Comstock Mining (LODE) Corporate Presentation from NobleCon18Research, News and Market Data on Comstock MiningNobleCon 18 Complete Rebroadcast

|

Category:

Comtech Telecommunications (CMTL) NobleCon18 Presentation Replay

Cumulus Media (CMLS) NobleCon18 Presentation Replay

Release – Bowlero Corp. to Report Financial Results for the Third Quarter of Fiscal Year 2022

Bowlero Corp. to Report Financial Results for the Third Quarter of Fiscal Year 2022

Research, News, and Market Data on Bowlero

RICHMOND, Va., May 02, 2022 (GLOBE NEWSWIRE) — Bowlero Corp. (NYSE: BOWL) (“Bowlero” or the “Company”), the world’s largest owner and operator of bowling centers, will report financial results for the third quarter of fiscal year 2022 on Wednesday May 11, 2022 after the market closes.

Listeners may access an investor webcast hosted by Bowlero. The webcast and results presentation will be accessible Wednesday May 11, 2022 at 5:30 PM ET in the Events & Presentations section of the Bowlero Investor Relations website at

https://ir.bowlerocorp.com/overview/default.aspx.

About

Bowlero Corp.

Bowlero Corp. is the worldwide leader in bowling entertainment, media, and events. With more than 300 bowling centers across North America, Bowlero Corp. serves more than 26 million guests each year through a family of brands that includes Bowlero, Bowlmor Lanes, and AMF. In 2019, Bowlero Corp. acquired the Professional Bowlers Association, the major league of bowling, which boasts thousands of members and millions of fans across the globe. For more information on Bowlero Corp., please visit BowleroCorp.com.

Contacts:

For Media:

ICR, Inc.

Tom Vogel

Tom.Vogel@icrinc.com

For Investors:

ICR, Inc.

Ryan Lawrence

Ryan.Lawrence@icrinc.com

Ashley DeSimone

Ashley.desimone@icrinc.com

Source: Bowlero Corp

Release – Aurania Appoints Senior Geological Consultant, Dr. Cristian Vallejo

Aurania Appoints Senior Geological Consultant, Dr. Cristian Vallejo

Research, News, and Market Data on Aurania Resources

Toronto, Ontario, May 2, 2022 –

Aurania Resources Ltd. (TSXV: ARU) (OTCQB: AUIAF) (Frankfurt: 20Q) (“Aurania”

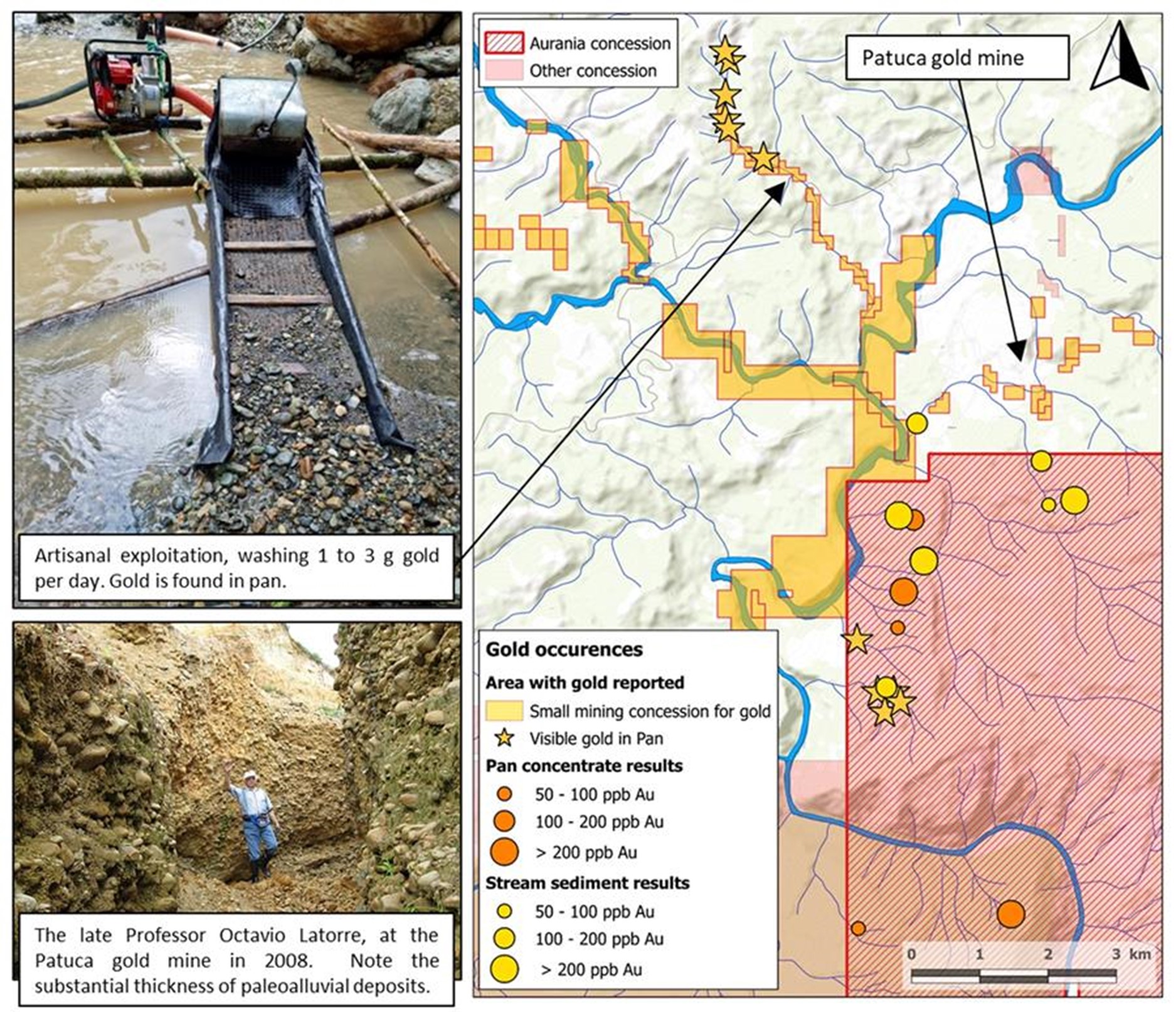

or the “Company”) announces it has retained Dr. Cristian Vallejo of Geostrat S.A. as a Geological Consultant. Dr. Vallejo is currently working in the Patuca area of Aurania’s Lost Cities-Cutucu project (the “Project”) in southeastern Ecuador. The village of Patuca is located near a small alluvial gold mine which is just on the edge and outside the Company’s concessions. This small gold mine has been actively worked since at least 2008 when it was initially examined by Aurania’s President and CEO, Dr. Keith Barron and Professor Octavio Latorre.

Dr. Keith Barron, commented, “Because of the proximity of Aurania’s Crunchy Hill, Latorre, and Yawi epithermal prospects, I believe that the gold coming from the small alluvial gold mine near Patuca has its ultimate origin from the Aurania concessions. Cristian Vallejo has been retained to provide us guidance in this respect, using his knowledge of sedimentology.”

Dr. Vallejo is an Ecuadorian national and a Geologist with twenty-two years experience in the mining/oil industry and academia. During his PhD at the Swiss Federal Institute of Technology (ETH-Zurich) he worked on the geology of the Oriente Basin of Ecuador and the geodynamic evolution of the Western Cordillera of Ecuador and Colombia. In these studies, he applied field mapping, sedimentology, organic matter analysis, radiometric dating of igneous rocks, isotope geochemistry and provenance analysis.

After finishing his PhD he worked for two years as Project Manager of Salazar Resources in the Curipamba Project, being part of the team that discovered the El Domo Volcanogenic Massive Sulphide deposit (VMS), currently in the mine construction phase.

During the last twelve years he has worked as a consultant for the oil industry in the geological modelling of the main oil fields of the Oriente Basin of Ecuador, Putumayo, Guajira and Magdalena basins of Colombia and the Peten Basin of Guatemala. The results of his studies have been published in peer-reviewed journals and presented at international geological meetings.

Most recently Cristian was lead author on: “Jurassic to Early Paleogene sedimentation in the Amazon region of Ecuador: Implications for the paleogeographic evolution of northwestern South America” published in September 2021. This work specifically refers to geological mapping he carried out in the Cordillera de Cutucu, within the confines of Aurania’s Lost Cities Project.

Dr. Barron further commented, “Back in 2008 there was only a single small miner’s concession at Patuca where they were recovering gold by hydrauliking hillsides and catching the gold in wooden sluice boxes. It was a very primitive operation, but it supported about a dozen people. What impressed me at the time was that this was clearly not a modern placer, but an ancient “paleoplacer” of unknown age. The source of the gold was not apparent, neither was there a stream or river nearby, though the deposit indicated that a substantial river must have existed there at one time. More recently, there has been what can only be described as an “explosion” of small miner activity and the majority of flowing streams in the Patuca area have now been staked, but this is a “red herring”. From a geological perspective, the miners may not appreciate that the gold occurrence, worked since 2008, is a fossil system. They are however recovering small amounts of “second or third cycle” gold; in other words, capturing gold from erosion of this paleoplacer and others nearby.

On a greater scale however, I believe Cristian is Ecuador’s authority on the Cutucu Basin, which contains Aurania’s copper-silver and zinc-silver-lead prospects hosted in sediments at Tsenken and Tiria-Shimpia. Due to his enormous experience in stratigraphy and sedimentology in the area he will be a valuable addition to Aurania’s team, and I believe will have much to contribute on these exciting prospects. For now, he will be examining and evaluating all of Aurania’s information collected to date.”

Figure 1: Gold results from the Aurania property near the artisanal Patuca Gold Mine.

Qualified Person

The geological information contained in this news release has been verified and approved by Jean-Paul Pallier, MSc. Mr. Pallier is a designated EurGeol by the European Federation of Geologists and a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators.

About Aurania

Aurania is a mineral exploration company engaged in the identification, evaluation, acquisition and exploration of mineral property interests, with a focus on precious metals and copper in South America. Its flagship asset, The Lost Cities – Cutucu Project, is located in the Jurassic Metallogenic Belt in the eastern foothills of the Andes mountain range of southeastern Ecuador.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain forward-looking information that involves substantial known and unknown risks and uncertainties, most of which are beyond the control of Aurania. Forward-looking statements include estimates and statements that describe Aurania’s future plans, objectives or goals, including words to the effect that Aurania or its management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to Aurania, Aurania provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to Aurania’s objectives, goals or future plans, statements, exploration results, potential mineralization, the corporation’s portfolio, treasury, management team and enhanced capital markets profile, the estimation of mineral resources, exploration, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, regulatory, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, the effects of COVID-19 on the business of the Company including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restrictions on labour and international travel and supply chains, and those risks set out in Aurania’s public documents filed on SEDAR. Although Aurania believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Aurania disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Release – Ocugen to Host Conference Call on Friday, May 6 at 8:30 a.m. ET to Provide Business Update and Discuss First Quarter 2022 Financial Results

Ocugen to Host Conference Call on Friday, May 6 at 8:30 a.m. ET to Provide Business Update and Discuss First Quarter 2022 Financial Results

Research, News, and Market Data on Ocugen

MALVERN, Pa., May 02, 2022 (GLOBE NEWSWIRE) — Ocugen, Inc. (NASDAQ: OCGN), a biotechnology company focused on discovering, developing and commercializing novel gene therapies, biologicals and vaccines, today announced that it will host a conference call to provide a business update and discuss its first quarter 2022 financial results at 8:30 a.m. ET on Friday, May 6, 2022.

Ocugen will issue a pre-market earnings announcement on the same day. Investors are invited to participate on the call using the following details:

- Dial-In Number: (844) 873-7330 (toll free) or (602) 563-8473 (Int’l)

- Conference ID: 6995784

- Webcast: Available in the “Investors” section of the

Ocugen website and archived for approximately 45 days following the call

About Ocugen, Inc.

Ocugen, Inc. is a biotechnology company focused on discovering, developing, and commercializing novel gene therapies, biologicals and vaccines that improve health and offer hope for people and global communities. We are making an impact through courageous innovation, taking science in new directions in service of patients. Our breakthrough modifier gene therapy platform has the potential to treat multiple diseases with one drug and we are advancing research in other therapeutic areas to offer new options for people with unmet medical needs. Discover more at www.ocugen.com and follow us on Twitter and LinkedIn.

Cautionary Note on Forward-Looking Statements

This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995, which are subject to risks and uncertainties. Such forward-looking statements within this press release include, without limitation, the intended use of net proceeds from the registered direct offering. We may, in some cases, use terms such as “predicts,” “believes,” “potential,” “proposed,” “continue,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should” or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Such statements are subject to numerous important factors, risks and uncertainties that may cause actual events or results to differ materially from our current expectations, such as market and other conditions. These and other risks and uncertainties are more fully described in our periodic filings with the Securities and Exchange Commission (the “SEC”), including the risk factors described in the section entitled “Risk Factors” in the quarterly and annual reports that we file with the SEC. Any forward-looking statements that we make in this press release speak only as of the date of this press release. Except as required by law, we assume no obligation to update forward-looking statements contained in this press release whether as a result of new information, future events or otherwise, after the date of this press release.

Ocugen Contact:

Ken Inchausti

Head, Investor Relations & Communications

ken.inchausti@ocugen.com

Please submit investor-related inquiries to:

IR@ocugen.com

Release – Alliance Resource Partners, L.P. Reports Increased Financial and Operating Results

Alliance Resource Partners, L.P. Increases Quarterly Cash Distribution 40% to $0.35 Per Unit; Provides Preliminary View of Results for the Quarter Ended March 31, 2022; and Increases Guidance

Research, News, and Market Data on Alliance Resource Partners

TULSA, Okla.–(BUSINESS WIRE)– Alliance Resource Partners, L.P. (NASDAQ: ARLP) today reported increased financial and operating results for the quarter ended March 31, 2022 (the “2022 Quarter”). Total revenues in the 2022 Quarter increased 44.6% to $460.9 million compared to $318.6 million for the quarter ended March 31, 2021 (the “2021 Quarter”) as a result of higher coal sales volumes and prices, which rose 19.5% and 13.0%, respectively, and higher oil & gas royalty volumes and prices, which increased by 26.3% and 74.9%, respectively. Total operating expenses increased to $373.0 million in the 2022 Quarter, compared to $282.3 million in the 2021 Quarter, due primarily to increased coal sales volumes and inflationary cost pressures. Income before income taxes increased 221.0% to $79.7 million in the 2022 Quarter as compared to $24.8 million in the 2021 Quarter. As previously reported, during the 2022 Quarter, ARLP recognized a one-time non-cash deferred income tax charge of $37.3 million and a current income tax expense of $4.8 million associated with its election to have our oil & gas royalty activities treated as a taxable entity for federal and state income tax purposes, which collectively reduced net income by $0.33 per basic and diluted limited partner unit. This election effectively reduces the total income tax burden on our oil & gas royalties, as ARLP will pay entity-level taxes at corporate tax rates that are well below the individual tax rates that would otherwise be paid by our unitholders. Reflecting higher revenues, partially offset by increased total operating and income tax expenses, net income for the 2022 Quarter increased to $36.7 million, or $0.28 per basic and diluted limited partner unit, compared to $24.7 million, or $0.19 per basic and diluted limited partner unit, for the 2021 Quarter. EBITDA also increased 61.5% in the 2022 Quarter to $152.3 million compared to $94.3 million in the 2021 Quarter. (Unless otherwise noted, all references in the text of this release to “net income” refer to “net income attributable to ARLP.” For a definition of EBITDA and related reconciliation to its comparable GAAP financial measure throughout this release, please see the end of this release.)

Compared to the quarter ended December 31, 2021 (the “Sequential Quarter”), total revenues decreased by 2.7% primarily as a result of lower coal sales volumes due to previously reported coal shipment delays, partially offset by higher coal sales price realizations and increased oil & gas royalty volumes and prices. Total operating expenses decreased 9.5% to $373.0 million due primarily to lower coal sales volumes in the 2022 Quarter and expenses incurred in the Sequential Quarter related to an $11.8 million buy-out of a coal contract and $6.8 million of unfavorable year end non-cash actuarial and accrual adjustments. Lower total operating expenses more than offset reduced revenues leading income before income taxes higher by 52.5% to $79.7 million in the 2022 Quarter compared to $52.2 million for the Sequential Quarter. Although income before income taxes was higher in the 2022 Quarter, net income decreased to $36.7 million compared to $51.8 million in the Sequential Quarter due to the impact of income tax expense attributable to the above discussed change in tax status of our oil & gas royalty segment. EBITDA increased 16.9% in the 2022 Quarter to $152.3 million compared to $130.2 million in the Sequential Quarter.

As previously announced on April 26, 2022, the Board of Directors of ARLP’s general partner (the “Board”) increased the cash distribution to unitholders for the 2022 Quarter to $0.35 per unit (an annualized rate of $1.40 per unit), payable on May 13, 2022, to all unitholders of record as of the close of trading on May 6, 2022. The announced distribution represents a 250.0% increase over the cash distribution of $0.10 per unit for the 2021 Quarter and a 40.0% increase over the cash distribution of $0.25 per unit for the Sequential Quarter.

“Buoyed by robust energy market fundamentals during the 2022 Quarter, ARLP delivered strong operating and financial performance with coal and oil & gas sales volumes, total revenues, net income and EBITDA all increasing significantly over the 2021 Quarter,” said Joseph W. Craft III, Chairman, President and Chief Executive Officer. “Our coal operations performed exceptionally well, particularly in light of the transportation challenges experienced during the 2022 Quarter, which resulted in delayed shipments of approximately 1.1 million tons. Through the efforts of our marketing teams, ARLP continued to benefit from rising coal markets as coal price realizations per ton increased $5.48 and $2.39 compared to the 2021 and Sequential Quarters, respectively. We also further strengthened our contract book during the 2022 Quarter, securing new agreements for the delivery of approximately 8.7 million tons through 2025 at prices well above our initial expectations. Higher energy prices and increased royalty volumes also drove strong performance by our royalties businesses, with both oil & gas royalties and coal royalties achieving a record EBITDA during the 2022 Quarter.”

Operating Results and Analysis

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% Change |

|

|

|

|

|

|

|

|

|

|

2022 First |

|

2021 First |

|

Quarter / |

|

2021 Fourth |

|

% Change |

|||||

|

(in |

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

|

Sequential |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coal Operations (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Illinois Basin |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons sold |

|

|

5.882 |

|

|

4.760 |

|

23.6 |

% |

|

|

6.329 |

|

(7.1) |

% |

|

Coal sales price per ton sold |

|

$ |

43.17 |

|

$ |

38.37 |

|

12.5 |

% |

|

$ |

41.63 |

|

3.7 |

% |

|

Segment Adjusted EBITDA Expense per ton |

|

$ |

30.19 |

|

$ |

26.38 |

|

14.4 |

% |

|

$ |

31.27 |

|

(3.5) |

% |

|

Segment Adjusted EBITDA |

|

$ |

78.2 |

|

$ |

57.7 |

|

35.6 |

% |

|

$ |

67.7 |

|

15.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Appalachia |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons sold |

|

|

2.280 |

|

|

2.068 |

|

10.3 |

% |

|

|

2.771 |

|

(17.7) |

% |

|

Coal sales price per ton sold |

|

$ |

58.97 |

|

$ |

50.70 |

|

16.3 |

% |

|

$ |

53.30 |

|

10.6 |

% |

|

Segment Adjusted EBITDA Expense per ton |

|

$ |

36.72 |

|

$ |

35.65 |

|

3.0 |

% |

|

$ |

37.47 |

|

(2.0) |

% |

|

Segment Adjusted EBITDA |

|

$ |

51.1 |

|

$ |

31.5 |

|

62.2 |

% |

|

$ |

46.7 |

|

9.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Coal Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons sold |

|

|

8.162 |

|

|

6.828 |

|

19.5 |

% |

|

|

9.100 |

|

(10.3) |

% |

|

Coal sales price per ton sold |

|

$ |

47.58 |

|

$ |

42.10 |

|

13.0 |

% |

|

$ |

45.19 |

|

5.3 |

% |

|

Segment Adjusted EBITDA Expense per ton |

|

$ |

32.90 |

|

$ |

29.72 |

|

10.7 |

% |

|

$ |

33.86 |

|

(2.8) |

% |

|

Segment Adjusted EBITDA |

|

$ |

132.0 |

|

$ |

90.6 |

|

45.7 |

% |

|

$ |

116.4 |

|

13.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Royalties (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil & Gas Royalties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOE sold (2) |

|

|

0.505 |

|

|

0.400 |

|

26.3 |

% |

|

|

0.458 |

|

10.3 |

% |

|

Oil percentage of BOE |

|

|

44.2 |

% |

|

48.4 |

% |

(8.7) |

% |

|

|

45.9 |

% |

(3.7) |

% |

|

Average sales price per BOE (3) |

|

$ |

61.26 |

|

$ |

35.02 |

|

74.9 |

% |

|

$ |

51.80 |

|

18.3 |

% |

|

Segment Adjusted EBITDA Expense |

|

$ |

3.0 |

|

$ |

2.1 |

|

45.8 |

% |

|

$ |

2.8 |

|

6.2 |

% |

|

Segment Adjusted EBITDA |

|

$ |

28.6 |

|

$ |

11.9 |

|

139.0 |

% |

|

$ |

22.4 |

|

27.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coal Royalties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Royalty tons sold |

|

|

5.553 |

|

|

4.521 |

|

22.8 |

% |

|

|

5.675 |

|

(2.1) |

% |

|

Revenue per royalty ton sold |

|

$ |

2.73 |

|

$ |

2.50 |

|

9.2 |

% |

|

$ |

2.64 |

|

3.4 |

% |

|

Segment Adjusted EBITDA Expense |

|

$ |

4.8 |

|

$ |

4.0 |

|

19.6 |

% |

|

$ |

5.1 |

|

(5.7) |

% |

|

Segment Adjusted EBITDA |

|

$ |

10.3 |

|

$ |

7.3 |

|

42.3 |

% |

|

$ |

9.9 |

|

4.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Royalties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total royalty revenues |

|

$ |

46.1 |

|

$ |

25.3 |

|

82.2 |

% |

|

$ |

39.4 |

|

16.9 |

% |

|

Segment Adjusted EBITDA Expense |

|

$ |

7.8 |

|

$ |

6.1 |

|

28.5 |

% |

|

$ |

7.9 |

|

(1.5) |

% |

|

Segment Adjusted EBITDA |

|

$ |

38.9 |

|

$ |

19.2 |

|

102.4 |

% |

|

$ |

32.3 |

|

20.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Total (4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues |

|

$ |

460.9 |

|

$ |

318.6 |

|

44.6 |

% |

|

$ |

473.5 |

|

(2.7) |

% |

|

Segment Adjusted EBITDA Expense |

|

$ |

261.2 |

|

$ |

197.7 |

|

32.1 |

% |

|

$ |

301.1 |

|

(13.3) |

% |

|

Segment Adjusted EBITDA |

|

$ |

170.9 |

|

$ |

109.8 |

|

55.6 |

% |

|

$ |

148.8 |

|

14.9 |

% |

_________________

|

(1) |

|

For definitions of Segment Adjusted EBITDA Expense and Segment Adjusted EBITDA and related reconciliations to comparable GAAP financial measures, please see the end of this release. Segment Adjusted EBITDA Expense per ton is defined as Segment Adjusted EBITDA Expense – Coal Operations (as reflected in the reconciliation table at the end of this release) divided by total tons sold. |

|

(2) |

|

Barrels of oil equivalent (“BOE”) for natural gas volumes is calculated on a 6:1 basis (6,000 cubic feet of natural gas to one barrel). |

|

(3) |

|

Average sales price per BOE is defined as oil & gas royalty revenues excluding lease bonus revenue divided by total BOE sold. |

|

(4) |

|

Reflects total consolidated results, which include our other and corporate activities and eliminations in addition to the Illinois Basin, Appalachia, Oil & Gas Royalties and Coal Royalties reportable segments highlighted above. |

ARLP’s coal sales prices per ton increased in all regions compared to both the 2021 and Sequential Quarters as a result of favorable market conditions. In the Illinois Basin, increased domestic prices and significantly higher export prices during the 2022 Quarter drove coal sales prices higher by 12.5% and 3.7% compared to the 2021 and Sequential Quarters, respectively. In Appalachia, sales prices increased by 16.3% and 10.6% compared to the 2021 and Sequential Quarters, respectively, primarily due to significantly higher export price realizations at our Mettiki and MC Mining operations. Coal sales volumes were higher by 23.6% in the Illinois Basin compared to the 2021 Quarter as a result of increased sales volumes across all mines in the region. In Appalachia, coal sales volumes increased 10.3% compared to the 2021 Quarter as a result of higher export volumes. Compared to the Sequential Quarter, shipment delays resulted in reduced coal sales volumes in both the Illinois Basin and Appalachian regions, which fell 7.1% and 17.7%, respectively, during the 2022 Quarter. ARLP ended the 2022 Quarter with total coal inventory of 1.6 million tons, representing a decrease of 0.2 million tons compared to the end of the 2021 Quarter and an increase of 1.0 million tons compared to the end of the Sequential Quarter.

Segment Adjusted EBITDA Expense per ton increased by 14.4% and 3.0% in the Illinois Basin and Appalachia, respectively, compared to the 2021 Quarter as a result of inflationary pressures on numerous expense items, including labor-related expenses and supply and maintenance costs, as well as longwall moves at our Hamilton, Tunnel Ridge and Mettiki mines. Lower recoveries at our Illinois Basin mines also contributed to increased per ton expenses in that region compared to the 2021 Quarter. Compared to the Sequential Quarter, Segment Adjusted EBITDA expense per ton decreased 3.5% and 2.0% in the Illinois Basin and Appalachia, respectively, primarily due to the previously discussed contract buy-out expense and unfavorable non-cash actuarial and accrual adjustments recognized in the Sequential Quarter.

For our Oil & Gas Royalties segment, significantly higher sales price realizations per BOE and increased volumes in the 2022 Quarter drove Segment Adjusted EBITDA higher by 139.0% to a record $28.6 million compared to $11.9 million for the 2021 Quarter. Compared to the Sequential Quarter, Segment Adjusted EBITDA increased by $6.2 million in the 2022 Quarter due to higher volumes, which increased 10.3%, and increased oil & gas prices, which rose by 18.3%.

Segment Adjusted EBITDA for our Coal Royalties segment increased 42.3% to a record $10.3 million for the 2022 Quarter compared to $7.3 million for the 2021 Quarter as a result of increased royalty tons sold and higher average royalty rates per ton.

Matrix and Alliance Technologies Group High

Level Strategy

Matrix Design Group, LLC (“Matrix”) is a wholly owned subsidiary of ARLP created in 2006 as a technical service group focused on deploying technology in domestic underground coal operations in response to the passage of The MINER Safety Act by the United States Congress. The Matrix strategy evolved over the last decade with a primary focus on supporting U.S. based coal mining operations with proximity detection equipment and other products and services. The customer base has grown to include international coal mining operations and expanded into non-coal mining applications. In 2021 Matrix had revenue of $22.7 million and EBITDA of $4.7 million. As factored into our 2022 consolidated guidance, we estimated revenue of approximately $35.0 million and EBITDA of $8.0 million for Matrix. Matrix is and always has been a cash flow positive business growing organically with limited capital investment to date.

We have more recently been developing Matrix as an incubator as a key component of our diversification strategy. Matrix and its subsidiaries today employ over 100 professionals covering hardware and software development, data analytics and AI technologies. There are many “AI companies” and many “software development” companies that exist but we believe Matrix has attributes which distinguish it from many of its peers. Matrix combines hardware, software and analytics in one platform, which is a powerful combination. Moreover, we believe the investments we are making into Francis Energy and Infinitum Electric (discussed below) have the potential to significantly benefit from the growing skills base, analytics and AI opportunities being developed by Matrix. These three companies are all focused in strong growth sectors aligned with the broader energy transition. Our long-term goals for these companies are to provide tangible offerings which are enhanced by this transition, rather than being dependent on it.

Over the past year, Matrix has embarked on a new strategy, which aims to position the company to compete in the energy transition space, while at the same time remaining committed to the markets they already serve. The reduction of base load coal powered generation resources from our country’s electrical grid combined with the anticipated growth of renewable power sources and the electric vehicle (“EV”) market are changing how electricity is generated, consumed and priced in the United States. As intermittent resources become a more significant portion of the energy mix, the market value of power will become more correlated with generation capacity in real time. This transition creates additional challenges for the electrical infrastructure in America, which was not designed to accommodate this load. ARLP’s relationships with electric utilities, industrial customers, and federal and state governments, along with our technology and manufacturing capabilities give us confidence that these challenges will provide growth opportunities for our Partnership.

Matrix is currently delivering products focused on data networking, communication and tracking systems, mining proximity detection systems, industrial collision avoidance systems, and data and analytics software. Future areas of potential investment by Matrix and ARLP’s broader management team focused on technology development (our “Alliance Technologies Group”) include smart cameras, energy storage, energy efficiency, renewable power generation, EV charging, smart metering and energy demand management.

Francis Energy

Earlier today Francis Renewable Energy, LLC (“Francis Energy”), an Oklahoma-based owner and operator of a leading comprehensive statewide network of EV fast charging infrastructure, with plans to service states across the Midwest and Eastern U.S., announced an equity investment by ARLP to help propel Francis Energy’s future growth. To date, Francis Energy has built a network with hundreds of fast chargers across Oklahoma and several other states, with a goal of providing EV drivers convenient, affordable, easy to use public access to charging stations.

The $1.2 trillion infrastructure bill that President Biden signed into law in November 2021 includes a large federal investment in electric vehicle charging infrastructure. The law authorizes $7.5 billion in federal spending available through two new programs to incentivize the buildout of EV infrastructure to eliminate range anxiety for EV drivers and support the booming growth of the U.S. electric vehicle market. The money will be allocated to private sector companies by federal, state and local governments creating opportunities for project developers and equipment manufacturers, like Matrix and Francis Energy.

Infinitum Electric Inc.

ARLP has also agreed to an equity investment in Infinitum Electric, Inc. (“Infinitum”), a Texas-based startup developer and manufacturer of electric motors featuring printed circuit board stators which have the potential to result in motors that are smaller, lighter, quieter, more efficient and capable of operating at a fraction of the carbon footprint of conventional electric motors. Infinitum’s products are supported by multiple patents and patent applications, which may have broad application across multiple industries.

Outlook

“Much has changed since we last released earnings in January,” said Mr. Craft. “We are excited to share our current energy transition strategy and the announcement of our investment in two entrepreneurial companies that we believe will provide significant returns for our unitholders within four to seven years. We are equally excited to continue supporting Matrix efforts to develop new product offerings that have the potential to grow their sales by 5 to 10 times over the same time period.”

Addressing ARLP’s current outlook, Mr. Craft added, “Commodity price realizations escalated dramatically during the 2022 Quarter, reflecting systemic supply shortages due, in part, to the impact of governmental policies over the last fifteen years and exacerbated by uncertainties created by Russia’s invasion of Ukraine in February of this year. Energy supplies have also been impacted by labor shortages along with supply chain and transportation disruptions. Demand has remained surprisingly strong despite Covid-19 related cases still impacting economies around the world, sanctions imposed on Russia and inflationary cost pressures in the United States not seen in 40 years.”

Mr. Craft added, “Forward pricing for worldwide commodities also rose dramatically during the 2022 Quarter, well above our initial expectations earlier this year. As a result, we updated 2022 full year guidance on April 26, 2022 (as shown below) as well as released our Board’s decision to increase ARLP’s cash distribution to unitholders by 40.0% to $0.35 for the 2022 Quarter. Future distributions will be considered by our Board on a quarterly basis. Consistent with our full-year guidance, management anticipates current market conditions continuing for the foreseeable future, which supports ARLP targeting increases to unitholder distributions of 10.0% to 15.0% per quarter over the balance of this year.”

ARLP’s updated guidance, as reported on April 26, 2022, is outlined below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2022 Full Year Guidance |

|||||

|

|

|

|

|

|

|

|

Coal Operations |

|

|

|

|

|

|

Volumes (Million Short Tons) |

|

|

|

|

|

|

Illinois Basin Sales Tons |

|

|

|

|

25.2 — 26.0 |

|

Appalachia Sales Tons |

|

|

|

|

10.3 — 11.0 |

|

Total Sales Tons |

|

|

|

|

35.5 — 37.0 |

|

|

|

|

|

|

|

|

Committed |

|

|

|

|

|

|

2022 — Domestic/Export/Total |

|

|

|

|

30.1/4.1/34.2 |

|

2023 — Domestic/Export/Total |

|

|

|

|

17.9/2.0/19.9 |

|

|

|

|

|

|

|

|

Per |

|

|

|

|

|

|

Coal Sales Price per ton sold (1) |

|

|

|

|

$54.00 — $63.00 |

|

Segment Adjusted EBITDA Expense per ton sold (2) |

|

|

|

|

$33.50 — $35.50 |

|

|

|

|

|

|

|

|

Royalties |

|

|

|

|

|

|

Oil & Gas Royalties |

|

|

|

|

|

|

Oil (000 Barrels) |

|

|

|

|

885 – 935 |

|

Natural gas (000 MCF) |

|

|

|

|

3,000 – 3,400 |

|

Liquids (000 Barrels) |

|

|

|

|

350 – 380 |

|

Segment Adjusted EBITDA Expense (% of Oil & Gas Royalties Revenue) |

|

|

|

|

~ 12.0% |

|

|

|

|

|

|

|

|

Coal Royalties |

|

|

|

|

|

|

Royalty tons sold (Million Short Tons) |

|

|

|

|

21.5 — 22.0 |

|

Revenue per royalty ton sold |

|

|

|

|

$3.10 — $3.20 |

|

Segment Adjusted EBITDA Expense per royalty ton sold |

|

|

|

|

$1.10 — $1.20 |

|

|

|

|

|

|

|

|

Consolidated (Millions) |

|

|

|

|

|

|

Depreciation, depletion and amortization |

|

|

|

|

$260 — $270 |

|

General and administrative |

|

|

|

|

$82 — $84 |

|

Net interest expense |

|

|

|

|

$37 — $38 |

|

Income tax expense |

|

|

|

|

$53 — $55 |

|

Capital expenditures |

|

|

|

|

$220 — $240 |

_________________

|

(1) |

Sales price per ton is defined as total coal sales revenue divided by total tons sold. |

|

|

(2) |

Segment Adjusted EBITDA Expense is defined as operating expenses, coal purchases and other expense. |

A conference call regarding ARLP’s 2021 Quarter financial results is scheduled for today at 10:00 a.m. Eastern. To participate in the conference call, dial (877) 407-0784 and request to be connected to the Alliance Resource Partners, L.P. earnings conference call. International callers should dial (201) 689-8560 and request to be connected to the same call. Investors may also listen to the call via the “investor information” section of ARLP’s website at http://www.arlp.com.

An audio replay of the conference call will be available for approximately one week. To access the audio replay, dial U.S. Toll Free (844) 512-2921; International Toll (412) 317-6671 and request to be connected to replay using access code 13729024.

About Alliance Resource Partners, L.P.

ARLP is a diversified energy company that is currently the second largest coal producer in the United States. ARLP also generates operating and royalty income from mineral interests it owns in strategic coal and oil & gas producing regions in the United States. In addition, ARLP is positioning itself as an energy provider for the future by leveraging its core technology and operating competencies to make strategic investments in the fast-growing energy and infrastructure transition.

News, unit prices and additional information about ARLP, including filings with the Securities and Exchange Commission (“SEC”), are available at http://www.arlp.com. For more information, contact the investor relations department of ARLP at (918) 295-7674 or via e-mail at investorrelations@arlp.com.

About Matrix Design Group, LLC

Matrix is an ISO 9001 certified designer, developer and marketer of safety and productivity technology for use in mining and industrial applications. Its innovative, industry-leading systems include products focused on data networking, communication and tracking systems, mining proximity detection systems, industrial collision avoidance systems, and data and analytics software. Headquartered in Newburgh, Indiana, Matrix has offices in Lexington, KY, Johannesburg and Pretoria, South Africa and service locations throughout its mining regions.

The statements and projections used throughout this release are based on current expectations. These statements and projections are forward-looking, and actual results may differ materially. These projections do not include the potential impact of any mergers, acquisitions or other business combinations that may occur after the date of this release. We have included more information below regarding business risks that could affect our results.

FORWARD-LOOKING STATEMENTS: With the exception

of historical matters, any matters discussed in this press release are

forward-looking statements that involve risks and uncertainties that could

cause actual results to differ materially from projected results. Those

forward-looking statements include expectations with respect to coal and oil

& gas consumption and expected future prices, our ability to increase

unitholder distributions in future quarters, business plans and potential growth

with respect to Matrix, Francis Energy and Infinitum, optimizing cash flows,

reducing operating and capital expenditures, preserving liquidity and

maintaining financial flexibility, among others. These risks to our ability to

achieve these outcomes include, but are not limited to, the following: the

outcome or escalation of current hostilities in Ukraine, the severity,

magnitude, and duration of the COVID-19 pandemic and the emergence of new virus

variants, including impacts of the pandemic and of businesses’ and governments’

responses to the pandemic, including actions to mitigate its impact and the

development of treatments and vaccines, on our operations and personnel, and on

demand for coal, oil, and natural gas, the financial condition of our customers

and suppliers, available liquidity and capital sources and broader economic

disruptions; changes in macroeconomic and market conditions and market

volatility arising from hostilities in Ukraine, the COVID-19 pandemic or

otherwise, including inflation, changes in coal, oil, natural gas, and natural

gas liquids prices, and the impact of such changes and volatility on our

financial position; decline in the coal industry’s share of electricity

generation, including as a result of environmental concerns related to coal

mining and combustion and the cost and perceived benefits of other sources of

electricity and fuels, such as oil & gas, nuclear energy, and renewable

fuels; changes in global economic and geo-political conditions or in industries

in which our customers operate; changes in coal prices and/or oil & gas

prices, demand and availability which could affect our operating results and

cash flows; actions of the major oil-producing countries with respect to oil

production volumes and prices could have direct and indirect impacts over the

near and long term on oil & gas exploration and production operations at

the properties in which we hold mineral interests; changes in competition in

domestic and international coal markets and our ability to respond to such

changes; potential shut-ins of production by operators of the properties in

which we hold mineral interests due to low oil, natural gas, and natural gas

liquid prices or the lack of downstream demand or storage capacity; risks

associated with the expansion of our operations and properties; our ability to

identify and complete acquisitions; the success of our development plans for

Matrix and our investments in Francis Energy and Infinitum which are emerging

infrastructure and technology companies; dependence on significant customer

contracts, including renewing existing contracts upon expiration; adjustments

made in price, volume, or terms to existing coal supply agreements; the effects

of and changes in trade, monetary and fiscal policies and laws, including the

interest rate policies of the Federal Reserve Board; the effects of and changes

in taxes or tariffs and other trade measures adopted by the United States and

foreign governments; legislation, regulations, and court decisions and

interpretations thereof, both domestic and foreign, including those relating to

the environment and the release of greenhouse gases, mining, miner health and

safety, hydraulic fracturing, and health care; deregulation of the electric

utility industry or the effects of any adverse change in the coal industry,

electric utility industry, or general economic conditions; investors’ and other

stakeholders’ increasing attention to environmental, social, and governance

matters; liquidity constraints, including those resulting from any future

unavailability of financing; customer bankruptcies, cancellations or breaches

to existing contracts, or other failures to perform; customer delays, failure

to take coal under contracts or defaults in making payments; our productivity

levels and margins earned on our coal sales; disruptions to oil & gas

exploration and production operations at the properties in which we hold

mineral interests; changes in raw material costs, including due to inflationary

pressures; changes in our ability to recruit, hire and maintain labor,

including, as a result of, the potential impact of government-imposed vaccine

mandates; our ability to maintain satisfactory relations with our employees;

increases in labor costs including costs of health insurance and taxes resulting

from the Affordable Care Act, adverse changes in work rules, or cash payments

or projections associated with workers’ compensation claims; increases in

transportation costs and risk of transportation delays or interruptions;

operational interruptions due to geologic, permitting, labor, weather, supply

chain shortages of equipment or mine supplies, or other factors; risks

associated with major mine-related accidents, mine fires, mine floods or other

interruptions; results of litigation, including claims not yet asserted;

foreign currency fluctuations that could adversely affect the competitiveness

of our coal abroad; difficulty maintaining our surety bonds for mine

reclamation as well as workers’ compensation and black lung benefits;

difficulty in making accurate assumptions and projections regarding post-mine

reclamation as well as pension, black lung benefits, and other post-retirement

benefit liabilities; uncertainties in estimating and replacing our coal mineral

reserves and resources; uncertainties in estimating and replacing our oil &

gas reserves; uncertainties in the amount of oil & gas production due to

the level of drilling and completion activity by the operators of our oil &

gas properties; uncertainties in the future of the electric vehicle industry

and the market for EV charging stations; the impact of current and potential

changes to federal or state tax rules and regulations, including a loss or

reduction of benefits from certain tax deductions and credits; difficulty

obtaining commercial property insurance, and risks associated with our

participation in the commercial insurance property program; evolving

cybersecurity risks, such as those involving unauthorized access,

denial-of-service attacks, malicious software, data privacy breaches by employees,

insiders or others with authorized access, cyber or phishing-attacks,

ransomware, malware, social engineering, physical breaches, or other actions;

and difficulty in making accurate assumptions and projections regarding future

revenues and costs associated with equity investments in companies we do not

control.

Additional information concerning these and

other factors can be found in ARLP’s public periodic filings with the SEC,

including ARLP’s Annual Report on Form 10-K for the year ended December 31,

2021, filed on February 25, 2022 with the SEC. Except as required by applicable

securities laws, ARLP does not intend to update its forward-looking statements.

|

ALLIANCE RESOURCE PARTNERS, L.P. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND OPERATING (In thousands, except unit and per unit data) (Unaudited) |

|||||||||

|

|

|

|

|

|

|

|

|

||

|

|

|

Three Months Ended |

|

||||||

|

|

|

March 31, |

|

||||||

|

|

|

2022 |

|

2021 |

|

||||

|

|

|

|

|

|

|

|

|

||

|

Tons Sold |

|

|

8,162 |

|

|

|

6,828 |

|

|

|

Tons |

|

|

9,178 |

|

|

|

8,001 |

|

|

|

Mineral Interest Volumes (BOE) |

|

|

505 |

|

|

|

400 |

|

|

|

|

|

|

|

|

|

|

|

||

|

SALES AND OPERATING REVENUES: |

|

|

|

|

|

|

|

||

|

Coal sales |

|

$ |

388,360 |

|

|

$ |

287,487 |

|

|

|

Oil & gas royalties |

|

|

30,927 |

|

|

|

13,999 |

|

|

|

Transportation revenues |

|

|

29,372 |

|

|

|

11,068 |

|

|

|

Other revenues |

|

|

12,204 |

|

|

|

6,068 |

|

|

|

Total revenues |

|

|

460,863 |

|

|

|

318,622 |

|

|

|

|

|

|

|

|

|

|

|

||

|

EXPENSES: |

|

|

|

|

|

|

|

||

|

Operating expenses (excluding depreciation, depletion and amortization) |

|

|

261,746 |

|

|

|

196,520 |

|

|

|

Transportation expenses |

|

|

29,372 |

|

|

|

11,068 |

|

|

|

General and administrative |

|

|

18,596 |

|

|

|

15,504 |

|

|

|

Depreciation, depletion and amortization |

|

|

63,314 |

|

|

|

59,202 |

|

|

|

Total operating expenses |

|

|

373,028 |

|

|

|

282,294 |

|

|

|

|

|

|

|

|

|

|

|

||

|

INCOME FROM OPERATIONS |

|

|

87,835 |

|

|

|

36,328 |

|

|

|

|

|

|

|

|

|

|

|

||

|

Interest expense, net |

|

|

(9,662 |

) |

|

|

(10,396 |

) |

|

|

Interest income |

|

|

35 |

|

|

|

17 |

|

|

|

Equity method investment income |

|

|

883 |

|

|

|

62 |

|

|

|

Other income (expense) |

|

|

566 |

|

|

|

(1,197 |

) |

|

|

INCOME BEFORE INCOME TAXES |

|

|

79,657 |

|

|

|

24,814 |

|

|

|

|

|

|

|

|

|

|

|

||

|

INCOME TAX EXPENSE (BENEFIT) |

|

|

42,715 |

|

|

|

(12 |

) |

|

|

|

|

|

|

|

|

|

|

||

|

NET INCOME |

|

|

36,942 |

|

|

|

24,826 |

|

|

|

|

|

|

|

|

|

|

|

||

|

LESS: NET INCOME ATTRIBUTABLE TO NONCONTROLLING INTEREST |

|

|

(290 |

) |

|

|

(78 |

) |

|

|

|

|

|

|

|

|

|

|

||

|

NET INCOME ATTRIBUTABLE TO ARLP |

|

$ |

36,652 |

|

|

$ |

24,748 |

|

|

|

|

|

|

|

|

|

|

|

||

|

EARNINGS PER LIMITED PARTNER UNIT – |

|

$ |

0.28 |

|

|

$ |

0.19 |

|

|

|

|

|

|

|

|

|

|

|

||

|

WEIGHTED-AVERAGE NUMBER OF UNITS |

|

|

127,195,219 |

|

|

|

127,195,219 |

|

|

|

ALLIANCE RESOURCE PARTNERS, L.P. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands, except unit data) (Unaudited) |

|||||||||

|

|

|

|

|

|

|

|

|

||

|

|

|

March 31, |

|

December 31, |

|

||||

|

|

|

2022 |

|

2021 |

|

||||

|

ASSETS |

|

|

|

|

|

|

|

||

|

CURRENT |

|

|

|

|

|

|

|

||

|

Cash and cash equivalents |

|

$ |

128,191 |

|

|

$ |

122,403 |

|

|

|

Trade receivables |

|

|

156,698 |

|

|

|

129,531 |

|

|

|

Other receivables |

|

|

440 |

|

|

|

680 |

|

|

|

Inventories, net |

|

|

95,745 |

|

|

|

60,302 |

|

|

|

Advance royalties |

|

|

4,385 |

|

|

|

4,958 |

|

|

|

Prepaid expenses and other assets |

|

|

19,238 |

|

|

|

21,354 |

|

|

|

Total current assets |

|

|

404,697 |

|

|

|

339,228 |

|

|

|

PROPERTY, |

|

|

|

|

|

|

|

||

|

Property, plant and equipment, at cost |

|

|

3,666,987 |

|

|

|

3,608,347 |

|

|

|

Less accumulated depreciation, depletion and amortization |

|

|

(1,975,381 |

) |

|

|

(1,909,669 |

) |

|

|

Total property, plant and equipment, net |

|

|

1,691,606 |

|

|

|

1,698,678 |

|

|

|

OTHER |

|

|

|

|

|

|

|

||

|

Advance royalties |

|

|

71,403 |

|

|

|

63,524 |

|

|

|

Equity method investments |

|

|

26,194 |

|

|

|

26,325 |

|

|

|

Goodwill |

|

|

4,373 |

|

|

|

4,373 |

|

|

|

Operating lease right-of-use assets |

|

|

15,165 |

|

|

|

14,158 |

|

|

|

Other long-term assets |

|

|

12,109 |

|

|

|

13,120 |

|

|

|

Total other assets |

|

|

129,244 |

|

|

|

121,500 |

|

|

|

TOTAL ASSETS |

|

$ |

2,225,547 |

|

|

$ |

2,159,406 |

|

|

|

|

|

|

|

|

|

|

|

||

|

LIABILITIES AND PARTNERS’ CAPITAL |

|

|

|

|

|

|

|

||

|

CURRENT |

|

|

|

|

|

|

|

||

|

Accounts payable |

|

$ |

92,904 |

|

|

$ |

69,586 |

|

|

|

Accrued taxes other than income taxes |

|

|

15,209 |

|

|

|

17,787 |

|

|

|

Accrued payroll and related expenses |

|

|

31,178 |

|

|

|

36,805 |

|

|

|

Accrued interest |

|

|

12,500 |

|

|

|

5,000 |

|

|

|

Workers’ compensation and pneumoconiosis benefits |

|

|

12,293 |

|

|

|

12,293 |

|

|

|

Current finance lease obligations |

|

|

665 |

|

|

|

840 |

|

|

|

Current operating lease obligations |

|

|

2,133 |

|

|

|

1,820 |

|

|

|

Other current liabilities |

|

|

19,815 |

|

|

|

17,375 |

|

|

|

Current maturities, long-term debt, net |

|

|

15,359 |

|

|

|

16,071 |

|

|

|

Total current liabilities |

|

|

202,056 |

|

|

|

177,577 |

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

|

|

|

||

|

Long-term debt, excluding current maturities, net |

|

|

415,990 |

|

|

|

418,942 |

|

|

|

Pneumoconiosis benefits |

|

|

108,491 |

|

|

|

107,560 |

|

|

|

Accrued pension benefit |

|

|

24,857 |

|

|

|

25,590 |

|

|

|

Workers’ compensation |

|

|

44,669 |

|

|

|

44,911 |

|

|

|

Asset retirement obligations |

|

|

123,989 |

|

|

|

123,517 |

|

|

|

Long-term finance lease obligations |

|

|

590 |

|

|

|

618 |

|

|

|

Long-term operating lease obligations |

|

|

13,009 |

|

|

|

12,366 |

|

|

|

Deferred income tax liabilities |

|

|

37,621 |

|

|

|

391 |

|

|

|

Other liabilities |

|

|

20,882 |

|

|

|

21,865 |

|

|

|

Total long-term liabilities |

|

|

790,098 |

|

|

|

755,760 |

|

|

|

Total liabilities |

|

|

992,154 |

|

|

|

933,337 |

|

|

|

|

|

|

|

|

|

|

|

||

|

COMMITMENTS |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

|

PARTNERS’ |

|

|

|

|

|

|

|

||

|

ARLP Partners’ Capital: |

|

|

|

|

|

|

|

||

|

Limited Partners – Common Unitholders 127,195,219 units outstanding |

|

|

1,285,725 |

|

|

|

1,279,183 |

|

|

|

Accumulated other comprehensive loss |

|

|

(63,439 |

) |

|

|

(64,229 |

) |

|

|

Total ARLP Partners’ Capital |

|

|

1,222,286 |

|

|

|

1,214,954 |

|

|

|

Noncontrolling interest |

|

|

11,107 |

|

|

|

11,115 |

|

|

|

Total Partners’ Capital |

|

|

1,233,393 |

|

|

|

1,226,069 |

|

|

|

TOTAL LIABILITIES AND PARTNERS’ CAPITAL |

|

$ |

2,225,547 |

|

|

$ |

2,159,406 |

|

|

|

ALLIANCE RESOURCE PARTNERS, L.P. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) (Unaudited) |

|||||||||

|

|

|

|

|

|

|

|

|

||

|

|

|

Three Months Ended |

|

||||||

|

|

|

March 31, |

|

||||||

|

|

|

2022 |

|

2021 |

|

||||

|

|

|

|

|

|

|

|

|

||

|

CASH FLOWS FROM OPERATING ACTIVITIES |

|

$ |

89,036 |

|

|

$ |

54,647 |

|

|

|

|

|

|

|

|

|

|

|

||

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

||

|

Property, plant and equipment: |

|

|

|

|

|

|

|

||

|

Capital expenditures |

|

|

(59,153 |

) |

|

|

(31,437 |

) |

|

|

Increase in accounts payable and accrued liabilities |

|

|

13,551 |

|

|

|

7,200 |

|

|

|

Proceeds from sale of property, plant and equipment |

|

|

928 |

|

|

|

1,139 |

|

|

|

Distributions received from investments in excess of cumulative earnings |

|

|

131 |

|

|

|

361 |

|

|

|

Other |

|

|

(982 |

) |

|

|

— |

|

|

|

Net cash used in investing activities |

|

|

(45,525 |

) |

|

|

(22,737 |

) |

|

|

|

|

|

|

|

|

|

|

||

|

CASH |

|

|

|

|

|

|

|

||

|

Payments under securitization facility |

|

|

— |

|

|

|

(17,800 |

) |

|

|

Payments on equipment financings |

|

|

(4,472 |

) |

|

|

(4,239 |

) |

|

|

Borrowings under revolving credit facilities |

|

|

— |

|

|

|

10,000 |

|

|

|

Payments under revolving credit facilities |

|

|

— |

|

|

|

(42,500 |

) |

|

|

Borrowings from line of credit |

|

|

— |

|

|

|

1,830 |

|

|

|

Payments on finance lease obligations |

|

|

(203 |

) |

|

|

(185 |

) |

|

|

Payment of debt issuance costs |

|

|

— |

|

|

|

(6 |

) |

|

|

Distributions paid to Partners |

|

|

(32,750 |

) |

|

|

— |

|

|

|

Other |

|

|

(298 |

) |

|

|

(141 |

) |

|

|

Net cash used in financing activities |

|

|

(37,723 |

) |

|

|

(53,041 |

) |

|

|

|

|

|

|

|

|

|

|

||

|

NET |

|

|

5,788 |

|

|

|

(21,131 |

) |

|

|

|

|

|

|

|

|

|

|

||

|

CASH |

|

|

122,403 |

|

|

|

55,574 |

|

|

|

|

|

|

|

|

|

|

|

||

|

CASH |

|

$ |

128,191 |

|

|

$ |

34,443 |

|

|

Reconciliation of

GAAP “net income attributable to ARLP” to non-GAAP “EBITDA”

and “Distributable Cash Flow” (in thousands).

EBITDA is defined as net income attributable to ARLP before net interest expense, income taxes and depreciation, depletion and amortization. Distributable cash flow (“DCF”) is defined as EBITDA excluding interest expense (before capitalized interest), interest income, income taxes and estimated maintenance capital expenditures. Distribution coverage ratio (“DCR”) is defined as DCF divided by distributions paid to partners.

Management believes that the presentation of such additional financial measures provides useful information to investors regarding our performance and results of operations because these measures, when used in conjunction with related GAAP financial measures, (i) provide additional information about our core operating performance and ability to generate and distribute cash flow, (ii) provide investors with the financial analytical framework upon which management bases financial, operational, compensation and planning decisions and (iii) present measurements that investors, rating agencies and debt holders have indicated are useful in assessing us and our results of operations.

EBITDA, DCF and DCR should not be considered as alternatives to net income attributable to ARLP, net income, income from operations, cash flows from operating activities or any other measure of financial performance presented in accordance with GAAP. EBITDA and DCF are not intended to represent cash flow and do not represent the measure of cash available for distribution. Our method of computing EBITDA, DCF and DCR may not be the same method used to compute similar measures reported by other companies, or EBITDA, DCF and DCR may be computed differently by us in different contexts (i.e. public reporting versus computation under financing agreements).

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Three Months Ended |

|

Three Months Ended |

|

||||||||

|

|

|

March 31, |

|

December 31, |

|

||||||||

|

|

|

2022 |

|

2021 |

|

2021 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Net income attributable to ARLP |

|

$ |

36,652 |

|

|

$ |

24,748 |

|

|

$ |

51,826 |

|

|

|

Depreciation, depletion and amortization |

|

|

63,314 |

|

|

|

59,202 |

|

|

|

68,679 |

|

|

|

Interest expense, net |

|

|

9,697 |

|

|

|

10,465 |

|

|

|

9,628 |

|

|

|

Capitalized interest |

|

|

(70 |

) |

|

|

(86 |

) |

|

|

(82 |

) |

|

|

Income tax expense (benefit) |

|

|

42,715 |

|

|

|

(12 |

) |

|

|

190 |

|

|

|

EBITDA |

|

|

152,308 |

|

|

|

94,317 |

|

|

|

130,241 |

|

|

|

Interest expense, net |

|

|

(9,697 |

) |

|

|

(10,465 |

) |

|

|

(9,628 |

) |

|

|

Income tax (expense) benefit |

|

|

(42,715 |

) |

|

|

12 |

|

|

|

(190 |

) |

|

|

Deferred income tax expense (benefit) (1) |

|

|

37,294 |

|

|

|

(12 |

) |

|

|

123 |

|

|

|

Estimated maintenance capital expenditures (2) |

|

|

(51,947 |

) |

|

|

(39,205 |

) |

|

|

(42,821 |

) |

|

|

Distributable Cash Flow |

|

$ |

85,243 |

|

|

$ |

44,647 |

|

|

$ |

77,725 |

|

|

|

Distributions paid to partners |

|

$ |

32,750 |

|

|

$ |

— |

|

|

$ |

26,072 |

|

|

|

Distribution Coverage Ratio |

|

|

2.60 |

|

|

|

— |

|

|

|

2.98 |

|

|

_________________

|

(1) |

Deferred income tax expense (benefit) is the amount of income tax expense (benefit) during the period on temporary differences between the tax basis and financial reporting basis of recorded assets and liabilities. These differences generally arise in one period and reverse in subsequent periods to eventually offset each other and do not impact the amount of distributable cash flow available to be paid to partners. |

|

|

(2) |

Maintenance capital expenditures are those capital expenditures required to maintain, over the long-term, the existing infrastructure of our coal assets. We estimate maintenance capital expenditures on an annual basis based upon a five-year planning horizon. For the 2022 planning horizon, average annual estimated maintenance capital expenditures are assumed to be $5.66 per ton produced compared to an estimated $4.90 per ton produced in 2021. Our actual maintenance capital expenditures fluctuate depending on various factors, including maintenance schedules and timing of capital projects, among others. |

Reconciliation of

GAAP “Cash flows from operating activities” to non-GAAP “Free

cash flow” (in thousands).

Free cash flow is defined as cash flows from operating activities less capital expenditures. Free cash flow should not be considered as an alternative to cash flows from operating activities or any other measure of financial performance presented in accordance with GAAP. Our method of computing free cash flow may not be the same method used by other companies. Free cash flow is a supplemental liquidity measure used by our management to assess our ability to generate excess cash flow from our operations.

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Three Months Ended |

|

Three Months Ended |

|

||||||||

|

|

|

March 31, |

|

December 31, |

|

||||||||

|

|

|

2022 |

|

2021 |

|

2021 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Cash flows from operating activities |

|

$ |

89,036 |

|

|

$ |

54,647 |

|

|

$ |

114,225 |

|

|

|

Capital expenditures |

|

|

(59,153 |

) |

|

|

(31,437 |

) |

|

|

(34,323 |

) |

|

|

Free cash flow |

|

$ |

29,883 |

|

|

$ |

23,210 |

|

|

$ |

79,902 |

|

|

Reconciliation of

GAAP “Operating Expenses” to non-GAAP “Segment Adjusted EBITDA

Expense” and Reconciliation of non-GAAP ” EBITDA” to

“Segment Adjusted EBITDA” (in thousands).