Motorsport Games Reports First Quarter 2022 Financial Results

Research, News, and Market Data on Motorsport Games

MIAMI, May 16, 2022 (GLOBE NEWSWIRE) — Motorsport Games Inc. (NASDAQ: MSGM) (“Motorsport Games” or the “Company”) today reported financial results for its first quarter ended March 31, 2022 (“Q1 2022”). The Company has also posted to the Company’s investor relations

website a Q1 2022 Quarter End Review video and a Q1 2022 earnings slide deck, which highlight certain key milestones that occurred in the period, as well as an updated Investor Presentation.

Dmitry Kozko, Chief Executive Officer of Motorsport Games, commented, “In Q1 2022, we continued our product and content releases. We brought the full release of our KartKraft karting simulation to PC, as well as a user experience update to our rFactor 2 racing simulation game that was positively received by our audience. In January 2022, our esports team delivered the sequel to the 24 Hours of Le Mans Virtual as a world-class event, and in February 2022 we held the inaugural 2022 INDYCAR Pro-Challenge. Games and esports initiatives were also bolstered by expanding our relationship with Formula E, and we were selected by Kindred Concepts to power their next generation racing simulation experience for Formula 1 using our rFactor 2 platform.”

Kozko added, “While we continue to explore multiple funding options to resolve our going concern qualifications, we remain confident in our ability to deliver against our product roadmap.”

First Quarter 2022

Business Update

- Le

Mans Virtual Series Grand Finale. The Company held the 2-day grand finale esports event for the 5-round 2021/22 Le Mans Virtual Series in January 2022, bringing together 50 cars with 200 drivers from 39 different countries. The series was followed by more than 81 million fans across live tv, digital streaming and social media platforms.

- Official

KartKraft Launch in January 2022. The Company officially launched its first KartKraft racing game in January 2022 after acquiring the intellectual property, assets and code from original developer, Black Delta, in March 2021.

- rFactor

2 User Interface Refresh and Content Updates. The Company released a new, easier to navigate User Interface for rFactor 2 in January 2022. Additionally, the Company began releasing a regular cadence of quarterly content updates to provide players with the most robust product offering for their virtual racing needs. The Company expects the updates to revamp and improve both its rFactor 2 platform and user experience.

- INDYCAR

2022 Esports Pro-Challenge. The Company held the inaugural 2022 INDYCAR Esports Pro-Challenge in February 2022, featuring current NTT INDYCAR SERIES drivers, including reigning champion Alex Palou, 4-time Indianapolis 500 champion Helio Castroneves and 2-time series champion Josef Newgarden, making it the first official INDYCAR-branded esports event since the Company entered into the long-term license in July 2021 to produce INDYCAR virtual racing series.

- rFactor

2 Racing Simulation Platform Selected To Power Next-Level Formula 1

Competitive Socializing Experience. Adam Breeden, the pioneer of competitive socializing in the U.K., selected rFactor 2 as the racing simulation platform for the newly-formed Kindred Concepts – a groundbreaking, immersive, state of the art F1® racing simulation experience, gamified for a mass audience.

- rFactor

2 Became the Official SIM Racing Platform of Formula E. The Company implemented Formula E content, including its drivers and teams, into rFactor 2. rFactor 2 now features every season of Formula E since 2018 and enables racing on many high-fidelity circuits within the series. The Formula E content pack was updated in March 2022 and is available to purchase for all users of rFactor 2. In addition, Formula E launched its Accelerate Esports series powered by rFactor 2’s in-game competitions platform, and rFactor 2 will power the Formula E Gaming Arena at future esports races and events allowing players to experience the thrill of the ABB FIA Formula E World Championship in esports venues all around the world.

Financial Results for

the Three Months Ended March 31, 2022

Revenues for Q1 2022 were $3.3 million, as compared to $2.5 million for Q1 2021. The $0.8 million, or 34%, quarter-over-quarter increase reflects higher gaming sales of $0.5 million in Q1 2022, primarily from rFactor 2. Q1 2022 esports revenues increased by $0.3 million, primarily from the 24 Hours of Le Mans esports event held in January 2022.

Jon New, Chief Financial Officer of Motorsport Games, commented, “It is great to see both the growth of revenues in each of our Gaming and esports segments and the increased diversity of our revenue stream, with rFactor 2 and esports contributing 27% of total revenues for the quarter. Our business plan to increase and diversify our revenue stream is beginning to drive improved top-line financial performance.”

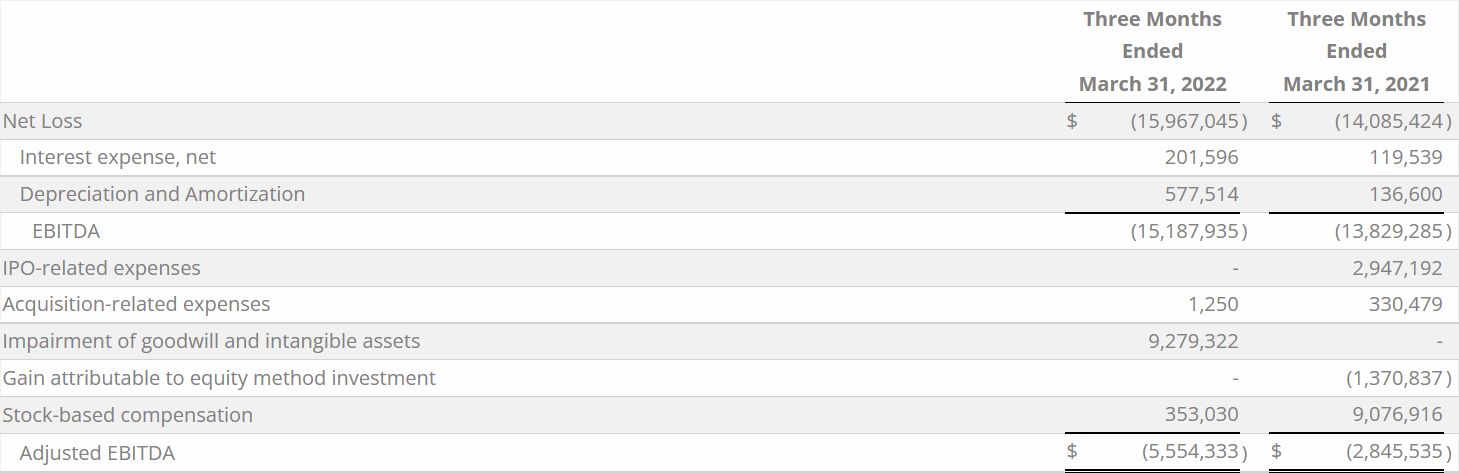

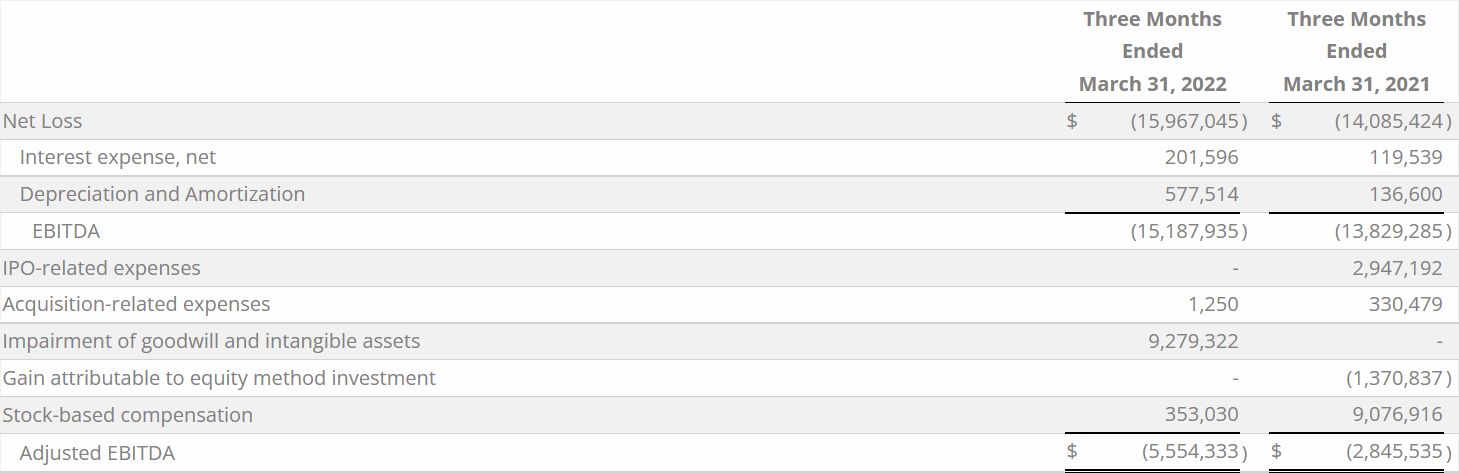

Q1 2022 net loss was $16.0 million, as compared to Q1 2021 net loss of $14.1 million. The $1.9 million increase in net loss was primarily due to a non-cash $9.3 million write-down of goodwill and intangible assets. This was primarily driven by revisions to the product roadmap during Q1 2022, resulting in changes to the scope and timing of new product releases, as well as changes in the value of the Company’s market capitalization during the first quarter of 2022. A $1.2 million increase in Q1 2022 development expenditures, and a $0.7 million increase in sales and marketing spend further contributed to the Q1 2022 increased net loss. The increases in expenses described above were partially offset by a $11.3 million reduction in general and administrative expenses and a $1.4 million reduction in gains from equity method investments.

The Q1 2022 decrease of $11.3 million in general and administrative expenses was primarily due to an $11.9 million reduction in non-recurring IPO expenses that were incurred in Q1 2021, including IPO bonuses and stock-based compensation.

Q1 2022 Adjusted EBITDA loss(1) was $5.6 million, as compared to Q1 2021 Adjusted EBITDA loss of $2.8 million. The $2.7 million increase in Q1 2022 Adjusted EBITDA loss(1) was primarily driven by the same factors as the increased Q1 2022 net loss, higher Q1 2022 interest and amortization and Q1 2021 had more non-operational add-backs with Q1 2021 IPO related expenses (including stock-based compensation).

The following table provides a reconciliation from net loss to Adjusted EBITDA(1) for Q1 2022 and Q1 2021, respectively:

Cash Flow and

Liquidity

For Q1 2022, the Company had negative cash flows from operations of approximately $5.6 million. The Company expects to continue to have negative operating cash flows for the foreseeable future, as it continues to incur expenses to develop new game franchises. The Company’s existing cash on hand will be insufficient to fund its minimum liquidity requirements for at least the next 12 months and will need to be supplemented with additional debt and/or equity financing, cash generated by cost control initiatives, and/or additional changes to its product roadmap to reduce working capital requirements.

The Company’s future liquidity and capital requirements include funds to support the planned costs to operate its business, including amounts required to fund working capital, support the development and introduction of new products, maintain existing game titles and certain capital expenditures. The adequacy of the Company’s available funds generally depends on many factors, including its ability to successfully develop consumer-preferred new products or enhancements to its existing products, continued development and expansion of the Company’s esports platform and its ability to collaborate with and/or acquire other companies or technologies to enhance or complement the Company’s product and service offerings.

The Company is currently seeking additional funds through a variety of arrangements discussed above, and through maintaining and enhancing strong cost controls. There can be no assurances that the sources of liquidity referred to above will provide the Company with sufficient liquidity to meet its ongoing cash requirements as, among other things, the Company’s liquidity can be impacted by a number of factors, including the Company’s level of sales and expenditures, as well as accounts receivable, sales allowances, prepaid manufacturing expenses and accrued expenses.

(1)Use of Non-GAAP Financial Measures

Adjusted EBITDA (the “Non-GAAP Measure”) is not a financial measure defined by U.S. generally accepted accounting principles (“U.S. GAAP”). See the reconciliations of the Non-GAAP Measure to its most directly comparable U.S. GAAP measure in the financial table above.

Adjusted EBITDA, a measure used by management to assess the Company’s operating performance, is defined as EBITDA, which is net loss plus interest (income) expense, depreciation and amortization, less income tax benefit (if any), adjusted to exclude: (i) IPO-related expenses; (ii) acquisition related expenses; (iii) gain attributable to equity method investment resulting from the acquisition of additional equity interest in Le Mans Esports Series Ltd.; (iv) stock-based compensation expenses; (v) impairment of goodwill and intangible assets, and (vi) other charges or gains resulting from non-recurring events.

The Company uses the Non-GAAP Measure to manage its business and evaluate its financial performance, as Adjusted EBITDA eliminates items that affect comparability between periods that the Company believes are not representative of its core ongoing operating business. Additionally, management believes that using the Non-GAAP Measure is useful to its investors because it enhances investors’ understanding and assessment of the Company’s normalized operating performance and facilitates comparisons to prior periods and its competitors’ results (who may define Adjusted EBITDA differently).

The Non-GAAP Measure is not a recognized term under U.S. GAAP and does not purport to be an alternative to revenue, income/loss from operations, net (loss) income, or cash flows from operations or as a measure of liquidity or any other performance measure derived in accordance with U.S. GAAP. Additionally, the Non-GAAP Measure is not intended to be a measure of free cash flows available for management’s discretionary use, as it does not consider certain cash requirements, such as interest payments, tax payments, working capital requirements and debt service requirements. The Non-GAAP Measure has limitations as an analytical tool, and investors should not consider it in isolation or as a substitute for the Company’s results as reported under U.S. GAAP. Management compensates for the limitations of using non-GAAP financial measures by using them to supplement U.S. GAAP results to provide a more complete understanding of the factors and trends affecting the business than would be presented by using only measures in accordance with U.S. GAAP. Because not all companies use identical calculations, the Company’s measures may not be comparable to other similarly titled measures of other companies. Reconciliations of the Non-GAAP Measure to net loss, its most directly comparable financial measure, calculated and presented in accordance with U.S. GAAP, are presented in the table above.

Conference Call and

Webcast Details

The Company will host a conference call and webcast at 5:00 p.m. ET today, May 16, 2022, to discuss its financial results. The live conference call can be accessed by dialing 1-800-786-6104 from the U.S. or 1-416-981-9029. Alternatively, participants may access the live webcast on the Motorsport Games Investor Relations website at

https://ir.motorsportgames.com under “Events.”

About Motorsport Games

Motorsport Games, a Motorsport Network company, combines innovative and engaging video games with exciting esports competitions and content for racing fans and gamers around the globe. The Company is the officially licensed video game developer and publisher for iconic motorsport racing series across PC, PlayStation, Xbox, Nintendo Switch and mobile, including NASCAR, INDYCAR, 24 Hours of Le Mans and the British Touring Car Championship (“BTCC”). Motorsport Games is an award-winning esports partner of choice for 24 Hours of Le Mans, Formula E, BTCC, the FIA World Rallycross Championship and the eNASCAR Heat Pro League, among others.

For more information about Motorsport Games visit: www.motorsportgames.com.

Forward-Looking Statements

Certain statements in this press release, the related conference call and webcast which are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are provided pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Any statements in this press release, the related conference call and webcast that are not statements of historical fact may be deemed forward-looking statements. Words such as “continue,” “will,” “may,” “could,” “should,” “expect,” “expected,” “plans,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, but are not limited to, statements concerning: (i) Motorsport Games’ future business, future results of operations and/or financial condition; (ii) the expected future impact of new or planned products or offerings and the timing of launching such products and offerings, including, without limitation our belief that we will deliver against our product roadmap, our expectations that our rFactor 2 updates will revamp and improve both our rFactor 2 platform and user experience and our expectations that rFactor 2 will power the Formula E Gaming Arena at future esports races and events and allow players to experience the thrill of the ABB FIA Formula E World Championship in esports venues all around the world; (iii) the expected future impact of implementing management strategies and the impact of other industry trends, including, without limitation our ability to execute a business continuity plan and adapt to developments real-time, as well as our business plan to increase and diversify our revenue stream; (iv) the ability of the Company to fund future development and operating expenses, including, without exception our expectation that the Company will continue to have negative operating cash flows for the foreseeable future, as we continue to incur expenses to develop new game franchises; and (v) our liquidity and capital requirements, including, without limitation, our ability to continue as a going concern, our belief that our existing cash on hand will not be sufficient to fund our liquidity requirements for at least the next 12 months, our belief that it will be necessary for us to secure additional funds to continue our existing business operations, including any references to our existing $12 million line of credit with our parent company, Motorsport Network, and to fund our obligations, including, without limitation, the Company’s expectation to supplement its liquidity through additional debt and/or equity financing, cash generated by cost control initiatives, and/or additional changes to our product roadmap to reduce working capital requirements, as well as statements regarding our cash flows and anticipated uses of cash. All forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements, many of which are generally outside the control of Motorsport Games and are difficult to predict. Examples of such risks and uncertainties include, but are not limited to: (i) difficulties, delays or less than expected results in achieving the Company’s growth plans, objectives and expectations, such as due to a slower than anticipated economic recovery and/or the Company’s inability, in whole or in part, to continue to execute its business strategies and plans, such as due to less than anticipated customer acceptance of the Company’s new game titles, the Company’s experiencing difficulties or the inability to launch its games as planned, less than anticipated performance of the games impacting customer acceptance and sales and/or greater than anticipated costs and expenses to develop and launch its games, including, without limitation, higher than expected labor costs and, in addition to the factors set forth in (ii) through (iv) below, the Company’s continuing financial condition and ability to obtain additional debt or equity financing to meet its liquidity requirements, such as the going concern qualification on the Company’s annual audited financial statements posing difficulties in obtaining new financing on terms acceptable to the Company, or at all; (ii) difficulties, delays in or unanticipated events that may impact the timing and scope of new product launches, such as due to difficulties or delays in using its product development personnel in Russia due to the Russia invasion of Ukraine and the related sanctions and/or more restrictive sanctions rendering transacting in the region more difficult or costly and/or difficulties and/or delays arising out of any resurgence of the ongoing and prolonged COVID-19 pandemic; (iii) less than expected benefits from implementing the Company’s management strategies and/or adverse economic, market and geopolitical conditions that negatively impact industry trends, such as significant changes in the labor markets, an extended or higher than expected inflationary environment (such as the impact on consumer discretionary spending as a result of significant increases in energy and gas prices which have been increasing since early in 2020), a higher interest rate environment, tax increases impacting consumer discretionary spending and or quantitative easing that results in higher interest rates that negatively impact consumers’ discretionary spending, or adverse developments relating to the Russia invasion of Ukraine; and/or (iv) difficulties and/or delays in resolving our liquidity position, and other unanticipated difficulties in resolving our continuing financial condition and ability to obtain additional capital to meet our liquidity needs, including without limitation, difficulties in securing funding that is on commercially acceptable terms to us or at all, such as our inability to complete in whole or in part any potential debt and/or equity financing transactions, as well as any inability to achieve cost reductions and/or less than expected availability of funds under its $12 million line of credit from Motorsport Network. Factors other than those referred to above could also cause Motorsport Games’ results to differ materially from expected results. Additional examples of such risks and uncertainties include, but are not limited to: (i) delays and higher than anticipated expenses related to the ongoing and prolonged COVID-19 pandemic, any resurgence of COVID-19 and the Russia invasion of Ukraine; (ii) Motorsport Games’ ability (or inability) to maintain existing, and to secure additional, licenses and other agreements with various racing series; (iii) Motorsport Games’ ability to successfully manage and integrate any joint ventures, acquisitions of businesses, solutions or technologies; (iv) unanticipated operating costs, transaction costs and actual or contingent liabilities; (v) the ability to attract and retain qualified employees and key personnel; (vi) adverse effects of increased competition; (vii) changes in consumer behavior, including as a result of general economic factors, such as increased inflation, higher energy prices and higher interest rates; (viii) Motorsport Games’ ability to protect its intellectual property; and/or (ix) local, industry and general business and economic conditions. Additional factors that could cause actual results to differ materially from those expressed or implied in the forward-looking statements can be found in Motorsport Games’ filings with the SEC, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2021, its Quarterly Reports on Form 10-Q filed with the SEC during 2022, as well as in its subsequent filings with the SEC. Motorsport Games anticipates that subsequent events and developments may cause its plans, intentions and expectations to change. Motorsport Games assumes no obligation, and it specifically disclaims any intention or obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by law. Forward-looking statements speak only as of the date they are made and should not be relied upon as representing Motorsport Games’ plans and expectations as of any subsequent date.

Website and Social

Media Disclosure

Investors and others should note that we announce material financial information to our investors using our investor relations website (ir.motorsportgames.com), SEC filings, press releases, public conference calls and webcasts. We use these channels, as well as social media and blogs, to communicate with our investors and the public about our company and our products. It is possible that the information we post on our websites, social media and blogs could be deemed to be material information. Therefore, we encourage investors, the media and others interested in our company to review the information we post on the websites, social media channels and blogs, including the following (which list we will update from time to time on our investor relations website):

|

Websites

|

|

Social Media

|

|

motorsportgames.com

|

|

Twitter: @msportgames &

@traxiongg

|

|

|

|

|

|

traxion.gg

|

|

Instagram: msportgames & traxiongg

|

|

|

|

|

|

motorsport.com

|

|

Facebook: Motorsport

Games & traxiongg

|

|

|

|

|

|

|

|

LinkedIn: Motorsport

Games

|

|

|

|

|

|

|

|

Twitch: traxiongg

|

|

|

|

|

|

|

|

Reddit: traxiongg

|

The contents of these websites and social media channels are not part of, nor will they be incorporated by reference into, this press release.

Contacts:

Investors:

Ashley DeSimone

Ashley.DeSimone@icrinc.com

Media:

ASTRSK PR

motorsportgames@astrskpr.com