|

|

|

One Stop Systems President & CEO David Raun provides a preview of their upcoming presentation at NobleCon18 NobleCon18 – Noble Capital Markets 18th Annual Small and Microcap Investor Conference – April 19-21, 2022 – Hard Rock, Hollywood, FL 100+ Public Company Presentations | Scheduled Breakouts | Panel Presentations | High-Profile Keynotes | Educational Sessions | Receptions & Networking Events Free Registration Available – More InfoResearch News and Advanced Market Data on OSSNobleCon18 Presenting Companies

About One Stop Systems

One Stop Systems, Inc. (OSS) designs and manufactures innovative AI Transportable edge computing modules and systems, including ruggedized servers, compute accelerators, expansion systems, flash storage arrays and Ion Accelerator™ SAN, NAS and data recording software for AI workflows. These products are used for AI data set capture, training, and large-scale inference in the defense, oil and gas, mining, autonomous vehicles and rugged entertainment applications. |

Category:

Elite Education Group International (EEIQ) Scheduled to Present at NobleCon18 Investor Conference

|

|

|

Elite Education Group International CFO Zhenyu Wu & Director Craig Wilson provide a preview of their upcoming presentation at NobleCon18 NobleCon18 – Noble Capital Markets 18th Annual Small and Microcap Investor Conference – April 19-21, 2022 – Hard Rock, Hollywood, FL 100+ Public Company Presentations | Scheduled Breakouts | Panel Presentations | High-Profile Keynotes | Educational Sessions | Receptions & Networking Events Free Registration Available – More InfoNews and Advanced Market Data on EEIQNobleCon18 Presenting Companies

About Elite Education Group Elite Education Group International Limited (“Elite Education” or the “Company”), through its subsidiaries Quest Holding International LLC and Highrim Holding International Limited, provides comprehensive education solutions for domestic and international students interested in university and college degree programs in the US, Canada and the UK. The Company recently acquired 80% of the equity of EduGlobal College, based in British Columbia, Canada, which focuses on English proficiency educational programming for students pursuing academic degrees. The Company also recently acquired the right to a controlling equity ownership position in Davis College, a career training college located in Toledo, Ohio. In addition, the Company has a recruiting relationship with the regional campuses of Miami University located in Oxford, Ohio (“the MU Regional Campuses”), where it maintains residential facilities, a full-service cafeteria, recreational facilities, shuttle buses and an office for the regional campuses that provides study abroad and post-study services for its students; these facilities are not owned, maintained, operated or are a part of Miami University. The Company also acts as a recruiting agent for the University of the West of Scotland (through The Education Group (London) Ltd) and Coventry University, both of which are located in the United Kingdom. For more information, please visit www.eei-global.net. |

Izotropic (IZOZF) Scheduled to Present at NobleCon18 Investor Conference

|

|

|

Izotropic CEO John McGraw provides a preview of their upcoming presentation at NobleCon18 NobleCon18 – Noble Capital Markets 18th Annual Small and Microcap Investor Conference – April 19-21, 2022 – Hard Rock, Hollywood, FL 100+ Public Company Presentations | Scheduled Breakouts | Panel Presentations | High-Profile Keynotes | Educational Sessions | Receptions & Networking Events Free Registration Available – More InfoNews and Advanced Market Data on IZOZFNobleCon18 Presenting Companies

About Izotropic Izotropic Corporation is the only publicly traded company commercializing a dedicated breast CT imaging platform, IzoView, for the more accurate detection and diagnosis of breast cancers. To expedite patient and provider access to IzoView, Izotropic’s initial clinical study intends to demonstrate superior performance of diagnostic breast CT imaging over diagnostic mammography procedures and will initiate in Q2 2022. In follow-on clinical studies, Izotropic intends to validate platform applications, including breast screening in radiology, treatment planning and monitoring in surgical oncology, and breast reconstruction and implant monitoring in plastic and reconstructive surgery. More information about Izotropic Corporation can be found on its website at izocorp.com and by reviewing its profile on SEDAR at sedar.com. |

The Basket of Goods Will Become Financially Heavier

Image Credit Marco Verch (Flickr)

We Still Haven’t Reached the Inflation Finale

Inflations have an inbuilt mechanism that works to burn them out.

Government (including the central bank) can thwart the mechanism if they resort to further monetary injections of sufficient power.

Hence inflations can run for a long time and in virulent form. This occurs where the money issuers see net benefit from making new monetary injections even though likely to be less than for the initial one which took so many people by surprise.

Ultimately at some point the cost-benefit calculus shifts in favor of government not blocking the operation of the burn-out mechanism.

Let’s try to work out which model of burnout the Great Pandemic inflation in the US will follow.

|

About the Author:

Brendan Brown is a founding partner of Macro Hedge Advisors (www.macrohedgeadvisors.com) and senior fellow at Hudson Institute. He is an international monetary and financial economist, consultant, and author. He is also a Senior Fellow of the Mises Institute. Brendan is the author of Europe’s Century of Crises under Dollar Hegemony: A Dialogue on the Global Tyranny of Unsound Money with Philippe Simonnot, among other books. |

Our process of discovery starts with Milton Friedman’s observation about the nature of the “inflation gap.” Paraphrasing this we can say that monetary inflation is where the supply of money is persistently veering ahead of demand for money. Ideally this comparison is for base money (rather than broad money).

This gap between supply and demand is always in the future. Like the mirage on a hot road, when we get to the place where we saw the gap it is no longer there. Prices have adjusted upwards (and maybe other economic variables have shifted) so as to lift the demand for money in nominal terms into line with the initial increase in supply.

Meanwhile, however, the issuer has injected a new supply of money. And so the gap is still out there when we look into the future (along the inflation highway).

We can think of the burn-out mechanism as a rise of prices (and possible swing in other variables) which keeps lifting demand for money (in nominal terms) into line with increased supply. The essence of the burn-out mechanism is the destruction of real wealth in the form of money (and government bonds) by the rise in prices. These wealth losses and the need to replenish money holdings in real terms to some extent bear down on demand in goods and services markets.

The laboratory of monetary history provides some insights here.

Take first the extreme case of the German hyperinflation. The government in Berlin, desperate for funds, kept making monetary injections even as the burn-out mechanism functioned. In real terms the revenue gains for government got smaller and smaller as individuals switched out of mark money into dollars instead. Eventually the gains were so tiny from new injections and the social political costs so great that these halted.

Fast-forward to the monetary inflation of World War II. From 1946–48 the Fed made no new monetary injection (monetary base constant) despite prices galloping ahead as driven by the excess of money created during the war. A very mild recession in 1948 and the vast run down in military spending which had occurred meant there was no incentive for the government/Fed to make new injections as consumer prices reached a plateau after their sharp jump. Nominal yields on long Treasury bonds remained close to 2 percent throughout.

It was quite different in the “greatest US peacetime inflation” from the early/mid 1960s to the end of the 1970s. Then the Fed responded multiple times to inflation burnout by new injections; think of 1967–68; 1970–72; 1975–77; and yes, 1980.

Each injection during the Greatest Monetary Inflation had its own distinct cost-benefit analysis. In 67/8 a priority was to hold down the cost of government borrowing in the midst of the Vietnam war; in 70/72 Chair Burns was a top member of the Richard Nixon reelection campaign; later in 75/7 his aim was promoting recovery in the context of challenging elections ahead for the Republicans (1976); in 1980 there was a looming election and recession fright.

Two overriding comments apply to these continued injections through the Greatest Peacetime Inflation.

First, the injectors (the Fed and more broadly the Administration economic team) persistently overestimated the severity of the economic downturn which seemed to be emerging. Given all the revisions in the data since the analyst today would be hard-pressed to use the term severe recession or indeed recession at all in some cases with respect to the episodes of economic weakness in 1970, 1974–75, or 1980s. Yet at the time the injectors saw the current data as justification for interfering with the burn-out mechanism.

Second, a whole Keynesian/neo-Keynesian mythology has developed about how high and rising inflation expectations were the challenge which prevented the monetary authority from allowing a “natural” burnout to take place. It is difficult, however, to substantiate such a claim. In the counterfactual of the Fed resolutely refusing to reinject, expectations would surely have fallen.

Jumping forward to today, Spring 2020, is the Fed at last allowing the burn-out mechanism to work, having consummated its “hawkish turn?”

A key problem in answering this question is how to estimate in a non-anchored monetary system what burnout is occurring. How to measure demand for money in a system which has become so distorted?

Examples of such distortion include bank reserves, a large component of monetary base, paying interest and at a rate above market. Base money has lost much of its special qualities in an environment where banks or individuals are confident of liquidity provision, whether in form of “too big to fail,” “lender of last resort,” or “deposit insurance.”

Without any precision we can say that substantial monetary inflation has emerged during the pandemic with prices of goods and services surely rising by more than what could be explained by supply shortages and dislocations such as would occur under sound money regimes. But by how much?

Whatever the unmeasurable inflation gap has been the near 8 percent rise in consumer prices in the past year has surely helped narrow it the nearer we get to the point in the highway of inflation where we initially saw it.

Chief Powell is now telling us that he has no intention of accommodating inflation. For this top monetary bureaucrat and his colleagues this means projecting a series of rises for the fed funds rate which seems to be impressive both whether measured by frequency or cumulative size. No one, of course, has a clue about how interest rates would be moving in the counterfactual case of just allowing the burnout to take place and no new monetary injections.

So, it is far too early for any sober-rational commentator to announce that the burn-out mechanism is now healthily at work and will accomplish its purpose. And yes, it is possible that the Fed will at some point constrain (by mistake amidst the general fog) the money supply such that this lags behind demand for money, meaning a period of monetary deflation.

It is hard to form a diagnosis of the monetary inflation gap based just on contemporaneous readings of CPI inflation or taking the speculative temperature in asset markets.

Notably the distortions of price signals in asset market as caused by monetary inflation can persist well beyond the closing of the inflation gap—as was the case with both the crash of 1929 and of 2008.

The central scenario of this writer is that the pandemic monetary inflation theatre still has several acts before its finale.

One of these would feature the apparent onset of recession and asset deflation to which the Fed responds ultimately by further inflationary injections of money. And even though there is an inflation curse on all fiat monies, one act entitled flight from the dollar will most likely come into the schedule before this monetary theater season is over.

Suggested Reading

How the Cost of Owning a New EV Could Also Climb Quickly

|

Nancy Pelosi’s Coattail Investors Get an Update

|

Since 2008, Monetary Policy Has Cost American Savers about $4 Trillion

|

Lessons from How the Back of Inflation Finally Broke in 1982

|

Stay up to date. Follow us:

|

Energy Fuels (UUUU)(EFR:CA) – Production Timeline May Be Moving Up. Price Target Raised

Thursday, April 14, 2022

Energy Fuels (UUUU)(EFR:CA)

Production Timeline May Be Moving Up. Price Target Raised

As of April 24, 2020, Noble Capital Markets research on Energy Fuels is published under ticker symbols (UUUU and EFR:CA). The price target is in USD and based on ticker symbol UUUU. Research reports dated prior to April 24, 2020 may not follow these guidelines and could account for a variance in the price target.

Energy Fuels is the largest uranium producer in the U.S. and holds more production capacity and uranium resources than any other U.S. producer. The Company also produces vanadium. Headquartered in Colorado, Energy Fuels holds three of America’s key uranium production centers: the White Mesa Mill in Utah, the Nichols Ranch ISR Facility in Wyoming, and the Alta Mesa ISR Facility in Texas. The producing White Mesa Mill is the only conventional uranium mill in the U.S. and has a licensed capacity of 8 million pounds of U3O8 per year. Nichols Ranch is in production and has a licensed capacity of 2 million pounds of U3O8 per year. Alta Mesa is currently on standby. Energy Fuels also owns several licensed and developed uranium and vanadium mines on standby and other projects in development.

Michael Heim, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Energy Fuels ships Uranium, Vanadium and Rare Earth Element (REE) Carbonate in the same week. The shipment of Vanadium is not unusual nor is the shipment of REE Concentrate although it is worth noting that shipments of both elements can be erratic. The shipment of Uranium to an enrichment center in Illinois does not represent sales, per se, but can be viewed as a sign that the company is getting closer to sales. While not significant by itself, the shipment all three elements in the same week represents a milestone for the company.

Energy Fuels REE production is advancing. The company has begun producing a “more advanced” form of REE Carbonate. Importantly, it was achieved with existing operations and will set the stage for the company as it takes the next step of considering complete separation of Rare Earth Elements. Energy Fuels has already begun a pilot to evaluate the separation of heavy elements and has engaged a firm …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Two Key Elements to Musks $54.20 a Share Offer for Twitter

Will the Twitter Board Consider Musk’s Offer as Best for Shareholders?

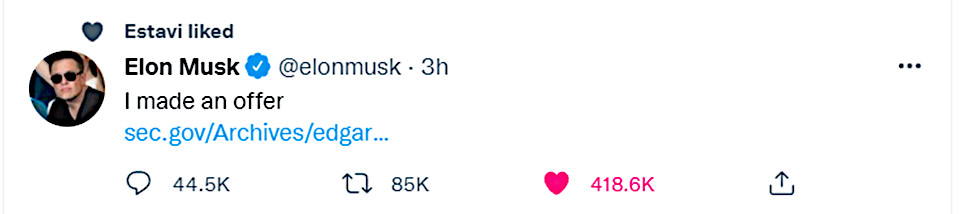

By now you’re aware that Elon Musk has offered $43 billion for every share of Twitter (TWTR). His offer is to buy the company outright and run it as a private company.

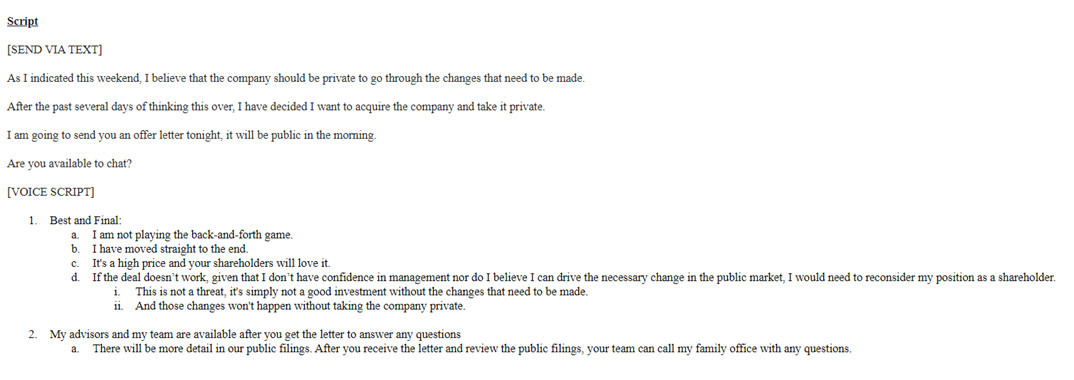

The offer is not, according to the filing, a negotiation. Management will have to make a recommendation to the Board of Directors which will then be expected to decide as a fiduciary and act in the shareholder’s best interest. A counter offer may end the deal. In Musk’s words, “I am not playing the back and forth game.” He also said, “It’s a high price and your shareholder’s will love it.”

The richest man alive also made it clear that if the offer is declined, the 9.2% stake he owns may go up for sale. This could have the opposite impact on the stock price.

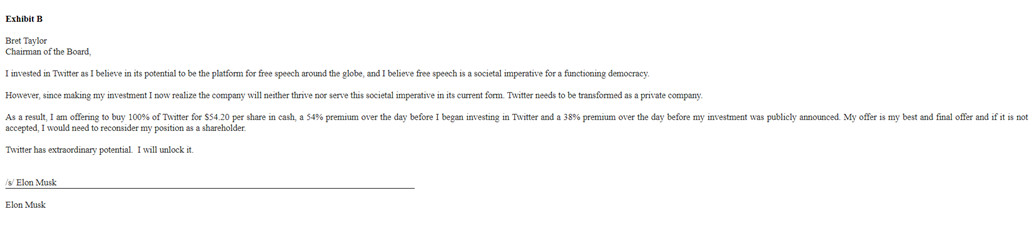

Elon’s Notes to Bret Taylor, Chairman of Twitter’s Board

|

|

Source: SEC.Gov Amendment #2 to 13D Filing |

|

|

Source: SEC.Gov Amendment #2 to 13D Filing |

In the filing Mr. Musk includes his text and follow-up note to Twitter’s Board chairman. The communications are peppered with language that includes “free speech” and “societal imperative.” It is clear that the offer is designed to either cause the board to accept, as it is a high relative price for the company, or embarrass the company as it would seem akin to saying they don’t have his concerns about society.

The Price

$43 Billion is the approximate valuation of Twitter as per Musk’s offer. This should help avoid trouble and concerns of stock manipulation from the regulators as it represents a 54% premium over the company’s value the day before he began investing in it.

The price of 54.20 per share may reflect Musk’s sense of humor. The number 420 is code for smoking marijuana. Musk has used the number before to amuse

his girlfriend and others that are aware of this.

Next week, April 20 is celebrated as the high holiday, National Weed Day, perhaps he is looking to settle this by then.

Managing Editor, Channelchek

Stay up to date. Follow us:

|

Release – Cocrystal Pharma to Present at the Noble Capital Markets NobleCon18 Conference

Cocrystal Pharma to Present at the Noble Capital Markets’ NobleCon18 Conference

Research, News, and Market Data on Cocrystal Pharma

BOTHELL, Wash., April 14, 2022 (GLOBE NEWSWIRE) — Cocrystal Pharma, Inc. (Nasdaq: COCP) announces that James Martin, Chief Financial Officer and co-interim Chief Executive Officer, will present a Company overview at the NobleCon18—Noble Capital Markets’ Eighteenth Annual Investor Conference on Thursday, April 21, 2022 at 9:30 a.m. Eastern Time. The conference is being held at the Hard Rock Hotel & Casino in Hollywood, Fla.

A video webcast of the presentation will be available the following day on the Company’s https://www.channelchek.com/, as well as at the Noble Capital Markets’ Conference website and on the Channelchek website. The webcast will be archived for 90 days following the event.

About Noble Capital Markets, Inc.

Noble Capital Markets is a research-driven investment bank that has supported small and microcap companies since 1984. As a FINRA and SEC licensed broker dealer, Noble provides institutional-quality equity research, merchant and investment banking, and order execution services. In 2005, Noble established NobleCon, an investor conference that has grown substantially over the past decade. In 2018, Noble launched Channelchek—an investor community dedicated exclusively to public small and micro-cap companies and their industries. Channelchek is the first service to offer institutional-quality research to the public for free without a subscription.

About Cocrystal Pharma, Inc.

Cocrystal Pharma, Inc. is a clinical-stage biotechnology company discovering and developing novel antiviral therapeutics that target the replication process of influenza viruses, coronaviruses (including SARS-CoV-2), hepatitis C viruses and noroviruses. Cocrystal employs unique structure-based technologies and Nobel Prize-winning expertise to create first- and best-in-class antiviral drugs. For further information about Cocrystal, please visit www.cocrystalpharma.com.

Investor Contact:

LHA Investor Relations

Jody Cain

310-691-7100

jcain@lhai.com

Media Contact:

JQA Partners

Jules Abraham

917-885-7378

Jabraham@jqapartners.com

Source: Cocrystal Pharma, Inc.

Release – Salem Media Group to Present at NobleCon18

Salem Media Group to Present at NobleCon18

Research, News, and Market Data on Salem Media

IRVING, Texas–(BUSINESS WIRE)– Salem Media Group, Inc. (NASDAQ: SALM), announced today that it will present at NobleCon18 – Noble Capital Markets’ Eighteenth Annual Institutional Investor Conference on Wednesday, April 20th at 1:30 PM Central Time.

A high-definition, video webcast of the presentation will be available the following day on the Company’s website www.salemmedia.com, and as part of a complete catalog of presentations available at Noble Capital Markets’ Conference website: www.nobleconference.com and on Channelchek www.channelchek.com the investor portal created by Noble. The webcast will be archived on the company’s website, the NobleCon website and on Channelchek.com for 90 days following the event.

ABOUT SALEM MEDIA GROUP

Salem Media Group is America’s leading multimedia company specializing in Christian and conservative content, with media properties comprising radio, digital media and book and newsletter publishing. Each day Salem serves a loyal and dedicated audience of listeners and readers numbering in the millions nationally. With its unique programming focus, Salem provides compelling content, fresh commentary and relevant information from some of the most respected figures across the Christian and conservative media landscape. Learn more about Salem Media Group, Inc. at www.salemmedia.com, Facebook and Twitter.

ABOUT NOBLE CAPITAL MARKETS, INC.

Noble Capital Markets (“Noble”) is a research driven investment bank that has supported small & microcap companies since 1984. As a FINRA and SEC licensed broker dealer Noble provides institutional-quality equity research, merchant and investment banking, and order execution services. In 2005, Noble established NobleCon, an investor conference that has grown substantially over the last decade. Noble launched www.channelchek.com in 2018 – an investor community dedicated exclusively to public small and micro-cap companies and their industries. Channelchek is the first service to offer institutional-quality research to the public, for FREE at every level without a subscription. More than 6,000 public emerging growth companies are listed on the site, with growing content including research, webcasts, podcasts, and balanced news.

Evan D. Masyr

Executive Vice President & Chief Financial Officer

(805) 384-4512

evan@SalemMedia.com

Source: Salem Media Group, Inc.

Release – 1-800-FLOWERS.COM Inc. to Release Results for its Fiscal 2022 Third Quarter on Thursday April 28 2022

1-800-FLOWERS.COM, Inc. to Release Results for its Fiscal 2022 Third Quarter on Thursday, April 28, 2022

Research, News, and Market Data on 1-800-FLOWERS.COM

The conference call will be available via live webcast from the Investor Relations section of the Company’s website at 1800flowersinc.com. A recording of the call will be posted on the website within two hours of the call’s completion. A telephonic replay of the call can be accessed beginning at 2:00 p.m. (ET) on April 28, 2022, through May 5, 2022, at: (US) 1-877-344-7529; (

Special Note Regarding Forward-Looking Statements:

Some of the statements contained in the Company’s scheduled Thursday, April 28, 2022, press release and conference call regarding its fiscal 2022 third quarter (ended 3/27/22) results, other than statements of historical fact, may be forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the applicable statements. For a more detailed description of these and other risk factors, please refer to the Company’s SEC filings including its Annual Reports and Forms 10K and 10Q available at the Investor Relations section of the Company’s website at 1800flowersinc.com. The Company expressly disclaims any intent or obligation to update any of the forward-looking statements made in the scheduled conference call and any recordings thereof, or in any of its SEC filings, except as may be otherwise stated by the Company.

About1-800-FLOWERS.COM, Inc.

1-800-FLOWERS.COM, Inc. is a leading provider of gifts designed to help customers express, connect and celebrate. The Company’s e-commerce business platform features an all-star family of brands, including: 1-800-Flowers.com®, 1-800-Baskets.com®, Cheryl’s Cookies®, Harry & David®, PersonalizationMall.com®, Shari’s Berries®, FruitBouquets.com®, Moose Munch®, The Popcorn Factory®, Wolferman’s Bakery®, Vital Choice®, Stock Yards® and Simply Chocolate®. Through the Celebrations Passport® loyalty program, which provides members with free standard shipping and no service charge across our portfolio of brands, 1-800-FLOWERS.COM, Inc. strives to deepen relationships with customers. The Company also operates BloomNet®, an international floral and gift industry service provider offering a broad-range of products and services designed to help members grow their businesses profitably; Napco?, a resource for floral gifts and seasonal décor; DesignPac Gifts, LLC, a manufacturer of gift baskets and towers; and Alice’s Table®, a lifestyle business offering fully digital livestreaming floral, culinary and other experiences to guests across the country. 1-800-FLOWERS.COM, Inc. was recognized among the top 5 on the National Retail Federation’s 2021 Hot 25 Retailers list, which ranks the nation’s fastest-growing retail companies. Shares in 1-800-FLOWERS.COM, Inc. are traded on the NASDAQ Global Select Market, ticker symbol: FLWS. For more information, visit 1800flowersinc.com or follow @1800FLOWERSInc on Twitter.

FLWS-COMP

FLWS-FN

Investor:

Joseph D. Pititto

(516) 237-6131

invest@1800flowers.com

Media:

Kathleen Waugh

(516) 237-6028

kwaugh@1800flowers.com

Source: 1-800-FLOWERS.COM, Inc

Release – FAT Brands Announces Michael G. Chachula as Chief Information Officer

FAT Brands Announces Michael G. Chachula as Chief Information Officer

Research, News, and Market Data on FAT Brands

Global Restaurant Fr anchising Company Hires Award-Winning IT Veteran to Support Growing Brand Portfolio

LOS ANGELES, April 14, 2022 (GLOBE NEWSWIRE) — FAT (Fresh. Authentic. Tasty.) Brands Inc., announces the hiring of its first Chief Information Officer, Michael G. Chachula. Chachula joins FAT Brands with over 25 years of senior management experience in business and technology and will be focused on delivering scalable, sustainable, and efficient technology platforms across the portfolio and franchise system to aid in the growth of the company.

A seasoned executive with experience across the financial services, consumer goods, pharmaceuticals, and hospitality industries, Chachula has a track-record of identifying and implementing innovative technological solutions that drive further revenue growth. Most recently, Chachula was the Head of Digital and Revenue Growth for The Coffee Bean & Tea Leaf®. He focused on delivering an enterprise POS solution, CRM, marketing automation, and cross-channel Omni-Channel growth solutions for the brand and its franchise system. Prior to that, Chachula served as the Head of Technology and Executive Director for IHOP® Restaurants within the Dine Brands Global Inc. portfolio. While at IHOP, Chachula introduced online ordering, delivery, POS, and CRM alternatives, technology footprint simplifications, and numerous other technology improvements, focusing on corporate and franchisee scalability, enablement, and profitability.

In addition, under Chachula’s leadership, IHOP was presented with CIO Magazine’s 2018 CIO 100 award for in-car marketplace ordering through the dashboard console and natural voice ordering on Amazon’s Alexa as well as Google Home. These initiatives changed the brand’s narrative, moving IHOP to the forefront of technology innovation, providing new and exciting experiences for customers.

“Michael’s experience is a perfect fit to support the growing FAT Brands’ portfolio,” said Thayer Wiederhorn, Chief Operating Officer of FAT Brands. “Michael’s extensive technology background and industry knowledge will help FAT Brands strengthen our technology ecosystem, develop strategic partnerships, and support our domestic and international growth, which, in turn, will enable our company and franchisees to become more efficient and profitable.”

“I am so pleased to join FAT Brands, a company with a proven business model and incredibly talented management team,” said Michael Chachula. “Throughout the pandemic, technology has been front and center in the restaurant space, and, as we look to a post-COVID world, it will be even more imperative to have strong systems in place at the corporate, franchisee and consumer level. I look forward to amplifying what is currently in place and identifying new solutions that will keep FAT Brands at the forefront of our industry.”

For more information on FAT Brands, visit www.fatbrands.com.

About FAT (Fresh. Authentic. Tasty.) Brands

FAT Brands (NASDAQ: FAT) is a leading global franchising company that strategically acquires, markets, and develops fast casual, quick-service, casual dining, and polished casual dining concepts around the world. The Company currently owns 17 restaurant brands: Round Table Pizza, Fatburger, Marble Slab Creamery, Johnny Rockets, Fazoli’s, Twin Peaks, Great American Cookies, Hot Dog on a Stick, Buffalo’s Cafe & Express, Hurricane Grill & Wings, Pretzelmaker, Elevation Burger, Native Grill & Wings, Yalla Mediterranean and Ponderosa and Bonanza Steakhouses, and franchises over 2,300 units worldwide.

MEDIA CONTACT :

Erin Mandzik, FAT Brands

emandzik@fatbrands.com

860-212-6509

Source: FAT Brands Inc.

Release – Comstock To Present At The NobleCon 18th Annual Small & Microcap Investor Conference

Comstock To Present At The NobleCon 18th Annual Small & Microcap Investor Conference

Research, News, and Market Data on Comstock Mining

VIRGINIA CITY, NEVADA, April 14, 2022 – Comstock Mining Inc. (NYSE: LODE) (“Comstock” and the “Company”) today announced Corrado De Gasperis, Executive Chairman and CEO, Kevin Kreisler, President and CFO and William McCarthy, COO, will attend and present at the NobleCon 18th Annual Small & Microcap Investor Conference April 19-21, 2022, at the Hard Rock Guitar Hotel, Miami Gardens, in Hollywood, FL.

Organized by Noble Capital Markets, NobleCon 18 is a multi-sector Institutional Investor Conference and a Micr-Cap Showcase for investors with an emerging growth investment strategy. Noble Capital Markets is a research-driven investment bank focused on small cap emerging growth companies in the natural resources, transportation & logistics, technology, healthcare, and media sectors. Comstock converts under-utilized waste and renewable natural resources into fuels and electrification products that enable systemic decarbonization.

Mr. De Gasperis will provide a Company update during the live presentation and the whole Comstock team is scheduled to participate in one-on-one meetings with registered conference investors. Registration for these meetings includes a range from qualified investors, portfolio managers, and buy-side analysts from the largest institutions following small cap companies, to investment managers for single and multi-family offices. Private equity professionals, retail brokers, high net worth individuals and their advisors will also be in attendance.

NobleCon18 Investor Conference information and free registration can be found here.

About Comstock

Comstock (NYSE: LODE) innovates technologies that enable systemic decarbonization and circularity by efficiently converting under-utilized waste and renewable natural resources into fuels and electrification products that contribute to balancing global uses and emissions of carbon. Comstock plans to achieve extraordinary financial, natural, and social gains by building, owning, and operating a fleet of advanced carbon neutral extraction and refining facilities, commercializing complimentary process solutions and related services, and licensing selected technologies to strategic partners.

To learn more, please visit www.comstock.inc.

Forward-Looking Statements

This press release and any related calls or discussions may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, are forward-looking statements. The words “believe,” “expect,” “anticipate,” “estimate,” “project,” “plan,” “should,” “intend,” “may,” “will,” “would,” “potential” and similar expressions identify forward-looking statements, but are not the exclusive means of doing so. Forward-looking statements include statements about matters such as: future industry market conditions; future explorations or acquisitions; future changes in our exploration activities; future changes in our research and development; and future prices and sales of, and demand for, our products and services. Except as may be required by securities or other law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Neither this press release nor any related call or discussion constitutes an offer to sell, the solicitation of an offer to buy or a recommendation with respect to any securities of the Company, the fund or any other issuer.

| Contact information: | ||

| Comstock Mining Inc. P.O. Box 1118 Virginia City, NV 89440 ComstockMining.com |

Corrado De Gasperis Executive Chairman & CEO Tel (775) 847-4755 degasperis@comstockmining.com |

Zach Spencer Director of External Relations Tel (775) 847-5272 Ext.151 questions@comstockmining.com |

As Dorseys Tweet Exemplifies NFT Market is Still Maturing

NFT Market is Still Finding its Footing as Demonstrated by the Resale of Jack Dorsey’s First Tweet

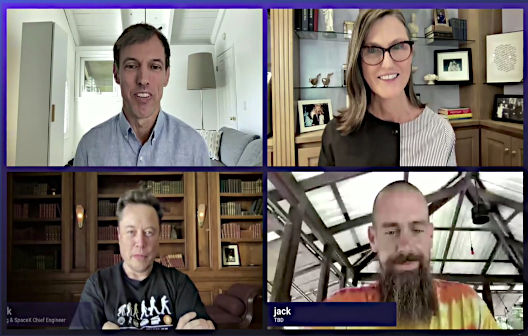

Sixteen years ago, Twitter Founder wrote his first Tweet. Today the “autographed” NFT has received a high bid of $277.

Just over a year ago, Twitter founder Jack Dorsey auctioned off an NFT of his very first tweet. The winning bidder’s name is Sina Estavi, he had founded the now defunct CryptoLand Exchange. Estavi had held his high bid of exactly $2.5 million for 16 days without being outbid. At the last minute he upped his winning bid to $2,915,835.47. There is some speculation that the non-competitive pop in price may be because of a cryptocurrency to dollars exchange translation. What’s $415,000 among tech company founders?

Dorsey had put the tweet up for digital auction as a non-fungible token on the Ethereum blockchain on March 5, 2021. Bids were handled on a platform called Valuables by Cent that lets people make offers on tweets that are “autographed by their original creators.”

Thirteen months after his purchase Estavi announced that he was ready to sell the Dorsey NFT and would accept offers until April 13th. He listed the digital collectible on the OpenSea market for $48.8 million. This is more than 16 times what he paid for it last year. As of Wednesday, the highest bid on Jack Dorsey’s original tweet in NFT form was $277. This would be a 99.991% loss on the unique token.

Sina Estavi, the purchaser of the Jack Dorsey NFT Tweet

is seen today as having “Liked” Elon Musks tweet about his offer to purchase

Twitter.

Sina Estavi purchased the NFT in March of 2021. Following Estavi’s May 2021 arrest in Iran on charges of “disrupting the economic system,” the CryptoLand Exchange he founded collapsed. Now out of prison, the Iran-born crypto entrepreneur is working on new projects using the blockchain.

Estavi’s less than exciting auction highlights the ups and downs of early investors. His sale at auction comes at a time when NFT sales tracked on Opensea—the single largest marketplace in the space, are down around 50% since the beginning of the year. They have gone from $5 billion in January down to $2.5 billion in March.

Suggested Reading

Bombshells from Musk, Dorsey, and Wood at Bitcoin Conference

|

Dogecoin Group Works to Give Currency Greater Purpose

|

Will the Twitter Board Consider Musk’s Offer as Best for Shareholders?

|

Zuckerberg Top Executive Joins NobleCon18 Lineup

|

Sources

https://twitter.com/JoePompliano/status/1514330003734941702

https://www.linkedin.com/in/sina-estavi-56642663/

https://www.yahoo.com/now/buyer-jack-dorsey-tweet-nft-203946809.html

Stay up to date. Follow us:

|

Media and Games Invest Scheduled to Present at NobleCon18 Investor Conference

|

|

|

Media and Games Invest CFO Paul Echt provides a preview of their upcoming presentation at NobleCon18 NobleCon18 – Noble Capital Markets 18th Annual Small and Microcap Investor Conference – April 19-21, 2022 – Hard Rock, Hollywood, FL 100+ Public Company Presentations | Scheduled Breakouts | Panel Presentations | High-Profile Keynotes | Educational Sessions | Receptions & Networking Events Free Registration Available – More InfoMore info on MGINobleCon18 Presenting Companies

About MGI Media and Games Invest SE (‘MGI’) is an advertising software platform with strong first party games content. MGI’s main operational presence is in Europe and North America. The company combines organic growth with value-generating synergetic acquisitions, demonstrating continuous strong, profitable growth with a revenue CAGR of 77% (2018 – 2021). Next to strong organic growth, the MGI Group has successfully acquired more than 35 companies and assets in the past 6 years. The acquired assets and companies are integrated and amongst others cloud technology is actively used to achieve efficiency gains and competitive advantages. MGI’s shares are listed on Nasdaq First North Premier Growth Market in Stockholm and in the Scale segment of the Frankfurt Stock Exchange. The Company has a secured bond that is listed on Nasdaq Stockholm and on the Frankfurt Stock Exchange Open Market. |