Vectrus Shareholders Approve Combination with Vertex

Research, News, and Market Data on Vectrus

Following Transaction Close, Newly

Combined Company Will be Renamed V2X, Inc.; to Trade on NYSE under New Ticker:

VVX

COLORADO SPRINGS, Colo., June 15, 2022 /PRNewswire/ — Vectrus, Inc. (NYSE: VEC) today announced that based on voting results from the Special Meeting of Shareholders held today, Vectrus shareholders voted to approve the combination with Vertex. Following the close of the transaction, the combined company will be renamed V2X, Inc, and its common stock will trade on the NYSE under a new ticker symbol, “VVX”.

“Today’s overwhelming approval marks a significant step toward completing our merger with Vertex, and creating one of the leading providers of critical mission solutions and support to defense clients globally,” said Chuck Prow, Chief Executive Officer of Vectrus. “Vectrus and Vertex – together as V2X – will be better positioned to meet the mission-essential needs of our clients while delivering cost efficiencies, increased security and resiliency, with more strategic use of resources. We thank all of our stakeholders for their continued support and look forward to completing the pending combination so we can begin unlocking the incredible potential of our combined platform.”

As previously announced, under the terms of the merger agreement, Vertex shareholders will own approximately 62% of the combined company on a fully diluted basis, while Vectrus shareholders will own approximately 38%. The merger is expected to close early in the third quarter of 2022, and remains subject to satisfaction of customary closing conditions, including receipt of regulatory approvals.

The final voting results will be reported in a Current Report on Form 8-K to be filed with the Securities and Exchange Commission after certification by Vectrus’ inspector of elections.

About Vectrus

For more than 70 years, Vectrus has provided critical mission support for our customers’ toughest operational challenges. As a high-performing organization with exceptional talent, deep domain knowledge, a history of long-term customer relationships, and groundbreaking technical expertise, we deliver innovative, mission-matched solutions for our military and government customers worldwide. Whether it’s base operations support, supply chain and logistics, IT mission support, engineering and digital integration, security, or maintenance, repair, and overhaul, our customers count on us for on-target solutions that increase efficiency, reduce costs, improve readiness, and strengthen national security. Vectrus is headquartered in Colorado Springs, Colo., and includes about 8,100 employees spanning 205 locations in 28 countries. In 2021, Vectrus generated sales of approximately $1.8 billion. For more information, visit the company’s website at www.vectrus.com or connect with Vectrus on Facebook, Twitter, and LinkedIn.

FORWARD-LOOKING STATEMENTS

Certain material presented in this press release includes forward-looking statements intended to qualify for the safe harbor from liability established by the Act. These forward-looking statements include, but are not limited to, conditions to the closing of the Transaction may not be satisfied; the possibility that anticipated benefits of the Transaction may not be realized or may take longer to realize than expected; the possibility that costs related to Vectrus’s integration of Vertex’s operations may be greater than expected and/or that revenues following the Transaction may be lower than expected; Vectrus’s business may suffer as a result of uncertainty surrounding the Transaction and disruption of management’s attention due to the Transaction; the outcome of any legal proceedings that are related to the Transaction; Vectrus may be adversely affected by other economic, business, and/or competitive factors; the risk that Vectrus may be unable to obtain governmental and regulatory approvals required for the Transaction, or that required governmental and regulatory approvals may delay the Transaction or result in the imposition of conditions that could reduce the anticipated benefits from the Transaction or cause the parties to abandon the Transaction; the impact of legislative, regulatory, competitive and technological changes; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; the effect of the Transaction on the ability of Vectrus to retain and maintain relationships with both Vectrus’s and Vertex’s customers, including the U.S. Government; other risks to the consummation of the mergers, including the risk that the mergers will not be consummated within the expected time period or at all; responses from customers and competitors to the Transaction; the risk that the integration of Vertex may distract management from other important matters; results from the Transaction may be different than those anticipated; statements about Vectrus’s 2022 performance outlook, five-year growth plan, revenue, DSO, contract opportunities, the impacts of COVID-19, and any discussion of future operating or financial performance.

Whenever used, words such as “may,” “are considering,” “will,” “likely,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “could,” “potential,” “continue,” “goal” or similar terminology are forward-looking statements. These statements are based on the beliefs and assumptions of our management based on information currently available to management.

These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside our management’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. For a discussion of some of the risks and important factors that could cause actual results to differ from such forward-looking statements, see the risks and other factors detailed from time to time in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and other filings with the U.S. Securities and Exchange Commission.

Vectrus undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Contact Information

Mike Smith, CFA

michael.smith@vectrus.com

(719) 637-5773

Or

Jim Golden / Scott Bisang / Tim Ragones

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449

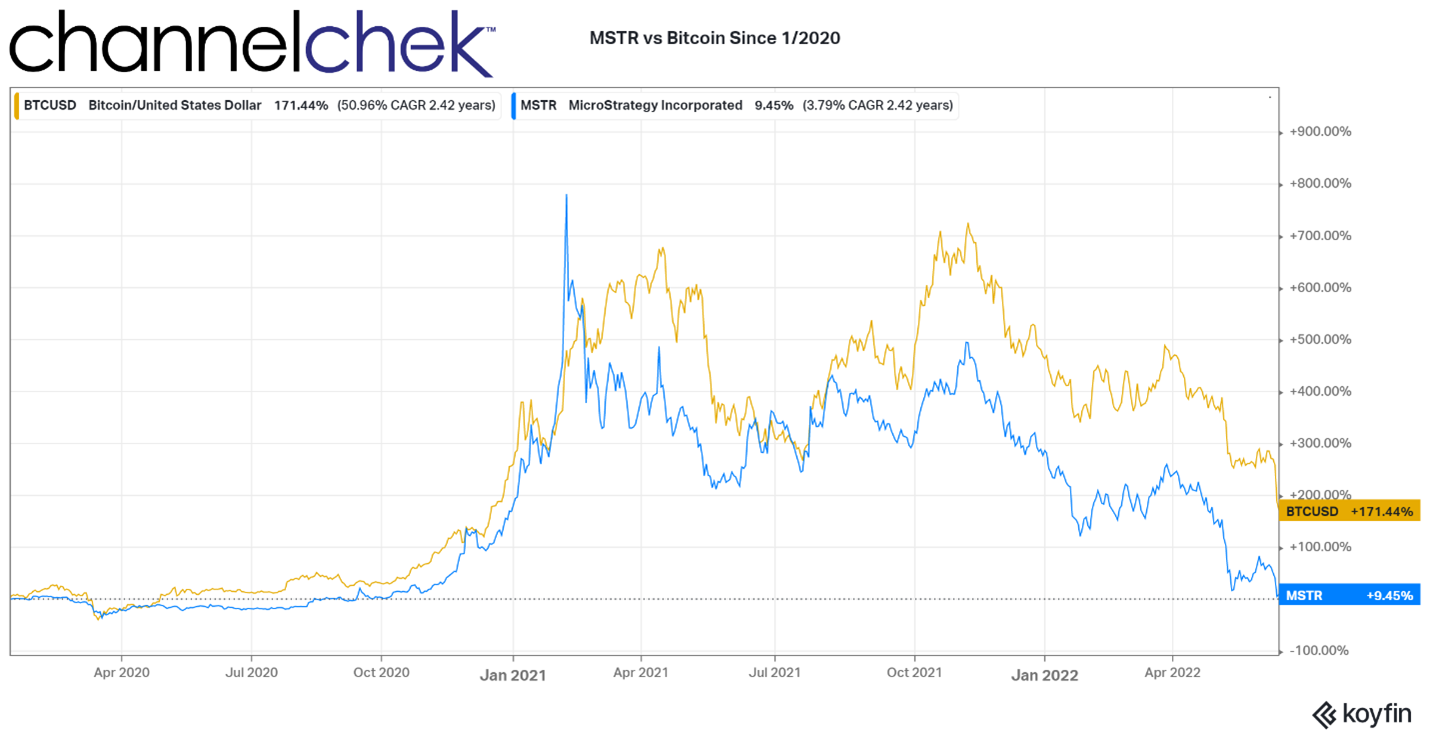

Let’s discuss the author’s credentials. No one had ever heard of Satoshi Nakamoto when it was published. Even today, no one can identify this person. It is unknown whether the theory was created by a group of people, one person, or even a government entity. It is a mystery that remains unsolved. Does that sound like something worth investing $1,000 or more in?

Let’s discuss the author’s credentials. No one had ever heard of Satoshi Nakamoto when it was published. Even today, no one can identify this person. It is unknown whether the theory was created by a group of people, one person, or even a government entity. It is a mystery that remains unsolved. Does that sound like something worth investing $1,000 or more in?