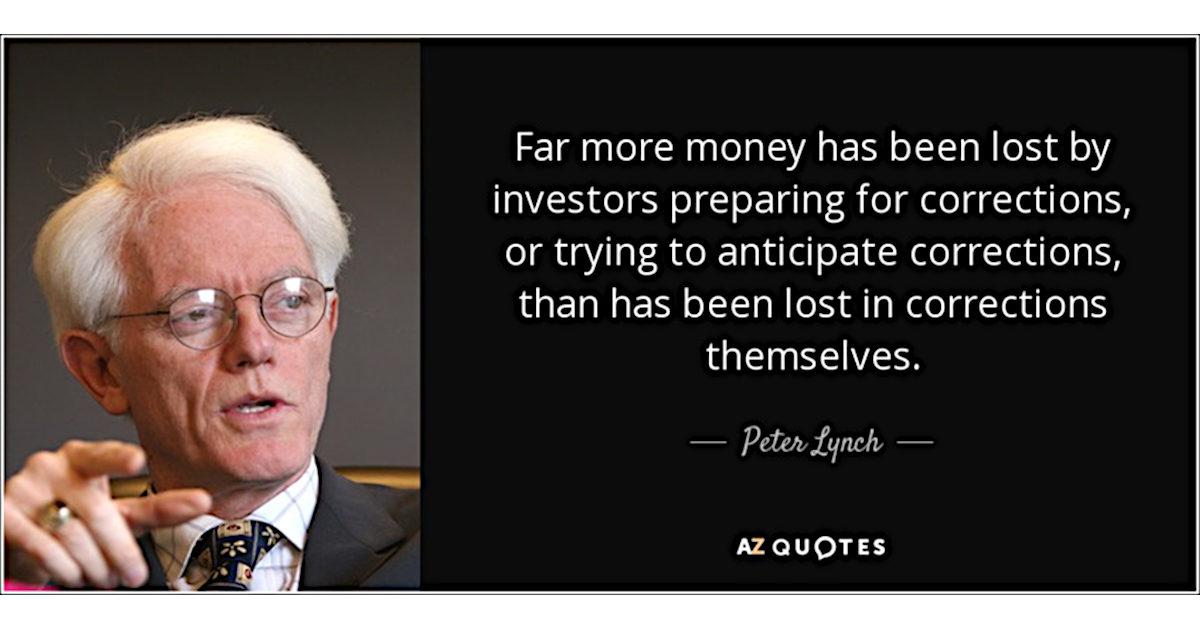

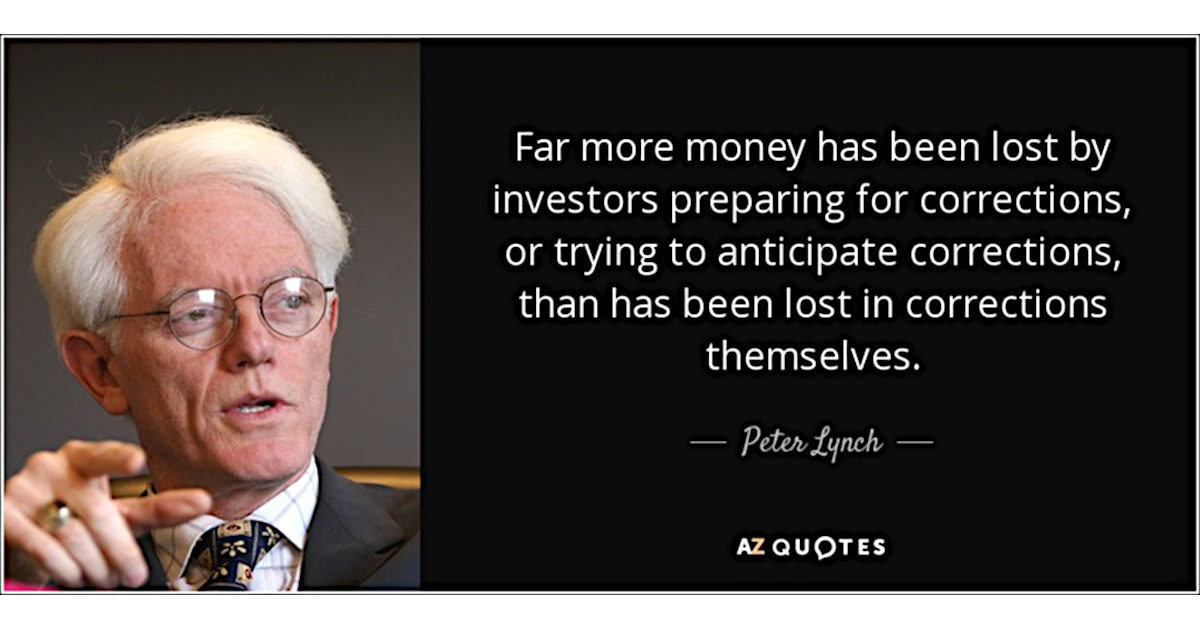

Image Source: AZ Quotes

Peter Lynch Opens Up About His Views on Index Funds and ETFs

Back when investors regularly read the Wall Street Journal, perused the business section of the New York Times, and on Friday evenings poured themselves a wine cooler, then got up and changed the channel to PBS to watch Wall Street Week with Luis Rukeyser, they would also do something else. Investors would hang on every word coming out of the mouth of Peter Lynch.

This made sense as Peter Lynch’s performance credentials spanned over a decade and are still quite impressive.

Lynch managed the best-performing mutual fund in the world. As the manager of Fidelity’s Magellan Fund (1977-1990), Lynch averaged a 29.2% annual return. To put this in perspective, he consistently outperformed the S&P 500 by a factor of two. In a world not yet filled with 24-hour business news, YouTube influencers, Reddit rebels, or Stocktwit memefluencers, there was much less information bombarding individual investors. We sought information out; and when we did, we looked toward successful people whose wisdom we tried to absorb.

Despite now having many more people jumping at us with advice in the 2020s, we have very few universally accepted, undeniable oracles whose wisdom is quoted on professional trading floors just as much as at neighborhood holiday parties.

In a rare radio interview last week, Peter Lynch spoke with Bloomberg. He had a message for investors it was a familiar message to those who follow the advice and trading of more recent “oracle” Michael Burry.

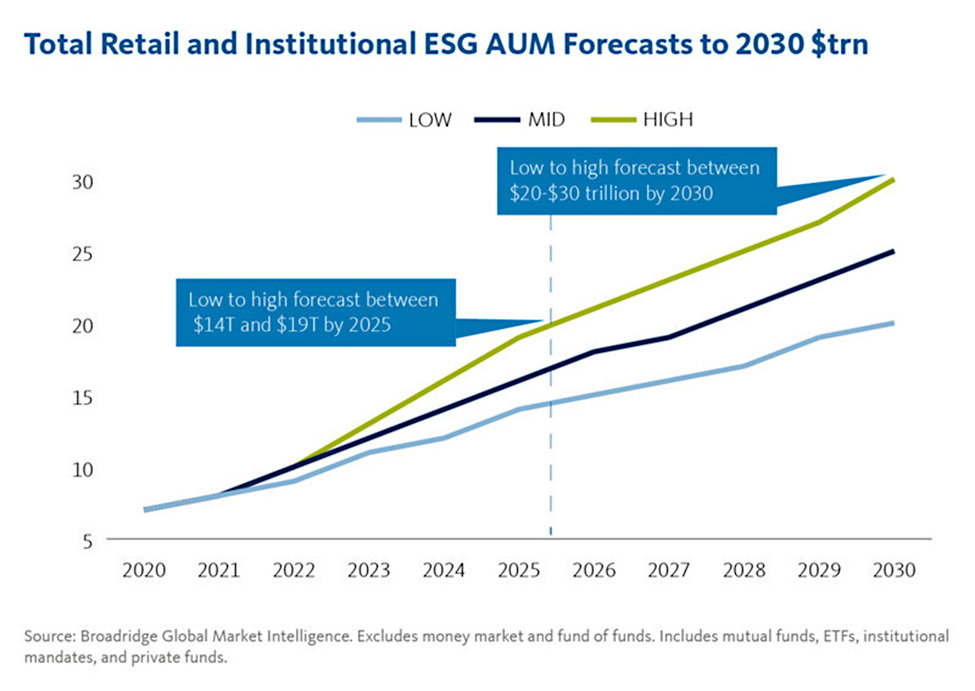

Lynch said that passive investors are missing out on market-beating returns. He was critical of the normalization of investing in indexes rather than stock-picking. He warned buyers of index funds and index ETFs are “missing out on superior returns.” This echoed the ongoing warnings of Burry, who also cautions the result of this trend could be disastrous. Burry is on record as expressing that the passive-investing trend is hurting small value stocks and shareholder activism.

During the Lynch interview, he can be heard saying, “This move to passive is a mistake.” He also said, “People are missing the boat,” noting that he expects the best active managers to consistently trounce the “markets” performance.

While Burry’s comments were also in a Bloomberg interview, these were back in the Fall of 2019. At the time, the hedge fund manager, best known for having shorted the mortgage market in 2008, observed the growing trend was pulling dollars away from smaller, undervalued securities around the world. “There is all this opportunity, but so few active managers looking to take advantage,” according to Burry.

Burry reiterated his position recently in a September Tweet. In it, he warned the flood of millennial money into index funds, and ETFs was fueling unsustainable valuations and putting the stock market in a precarious position. “Parabolas don’t resolve sideways,” he said.

Getting back to Peter Lynch, the market doesn’t have to wait and see if he is correct, he brought proof to his interview that active management can excel. Referencing a few Fidelity funds, he offered proof, “Our active guys have beat the market for 10, 20, 30 years, and I think they’ll keep doing it.” He named names and particular funds that are among actively managed funds that consistently beat the indexes.

The 77-year-old Lynch works part-time as Co-Chairman at Fidelity Management and Research Co. He mentors young analysts and focuses on his philanthropy, including giving through his charitable foundation. He retired from Fidelity at 46 years of age.

He said he doesn’t concern himself with whether a stock-picker is going to overshadow his remarkable history. In his words, “I don’t keep score, I’ve got ten grandchildren, just had number ten six weeks ago. That’s what I keep score on,” Lynch

Paul Hoffman

Managing Editor, Channelchek

Suggested Reading:

Sources:

https://www.bloomberg.com/news/articles/2021-12-07/peter-lynch-says-all-in-on-passive-investing-is-all-wrong

www.bloombergquint.com

https://markets.businessinsider.com/news/stocks/big-short-michael-burry-stock-market-federal-reserve-big-tech-2021-9?utm_medium=ingest&utm_source=markets

https://markets.businessinsider.com/news/stocks/peter-lynch-warren-buffett-passive-investing-index-funds-active-management-2021-12?utm_medium=ingest&utm_source=markets

Stay up to date. Follow us: