Image Credit: Federal Reserve (Flickr)

What’s Going on With the Weakening of the Markets?

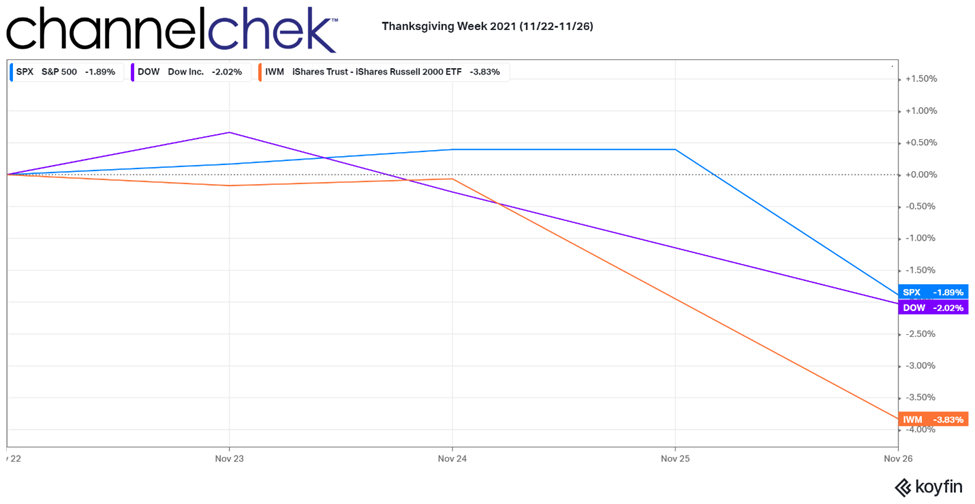

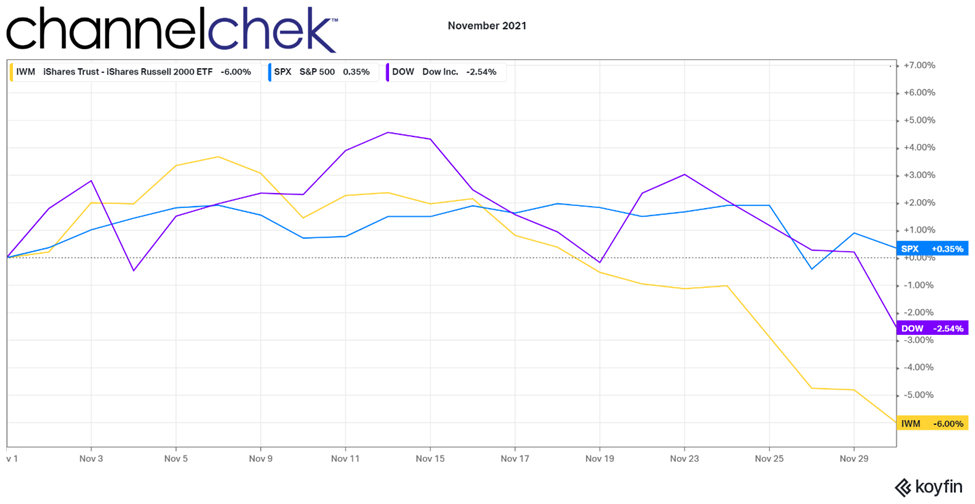

The Consumer Confidence report, ramped-up tapering, the Covid-19 Omicron variant, and debt ceiling issues have all combined to send the stock market and metals markets sharply lower. Investors and traders across many markets seem to be stepping back to assess what all the cross-currents could mean.

Consumer Confidence

U.S. consumers are feeling less confident about their situations than they have since the beginning of the year. The Consumer Conference Board released their November report showing that Consumer Confidence fell 2.1 points to 109.5. Primary drivers for the decrease were concerns about employment and income, rising prices, and to a lesser degree, persistent Covid-19.

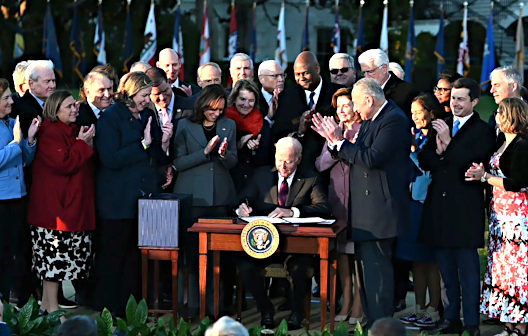

Yellen and Powell Testify

Fed Chair Powell and U.S. Treasury Secretary Yellen testified before the Senate today (November 30). They outlined their thoughts and responded to questions. In their testimony and in response to questions, Janet Yellen spoke of the need to raise the debt ceiling. She implored the Senate to raise the amount of debt permitted by the U.S. government. Yellen explained that failure to deal with the debt limit would “eviscerate” the economic recovery. The U.S. is expected to run out of money to pay its bills by mid-December without Congresses permission to borrow above the current ceiling.

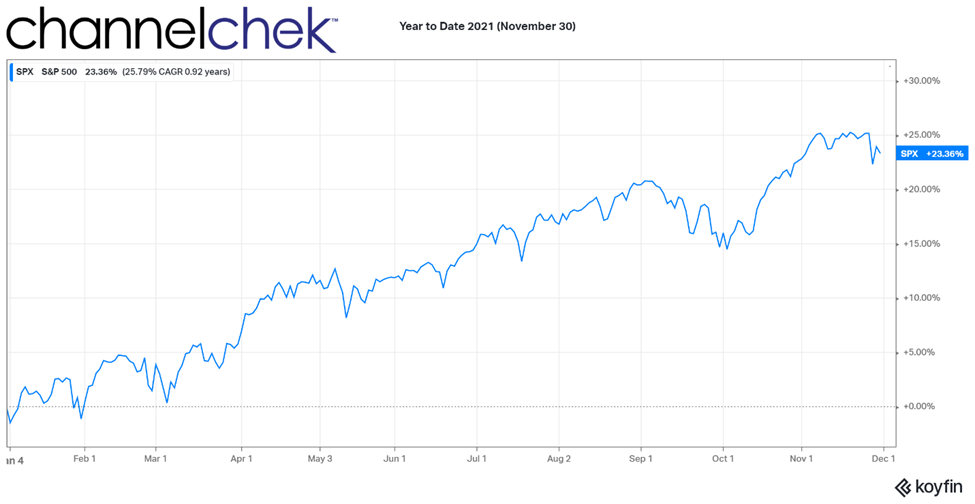

The three major stock market indexes were in the red as the head of the U.S. Treasury and Chairman of the Federal Reserve began to testify. The markets then traded off sharply as the Fed made clear its intent to end the pandemic-era stimulus and indicated the possible need to speed up the process. “At this point, the economy is very strong and inflationary pressures are high, it is therefore appropriate in my view to consider wrapping up the taper of our asset purchases … perhaps a few months sooner,” said Fed Chair Jerome Powell.

Secretary Yellen addressed stablecoins, saying, “I believe that stablecoins can lead to some efficiency in the payments system…,” she later included, “but only if they’re adequately regulated.” The major cryptocurrencies began the day up two or three percent and later traded negative as the testimony shed more light on the Treasury’s intentions. Yellen agreed with Powell that the current economic recovery is strong. But she did have a stern warning for lawmakers. She warned that Congress must take action to address the debt limit by Dec. 15 or the country will not be able to pay its bills. A default on its debts would be the United States’ first in its history and could have a devastating effect on the global economy. “I cannot overstate how critical it is that Congress address this issue,” Yellen said. Putting it more bluntly, Yellen implored, “America must pay its bills on time and in full. If we do not, we will eviscerate our current recovery.”

Omicron was the wild card discussed before the Senate. She said the newly discovered variant could threaten the country’s economic recovery. Also on her list of possible threats were supply shortages and inflation risks.

Markets Reaction

With the news of the decline in Consumer Confidence, the unknowns surrounding Omicron, a faster tapering schedule, and even confirmation of more regulation coming for digital currency, the markets sold off. By 3 pm all the major stock indexes were down 1.6% or more, the gold price fell $7.70 or 0.43% an ounce level, Bitcoin dropped $515 or 0.89%, and crude, which has been moving on covid fears was down 4.86%. Interestingly, despite the Fed’s declining bond purchase amounts, U.S. Treasuries rallied on the news that the Fed would be fighting inflation. The 10 Year U.S. Treasury Note rallied on the news, with its yield dropping to 1.44%.

Take-Away

The Fed is not likely to use the word “transitory” when discussing current inflation. Powell made it clear he intends to attack it while the economic recovery is strong. Yellen for her part wants to make sure the U.S. dollar doesn’t lose its standing in the world, which she says would happen if the debt ceiling is not raised soon. Consumers were also heard today, and they are not as confident as they have been since last Winter.

The latest variant of Covid-19 is making news and is just now being understood. Much will depend on the global reaction to this new threat.

Paul Hoffman

Managing Editor, Channelchek

Suggested Reading:

Sources:

https://www.conference-board.org/data/consumerconfidence.cfm

https://www.prnewswire.com/news-releases/consumer-confidence-declined-in-november-301434044.html

https://www.youtube.com/watch?v=JJxqiyKIEW8

Stay up to date. Follow us: