BioSig’s PURE EP™ System to be Featured During EPLive 2022

News and Market Data on BioSig Technologies

The Company’s flagship technology to be featured during a

two-day educational conference that draws the world’s top cardiac

electrophysiology experts

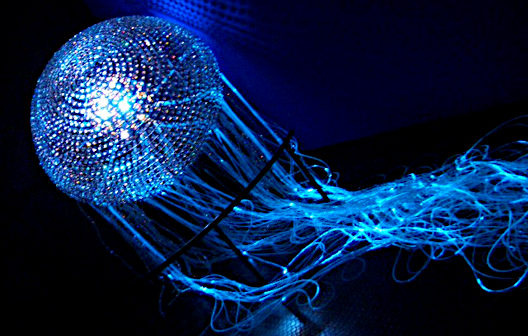

Westport, CT, May 25, 2022 (GLOBE NEWSWIRE) — BioSig Technologies, Inc. (NASDAQ: BSGM) (“BioSig” or the “Company”), a medical technology company advancing electrophysiology workflow by delivering greater intracardiac signal fidelity through its proprietary signal processing platform, today announced that its flagship technology will be featured during EPlive, a hybrid event taking place at St. David’s Medical Center in Austin, Texas from June 2-3, 2022.

EPLive is a two-day intensive educational meeting for practicing clinical cardiac electrophysiologists, electrophysiologist fellows and general cardiologists who have an interest in treating complex cardiac arrhythmias. During the event, BioSig will be exhibiting and offering technology demonstrations, including features of its newly released PURE EP NOVA-5 Software. Enhanced with NOVA-5 Software, the Company believes that the PURE EP(TM) System delivers a new standard in signal processing, offering greater customization and smarter workflows. Additionally, the Company will showcase the next generation of PURE EP(TM) Software Modules currently in advanced development stages.

The concept for EPLive was first created and developed by Dr. Andrea Natale, Cardiac Electrophysiologist at St. David’s Medical Center in Austin, Texas. As an internationally respected physician and leader in the field of cardiac electrophysiology, Dr. Natale is passionate about education, training and knowledge sharing when it comes to delivering the best possible care to arrhythmia patients. As the first center to commercially adopt the PURE EP(TM) System, Dr. Natale and the physicians at Texas Cardiac Arrhythmia Institute (TCAI) have performed over 500 cases with the PURE EP(TM) System since its installation in November 2019.

“We have spent approximately thirteen years working in collaboration with the physicians at TCAI to bring this important innovation to market. Our collaboration with this center of excellence has supported our company in so many positive ways and we are excited to participate in this great event,” commented Kenneth L. Londoner, Chairman and CEO of BioSig Technologies, Inc.

To

register to attend the event, please click here.

The PURE EP(TM) is an FDA 510(k) cleared non-invasive class II device that aims to drive procedural efficiency and efficacy in cardiac electrophysiology. To date, more than 73 physicians have completed over 2,200 patient cases with the PURE EP(TM) System.

Clinical data acquired by the PURE EP™ System in a multi-center study at centers of excellence including Texas Cardiac Arrhythmia Institute at St. David’s Medical Center and Mayo Clinic was recently published in the Journal of Cardiovascular Electrophysiology and is available electronically with open access via the Wiley Online Library. Study results showed 93% consensus across the blinded reviewers with a 75% overall improvement in intracardiac signal quality and confidence in interpreting PURE EP™ signals over conventional sources.

About

EPLive

EPLive is an intensive, two-day educational meeting for practicing clinical cardiac electrophysiologists, electrophysiologist fellows and general cardiologists who have an interest in treating complex cardiac arrhythmias, a condition in which the heart beats with an irregular or abnormal rhythm. Live cases broadcast from the new, state-of-the-art Electrophysiology Center at St. David’s Medical Center, with expert commentary, will serve as the primary teaching tool. EPLive consists of four sections: Atrial Fibrillation (A Fib) ablation, Ventricular Tachycardia (VT) ablation, Devices, and New Technology. The sessions consist of a combination of live and recorded cases from TCAI and some of the world’s premier centers. Cases include procedures such as A Fib ablation and ablation of post-A Fib atrial arrhythmias, VT ablation (endocardial and epicardial), balloon cases (cryo, Apama and laser), CRT implants, SQ ICD and lead extraction and venoplasty. Additionally, EPLive will feature new technology pioneered by physicians at TCAI, including electroporation and leadless dual chamber pacing.

About

BioSig Technologies

BioSig Technologies is a medical technology company commercializing a proprietary biomedical signal processing platform designed to improve signal fidelity and uncover the full range of ECG and intra-cardiac signals (www.biosig.com).

The Company’s first product, PURE EPä System is a computerized system intended for acquiring, digitizing, amplifying, filtering, measuring and calculating, displaying, recording and storing of electrocardiographic and intracardiac signals for patients undergoing electrophysiology (EP) procedures in an EP laboratory.

Forward-looking

Statements

This press release contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential” or similar words. Forward- looking statements are not guarantees of future performance, are based on certain assumptions and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s control, and cannot be predicted or quantified and consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, risks and uncertainties associated with (i) the geographic, social and economic impact of COVID-19 on our ability to conduct our business and raise capital in the future when needed, (ii) our inability to manufacture our products and product candidates on a commercial scale on our own, or in collaboration with third parties; (iii) difficulties in obtaining financing on commercially reasonable terms; (iv) changes in the size and nature of our competition; (v) loss of one or more key executives or scientists; and (vi) difficulties in securing regulatory approval to market our products and product candidates. More detailed information about the Company and the risk factors that may affect the realization of forward-looking statements is set forth in the Company’s filings with the Securities and Exchange Commission (SEC), including the Company’s Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Investors and security holders are urged to read these documents free of charge on the SEC’s website at http://www.sec.gov. The Company assumes no obligation to publicly update or revise its forward-looking statements as a result of new information, future events or otherwise.

Andrew Ballou

BioSig Technologies, Inc.

Vice President, Investor Relations

55 Greens Farms Road

Westport, CT 06880, US

aballou@biosigtech.com

203-409-5444, x119