Image Credit: Venom82 (Flickr)

Why Microcaps are the New Small Cap Stocks, and How to Adjust

The 2021 Russell Reconstitution, which occurred on the last Friday in June, dramatically changed sector definitions. The market cap dividing line from where the small-cap Russell 2000 Index ends and the large-cap Russell 1000 Index begins became $5.2 billion in market capitalization. This number was only $3.0 billion last year. The 73% jump is massive. On the lower end of the category, entry into the small-cap index last year took $95 million (Limestone Bancorp) in market cap. This year the smallest company in the Russell 2000 had a market cap of $257 million (Velocity Capital). This is more than twice as large – a 171% increase.

The category of small-cap, at least by the well followed FTSE Russell indices, is a relative definition (not dollar amount). Last year, a small-cap may have gained market-cap over 12 months yet still drops down into the microcap category if others grew more. Investors in small and mid-cap stocks should be aware of this as they may not be receiving the same potential for growth in today’s mid and small defined categories than they were when the sectors were all less inflated.

Microcaps

are the “New” Small-Caps

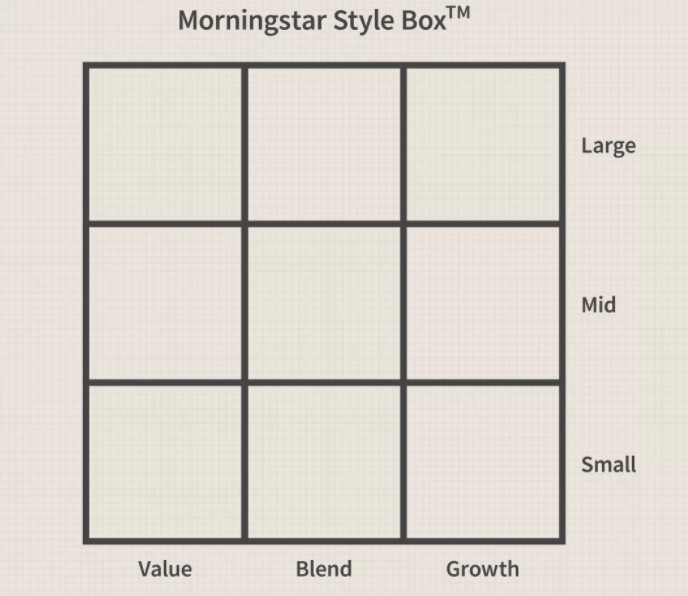

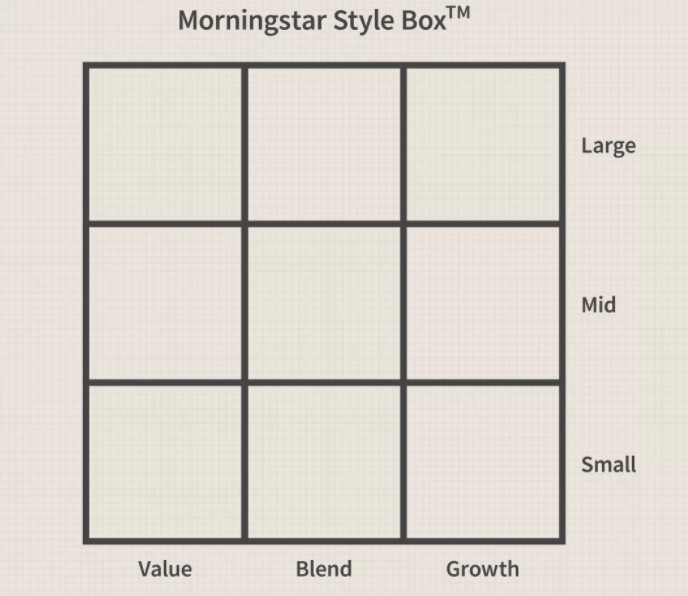

In the past microcap investments have historically received less attention than small-cap, mid-cap and large-cap companies. Noteworthy reasons for this include less scalability for a large fund manager; also, microcaps often have less coverage on the research side. Another impactful oddity is that the whole microcap space lacks a position in the “Investment Style Box.”

Aside from the idea that the capitalization of many Microcaps in 2021 is larger than what were deemed small-caps last June, there are other noteworthy reasons for investors to now explore micro.

The

2021 Case for Smaller

Scalability, research and analysis, and not fitting neatly into the recognized style box all depress interest, awareness, and understanding of high potential companies. Individual investors can take advantage of the less talked about microcap sector and at the same time add diversification that could help key measures of performance.

Scalability

Scalability in the smallest of stocks places individuals with average size accounts in an enviable position relative to fund managers. Here’s why: Imagine you’re an equity portfolio manager and have found the “secret sauce” to small company stock picking. You’ve backtested to 5 years with a $100,000 portfolio and the results have averaged 60% winners with a 42% average gain, and the losers and breakeven trades average just a 6% loss. With these results, your firm seeds an account with $10,000. and you now begin to test your methodology with live “ammo.” The methods driving your results include a mix of using trusted third-party fundamental analysis on small company stocks, then a common chart setup to find an entry point. After six months, your results aren’t quite as favorable relative to benchmarks as they had been, but still well ahead of the major market indexes.

The money management firm you work for has been reviewing your results and has now decided to create a fund around your investment style. They market the microcap fund heavily, and over time, with very good performance, it attracts a few hundred million in assets.

With each large inflow to the fund, you find fewer opportunities because your original tested methods had fewer dollars to put to work; being nimble with large dollar amounts is more difficult. Even worse, whereas scaling into a position over the course of a few days with $2,000-$5,000 allowed decent price execution, doing the same with $25,000 – $75,000 or more tends to lift the stock price to the point where the trade may no longer be feasible – if the size is available at all.

Unlike other markets where having more to spend gives you price preference or negotiation power, small investors have an advantage with smaller, less liquid companies. The $10,000 “test” account with a 5% limit per name was able to outperform consistently. The exact same methods but with 100x the assets or more have watered down the success rate dramatically.

This is why there aren’t hundreds of funds run by large companies in the micro sectors. The supply and demand issue would be too challenging. And since the big firms are the ones that push to get on TV to discuss their performance while they bombard us with paid ads, it is their products and stock picks that get far more coverage. This doesn’t mean there aren’t very successful small and microcap money managers, they just don’t often get invited on to a major financial TV show as they aren’t big advertisers or even in need of adding hundreds of millions to any one of their portfolios.

Available

Equity Research

The firms that do manage funds and portfolios that specialize in smaller companies rely on their understanding of the company fundamentals. This is another reason individuals may not now be taking full advantage of the smallest of companies – the average investor simply doesn’t find much information written on them, and most investors aren’t capable of digging into the firm’s business model, their financials, or inviting themselves to meetings with management.

So, an asset management firm with in-house analysis can find less heard of companies that are necessarily overlooked by large funds because of scalability, yet the stocks that represent great value can achieve outsized performance. They are the players with “better” information and opportunity.

Fortunately for those transacting for smaller pools of money or even themselves, if they understand the value of investing in less correlated (vs. S&P 500 or Nasdaq 100) assets, they can now find well-presented research from veteran analysts with bulge-bracket firm pedigree. This top-tier analysis, coupled with low or no-cost brokerage trades, makes small company stocks well worth considering for a prudent portion of an overall asset mix.

Image Credit: Morningstar

Style

Box

Since 1992 Morningstar and others that adopted the style box grid have taught investors to think of nine different categories of stock market investing. At the time, Morningstar served those evaluating mutual funds, so the simplicity of boiling it down to a few columns made investor choices easy. However, the reduced complexity is oversimplified and ignores important sectors that can’t easily be scaled up into large mutual funds. There is a reason people are always encouraged to “think outside the box,” for many, it isn’t natural to look beyond what is put in front of them. If we round the style box up to a dozen options by now, including “Micro Value,” “Micro Blend,” and “Micro Growth,” investors would visually see more of their options and possibly improve diversification.

The massive dollar leap in sector definitions and how this impacts Style Box make-up make exploring what is now called Micro more prudent than ever.

Take-Away

The extreme growth in terms of company valuations within the major indexes could necessitate investors digging deeper into the smaller sectors, especially since they now contain companies with higher valuations than ever before.

Individuals aren’t as exposed to the less-heralded companies until they become powerful enough to attract attention. The reasons are that media coverage is far less, and for individuals the effort to uncover opportunities may be a bit higher. They could also be mentally stuck inside of a style box that was designed to serve the mutual fund industry. Many stocks defined as micro were well within the definition of small last year. They should be explored with the idea that they may now meet the same valuation definition as you always used, but for other reasons moved to a sector that hasn’t been on your radar.

Channelchek is a resource for exploring opportunities in the small and microcap space. With a growing list of companies covered by top-tier analysts, it is worth regular visits to the website to help find ideas to enhance and diversify your portfolio outside of the very dated box.

Paul

Hoffman

Managing Editor, Channelchek

Suggested Reading:

Sources:

https://en.wikipedia.org/wiki/Morningstar_Style_Box

https://www.ftserussell.com/resources/russell-reconstitution

Stay up to date. Follow us: