Analysis of a Special Purpose Acquisition Company

(Part of a Channelchek Series on SPACs)

Special purpose acquisition companies (SPACs) are an increasingly popular vehicle for various transactions, including transitioning a business from a private company to a publicly traded corporation. Some market participants believe that, through a SPAC transaction, a private company can become a publicly-traded company with a higher level of certainty as to pricing and control over deal terms when compared to a traditional initial public offerings (IPOs).

Analysis of a SPAC is part of a series of ongoing educational pieces published by Channelchek on the subject. From this edition, you should expect to gain a better understanding of:

- Investor rights when a SPAC is in its shell company stage

- Financial interests and motivations of SPAC sponsors

- Evaluating investor options as it begins to de-SPAC

- Warrants and possible impact on stockholders

Common Acquisition/Merger

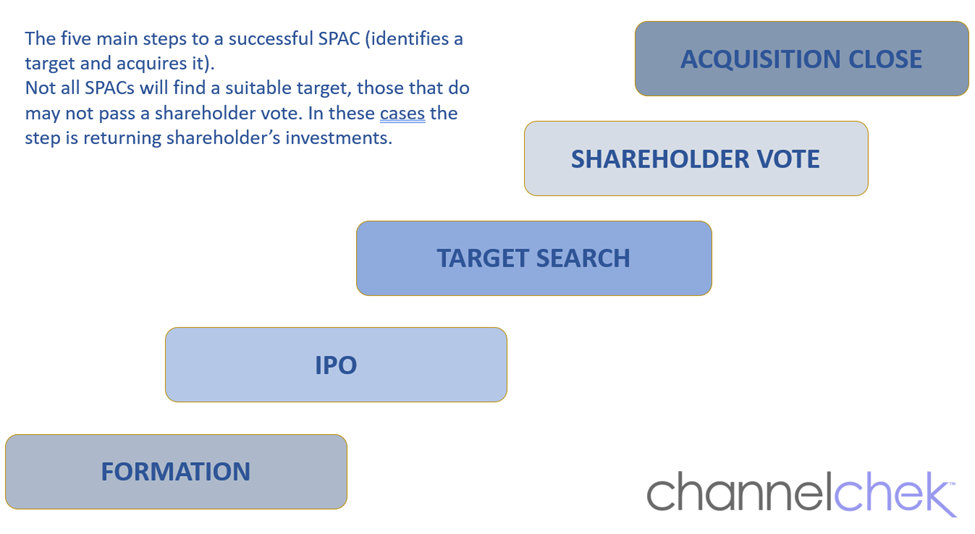

Typically, a SPAC acquires or merges with a private company after a period of fewer than two years after the SPACs own introduction to the market as an IPO. Unlike a fully functioning business going public, a SPAC is non-operating and yet to be further defined aside from objective. Its primary asset is the cash which was proceeds from the IPO and perhaps contributions of founding members and sponsors.

Investing in a SPAC offering should involve a review of the potential success of the management team that formed the SPAC and the expectation that they will be able to acquire or combine with an operating business. That acquisition or combination is known as the initial business combination; it is when the SPAC de-SPACs and is trading as other functioning public corporations do. One consideration that must be understood is a SPAC may identify in its IPO prospectus a specific industry or business that it will target. However, it is not obligated to pursue a target in that suggested industry.

The Initial Business Combination

As the SPAC identifies the opportunity of an initial business combination, its founders and sponsors negotiate with the target before presenting for approval to SPAC shareholders. If approved by a majority vote, they execute on the takeover. The transaction is commonly structured as a reverse merger where the operating company merges with and into the publicly traded SPAC. The initial business may be structured in various ways; however, the combined company, once the transaction is executed, is a publicly-traded company and carries on the business it had been engaged in, while the SPAC designation ceases to exist (de-SPAC).

Evaluating an Investment in a SPAC

Before the initial business combination, retain a copy of the prospectus and other reports (periodic and current field). If there is third-party research available (quality research by credentialed providers), read and develop an understanding of the analyst’s evaluation. It’s important to comprehend the terms of any investment and the expectations of management. While SPACs are generally uniform in structure and may be subject to certain minimum exchange listing requirements, it’s important to understand the specific features of any SPAC that you may commit money to. Part of this understanding includes the equity interests held by the sponsor and how they were derived (purchased versus nominal consideration). Since the SPAC doesn’t have an operating history to evaluate, it’s important to evaluate the background of SPAC management, you should read and understand a SPAC’s IPO prospectus and periodic and current reports in the SEC’s EDGAR database.

SPACs generally invest the proceeds from the IPO in relatively safe, interest-bearing instruments. You’ll find the acceptable deposits or investments listed in the IPO prospectus, there are no regulatory guidelines for cash investments, so this section is important to visit. Also, understand what anyb investment earnings are to be used for. SPACs often use the interest on the trust or escrow account assets to pay taxes.

Investor Redemption Option

A SPAC provides its investors with the option to redeem their shares rather than become a shareholder of the combined company. Should the SPAC not be able to move forward and complete a business combination, shareholders are beneficiaries of the trust and are entitled to their pro-rata share of the amount left on deposit in the trust account. This is another area to focus on when reviewing the SPAC prospectus before committing to an investment. Review the IPO prospectus to understand the terms of the trust account, including your redemption rights and the circumstances in which cash may be released from the account.

If you purchased your shares on the open market at a cost different from the SPAC price (usually $10), your shares are redeemed at the same valuation as those that invested at the IPO price. If you own shares at a discount to the IPO price, you may profit (and have a tax situation). If you paid a premium, you will have your shares redeemed at a loss.

Consummation Period

Most

SPACs provide a two-year period for the management to identify and complete an initial business combination transaction. The time frame is spelled out in the prospectus and should be verified. Some SPACs have opted for shorter periods. The SPAC’s governing instruments may permit it to extend that time period – understand what you’re investing in. In some governing documents, if a SPAC wants to extend the search period, it may be required to get shareholder approval. There is a regulatory maximum if a SPAC lists its securities on an exchange; then it is required to complete an initial business combination within three years of its IPO.

The current use of SPACs to acquire companies has the effect of increasing competition among SPACs and reducing the potential ideal targets. This should be weighed into your decision when tying up investment capital.

Secondary Trading

Be certain of the class of security that you’re putting in your portfolio. The initial public offering of a SPAC is often structured with securities that include common shares and warrants. The warrants are contractual arrangements that provide registered holders the right to purchase from the company a specified number of additional shares of common stock in the future at a certain price, often a premium (out of the money) to the stock price when issued.

The initial SPAC unit will trade for some time after the IPO. Over time, the SPAC common stock and warrants may begin trading on exchanges separately under unique trading symbols. The SPAC generally files an 8K (Form 8-K ) and issues a press release to make interested parties aware when separate trading is to begin. Investors who purchase SPAC securities after the IPO on the open market should be aware of whether they are purchasing units, common stock, or warrants.

The terms and stipulations of warrants are unique arrangements individual to each SPAC. It’s important to understand the contractual agreements as either an investor in common stock or in secondary warrants. The Terms will include how many shares warrant holders have the right to purchase (possible dilution of common shareholders) and as an investor how many shares a warrant would allow, the price at and period during which shares may be purchased, any circumstances under which the SPAC may be permitted to redeem the warrants, and the warrant expiration date. These terms and quantity can be found in the IPO prospectus for the SPAC.

Initial Business Combination Action Items

As the SPAC is successful in identifying a target for an initial business combination, shareholders of the SPAC can expect to receive a proxy statement to solicit shareholder approval. Shareholders will have the opportunity to vote on the transaction and as is standard in most SPAC documents, either remain a shareholder after the initial business combination or redeem their shares at its pro-rata amount as outlined earlier. In some cases, SPAC sponsors and affiliates may have enough votes to approve the transaction without a full shareholder vote.

This is a critical step, the successful (in terms of finding a target and transacting) SPAC now transitions from having assets that are a trust account to owning an operating company. Depending on how you as an investor view the business being transacted on and whether it represents value to you, you have a window to be in or out at a pro-rata amount.

If the SPAC seeks shareholder approval of an initial business combination, it will provide shareholders with a proxy in advance of the shareholder vote. In cases where the SPAC does not solicit the approval of public shareholders, because certain shareholders, such as the sponsor and its affiliates, hold enough votes to approve the transaction, it will provide shareholders with an Information Statement in advance of the completion of the initial business combination.

The Proxy or Information Statement will contain information about the business of the company to be acquired, their financial statements, parties to the transaction, and the terms of the initial business combination transaction, including the capital structure of the combined entity.

What Else?

In addition, the SPAC may require additional financings to fund the initial business combination, and those financings often involve the sponsors. As a result, the interests of the sponsors may further diverge from your interests. For example, additional funding from the sponsors may dilute your interest in the combined company or may be provided in the form of a loan or security that has different rights from your investments.

To learn more about a sponsor’s interests in a SPAC, review the Principal Stockholders and Certain

Relationships and Related Party Transactions sections of a SPAC’s IPO prospectus. You can learn more about an initial business combination and the sponsor’s interest from the Proxy Statement, Information Statement, or Tender Offer Statement.

You May Also Be Interested In:

Stay up to date. Follow us:

Stay up to date. Follow us: