Smart for Life (SMFL) Corporate Presentation from NobleCon18News and Market Data on Smart for LifeNobleCon 18 Complete Rebroadcast

|

Category:

Splash Beverage Group (SBEV) NobleCon18 Presentation Replay

SQL Technologies (SKYX) NobleCon18 Presentation Replay

SurgePays (SURG) NobleCon18 Presentation Replay

Tonix Pharmaceuticals (TNXP) NobleCon18 Presentation Replay

Townsquare Media (TSQ) NobleCon18 Presentation Replay

Vivakor (VIVK) NobleCon18 Presentation Replay

Volition (VNRX) NobleCon18 Presentation Replay

Vox Royalty Corp (VOXCF) NobleCon18 Presentation Replay

Voyager Digital (VYGVF) NobleCon18 Presentation Replay

Wesana Health (WSNAF) NobleCon18 Presentation Replay

Did the Stock Market Already Overshoot to the Downside in 2022?

Image Credit: Kirt Edblom (Flickr)

Any Surprise After the FOMC Meeting and Announcement Could Be Rally-Worthy

The markets are again in an awkward position where bad economic news tends to cause a market rally. Strong economic news, of course, strengthens the Fed’s case for aggressively tightening. Equity markets have not been reacting well to the prospect of tightening. During April, almost all news was taken as bad. For example, after low unemployment numbers, the market traded off as this could heighten wage inflation. The negative GDP report also prompted market weakness as it may mean we are already in a recession.

Room to Significantly Bounce

May trading will start off with what most look at as getting “bad news” out of the way. The bad news is the FOMC decision on Rates which we should know by 2 pm Wednesday (May 4). Recently the Fed has been guiding the markets to expect 50bp of tightening in May. Another 50bp has been foreshadowed for June.

Anything more than 50bp in May or a statement suggesting that June could be higher than 50bp will bring in the sellers. But, there is a possibility the Fed may actually tone down its hawkish stance, and very little possibility they will amplify it.

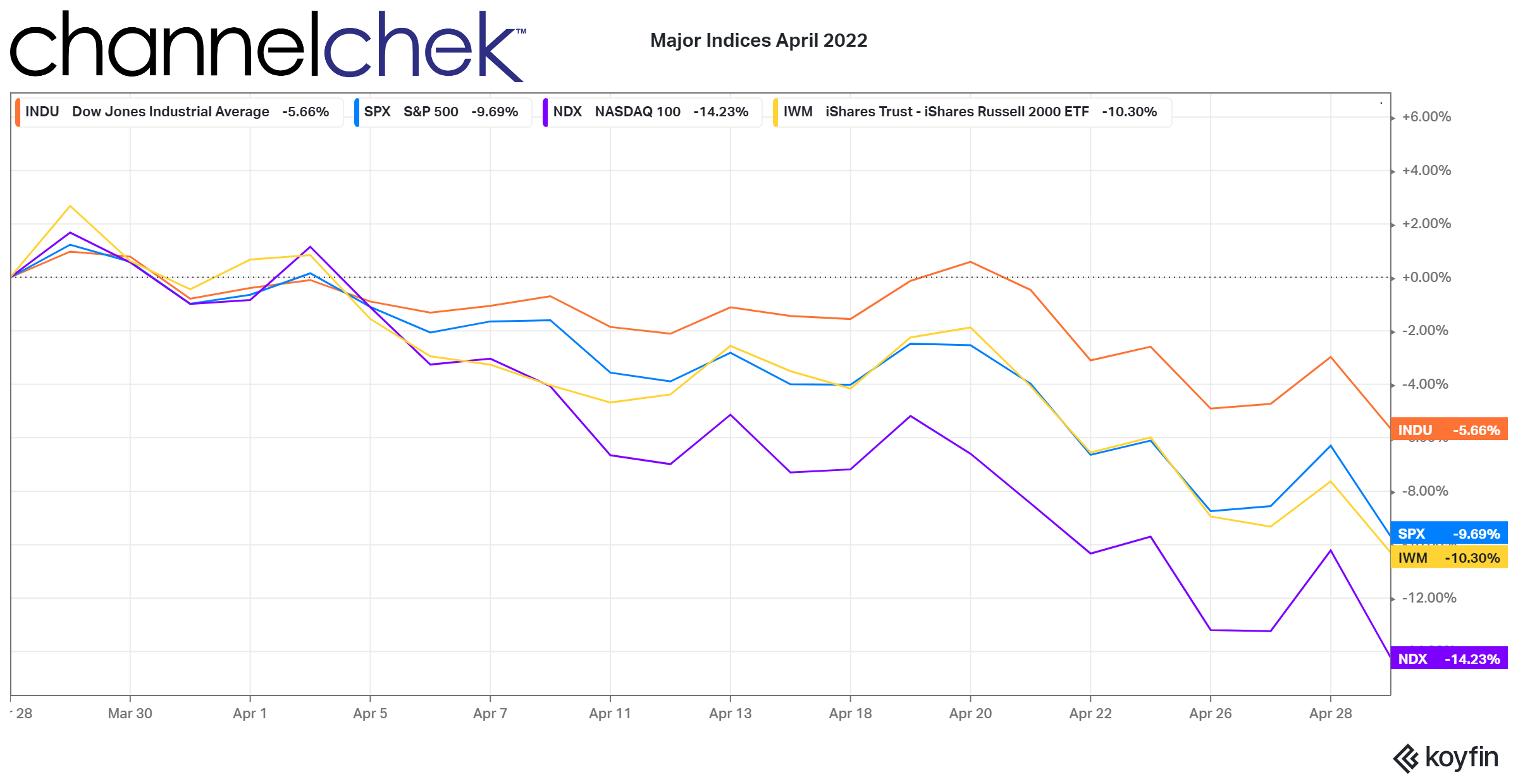

Source: Koyfin

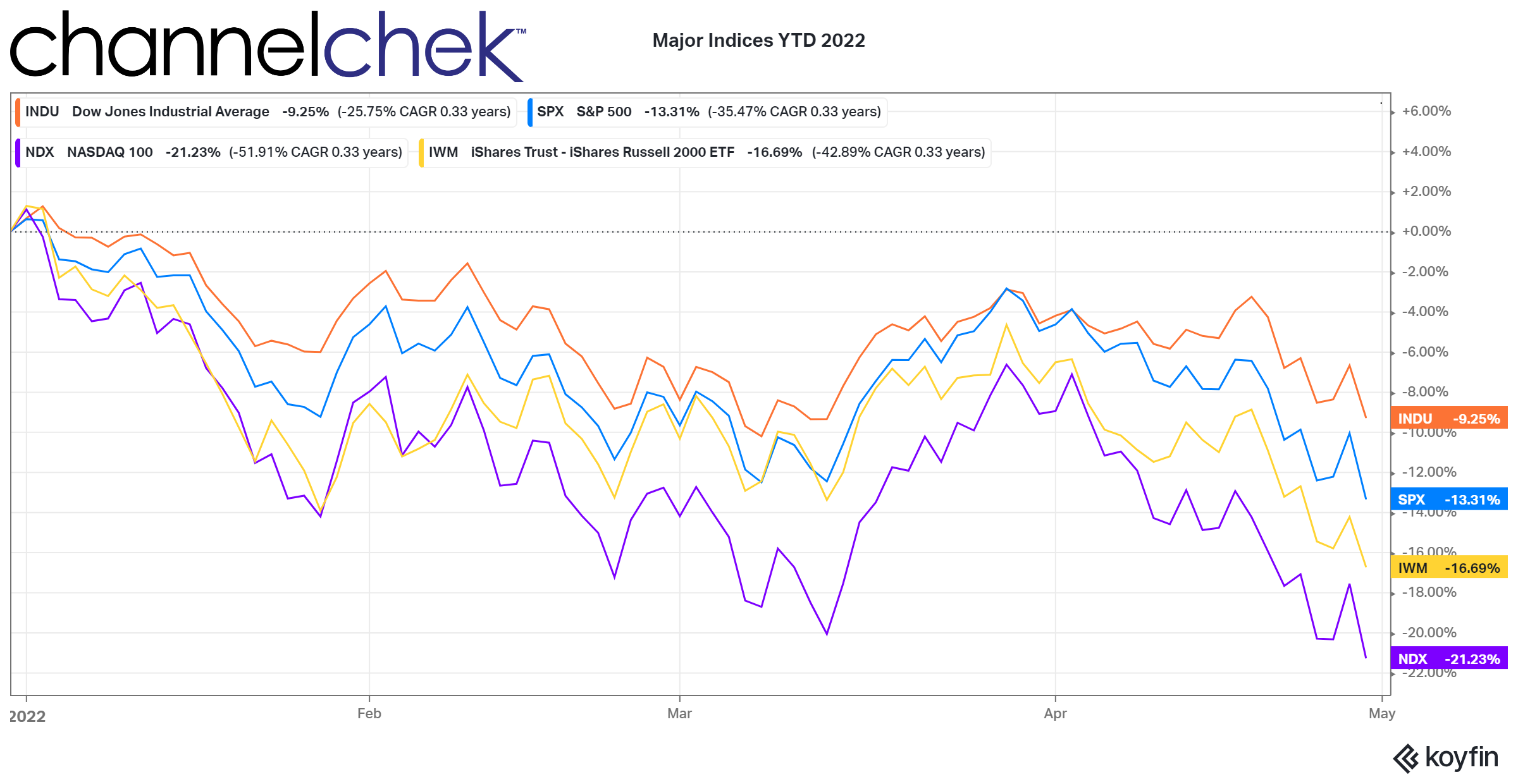

All major indices increased their losses during the month of April. Investors in the Nasdaq 100, which is heavily weighted toward large tech stocks, took the brunt of the fall. The indices all reached their high for the year during the first week in January. Shortly after this, the Fed began discussing inflation in terms that suggested rising prices would be more persistent than originally thought when they were labeled “transitory.”

The markets were then told to expect higher overnight bank lending rates (Fed Funds) and a smaller balance sheet (let bond purchases roll-off). The Fed approved a 0.25 percentage point rate hike on March 16, the first increase since December 2018.

Source: Koyfin

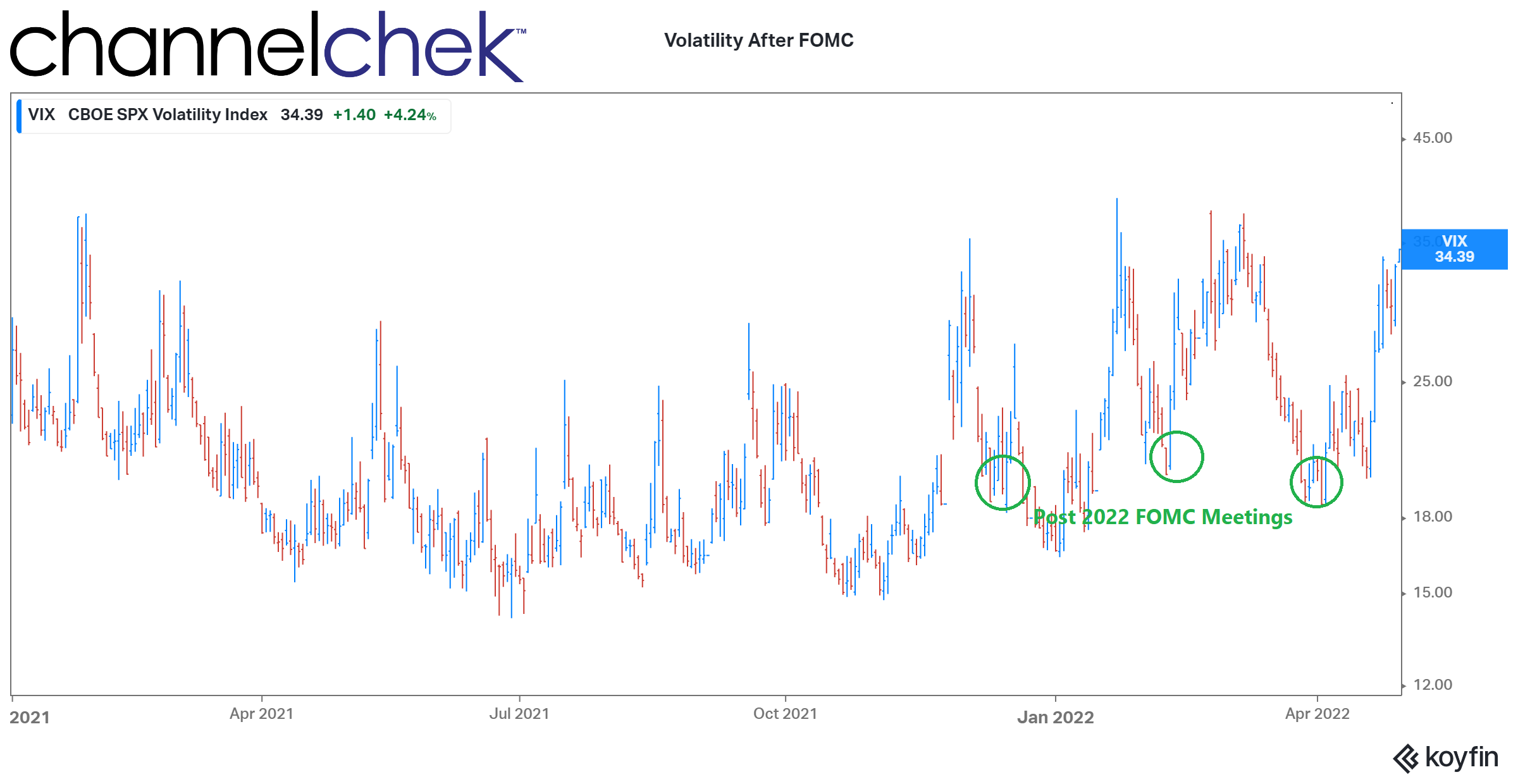

FOMC Meetings and Volatility

The VIX index, which is a measure of implied volatility, is currently trading around 33. This suggests the options market is pricing in a nearly 2.1% daily move in the S&P 500. If this number falls, it suggests volatility is decreasing.

Using the VIX as a guide, since the start of 2022, stock market investors have been more fearful before Fed meetings than after the meeting. In fact, the FOMC meetings have been followed by market rallies in the S&P 500. Unless the Fed does something more aggressive than previously indicated, the activity prior to the May meeting has given stocks plenty of room to bounce. The first look at the first-quarter GDP, which was negative, could cause the Fed to tone down their rhetoric. A market hanging on every word would breathe a sigh of relief if a “softening” in the first quarter is mentioned.

Source: Koyfin

The definition of a recession is two consecutive quarters or more of negative growth. We are now in the second quarter; shrinking the economy would put us in a recession. Recessions accompanied by high inflation are the worst economic scenario (stagflation). No Fed wants to be viewed as being partially responsible for a period of stagflation.

Take-Away

Markets are not predictable, but they do establish patterns. The pattern for 2022 has been panic leading up to Fed meetings, then a relief rally after. The GDP number just released is likely to keep the Fed from becoming more aggressive in its stance. This has the potential to cause a bear market rally for investors that would prefer the market to repeat its dismal April performance.

Managing Editor, Channelchek

Suggested Reading

Has the Fed Run Out of Good Options?

|

Russell Reconstitution 2022, What Investors Should Know

|

Consumer Price Index Report was a Contrarian Dream

|

Rumors of Fossil Fuels Death are Quite Premature

|

Stay up to date. Follow us:

|

NobleCon18 Recap – 2 Days in Less Than 20 Minutes

|

|

NobleCon18 Recap – 2 Days in Less Than 20 MinutesIf you didn’t make it to the LIVE event, or even if you did and want to revisit this memorable conference, here’s your opportunity exclusively on Channelchek. Our on-demand catalog captured close to 50 hours of content. Individual corporate presentations and compelling panels. Get a taste for it with our “2 Days in Less Than 20 Minutes” video. It’s all here on Channelchek. And as always, it’s free for subscribers (and there’ no cost to subscribe). Take your time or binge. If you’re looking for the next apple, this is the orchard. NobleCon 18 Complete Rebroadcast

|