that E.W. Scripps, a television broadcaster, has taken interest in esports. E.W. Scripps is certain to use the investment as a programming element for its Florida based television stations. We are intrigued if the esports programming on its TV stations will drive viewers, as gamers traditionally have not been television viewers. If successful, we believe that there will be more companies like Scripps looking for programming options in the esports industry. Furthermore, we would not rule out the prospect of Scripps adding to its investment. Scripps has been a very entrepreneurial company, creating significant shareholder value in areas such as cable networks, and, most recently podcasting. Investors should take note.

Recognizing the growth of the industry and the favorable risk/reward that the esports and igaming stocks offer, we expanded our coverage in the space. In the last quarter, we expanded coverage to include Engine Media (GAME) and Motorsport Games (MSGM). This is in addition to our previous coverage of eSports Entertainment (GMBL). While many of the stocks are considered to be relatively small and developmental, investors should consider taking a basket approach when investing in the industry. By adding all three to a portfolio, an investor could cover the industry from soup to nuts, so to speak. Motorsport Games is a game publisher and developer. Engine Media includes sports betting, esports, and game developing. And, eSports Entertainment is a leading esports and gaming company. Each company has unique attributes in the industry and each with favorable growth opportunities. As Figure #5 Esports/IGaming Company Comparables illustrate, our favorites trade well below the industry’s mean on the basis of Enterprise Value to Revenue. Furthermore, the industry is considered to be over sold and, we believe, offers a favorable risk/reward relationship.

Figure #5 Esports/IGaming Company Comparables

Market Data as of 10/11/2021

Television Broadcasting

A Content Push

As Figure #6 Q3 Broadcast Performance illustrates, the Television group had a difficult quarter, ending down 2.9% versus a modest gain for the general market. The weakness is somewhat surprising given the current rebounding advertising environment, especially as we close in on another Political year in 2022. The stocks were due for a breather, however, up a solid 49.1% in the past 12 months. Bucking the trend in stock performance in the quarter was Entravision. The stock was up 6.3% in the quarter out-performing the industry and the general stock market. Entravision is riding a wave of an acceleration in its revenue growth from recent acquisitions in Digital Marketing. The company’s Digital businesses now account for more than 70% of total company revenues.

Figure #6 Q3 Broadcast Performance

We believe that there were several important developments in the quarter. One development highlighted the industry’s ongoing debt reduction strategy. Another development focused on several companies’ investments into programming and/or content.

First, in the latest quarter, E.W Scripps increased free cash flow guidance for the full year from a range of $210 million to $240 million to a range of $240 million to $260 million. Consequentially, its debt leverage multiple is expected to be in the low 4s by the end of next year. Furthermore, the company made a small, but important investment into esports, described earlier in this report. In spite of the favorable news, the SSP shares under-performed its peer group in the latest quarter, down 11.4%. We believe that the performance follows the trend that if the industry gets a cold, the SSP shares catch a flu. Conversely, if the TV stocks perform better, the SSP shares tend to outperform. We believe that the company is in a strong position to benefit from an influx of Political advertising in 2022.

In addition, we encourage investors to view the company’s recent video presentation (click here), which highlights its differentiated approach to the industry and its favorable growth potential in its Over The Air (OTA) and Over The Top (OTT) platforms and networks.

Another development in the industry was on the content investment front. In addition to E.W. Scripps investing into esports content, Gray Television announced that it acquired Third Rail Studios from Integral Group for $27.5 million. Third Rail Studios is located adjacent to the studio compound that Gray is building in Atlanta. It has notable clients including Netflix and Apple and is known for such series and films as Ozark, Mile 22, the Dolly Parton series and the Ballad of Richard Jewell, among others.

We believe that investors will focus on the upcoming third quarter results, which will reflect tougher comparisons to the year earlier influx of Political advertising and improving advertising trends. It is likely that the hoped for improvement in certain categories, like Auto, may be elusive, given the ongoing chip shortage and supply issues. We believe that any potential revenue disappointment may be short lived as investors focus on 2022 and the expected large influx of Political advertising. We continue to view E.W. Scripps, Gray Television and Entravision as among our favorites in the sector. As Figure #7 Broadcast TV Company Comparables illustrate, the shares of E.W. Scripps and Gray Television are among the cheapest in the industry, trading below peer group averages.

Figure #7 Broadcast TV Company Comparables

Market Data as of 10/11/2021

While the share of Entravision may trade above its peer group, the company has one of the best revenue and cash flow growth profiles in the industry. As Figures #8 & #9 illustrates, Entravision reported among the strongest revenue and EBITDA growth in the second quarter. Certainly, the results reflected acquisition fueled growth. However, we believe that the company will likely reflect revenue growth above many in its peer group.

Figure #8 Q2 Revenue Performance

Figure #9 Q2 EBITDA Performance

Radio Broadcasting

Hitting the refresh button

As the Figure #6 Q3 Broadcast Performance illustrates, the Radio Index declined 3.0% in the third quarter, giving back some of the strong gains over the past year. On a year-to-date basis the Radio Index is still up a remarkable 66.4% and 131.6% over the past 12 months. So, it was not surprising that investors took some chips off of the table. Among the strongest performer in the group in Q3 was one of our favorites, Salem Media Group, up a strong 45.7%. The company benefited from a refinancing that de-risked its balance sheet and put the company on a path toward significant debt reduction. The refinancing lengthened the maturity of roughly 50% of its debt to 2028, with a modest increase in its interest rate. With the company’s free cash flow, current cash and availability on its revolver, the company has the ability to pay off its debt which comes due in 2024. We believe that the refinancing assuaged investor concerns over the company’s relatively high debt leverage.

Another highlight in the last quarter was the continued movement to re-brand. Townsquare Media was among the first to highlight the fact that it no longer was a “radio-first” company and that it was now a “digital first” company. The move to re-brand followed strong growth in its Digital Media segment, which now accounts for nearly 50% of the total company revenues and cash flow. In the latest quarter, Cumulus Media used the Channelchek.com platform to announce in its new investor presentation its re-branding as an “audio-first, multi-platform” company. The company’s presentation may be viewed by clicking here. These moves were designed for investors to focus on the growthier elements of the companies.

Following through on its multi-platform strategy, Cumulus announced a content distribution partnership to bring Cumulus’s 413 radio stations and podcasts to the Audacy platform. We believe that the move provides a significant boost to Audacy to scale its digital platform, competing with recent moves made by iHeartMedia. The Audacy app has over 2,000 local and national radio stations, from more than 100 markets and podcasts. For Cumulus, it allows the company to distribute its content on multiple platforms to make it available “anywhere and anytime people want to enjoy it.” While terms of the agreement were not disclosed, we believe that it is based on a revenue share, a win-win for both companies.

The latest move follows Audacy’s radio station “land” grab with other station operators including the 57 Urban One stations, located in 13 markets, announced in August. As a result, the Audacy digital media platform now boasts stations from Alpha Media, Beasley Media, Bonneville, CodComm, Cox Media Group, Entravision, Mid-West Family Broadcasting, Salem Media Group and Seven Mountains Media. These agreements follow iHeartMedia’s July 29th move to partner with TuneIn to distribute its 850 digital stations and podcasts on its platform. We believe that iHeart is capitalizing on its recent purchase of Triton Digital to provide advertising and programmatic sales on its platform. We believe that these moves toward digital platforms and recent re-branding are a solid strategy to reshape the narrative of the industry and to hit a refresh button with investors.

We are concerned that the supply issues in the general economy may adversely affect large market radio advertising in the near future. Companies may simply cut back on advertising should supply constraints continue. We believe that smaller market radio stations may fare better. In addition, companies with diversified revenue streams in growthier digital media platforms should perform better. Finally, we believe companies that have solid debt reduction strategies should assuage investor concerns should the general economy falters. As such, our favorites include Townsquare Media, Salem Media Group, and Cumulus Media.

As Figure #10 Broadcast Radio Company Comparables illustrates, the shares of Townsquare and Cumulus Media trade at compelling multiples. While the shares of Salem Media trade at higher multiples, the company’s significant debt reduction should improve the equity value.

Figure #10

Market Data as of 10/11/2021

We would note that Townsquare Media has some of the highest margins in the industry, as Figure #11 Q2 Radio Margins illustrate. The company’s margins are bolstered by roughly 30% margins in its Digital Media segment, which accounts for nearly 50% of total company revenues.

Figure #11

Companies Mentioned In This Report:

Cumulus Media

Engine Media

Entravision

eSports Entertainment

E.W. Scripps

Gray Television

Harte Hanks

Motorsport Games

Townsquare Media

GENERAL DISCLAIMERS

All statements or opinions contained herein that include the words “we”, “us”, or “our” are solely the responsibility of Noble Capital Markets, Inc.(“Noble”) and do not necessarily reflect statements or opinions expressed by any person or party affiliated with the company mentioned in this report. Any opinions expressed herein are subject to change without notice. All information provided herein is based on public and non-public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed. No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio. The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on its own appraisal of the implications and risks of such decision.

This publication is intended for information purposes only and shall not constitute an offer to buy/sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile. This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice. Past performance is not indicative of future results.

Noble accepts no liability for loss arising from the use of the material in this report, except that this exclusion of liability does not apply to the extent that such liability arises under specific statutes or regulations applicable to Noble. This report is not to be relied upon as a substitute for the exercising of independent judgement. Noble may have published, and may in the future publish, other research reports that are inconsistent with, and reach different conclusions from, the information provided in this report. Noble is under no obligation to bring to the attention of any recipient of this report, any past or future reports. Investors should only consider this report as single factor in making an investment decision.

IMPORTANT DISCLOSURES

This publication is confidential for the information of the addressee only and may not be reproduced in whole or in part, copies circulated, or discussed to another party, without the written consent of Noble Capital Markets, Inc. (“Noble”). Noble seeks to update its research as appropriate, but may be unable to do so based upon various regulatory constraints. Research reports are not published at regular intervals; publication times and dates are based upon the analyst’s judgement. Noble professionals including traders, salespeople and investment bankers may provide written or oral market commentary, or discuss trading strategies to Noble clients and the Noble proprietary trading desk that reflect opinions that are contrary to the opinions expressed in this research report.

The majority of companies that Noble follows are emerging growth companies. Securities in these companies involve a higher degree of risk and more volatility than the securities of more established companies. The securities discussed in Noble research reports may not be suitable for some investors and as such, investors must take extra care and make their own determination of the appropriateness of an investment based upon risk tolerance, investment objectives and financial status.

Company Specific Disclosures

The following disclosures relate to relationships between Noble and the company (the “Company”) covered by the Noble Research Division and referred to in this research report.

Noble is not a market maker in any of the companies mentioned in this report. Noble intends to seek compensation for investment banking services and non-investment banking services (securities and non-securities related) with any or all of the companies mentioned in this report within the next 3 months

ANALYST CREDENTIALS, PROFESSIONAL DESIGNATIONS, AND EXPERIENCE

Director of Research. Senior Equity Analyst specializing in Media & Entertainment. 34 years of experience as an analyst. Member of the National Cable Television Society Foundation and the National Association of Broadcasters. BS in Management Science, Computer Science Certificate and MBA specializing in Finance from St. Louis University.

Named WSJ ‘Best on the Street’ Analyst six times.

FINRA licenses 7, 24, 66, 86, 87

WARNING

This report is intended to provide general securities advice, and does not purport to make any recommendation that any securities transaction is appropriate for any recipient particular investment objectives, financial situation or particular needs. Prior to making any investment decision, recipients should assess, or seek advice from their advisors, on whether any relevant part of this report is appropriate to their individual circumstances. If a recipient was referred to Noble Capital Markets, Inc. by an investment advisor, that advisor may receive a benefit in respect of transactions effected on the recipients behalf, details of which will be available on request in regard to a transaction that involves a personalized securities recommendation. Additional risks associated with the security mentioned in this report that might impede achievement of the target can be found in its initial report issued by Noble Capital Markets, Inc.. This report may not be reproduced, distributed or published for any purpose unless authorized by Noble Capital Markets, Inc.

RESEARCH ANALYST CERTIFICATION

Independence Of View

All views expressed in this report accurately reflect my personal views about the subject securities or issuers.

Receipt of Compensation

No part of my compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed in the public

appearance and/or research report.

Ownership and Material Conflicts of Interest

Neither I nor anybody in my household has a financial interest in the securities of the subject company or any other company mentioned in this report.

| NOBLE RATINGS DEFINITIONS |

% OF SECURITIES COVERED |

% IB CLIENTS |

| Outperform: potential return is >15% above the current price |

84% |

29% |

| Market Perform: potential return is -15% to 15% of the current price |

4% |

2% |

| Underperform: potential return is >15% below the current price |

0% |

0% |

NOTE: On August 20, 2018, Noble Capital Markets, Inc. changed the terminology of its ratings (as shown above) from “Buy” to “Outperform”, from “Hold” to “Market Perform” and from “Sell” to “Underperform.” The percentage relationships, as compared to current price (definitions), have remained the same.

Additional information is available upon request. Any recipient of this report that wishes further information regarding the subject company or the disclosure information mentioned herein, should contact Noble Capital Markets, Inc. by mail or phone.

Noble Capital Markets, Inc.

150 East Palmetto Park Rd., Suite 110

Boca Raton, FL 33432

561-994-1191

Noble Capital Markets, Inc. is a FINRA (Financial Industry Regulatory Authority) registered broker/dealer.

Noble Capital Markets, Inc. is an MSRB (Municipal Securities Rulemaking Board) registered broker/dealer.

Member – SIPC (Securities Investor Protection Corporation)

Report ID: 24100