Image Credit: Governor Tom Wolf, (Flickr)

Have Reddit Posts Been Paving the Way for State Marijuana Reform?

Could Reddit, which came into existence in 2005, be a powerful reason U.S. support for marijuana legalization grew from 38% to 65% from 2008-2019? A 275-page academic paper was just made available that studies the discourse that preceded and followed the shift in attitudes. It makes a case that changes in public sentiment can be attributed to what is posted on Reddit. This sentiment can work its way into new legislative efforts. The research work also identifies what type of conversations had the most influence on shifting public support of marijuana legalization.

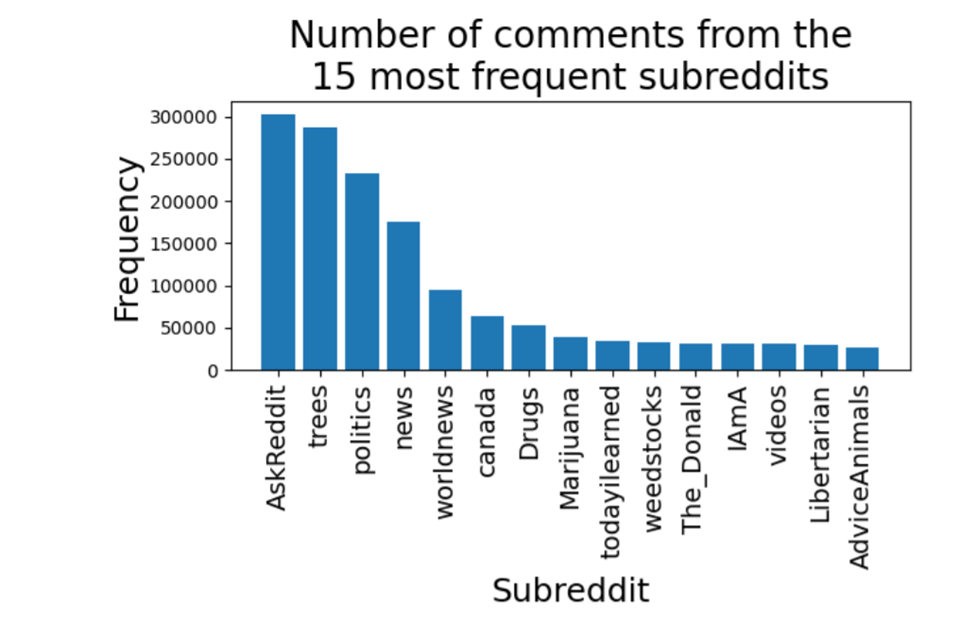

The researcher from Brown University compiled more than three million Reddit comments from 2009 to 2019 and then used machine learning to analyze the interactions. His method of analysis was designed to first separate the comments into categories (for example, anecdotal vs. generalized comments) and then better understand the more persuasive online conversations. The conversations came from a broad swath of subreddits that the researcher deemed diverse enough for an accurate study.

The frequency of comments from the 15 most frequent subreddits in the corpus

The research was part of a Ph.D. dissertation by Ph.D. candidate Babak Hemmatian Borujeni. The paper was titled “Taking the High

Road: A Big Data Investigation of Natural Discourse in the Emerging U.S.

Consensus about Marijuana Legalization” In his research, he uncovers empirically-based truths that may surprise non-social media users. One such truth is that while historically, sharing personal anecdotes and experiences has been a major factor in changing one’s strongly held viewpoint, this is less true today with social media. Instead, people posting more generalized, character judgment-based arguments was a more clear factor when impacting state-level cannabis reform measures. “Anecdotes were less often used to persuade people, meaning their persuasive potential was somewhat wasted,” Hemmatian said. “Still, people did often briefly mention them to buttress more general claims like the mentioned character judgments.”

An increase in character judgments and assertions about people’s attributes, like whether being a prohibitionist makes someone a bad person, commonly preceded state legalization efforts, particularly around 2012 as the first states moved to end prohibition, the study found.

There were some other interesting themes identified in the study. For example, discussions of the health impacts of cannabis “only picked up after legalization was all but over, and only in casual conversations.” Legal implications of reform, meanwhile, “were not prominently discussed even after legalization had succeeded in most states.” This would seem peculiar as, “Both topics are highly relevant to whether and how the substance should be de-regulated, but were ignored in decision-making and at best attended to once the societal decision was already made,” the author said.

The study emphasizes that character judgments were the main factor but also pointed out that it was not a strong change agent. It was able to persuade those that were more indifferent, not those strictly opposed. “While not the most persuasive approach according to previous research, character judgments may have still pushed people who were on the fence but not diametrically opposed to legalization over to the pro-legalization camp,” he wrote. “This is because they highly simplify decision-making: One no longer needs to know the complicated effects of cannabis on health, the economy and the society to make up their mind; they just need to think through their personal moral principles. This may have been comforting during a transition period when the uncertainty surrounding marijuana’s status would have been anxiety-inducing for many folks.”

The broad conclusion of the study is that “early legalization victories depended on character judgments while the final nails were hammered into prohibition’s coffin with Plot-focused strategies revolving around politics and crime.” The paper explains, “The shift happened entirely within the generalized portion of the discourse, meaning that a non-compositional approach to frame classification would have missed it.”

Others Gaining Insight from Social Media

Ph.D. candidates aren’t the only ones mining information from social media posts. Recently the Food and Drug Administration (FDA) announced that it plans to use Reddit and other “novel” data sources to gain a better understanding of public health issues surrounding the use of CBD and other “emerging” marijuana derivatives like delta-8 THC. The agency also wants to develop a system of finding “safety signals and usage patterns associated with emerging CDPs in real-time.” This includes Delta-8, a cannabinoid that may have been overlooked legislatively in many states, and placed in the general category of CBD without evaluation as to safety and efficacy.

Managing Editor, Channelchek

What is the Approval Process for Medical Devices?

|

Will Companies that Make Covid Test Kits Rally?

|

Attend Paris Hilton’s Metaverse NYE Party

|

Cannabis Customers Served by the Ice Cream Truck Delivery Model

|

Sources:

https://www.fda.gov/media/153183/download

Stay up to date. Follow us:

|