Image Credit: GoToVan

Cannabis Store Openings in Canada Only Slightly Affected the Number of Users

This article was republished with permission from The

Conversation, a news site dedicated to sharing ideas from academic experts. It represents the research-based findings and thoughts of

Michael J. Armstrong, Associate professor of operations research, Goodman School of Business, Brock University

|

Despite Canada approaching its third anniversary of cannabis legalization, some municipalities still ban licensed shops. Other countries talking about legalizing cannabis also seem inclined toward minimizing legal access. But my research suggests those policies are probably counterproductive.

Canada legalized recreational cannabis on Oct. 17, 2018. After initial product shortages eased in spring 2019, store openings and retail sales soared. Monthly sales hit $339 million in July 2021 and the national store total now exceeds 2,600.

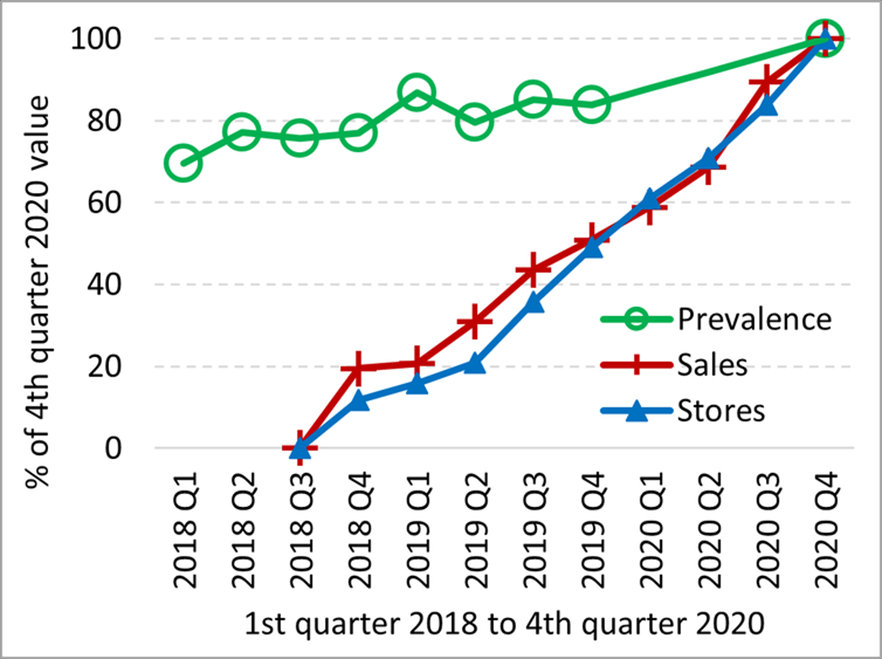

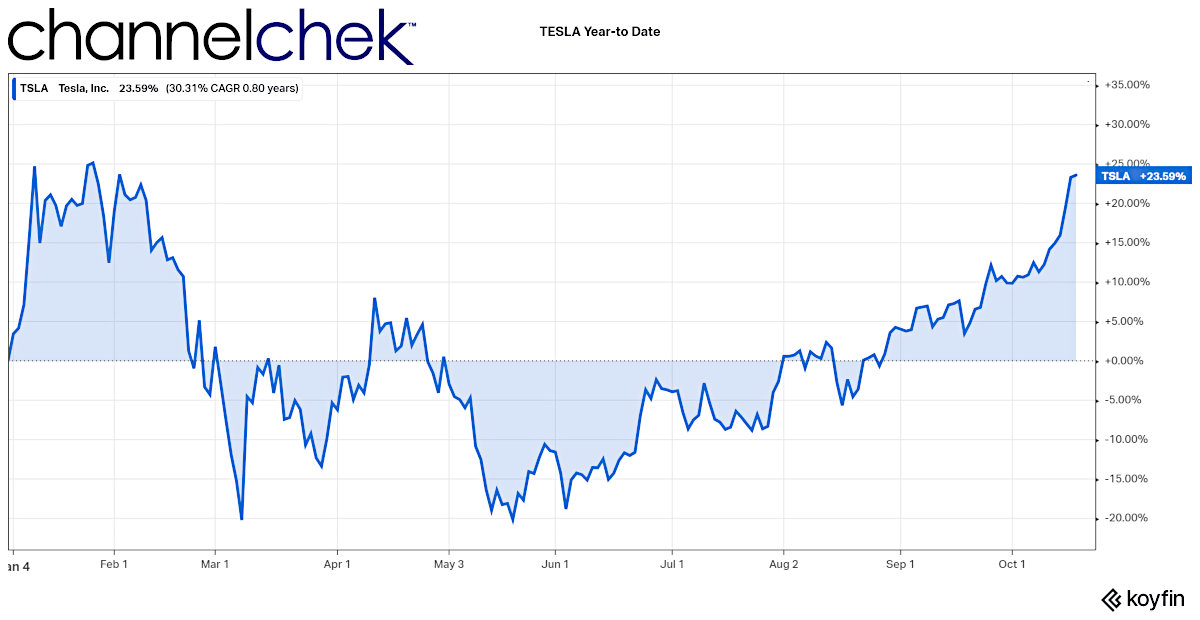

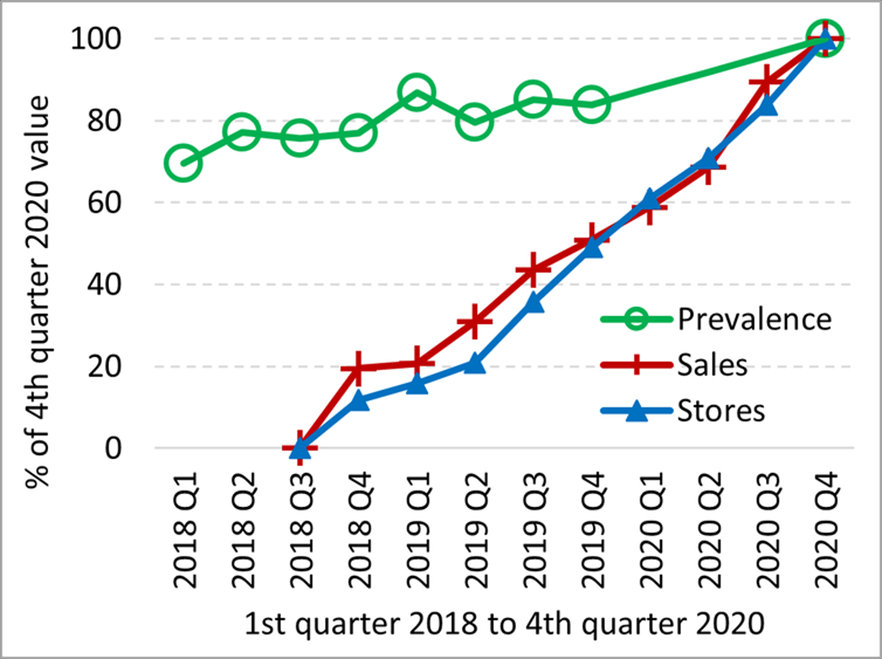

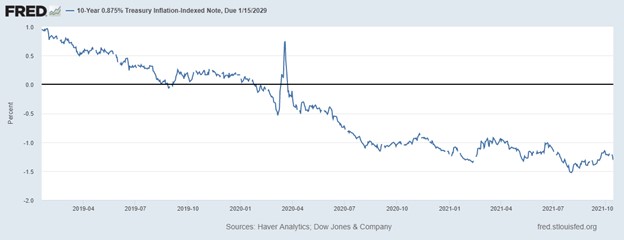

Line chart showing relative number of Canadian cannabis

users, stores and sales

User numbers have also grown. In 2018, 14 per cent of the population aged 15 and up admitted to using cannabis. That reached 20 per cent in 2020, equivalent to 6.2 million users.

Quarterly recreational cannabis sales, stores, and user prevalence, as percentages of fourth quarter 2020 values. Prepared by author from government data.

Canada’s cannabis approach differs greatly from the American (USA) one. But both countries share one detail: municipal governments opting out of allowing cannabis stores.

Do experts have something to add to public debate?

Local Store Bans

Several million Canadians live in places that ban licensed shops, including cities like Mississauga, Ont., and Surrey, B.C.

Meanwhile in the U.S., most California municipalities opted out of allowing stores after recreational sales began there in 2018. More recently, 71 per cent of towns in New Jersey and 90 per cent of those in Maine did likewise. New York’s communities have until Dec. 31 to decide.

Licensed shops could provide economic benefits. But some politicians and residents worry they’d also boost cannabis use and crime.

This apparent trade-off motivated my research.

Stores, Sales and Users

My study compared per capita growth in store numbers, recreational cannabis sales dollars and user numbers from 2018 to 2020 in Canada.

Stores and sales were strongly related. Differences in provincial store growth explained 46 per cent of the differences in sales growth. That’s a lot, given that many other factors like pricing, consumer tastes and weather also affect sales.

By contrast, store growth explained just eight per cent of user growth. A simple quarterly trend better explained the user increases.

In other words, almost the same user growth occurred regardless of how many shops opened. But where shops were plentiful, users increasingly bought legally.

One reason for the weak stores-and-users relationship was that user estimates came from government surveys with large error margins. They might not detect subtle changes.

Legal Versus Illegal Markets

The black market provides another likely reason. Licensed shops clearly increase access to legal products. But they only marginally increase overall access if illegal dealers are already widespread.

Consider the southern Ontario city of Hamilton. In January 2019, the city had 34 illegal dispensaries and countless online dealers. So when the first licensed shop opened three months later, it suddenly made legal products accessible. But the city’s total cannabis supply barely budged. Advertising restrictions likely played a role. Cannabis retailers couldn’t use ad blitzes or free samples to stimulate demand.

Canada’s 2018-20 user growth might have instead come from legalization’s removal of criminal penalties. That could have encouraged non-users to start, regardless of whether shops opened nearby.

Or the growth might have just represented ongoing trends. Canada’s cannabis use had been increasing since 2010.

My study analyzed province-level outcomes. But it has implications for other government levels too.

Are Opt-Outs Mostly Cop-Outs?

At the municipal level, politicians banning licensed stores might think they’re protecting residents.

But my study implies communities will see similar user growth after legalization whether they allow shops or not.

Those users will increasingly buy legally if local shops open. But without such stores, users will keep visiting illicit sources where products might be misrepresented or contaminated.

This means community store bans could lead to more crime and health problems rather than less.

It’s probably OK for politicians to briefly delay store licensing while they update local regulations. But beyond that, retail opt-outs risk becoming political cop-outs that hide problems instead of addressing them.

Similar logic applies at the national level when countries legalize.

Legalizing Countries Need Legal Access

Mexico’s courts ruled in 2018 that cannabis should be legal there. But its Congress still hasn’t passed legislation. One proposed bill would have legalized cannabis but made it very inaccessible.

South Africa has been similarly slow at implementing its own court’s 2018 ruling.

Both countries should rethink their reluctance. If they don’t provide practical legal access to a theoretically legal substance, they risk getting legalization’s pains without its gains. The main winners will be illicit dealers.

Switzerland and the Netherlands should consider this issue too during their cannabis pilot studies next year. As should other countries contemplating legalization, like Luxembourg, Italy, Germany and the U.S.

Of course, there’s more to sales than just stores. Research suggests ample supplies, convenient shopping hours and competitive prices also matter. And don’t forget product quality or package design.

Cannabis legalization is complex. Canada is still learning from its experiences. Hopefully other countries can learn from them too.

Suggested Reading:

Stay up to date. Follow us:

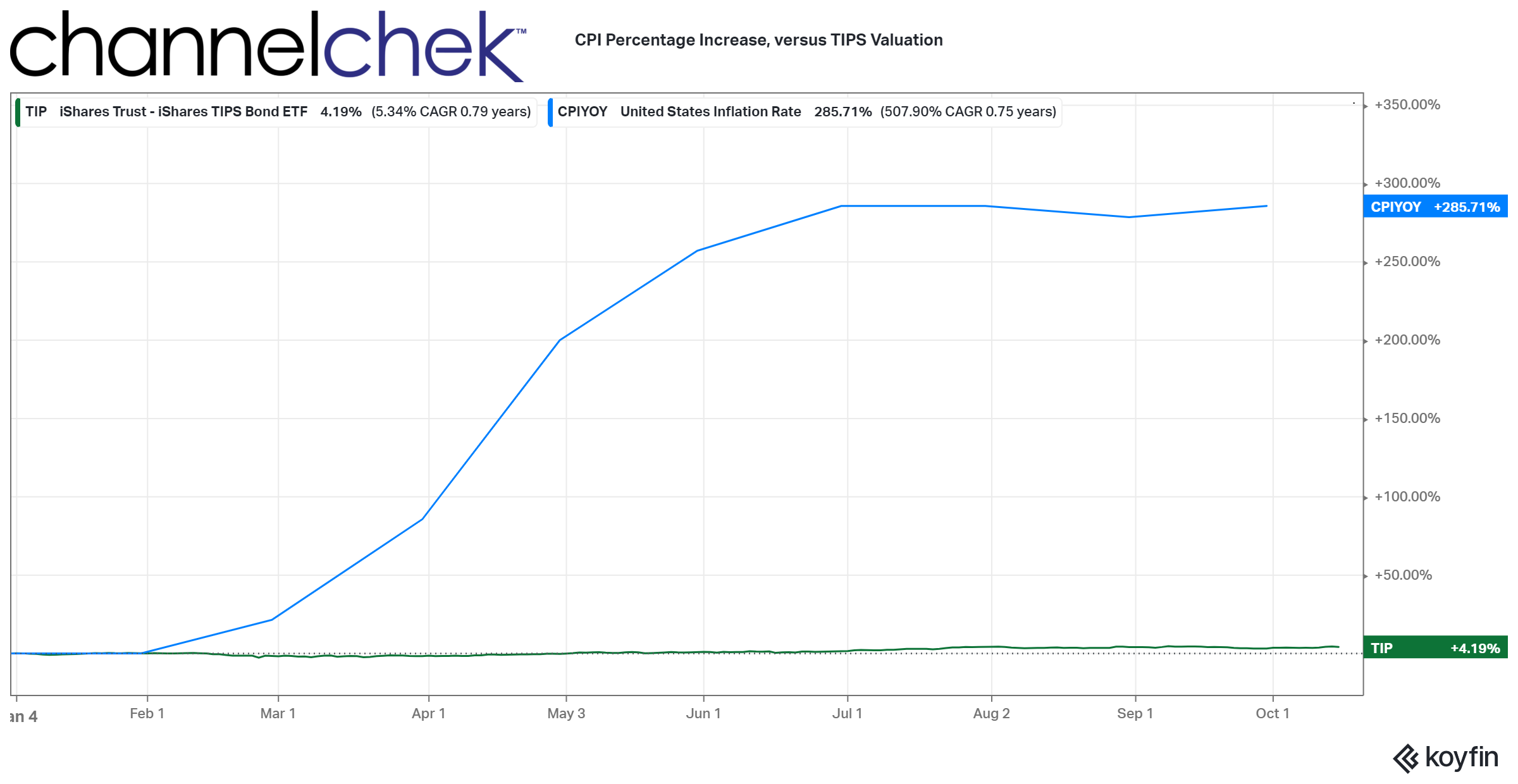

While the first chart demonstrates yield, the above shows year-over-year total return over the past 12 months. CPI increased 285% during this time while the value of a TIPS portfolio increased 4.2%.

While the first chart demonstrates yield, the above shows year-over-year total return over the past 12 months. CPI increased 285% during this time while the value of a TIPS portfolio increased 4.2%.