Ignore the Anecdotes, Robinhood Traders are Solid Investors (Mostly)

Taking positions in bankrupt corporations, indefinitely berthed cruise lines, airline stocks, cannabis, unknown electric vehicle startups, equities that legendary investors are short, and Chinese retailers are all activities Robinhood traders have been ridiculed for. But is the reputation deserved? As a group, the performance of these self-directed investors can be measured. True analysis (not anecdotes) has tested the hypothesis that “they’re all nuts.” This analysis has been done covering the last two years’ worth of data on customers of the company. The results run counter to the reputation these presumably younger, inexperienced investors have been tagged with. The collective Robinhood buys and sells, as a portfolio did not underperform when compared to standard academic benchmark models.

What Was Learned

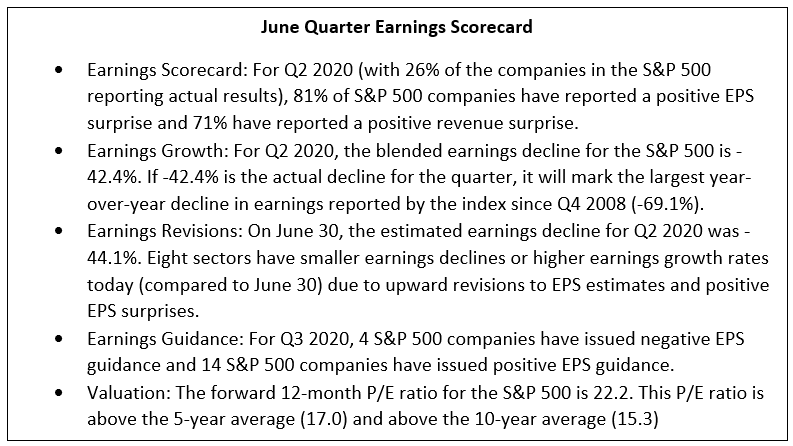

The National Bureau of Economic Research released a working paper late last month titled: “RETAIL RAW: WISDOM OF THE ROBINHOOD CROWD AND THE COVID CRISIS.” At the heart of the paper, the author, Ivo Welch, a finance professor at UCLA’s Anderson School of Management, looked at the holdings and results of all Robinhood transactions (since inception), using information available through *Robintrack. He then compared risk/reward to professional money managers’ performance, cash, and the overall market. His results uncovered that Robinhood user’s portfolios, on average, contain 5% of small, less liquid stocks that may be subject to much wider price swings. These smaller positions are often in companies the younger demographic is very familiar with. They also included industries that had either been beaten down, could potentially benefit from the COVID-19 economy, or those nearing a breakthrough of one kind or another. A much higher percentage of the positions were similar to those held in managed major index mutual funds. Although RH investors have created volume spikes and even price spikes in lesser-known companies, these were not their largest trading plays. By Professor Welch’s calculations, up to 60% of Robinhood investors’ holdings were stocks with large daily volumes. Companies with the heaviest weights in the average Robinhood portfolio according to the study include Ford Motor Co., General Electric Co., American Airlines Group Inc., and Walt Disney Co.

“The actual RH investors portfolio (ARH) was not as crazy as these ‘anecdotal holdings would suggest,” writes Ivo Welch. “Instead, most of the interest of RH investors revolved around larger and highly liquid firms.” The 5% held in smaller companies with lower volumes could easily be argued as appropriate or even prudent for the younger investor. It was additive to the aggregate portfolio outperformance.

New York Times, July 8, 2020

Smoothed Pandemic Crisis Selling

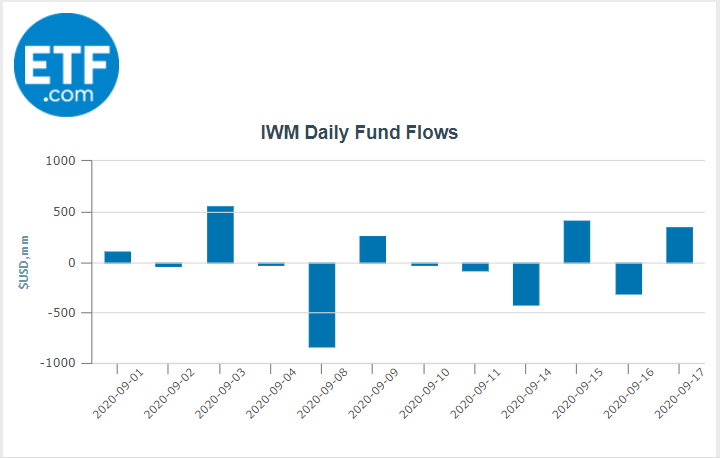

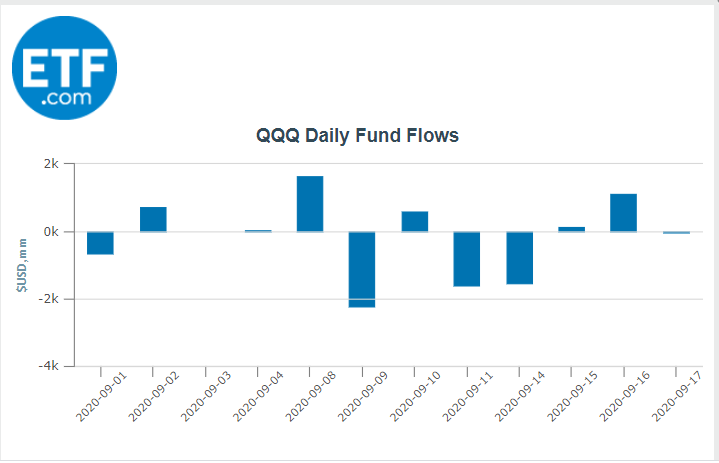

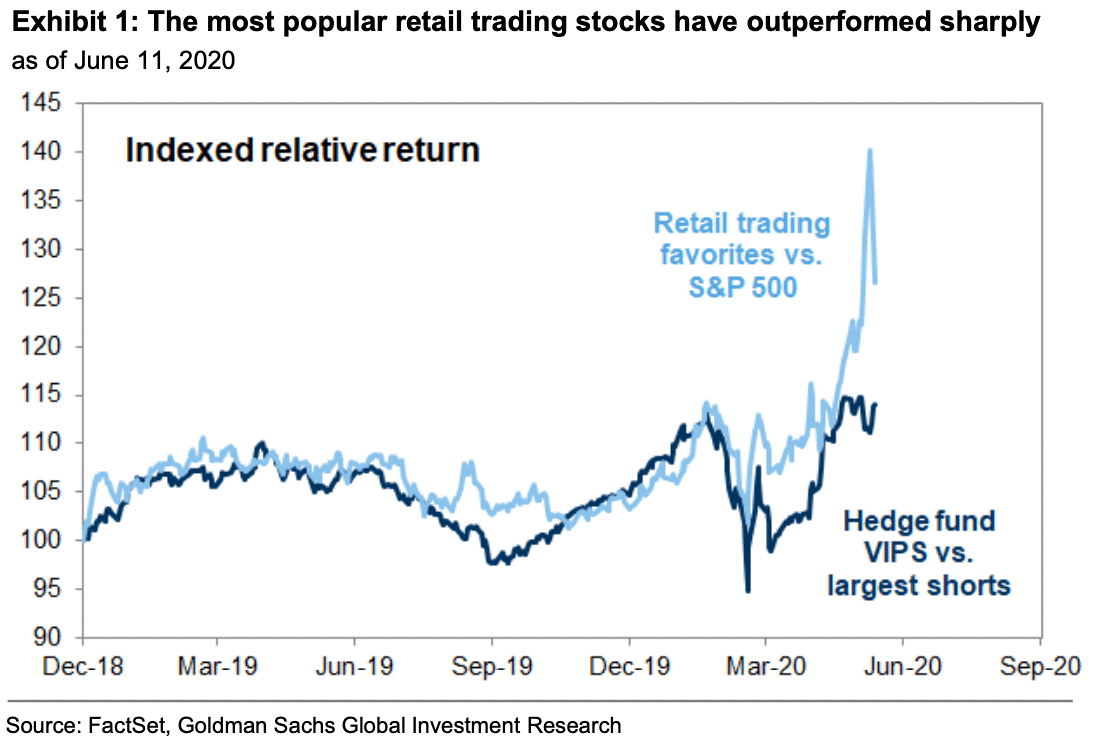

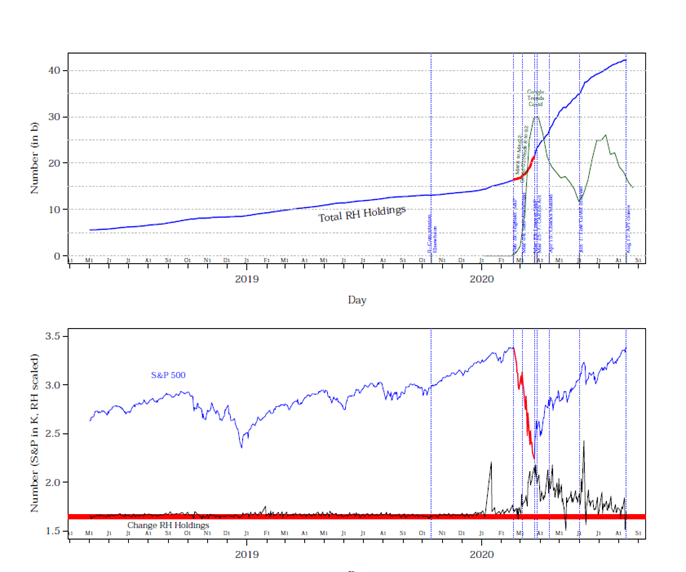

The RH self-directed investors are impacting price movements in ways unexpected by more experienced professionals. This is getting more attention from veteran traders as individuals now account for 20% of equity trading. This makes it important to understand them, and foolish to ignore. Welch’s paper provides that the composite model Robinhood equity portfolio has outperformed so far in 2020, and the presence of individual investors has possibly acted as a dampening force during a volatile environment. Whenever the stock market fell in 2020, spikes in retail buying occurred as early as the next day. Then, the second surge in RH volume usually occurred roughly three days after a spike down. Three days is about the time it takes to complete an ACH transfer and make sure there’s good funds in an account.

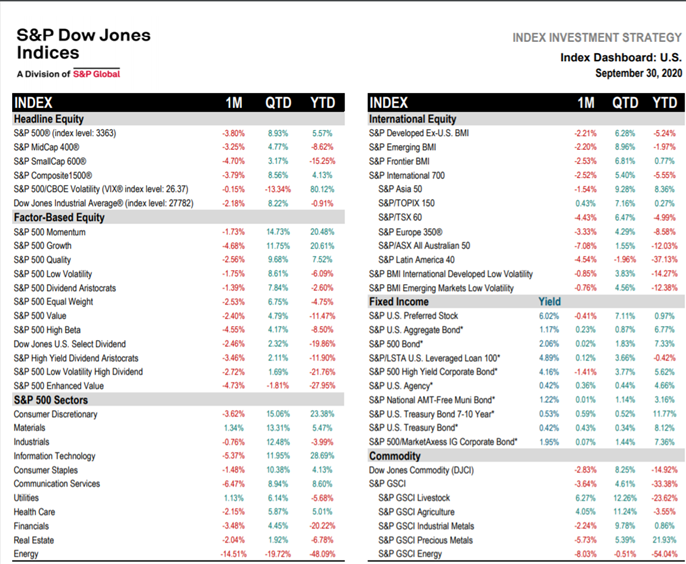

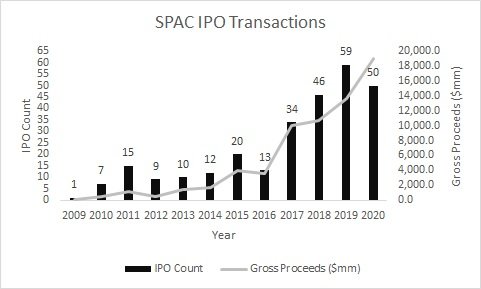

Stock Market performance vs. Robinhood Interest 2018-2020

The combined actions of RH trader’s willingness to buy into selling served them and the overall market well. The top plot shows the total Robinhood investment account size (blue/red) charted against the incidence of the word “Covid” on Google Trends (green). It clearly shows RH investing accelerated at the beginning of the crisis in the U.S. The bottom plot shows the change in Robinhood holdings (black) against the changes in the value of the S&P 500. The drop in the overall market was met with growth in total RH portfolio value. RH investors did not panic or experience margin calls. Instead, there is evidence that as the stock market declined, they actively added cash to fund purchases of more stocks.

CNBC June 12, 2020

Method of Comparison

After downloading stock data from Robintrack, which aggregated RH trades across all account owners, Professor Welch found that while it’s true that Robinhood investors have been attracted to “some rather odd stocks,” these shares are not Robinhood users’ largest holdings. Instead, the average Robinhood portfolio “was a lot more ordinary.” He then applied the Fama and French model to create a benchmark to measure performance against. Walsh broke down the significantly different styles within the holdings to capture size and value. He used their calculated weights and applied the weighting to a merged Value and S&P 500 portfolio. This is not a perfect measure but creates a reasonable benchmark of the full RH portfolio.

|

This is where naysayers may have to watch who they sneer at. The Robinhood portfolio, based on the collective wisdom of their cohorts, did not underperform. The alphas were positive, and despite the very short sample period, it is viewed as statistically significant at a respectable +1.3% per month. |

|

CNBC, June 15, 2020

What Robinhood Traders are Doing

It is not uncommon for veterans in any discipline to poke fun at newcomers that do things differently. This usually changes if the new way is more successful than the more accepted old way. When it comes to people’s money, this is doubly true. There are 13 million primarily young or new Robinhood self-directed investors. They have been stereotyped as unsophisticated followers who have yet to move out of their parent’s house and are throwing away their COVID-19 stimulus check in the markets. There may be some among the 13 million who fit this description. However, data supports the idea that as a whole, the performance of this group is quite admirable and should not be scorned.

On average, those pulling the trigger on trades through the Robinhood app performed well; they earned positive alpha versus cash, the overall market, and even the weighted Fama-French factor model. This simple two-variable model served as the proxy for the investment performance of small retail investors throughout the app trading universe. It will be interesting to see if the model vs. actual experience holds this level of performance over time. One variable during the measurement period with hard to assess influence is the timing of government stimulus checks, this may have impacted investible assets while the market was at a low for the year. Another variable is individuals out of work or working remotely during this period, they may have had more opportunity than normal to research and study some of the high potential names found in the 5% of their portfolio. Anecdotally, as a resource, Channelchek experienced a threefold increase in activity during 2020. A full 25% of that activity is from visitors 25-34 years-of-age accessing company research, articles, and other helpful content. More time to explore and solid resources once reserved for large institutions may also be a contributor to performance results.

Paul Hoffman

Managing Editor, Channelchek

Register for Access to Channelchek Premium and Channelchek Emails to Keep Your Fundamental Knowledge and Awareness of High Potential Offerings on Par With Your Peers. Free Registration

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meetings intrigue you here.

Each event in our popular Virtual Road Shows Series has a maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meetings intrigue you here.

Sources:

“Retail Raw: Wisdom of the Robinhood Crowd and the Covid Crisis”

Robinhood Traders Nailed the Market Bottom

Kramer Thinks Wall St Pros May Be Playing a Game With Amateur Robinhood Traders

*Robintrack, a website that provided updates on retail stock demand using Robinhood’s public application programming interface, was forced to shut in early August after the data feed was cut.