Emotions, Markets, and Mayhem (Faith in Cycles)

In a crisp white shirt, charcoal pinstripes, and yellow “power tie,” I turned to leave the crowded deli near Federal Hall off Wall Street. This hole-in-the-wall was my daily breakfast stop. Here the counter clerk would spot me through the crowd and know to wrap up a jumbo bran muffin and regular coffee, medium — then I’d continue down to the corner of Williams and Wall. The date was October 23, 1987. Just four days earlier, the Dow Jones Industrials had suffered its largest one-day loss in history, 22.6%. Minutes before, unspoken concern had brought an eerie quiet to my subway ride from Penn Station to Trinity Church. Commuters stayed hush while immersing their brains in newspapers shouting bold doomsday headlines.

Most mornings, this deli was lively and filled with boisterous overachievers enthusiastic about starting their day. Not on this Tuesday — it was tense and quiet. The quietness was broken after one man began chuckling for no apparent reason. His laugh quickly annoyed the guy in the green trading smock standing in front of him, who asked: “what’s your problem?” Before I reached the door, the laughing man was shoved into a corner payphone hanging above a news rack that spilled papers onto the floor. This brawl escalated as three more Wall Streeters lost their cool and jumped into the fight.

I made it out and down to 48 Wall, here the elevator man knew to take me to the trading floor on three. At 25-years old, I had never experienced anything like this. I felt a bit shaken.

I didn’t have any of my own money in the stock market. Professionally I was trusted to manage a little over a billion in US Treasuries; this pool was earning over 9%. Back then, I was a Fed analyst and a fixed income guy, but I had been around financial markets enough to wonder, is the Dow dropping 508 points last Friday a buying opportunity?

At lunch, I headed down the street and opened a trading account while simultaneously funding it with a check. Two days later, when the check cleared, I bought 200 shares of a utility — A familiar company that mailed me a bill each month. Less than a week after the stock certificates arrived in my mailbox, I sold the position for a $322 gain. My very first “round-trip” in equities. I earned enough to pay my electric bill for the next four months. More valuable than that, I learned a lesson in market moves.

Psychology

of Market Moves

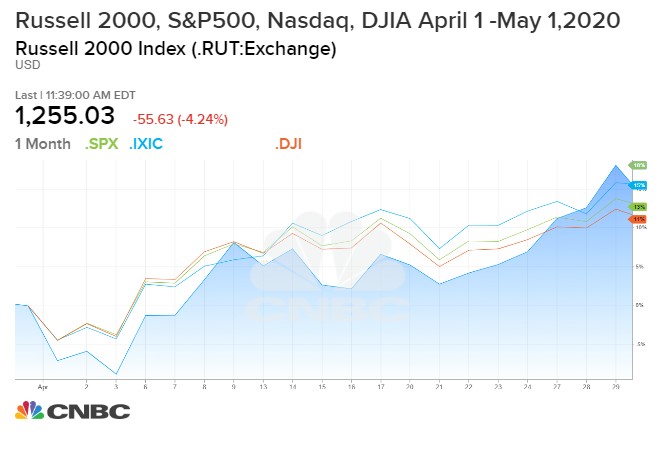

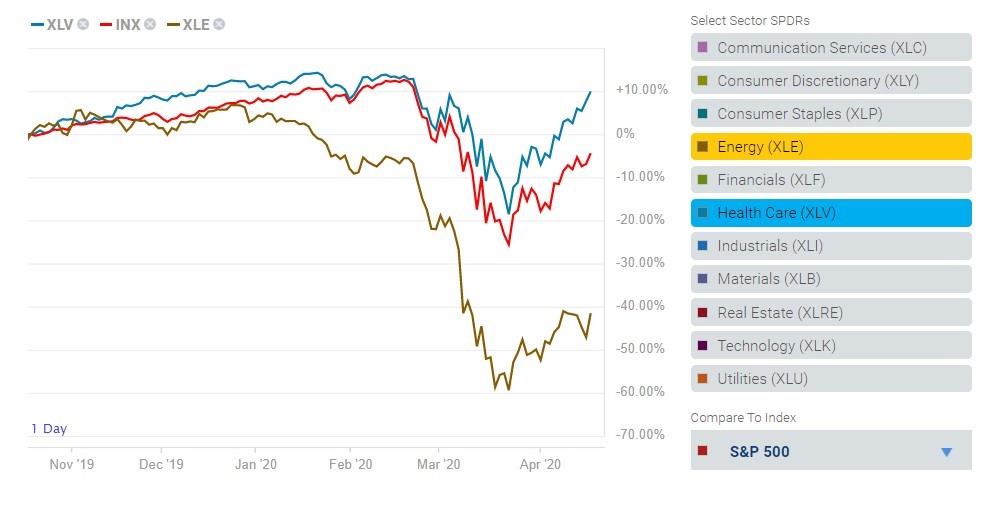

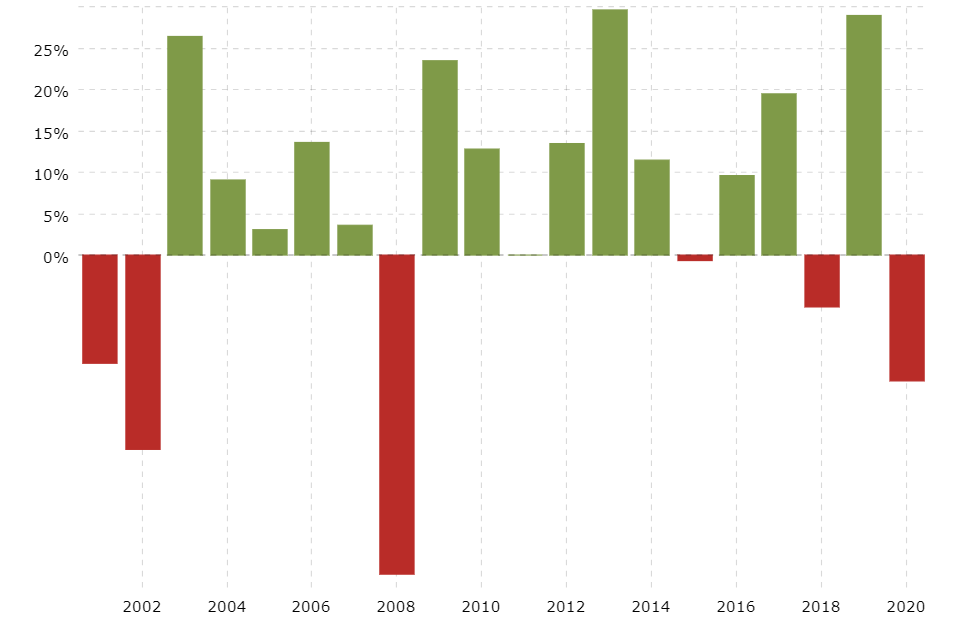

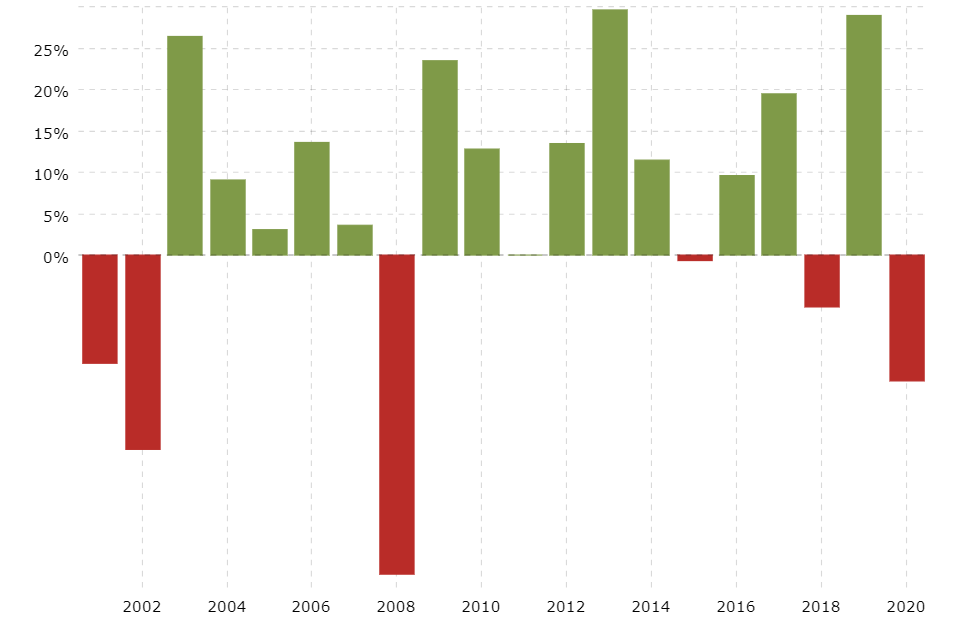

If you’ve been in the investment world for a while, you’ve learned a few lessons yourself. You’ve certainly been through a few bull and bear cycles. First, the stock market behaves well for a while. The returns become better than available in other liquid asset classes, it attracts new cash from the other markets, and the equities prices continue upward. At some point, the sentiment changes, slow and uncertain at first, then people throw in the towel and sell at a fevered pace. Over the past 20 years, the equity market moves downward have been fewer and much more abrupt than the marches upward.

20 Year History, S&P 500 Source: Macrotrends

So far, I’m sure I’m not telling you anything you don’t know. The markets are moving (in either direction) based on the combined expectations of the participants in the marketplace. The study of Behavioral Economics, which combines many disciplines, interprets market psychology. That is the psyche of the combined participants that puts in place direction, momentum, and then turns in sentiment. Behavioral scientists hold that emotions are the main driving force behind market fluctuations.

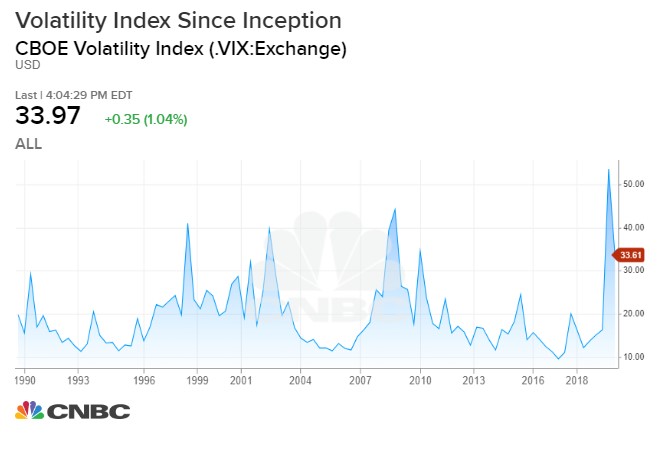

When prices are rising consistently, and sentiment is good, market activity leads to a bull market. Consistent declines and poor market sentiment place us in a bear market. Bear markets tend to be less gradually sloped than bull markets (steeper declines). Negative sentiment (fear) tends to react with more urgency than optimism.

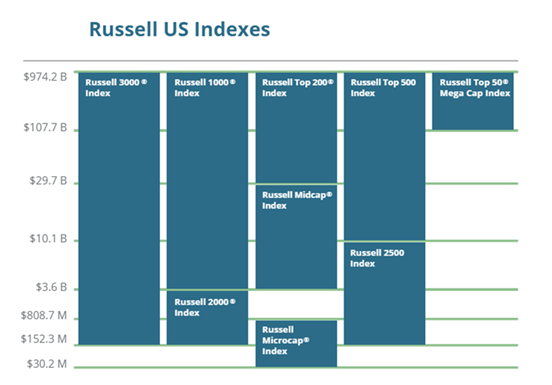

Price discovery of most anything is largely set by buyers and sellers deciding where they can both agree to transact. For this reason, the higher the number of active market participants interested in transacting shares in a company, the tighter the bid-offer spreads become.

Beware

the Ides of the Upward March

When stocks are marching higher (expansion phase), there is eventually a peak to the optimism. Blind confidence, fear of missing out, and fantasy control the direction. This strong buying activity usually accompanies the middle through the end of bullish sentiment. Some say the bull market ends when all the buyers are involved. With no new buyers to enter, there is no price support and no place left for it to go but down. At times it will move within a narrow band sideways; this is called the distribution phase. During distribution, some holders of stock begin to slowly take profits by selling shares into a market that still has a buying appetite.

Sparse numbers of buyers and the appearance of sellers begins to cause more down days than up, the mood shifts from very optimistic to complacent or confident. By now in the cycle, participants have grown accustomed to expecting the market to act in a specific way (rising values), so they wait, comfortable in the unrealized profits they’re holding.

As prices continue to trend lower, confidence gives way to the feeling of regret that they didn’t book profits when they had them. When the pain of the new downward trend builds to the point of realization that it will only get worse, then a feeling of not being able to get out fast enough takes over. As mentioned above, declines are often steeper than climbs as anxiety quickly turns to panic. At first it’s hard for many investors to sell and take a loss, even when the loss is likely to deepen. Plus, there’s ego involved that causes many to sit and try to wish the price back up. Then, seemingly all at once they give in and sell.

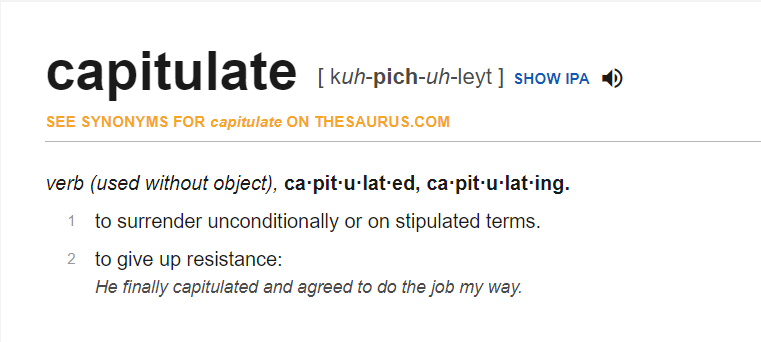

As the price drops become even deeper, the pain becomes too much, and the hold outs give up and sell. This is referred to as capitulation. At this point, the market is probably close to the bottom. Volatility is high at this stage, and the market may again trade sideways within a narrow band as buyers begin to show some optimism and maybe even “bargain hunting.”

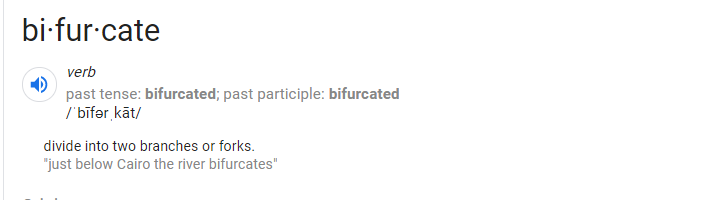

Source: Dictionary.com

How to

Benefit from Market Psychology

Investors and traders should trust that historically, the broader market has done three things. These three movements demonstrate a cycle which, similar to what is mentioned above, sets up fearful investors to lose. They buy after the market has risen and finally become convinced that the direction is up, and they hold while it’s going down as they either fail to recognize the new trend or have already counted how much the position was once were worth — even though they never booked the profit. For those that mentally count earnings they never take, selling at lower prices is uncomfortable.

These are the three things the market has always done:

- Gone up

- Gone down

- Gone up even more

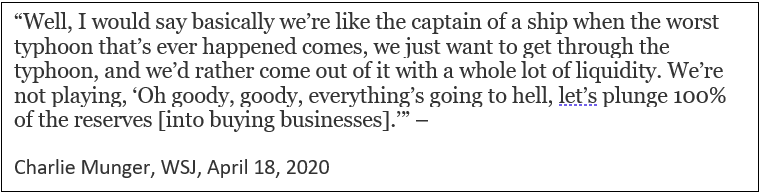

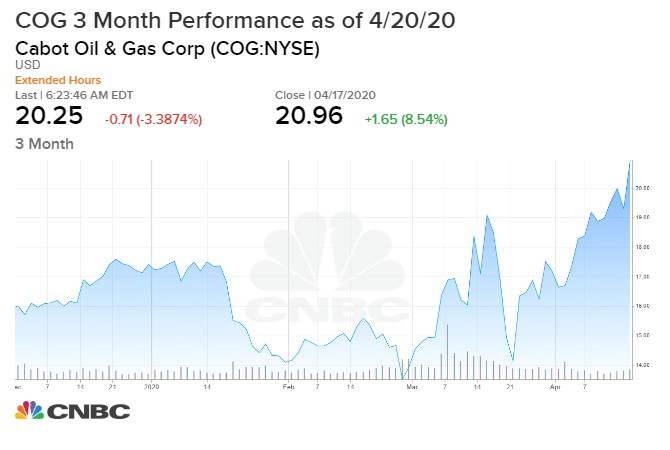

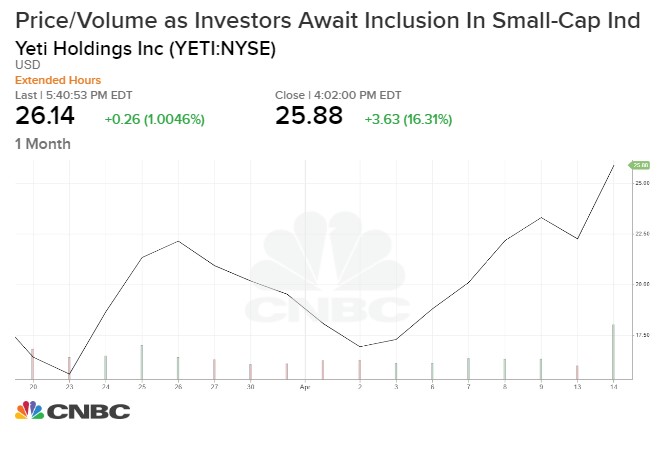

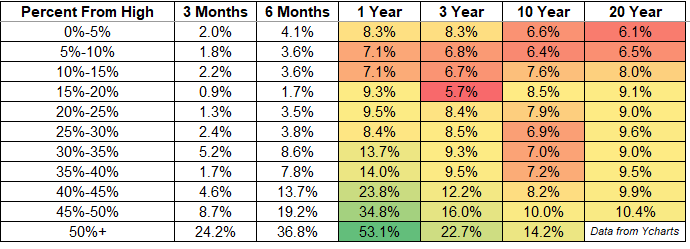

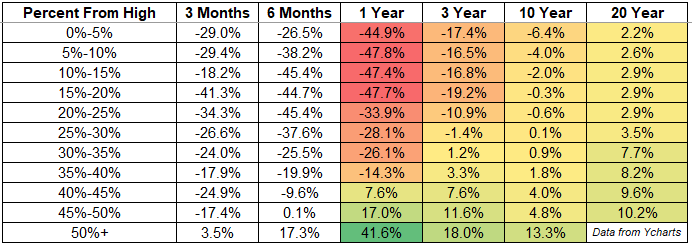

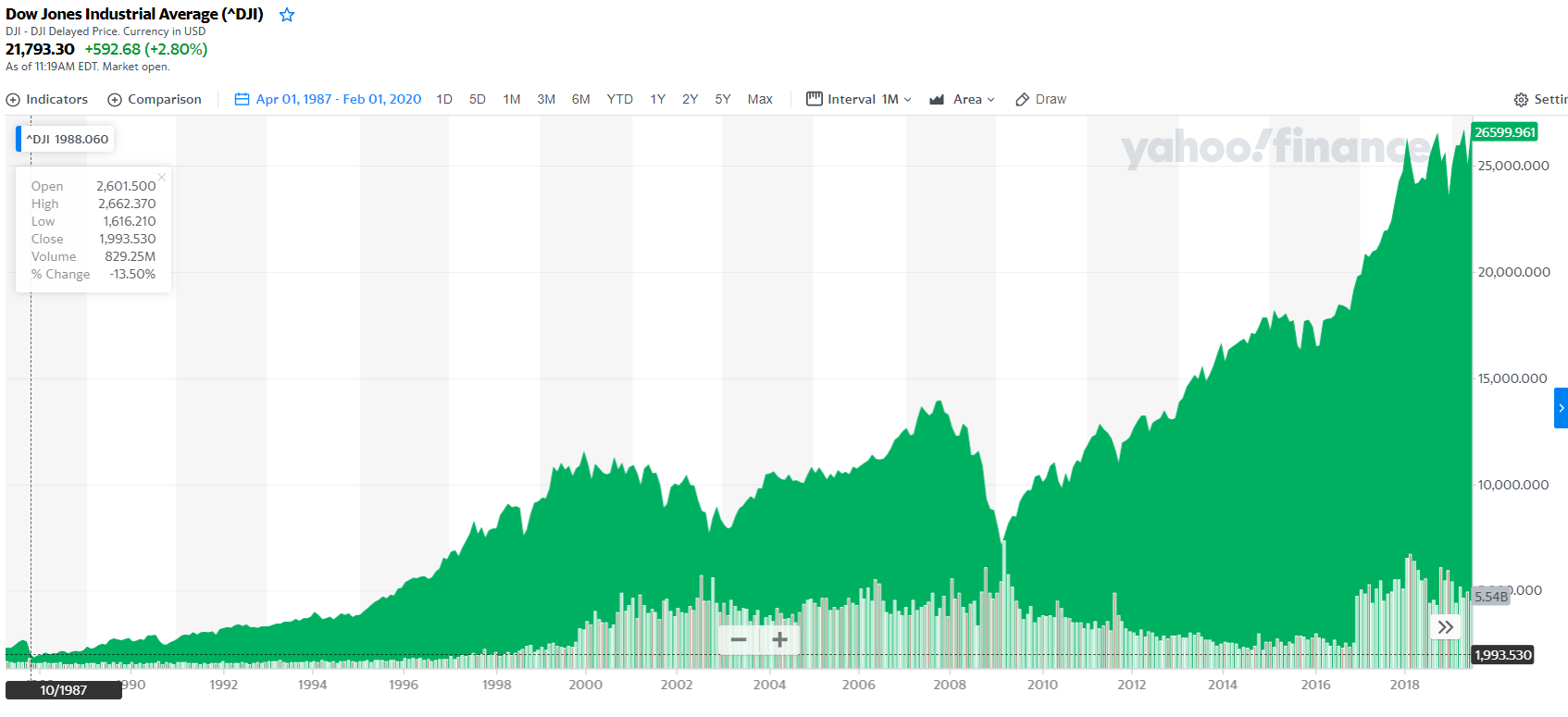

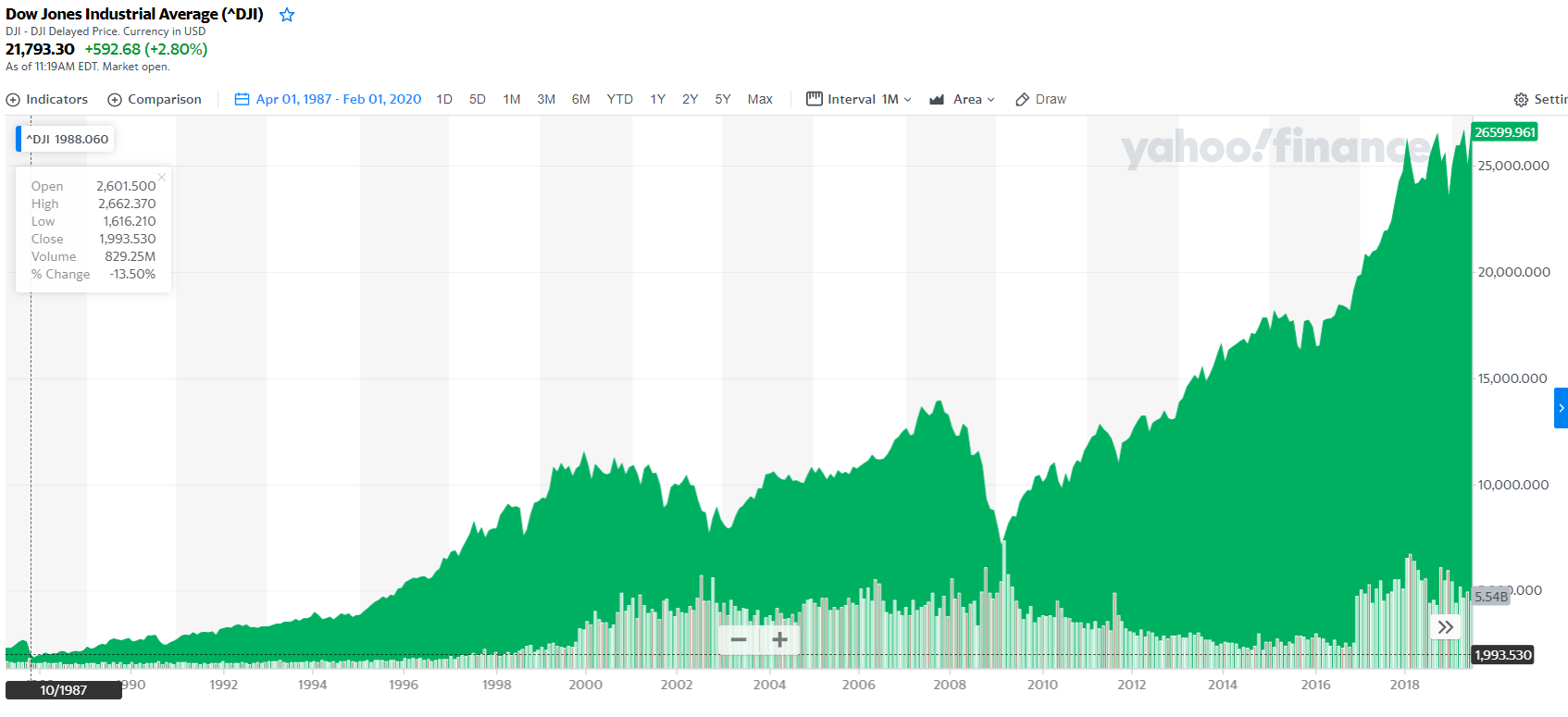

Through the end of 2019, markets have reached new highs 100% of the time after going lower. We know this, the chart below demonstrates it, yet buying on the way down is very difficult for even the most seasoned investors.

Source: Yahoo Finance

For those that find buying on extreme weakness hard, the key is to make believe the stock market is a store. When prices are higher than you’ve ever seen them, you should avoid buying. In fact, you can lighten up some, perhaps sell the weaker stocks first. When the market is cheaper than recent averages, use it as you would a Groupon to your favorite event. Don’t wait until it expires and then pay full price.

Cognitive

Bias

This bias suggests a thinking pattern that can lead to unwise or wrong decisions. One of these biases is confirmation bias. This is the tendency to overvalue information that confirms our expectations. We only see or recognize what we want to. At the same time, confirmation bias will cause the trader to ignore information that runs counter to their expectation.

Loss

Aversion

Aversion to loss, causes the trader to fear losses more than they enjoy gains. Investors feel the pain from a loss as higher than the joy of a gain, so they miss good investment or trading signals.

Endowment

Effect

The endowment effect is common, it’s the mindset that values those things already owned more highly than those not owned. The problem lies in the idea that if one owns a stock that is no longer likely to rise, and they hold it, the investor misses the opportunity to redeploy the funds into a better prospect. The stock with dim prospects should be sold, and the higher probability stock should be purchased.

This Time

it’s (not) Different

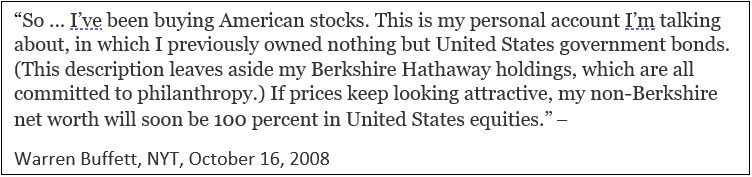

Fading refers to a contrarian investment strategy that suggests trading against the prevailing trend. The idea is the market has already factored in all information and is going to change direction. For those with a short-term time horizon, fading the direction of the market could be dangerous. For longer-term investors fading a declining market by buying has demonstrated itself to be safer than shorting an upward market. The reason is that the long-term market direction has been upward. The ceiling on a stock or market price rise is infiniti, this makes fading the market by shorting a riskier proposition. Fading the downward market is safer, however, investors aren’t going to time this perfect, but markets have rewarded those that are patient. The proof of this is in the all-time highs we registered this quarter. The market has always bailed out long market positions (eventually).

Mayhem

Happens

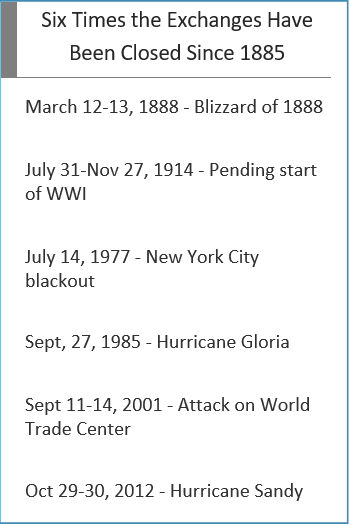

We can all learn from 1987 (two years to full recovery), or from September 11, 2001 (one month to recover), or the 2008 financial crisis (followed by a 10-year bull market), and almost certainly 2020 will not be the markets undoing. The U.S. economy is legendary for its strength and ability to climb back. Americans’ national optimism is hard to shake; the desire to win and find opportunity never stops.

Paul Hoffman

Managing Editor

Suggested Reading:

Market Selloffs and

IRA Contributions

Will the Stock

Market Survive COVID-19?

The Economic

Symptoms from Epidemics Have Been Felt Before

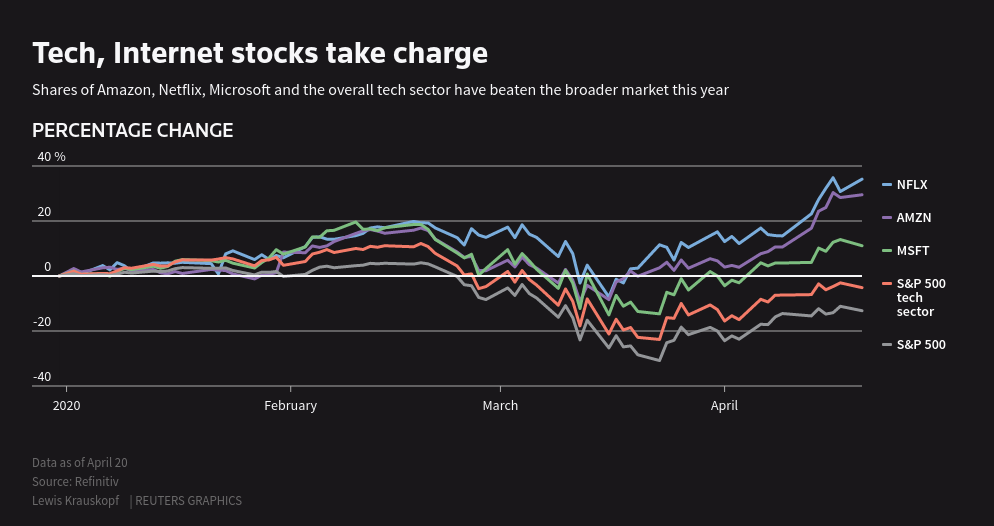

performance in a way that overstates overall market movement.

performance in a way that overstates overall market movement.