Image: Fed Governor Lael Brainard and Fed Chair Jerome Powell

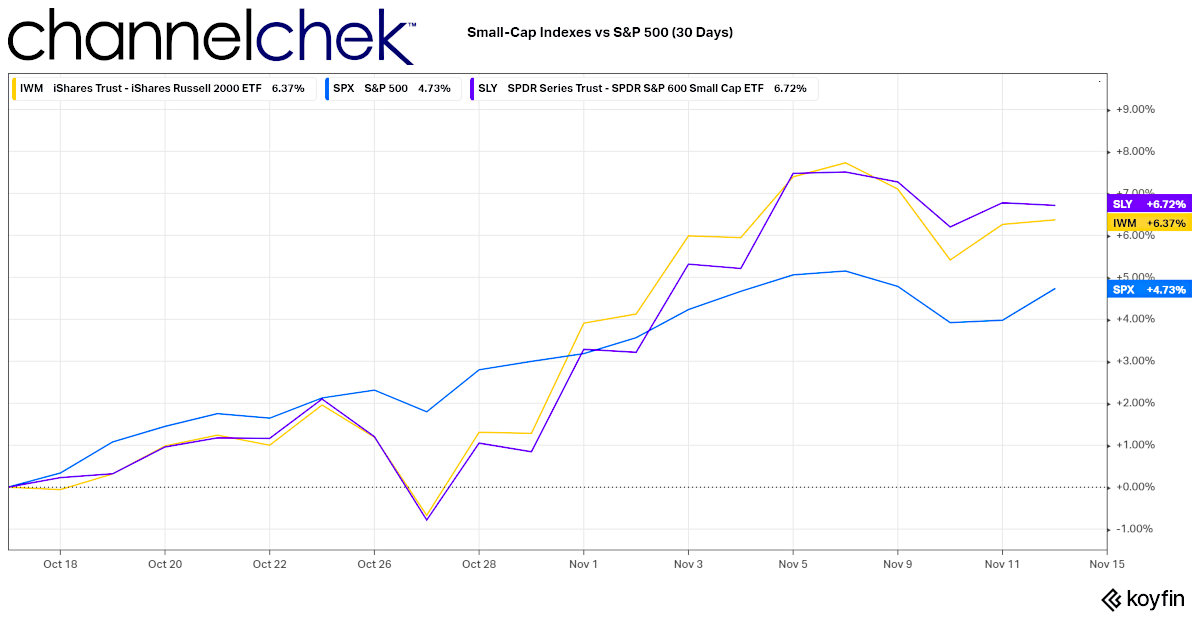

Why Less Gradual Tapering from the Fed is Likely

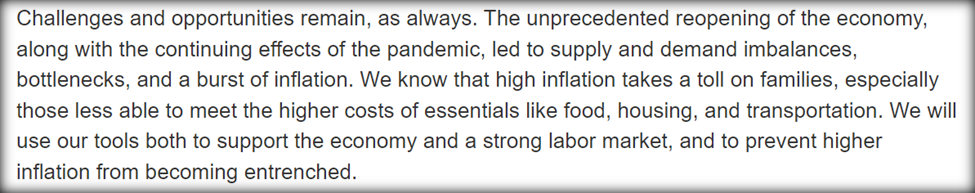

Does the re-nomination of current Fed Chair Jay Powell for a second term, and the nomination to elevate Fed Governor Lael Brainard to Vice-Chair indicate a status quo at the Fed? As it relates to fighting inflation, last month Powell said “we can be patient” in raising rates in order to “allow the labor market to heal.” In both Powell’s and Brainard’s acceptance statements, inflation was brought up as a problem – the familiar words “transitory” or “temporary” were non-existent. Instead, tackling inflation was considered a priority for both.

The Nominations

The President chose to renominate Jerome Powell for a second four-year term as Federal Reserve Chair yesterday (November 22). Fed Governor Lael Brainard was nominated to replace Richard Clarida for the number two position at the Fed. Both candidates now need to be confirmed by the Senate.

Powell was appointed almost four years ago by President Trump. His confirmation is expected to be smooth. Brainard, who had been considered a potential replacement for Powell in the top spot, would likely have faced much more resistance to being confirmed for that position.

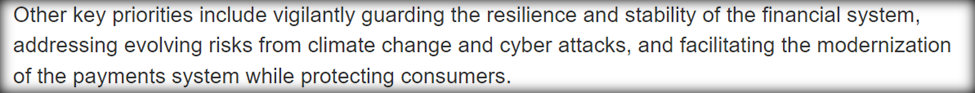

With the future make-up of the Fed largely out of the way, it appears a U-turn on inflation and a more hawkish demeanor could set a new tone at the December 15 Federal Open Market Committee’s (FOMC) meeting.

Evidence the Fed Will Alter Course

Fed Governor Christopher Waller argued in a speech Friday (November 19) that “the rapid improvement in the labor market and the deteriorating inflation data have pushed me towards favoring a faster pace of tapering and a more rapid removal of accommodation in 2022.”

James Bullard, who is a non-voting FOMC member, said, “I think it behooves the committee to go in a more hawkish direction in the next couple of meetings, so we are managing the risk of inflation appropriately.”

Outgoing Vice-Chair Clarida also spoke Friday and suggested that the committee would be best served by a debate about speeding up the currently-planned $15 billion per month taper pace to its asset purchase program at the upcoming meeting.

Lael Brainard lead her acceptance statement with, “I am committed to putting working Americans at the center of my efforts at the Federal Reserve. This means getting inflation down at a time when people are focused on their jobs and how far their paychecks will go.”

The above comments, coupled with the statements released yesterday by the expected ongoing and incoming Fed heads, are evidence the Fed is altering course. While employment will still be a priority, inflation has become a big enough concern to move it to the forefront of the conversation.

Source: Fed Chair Powell’s acceptance statement

The change in tone at the top contrasts sharply with Powell’s declaration last month related to inflation, he said, “we can be patient” in raising rates in order to “allow the labor market to heal,” as total non-farm payrolls remain 3.9 million below their pre-pandemic peak.

Source: Fed Chair Powell’s acceptance statement

Interest Rates

While the Fed debates its next move before the December 15 rate decision, the markets may move before they do. It is not uncommon for the Fed to create an environment where the bond market leads, the Fed then can check for economic fallout, and either matches the bond move or jawbone the bond market back. To date, Powell has said his timeline for rate hikes (Fed Funds) would not begin until after tapering was complete. At the current pace, bond purchases won’t fully end until June 2022.

Stocks and other Assets

Since Powell filled the role of Fed Chair in 2018, the S&P 500 has returned 76% and the Russell Small Cap index 63%. While the Fed’s stated role is not to meddle with stock prices, household wealth, including other assets (real estate, crypto, etc.) impact economic activity which is solidly in their wheelhouse. The four years under Powell have seen the best run-up in stocks since Alan Greenspan.

Will a Powell sequel be as good for asset prices as the first term? What might a swifter-than-expected cessation of near-zero rates and Fed asset purchases mean for asset prices? There are analysts and pundits lined up on both sides of this debate. Common arguments of those that are bearish say inflation shocks will lead to rate shocks. Assets that are vulnerable to higher rates, including real estate and heavily leveraged companies, may not fare well.

For those that see continued stock market growth, they point to the amount of additional money that has been created and circulating within the economy. The U.S. government’s planned spending programs alone are fiscally stimulating, perhaps not at the same degree as in 2020, but certainly by historical standards.

Take-Away

There is a change that is likely coming to monetary policy. Investors are best to stay in touch through sources whose purpose it is to look out for them. Registering for Channelchek

daily emails is one way to receive unique additional information on topics you care about.

Managing Editor, Channelchek

Suggested Reading:

Since 2008, Monetary Policy Has Cost American Savers about $4 Trillion

|

What the Infrastructure Law Does for Investors

|

Was the Inflation of 1982 Like Today’s?

|

Extremely Conservative Investors May Cause Small Companies to Outperform

|

Sources:

https://www.federalreserve.gov/newsevents/pressreleases/other20211122a.htm

https://www.federalreserve.gov/newsevents/pressreleases/other20211122b.htm

https://seekingalpha.com/news/3753290-markets-will-face-a-rates-shock-in-2022-bofa

https://www.grantspub.com/almostDailyHTML.cfm?dcid=964&article=2&email=phoffman%40channelchek%2Ecom

Stay up to date. Follow us:

|

Source:

Source: