Volition (VNRX) Corporate Presentation from NobleCon18News and Market Data on VolitionNobleCon 18 Complete Rebroadcast

|

Category:

Vox Royalty Corp (VOXCF) NobleCon18 Presentation Replay

Voyager Digital (VYGVF) NobleCon18 Presentation Replay

Wesana Health (WSNAF) NobleCon18 Presentation Replay

Did the Stock Market Already Overshoot to the Downside in 2022?

Image Credit: Kirt Edblom (Flickr)

Any Surprise After the FOMC Meeting and Announcement Could Be Rally-Worthy

The markets are again in an awkward position where bad economic news tends to cause a market rally. Strong economic news, of course, strengthens the Fed’s case for aggressively tightening. Equity markets have not been reacting well to the prospect of tightening. During April, almost all news was taken as bad. For example, after low unemployment numbers, the market traded off as this could heighten wage inflation. The negative GDP report also prompted market weakness as it may mean we are already in a recession.

Room to Significantly Bounce

May trading will start off with what most look at as getting “bad news” out of the way. The bad news is the FOMC decision on Rates which we should know by 2 pm Wednesday (May 4). Recently the Fed has been guiding the markets to expect 50bp of tightening in May. Another 50bp has been foreshadowed for June.

Anything more than 50bp in May or a statement suggesting that June could be higher than 50bp will bring in the sellers. But, there is a possibility the Fed may actually tone down its hawkish stance, and very little possibility they will amplify it.

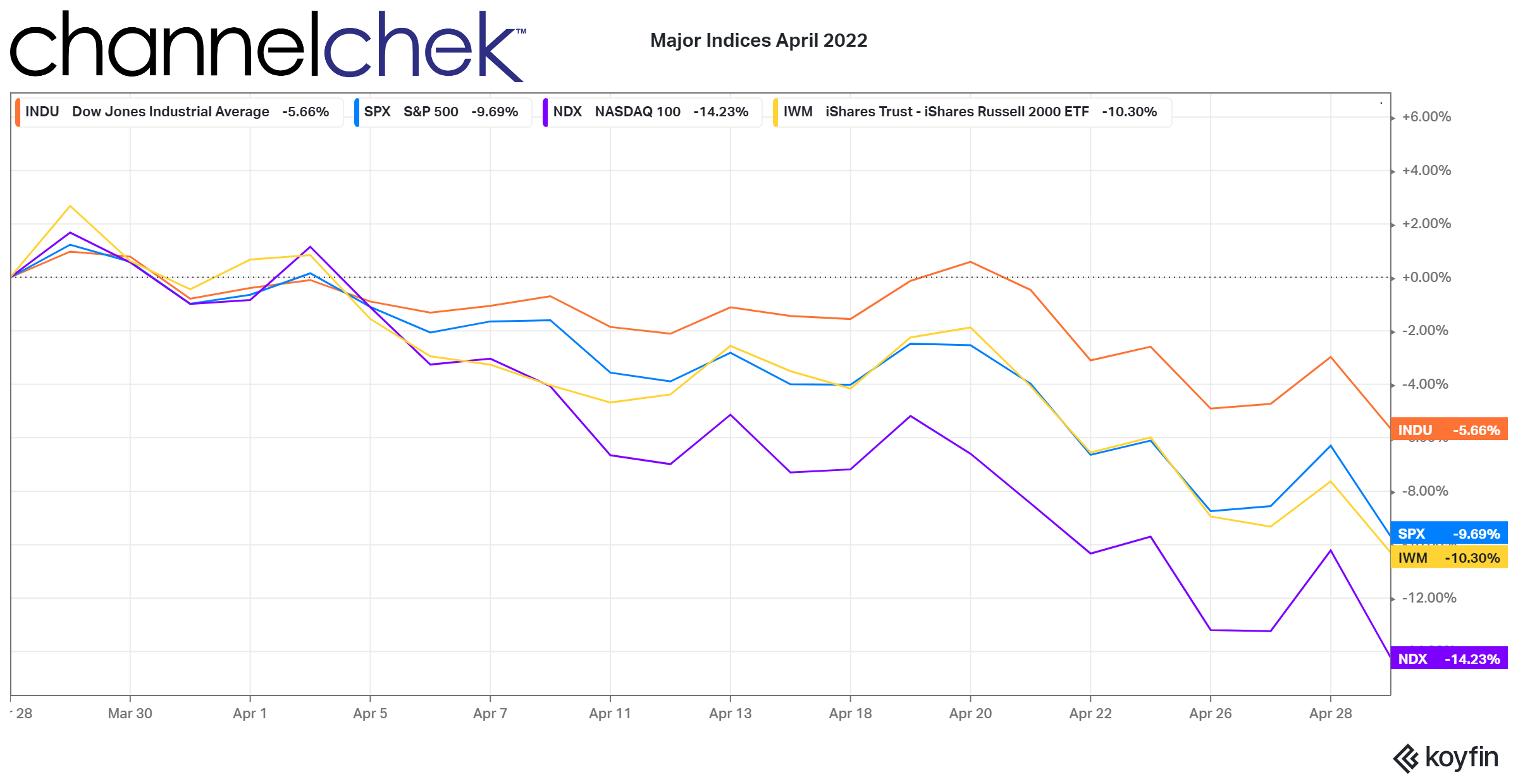

Source: Koyfin

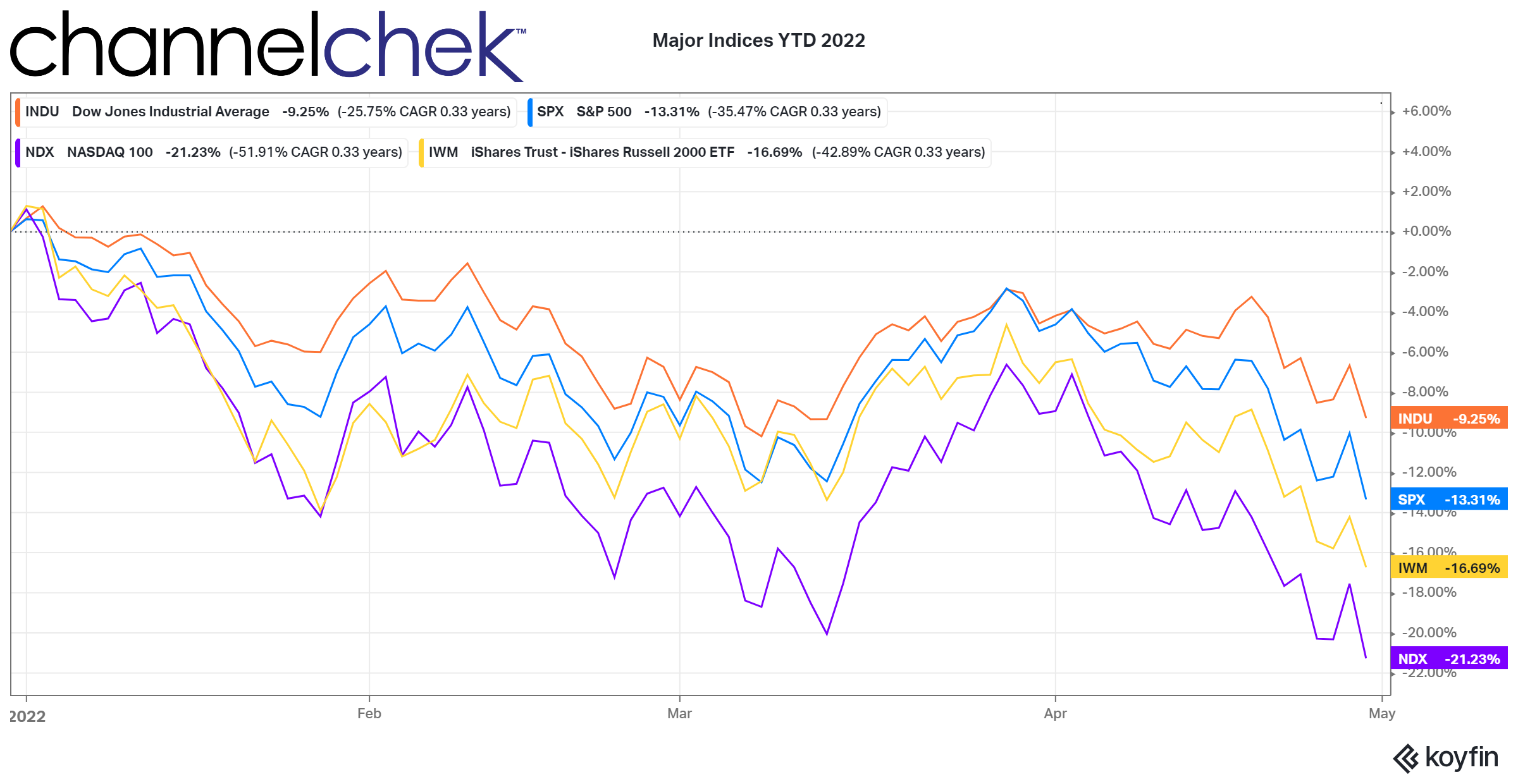

All major indices increased their losses during the month of April. Investors in the Nasdaq 100, which is heavily weighted toward large tech stocks, took the brunt of the fall. The indices all reached their high for the year during the first week in January. Shortly after this, the Fed began discussing inflation in terms that suggested rising prices would be more persistent than originally thought when they were labeled “transitory.”

The markets were then told to expect higher overnight bank lending rates (Fed Funds) and a smaller balance sheet (let bond purchases roll-off). The Fed approved a 0.25 percentage point rate hike on March 16, the first increase since December 2018.

Source: Koyfin

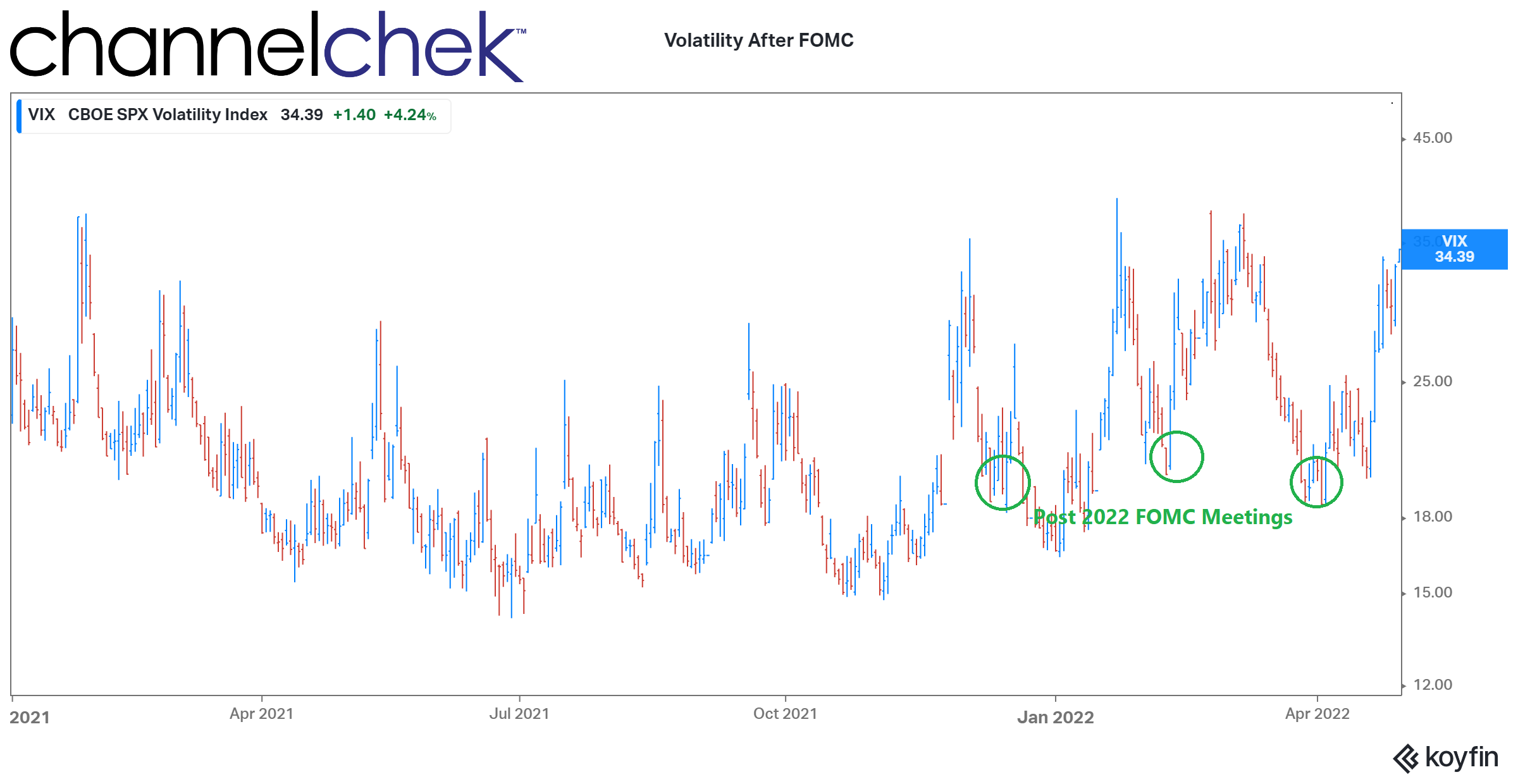

FOMC Meetings and Volatility

The VIX index, which is a measure of implied volatility, is currently trading around 33. This suggests the options market is pricing in a nearly 2.1% daily move in the S&P 500. If this number falls, it suggests volatility is decreasing.

Using the VIX as a guide, since the start of 2022, stock market investors have been more fearful before Fed meetings than after the meeting. In fact, the FOMC meetings have been followed by market rallies in the S&P 500. Unless the Fed does something more aggressive than previously indicated, the activity prior to the May meeting has given stocks plenty of room to bounce. The first look at the first-quarter GDP, which was negative, could cause the Fed to tone down their rhetoric. A market hanging on every word would breathe a sigh of relief if a “softening” in the first quarter is mentioned.

Source: Koyfin

The definition of a recession is two consecutive quarters or more of negative growth. We are now in the second quarter; shrinking the economy would put us in a recession. Recessions accompanied by high inflation are the worst economic scenario (stagflation). No Fed wants to be viewed as being partially responsible for a period of stagflation.

Take-Away

Markets are not predictable, but they do establish patterns. The pattern for 2022 has been panic leading up to Fed meetings, then a relief rally after. The GDP number just released is likely to keep the Fed from becoming more aggressive in its stance. This has the potential to cause a bear market rally for investors that would prefer the market to repeat its dismal April performance.

Managing Editor, Channelchek

Suggested Reading

Has the Fed Run Out of Good Options?

|

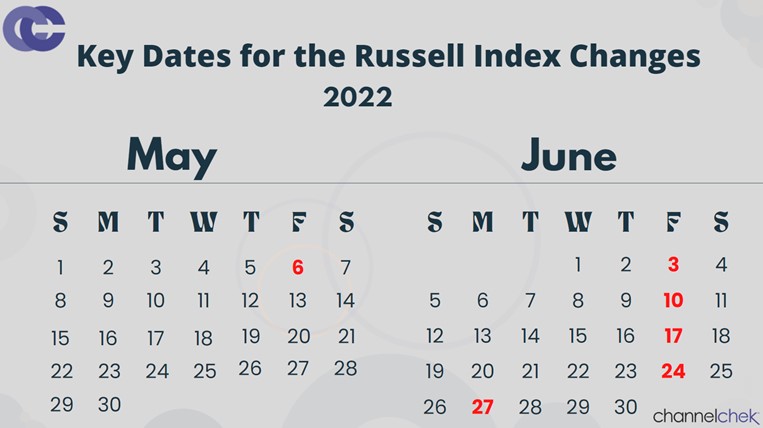

Russell Reconstitution 2022, What Investors Should Know

|

Consumer Price Index Report was a Contrarian Dream

|

Rumors of Fossil Fuels Death are Quite Premature

|

Stay up to date. Follow us:

|

NobleCon18 Recap – 2 Days in Less Than 20 Minutes

|

|

NobleCon18 Recap – 2 Days in Less Than 20 MinutesIf you didn’t make it to the LIVE event, or even if you did and want to revisit this memorable conference, here’s your opportunity exclusively on Channelchek. Our on-demand catalog captured close to 50 hours of content. Individual corporate presentations and compelling panels. Get a taste for it with our “2 Days in Less Than 20 Minutes” video. It’s all here on Channelchek. And as always, it’s free for subscribers (and there’ no cost to subscribe). Take your time or binge. If you’re looking for the next apple, this is the orchard. NobleCon 18 Complete Rebroadcast

|

The World Is HOT Right Now! – Panel Presentation from NobleCon18

|

|

The World Is HOT Right Now!Making sense of the hot-button issues facing investors including: Supply chain constraints, ESG regulation, political unrest, inflation and War.

NobleCon 18 Complete Rebroadcast

|

Metaverse: Is The Future Real? – Panel Presentation from NobleCon18

|

|

Metaverse: Is The Future Real?The Metaverse has the potential to disrupt a large number of industries. What’s in store for the next gen of the Internet? How should businesses prepare?

NobleCon 18 Complete Rebroadcast

|

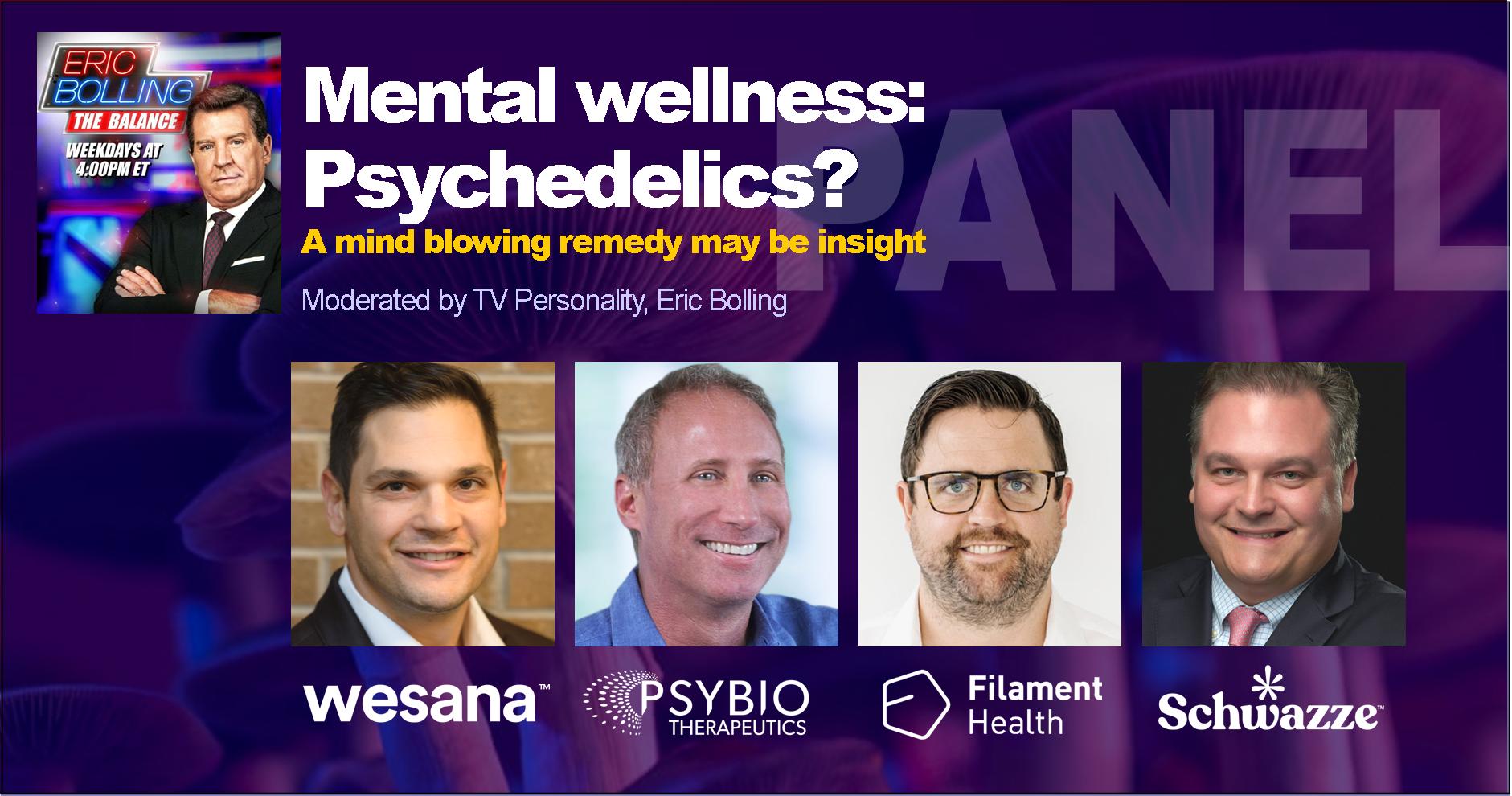

Mental Wellness: A Mind Blowing Remedy May Be In Sight – Panel Presentation from NobleCon18

|

|

Mental Wellness: A Mind Blowing Remedy May Be In SightScience has taken a closer look at the use of psychedelics to treat mental illness; investors should too. Are there comparable pathways to Cannabis?

NobleCon 18 Complete Rebroadcast

|

Can Energy Stocks Continue Their High Octane Performance?

Image Credit: Burak Kebapki

Many Reasons to Remain Bullish on the Energy Sector

Do you recall how big tech stocks started to climb dramatically in 2020? Then when many thought they were overdone, they rose even higher in 2021? Well, energy stocks, despite their staggering climb, seem to be having their turn, and there are reasons to believe the sector’s momentum will continue. Just as with the tech sector, they can’t keep rocketing upwards forever, but there are many factors that suggest the run is not yet over.

JP Morgan is quite bullish on the energy sector. In a recent report, they stated, “Energy is the only sector that is seeing its quality, growth, and momentum scores improve simultaneously.” The bank believes that energy stocks remain the best equity investment as commodity prices continue to rise. They point to continued rapid earnings growth. Despite the massive gains in 2021 and year-to-date, they wrote in a research note on Thursday (April 28), there is still room for more upside in energy stocks.

| “Energy is the only sector that is seeing quality, growth, and momentum scores improve simultaneously while maintaining an attractive value and income profile,” – Dubravko Lakos-Bujas, Chief U.S. Equity Strategist and Global Head of Quantitative Research, JPMorgan |

Energy remains the bank’s highest conviction investment. Commodity prices continue to rise and the underlying fundamentals of companies are improving. Accordingly, the expectation is that a combination of rapid earnings growth and renewed ratings for key multiples will continue to drive the sector.

And while demand remains elevated for commodities, supply could stay constrained due to a rising cost of capital and pressure from ESG policies. “The supply-demand balance continues to be tilted in favor of improving demand with higher commodity prices,” Lakos-Bujas said.

The highly regarded strategist estimates that energy demand will exceed supply by 20% and would require $1.3 trillion in incremental capital to close the gap by 2030. “While investor interest and sentiment has clearly inflected from record lows over the past year, energy stocks are far from pricing in strong and sustainable outlooks for fundamentals and shareholder returns,” the Chief Equity Strategists said.

JPMorgan’s note highlighted that energy remains the “cheapest sector” based on forward-looking earnings and book value. This is despite the sector rising 53% in 2021, and another 38% year-to-date. The energy sector trades at 9.5x forward earnings, which is well below its long-term average multiple of 16.5x.

Noble Capital Markets analysts, in their newsletter, Energy: First Quarter 2022 Review and

Outlook wrote, “Energy industry fundamentals remain strong. Energy prices are high and show no sign of decreasing. High oil prices, combined with improved operating efficiencies, mean that production companies are facing very favorable returns on their investment. We look for companies to continue reporting strong positive cash flow and to use cash flow to increase drilling and improve balance sheets.”

Take-Away

All rallies eventually come to an end. But analysts seem to be in agreement, the fundamentals, global events, and current valuation make a compelling case for the energy sector. Channelchek is a great resource to review, explore and discover small and microcap energy stocks from green energy, to fossil fuels, and even natural resources used in energy storage or transmission.

Sign up here for Channelchek notifications.

Paul Hoffman

Managing Editor, Channelchek

Suggested Reading

Energy and Global Fundamentals Make a Good Case for Owning Western Uranium Stocks

|

Exploration and Production Review and Outlook – Noble Capital Markets Energy Sector Review – Q1 2022

|

Energy Fuels (UUUU) NobleCon18 Presentation Replay

|

Alvopetro Energy (ALVOF) NobleCon18 Presentation Replay

|

Sources

https://am.jpmorgan.com/sg/en/asset-management/per/funds/global-growth/

Stay up to date. Follow us:

|

Release – Great Lakes Dredge & Dock Corporation Awarded Large-Scale U.S. Offshore Wind Rock Installation Project

Great Lakes Dredge & Dock Corporation Awarded Large-Scale U.S. Offshore Wind Rock Installation Project

Research, News, and Market Data on Great Lakes Dredge & Dock

HOUSTON, May 02, 2022 (GLOBE NEWSWIRE) — Great Lakes Dredge & Dock Corporation (“Great Lakes” or the “Company”) (NASDAQ: GLDD), the largest provider of dredging services in the United States, announced today that Empire Offshore Wind, a joint venture between Equinor (NYSE: EQNR) and bp (NYSE: bp), have chosen Great Lakes in consortium with Van Oord to perform the subsea rock installation work for the Empire Wind I and II wind farms in the East Coast of the United States. Empire Wind I and II are expected to provide over 2 Gigawatts (GW) of renewable energy to the State of New York.

Great Lakes will use the first Jones Act compliant subsea rock installation vessel, currently under construction at the Philly Shipyard in the U.S., to install rocks to protect and stabilize monopile foundations, electrical substructures, and export cables, starting with Empire Wind I in the mid-2020s and continuing with Empire Wind II. Van Oord will mobilize the flexible fallpipe vessel, Stornes, to install rock prior to the installation of the monopile foundations.

Lasse Petterson, President and Chief Executive Officer at Great Lakes, commented, “The consortium of Great Lakes with Van Oord combines the experience of Van Oord, the global market leader in subsea rock installation, with Great Lakes, the only U.S. marine contractor to invest in building the first Jones Act compliant fallpipe vessel purpose built for the U.S. offshore wind market. This unique combination offered a competitive advantage in terms of experience, equipment availability, local content, and knowledge of labor and regulatory environments in the U.S.”

Great Lakes will be generating local content, employment, and economic activity in the State of New York by purchasing rock from domestic New York quarries, which are in close proximity to the Empire Wind I and II offshore wind farm sites. The Company is working closely with NYSERDA on NY Supply Chain development and will be using the GLDD marine base in Staten Island, New York, for its site operations.

The renewable power generated by the two wind farms is estimated to power more than one million households in New York. This project is considered a flagship offshore wind development, shaping the future of this industry in the United States. Designed to produce renewable electricity to deliver on the state’s climate ambitions, it also creates new opportunities for economic growth and employment for the State of New York.

Eleni Beyko, Senior Vice President-Offshore Wind at Great Lakes, commented, “This award by Equinor and bp solidifies Great Lakes’ entry into the U.S. offshore wind market with a major project award for one of the flagship offshore wind developments for the State of New York. We are very happy to support New York in building a more sustainable future. We have a long track record working with the state and the local unions and supply chains, having executed dredging projects in New York for many decades. Our goal now is to contribute to building the U.S. offshore wind industry, while creating local employment and economic activity in the state.”

The

Company

Great Lakes Dredge & Dock Corporation is the largest provider of dredging services in the United States. In addition, Great Lakes is fully engaged in expanding its core business into the rapidly developing offshore wind energy industry. The Company has a long history of performing significant international projects. The Company employs experienced civil, ocean and mechanical engineering staff in its estimating, production and project management functions. In its over 131-year history, the Company has never failed to complete a marine project. Great Lakes owns and operates the largest and most diverse fleet in the U.S. dredging industry, comprised of approximately 200 specialized vessels. Great Lakes has a disciplined training program for engineers that ensures experienced-based performance as they advance through Company operations. The Company’s Incident-and Injury-Free® (IIF®) safety management program is integrated into all aspects of the Company’s culture. The Company’s commitment to the IIF® culture promotes a work environment where employee safety is paramount.

Cautionary

Note Regarding Forward-Looking Statements

Certain statements in this press release may constitute “forward-looking” statements as defined in Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), the Private Securities Litigation Reform Act of 1995 (the “PSLRA”) or in releases made by the Securities and Exchange Commission (the “SEC”), all as may be amended from time to time. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements of Great Lakes and its subsidiaries, or industry results, to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Statements that are not historical fact are forward-looking statements. These cautionary statements are being made pursuant to the Exchange Act and the PSLRA with the intention of obtaining the benefits of the “safe harbor” provisions of such laws. Great Lakes cautions investors that any forward-looking statements made by Great Lakes are not guarantees or indicative of future events.

Although Great Lakes believes that its plans, intentions and expectations reflected in this press release are reasonable, actual events could differ materially. The forward-looking statements contained in this press release are made only as of the date hereof and Great Lakes does not have or undertake any obligation to update or revise any forward-looking statements whether as a result of new information, subsequent events or otherwise, unless otherwise required by law.

For

further information contact:

Tina Baginskis

Director, Investor Relations

630-574-3024

NobleCon18 Rebroadcast

|

NobleCon18 Recap – 2 Days in Less Than 20 MinutesIf you didn’t make it to the LIVE event, or even if you did and want to revisit this memorable conference, here’s your opportunity exclusively on Channelchek. Our on-demand catalog captured close to 50 hours of content. Individual corporate presentations and compelling panels. Get a taste for it with our “2 Days in Less Than 20 Minutes” video. |

Panels

Open to all registered Channelchek users. Register here – It’s free. We only need a name and email address.

The World is HOT! |

The Metaverse |

PSychedelics Panel |

NobleCon18 Presenting Companies

(Noble Capital Markets research coverage)

NobleCon18 Presenting Companies

(featured on Channelchek)

1-800-Flowers.com (FLWS) – What To Do Now?

Friday, April 29, 2022

1-800-Flowers.com (FLWS)

What To Do Now?

1-800-FLOWERS.COM, Inc. is the leading provider of gourmet and floral gifts for all occasions. For nearly 40 years, 1-800-FLOWERS® has been helping deliver smiles for customers with gifts for every occasion, including fresh flowers, premium, gift-quality fruits, and other gourmet items from Harry & David®, popcorn and specialty treats from The Popcorn Factory®; cookies and baked gifts from Cheryl’s®; premium chocolates and confections from Fannie May®; gift baskets and towers from 1-800-Baskets.com®; premium English muffins and other breakfast treats from Wolferman’s; carved fresh fruit arrangements from FruitBouquets.com; and top quality steaks and chops from Stock Yards®. The Company’s BloomNet® international floral wire service provides a broad range of quality products and value-added services designed to help professional florists grow their businesses profitably.

Michael Kupinski, Director of Research, Noble Capital Markets, Inc.

Patrick McCann, Research Associate, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Fiscal Q3 miss. The company reported fiscal Q3 2022 revenue of $469.6 million, missing our estimate of $478.8 million by 1.9%. Adj. EBITDA also missed our expectation in the quarter at a seasonal loss of $12 million compared with our forecast of a loss of $8 million.

Costs challenges. Gross profit margin was down in all three business segments compared with the prior year period. The sharpest gross margin decline was in the Gourmet Foods & Gift Baskets segment. The decline in company wide gross margins, down over 600 basis points, was due to increased labor costs, higher inbound and outbound shipping costs, and write-offs of inventories …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.