Image Credit: DavidGSteadman (Flickr)

Understanding the Differences Between American Depository Receipts (ADR) and U.S. Stocks

If you own Anheuser Busch (BUD), AstraZeneca (AZN), NIO, SONY, or even Toyota (TM) and purchased them on a U.S. exchange, it is likely you possess an American Depository Receipt, commonly referred to as an ADR. ADRs have been in the news in recent days as those that stem from China are receiving more attention from the SEC and lawmakers in Washington. Some of the best companies in the world trade in the U.S. as ADRs, but there is a real distinction between a U.S. company stock and a foreign private issuer trading on a U.S. exchange – the number one rule of investing is, know what you’re buying.

An ADR is not a Stock?

ADRs allow U.S. investors to invest in non-U.S. companies while providing these companies easier access to the U.S. capital markets. Over 2000 non-U.S. issuers from over 70 countries use ADRs as a means of raising capital or establishing a trading presence in the states.

An ADR is a negotiable certificate that evidences an ownership interest in American Depositary Shares (ADS), which in turn, represents an interest in the shares of the non-U.S. company that have been deposited with a U.S. bank. It does represent shares of stock and ownership interest but is not considered a stock certificate. The terms ADR and ADS are often used interchangeably by market participants. ADRs help the investor in a foreign-based company to avoid foreign exchange transactions and non-$USD currency risk – they clear through the U.S. settlement system.

An ADR may represent the underlying shares on a one-for-one basis or may represent a fraction of a share or multiple shares. Ratios allow ADRs to be priced at an amount more typical of U.S. market share prices. They’re created by a depositary bank when the foreign company, or an investor who already holds the underlying non-U.S. securities, delivers them to the bank or its custodian in the non-U.S. company’s home country. The bank will issue ADRs to the investor in the U.S., and the investor will be able to re-sell the ADRs on a U.S. exchange or OTC.

As ADRs give holders the rights to underlying shares, holders may surrender ADRs in exchange for the shares of the non-U.S. company, often in the native currency. These transactions are generally performed by brokers and others who are active in foreign securities markets.

|

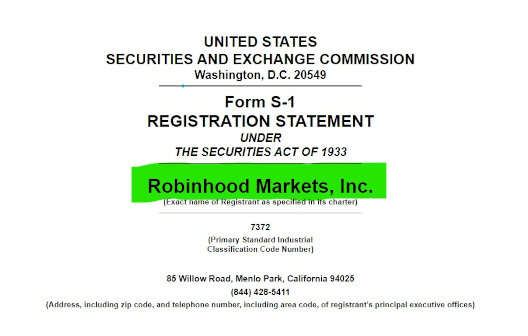

An ADR may not be established unless the non-U.S. company is either subject to the reporting requirements under the Securities Exchange Act of 1934 or is exempt under the Act. ADRs are always registered with the SEC on a Form F-6 registration statement.

|

They may be considered “sponsored” or “unsponsored.” Sponsored ADRs are those in which the non-U.S. company enters into an agreement directly with the U.S. depositary bank to arrange for recordkeeping, forwarding of shareholder communications, payment of dividends, and other services. An unsponsored ADR is set up without the cooperation of the non-U.S. company and may be created by a broker-dealer wishing to establish a U.S. trading market. An ADR, however, may not be shown unless the non-U.S. company is either subject to the reporting requirements under the Securities Exchange Act of 1934 or is exempt under the Act. ADRs are always registered with the SEC.

How the Market View ADRs?

Market participants have generally categorized ADRs into three “levels,” depending on the extent to which the foreign company has accessed the U.S. markets:

Level 1 ADR programs establish a trading presence but may not be used to raise capital. It is the only type of facility that may be unsponsored and, as a result, may be traded only on the over-the-counter market. No information about the issuer would be available on the SEC’s EDGAR system; information should be available on the issuer’s website.

Level 2 ADR programs establish a trading presence on a national securities exchange but may not be used to raise capital.

Level 3 ADR programs may be used to both establish a trading presence and also to raise capital for the foreign issuer. The non-U.S. company would be required to file annual reports.

What Fees are Charged?

ADR depositary banks charge holders of ADRs custody fees, sometimes referred to as Depositary Services Fees, to compensate the depositary banks for inventorying the non-U.S. shares and performing registration, compliance, dividend payment, communication, and recordkeeping services. A common practice for the collection of the custody fee is for the ADR depositary bank to subtract the amount of the fee from the gross dividends paid by the bank to ADR holders. Typically, the Depository Trust Company (DTC) will announce both the gross dividend rate and the net dividend rate after deducting the ADR custody fee. However, a number of ADR issues do not pay periodic dividends, which prevents the fees from being collected through this process. In this case, DTC charges the fee to its users (i.e., banks and broker-dealers) who pass them on to their customers. Depositary banks may charge other fees, such as relating to the distribution of dividends, foreign currency exchange, voting of shares, and other matters.

What Should Investors Do Before Investing in ADRs?

Like any other investment, you should learn as much as you can about a company before you invest. Research the political, economic, and social conditions in the company’s home country so you will understand better the factors that affect the company’s financial results and stock price. You should understand that non-U.S. companies are subject to financial and other disclosure requirements that differ from those required of U.S. public companies. Except for the annual report, companies are generally only required to disclose what is required in their native country. Disclosures may also not be as extensive or comparable to that of U.S. public companies.

Prior to investing in an ADR, investors should learn from their broker-dealer what fees are charged to them as ADR investors. Typically, fees are assessed per ADR. For example, 1000 ADRs could be assessed a fee ranging from $20 to $50. Fees can be viewed in the section of the registration statement often titled “Description of American Depository Shares” or “Description

of American Depository Receipts.” The websites of depositary banks that are active in the U.S. also contain information about investing in ADRs and serve as a source of information for investors.

Take-Away

The means by which most ADRs transact each day is not unlike that of a U.S. stock certificate. Investors should be aware of small nuances of fee differences, reporting requirements, and sovereign or political risk. Reviewing equity research and analysis from highly ranked analysts is another recommended step investors could take to make sure they are getting information from experienced professionals able to spot things that they may overlook.

Suggested Reading:

Sources:

https://www.sec.gov/investor/alerts/adr-bulletin.pdf