Michael Burry vs Cathie Wood is Not an Even Competition

With proof that Michael Burry has shorted tens of millions of one of Cathie Wood’s Ark ETFs, the headlines are asking, “who is right, the hedge fund manager or popular tech fund manager?” Although there may be a conflict of forecasts between these two very successful money managers, the role and flexibility of each are very different.

Burry and His Position

In a filing made available Monday (August 16), Burry’s Scion Asset Management disclosed it held Put options on 235,500 shares of Ark Investments, Innovation ETF (ARKK). At the end of the second quarter, these bets against Cathie Wood’s renowned Ark Investments were valued at $30.8 million dollars. The position is essentially a speculative play that expects that the value of the ETF will drop before the expiration date.

Burry, who is 50 years old, is best known for his being portrayed in the movie of the real-life drama where he managed to massively short the subprime mortgage market beginning in 2005. The positions paid off fabulously years later. As per Michael Lewis’ book, The Big Short from which the movie of the same name is based, the nature of Scion’s positions is long-term as they’re scaled into and play out over time — long before a trend takes root. As an individual, Burry is never seen on TV or any other promotional forum. The few interviews have been via Bloomberg Messenger with Bloomberg reporters, and he will at times share his thoughts in Twitter posts.

Wood’s Stature

Wood, who is 65 years old, founded Ark Investments in 2014 on the idea of actively traded funds based on disruptive innovation. Ticker symbol $AARK is one of the actively managed funds she oversees at her company. The year 2020 was especially good for many of her funds including AARK. This gave her much to talk about last year as a regular on CNBC and other channels, she has managed to develop her own celebrity status. Ms. Wood and her funds have an almost cult following, however, the high returns of last year have not followed through so far in 2021.

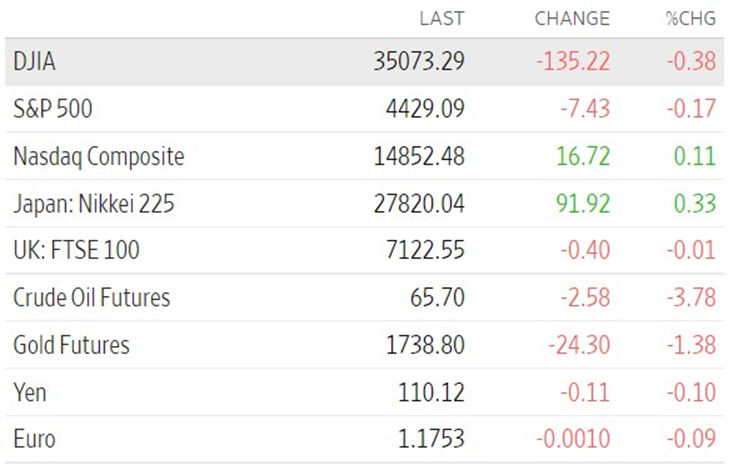

Source: Bloomberg Terminal (8/17/21)

As the successes of both Wood and Burry place them on investor’s radar, the story of this massive short against technology has gained attention. The truth is, the two are in very different positions. Although they may both try to maximize returns on the funds they manage, they are not even in the same ring or constrained by the same rules.

Is This a Fair “Fight”

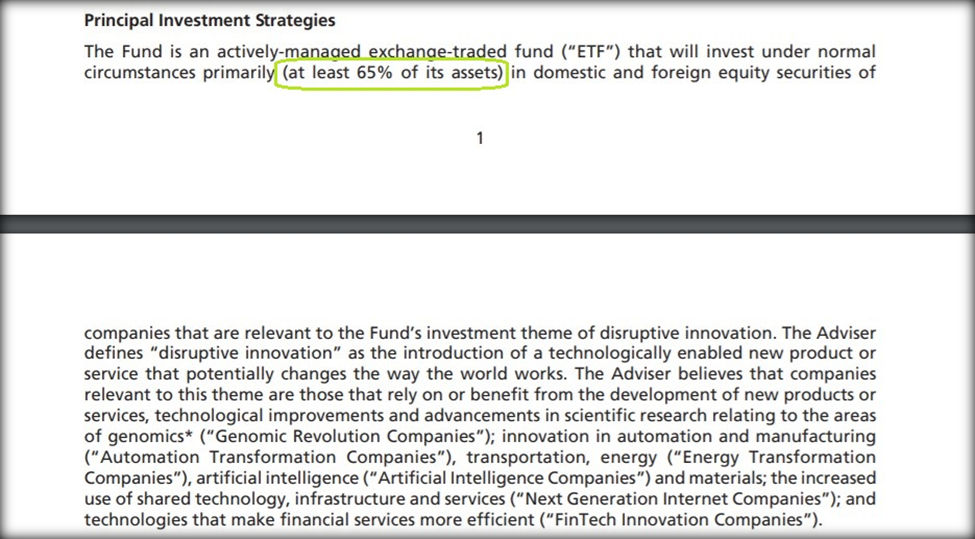

As the Chief Investment Officer overseeing the funds within her company, Cathie Wood is bound by the SEC filed prospectus and other documents guiding each of Ark’s ETFs. Dr. Michael J. Burry, for his part, is an individual investor and runs a hedge fund without the same restrictions as a publicly-traded ETF. Should Scion decide that a particular investment class is not going to add value to the overall position, Scion is not under any obligation to own the sector. If Burry sees fit as manager, he may enter a position that is triple leveraged short. This flexibility is important to understand.

Source: Page 1 and 2 of AARK Summary Prospectus

ETFs and other mutual funds are generally used by investors seeking broad exposure to a sector, index, or particular investment style. The onus is on the end investor of the fund (not the manager) to reduce their position if they are bearish. Management is obligated to continue to follow the style the investors have placed funds in; within the margins of the prospectus there is some leeway (see AARK document above); however, the overall marching orders remain the same.

This is why fund performance is judged within sectors and indices. The fund managers’ comparative benchmarks are almost always within the investment style, not versus what was available in unrelated investments.

Another advantage investors with complete flexibility have over fund managers is that when performance falters in a fund sector, money flows out of the funds, this often forces the manager to sell when values are low. When sectors are hot, new money flows in, putting this money to work places the manager in the tricky position of deploying new funds in companies that may already be near their peak. Individuals and money managers such as Burry are not presented with performance-limiting cash flow which waters down return on public funds.

Take-Away

Hedge fund managers and individual investors have more leeway than fund managers of publicly offered funds that are guided by a prospectus and other SEC-related documents. ETFs and other funds are popular when an entire sector is moving up. When companies within that sector or index begin to weigh down performance, those that can hand select equity positions for their portfolio, and even go short, have far more opportunities.

Exploring opportunities and discovering growth companies is how Channelchek serves its readers. Take a moment to register for daily updates and research designed to provide ideas and insight to small and microcap investors.

Managing Editor, Channelchek

Suggested Reading:

Index Funds May Still Fall Apart Over Time

|

Is the Index Bubble Michael Burry Warned us About Still Looming?

|

Michael Burry Tweets Advice on Cryptocurrency

|

Michae Burry Says Covid Cure Worse Than Disease

|

Sources:

Stay up to date. Follow us:

|