Element79 Gold Announces 2022 AGM Results

|

||||||

|

Looking for the next apple? This is the orchard.

|

||||||

|

Thursday, June 23, 2022

Engine Gaming and Media, Inc. (NASDAQ:GAME) (TSX-V:GAME) provides premium social sports and esports gaming experiences, as well as unparalleled data analytics, marketing, advertising, and intellectual property to support its owned and operated direct-to-consumer properties, while also providing these services to enable its clients and partners. The company’s subsidiaries include Stream Hatchet, the global leader in gaming video distribution analytics; Sideqik, a social influencer marketing discovery, analytics, and activation platform; WinView Games, a social predictive play-along gaming platform for viewers to play while watching live events; and Frankly Media, a digital publishing platform used to create, distribute and monetize content across all digital channels. Engine Media generates revenue through a combination of direct-to-consumer fees, streaming technology and data SaaS-based offerings, and programmatic advertising. For more information, please visit www.enginegaming.com.

Michael Kupinski, Director of Research, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Exits UMG. The company announced that it has sold its UMG subsidiary to Harena Data, Inc. in an asset purchase. Purchase price was not disclosed, but we expect it to be diminutive. We view the sale favorably as the company exits this money losing operation and as the company positions itself to swing toward break even and concentrates on its profitable growth oriented businesses.

Strategy gains visibility. The recent moves shift the company away from direct-to-consumer platforms in order to focus on its B2B businesses that carry higher margins. The repositioning of the company is expected to swing the company toward run rate break cash flow by the second half fiscal 2023….

This Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Thursday, June 23, 2022

Voyager Digital Ltd.’s (TSX: VOYG) (OTCQX: VYGVF) (FRA: UCD2) US subsidiary, Voyager Digital, LLC, is a fast-growing cryptocurrency platform in the United States founded in 2018 to bring choice, transparency, and cost-efficiency to the marketplace. Voyager offers a secure way to trade over 100 different crypto assets using its easy-to-use mobile application. Through its subsidiary Coinify ApS, Voyager provides crypto payment solutions for both consumers and merchants around the globe. To learn more about the company, please visit https://www.investvoyager.com.

Joe Gomes, Senior Research Analyst, Noble Capital Markets, Inc.

Joshua Zoepfel, Research Associate, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Three Arrows Capital. Voyager is caught up in the Three Arrows collapse. According to press reports, Three Arrows Capital is facing a liquidity crisis due to the collapse of the crypto market. It’s believed that the firm could be facing bankruptcy as it struggles to pay off its debts. Yesterday, Voyager announced it may issue a notice of default to Three Arrows Capital for failure to repay its loan, which consists of 15,250 Bitcoin, roughly $305 million at the current price, and $350 million of USDC.

Voyager Response. Voyager has requested payment in full by June 27th. Voyager intends to pursue recovery from 3AC and is in discussions with the Company’s advisors regarding the legal remedies available. The Company is unable to assess at this point the amount it will be able to recover from 3AC….

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Thursday, June 23, 2022

Motorsport Games, a Motorsport Network company, combines innovative and engaging video games with exciting esports competitions and content for racing fans and gamers around the globe. The Company is the officially licensed video game developer and publisher for iconic motorsport racing series across PC, PlayStation, Xbox, Nintendo Switch and mobile, including NASCAR, INDYCAR, 24 Hours of Le Mans and the British Touring Car Championship (“BTCC”). Motorsport Games is an award-winning esports partner of choice for 24 Hours of Le Mans, Formula E, BTCC, the FIA World Rallycross Championship and the eNASCAR Heat Pro League, among others.

Michael Kupinski, Director of Research, Noble Capital Markets, Inc.

Patrick McCann, Research Associate, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Non-deal roadshow highlights. Last week, Dmitry Kozko, CEO, hosted meetings for investors in the Midwest. Key highlights include the company’s product roadmap, exclusive world-class licenses, and insights into its financial flexibility in bringing its products to market.

Long runway. The company’s exclusive racing game licenses last up to 10 years. This allows the company a favorably runway to develop and bring to market its games across all its franchises. The company has not changed its product launch roadmap, but could should market conditions warrant.

…

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Image Credit: Pixabay (Pexels)

When you take aspirin for a headache, how does the aspirin know to travel to your head and alleviate the pain?

The short answer is, it doesn’t: Molecules can’t transport themselves through the body, and they don’t have control over where they eventually end up. But researchers can chemically modify drug molecules to make sure that they bind strongly to the places we want them and weakly to the places we don’t.

Pharmaceutical products contain more than just the active drug that directly affects the body. Medications also include “inactive ingredients,” or molecules that enhance the stability, absorption, flavor and other qualities that are critical to allowing the drug to do its job. For example, the aspirin you swallow also has ingredients that both prevent the tablet from fracturing during shipping and help it break apart in your body.

| This article was republished with permission from The Conversation, a news site dedicated to sharing ideas from academic experts. It was written by and represents the research-based opinions of Tom Anchordoquy, Professor of Pharmaceutical Sciences, University of Colorado Anschutz Medical Campus. |

As a pharmaceutical scientist, I’ve been studying drug delivery for the past 30 years. That is, developing methods and designing nondrug components that help get a medication where it needs to go in the body. To better understand the thought process behind how different drugs are designed, let’s follow a drug from when it first enters the body to where it eventually ends up.

How Drugs

are Absorbed in the Body

When you swallow a tablet, it will initially dissolve in your stomach and intestines before the drug molecules are absorbed into your bloodstream. Once in the blood, it can circulate throughout the body to access different organs and tissues.

Drug molecules affect the body by binding to different receptors on cells that can trigger a particular response. Even though drugs are designed to target specific receptors to produce a desired effect, it is impossible to keep them from continuing to circulate in the blood and binding to nontarget sites that potentially cause unwanted side effects.

Image Credit: Jorgen Schyberg (Flickr)

Drug molecules circulating in the blood also degrade over time and eventually leave the body in your urine. A classic example is the strong smell your urine might have after you eat asparagus because of how quickly your kidney clears asparagusic acid. Similarly, multivitamins typically contain riboflavin, or vitamin B2, which causes your urine to turn bright yellow when it is cleared. Because how efficiently drug molecules can cross the intestinal lining can vary depending on the drug’s chemical properties, some of the drugs you swallow never get absorbed and are removed in your feces.

Because not all of the drug is absorbed, this is why some medications, like those used to treat high blood pressure and allergies, are taken repeatedly to replace eliminated drug molecules and maintain a high enough level of drug in the blood to sustain its effects on the body.

Getting Drugs

to the Right Place

Compared with pills and tablets, a more efficient way of getting drug into the blood is to inject it directly into a vein. This way, all the drug gets circulated throughout the body and avoids degradation in the stomach.

Many drugs that are given intravenously are “biologics” or “biotechnology drugs,” which include substances derived from other organisms. The most common of these are a type of cancer drug called monoclonal antibodies, proteins that bind to and kill tumor cells. These drugs are injected directly into a vein because your stomach can’t tell the difference between digesting a therapeutic protein and digesting the proteins in a cheeseburger.

In other cases, drugs that need very high concentrations to be effective, such as antibiotics for severe infections, can be delivered only through infusion. While increasing drug concentration can help make sure enough molecules are binding to the correct sites to have a therapeutic effect, it also increases binding to nontarget sites and the risk of side effects.

One way to get a high drug concentration in the right location is to apply the drug right where it’s needed, like rubbing an ointment onto a skin rash or using eyedrops for allergies. While some drug molecules will eventually get absorbed into the bloodstream, they will be diluted enough that the amount of drug that reaches other sites is very low and unlikely to cause side effects. Similarly, an inhaler delivers the drug directly to the lungs and avoids affecting the rest of the body.

Patient Compliance

Finally, a key aspect in all drug design is to simply get patients to take medications in the right amounts at the right time.

Because remembering to take a drug several times a day is difficult for many people, researchers try to design drug formulations so they need to be taken only once a day or less.

Similarly, pills, inhalers or nasal sprays are more convenient than an infusion that requires traveling to a clinic for a trained clinician to inject it into your arm. The less troublesome and expensive it is to administer a drug, the more likely it is that patients will take their medication when they need it. However, sometimes infusions or injections are the only effective way that certain drugs can be administered.

Even with all the science that goes into understanding a disease well enough to develop an effective drug, it is often up to the patient to make it all work as designed.

Suggested Content

Axcella Therapeutics (AXLA) NobleCon18 Presentation Replay

|

Genprex (GNPX) NobleCon18 Presentation Replay

|

Baudax Bio (BXRX) NobleCon18 Presentation Replay

|

Cocrystal Pharma (COCP) NobleCon18 Presentation Replay

|

Stay up to date. Follow us:

|

Research, News, and Market Data on Chakana Copper

Vancouver, B.C., June 22, 2022

– Chakana Copper Corp. (TSX-V: PERU; OTCQB: CHKKF; FWB: 1ZX) (the “Company” or “Chakana”) is pleased to announce that it has completed a second and final tranche of its previously announced private placement (the “Private

Placement”) for 10,470,451 units of the Company (“Units”) at a price of C$0.11 per Unit for gross proceeds of C$1,151,749. Combined with the first tranche that closed in May (see news release dated May 24, 2022), the financing resulted in total gross proceeds of $6,241,353.

Each Unit consists of one common share in the capital of the Company (each, a “Share”) and one-half of one common share purchase warrant (each whole warrant, a “Warrant”). Each Warrant entitles the holder to purchase one additional Share at a price of $0.20 per Share for a period of two years from closing of the Private Placement. The Company may accelerate the expiry of the Warrants in the event that for any ten consecutive trading days the closing price of the Shares is greater than $0.30.

David Kelley, President and CEO commented, “We are excited to be fully financed as we execute an aggressive exploration drilling campaign that began June 15, 2022. This is a bold step-out exploration program applying what we have learned in the last 4 years and utilizing the expertise and support from the Gold Fields exploration team. We have updated our target ranking criteria to include the potential to discover larger tonnage deposits. In addition to high-grade mineralization hosted in tourmaline breccia pipes, we will also be testing targets related to the potential coalescence of breccia pipes (mega-breccias), epithermal mineralization in zones of pervasive argillic alteration, and mineralization related to a rhyodacite dome. We believe these mineralization styles are all part of the same Soledad mineral system that occupies a 12 km2 footprint.”

The Company intends to use the net proceeds of the Private Placement for exploration and development of the Company’s high-grade copper-gold-silver discovery at the Soledad Project, located in the Ancash region of Peru, and for ESG programs, general working capital and administrative purposes. On January 11, 2022, the Company announced aninitial inferred resource hosting

191,000 ounces of gold, 11.7 million ounces of silver, and 130 million pounds

of copper in seven tourmaline breccia pipes.

Chakana paid aggregate finder’s fees of C$56,511 and issued 513,736 finder’s warrants (the “Finder’s

Warrants”) in connection with the second tranche of the Private Placement. Each Finder’s Warrant is exercisable to purchase one Share at a price of $0.20 per Share for a period of two years from closing of the Private Placement.

All securities issued under the Private Placement are subject to a four-month hold period expiring on October 22, 2022 in accordance with applicable Canadian securities laws, in addition to such other restrictions as may apply under applicable securities laws in jurisdictions outside of Canada. Final closing of the Private Placement is subject to all necessary regulatory approvals, including the approval of the TSX Venture Exchange.

The common shares have not been registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. This news release does not constitute an offer to sell or a solicitation of an offer to buy such securities in any jurisdiction in which such an offer or sale would be unlawful.

Corporate

Update

Pursuant to the extension agreement and revised payment terms for the Company’s purchase option agreement with Condor Resources, the Company has elected to proceed with the second option which requires cash and share payments to be made over a three-year period, as described in more detail in the Company’s news release dated April 18, 2022. Accordingly, the Company will pay Condor US$800,000 and issue 1,379,310 shares prior to June 23, 2022.

Exploration

Update

The company initiated a step-out exploration drilling campaign on June 15, 2022 to test thirteen new targets not previously drilled on the north side of the project. The campaign is initially planned with one drill rig for approximately 3,000m of core drilling with one or two holes in each target. Once these targets have been drilled, a decision will be made regarding both additional target testing and follow-up drilling. These thirteen targets were selected from a total of 154 targets identified on the project that were prioritized during an in-house technical workshop incorporating recently acquired Offset IP survey results. The principal target areas for this round of drilling on the north side of the project are 1) Cima Blanca (in-progress), 2) Bx 4 cluster, 3) Faro, 4) Western Breccias, 5) Paloma Trend, and 6) Paloma-Huancarama megabreccia target (Figure 1). Numerous additional high priority targets exist on the south side of the project that will be drill tested once a drill permit is awarded for this area.

About

Chakana Copper Corp

Chakana Copper Corp is a Canadian-based minerals exploration company that is currently advancing the Soledad Project located in the Ancash region of Peru, a highly favorable mining jurisdiction with supportive communities. The Soledad Project is notable for the high-grade copper-gold-silver mineralization that is hosted in tourmaline breccia pipes. An initial inferred resource estimate for seven breccia pipes was announced in Q1 2022 (see news release dated February 23, 2022), with 6.73 Mt containing 191,000 ounces of gold, 11.7 million ounces of silver, and 130 million pounds of copper. In addition, extensive multidisciplinary exploration has defined 154 exploration targets, 18 of which have been tested to date (12%), confirming that Soledad is a large, well-endowed mineral system with strong exploration upside. Chakana’s investors are uniquely positioned as the Soledad Project provides exposure to copper and precious metals. For more information on the Soledad project, please visit the website at www.chakanacopper.com.

Results of an initial resource estimate and additional information concerning the Project, including a technical report prepared in accordance with National Instrument 43-101, are available on Chakana’s profile at www.sedar.com.

ON

BEHALF OF THE BOARD

(signed) “David Kelley”

David Kelley

President and CEO

For further information contact:

Joanne Jobin, Investor Relations Officer

Phone: 647 964 0292

Email:

jjobin@chakanacopper.com

Neither

TSX Venture Exchange nor its Regulation Services Provider (as that term is

defined in the policies of the Exchange) accepts responsibility for the

adequacy or accuracy of this release.

Forward-looking

Statement Advisory: This release contains forward-looking statements, including

statements relating to the use of proceeds and completion of the Private

Placement. Forward-looking statements involve known and unknown risks, uncertainties,

and other factors which may cause the actual results, performance, or

achievements of Chakana to be materially different from any future results,

performance, or achievements expressed or implied by the forward-looking

statements. Forward looking statements or information relates to, among other

things, the interpretation of the nature of the mineralization at the Soledad copper-gold-silver project (the “Project”), the

potential to expand the mineralization, and to develop and grow a resource

within the Project, the planning for further exploration work,

the ability to de-risk the potential exploration targets, and our belief in the

potential for mineralization within unexplored parts of the Project.

These forward-looking statements are based on management’s current expectations

and beliefs but given the uncertainties, assumptions and risks, readers are

cautioned not to place undue reliance on such forward- looking statements or

information. The Company disclaims any obligation to update, or to publicly

announce, any such statements, events or developments except as required by

law.

Figure 1 – Map showing total defined targets for the Soledad project by type. Principal target clusters on the north side of the project being tested in the current exploration drilling program are Cima Blanca, Bx 4, Faro, Western Breccias, Paloma-Huancarama trends. Target clusters on the south side will be drill tested once the drill permit is approved for this area.

Research, News, and Market Data on Engine Gaming & Media

NEW YORK, NY / ACCESSWIRE / June 22, 2022 / Engine Gaming and Media, Inc. (“Engine” or the “Company”) (NASDAQ:GAME) (TSX-V:GAME), a data-driven, gaming, media and social influencer marketing solutions company, today announced that its wholly owned subsidiary, UMG Events, LLC (“UMG”), had entered into an agreement with Harena Data, Inc. (“Harena Data”) for the sale of certain UMG assets. In addition to the transfer of assets, UMG will supply various technology services to Harena Data following the closing of the transaction. The transaction is subject to customary closing conditions, including regulatory approvals, and is expected to close in the Company’s fiscal fourth quarter.

Harena Data will take ownership of the UMG online business, which hosts daily tournaments and matches for competitive esports players, as well as the ownership of the studio and media properties under UMG including its social channels. This transaction marks the next step in the Company’s ongoing portfolio shaping strategy to sharpen the focus on its core businesses and drive enhanced value creation. Harena Data Inc has focused on the building of gaming ecosystems and business units to serve those ecosystems.

“Earlier this year, we began a comprehensive portfolio review to identify cost savings opportunities available to Engine that would best position our Company for continued sustainable growth while focusing on our core businesses,” commented Lou Schwartz, Chief Executive Officer of Engine. “The transition of UMG will further reduce cash expenditure by approximately $16M on a year-over-year basis and enable us to utilize our capital more efficiently. This is part of an overall effort to relieve the Company of the more significant cash expenditures necessary to support B2C gaming businesses, particularly as we enter a far more difficult macroeconomic environment. With this transaction, the sale of Eden games, and other cost savings initiatives we have implemented or will implement in the near term, we position the Company to achieve its goal of run rate breakeven in 2023.”

Tom Rogers, Executive Chairman of Engine, added, “We continue to take meaningful action to focus the business more narrowly on our B2B analytics, marketing, advertising and gaming businesses and sharpen our attention on our core growth engines while unlocking value for our shareholders. Beyond the benefits to our shareholders, this transaction will ensure the Engine team can focus on continuing to execute on our long-term strategy by positioning our assets to capitalize on numerous macro sector growth trends within the advertising and marketing landscape with particular focus on the fast growing social influencer space.”

Mr. Rogers concluded, “Engine will maintain close partnerships with many of UMG’s existing and historical clients, most notably Microsoft, Electronic Arts, and Riot Games through relationships with our other subsidiaries. We want to especially thank the terrific team at UMG for their great work building a high-quality next-generation gaming experience.”

About

Engine Gaming and Media, Inc.

Engine Gaming and Media, Inc. (NASDAQ:GAME) (TSX-V:GAME) provides premium social sports and esports gaming experiences, as well as unparalleled data analytics, marketing, advertising, and intellectual property to support its owned and operated direct-to-consumer properties, while also providing these services to enable its clients and partners. The company’s subsidiaries include Stream Hatchet, the global leader in gaming video distribution analytics; Sideqik, a social influencer marketing discovery, analytics, and activation platform; WinView Games, a social predictive play-along gaming platform for viewers to play while watching live events; and Frankly Media, a digital publishing platform used to create, distribute and monetize content across all digital channels. Engine Media generates revenue through a combination of direct-to-consumer fees, streaming technology and data SaaS-based offerings, and programmatic advertising. For more information, please visit www.enginegaming.com.

About

Harena Data Inc.

Founded in 2017, Harena Data has developed software for league development, launched streaming channels and have worked closely with educational and community organizations to develop the gaming ecosystem. Harena Data Inc is also the founder of “The Esports Combine”, the largest aggregator of esports scholarships on the planet. The principles of Harena Data have a strong background in esports, event management, motion picture production, and telecommunications. In addition to GYO Score, Harena Data specializes in esports consultation regarding the development and deployment of esports venues, scholastic esports programs, and esports league concepts. For more information, please visit www.harenadata.net.

Cautionary

Statement on Forward-Looking Information

This news release contains forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Engine to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “estimates”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. In respect of the forward-looking information contained herein, Engine has provided such statements and information in reliance on certain assumptions that management believed to be reasonable at the time. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements stated herein to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Actual results could differ materially from those currently anticipated due to a number of factors and risks. Accordingly, readers should not place undue reliance on forward-looking information contained in this news release.

The forward-looking statements contained in this news release are made as of the date of this release and, accordingly, are subject to change after such date. Engine does not assume any obligation to update or revise any forward-looking statements, whether written or oral, that may be made from time to time by us or on our behalf, except as required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investor

Relations Contact:

Shannon Devine

MZ North America

Main: 203-741-8811

GAME@mzgroup.us

SOURCE: Engine Gaming and Media, Inc.

Image Credit: Zee (Flickr)

While the metaverse now includes fast-food chains like Wendy’ (WEN), McDonald’s (MCD), and Chipotle (CMG) that have positioned themselves on augmented reality platforms for branding, a newcomer, Lowe’s (LOW), the home improvement store, has bigger goals. Lowe’s announced yesterday (June 21) in a press release that customers will be able to enter the metaverse and use augmented reality to help them visualize a project they are involved in. The initial launch will include free downloads of products for added home design inspiration.

In the release announcing the additional service, Lowe’s says they have been at the forefront of building in the real world for more than 100 years, and now they will be helping builders of the metaverse create new possibilities. Rather than entering the metaverse with a storefront to sell virtual goods, Lowe’s aims to equip builders (at no cost) with items from its real-world shelves to give their creations more eye appeal.

To get them started, Lowe’s has made more than 500 3D metaverse products available for download for free using Lowe’s Open Builder. Open builder is a new asset hub designed to be available to all creators.

“We’ve been at the forefront of building since our beginning, and the metaverse is in a pivotal stage of development. It’s only natural that we would be interested in working alongside and in service of the emerging community of builders creating this new world, with the democratization of possibility in mind,” said Marisa Thalberg, Lowe’s chief brand and marketing officer. “At the same time, we are also very clear on our reason for being – to make homes better for all by helping our customers to create real-world value in their homes, in their jobs and in their communities. This will continue to be our North Star in the metaverse.”

Image: Lowe’s pioneered virtual reality training within its stores with Holoroom

Lowe’s says its vision is for both virtual and augmented worlds to play a role in its customers’ lives. While this is the company’s first step into the metaverse, Lowe’s has been using emerging technology to help customers gain inspiration and more easily visualize and plan their home improvement projects. The recently launched Measure Your Space, uses LiDAR to sense depth and map dimensions of a space, and Holoroom How To, was one of the first home improvement virtual reality clinics. It teaches customers skills like how to tile a shower and does it in a fully immersive virtual environment.

“Over the past several years, we have infused new technologies into the planning and shopping experience and know our customers have benefitted greatly from being able to explore and test home improvement projects in the virtual world before taking the leap to implementation in their real-world homes or job sites,” said Seemantini Godbole, chief information officer of Lowe’s. “By entering the metaverse now, we can explore new opportunities to serve, enable and inspire our customers in a way no other home improvement retailer today is doing.”

The 500 starter assets available include items such as lighting, patio furniture, area rugs, kitchen, and bath accessories, they will be usable across metaverse and non-metaverse environments, such as gaming, augmented reality, and creative design. It is expected that these assets will be adopted by metaverse builders making virtual land, homes, goods, and experiences for use in other decentralized communities. These will even include custom, wearable NFTs.

Lowe’s stock price saw little or no impact from the announcement.

Managing Editor, Channelchek

Suggested Content

Wendyverse Allows Wendy’s to Meta Market

|

Walmart’s Metaverse, NFT, and Crypto Plans

|

Could Blockchain Survive if Unchained from Digital Currency?

|

Metaverse: Is the Future Real? Panel Presentation from NobleCon18

|

Sources

https://www.lowesinnovationlabs.com/

Stay up to date. Follow us:

|

|

|

|

Noble Capital Markets Senior Research Analyst Joe Gomes sits down with Great Lakes Dredge & Dock (GLDD) President & CEO Lasse Petterson and SVP, US Offshore Wind Eleni Beyko Research, News, and Advanced Market Data on GLDDView all C-Suite InterviewsThe 2022 C-Suite Interview series is now available on major podcast platforms

About Great Lakes Great Lakes Dredge & Dock Corporation is the largest provider of dredging services in the United States. In addition, Great Lakes is fully engaged in expanding its core business into the rapidly developing offshore wind energy industry. The Company has a long history of performing significant international projects. The Company employs experienced civil, ocean and mechanical engineering staff in its estimating, production and project management functions. In its over 132-year history, the Company has never failed to complete a marine project. Great Lakes owns and operates the largest and most diverse fleet in the U.S. dredging industry, comprised of approximately 200 specialized vessels. Great Lakes has a disciplined training program for engineers that ensures experienced-based performance as they advance through Company operations. The Company’s Incident-and Injury-Free® (IIF®) safety management program is integrated into all aspects of the Company’s culture. The Company’s commitment to the IIF® culture promotes a work environment where employee safety is paramount. |

News and Market Data on BioSig Technologies

Westport, CT, June 22, 2022 (GLOBE NEWSWIRE) — BioSig Technologies, Inc. (NASDAQ: BSGM) (“BioSig” or the “Company”) a medical technology company advancing electrophysiology workflow by delivering greater intracardiac signal fidelity through its proprietary signal processing platform, today announced it has entered an evaluation agreement for its PURE EP(TM) System with the Cleveland Clinic.

The evaluation agreement marks the first since BioSig inducted a new commercialization team. Consistent with The Company’s stated national rollout strategy, Cleveland Clinic will participate in a 60-day evaluation of BioSig’s PURE EP(TM) System. The Company recently announced that is has restructured its clinical support and installation teams to streamline and accelerate the pathway from product evaluation to adoption.

“We are excited to include Cleveland Clinic as an evaluation center for the Pure EP System. We look forward to working alongside their physicians to demonstrate the superior signal quality that can be achieved on even the most difficult arrhythmias,” commented Gray Fleming, Chief Commercialization Officer, BioSig Technologies, Inc.

Cleveland Clinic is a nonprofit multispecialty academic medical center that integrates clinical and hospital care with research and education. U.S. News & World Report consistently names Cleveland Clinic as one of the nation’s best hospitals in its annual “America’s Best Hospitals” survey. As a leader in arrhythmia treatment and diagnosis, Cleveland Clinic medical centers include state-of-the-art electrophysiology laboratories, world-class physicians and researchers, and the latest cutting-edge technologies and protocols deployed for the treatment of heart abnornmalities. To learn more, visit clevelandclinic.org.

To date, over 75 physicians have completed over 2500 patient cases with the PURE EP(TM) System. The Company is in a national commercial launch of the PURE EP(TM) System. The technology is in regular use in some of the country’s leading centers of excellence, including Mayo Clinic, and Texas Cardiac Arrhythmia Institute at St. David’s Medical Center.

Clinical data acquired by the PURE EP(TM) System in a multi-center study at centers of excellence including Texas Cardiac Arrhythmia Institute at St. David’s Medical Center was recently published in the Journal of Cardiovascular Electrophysiology and is available electronically with open access via the Wiley

Online Library. Study results showed 93% consensus across the blinded reviewers with a 75% overall improvement in intracardiac signal quality and confidence in interpreting PURE EP(TM) signals over conventional sources.

About

BioSig Technologies

BioSig Technologies is a medical technology company commercializing a proprietary biomedical signal processing platform designed to improve signal fidelity and uncover the full range of ECG and intra-cardiac signals (www.biosig.com).

The Company’s first product, PURE EP(TM) System, is a novel signal processing and acquisition platform designed to extract advanced diagnostic and therapeutic data that enhances physician workflow and increases throughput. PURE EP(TM) was engineered to address the limitations of existing EP technologies by empowering physicians with superior signals and actionable insights.

Forward-looking

Statements

This press release contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential” or similar words. Forward-looking statements are not guarantees of future performance, are based on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s control and cannot be predicted or quantified, and consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, risks and uncertainties associated with (i) the geographic, social, and economic impact of COVID-19 on our ability to conduct our business and raise capital in the future when needed, (ii) our inability to manufacture our products and product candidates on a commercial scale on our own, or in collaboration with third parties; (iii) difficulties in obtaining financing on commercially reasonable terms; (iv) changes in the size and nature of our competition; (v) loss of one or more key executives or scientists; and (vi) difficulties in securing regulatory approval to market our products and product candidates. More detailed information about the Company and the risk factors that may affect the realization of forward-looking statements is set forth in the Company’s filings with the Securities and Exchange Commission (SEC), including the Company’s Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Investors and security holders are urged to read these documents free of charge on the SEC’s website at http://www.sec.gov. The Company assumes no obligation to publicly update or revise its forward-looking statements as a result of new information, future events, or otherwise.

Andrew Ballou

BioSig Technologies, Inc.

Vice President, Investor Relations

55 Greens Farms

Westport, CT 06880

aballou@biosigtech.com

203-409-5444, x133

Source: BioSig Technologies, Inc.

Released

June 22, 2022

Research, News, and Market Data on Voyager Digital

NEW YORK, June 22, 2022 /CNW/ – Voyager Digital Ltd. (“Voyager” or the “Company”) (TSX: VOYG) (OTCQX: VYGVF) (FRA: UCD2) today announced its subsidiary, Voyager Digital Holdings, Inc. (“VDH”), has entered into a definitive agreement with Alameda Ventures Ltd. (“Alameda”) related to the previously disclosed credit facility, which is intended to help Voyager meet customer liquidity needs during this dynamic period.

VDH entered into a definitive agreement with Alameda for a US$200 million cash and USDC revolver and a 15,000 BTC revolver (the “Loan”). As previously disclosed, the proceeds of the credit facility are intended to be used to safeguard customer assets in light of current market volatility and only if such use is needed. In addition to this facility, as of June 20, 2022, Voyager has approximately US$152 million cash and owned crypto assets on hand, as well as approximately US$20 million of cash that is restricted for the purchase of USDC.

Alameda’s obligation to provide funding is subject to certain conditions, which include: no more than US$75 million may be drawn down over any rolling 30-day period; the Company’s corporate debt must be limited to approximately 25 percent of customer assets on the platform, less US$500 million; and additional sources of funding must be secured within 12 months. This is a summary of the Loan terms; a copy of the Loan agreement will be filed at http://www.sedar.com.

Voyager concurrently announced that its operating subsidiary, Voyager Digital, LLC, may issue a notice of default to Three Arrows Capital (“3AC”) for failure to repay its loan. Voyager’s exposure to 3AC consists of 15,250 BTC and $350 million USDC. The Company made an initial request for a repayment of $25 million USDC by June 24, 2022, and subsequently requested repayment of the entire balance of USDC and BTC by June 27, 2022. Neither of these amounts has been repaid, and failure by 3AC to repay either requested amount by these specified dates will constitute an event of default. Voyager intends to pursue recovery from 3AC and is in discussions with the Company’s advisors regarding the legal remedies available. The Company is unable to assess at this point the amount it will be able to recover from 3AC.

Alameda currently indirectly holds 22,681,260 common shares of Voyager (“Common Shares”), representing approximately 11.56% of the outstanding Common and Variable Voting Shares. The Loan is considered a “related party transaction” pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). Voyager is relying on the exemption available under Section 5.7(1)(f) of MI 61-101 minority shareholder approval requirement. Additionally, the Loan is exempt from the formal valuation requirement of MI 61-101 pursuant to Section 5.4(1) of MI 61-101. The Loan Agreement was approved by the Board of Directors of Voyager.

About Voyager Digital

Ltd.

Voyager Digital Ltd.’s (TSX: VOYG) (OTCQX: VYGVF) (FRA: UCD2) US subsidiary, Voyager Digital, LLC, is a cryptocurrency platform in the United States founded in 2018 to bring choice, transparency, and cost-efficiency to the marketplace. Voyager offers a secure way to trade over 100 different crypto assets using its easy-to-use mobile application. Through its subsidiary Coinify ApS, Voyager provides crypto payment solutions for both consumers and merchants around the globe. To learn more about the company, please visit https://www.investvoyager.com.

Forward

Looking Statements

Certain information in this press release, including, but not limited to, statements regarding future growth and performance of the business, momentum in the businesses, future adoption of digital assets, the terms of the term sheet and any definitive loan documentation and the Company’s anticipated results may constitute forward looking information (collectively, forward-looking statements), which can be identified by the use of terms such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe” (or the negatives) or other similar variations. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Voyager’s actual results, performance or achievements to be materially different from any of its future results, performance or achievements expressed or implied by forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this press release may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. There is no assurance that the funds available under the Loan agreement will be available in a timely manner or, even if available will, together with any other assets of Voyager be sufficient to safeguard customer assets. It is uncertain what amount Voyager will be able to recover from 3AC for non-payment or the legal remedies available to Voyager in connection with such non-payment or the impact on the future business, cash flows, liquidity and prospects of Voyager as a result of 3AC’s non-payment. Forward looking statements are subject to the risk that the global economy, industry, or the Company’s businesses and investments do not perform as anticipated, that revenue or expenses estimates may not be met or may be materially less or more than those anticipated, that parties to whom the Company lends assets are able to repay such loans in full and in a timely manner, that trading momentum does not continue or the demand for trading solutions declines, customer acquisition does not increase as planned, product and international expansion do not occur as planned, risks of compliance with laws and regulations that currently apply or become applicable to the business and those other risks contained in the Company’s public filings, including in its Management Discussion and Analysis and its Annual Information Form (AIF). Factors that could cause actual results of the Company and its businesses to differ materially from those described in such forward-looking statements include, but are not limited to, a decline in the digital asset market or general economic conditions; changes in laws or approaches to regulation, the failure or delay in the adoption of digital assets and the blockchain ecosystem by institutions; changes in the volatility of crypto currency, changes in demand for Bitcoin and Ethereum, changes in the status or classification of cryptocurrency assets, cybersecurity breaches, a delay or failure in developing infrastructure for the trading businesses or achieving mandates and gaining traction; failure to grow assets under management, an adverse development with respect to an issuer or party to the transaction or failure to obtain a required regulatory approval. Readers are cautioned that Assets on Platform and trading volumes fluctuate and may increase and decrease from time to time and that such fluctuations are beyond the Company’s control. Forward-looking statements, past and present performance and trends are not guarantees of future performance, accordingly, you should not put undue reliance on forward-looking statements, current or past performance, or current or past trends. Information identifying assumptions, risks, and uncertainties relating to the Company are contained in its filings with the Canadian securities regulators available at

www.sedar.com. The forward-looking statements in this press release are applicable only as of the date of this release or as of the date specified in the relevant forward-looking statement and the Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events, except as required by law. The Company assumes no obligation to provide operational updates, except as required by law. If the Company does update one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements, unless required by law. Readers are cautioned that past performance is not indicative of future performance and current trends in the business and demand for digital assets may not continue and readers should not put undue reliance on past performance and current trends. There is no assurance that the transactions contemplated by the non-binding term sheet will be completed or if completed they will be on the terms agreed. There is no assurance that the funds available under the loan agreement will be available or, even if available will, together with any other assets of Voyager be sufficient to safeguard customer assets.

The TSX

has not approved or disapproved of the information contained herein.

SOURCE Voyager Digital Ltd.

For further information: Voyager Digital, Ltd., Voyager Public Relations Team, pr@investvoyager.com

Image Credit: Diverse Stock Photos (Flickr)

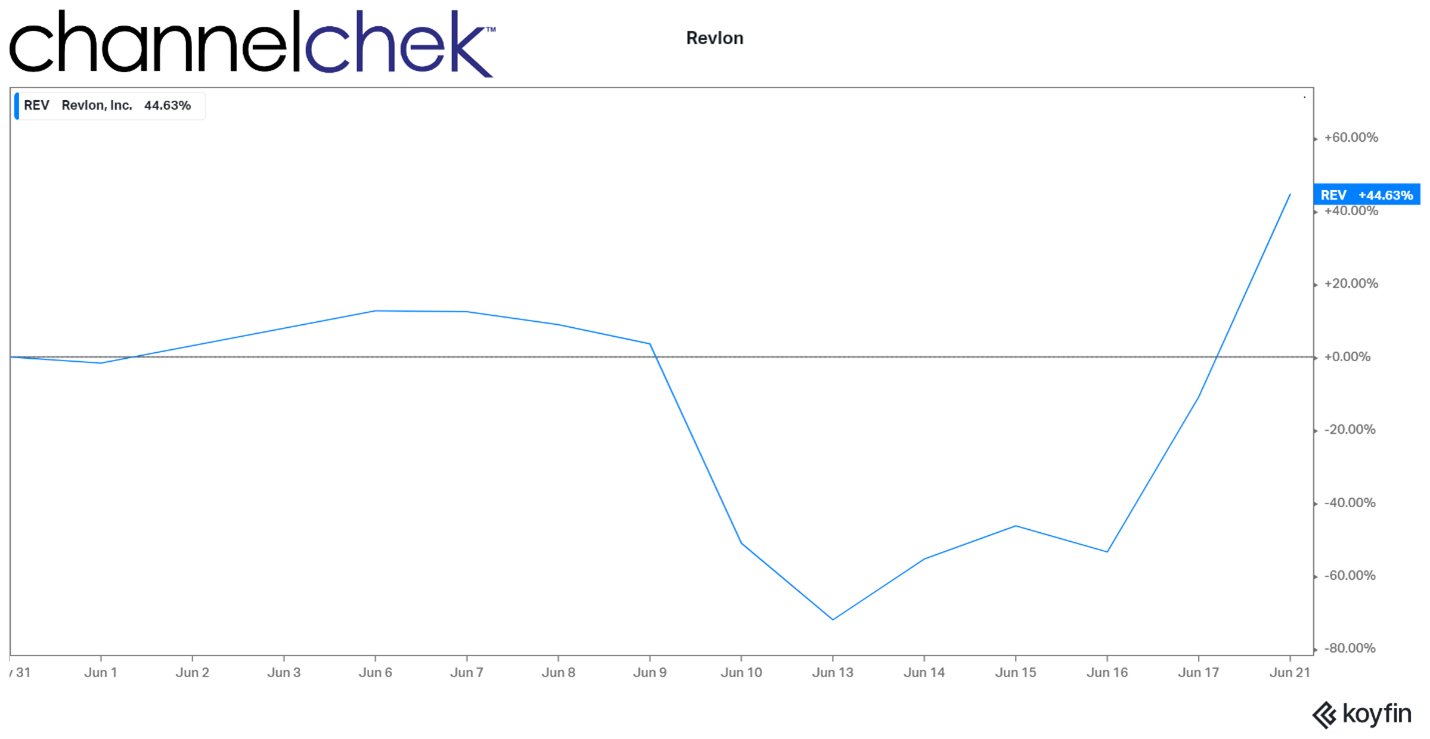

The 80% increase in Revlon’s (REV) price Tuesday (June 21) shows that strong influence remains in the hands of retail investors. The company, which declared bankruptcy last week, is now up 461% since that announcement. At play is the same social media communication network that helped drive up GameStop (GME) in early 2021, provided capital to AMC Theaters (AMC), and elevated values of cruise lines that sat mostly idle during the pandemic. This time, it’s again with a household name that was getting a large amount of short-seller attention.

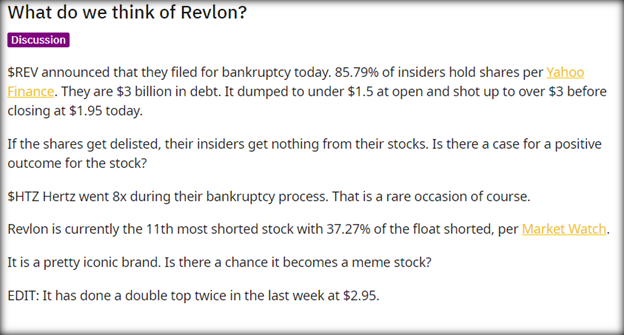

Revlon hit a low last week of $1.08 and has since rocketed up to $6.06 which it hit yesterday (June 21). The impetus seems to have begun with a Reddit post. A member of r/wallstreetbets compared the current setup in Revlon to Hertz (HTZ) in 2020, noting that the company has an iconic 90-year-old brand and also has a high short interest of 37%. Today, Revlon’s short interest as a percentage of the total float increased to more than 50%, and Fintel identified the company as a top short-squeeze candidate.

The Reddit post asked, “Is there a chance [Revlon] becomes a meme stock?”

Source: Koyfin

The strong buying by self-directed individual investors is reflected as it’s one of Fidelity’s top ten-traded tickers. The broker showed Revlon as the ninth most popular stock traded by their customers on Tuesday, with buying pressure outweighing selling pressure.

Image: upikatruuu (r/wallstreetbets)

Hertz was able to quickly resolve its bankruptcy as its market value and access to capital increased and protection from lenders allowed it to shed over $5 billion in debt.

This is a possible attempt to replicate the magic of Hertz, which soared nearly ten-fold in June 2020 after the company filed for bankruptcy, this activity could provide Revlon with more options.

For now, the stock is acting in a similar fashion to Hertz and other meme stocks. The rally has been intense and supported by volume. The company is using the bankruptcy process to reorganize its capital structure as it has high debt and struggles with declining sales due to people staying inside during the pandemic, the continued work-from-home environment, and competition from Kim Kardashian West and Kylie Jenner’s makeup brands, among others.

One unanswered question equity investors in Revlon may wish to resolve, is if Revlon’s equity holders will be left with anything after the bankruptcy proceedings or if the courts and company prioritize paying back notes and other loans. For now, retail investors are betting there might just be some equity value remaining, and that momentum carries the stock price even higher.

Managing Editor, Channelchek

Suggested Content

Is it Game-Over for Meme Stock Investors?

|

Exposure to Non-Travel Leisure Stocks

|

You Can Own a Piece of r/wallstreetbets

|

Michael Burry Uses Burgernomic’s Logic to Evaluate the US Dollar

|

Sources

https://www.bloomberg.com/news/articles/2022-06-16/revlon-files-for-bankruptcy-facing-high-debt-supply-chain-pain

https://www.reddit.com/r/wallstreetbets/comments/vdx78t/what_do_we_think_of_revlon/

https://www.vandatrack.com/

https://eresearch.fidelity.com/eresearch/gotoBL/fidelityTopO

https://investorplace.com/2022/06/revlon-is-bankrupt-what-comes-next-for-rev-stock/

Stay up to date. Follow us:

|

Tonix Pharmaceuticals Announces Pricing of $30 Million Private Placement of Convertible Redeemable Preferred Stock

CHATHAM, N.J., June 22, 2022 (GLOBE NEWSWIRE) — Tonix Pharmaceuticals Holding Corp. (Nasdaq: TNXP), a clinical-stage biopharmaceutical company, today announced that it has entered into a securities purchase agreement with certain institutional investors to purchase 2,500,000 shares of Series A convertible redeemable preferred stock and 500,000 shares of Series B convertible redeemable preferred stock. Each share of Series A and Series B preferred stock has a purchase price of $9.50, representing an original issue discount of 5% of the $10.00 stated value of each share. Each share of Series A and Series B preferred stock is convertible into shares of the Company’s common stock at an initial conversion price of $4.00 per share. Shares of the Series A and Series B preferred stock are convertible at the option of the holder at any time following the Company’s receipt of shareholder approval for an increase to the authorized shares of common stock of the Company from 50 million to 150 million. The Company will be permitted to redeem the Series A preferred stock at its option upon the fulfillment of certain conditions and subject to certain limitations. The Company and the holders of the Series A and Series B preferred stock also entered into a registration rights agreement to register the resale of the shares of common stock issuable upon conversion of the Series A and Series B preferred stock. Total gross proceeds from the offerings, before deducting discounts, placement agent’s fees and other estimated offering expenses, is $30 million.

The Series A and Series B preferred stock permits the holders thereof to vote together with the holders of the Company’s common stock on a proposal to effectuate an increase to the authorized shares of common stock of the Company at a special meeting of Company shareholders. The Series B preferred stock permits the holder to cast 2,500 votes per share of Series B preferred stock on such proposal, provided, that such votes must be cast in the same proportions as the shares of common stock and Series A preferred stock are voted on that proposal. Except as required by law or expressly provided by the certificate of designation, holders of the Series A and Series B preferred stock will not be permitted to vote on any other matters. The holders of the Series A and Series B preferred stock agreed not to transfer, offer, sell, contract to sell, hypothecate, pledge or otherwise dispose of their shares of preferred stock until after the special meeting. The holders of the Series A and Series B preferred stock have the right to require the Company to redeem their shares of preferred stock for cash at 105% of the stated value of such shares commencing after the earlier of (i) the date on which the Company’s receives shareholder approval to increase the Company’s authorized shares of common stock or (ii) 60 days after the closing of the issuances of the Series A and Series B preferred stock and ending 90 days after such closing. The Company has the option to redeem the Series A preferred stock for cash at 105% of the stated value commencing after the Company’s shareholders’ approval of the increase to the authorized shares of common stock of the Company, subject to the holders’ rights to convert the shares prior to a redemption at the option of the Company.

The closing of the offering is expected to occur on or about June 24, 2022, subject to the satisfaction of customary closing conditions. Additional information regarding the securities described above and the terms of the offering are included in a Current Report on Form 8-K to be filed with the United States Securities and Exchange Commission (“SEC”).

A.G.P./Alliance Global Partners is acting as the sole placement agent in connection with the offering.

The Series A and Series B preferred stock and shares of common stock into which these preferred shares are convertible are being issued in reliance upon the exemption from the securities registration afforded by Section 4(a)(2) of the Securities Act of 1933, as amended (the “1933 Act”) and/or Rule 506 of Regulation D as promulgated by SEC under the 1933 Act.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state or other jurisdiction.

About Tonix Pharmaceuticals

Holding Corp.*

Tonix is a clinical-stage biopharmaceutical company focused on discovering, licensing, acquiring and developing therapeutics to treat and prevent human disease and alleviate suffering. Tonix’s portfolio is composed of central nervous system (CNS), rare disease, immunology and infectious disease product candidates. Tonix’s CNS portfolio includes both small molecules and biologics to treat pain, neurologic, psychiatric and addiction conditions. Tonix’s lead CNS candidate, TNX-102 SL (cyclobenzaprine HCl sublingual tablet), is in mid-Phase 3 development for the management of fibromyalgia with a new Phase 3 study launched in the second quarter of 2022 and interim data expected in the first quarter of 2023. TNX-102 SL is also being developed to treat Long COVID, a chronic post-acute COVID-19 condition. Tonix expects to initiate a Phase 2 study in Long COVID in the third quarter of 2022. TNX-1300 (cocaine esterase) is a biologic designed to treat cocaine intoxication that is Phase 2 ready and has been granted Breakthrough Therapy Designation by the FDA. TNX-1900 (intranasal potentiated oxytocin), a small molecule in development for chronic migraine, is expected to enter the clinic with a Phase 2 study in the second half of 2022. Tonix’s rare disease portfolio includes TNX-2900 (intranasal potentiated oxytocin) for the treatment of Prader-Willi syndrome. TNX-2900 has been granted Orphan-Drug Designation by the FDA. Tonix’s immunology portfolio includes biologics to address organ transplant rejection, autoimmunity and cancer, including TNX-1500 which is a humanized monoclonal antibody targeting CD40-ligand being developed for the prevention of allograft and xenograft rejection and for the treatment of autoimmune diseases. A Phase 1 study of TNX-1500 is expected to be initiated in the second half of 2022. Tonix’s infectious disease pipeline consists of a vaccine in development to prevent monkeypox and smallpox called TNX-801, next-generation vaccines to prevent COVID-19, and a platform to make fully human monoclonal antibodies to treat COVID-19. Tonix’s lead vaccine candidates for COVID-19 are TNX-1840 and TNX-1850, which are live virus vaccines based on Tonix’s recombinant pox vector (RPV) live virus vaccine platform.

*All of Tonix’s product

candidates are investigational new drugs or biologics and none have been

approved for any indication

This press release and further information about Tonix can be found at www.tonixpharma.com.

Forward Looking

Statements

Certain statements in this press release are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may be identified by the use of forward-looking words such as “anticipate,” “believe,” “forecast,” “estimate,” “expect,” and “intend,” among others. These forward-looking statements are based on Tonix’s current expectations and actual results could differ materially. There are a number of factors that could cause actual events to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, risks related to the failure to obtain FDA clearances or approvals and noncompliance with FDA regulations; delays and uncertainties caused by the global COVID-19 pandemic; risks related to the timing and progress of clinical development of our product candidates; our need for additional financing; uncertainties of patent protection and litigation; uncertainties of government or third party payor reimbursement; limited research and development efforts and dependence upon third parties; and substantial competition. As with any pharmaceutical under development, there are significant risks in the development, regulatory approval and commercialization of new products. Tonix does not undertake an obligation to update or revise any forward-looking statement. Investors should read the risk factors set forth in the Annual Report on Form 10-K for the year ended December 31, 2021, as filed with the Securities and Exchange Commission (the “SEC”) on March 14, 2022, and periodic reports filed with the SEC on or after the date thereof. All of Tonix’s forward-looking statements are expressly qualified by all such risk factors and other cautionary statements. The information set forth herein speaks only as of the date thereof.

Contacts

Jessica Morris

(corporate)

Tonix Pharmaceuticals

investor.relations@tonixpharma.com

(862) 799-8599

Olipriya Das, Ph.D.

(media)

Russo Partners

Olipriya.Das@russopartnersllc.com

(646) 942-5588

Peter Vozzo (investors)

ICR Westwicke

peter.vozzo@westwicke.com

(443) 213-0505

Source: Tonix Pharmaceuticals Holding Corp.

Released

June 22, 2022