Image: James St. John (Flickr)

Adding Precious Metal Exposure to Your Portfolio? Gold Royalty Company Considerations

Investors have many options to gain exposure to gold. They may purchase gold bullion, gold coins, gold exchange-traded funds (ETF) and mutual funds, gold mining companies, or gold futures and options. Publicly traded equities of gold producers and royalty companies may offer an attractive way to invest given the disproportionate percentage impact higher commodity prices may have on a company’s bottom line and valuation for a given percentage increase in the commodity itself. While most investors are likely familiar with mining companies and how they operate, royalty companies may be less familiar.

What is a Gold Royalty?

A gold royalty is a contract that gives the owner the right to a percentage of gold production or revenue. Since royalties typically cover the life of a mine, gold royalty companies benefit from the exploration upside that may extend the life of a mine and thus increase the amount of gold or revenue they receive from the mining company at no additional cost.

There are several ways to generate royalties. First, royalty businesses may help finance a development project in exchange for a royalty. Second, a royalty business may purchase existing royalties from third parties, and 3) a royalty company may take a property that they already own, sell it to a mining company, and retain a royalty on the property.

There are several types of royalties. The two most common are NSR and NPI royalties. A net smelter return (NSR) royalty is an agreement where the mining company agrees to pay the royalty owner a percentage of the revenue, less refining and smelting costs. A net profit interest (NPI) royalty entitles the royalty owner to a percentage of the profit from a mine.

A stream is a purchase agreement that provides the owner of the stream, in exchange for an upfront payment, the right to purchase all or a portion of one or more metals produced from a mine at a negotiated price for the life of the agreement. The negotiated price is generally at a significant discount to the spot price.

Royalty Company Advantages

Compared with investing in gold production companies, royalty businesses generally benefit from low overhead costs, geographically diversified asset portfolios, and exposure to multiple operators. Additionally, they avoid costly exploration expense which is borne by operators while sharing the benefit and upside of exploration investment in properties where they retain a royalty interest. Like mining companies, royalty businesses offer greater leverage to changes in gold prices than investing in bullion. Lastly, royalty businesses generally seek to build portfolios of producing royalties that support dividend payments to shareholders.

Investors in gold royalty companies understand that revenues increase with rising gold prices, increasing production on its royalty properties, and a growing royalty portfolio, while costs remain relatively fixed and stable. These various scenarios position royalty companies to thrive in good markets and weather more challenging sets of circumstances.

As a royalty company grows, it offers the potential for multiple expansion, dividend payments, and the ability to execute larger transactions which could accelerate its growth. Junior royalty companies generally perform well in their early years since they can grow rapidly based on an increasing capacity to transact larger deals. Additionally, junior royalty companies may become attractive acquisition candidates for a larger royalty company seeking to enlarge its royalty portfolio.

Investor Considerations

It is important for investors to keep several factors in mind when conducting due diligence on prospective royalty company investments. These include: 1) management, 2) asset portfolio, 3) asset quality, 4) jurisdiction, and 5) valuation.

Management – Should you bet on the horse or the jockey? It is important to evaluate management’s history and track record of creating value for shareholders. Does the management team reflect a balance of technical, financial, legal, and capital markets expertise? Is the board of directors comprised mostly of independent directors who provide a diversity of relevant experience and perspectives? Do they articulate clear objectives, and is their business model sound? Most importantly, do they focus on areas they know and employ a disciplined growth strategy, or are they seeking growth at any price?

Asset Portfolio – How is the company’s asset portfolio balanced between royalties that are producing cash flow streams versus royalties that are expected to produce cash flow within five years and/or longer?

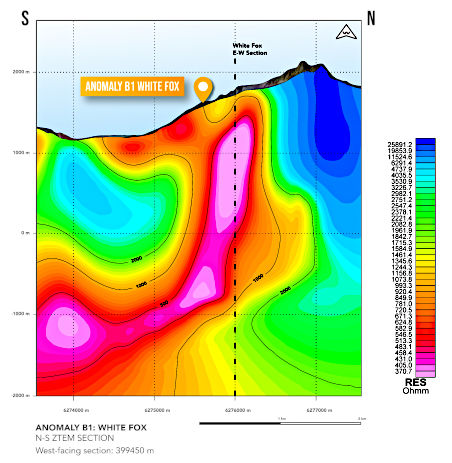

Asset Quality – Because royalty companies have little control over the decisions of the mining companies that control the properties on which the royalty interest is held, it is important for investors to evaluate the operators associated with the properties in the royalty portfolio. Are they well-capitalized major mining companies or small start-ups? Additionally, it is helpful to evaluate mineral resource estimates associated with properties in the portfolio and the operators’ plans for development.

Jurisdiction – While geographic diversity is a selling point for most royalty companies, it is often helpful to consult the Fraser Institute’s Annual Survey of Mining Companies to check if royalty interests are in favorable mining jurisdictions versus high-risk areas.

Valuation – Royalty companies are often valued based on price to net asset value. Net asset value is the net present value (NPV) or discounted cash flow (DCF) of all future cash flow of a mining asset, less any debt plus cash. Price to net asset value is the company’s market capitalization divided by the net present value of all mining assets minus net debt. For those that pay a dividend, investors may also compare dividend growth rates and yield. Larger companies generally trade at higher valuation multiples which generally increase with scale due to lower perceived risk due to greater asset diversification and a proven track record of growth. As royalty companies grow, they may be able to establish and grow dividends to shareholders, offer greater liquidity due to listings on major exchanges, and benefit from broader research. Some may also benefit from their inclusion in stock indices. For those that pay a dividend, it is important to know whether the dividend is paid from operating cash flow or whether the company is borrowing to pay the dividend.

Take-Away

Just as with other classes of equities, mining royalty company investing has categories and nuances within those categories that separate one from the other. Investors should be mindful of each of these and find respected sources of information on the particular names they are considering. Channelchek can be a goldmine of information when searching for companies, understanding their business, and looking at their numbers.

Suggested Reading

Will the Fed Push Gold and Crypto Up by Raising its Inflation Target?

|

Why Poison Pills Have Been Effective at Warding off Unsolicited Offers

|

April 20 Growing as a Day of Cannabis Recognition

|

What Media Experts Expect from the Metaverse

|

Sources

4 Reasons Why We Believe in Royalty Companies

How Precious Metals Royalty and Streaming Companies Create Value

Streaming & Royalty Companies: Mutually Beneficial Arrangements for Everyone, including Investors

Stay up to date. Follow us:

|