Does the “Sophisticated Investor Rule” Guarantee an Uneven Playing Field?

A majority of investors are prevented from opportunities in what could potentially be the more lucrative offerings. Private equity investments or 144A securities that, because of their lesser SEC registration and accompanying reporting, are not available to the “average Joe.” That is to say, individuals must first meet the definition of being a “sophisticated” investor.

Until recently, the definition of “sophisticated,” which was a requirement for an individual to become “accredited,” was income or wealth-based. This changed during the Fall of 2020 when the SEC amended the rule. Prior to the rule change, you may in practice be the most sophisticated investor on the planet, certified to give investment advice on billions, trade portfolios for large institutions, and even be an SEC lawyer writing the stipulations themselves, yet, if you didn’t consistently make over a certain amount per year or have a minimum net worth, you need not apply to be eligible to invest in private deals.

The old rules excluded a non-accredited (though potentially capable) investor from participation in many private equity investments, private hedge funds, venture capital funds, angel investments, and other private placements, both debt, and equity.

Level Playing Field?

Let’s resist discussing whether it’s fair that a completely unsophisticated person with a huge bank account has the investment advantage of more opportunities available to them. Instead, let’s be more positive and discuss how the SEC made some headway by expanding the definition of “sophisticated” as someone who has demonstrated investment knowledge and risk awareness in other (non-bank account) ways.

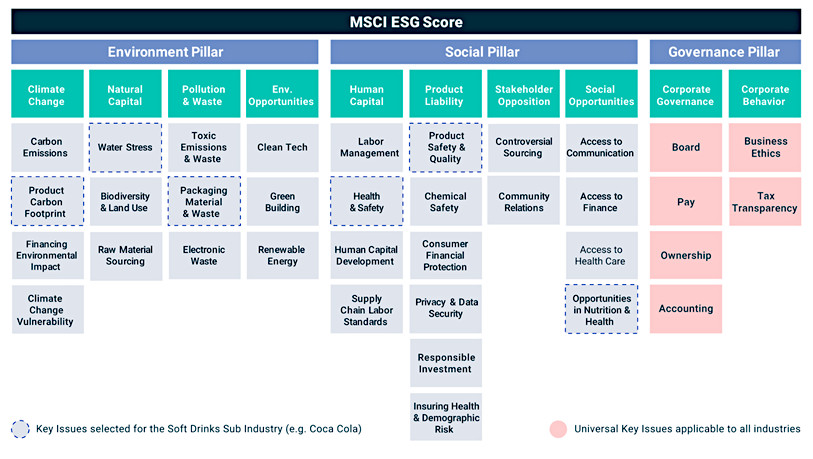

The SEC’s role is to protect investors. One way they do this is by requiring disclosure of specific investment information in public offerings. Private deals don’t meet the same disclosures requirements. For example, a portfolio manager may want to keep their hedge fund unregistered so as to not have to give away their “secret-sauce” management philosophy and portfolio make-up. Sharing investment information such as holdings the way SEC-registered mutual funds do could hurt a hedge fund’s ability to compete. This lack of transparency of what is below the surface or lack of ability to understand a non-registered equity offering is why regulators define who the offering may be made to. With less transparency comes a greater need for sophisticated investors – thus the limits to accredited investors only.

The Current Criteria

Meeting the definition of an accredited investor means the SEC considers you more sophisticated than those not meeting the definition. They also figure you have a greater tolerance for risk. And, with more financial resources, the SEC believes you have a greater capacity for due diligence.

Now that the definition has been broadened to also measure an ability to understand and not just financial resources, what is an accredited investor in 2021 under the SEC changes, and how do you know if you qualify? Until September 2020, sophistication for individuals had exclusively meant:

Earned income of more than $200,000 ($300,000 together with a spouse) in each of the last two years. You must reasonably expect to earn the same for the current year.

Or –

Having a net worth of over $1 million, either individually or together with a spouse. This net worth requirement excludes the value of your primary residence.

The above wealth-based threshold continues to serve to qualify investors as accredited investors. However, the new SEC rules now provide an additional method to qualify. The updated definition works around the wealth minimum requirement prior to investing. We’ll look at what that opens up for others below.

Last year there were two significant SEC changes that defined an accredited investor. One broadened the application of the wealth calculation. It now includes the term “spousal equivalent”. This means that if one spouse qualifies as an accredited investor, the person’s spouse also does. The other provides a path to accreditation that is not based on already accumulated wealth.

Individuals can now qualify based on specific professional credentials or certifications. The new definition includes those who have obtained Series 7, Series 65, or Series 82 investment securities licenses. State or SEC-registered investment advisors also qualify. This list may continue to expand over time as the ability of those who have passed these registrations and/or certifications and are considered sophisticated enough to make recommendations to others are deemed able to follow their own advice. It would otherwise seem odd to suggest that they are capable of doing enough due diligence to determine suitability for a client, but not for their own account.

The current state of the accredited investor rules may still seem like the playing field is unevenly split between two classes of investors. In some ways, the SEC’s mission for oversight is part of what keeps the playing field uneven with an advantage toward those that fit the definition by the very regulator that is there to protect investors. Agree or disagree, the SEC concludes that accredited investors are likely more financially sophisticated than the average person. The logic now presumes that a person that obtains the proper FINRA Series license has demonstrated the ability to independently analyze investment opportunities. What has been more important to the SEC logic is that accredited investors have ample financial resources and can withstand losses on investment opportunities should the outcome surprise on the negative side.

Becoming Accredited in 2021

There is not a government or fully defined regulatory body defined “process” for becoming an accredited investor. There is no certified exam or piece of paper issued stating a person meets the accredited investor status and therefore can be shown a private deal. The verification process is carried out in accordance with the SEC rule by the companies issuing unregistered securities, funds, or deals. They follow the accredited investor rule to determine a potential investor’s qualifications.

They do this by conducting due diligence on the investor prior to presenting an offering or allowing incoming funds. Each time an investor purchases unregistered securities, the due diligence must be conducted by the company making the offer using current information. But once you go through the process, if you’ve maintained or improved your wealth measures or securities licenses, being reapproved by the offering firm should be straightforward.

Access to an accredited investor determination so you may be shown private offerings available through Noble Capital Markets may begin by going here.

Should you choose to reach out to have Noble Capital Markets make an accredited investor determination, this process is separate and unrelated to information provided by Channelchek. Channelchek does not make any investment offerings.

Take-Away

The Securities and Exchange Commission exists to protect investors. Allowing some investors access to a broader range of offerings than others is not ideal. Discerning which investors can assess whether an offering has a suitable risk/reward ratio is a difficult task which they are refining to be more inclusive when appropriate.

Suggested Reading:

Sources:

https://www.sec.gov/news/press-release/2020-191

https://www.sec.gov/rules/final/2020/33-10824.pdf

https://aaplonline.com/how-the-jobs-act-opens-deal-flow-for-non-accredited-investors/

Photo: Dick Van Dyke as Mr. Dawes Jr. giving a sophisticated lesson about money to Mr. Banks children in Mary Poppins.