|

|

|

BacTech President & CEO Ross Orr provides a preview of their upcoming presentation at NobleCon18 NobleCon18 – Noble Capital Markets 18th Annual Small and Microcap Investor Conference – April 19-21, 2022 – Hard Rock, Hollywood, FL 100+ Public Company Presentations | Scheduled Breakouts | Panel Presentations | High-Profile Keynotes | Educational Sessions | Receptions & Networking Events Free Registration Available – More InfoNews and Advanced Market Data on BCCEFNobleCon18 Presenting Companies

About BacTech BacTech is a proven environmental technology company, delivering effective and eco-friendly bioleaching and remediation solutions to commercial operations to process and recover preferred metals (gold, silver, cobalt, and copper) smartly and safely remove and transform harmful contaminants like arsenic into benign EPA-approved products for landfill. Tapping into numerous environmental and economic advantages of its proprietary method of bioleaching, BacTech uses naturally occurring bacteria, harmless to both humans and the environment, to neutralize toxic mining sites with high-pay potential. BacTech is publicly traded on the CSE under the symbol “BAC”; on the OTC as “BCCEF”; and the Frankfurt Stock Exchange as “0BT1”. |

Category:

Perimeter Medical Imaging AI (PYNKF) Scheduled to Present at NobleCon18 Investor Conference

|

|

|

Perimeter Medical Imaging AI CEO Jeremy Sobotta provides a preview of their upcoming presentation at NobleCon18 NobleCon18 – Noble Capital Markets 18th Annual Small and Microcap Investor Conference – April 19-21, 2022 – Hard Rock, Hollywood, FL 100+ Public Company Presentations | Scheduled Breakouts | Panel Presentations | High-Profile Keynotes | Educational Sessions | Receptions & Networking Events Free Registration Available – More InfoNews and Advanced Market Data on PYNKFNobleCon18 Presenting Companies

About Perimeter Medical Imaging AI Based in Toronto, Canada and Dallas, Texas, Perimeter Medical Imaging AI (TSX-V:PINK) (OTC:PYNKF) (FSE:4PC) is a medical technology company driven to transform cancer surgery with ultra-high-resolution, real-time, advanced imaging tools to address areas of high unmet medical need. Available across the U.S., our FDA-cleared Perimeter S-Series OCT system provides real-time, cross-sectional visualization of excised tissues at the cellular level. The breakthrough-device-designated, investigational Perimeter B-Series OCT with ImgAssist AI represents our next-generation artificial intelligence technology that is currently under clinical development. The company’s ticker symbol “PINK” refers to the pink ribbons used during Breast Cancer Awareness Month. |

Jaguar Health (JAGX) Scheduled to Present at NobleCon18 Investor Conference

|

|

|

Jaguar Health President & CEO Lisa Conte provides a preview of their upcoming presentation at NobleCon18 NobleCon18 – Noble Capital Markets 18th Annual Small and Microcap Investor Conference – April 19-21, 2022 – Hard Rock, Hollywood, FL 100+ Public Company Presentations | Scheduled Breakouts | Panel Presentations | High-Profile Keynotes | Educational Sessions | Receptions & Networking Events Free Registration Available – More InfoNews and Advanced Market Data on JAGXNobleCon18 Presenting Companies

About Jaguar Health Jaguar Health, Inc. is a commercial stage pharmaceuticals company focused on developing novel, plant-based, non-opioid, and sustainably derived prescription medicines for people and animals with GI distress, including chronic, debilitating diarrhea. Jaguar Animal Health is a tradename of Jaguar Health. Jaguar Health’s wholly owned subsidiary, Napo Pharmaceuticals, Inc., focuses on developing and commercializing proprietary plant-based human pharmaceuticals from plants harvested responsibly from rainforest areas. Our crofelemer drug product candidate is the subject of the OnTarget study, an ongoing pivotal Phase 3 clinical trial for prophylaxis of diarrhea in adult cancer patients receiving targeted therapy. Jaguar Health is the majority shareholder of Napo Therapeutics S.p.A. (f/k/a Napo EU S.p.A.), an Italian corporation established by Jaguar Health in Milan, Italy in 2021 that focuses on expanding crofelemer access in Europe. |

Vox Royalty Corp. (VOXCF) Scheduled to Present at NobleCon18 Investor Conference

|

|

|

Vox Royalty CEO Kyle Floyd provides a preview of their upcoming presentation at NobleCon18 NobleCon18 – Noble Capital Markets 18th Annual Small and Microcap Investor Conference – April 19-21, 2022 – Hard Rock, Hollywood, FL 100+ Public Company Presentations | Scheduled Breakouts | Panel Presentations | High-Profile Keynotes | Educational Sessions | Receptions & Networking Events Free Registration Available – More InfoNews and Advanced Market Data on VOXCFNobleCon18 Presenting Companies

About Vox Royalty Vox is a high growth precious metals royalty and streaming company with a portfolio of over 50 royalties and streams spanning eight jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically focused transactional team and a global sourcing network which has allowed Vox to become the fastest growing company in the royalty sector. Since the beginning of 2019, Vox has announced over 20 separate transactions to acquire over 45 royalties. |

ISG Acquires AI Platform Solution Agreemint

ISG to Announce Third-Quarter Financial Results

Research, News, and Market Data on Information Services Group

Move strengthens ISG’s provider governance and risk management leadership

AI platform supports better negotiation and legal compliance of supplier contracts

Agreemint to be integrated into ISG GovernX® third-party management solution

STAMFORD, Conn.–(BUSINESS WIRE)– Information Services Group (ISG) (Nasdaq: III), a leading global technology research and advisory firm, said today it has acquired automated contracting solution Agreemint from its founders. Terms were not disclosed.

The AI-powered contracting platform brings important new capabilities to the market-leading ISG GovernX® vendor compliance and risk management solution and will be used by ISG to add value to future platform solutions now in development.

“Our SaaS-based GovernX platform has been one of our fastest-growing areas over the last two years, especially as large organizations seek to control costs and mitigate risk from their ever- expanding supplier ecosystems,” said Michael P. Connors, chairman and CEO of ISG. “Our acquisition of Agreemint creates the ultimate platform for enterprises to accelerate time to contract, keeping pace with their speed of technology adoption and partnership formation.”

The acquisition, Connors said, is part of ISG’s overall strategy to develop or acquire innovative SaaS-based platforms to complement its advisory business, bring more value to clients, and achieve consistent, double-digit recurring revenue growth.

Agreemint delivers automated contract authoring through a repository of legal positions to accelerate speed to contract. Its patented AI-powered smart functionality enables clients to negotiate better contracts by suggesting language proven to be legally compliant, governable and agreeable to both parties based upon analysis of previous contracting efforts. The software also anticipates language sticking points and includes a clause library that proposes pre-approved clause alternatives.

ISG has partnered with Agreemint since 2021 on solutions for several blue-chip ISG clients. Connors said the acquisition is a natural extension of that relationship and adding Agreemint software will make the ISG GovernX platform even more valuable for automating the entire contract lifecycle. GovernX has under management more than $60 billion of annual contact value, up 30 percent in the last year, across more than 10,000 client contracts, up 40 percent.

“Getting to ‘yes’ on a contract faster and more efficiently is what Agreemint is all about,” said Agreemint founder Peter Graham, who is joining ISG in an executive role. ”Agreemint’s AI-powered negotiating and contracting tools, coupled with GovernX’s extensive vendor compliance and risk management capabilities, makes GovernX the most complete solution for contract lifecycle management on the market today.”

For more information about ISG GovernX, visit this webpage. Further details about Agreemint can be found at agreemint.com.

About ISG

ISG (Information Services Group) (Nasdaq: III) is a leading global technology research and advisory firm. A trusted business partner to more than 800 clients, including more than 75 of the world’s top 100 enterprises, ISG is committed to helping corporations, public sector organizations, and service and technology providers achieve operational excellence and faster growth. The firm specializes in digital transformation services, including automation, cloud and data analytics; sourcing advisory; managed governance and risk services; network carrier services; strategy and operations design; change management; market intelligence and technology research and analysis. Founded in 2006, and based in Stamford, Conn., ISG employs more than 1,300 digital-ready professionals operating in more than 20 countries—a global team known for its innovative thinking, market influence, deep industry and technology expertise, and world-class research and analytical capabilities based on the industry’s most comprehensive marketplace data. For more information, visit www.isg-one.com.

Source: Information Services Group, Inc.

BioSig Technologies, Inc. Partners with Summit Blue Capital to Provide Equipment Leasing Services

BioSig Technologies, Inc. Partners with Summit Blue Capital to Provide Equipment Leasing Services

News and Market Data on BioSig Technologies

The leasing and finance program provides a non-recourse financial solution for PURE EP™ to improve purchase flexibility for U.S. hospitals

Westport, CT, March 29, 2022 (GLOBE NEWSWIRE) — BioSig Technologies, Inc. (Nasdaq: BSGM) (“BioSig” or the “Company”), a medical technology company commercializing an innovative signal processing platform designed to improve signal fidelity and uncover the full range of ECG and intra-cardiac signals, today announced a new partnership agreement with Summit Blue Capital for implementing a leasing and finance program for the Company’s PURE EP™ System.

The Minneapolis-based Summit Blue Capital is a leader in equipment finance and leasing. It offers tailored leasing and financing solutions for its partners and clients in industries such as healthcare, manufacturing, hospitality, technology solutions, and more. Most notably, Summit Blue Capital specializes in simplifying the financing experience and finding solutions to advance commercial roll outs in the healthcare industry.

“We believe that partnering with Summit Blue Capital will have considerable benefits to our commercial plans. We intend to take advantage of the Summit team’s expertise, flexibility, and financial solutions as a leasing partner,” said Kenneth L. Londoner, Chairman and CEO of BioSig Technologies, Inc. “Summit Blue Capital came highly recommended by one of the largest money center U.S. financial institutions. We believe this relationship will help take friction out of the sales cycle and advance our timeline while allowing BioSig to get paid up front per installation. The team at Summit Blue Capital is expected to also help us launch a subscription-based revenue model for our software.”

“The pathway to purchase is always of great consideration in the capital equipment forum. We anticipate that partnering with Summit Blue Capital will impact our ability to expedite PURE EP’s entrance into new electrophysiology labs across the United States,” commented Gray Fleming, Chief Commercial Officer of BioSig Technologies, Inc.

“BioSig has made significant improvements to the EP market, and they have a unique technology offering with their PURE EP,” said Adam Drill, President of Summit Blue Capital. “Summit Blue Capital is excited to partner with BioSig and execute on a strategic financing and leasing program that we believe will benefit their customer roll out and help position them as a leader in medical technology. We look forward to helping each other and building a solid foundation for the future.”

The PURE EP™ is an FDA 510(k) cleared non-invasive class II device that aims to drive procedural efficiency and efficacy in cardiac electrophysiology. To date, 75 physicians have completed more than 2,150 patient cases with the PURE EP™ System.

Clinical data acquired by the PURE EP™ System in a multi-center study at Texas Cardiac Arrhythmia Institute at St. David’s Medical Center, Mayo Clinic Jacksonville, and Massachusetts General Hospital was recently published in the Journal of Cardiovascular Electrophysiology and is available electronically with open access via the Wiley Online Library. Study results showed 93% consensus across the blinded reviewers with a 75% overall improvement in intracardiac signal quality and confidence in interpreting PURE EP™ signals over conventional sources.

About Summit Blue Capital

Summit Blue Capital is a national commercial finance business based in Minnesota. The Company specializes in custom vendor programs and lease lines-of-credit for companies across the United States. Summit Blue is a privately owned and independently operated finance company that serves all industries. For more information, visit www.summitbluecapital.com.

About BioSig Technologies

BioSig Technologies is a medical technology company commercializing a proprietary biomedical signal processing platform designed to improve signal fidelity and uncover the full range of ECG and intra-cardiac signals (www.biosig.com).

The Company’s first product, PURE EP™ System is a computerized system intended for acquiring, digitizing, amplifying, filtering, measuring and calculating, displaying, recording, and storing electrocardiographic and intracardiac signals for patients undergoing electrophysiology (EP) procedures in an EP laboratory.

Forward-looking Statements

This press release contains “forward-looking statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential” or similar words. Forward- looking statements are not guarantees of future performance, are based on certain assumptions and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s control, and cannot be predicted or quantified and consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, risks and uncertainties associated with (i) the geographic, social and economic impact of COVID-19 on our ability to conduct our business and raise capital in the future when needed, (ii) our inability to manufacture our products and product candidates on a commercial scale on our own, or in collaboration with third parties; (iii) difficulties in obtaining financing on commercially reasonable terms; (iv) changes in the size and nature of our competition; (v) loss of one or more key executives or scientists; and (vi) difficulties in securing regulatory approval to market our products and product candidates. More detailed information about the Company and the risk factors that may affect the realization of forward-looking statements is set forth in the Company’s filings with the Securities and Exchange Commission (SEC), including the Company’s Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Investors and security holders are urged to read these documents free of charge on the SEC’s website at http://www.sec.gov. The Company assumes no obligation to publicly update or revise its forward-looking statements as a result of new information, future events or otherwise.

Andrew Ballou BioSig Technologies, Inc. Vice President, Investor Relations 55 Greens Farms Road Westport, CT 06880 aballou@biosigtech.com 203-409-5444, x119

Source: BioSig Technologies, Inc.

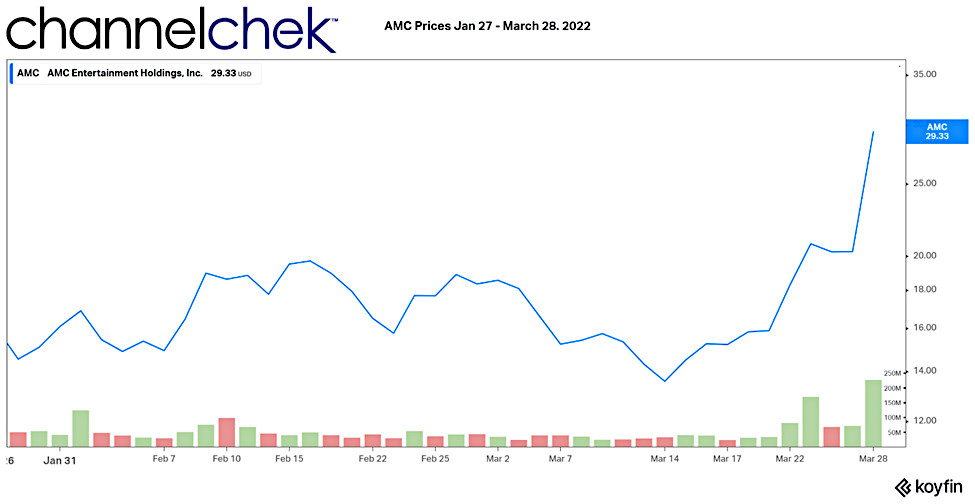

For Retail Investors AMC’s CEO Adam Aron May Have Been the Biggest Star at the Oscars

Image Credit: Image Credit: Twitter: @CEOAdam

AMC Entertainment’s Plot Twist Gets Even More Interesting to Investors

While on his way to the Oscars Sunday afternoon, the CEO of AMC Entertainment spoke on the phone while his driver navigated the vehicle to Hollywood’s “big night.” He was being interviewed by Reuter’s about AMC’s recent purchase and plans for future acquisitions. What Mr. Aron revealed as part of the company’s evolution demonstrates a complete rethinking of the AMC’s strengths and what they can do to reward investors.

AMC is sitting on a large cash position that could benefit investors better if deployed to serve those that have believed in the company and invested in it during the pandemic – covid19 challenged the entertainment industry. They are beginning to recognize their current potential; this includes being able to shop for and make strategic acquisitions. The make-up of companies they would look to get involved with are those that could benefit from AMC’s competence in the capital markets.

On March 15, AMC surprised many by announcing a $27.9 million investment for a 22%

stake in Hycroft Mining Holding Corp (HYMC). This outlay initially met with some head-scratching as the investment in the Nevada-based gold mine didn’t naturally seem like a fit for a company operating 900 theaters. It was explained by the CEO that one of the company’s core competencies is navigating the capital markets, he evidenced this by pointing to its success after being left for dead by investors in 2020. After just 10 trading days, AMC’s Hycroft purchase looks good. AMC bought Hycroft shares at $1.07, and it is trading this morning (March 29) at $2.44. Hycroft has since raised $139 million by selling stock to investors in a bid to strengthen its balance sheet and grow operations at its gold and silver mine.

AMC has “dry powder” of about $1.8 billion that came from selling stock during the meme stock and short squeeze frenzy.

In another Adam Aron interview held by CNBC the day after the Academy Awards, David Faber asked, “Is that the new core competence of AMC, to sort of use these meme-sters that you have to help turnaround the fortunes of a company because they’re willing to put money behind it?” “I think I have to say the answer is yes, and we proved it,” Aron responded.

This response on CNBC was not a surprise to investors that had read the Reuter’s interview where he said, “I’d like to think there will be more third-party external M&A announcements going forward…Transformational M&A is mandatory. Our shareholder base has given us capital to deploy with the clear expectation that we are… going to do exciting things with the money they entrusted to us”

Managing Editor, Channelchek

Suggested Reading

AMC is Thinking Outside the Box Office and Diversifying

|

AMC Theaters Now Accepts 4 Cryptocurrencies

|

Is it Game-Over for Meme Stock Investors?

|

SPACs and Potential Sellers are Successfully Thinking Outside the Box

|

Sources

https://www.google.com/search?q=what+is+a+transformational+acquisition

Stay up to date. Follow us:

|

Comstock Announces Full Year 2021 Results

Comstock Announces Full Year 2021 Results

Research, News, and Market Data on Comstock Mining

Unveils Bioleum™ Breakthrough; A Carbon Neutral Crude Oil Capable of Replacing Fossil Crude

VIRGINIA CITY, NEVADA, MARCH 29, 2022 – Comstock Mining Inc. (NYSE: LODE) (“Comstock” and the “Company”) today announced its 2021 results, summary of transactions completed in 2021, and our new business outlook.

Selected Strategic Highlights

- Approved a new strategy with a mission of enabling systemic decarbonization and a vision of a net zero carbon world.

- Acquired Comstock Innovations, formerly Plain Sight Innovations, with a portfolio of intellectual property that contributes to global decarbonization by efficiently converting massive supplies of unused and under-utilized woody-biomass resources into cellulosic ethanol, renewable diesel, sustainable aviation fuel, and other drop-in fuels.

- Acquired LINICO Corporation and a developing portfolio of technologies that contribute to global decarbonization by efficiently converting a diverse array of lithium-ion batteries (“LIBs”) into electrification products, including lithium, graphite, nickel, cobalt, copper, and cathode active materials (“CAMs”).

- Acquired Comstock Engineering, formerly Renewable Process Solutions, whose principals built twenty six biofuel refineries in the last fifteen years and managed multiple industrial-scale projects from construction to commissioning.

- Established and integrated new leadership, including Kevin Kreisler, President and Chief Financial Officer, William McCarthy, Chief Operating Officer, David Winsness, Chief Technology Officer, and Rahul Bobbili, Chief Engineer.

- Advanced Cellulosic Technology. Our cellulosic technologies can convert woody biomass into renewable fuels at extraordinary yields, including cellulosic ethanol and Bioleum™ – a remarkable new form of carbon neutral crude oil capable of replacing fossil crude for use in producing renewable diesel, aviation, and other drop-in fuels.

- Advanced Electrification Technology. Our electrification technologies crush, separate, and condition every class of lithium-ion battery (“LIB”) feedstock together with their host devices and other electrification residues for unrivaled throughput and flexibility, and then – in contrast to any known competing process, immediately extract lithium to produce unique “black mass” metal powders that are cleaner and far more concentrated than competing products.

- Advanced Monetizing Non-Strategic Assets. Our announced transactions for certain mineral and other properties now total over $25 million, including expected 2022 proceeds from Tonogold, Sierra Springs and others.

Selected Financial Results

- Total assets nearly tripled to $126,954,632 during 2021, as compared to $43,123,562, at December 31, 2020. Net equity also nearly tripled to $92,970,522 during 2021, as compared to $31,779,206 at December 31, 2020.

- Operating loss of $6,405,921 as compared to an operating loss of $5,474,261 for 2020, primarily resulting from increased administrative expense from acquisitions, increased personnel, and higher research and development costs.

- Full year 2021 net loss of $24,583,620 and $(0.49) per share, as compared to full year 2020 net income of $14,931,970 and $0.49 per share. The results in each year were driven by non-routine transactions, including goodwill impairments, changes in fair values of derivatives, and gains on sales of non-strategic assets.

- Debt was $4,486,256 million on December 31, 2021, representing unsecured promissory notes.

- Cash and equivalents were $5,912,188 on December 31, 2021.

- Outstanding common shares were 67,707,832 at March 28, 2022, and 71,207,832 at December 31, 2021.

“Our operating results reflect our investments in technology, people, and the increased research and development focus during the year, as we integrated the transactions necessary to build the foundation for growth,” said Corrado De Gasperis, Comstock’s executive chairman and chief executive officer. “Our investments during the year are already yielding breakthrough advancements in technology, and our team is making remarkable progress.”

Enabling Systemic Decarbonization – Cellulosic Fuels

The Company previously announced its plans to build, own, and operate a fleet of advanced carbon neutral extraction and refining facilities, with the goal of generating over $16 billion in revenue on an annualized basis by 2030. The Company has now formed a renewable fuels subsidiary, Comstock Fuels, that will efficiently convert wasted, unused, widely available, and rapidly replenishable woody biomass into advanced cellulosic fuels, unlocking vast quantities of historically underutilized feedstocks. These fuels work in existing infrastructure, depots, fueling stations, vehicles, and anything that burns fossil fuels. Just one of our biorefineries can produce over 100 million gallons of biofuel per year, including over 70 million gallons of cellulosic ethanol and 30 million gallons of renewable diesel from just 1 million metric tons of woody biomass per year.

“The scale of the financial and environmental impact that we can enable with our technologies is staggering,” continued De Gasperis. “There isn’t a technology on Earth that can absorb carbon from the atmosphere as quickly as trees, or that can offset as much fossil emissions from the 1.5 billion cars and trucks on today’s roads faster than by burning renewable fuels instead of fossil fuels. In this context, we have struck massive untapped supplies of carbon neutral oil that are hidden in plain sight.”

Enabling Systemic Decarbonization – Electrification Products

Electrification and continued advancements in energy storage are vitally necessary to reduce reliance on fossil fuels while shifting to and increasing use of renewable fuels. LiNiCo holds the rights to a portfolio of innovative processes that efficiently crush and separate LIBs, extract lithium, nickel, cobalt, and graphite, and reuse the recovered metals to produce 99% pure CAMs. These technologies give LiNiCo and its existing 137,000 square foot battery metal recycling facility differentiating competitive advantages, including the ability to process upwards of 100,000 tons of LIBs per year into an array of new products.

According to International Energy Agency (“IEA”), there were more than 10 million electric vehicles (“EVs”) on the road in 2020, with new EV registrations increasing by 41% over 2019 and another 140% during the first quarter of 2021. Meeting the increased EV demand is estimated to require about five times more lithium carbonate equivalent (“LCE”) than the entire lithium mining industry produces today. The world is clearly focused on further accelerating electrification to reduce reliance on fossil fuels, creating and driving this extraordinary demand for lithium, as well as nickel, cobalt, and other critical electrification resources. The push to electrify is so urgent that the Biden Administration recently invoked the Defense Production Act to develop increased lithium production capabilities in the United States.

“Our technologies are meeting the realities of this demand shortfall by extracting lithium first, immediately and efficiently, thereby enabling profitability at the earliest stages of production. The combination of that capability with the breadth of our feedstock acceptance capabilities positions our LIB recycling business to contribute billions to our enterprise value just based on the existing valuations of comparable public companies,” continued De Gasperis.

The Company is currently building commercial pilot scale facilities for LIBs and is preparing to commence operations at its state-of-the-art battery metal recycling facility later this year. The Company has already made significant strides in forging new cellulosic revenue and licensing streams, and is currently finalizing definitive agreements and timeframes, which will be shared soon. The Company has also made meaningful progress towards completing the monetization of its non-strategic assets as quickly as possible, while funding its businesses and limiting management’s focus to the renewable objectives outlined above.

De Gasperis concluded: “We look forward to our next communication and seeing those of you who can attend this year’s Annual General Meeting on May 26, 2022, where we plan on presenting our business plans and near-term revenues. We are extraordinarily focused on the renewable energy businesses that most impact our stakeholders in 2022 and beyond.”

About Comstock Mining Inc.

Comstock Mining Inc. (NYSE: LODE) innovates technologies that contribute to global decarbonization and circularity by efficiently converting massive supplies of under-utilized natural resources into renewable fuels and electrification products that contribute to balancing global uses and emissions of carbon. The Company intends to achieve exponential growth and extraordinary financial, natural, and social gains by building, owning, and operating a fleet of advanced carbon neutral extraction and refining facilities, by selling an array of complimentary process solutions and related services, and by licensing selected technologies to qualified strategic partners. To learn more, please visit www.comstock.inc.

Forward-Looking Statements

This press release and any related calls or discussions may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, are forward-looking statements. The words “believe,” “expect,” “anticipate,” “estimate,” “project,” “plan,” “should,” “intend,” “may,” “will,” “would,” “potential” and similar expressions identify forward-looking statements but are not the exclusive means of doing so. Forward-looking statements include statements about matters such as: future industry market conditions; future explorations or acquisitions; future changes in our exploration activities; future changes in our research and development; future prices and sales of, and demand for, our products and services; land entitlements and uses; permits; production capacity and operations; operating and overhead costs; future capital expenditures and their impact on us; operational and management changes (including changes in the Board of Directors); changes in business strategies, planning and tactics; future employment and contributions of personnel, including consultants; future land sales; investments, acquisitions, joint ventures, strategic alliances, business combinations, operational, tax, financial and restructuring initiatives, including the nature, timing and accounting for restructuring charges, derivative assets and liabilities and the impact thereof; contingencies; litigation, administrative or arbitration proceedings; environmental compliance and changes in the regulatory environment; offerings, limitations on sales or offering of equity or debt securities, including asset sales and associated costs; and future working capital, costs, revenues, business opportunities, debt levels, cash flows, margins, taxes, earnings and growth. These statements are based on assumptions and assessments made by our management in light of their experience and their perception of historical and current trends, current conditions, possible future developments and other factors they believe to be appropriate. Forward-looking statements are not guarantees, representations or warranties and are subject to risks and uncertainties, many of which are unforeseeable and beyond our control and could cause actual results, developments and business decisions to differ materially from those contemplated by such forward-looking statements. Some of those risks and uncertainties include the risk factors set forth in reports that we file with the Securities and Exchange Commission, including Item 1A, “Risk Factors” in our most recently-filed Annual Report on Form 10-K and/or Quarterly Report on Form 10-Q, and the following: adverse effects of climate changes or natural disasters; adverse effects of global or regional pandemic disease spread or other crises; global economic and capital market uncertainties; the speculative nature of gold or mineral exploration, mercury remediation and lithium, nickel and cobalt recycling, including risks of diminishing quantities or grades of qualified resources; operational or technical difficulties in connection with exploration or mercury remediation, metal recycling, processing or mining activities; costs, hazards and uncertainties associated with precious metal based activities, including environmentally friendly and economically enhancing clean mining and processing technologies, precious metal exploration, resource development, economic feasibility assessment and cash generating mineral production; costs, hazards and uncertainties associated with mercury remediation, metal recycling, processing or mining activities; contests over our title to properties; potential dilution to our stockholders from our stock issuances, recapitalization and balance sheet restructuring activities; potential inability to comply with applicable government regulations or law; adoption of or changes in legislation or regulations adversely affecting our businesses; permitting constraints or delays; ability to achieve the benefits of business opportunities that may be presented to, or pursued by, us, including those involving battery technology, mercury remediation technology and efficacy, quantum computing and advanced materials development, and development of cellulosic technology in bio-fuels and related carbon-based material production; ability to successfully identify, finance, complete and integrate acquisitions, joint ventures, strategic alliances, business combinations, asset sales, and investments that we may be party to in the future; changes in the United States or other monetary or fiscal policies or regulations; interruptions in our production capabilities due to capital constraints; equipment failures; fluctuation of prices for gold or certain other commodities (such as silver, zinc, lithium, nickel, cobalt, cyanide, water, diesel, gasoline and alternative fuels and electricity); changes in generally accepted accounting principles; adverse effects of war, mass shooting, terrorism and geopolitical events; potential inability to implement our business strategies; potential inability to grow revenues; potential inability to attract and retain key personnel; interruptions in delivery of critical supplies, equipment and raw materials due to credit or other limitations imposed by vendors; assertion of claims, lawsuits and proceedings against us; potential inability to satisfy debt and lease obligations; potential inability to maintain an effective system of internal controls over financial reporting; potential inability or failure to timely file periodic reports with the Securities and Exchange Commission; potential inability to list our securities on any securities exchange or market or maintain the listing of our securities; and work stoppages or other labor difficulties. Occurrence of such events or circumstances could have a material adverse effect on our business, financial condition, results of operations or cash flows, or the market price of our securities. All subsequent written and oral forward-looking statements by or attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. Except as may be required by securities or other law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Neither this press release nor any related call or discussion constitutes an offer to sell, the solicitation of an offer to buy or a recommendation with respect to any securities of the Company, the fund or any other issuer.

| Contact information: | ||

| Comstock Mining Inc. P.O. Box 1118 Virginia City, NV 89440 www.comstock.inc |

Corrado De Gasperis Executive Chairman & CEO Tel (775) 847-4755 degasperis@comstockmining.com |

Zach Spencer Director of External Relations Tel (775) 847-5272 Ext.151 questions@comstockmining.com |

Flotek Announces Earnings Schedule For 2021 Results

Flotek Announces Earnings Schedule For 2021 Results

Research, News, and Market Data on Flotek Industries

HOUSTON, March 28, 2022 – Flotek Industries, Inc. (“Flotek” or the “Company”) (NYSE: FTK) schedule for releasing its results for the twelve months ended December 31, 2021.

In a press release to be issued after market close on Wednesday, March 30, 2022, Flotek will release its full year 2021 financial and operating results for the twelve months ended December 31, 2021. The Company will host its earnings conference call on Thursday, March 31, 2022 at 9:00 a.m. CT (10:00 a.m. ET).

To participate in the call, participants should access the webcast on www.flotekind.com under the Investor Relations section or dial 1-844-835-9986 approximately five minutes prior to the start of the call. Following the conclusion of the conference call, a recording of the call will be available on the Company’s website.

About Flotek Industries, Inc.

Flotek Industries, Inc. creates solutions to reduce the environmental impact of energy on air, water, land and people. A technology driven, specialty green chemistry and data company, Flotek helps customers across industrial, commercial, and consumer markets improve their Environmental, Social, and Governance performance. Flotek’s Chemistry Technologies segment develops, manufactures, packages, distributes, delivers, and markets high-quality cleaning, disinfecting and sanitizing products for commercial, governmental and personal consumer use. Additionally, Flotek empowers the energy industry to maximize the value of their hydrocarbon streams and improve return on invested capital through its real-time data platforms and green chemistry technologies. Flotek serves downstream, midstream, and upstream customers, both domestic and international. Flotek is a publicly traded company headquartered in Houston, Texas, and its common shares are traded on the New York Stock Exchange under the ticker symbol “FTK.” For additional information, please visit www.flotekind.com.

Forward -Looking Statements

Certain statements set forth in this press release constitute forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934) regarding Flotek Industries, Inc.’s business, financial condition, results of operations and prospects. Words such as will, continue, expects, anticipates, intends, plans, believes, seeks, estimates and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this press release. Although forward-looking statements in this press release reflect the good faith judgment of management, such statements can only be based on facts and factors currently known to management. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. Further information about the risks and uncertainties that may impact the company are set forth in the Company’s most recent filing with the Securities and Exchange Commission on Form 10-K (including, without limitation, in the “Risk Factors” section thereof), and in the Company’s other SEC filings and publicly available documents. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to revise or update any forward-looking statements in order to reflect, any event or circumstance that may arise after the date of this press release.

Inquiries, contact:

Investor Relations

P: (713) 726-5322

Ayala Pharmaceuticals Reports Full-Year 2021 Financial Results and Provides Corporate Update

Ayala Pharmaceuticals Reports Full-Year 2021 Financial Results and Provides Corporate Update

Research, News, and Market Data on Ayala Pharmaceuticals

– Part A of AL102 RINGSIDE study fully enrolled; interim data expected mid-2022 –

REHOVOT, Israel and WILMINGTON, Del., March 28, 2022 (GLOBE NEWSWIRE) — Ayala Pharmaceuticals, Inc. (Ayala or the Company) (Nasdaq: AYLA), a clinical-stage oncology company focused on developing and commercializing small molecule therapeutics for patients suffering from rare and aggressive cancers today announced full-year 2021 financial results and provided a corporate update.

“2022 is off to a very promising start for Ayala, following a number of important accomplishments across our pipeline of innovative gamma-secretase inhibitors in 2021,” said Roni Mamluk, Ph.D., Chief Executive Officer of Ayala. “We are pleased with the progress of our AL102 program in desmoid tumors, having recently completed enrollment in Part A of the open label RINGSIDE study. We are encouraged by initial positive feedback received from investigators so far. We plan to announce initial interim data from Part A around mid-year 2022 and intend to move into Part B, the randomized portion of the study, immediately thereafter. We look forward to announcing additional data readouts and updates on our other clinical programs throughout 2022 including further data on AL101 in adenoid cystic carcinoma.”

2021 and Recent Business and Clinical Highlights

- Completed enrollment of Part A of the Phase 2/3 RINGSIDE study of AL102 in desmoid tumors: 36 patients have been enrolled in Part A of the RINGSIDE study, which is evaluating the safety and tolerability of AL102, as well as tumor volume by MRI at 16 weeks. Ayala expects to report an initial interim data read-out around mid-2022, with Part B of the study commencing immediately thereafter.

- Initiated “Window of Opportunity” study of AL101 in adenoid cystic carcinoma (ACC): The study is focused on determining the effects of AL101 for the treatment of ACC and other cancers. The goals of the study are to better understand the mechanism of AL101, determine the best treatment regime and generate data for the future development strategy. The study is being conducted in collaboration with M.D. Anderson Cancer Center and the Adenoid Cystic Carcinoma Research Foundation.

- Presented positive preliminary clinical data from the ongoing ACCURACY trial in ACC: Updated interim data from the 6mg cohort of the Phase 2 ACCURACY study of AL101 in recurrent/metastatic adenoid cystic carcinoma (R/M ACC) were presented at the European Society for Medical Oncology (ESMO) Congress 2021 demonstrating partial responses in three subjects (9%) and stable disease in 20 subjects (61%). At ESMO, the Company also presented preclinical proof of concept data on AL101 in combination with approved cancer therapies in patient-derived ACC tumor models

- Initiated Phase 1 trial of AL102 in combination with Novartis’ B-cell maturation antigen (BCMA) targeting agent WVT078 in relapsed/refractory multiple myeloma (MM): inhibition of gamma-secretase with AL102 prevents the cleavage and shedding of BCMA, which is ubiquitously expressed on MM cells. Preclinical data have demonstrated that treatment with AL102 increases the expression of membrane-bound BCMA on the surface of MM cells and could enhance the activity of WVT078. Ongoing patient enrollment continues as planned.

- AL101 in Notch-activated triple negative breast cancer: The Company has elected to discontinue the Phase 2 TENACITY study as part of its efforts to focus its resources on the more advanced programs and studies including the RINGSIDE study in desmoid tumors and the ACCURACY study for ACC.

Upcoming Milestones

- Initial interim data from the pivotal Phase 2/3 RINGSIDE trial in desmoid tumors (Mid-2022): Ayala expects to report an initial interim data read-out from Part A of the Phase 2/3 RINGSIDE trial of AL102 in desmoid tumors around mid-2022. Part B of the study will be a double-blind placebo-controlled study and will start immediately after dose selection from Part A.

- Additional data from the Phase 2 ACCURACY trial of AL101 in ACC: The ongoing ACCURACY trial is an open-label, single-arm Phase 2 clinical trial evaluating AL101 as monotherapy for the treatment of R/M ACC patients with Notch-activated mutations. The first cohort of the trial included 45 subjects dosed at 4 mg of AL101 IV once weekly. Final data from the 4 mg cohort and additional data from the 6 mg cohort,which includes 42 subjects are expected to be reported in the second half of 2022.

- Initiate Phase 2 Clinical Trial Evaluating AL102 in T-cell Acute Lymphoblastic Leukemia (T-ALL): Ayala plans to begin a Phase 2 clinical trial evaluating AL101 in R/R T-ALL in the second half of 2022.

Full Year 2021 Financial Results

Cash Position: Cash and cash equivalents were $37.3 million as of December 31, 2021, as compared to $42.4 million as of December 31, 2020.

Collaboration Revenue: Collaboration revenue was $3.5 million for the full year of 2021, as compared to $3.7 million for the full year of 2020.

R&D Expenses: Research and development expenses were $29.9 million for the full year 2021, compared to $22.4 million in 2020. The increase was primarily driven by additional costs in connection with the initiation and advancement of the Phase 2/3 RINGSIDE pivotal study for desmoid tumors.

G&A Expenses: General and administrative expenses were $9.3 million as of December 31, 2021, compared to $7.4 million as of December 31, 2020. The increase was primarily due to higher expenses in connection with our operations as a public company, including director and officer insurance, increased headcount, and stock-based compensation.

Net Loss: Net loss was $40.3 million for the full year 2021, resulting in basic and diluted net loss per share of ($2.80). This compares with a net loss was $30.1 million for the full year of 2020, equivalent to basic and diluted net loss per share of ($3.06).

For further details on the Company’s financial results, refer to our Annual Report on Form 10-K, for the year ended December 31, 2021 filed with the U.S. Securities and Exchange Commission (SEC) on March 28, 2022.

About Ayala Pharmaceuticals

Ayala Pharmaceuticals, Inc. is a clinical-stage oncology company focused on developing and commercializing small molecule therapeutics for patients suffering from rare and aggressive cancers,. Ayala’s approach is focused on predicating, identifying and addressing tumorigenic drivers of cancer through a combination of its bioinformatics platform and next-generation sequencing to deliver targeted therapies to underserved patient populations. The company has two product candidates under development, AL101 and AL102, targeting the aberrant activation of the Notch pathway with gamma secretase inhibitors to treat a variety of tumors including Adenoid Cystic Carcinoma, T-cell Acute Lymphoblastic Leukemia (T-ALL), Desmoid Tumors and Multiple Myeloma (MM) (in collaboration with Novartis). AL101, has received Fast Track Designation and Orphan Drug Designation from the U.S. FDA and is currently in a Phase 2 clinical trial for patients with ACC (ACCURACY) bearing Notch activating mutations and other gene rearrangements. AL102 is currently in a pivotal Phase 2/3 clinical trial for patients with desmoid tumors (RINGSIDE) and is being evaluated in a Phase 1 clinical trial in combination with Novartis’ BMCA targeting agent, WVT078, in patients with relapsed/refractory Multiple Myeloma. For more information, visit www.ayalapharma.com.

Contacts:

Investors:

Joyce Allaire

LifeSci Advisors LLC

+1-617-435-6602

jallaire@lifesciadvisors.com

Ayala Pharmaceuticals:

+1-857-444-0553

info@ayalapharma.com

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including statements relating to our development of AL101 and AL102, the promise and potential impact of our preclinical or clinical trial data, the timing of and plans to initiate additional clinical trials of AL101 and AL102, the timing and results of any clinical trials or readouts, the sufficiency of cash to fund operations, and the anticipated impact of COVID-19, on our business. These forward-looking statements are based on management’s current expectations. The words ”may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “estimate,” “believe,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: we have incurred significant losses since inception and anticipate that we will continue to incur losses for the foreseeable future. We are not currently profitable, and we may never achieve or sustain profitability; we will require additional capital to fund our operations, and if we fail to obtain necessary financing, we may not be able to complete the development and commercialization of AL101 and AL102; we have identified conditions and events that raise substantial doubt about our ability to continue as a going concern; we have a limited operating history and no history of commercializing pharmaceutical products, which may make it difficult to evaluate the prospects for our future viability; we are heavily dependent on the success of AL101 and AL102, our most advanced product candidates, which are still under clinical development, and if either AL101 or AL102 does not receive regulatory approval or is not successfully commercialized, our business may be harmed; due to our limited resources and access to capital, we must prioritize development of certain programs and product candidates; these decisions may prove to be wrong and may adversely affect our business; the outbreak of COVID-19, may adversely affect our business, including our clinical trials; our ability to use our net operating loss carry forwards to offset future taxable income may be subject to certain limitations; our product candidates are designed for patients with genetically defined cancers, which is a rapidly evolving area of science, and the approach we are taking to discover and develop product candidates is novel and may never lead to marketable products; we were not involved in the early development of our lead product candidates; therefore, we are dependent on third parties having accurately generated, collected and interpreted data from certain preclinical studies and clinical trials for our product candidates; enrollment and retention of patients in clinical trials is an expensive and time-consuming process and could be made more difficult or rendered impossible by multiple factors outside our control; if we do not achieve our projected development and commercialization goals in the timeframes we announce and expect, the commercialization of our product candidates may be delayed and our business will be harmed; our product candidates may cause serious adverse events or undesirable side effects, which may delay or prevent marketing approval, or, if approved, require them to be taken off the market, require them to include safety warnings or otherwise limit their sales; the market opportunities for AL101 and AL102, if approved, may be smaller than we anticipate; we may not be successful in developing, or collaborating with others to develop, diagnostic tests to identify patients with Notch-activating mutations; we have never obtained marketing approval for a product candidate and we may be unable to obtain, or may be delayed in obtaining, marketing approval for any of our product candidates; even if we obtain FDA approval for our product candidates in the United States, we may never obtain approval for or commercialize them in any other jurisdiction, which would limit our ability to realize their full market potential; we have been granted Orphan Drug Designation for AL101 for the treatment of ACC and may seek Orphan Drug Designation for other indications or product candidates, and we may be unable to maintain the benefits associated with Orphan Drug Designation, including the potential for market exclusivity, and may not receive Orphan Drug Designation for other indications or for our other product candidates; although we have received Fast Track designation for AL101, and may seek Fast Track designation for our other product candidates, such designations may not actually lead to a faster development timeline, regulatory review or approval process; we face significant competition from other biotechnology and pharmaceutical companies and our operating results will suffer if we fail to compete effectively; we are dependent on a small number of suppliers for some of the materials used to manufacture our product candidates, and on one company for the manufacture of the active pharmaceutical ingredient for each of our product candidates; our existing collaboration with Novartis is, and any future collaborations will be, important to our business. If we are unable to maintain our existing collaboration or enter into new collaborations, or if these collaborations are not successful, our business could be adversely affected; enacted and future healthcare legislation may increase the difficulty and cost for us to obtain marketing approval of and commercialize our product candidates, if approved, and may affect the prices we may set; if we are unable to obtain, maintain, protect and enforce patent and other intellectual property protection for our technology and products or if the scope of the patent or other intellectual property protection obtained is not sufficiently broad, our competitors could develop and commercialize products and technology similar or identical to ours, and we may not be able to compete effectively in our markets; we may engage in acquisitions or in-licensing transactions that could disrupt our business, cause dilution to our stockholders or reduce our financial resources; and risks related to our operations in Israel could materially adversely impact our business, financial condition and results of operations.

These and other important factors discussed under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2021 filed with the SEC on March 29, 2022 and our other filings with the SEC, could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward-looking statements represent management’s estimates as of the date of this press release. New risk factors and uncertainties may emerge from time to time, and it is not possible to predict all risk factors and uncertainties. While we may elect to update such forward-looking statements at some point in the future, except as required by law, we disclaim any obligation to do so, even if subsequent events cause our views to change. Although we believe the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.

AYALA PHARMACEUTICALS, INC.

CONSOLIDATED BALANCE SHEETS

U.S. dollars in thousands (except share and per share data)

| December 31, | December 31, | |||||||

| 2021 | 2020 | |||||||

| Assets | ||||||||

| Current Assets: | ||||||||

| Cash and Cash Equivalents | $ | 36,982 | $ | 42,025 | ||||

| Short-Term Restricted Bank Deposits | 122 | 90 | ||||||

| Trade Receivables | – | 681 | ||||||

| Prepaid Expenses and Other Current Assets | 2,636 | 1,444 | ||||||

| Total Current Assets | 39,740 | 44,240 | ||||||

| Long-Term Assets: | ||||||||

| Other Assets | 267 | 305 | ||||||

| Property and Equipment, Net | 1,120 | 1,283 | ||||||

| Total Long-Term Assets | 1,387 | 1,588 | ||||||

| Total Assets | $ | 41,127 | $ | 45,828 | ||||

| Liabilities and Stockholders’ Equity: | ||||||||

| Current Liabilities: | ||||||||

| Trade Payables | $ | 3,214 | $ | 3,726 | ||||

| Other Accounts Payables | 3,258 | 3,151 | ||||||

| Total Current Liabilities | 6,472 | 6,877 | ||||||

| Long-Term Liabilities: | ||||||||

| Long-Term Rent Liability | 497 | 553 | ||||||

| Total Long-Term Liabilities | $ | 497 | $ | 553 | ||||

| Stockholders’ Equity: | ||||||||

| Common Stock of $0.01 par value per share; 200,000,000 shares authorized at December 31, 2021 and 2020; 14,080,383 and 12,824,463 shares issued at December 31, 2021 and 2020, respectively; 13,956,035 and 12,728,446 shares outstanding at December 31, 2021 and 2020, Respectively. | $ | 139 | $ | 128 | ||||

| Additional Paid-in Capital | 145,160 | 109,157 | ||||||

| Accumulated Deficit | (111,141 | ) | (70,887 | ) | ||||

| Total Stockholders’ Equity | 34,158 | 38,398 | ||||||

| Total Liabilities and Stockholders’ Equity | $ | 41,127 | $ | 45,828 | ||||

AYALA PHARMACEUTICALS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

U.S. dollars in thousands (except shares and per shares data)

| Year ended | Year ended | |||||||

| December 31, | December 31, | |||||||

| 2021 | 2020 | |||||||

| Revenue from License Agreement | $ | 3,506 | $ | 3,708 | ||||

| Cost of Revenue | (3,506 | ) | (3,708 | ) | ||||

| Gross Profit | — | — | ||||||

| Research and Development | $ | 29,941 | $ | 22,406 | ||||

| General and Administrative | 9,277 | 7,371 | ||||||

| Operating Loss | (39,218 | ) | (29,777 | ) | ||||

| Financial income (expenses), net | (260 | ) | 56 | |||||

| Loss before taxes on income | (39,478 | ) | (29,721 | ) | ||||

| Taxes on Income | (776 | ) | (425 | ) | ||||

| Net Loss | $ | (40,254 | ) | $ | (30,146 | ) | ||

| Net Loss per Share attributable to Common Stockholders, Basic and Diluted | $ | (2.80 | ) | $ | (3.06 | ) | ||

| Weighted Average Shares Used to Compute Net Loss per Share, Basic and Diluted | 14,398,905 | 9,860,610 | ||||||

Release – Genco Shipping Trading Limited to Participate in Capital Links 16th Annual International Shipping Forum

Genco Shipping & Trading Limited to Participate in Capital Link’s 16th Annual International Shipping Forum

Research, News, and Market Data on Genco Shipping & Trading

NEW YORK, March 28, 2022 (GLOBE NEWSWIRE) — Genco Shipping & Trading Limited (NYSE: GNK) announced today that John C. Wobensmith, Chief Executive Officer, is scheduled to participate virtually in the Company Strategy and Capital Allocation panel discussion at Capital Link’s 16th Annual International Shipping Forum on Tuesday, March 29 at 11:30 am Eastern Time. Apostolos Zafolias, Chief Financial Officer, is also scheduled to participate in the Ship Finance Landscape – the Shipowners Perspective panel on Monday, March 28 at 2:05 pm Eastern Time. Genco management will participate in investor meetings held in conjunction with the event, which is organized in partnership with Citi, and in cooperation with Nasdaq & NYSE.

About Genco Shipping & Trading Limited

Genco Shipping & Trading Limited is a U.S. based drybulk ship owning company focused on the seaborne transportation of commodities globally. We provide a full-service logistics solution to our customers utilizing our in-house commercial operating platform, as we transport key cargoes such as iron ore, grain, steel products, bauxite, cement, nickel ore among other commodities along worldwide shipping routes. Our wholly owned high quality, modern fleet of dry cargo vessels consists of the larger Capesize (major bulk) and the medium-sized Ultramax and Supramax vessels (minor bulk) enabling us to carry a wide range of cargoes. We make capital expenditures from time to time in connection with vessel acquisitions. As of March 28, 2022, Genco Shipping & Trading Limited’s fleet consists of 17 Capesize, 15 Ultramax and 12 Supramax vessels with an aggregate capacity of approximately 4,635,000 dwt and an average age of 10.0 years.

CONTACT:

Apostolos Zafolias

Chief Financial Officer

Genco Shipping & Trading Limited

(646) 443-8550

Source: Genco Shipping & Trading Limited

Release – Motorsport Games rFactor 2 Becomes The Official Sim Racing Platform Of Formula E

Motorsport Games’ rFactor 2 Becomes The Official Sim Racing Platform Of Formula E

Research, News, and Market Data on Motorsport Games

CONTINUATION OF THE COMPANY’S MULTIYEAR AGREEMENT WILL SEE THE SERIES IMPLEMENTED WITHIN THE RACING SIMULATION, AS WELL AS THE CREATION OF ESPORTS EVENTS AND ACTIVATIONS FOR FANS

MIAMI, March 28, 2022 (GLOBE NEWSWIRE) — Motorsport Games Inc. (NASDAQ: MSGM) (“Motorsport Games”), a leading racing game developer, publisher and esports ecosystem provider of official motorsport racing series throughout the world, announces today that it has become the official sim racing platform of Formula E, the world’s first all-electric international single-seater motorsport series. The agreement comes as part of an extension on the current multiyear partnership between Motorsport Games and Formula E.

Motorsport Games will implement Formula E, including its drivers and teams, into rFactor 2, the premier racing simulation platform available today. All drivers and teams will be updated to reflect Season 8 of the ABB FIA Formula E World Championship that is currently underway. Once implemented, rFactor 2 will feature every season of Formula E since 2018 and provide availability to race on many high-fidelity circuits within the series. The Formula E content pack will be available to purchase for all users of rFactor 2.

“Formula E is one of the fastest growing motorsports series and we couldn’t be more excited and honored to bring it to life fully within rFactor 2,” said Dmitry Kozko, CEO of Motorsport Games. “rFactor 2 continues to be the best-in-class simulation platform in the marketplace. This addition to its robust offering of motorsport series will greatly enhance the experience and offerings available to our players. With our expertise on creating authentic racing simulations and remarkable esports events coupled with Formula E’s surging popularity, we know that our partnership will reach every goal in place between our teams.”

In addition to adding the Formula E series to rFactor 2, Formula E will launch its Accelerate esports series which will be powered by rFactor 2’s in-game competitions platform. Additionally, rFactor 2 will power the Formula E Gaming Arena at future races and events allowing players to experience the thrill of the ABB FIA Formula E World Championship in venues all around the world, including Rome, Berlin and New York City. “Formula E is all about accelerating change, for this reason we want to give more accessibility to our sport and push the boundaries of what is possible both on and off the track,” said Kieran Holmes-Darby, Gaming Director at Formula E.

The partnership between the two brands further builds upon the foundation that was previously set when Motorsport Games conducted the ABB Formula E Race at Home Challenge esports event for the FIA. The series of esports events, which served as a temporary replacement for the suspended 2019–20 ABB Formula E Championship season due to the COVID-19 pandemic, created a fantastic viewing experience for new and existing fans of the sport.

The Formula E update to rFactor 2 will be live starting today, for all players. For full details on the update, please visit www.studio-397.com.

To keep up with the latest Motorsport Game news visit www.motorsportgames.com and follow on Twitter, Instagram, Facebook and LinkedIn.

About Motorsport Games:

Motorsport Games, a Motorsport Network company, is a leading racing game developer, publisher and esports ecosystem provider of official motorsport racing series throughout the world. Combining innovative and engaging video games with exciting esports competitions and content for racing fans and gamers, Motorsport Games strives to make the joy of racing accessible to everyone. The Company is the officially licensed video game developer and publisher for iconic motorsport racing series across PC, PlayStation, Xbox, Nintendo Switch and mobile, including NASCAR, INDYCAR, 24 Hours of Le Mans, rFactor 2, KartKraft and the British Touring Car Championship (“BTCC”). Motorsport Games is an award-winning esports partner of choice for 24 Hours of Le Mans, Formula E, BTCC, the FIA World Rallycross Championship and the eNASCAR Heat Pro League, among others. Motorsport Games is building a virtual racing ecosystem where each product drives excitement, every esports event is an adventure and every story inspires.

About Formula E and the ABB FIA Formula E World Championship

As the world’s first all-electric FIA World Championship and the only sport certified net zero carbon since inception, the ABB FIA Formula E World Championship brings dramatic racing to the heart of some of the world’s most iconic cities providing an elite motorsport platform for the world’s leading automotive manufacturers to accelerate electric vehicle innovation.

The Formula E network of teams, manufacturers, partners, broadcasters and host cities are united by a passion for the sport and a belief in its potential to accelerate sustainable human progress and create a better future for people and planet.

For Formula E media enquiries, please contact – media@fiaformulae.com

Forward-Looking Statements:

Certain statements in this press release which are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are provided pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Any statements in this press release that are not statements of historical fact may be deemed forward-looking statements. Words such as “continue,” “will,” “may,” “could,” “should,” “expect,” “expected,” “plans,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, but are not limited to, statements concerning: (i) the expected benefits to Motorsport Games and to Formula E of implementing Formula E, including its drivers and teams, into rFactor 2; and (ii) the Company’s expected timing of releasing the Formula E update to rFactor 2. All forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements, many of which are generally outside the control of Motorsport Games and are difficult to predict. Examples of such risks and uncertainties include, but are not limited to the Company experiencing difficulties and/or delays in implementing Formula E into rFactor 2, such as due to higher than anticipated costs incurred in developing, launching and continuing to enhance and improve such products and/or less than anticipated consumer acceptance of the Company’s products and/or difficulties, delays in or unanticipated events that may impact the timing and scope of releasing the Formula E update to rFactor 2, such as due to difficulties or delays in using its product development personnel in Russia due to Russia’s invasion of Ukraine and the related sanctions, delays and higher than anticipated expenses related to the ongoing and prolonged COVID-19 pandemic and related economic lockdowns and government mandates; unanticipated operating costs, transaction costs and actual or contingent liabilities; adverse effects of increased competition; and unanticipated changes in consumer behavior, including as a result of general economic factors, such as increased inflation. Factors other than those referred to above could also cause Motorsport Games’ results to differ materially from expected results. All forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements, many of which are generally outside the control of Motorsport Games and are difficult to predict. Factors other than those referred to above could also cause Motorsport Games’ results to differ materially from expected results. Additional factors that could cause actual results to differ materially from those expressed or implied in the forward-looking statements can be found in Motorsport Games’ filings with the SEC, which may be found at www.sec.gov and at ir.motorsportgames.com, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2020, its Quarterly Reports on Form 10-Q filed with the SEC during 2021, Current Reports on Form 8-K filed during 2022, as well as in its subsequent filings with the SEC. Motorsport Games anticipates that subsequent events and developments may cause its plans, intentions and expectations to change. Motorsport Games assumes no obligation, and it specifically disclaims any intention or obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by law. Forward-looking statements speak only as of the date they are made and should not be relied upon as representing Motorsport Games’ plans and expectations as of any subsequent date. Additionally, the business and financial materials and any other statement or disclosure on, or made available through, Motorsport Games’ website or other websites referenced or linked to this press release shall not be incorporated by reference into this press release.

Website and Social Media Disclosure:

Investors and others should note that we announce material financial information to our investors using our investor relations website (ir.motorsportgames.com), SEC filings, press releases, public conference calls and webcasts. We use these channels, as well as social media and blogs, to communicate with our investors and the public about our company and our products. It is possible that the information we post on our websites, social media and blogs could be deemed to be material information. Therefore, we encourage investors, the media and others interested in our company to review the information we post on the websites, social media channels and blogs, including the following (which list we will update from time to time on our investor relations website):

| Websites | Social Media |

| motorsportgames.com | Twitter: @msportgames & @traxiongg |

| traxion.gg | Instagram: msportgames & traxiongg |

| motorsport.com | Facebook: Motorsport Games & traxiongg |

| LinkedIn: Motorsport Games | |

| Twitch: traxiongg | |

| Reddit: traxiongg |

The contents of these websites and social media channels are not part of, nor will they be incorporated by reference into, this press release.

Investors:

Ashley DeSimone

Ashley.Desimone@icrinc.com

Press:

ASTRSK PR

motorsportgames@astrskpr.com

Will the Chinese Yuan Disrupt US Dollar Investments and Cause Inflation

Image Credit: Image: Frankieleon (Flickr)

A Changing Dollar Value Impacts Investment Returns and US Inflation

In his upcoming book, “Bonfire of the Sanities,” author and investment advisor David Wright warns that “actions have consequences” and that the move toward electric vehicles and the progression to eliminate reliance on fossil fuels could weaken the US dollar. In recent weeks his warnings are heightened by reports that China has been in discussions with Saudi Arabia to price barrels of oil in something other than dollars, in this case, the Chinese Yuan. If successful, how would US dollar-denominated investments fare?

Background

When the US took its currency off the gold

standard in the 1970s, it negotiated to tie greenbacks to energy in that most oil around the globe is bought and sold in US dollars. This, in effect, made dollars backed by oil, (petrodollars) and added constant demand for greenbacks which helped its strength relative to other currencies.

When the US imposed sanctions on Russian foreign currency holdings, the power and risks of relying on the US currency did not go unnoticed by other nations. China as reported recently took steps to have oil denominated in its own currency, the Yuan, which would likely add to higher demand for the Yuan while reducing demand for dollars. If China’s Yuan is “upgraded” in the world, it could in effect be seen as a downgrade to the US dollar. It could also cause a devaluation that translates into more inflationary

pressures and a reduced desire to own US assets, including stocks. Imports, especially from China could cost more.

Further impacting the dollar’s dominance, in recent weeks, Russia and India entered talks to enact a Ruble/Rupee exchange ledger for transactions. Moscow has also said Europe would have to use Rubles to pay for its natural gas and that it may consider Bitcoin as well. Fewer global transactions are taking place in dollars.

Potential Impact

Baizhu Chen a professor in the Clinical Finance and Business Economics department at the University of Southern California is quoted in Business Insider as saying, “The use of Chinese currency will inevitably expand and play a much bigger role in the world.” Chen explained, “Some countries feel their economies could be held hostage to US policies because the dollar is dominant, and countries want to diversify their risk.” So, while reduced demand for oil could play a role in valuation, current policies that use dollar-denominated finances have caused eyes to open to the risks of not diversifying currency use in financial dealings.

The Yuan has been gaining popularity. Approximately 70 central banks hold some yuan as a reserve currency, while many African and Middle Eastern nations have adopted it for transactions. Central banks, according to the International Monetary Fund (IMF), have been diversifying their holdings, and reducing the dollar’s share of global reserves.

“Were the dollar to lose its status as the world’s reserve currency, it would raise interest rates for our historically large debt relative to the economy,” warned Tomas Philipson, former Acting Chairman for the White House Council of Economic Advisers. This of course causes concern as it would mean US consumers and businesses would face higher borrowing costs along with higher import prices.

Current Status

For now, greenbacks comprise 60% of global reserves versus the yuan’s 2.5%. In global payments, the dollar accounts for 40% while the yuan has about 3%, even though China is the second-largest economy, trailing closely behind the US, Philipson said. That could change, but it would take massive reforms.

A More Competitive Yuan

China would have to open up its market and relax controls, according to Baizhu Chen. He noted that historically, no currency that has had heavy-handed control has become one of the dominant global reserve currencies. China would also need to refrain from currency manipulation. This takes place now in the form of devaluing the yuan to boost exports, according to Chen. This could be facilitated by allowing for an independent central bank with transparent decision-making.

In addition, the yuan must become as stable, reliable, and trustworthy as the dollar. “Countries generally trust that the US isn’t going to screw up. But whether the yuan could be perceived as a store of value — a safe haven during uncertainty or war — that is a much more difficult thing,” Chen said.

The current trend in China has been more control, not less. There have been signs that the government will ease up on its recent tech sector crackdown – the market (Chinese stocks) reacted positively. It’s uncertain whether this will lead toward more easing of control.

Managing Editor, Channelchek

Suggested Reading

Add This to the List of Inflation Drivers

|

Alternative Vehicle Fuel Types

|

Publicly Traded Chinese Companies Duty to Shareholders

|

The Case for More US Produced Uranium

|

Sources

https://www.imf.org/en/Publications/WEO/Issues/2022/01/25/world-economic-outlook-update-january-2022

https://www.imf.org/en/publications/weo

https://wrightfinancialgroup.com/resources/newsletter

Stay up to date. Follow us:

|