Can Brokers Level the Playing Field for Individual Investors?

An interview with Alan Grujic, founder of All of Us Financial

With the dramatic change in technology over the last 30 years, it is now hard to imagine that at one time if a self-directed investor wanted to know how their stock was performing they’d have to sit in front of their TV and watch to see if the price scrolled across the ticker on the bottom of their screen. This access to prices, while the market was open, was an improvement over a few years earlier when they had to wait for the stock listing in the morning paper.

Technology has brought about many improvements in the way individuals participate in the financial markets. It has dramatically helped remove many disadvantages between the playing field of small investors and large and institutional players.

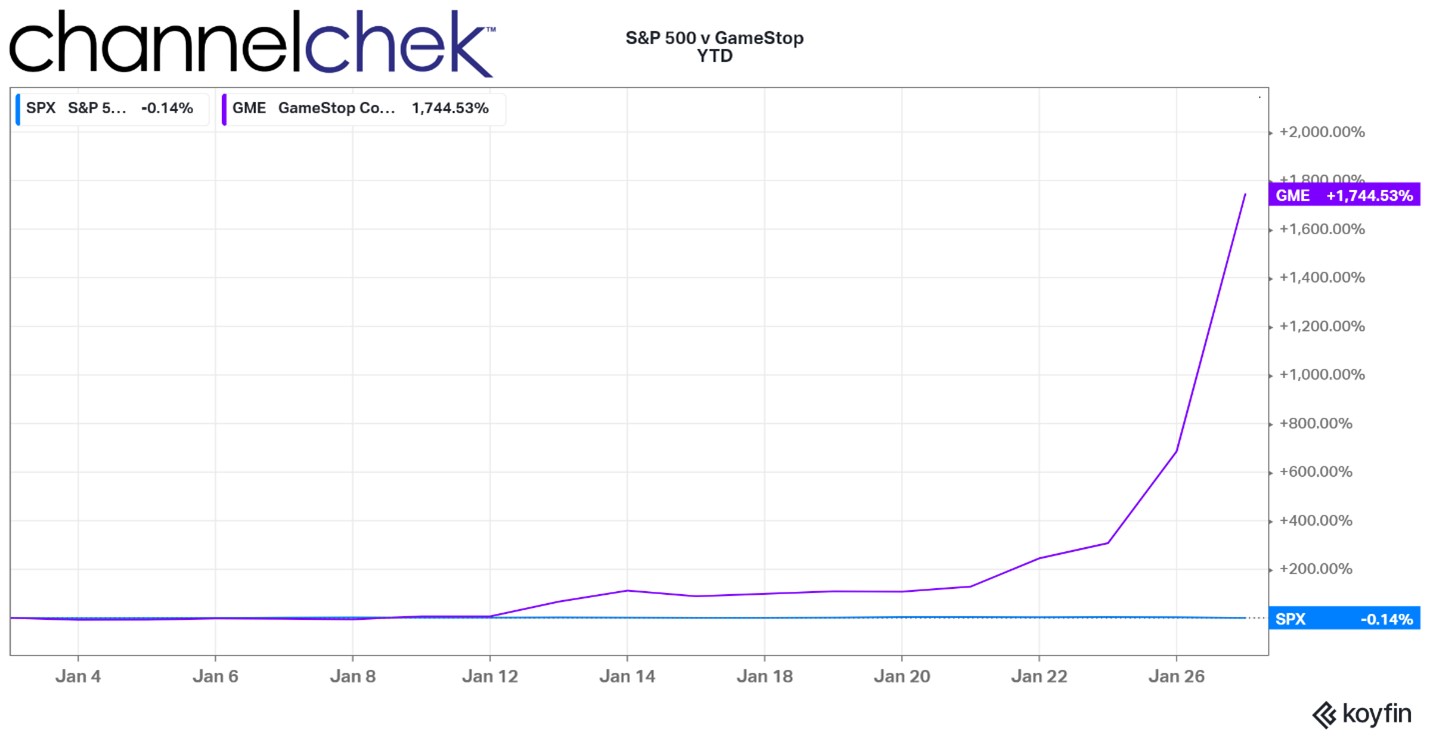

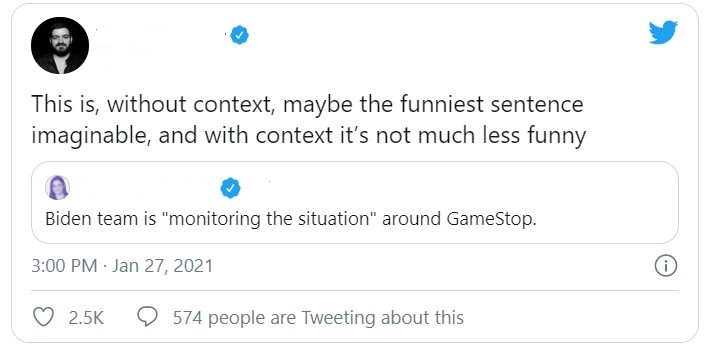

During the second half of January 2021, the issue of a level-playing field became front-page

news. The widely reported and hotly debated issue surrounds stocks that were popular short-sell positions among big-money players, and the “unionization” of individuals and their attempt to capitalize on what was seen by them as opportunity. Channelchek had published an article in April of 2020 about a unique broker investing app that launched in May of that year. I had plans to circle back just before income tax date in April of this year for an update. I moved the date up for the interview with Alan Grujic, CEO and Founder of All of Us Financial because I thought he could offer useful insight today into what self-directed investors should expect on the road to fairer competition and equal access.

All of Us is a trading platform for individuals. It shares a portion of each of its revenue streams with its customers. The CEO, Alan Grujic, is a trader, investor, and has built trading systems for bulge bracket investment firms. As an investor in Facebook before it went public, he has a unique take on the power in the information of collective users. Grujic believes that information can be distilled and shared with customers in a useful way. After he saw the trading app Robinhood build a community, then not determine what can be captured for the community benefit, Grujic decided to build what is his third financial company, All of Us Financial.

Below is Channelchek’s complete interview with Alan Grujic:

Channelchek (PH): Alan, I think if we grabbed nine friends and we played nine innings of baseball against the Dodgers, you and I would expect to lose in a big way. I’d think the loss would be less about our equipment than the practice and expertise of our opponents. How level is the playing field in terms of equipment between the “pros” and the “amateurs” in the investment markets?

All of Us (AG): The playing field isn’t level yet. Here’s how I see it and why I started this company. Technology, and the platform business model in particular, are really empowering. When you and I were young, at first, we didn’t have access to any basic information. Then even when we did, with say, a Charles Schwab account, we had to pay a whole bunch of money to execute a trade.

So this is how we’re empowered. The very first step to providing a level playing field is having information. I’m a professional trader. I have actually backtested terabytes of decades of data on models that have made hundreds of millions. So although it’s different than it used to be, I’m confident when I say, based on technical indicators I’ve backtested, they mostly don’t work. This doesn’t mean they aren’t useful as information to bring context into decisions. But not as a primary decision tool.

So, the first part of a level playing field is having the same information as everybody else. Then, if they’re more skilled, they’re still going to beat you, but you have to at least be equipped the same. We’re getting there, and active managers are now having a hard time beating the index because they don’t have superior information. This will continue to evolve, but we have come a long way toward having equally good information.

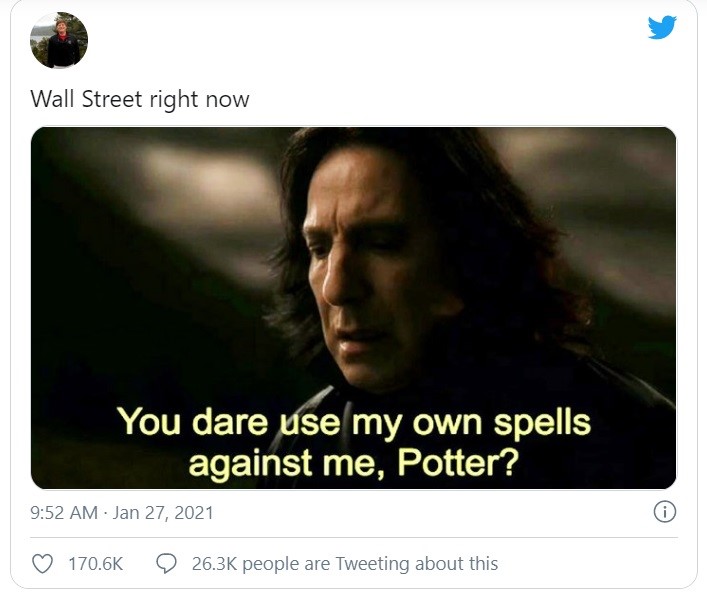

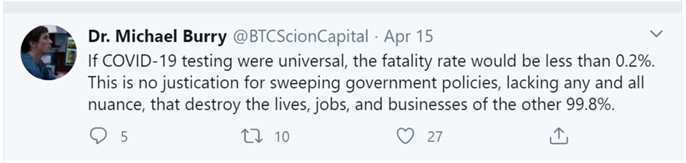

Let’s use Reddit as an example. Data from social media provides information that wasn’t initially being accessed by the incumbents. But if you watched closely at the GameStop transactions through the equities and options markets, there were large professionals that must have been capturing the activity and weighing it because they placed large profitable options trades. So, while a bunch of retail guys saw the short interest and decided they’d line up and go long, a couple of professionals quickly bought options based on that information; they understood the value of paying attention to social media activity. So, all information is valuable.

The next challenge becomes expertise. This is the second thing you need. And this expertise can nowadays be delivered powerfully and at scale via data science and automated information and tools. And of course, that also is not enough because the nature of all this information is so hard to process. So, if you have the information and expertise, the third thing you need is the capacity to do something with it in ways that can process the huge amounts of data and information, you need infrastructure and processing capability. Those catering to individual investors aren’t there yet.

The solution is for technology platforms to do what Facebook is doing for themselves. I was an early investor in Facebook, before they went public, the power of Facebook is understanding the value of the customer information. So, the solution for customers is for brokerages to do something customers can’t do on their own. Provide the technology, tools, features, all the fancy machine learning that does the heavy lifting for these customers as a group, and then synthesize all of this information in useful ways for them. Then, clearly, a million customers with a platform that does all of these things for them can be in the same order of magnitude as powerhouse hedge fund managers. Amassing information can certainly level the playing field.

In addition to the three I’ve mentioned, here are two additional things you also have to have. Access, if you don’t have access, for example to certain IPOs or private market investments, you aren’t even on the same field. Finally, the last leveler is influence. Individuals can’t negotiate what Warren Buffet did during the financial crisis or when he made a great deal to buy OXY. For these last two, platforms can aggregate individual customers’ value in order to negotiate and express access and influence on their behalf.

If you have these five, you are theoretically on a level playing field; you just have to be as good as the other players.

Channelchek (PH): You launched your broker app in May 2020; there are many popular apps and online access to markets, why would someone use All of Us rather than another provider?

Alan Grujic, (January 28, 2021)

|

All of Us (AG): There’s a lot of money being thrown at customer acquisitions in this business. If you think in terms of spending, there are a few examples of others spending several years of annual customer value in acquiring customers, almost 20% of customer lifetime value. Tastytrade just did a billion-dollar deal with IG out of Europe. They’re very aggressive. So why start another one? As an early investor in Facebook, I saw and know the power of creating tools that leverage social information for economic value. From this perspective, and having previously hired one of the Robinhood founders straight out of school, I was even more intrigued, I was watching Robinhood and thinking, this demonstrates the way people wish to have user experience delivered to them, but it also lends itself to so much more, and we also need to speak with people in the way they want to be spoken to, but of course we can say so much more. There isn’t anything inherently wrong with what they’re doing, or anyone else is doing. What if we [All of Us Financial] delivered modern tools for customers, delivered them value through sharing in our economics, did it with radical transparency, and didn’t just think of how to benefit ourselves?

The how I want to do that answers why someone would decide to have an account here; what I’m doing is creating something that is very powerful at scale. People that have a relationship here understand they will never get this with the other firms because it is not those firms’ intention. Those benefits aren’t part of their business model for growth.

This requires growth; until we’re bigger, we can’t yet provide a couple of the things I mentioned in the first question, like influence and access. When you’re bigger, you have more pull that you can use to benefit your customers, but only if that is what you plan was as a company in the first place, to use the greater scale to achieve these things.

If people have information through full company transparency, what they don’t have now at other brokerages, and if the business model aligns with customers where the firm promises to share every revenue stream with them, then this is actually the right way to build a Facebook meets Robinhood investment app where very powerful stuff is being done with the larger community and then delivered in a way that is really valuable and also enjoyable to customers. If it’s done in a social way and you show them that you’re going to act in their best interest.

A customer has the following values to this firm: they have assets that are going to generate revenues for them. Their data has value that is going to generate revenue. Their time activity, that would be watching ads or giving opinions, will generate common value. Customers have our promise that we will share in every revenue stream, that’s where we provide something different. It’s nice to say, “trust us,” but customers can also verify as we’re totally transparent.

We report on our platform exactly how much revenue we make from each customer, how much we’ve shared with them, and we promise to always share at least some amount of every revenue stream.

Channelchek (PH): A lot of people seemed surprised to learn all of the ways that a “free” brokerage account earns money for the broker. Do you think a broker owes it to the customer to be transparent about the various ways they make money?

All of Us (AG): Yes, and at a granular level. I think customers should understand the components of how we make money. People make decisions based on having good information. It’s silly for people to expect firms to not make money off of their business; if they didn’t exist, the benefit of their service wouldn’t exist. What’s reasonable? Well, if you know what everybody is making, then you can make an informed decision as to what’s fair.

Channelchek (PH): All of Us Financial seems more paternal than its older competitors; I know one of the things you were doing to encourage investors to think in terms of risk-adjusted returns was the SharpeShooter Challenge (named from the Sharpe ratio), paying out a reward each month. Can you give specifics on how it’s measured?

All of Us (AG): One of the things I think is helpful if you can show everybody how the overall platform is doing. Everybody talks about the Robinhood retail guys and wonder if they’re getting hurt or winning. Instead of talking about it, maybe customers have the right to know what the performance of the group is doing. This lets the customer evaluate success across the platforms. So what we do is we publish our overall platform return.

Another thing that is helpful if I’m a customer of a platform I want to know how well I’m doing relative to everyone else. It serves as a benchmark. This information sharing is something you have to opt-in to. I thought it would be fun to reward people for doing well. The SharpeShooter Challenge encourages opting-in, which I think helps the overall experience of customers. I didn’t want the contest to encourage people to take crazy risks in order to win best performance. So, as a former hedge fund manager, I was measured on performance net of risk, measured as volatility. I want to impress on people, your return is what you’re here to do, but your risk determines whether you’re going to last long-term. We use the Sharpe ratio, so we reward someone each month on return divided by portfolio volatility (return%/Volatility%). We are trying to raise awareness that while return is obviously good, volatility is an indicator of risk, which it is generally desirable to lower as much as possible.

Channelchek (PH): You opened your doors to customers a few months after COVID-19 hit the U.S. I am sure that was concerning. What impact do you think the pandemic has had on interest in self-directed investing?

All of Us (AG): I remember sitting there thinking, this is really bad luck, launching a company into a pandemic. Then as we all know, this became a popular thing, our industry grew like crazy as a result of it. In hindsight, it makes sense, but it wasn’t obvious when the pandemic hit.

Channelchek (PH): What are individual investors most in need of, regardless of whether it’s self-deprived or just not available to them?

All of Us (AG): There are a lot of great charting packages. They don’t need more charting packages or more people running basic robo-advisory algorithms. Good tools for these exist. What’s missing now is there is a lot of value in their collective information. What we will do when we reach and get beyond 10,000 customers is machine learn on that. And by the way, we are radically transparent here as well, showing how many customers we have right on the platform. I’ve done valuable machine learning within the first two companies I had; the theory is if you can look at a large enough sample size of independent customers, then take a look at their collective information and the errors that cancel out, you will be left with enriched information. That’s what retail customers need, synthesized data science that is in an easily digested format.

Another important thing, we need to give them information and access to private markets with supporting education. This is beginning to happen, but far from equal access at this point.

Channelchek (PH): The markets have been pretty strong since you opened your doors for business? Are you at all concerned that newer investors may have built up false confidence?

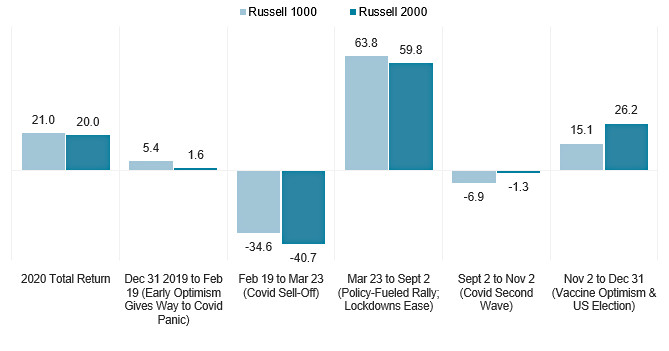

All of Us (AG): Yes. That could become a real problem. I think the way to solve that to give information on context. I don’t know if you can convince people because there’s always the “this time it’s different” feeling. So, that may not be enough. We’ve been on an upward trend for a long time. The concerns at the turn of the century of Y2K caused them to flood the economy with liquidity, causing a bubble which was followed by a halving of the market. Then we went down about 50% again during the credit crisis a short time later, that was quite a bit of pain happening twice in a short period, and we have been moving up for a long time since as on a long-term basis, we were probably due for some good times. So a lot of people haven’t seen a prolonged downturn. It’s going to be hard to convince them that it can happen.

What I learned early on is when the market is giving you money, you have to take it. Because most of the time, it’s not. Participating when the market is rallying makes up for long periods when it’s just up and down or sideways. But investing is hard; it’s vexing because you will get caught if you’re not cautious. If you’re young and you’ve never seen it, you’ve been rewarded for not being cautious. I don’t know how to fully solve this one.

Channelchek (PH): What’s in store for the year ahead?

All of Us (AG): The roadmap for this year is to add out product sets. To do another improvement based on our customer feedback in order to make their experience better. And we plan to grow past 10,000 customers so we can start doing meaningful data science. That’s all we want to tackle this year. It’s a fair bit.

Take-Away

There were quite a number of things I learned about Alan Grujic during our lengthy conversation before, after and during the interview. I’d summarize them by saying that he’s a problem solver. This seemed to be at the foundation of why he started his investment app platform. Finding solutions to problems others may not even realize exist work their way into his planned approach to each of the aspects of the online brokerage. He aims to either provide what isn’t currently being done, or offer better than what currently exists. He also places a high priority on empowering individuals. The firm’s business model involves social empowerment and using its valuable collective data to benefit those on the platform. He likened what has been happening with Reddit as a step toward social empowerment for individuals that falls in the “trial and error” stage in the industry. Alan likened what is happening with the subreddit group as part of the road for investors toward a level playing field. He said, “There’ll be several trial and errors in the evolution, and people shouldn’t dismiss this [Reddit/GameStop]. They should realize this is an expression of a business model leading to collective empowerment in investing.”

Paul Hoffman

Managing Editor, Channelchek

Suggested Reading:

Millennials

Could Use Help With Investing

Trading Technology Continues to level the playing Field for Investors

Will Janet Yellen as Treasury Secretary be Good for Investors?

Stay up to date. Follow us:

Stay up to date. Follow us:

Personal thanks to Alan Grujic at All of Us Financial for his time

Number One – In-depth, always current research on the company

Number One – In-depth, always current research on the company