Image Credit: Diverse Stock Photos (Flickr)

The DWAC SPAC Acquiring Trump Media Keeps Investors on Edge

When a SPAC, such as Digital World Acquisition Corp. (DWAC), soon to become Trump Media & Technology Group (TMTG), enters the DeSPAC phase, the terms are set, but the world keeps turning. For this reason, investors and potential investors need to continue to monitor events impacting the industry and the company to be acquired. There have been many surprises since October for DWAC shareholders, the past three days have been particularly challenging for investors to unravel.

Background

Since Trump Media agreed to be acquired on October 20, 2021, much has happened that could impact the company and the industry. These include an SEC probe of the deal, post-pandemic changes in users’ lifestyles, a frigid national relationship developing with Russia, and Twitter agreeing to be taken private by a “free speech” purchaser. Even when a SPAC’s formal ownership change hasn’t yet taken place, understanding the stock’s outlook (and future versions of the company) is as important as any other public company, perhaps a little more complex.

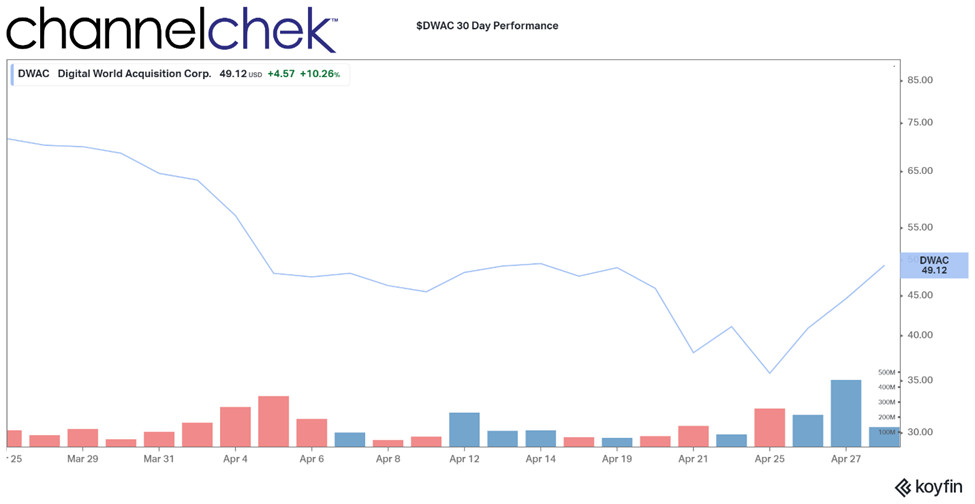

Source: Koyfin

The Trump Media example is star-studded and has faced renewed uncertainty within the past two weeks. When Elon Musk succeeded in striking a deal to take Twitter private for the purpose of providing a “platform for free speech around the globe,” this instantly created competition for the media start-up being acquired by the Digital Media SPAC. And it has caused gyrations in the price for the pre-merger stage for DWAC, which hit a 30-day low of $33.25 the day of the announcement (April 25) and then bounced significantly up to $47.36 as the future owner of the well-established Twitter demonstrated through various Tweets, that the companies are not really competitors, but instead exist for similar purposes.

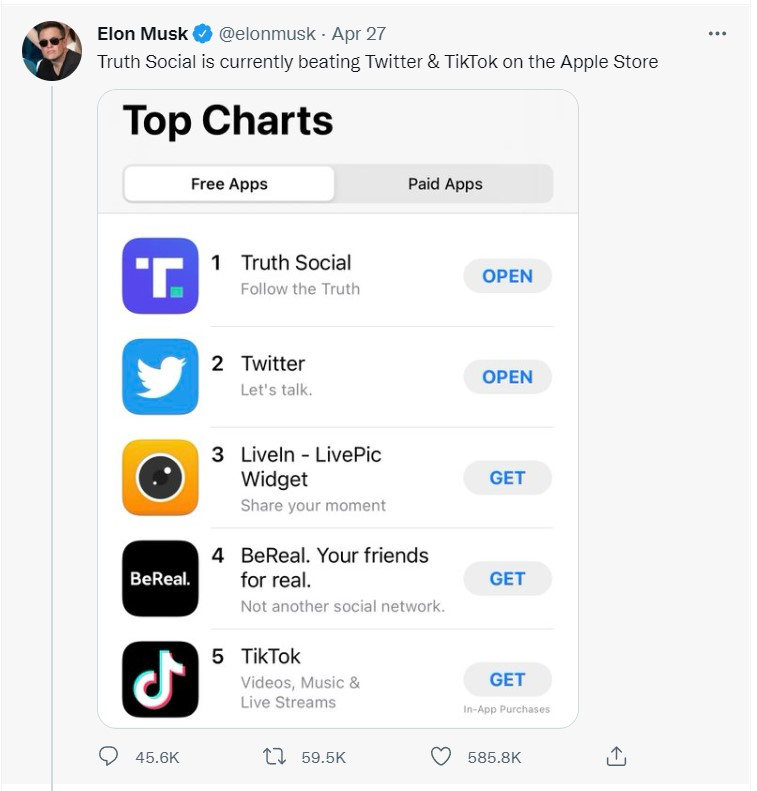

On April 27 Elon Musk gave DWACs share price a boost when he Tweeted “Truth Social is currently beating Twitter & TikTok on the Apple Store.” While Musk envisions Twitter as providing a platform for free speech around the globe, the smaller start-up social platform claims to be, “a free-speech haven without viewpoint discrimination or oppressive censorship.” If Musk is true to his stated purpose, the two may actually complement each other.

Take-Away

Investing in a SPAC with the trust that the acquisition company can steer the capital into a purchase you may not otherwise have been fortunate enough to participate in, is one reason for investors to allocate assets to SPACs. When the target has been identified and the deal requires a choice by the investor, information is important. Should an investor decide to be part of the deal and hold the acquisition company during the De-SPAC stage, they need to continue to be alert as to changes in the industry and the now identified company to be merged.

A perfect example of the challenges is the DWAC / Twitter scenario that DWAC shareholders are faced with. The company to be acquired seems to have had one of its mega-competitors working to steer its product line even closer to that of the small fledgling company.

Channelchek helps keep investors in smaller companies informed with quality research, insightful articles, and SPACtrac for select SPACs. Register for emails here.

As for the former President’s comments, Trump said,

“I am not going on Twitter, I am going to stay on TRUTH,” Prior to the purchase the former President stated, “I hope Elon buys Twitter because he’ll make improvements to it and he is a good man”

Managing Editor, Channelchek

Suggested Content

Investors Watch Media SPAC Stay in the Green as Markets Falter

|

De-SPAC – The Final Phase of a Special Purpose Acquisition Company

|

SPACtrac Report – Forbes Global Media Holdings

|

Capstar Special Purpose Acquisition Corp. Class A (Video)

|

Sources

https://www.sec.gov/Archives/edgar/data/0001849635/000110465921128231/tm2130724d1_ex99-1.htm

https://www.prnewswire.com/news-releases/elon-musk-to-acquire-twitter-301532245.html

https://www.cbsnews.com/news/trump-media-technology-group-investors-digital-world-acquisition-spac/

Stay up to date. Follow us:

|