Palladium One Announces Mineral Resource Estimate for the LK PGE-Cu-Ni Project

Research, News, and Market Data on Palladium One Mining

1.1 Million Ounces Total Precious Metals, 111 Million Pounds Copper, 92 Million Pounds Nickel and 5 Million Pounds Cobalt in Indicated AND 1.1 million Ounces Total Precious Metals, 173 Million Pounds Copper, 152 Million Pounds Nickel and 8 Million Pounds Cobalt in Inferred

Toronto, Ontario–(Newsfile Corp. – April 25, 2022) – Palladium One Mining Inc. (TSXV: PDM) (OTCQB: NKORF) (FSE: 7N11) (the “Company” or “Palladium One“) is pleased to announce an updated Indicated and Inferred Mineral Resource Estimate (“MRE”) prepared the Company under the supervision of SLR Consulting (Canada) Ltd. (formerly Roscoe, Postle Associates Inc.) disclosed in accordance with National Instrument 43-101 (“NI43-101”) for the 100%-owned Läntinen Koillismaa (“LK”) Project in north-central Finland (Figure 1).

“We are pleased to report important milestones that measurably de-risk our LK PGE-Cu-Ni Project in Finland. Namely, a) a maiden Mineral Resource Estimate at Kaukua South and Murtolampi which increases the Kaukua Area’s indicated resources tonnes by approximately 250%; b) advanced metallurgical testing conducted by SGS (Lakefield) which demonstrates consistently repeatable metallurgical recoveries; and c) the ability to produce both a high-value copper and nickel concentrate using a conventional flotation recovery process.

“These milestones substantially improve the economic potential by confirming scale and by delivering clarity of recovery rates for various rock types.

“With a grade of 30% copper in the copper concentrate and a value of approximately US$4,200 per tonne for the nickel concentrate, both are highly marketable, which bodes well for future concentrate marketing negotiations.

“While continued exploration in 2022 to increase the size of LK is ongoing, we have accelerated baseline environmental studies and plan to advance a Preliminary Economic Assessment (“PEA”).

“The bulk of 2022’s exploration efforts are expected to be in Canada and directed to the award winning Tyko Ni-Cu Project. Once drill permits are received, we plan to drill test several multi-line VTEM anomalies where highly anomalous soil sample values of copper nickel and cobalt were discovered in 2021. To date, additional drill permits have not been received,” commented Derrick Weyrauch, President and CEO.

Highlights

In addition to the Mineral Resource Estimate (“MRE”) which used US$1,700/oz palladium (Table 1a, 2b), a sensitivity analysis was completed with seven optimized open-pit constrained resource estimates, with palladium prices ranging from US$900/oz to US$2,500/oz (Table 2a, 2b).

Mineral Resource Estimate

- 1.1 million ounces Total Precious Metals (Pd+Pt+Au) (“TMP”) (0.89 g/t), 111 Million Pounds Copper (0.13%), 92 Million Pounds Nickel (0.11%) and 5 million Pounds Cobalt (65 g/t) are classified as Indicated, contained in 38.2 million tonnes (see Table 1b).

- 1.1 million ounces TMP (0.68 g/t), 173 Million Pounds Copper (0.16%), 152 Million Pounds Nickel (0.14%) and 8 million Pounds Cobalt (74 g/t) are classified as Inferred, contained in 49.7 million tonnes (see Table 1b).

- 248% increase in Indicated tonnes and a 14% increase in Inferred tonnes.

- 44% of the MRE is in the Indicated category.

- A waste to ore ratio (“Strip Ratio”) of 1.48:1 in the Kaukua Area (including Murtolampi) and a 0.58:1 Strip Ratio at Haukiaho.

- The MRE assumes a Net Smelter Return (“NSR”) cut-off of US$12.50 per tonne, based on a 20,000 tonne per day milling rate.

- Includes three open-pits in the Kaukua Area (including Murtolampi) and one at Haukiaho, 10-kilometers to the south of Kaukua.

- Recovered, and payable metal assumptions are based on the 2022 Phase II Metallurgical Testing Program, and preliminary indicative copper and nickel smelter quotes.

Future Resource Expansion

- LK remains open for additional resource expansion both along strike and at depth.

- The MRE covers approximately 5 kilometers of the 38-kilometer marginal series contact zone, for which reconnaissance historical drilling indicated mineralization along nearly it’s entire length.

- The Company’s near-term targeting includes two additional open-pit targets in the Kaukua Area and possibly multiple open-pit targets along the 17-kilometer Haukiaho Trend.

- Three areas of Target Potential have been defined for near term resource expansion representing an additional 2.4-kilometer of strike length along the favourable marginal series and could add between 21.6 million and 36.0 million tonnes of resource. Refer to Table 3, Figures 4 & 5.

2022 Phase II Metallurgical Testing Program

- The Phase II Metallurgical Testing Program demonstrates the ability to produce BOTH a high-value copper AND a high-value nickel concentrate (“Con”) utilizing conventional 3-stage flotation.

- The Cons were readily and consistently reproduced.

- Locked Cycle Test results:

- Locked Cycle Bulk Concentrate recoveries: 73.5% Pd, 56.1% Pt, 73.0% Au, 88.6% Cu, 30.3% Ni, and 18.6% Co (Table 5).

- Copper Concentrate: Grades of 30.0% Cu, 1.43% Ni, 0.1% Co, 38.3 g/t Pd, 13.1 g/t Pt, 11.2 g/t Au representing a value of US$6,300 per tonne of concentrate (Table 6).

- Nickel Concentrate: Grades of 4.8% Ni, 3.9% Cu, 0.2% Co, 40.8 g/t Pd, 11.0 g/t Pt, 2.9 g/t Au representing a value of US$4,200 per tonne of concentrate.

- Rhodium values up to 1.7 g/t and 1.0 g/t were reported in both the Nickel and Copper Concentrates respectively, while the MRE does not include rhodium values.

- Fortunately, both Cons are high in iron and sulfur and low in MgO, thereby improving marketability.

- A low mass pull of 1.2% was achieved, thereby suggestive of low transportation charges.

Other

- In aggregate, there is 38 million tonnes of Indicated and 50 million tonnes of inferred in resources, thereby providing the opportunity for a large tonnage long-life mine to be developed.

- The LK project has excellent infrastructure with paved roads, power, skilled labour and is less than 180 kilometers from the port of Oulu, thereby providing the opportunity for reduced initial capital cost estimates.

Mineral Resource Estimate:

Table 1a. 2022 LK MRE

| MINERAL RESOURCE ESTIMATE – April 2022 | |||||||||

| Tonnes & Grade – US$1,700 Pd per oz | |||||||||

| Strip Ratio | Tonnes (Mt) | Pd | Pt | Au | TPM | Cu | Ni | Co | |

| (g/t) | (g/t) | (g/t) | (g/t) | (%) | (%) | (g/t) | |||

| Indicated | |||||||||

| Kaukua Area | 1.50 | 38.2 | 0.61 | 0.22 | 0.07 | 0.89 | 0.13 | 0.11 | 64.56 |

| Inferred | |||||||||

| Kaukua Area +Murtolampi | 1.45 | 30.8 | 0.52 | 0.20 | 0.08 | 0.80 | 0.14 | 0.14 | 86.07 |

| Haukiaho | 0.58 | 18.9 | 0.27 | 0.11 | 0.10 | 0.48 | 0.18 | 0.14 | 54.30 |

| Total Inf. | 1.26 | 49.7 | 0.43 | 0.17 | 0.09 | 0.68 | 0.16 | 0.14 | 73.98 |

Table 1b: 2022 LK MRE In-situ contained metal

| MINERAL RESOURCE ESTIMATE – April 2022 | ||||||||

| Contained Metal – US$1,700 Pd per oz | ||||||||

| Strip | Pd | Pt | Au | TPM | Cu | Ni | Co | |

| Ratio | (M oz) | (M oz) | (M oz) | (M oz) | (M lbs) | (M lbs) | (M lbs) | |

| Indicated | ||||||||

| Kaukua Area | 1.50 | 0.74 | 0.26 | 0.08 | 1.09 | 110.7 | 91.6 | 5.4 |

| Inferred | ||||||||

| Kaukua Area +Murtolampi | 1.45 | 0.52 | 0.20 | 0.07 | 0.79 | 96.5 | 93.9 | 5.8 |

| Haukiaho | 0.58 | 0.16 | 0.07 | 0.06 | 0.29 | 76.4 | 57.5 | 2.3 |

| Total Inf. | 1.26 | 0.68 | 0.26 | 0.14 | 1.08 | 172.9 | 151.5 | 8.1 |

Notes

- CIM (2014) definitions were followed for Mineral Resources.

- The Mineral Resources have been reported above a preliminary open pit constraining surface using a Net Smelter Return (NSR) pit discard cut-off of US$12.5/t (which for comparison purposes equates to an approximately 0.65 g/t Palladium Equivalent in-situ cut-off, based on metal prices only).

- The NSR used for reporting is based on the following:

- Long term metal prices of US$ 1,700/oz Pd, US$ 1,100/oz Pt, US$ 1,800/oz Au, US$ 4.25/lb Cu, US$ 8.50/lb Ni and US$ 25/lb Co.

- Variable metallurgical recoveries for each metal were used at Kaukua and Murtolampi and fixed recoveries of 79.8% Pd, 80.1% Pt, 65% Au, 89% Cu, 64% Ni and 0% Co at Haukiaho.

- Commercial terms for a Cu and Ni concentrate based on indicative quotations from smelters.

- Total Precious Metals (TPM) equals palladium plus platinum plus gold.

- Bulk densities range between 1.8 and 3.23 t/m3.

- Numbers may not add up due to rounding.

- Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- The quantity and grade of reported inferred resources in this estimation are conceptual in nature and there has been insufficient exploration to define these inferred resources as an indicated or measured mineral resource and it is uncertain if further exploration will result in upgrading them to an indicated or measured mineral resource category.

Palladium Equivalent (PdEq)

Palladium equivalent (“PdEq”) is calculated using US$1,700 per ounce for palladium, US$1,100 per ounce for platinum, US$1,800 per ounce for gold, US$4.25 per pound for copper, US$8.50 per pound for nickel, and $25 per pound cobalt consistent with the calculation used in the Company’s current Mineral Resource Estimate for the LK project. PdEq was used for wireframe construction and metallurgical test work only, and does not include metallurgical recoveries or smelter terms, and was not used for generation of the conceptual pit shells or Mineral Resource reporting. The Mineral Resource tabulation is based on a unit NSR value which includes metal prices, metallurgical recoveries and contract terms for Ni and Cu concentrates.

Mineral Resource Estimation Methodology

The Kaukua/Murtolampti drillhole database comprises 210 drillholes for a total of 44 km drilling. The Haukiaho drillhole database comprises a further 84 drillholes for a total of 13,392.3 m drilling . An updated 3D geological model has been constructed using Leapfrog software version (Figure 4).

Kaukua

For Kaukua, Key lithological units modelled include the basement gabbro and granodiorite as well as the intrusive or Marginal Series pyroxenite, peridotite and gabbronorite units. Major controlling structures have been used to split the deposit into three zones with subsidiary faults, major stratigraphic units, diabase dykes and the overburden modelled within these four zones. Faults outline the Pit, Gap and South Zones (sub-domains of the Kaukua deposit). A topographic surface has been generated using Lidar data.

Grade shells have been modelled at 0.3 g/t and 0.6 g/t PdEq thresholds using the vein system modelling in Leapfrog Geo within the geological constraints as determined.

Capping was completed on assays prior to compositing. A composite length of 6 m has been used, with the composites within each mineralized domain assessed for the need to apply grade caps. Continuity analysis (variography) has been completed on the composited samples within the various mineralization domains with the resultant variograms checked against the mineralization domain to ensure geological consistency.

A block model has been constructed in Hexagon Minesight software using a 6 m (X) by 6 m (Y) by 6 m (Z) block size. No sub-celling or rotation of the block model has been undertaken.

The block model has been coded by lithology and mineralization domain for each element. The later, cross-cutting diabase dykes and overburden have been coded into the block model with the grades for Pd, Pt, Cu, Ni, Co and Au set to background values in the block model.

The estimation of grade has been undertaken in two interpolation passes using ordinary kriging, with the 0.6 g/t PdEq mineralization wireframes used as firm-boundaries during the estimation. Dynamic anisotropy was used to accommodate local changes in dip and strike of the mineralization. Each subsequent interpolation pass has used an increased search ellipse size and a decrease in the minimum number of samples required:

- Pass 1 estimations have been undertaken using a minimum of three and a maximum of 8 composites into a 120 m x 120 m x 60 m search ellipse, with a maximum of 2 composites per drillhole,

- Pass 2 estimations have been undertaken using a minimum of one and a maximum of 8 composites into a 200 m x 200 m x 60 m search ellipse, with a maximum of one composite per drillhole,

Final grade estimates for Pd, Pt, Ni, Cu, Co and Au have been validated by statistical analysis and visual comparison to the input drillhole composite data. The estimated Pd, Pt, Cu, Ni, Co and Au grades validate within acceptable limits to the input declustered composite grades. Therefore, the block model accurately reproduces the input grades at a global scale. Swath plots show that there are negligible local biases. Change of support validation shows that the kriged model grades contain a suitable amount of internal dilution for the anticipated mining selectivity.

Blocks were classified as Indicated and Inferred in accordance with CIM Definition Standards 2014. Blocks were classified to the Inferred category if the block fell within 80 m of a composite. Indicated category blocks were classified using a drill-spacing of 50 x 50 m in the Pit area and 100 x 50 m in the South area.

Murtolampi

A grade shell has been modelled at a 0.3 g/t PdEq threshold using the vein system modelling in Leapfrog Geo within the geological constraints as determined.

Capping was completed on assays prior to compositing. A composite length of 6 m has been used, with the composites within each mineralized domain assessed for the need to apply grade caps. The variogram modelled for Kaukua was used at Murtolampti as there are an insufficient number of composites to model a robust variogram.

A block model has been constructed in Hexagon Mineplan software using a 6 m (X) by 6 m (Y) by 6 m (Z) block size. No sub-celling or rotation of the block model has been undertaken.

The block model has been coded by lithology and mineralization domain for each estimation of grade has been undertaken in two interpolation passes.

The estimation of grade has been undertaken in two interpolation passes using ordinary kriging. Anisotropy directions were selected based on the geometry of the mineralization. Each subsequent interpolation pass has used an increased search ellipse size and a decrease in the minimum number of samples required:

- Pass 1 estimations have been undertaken using a minimum of three and a maximum of 8 composites into a 120 m x 120 m x 60 m search ellipse, with a maximum of 2 composites per drillhole,

- Pass 2 estimations have been undertaken using a minimum of one and a maximum of 8 composites into a 200 m x 200 m x 60 m search ellipse, with a maximum of one composite per drillhole,

Final grade estimates for Pd, Pt, Ni, Cu, Co and Au have been validated by statistical analysis and visual comparison to the input drillhole composite data. The estimated Pd, Pt, Cu, Ni, Co and Au grades validate within acceptable limits to the input declustered composite grades. Therefore, the block model accurately reproduces the input grades at a global scale. Swath plots show that there are negligible local biases.

Haukiaho

Key lithological units modelled include the basement, gabbro/peridotite/pyroxenite and diabase. A fault divides the mineralization into eastern and western blocks. A topographic surface has been generated using Lidar data.

A grade shell has been modelled at a 0.25 g/t PdEq thresholds using the vein system modelling in Leapfrog Geo within the geological constraints as determined.

Capping was completed on assays prior to compositing. Several historic drillholes are missing Au, Pt and Pd assays. Linear regression (RMA) with high correlation coefficients against Cu and Ni assays has been used to assign Au, Pt and Pd grades to these drillholes. A composite length of 5 m has been used, with the composites within each mineralized domain assessed for the need to apply grade caps.

A block model has been constructed in Hexagon Mineplan software using a 10 m (X) by 10 m (Y) by 10 m (Z) block size. No sub-celling or rotation of the block model has been undertaken.

The block model has been coded by lithology and mineralization domain for each element. The later, cross-cutting diabase dykes and overburden have been coded into the block model with the grades for Pd, Pt, Cu, Ni, Co and Au set to background values in the block model.

The estimation of grade has been undertaken using inverse-distance weighting to the power of three in two interpolation passes, with the 0.25 g/t Pd-equivalent mineralization wireframes used as a hard-boundary during the estimation. Dynamic anisotropy was used to accommodate local changes in dip and strike of the mineralization. Each subsequent interpolation pass has used an increased search ellipse size and a decrease in the minimum number of samples required:

- Pass 1 estimations have been undertaken using a minimum of three and a maximum of 8 composites into a 200 m x 200 m x 50 m search ellipse, with a maximum of 2 composites per drillhole,

- Pass 2 estimations have been undertaken using a minimum of two and a maximum of 8 composites into a 300 m x 300 m x 50 m search ellipse, with a maximum of two composites per drillhole,

Final grade estimates for Pd, Pt, Ni, Cu, Co and Au have been validated by statistical analysis and visual comparison to the input drillhole composite data. The estimated Pd, Pt, Cu, Ni, Co and Au grades validate within acceptable limits to the input declustered composite grades. Therefore, the block model accurately reproduces the input grades at a global scale. Swath plots show that there are negligible local biases. Change of support validation shows that the kriged model grades contain a suitable amount of internal dilution for the anticipated mining selectivity.

Blocks were classified as Inferred in accordance with CIM Definition Standards 2014. Blocks were classified to the Inferred category if the block fell within 120 m of a composite.

Table 2a: 2022 LK MRE Sensitivity to Palladium Price – Grade

| SENSITIVITY TO CUTOFF GRADE – Mineral Resource Estimate – March 2022 | ||||||||||

| Pd Price | Strip | Tonnes (Mt) | Pd | Pt | Au | TPM | Cu | Ni | Co | |

| (US$/oz) | Ratio | (g/t) | (g/t) | (g/t) | (g/t) | (%) | (%) | (g/t) | ||

| $ 900 | 1.69 | 26.8 | 0.67 | 0.24 | 0.08 | 0.98 | 0.14 | 0.12 | 67.9 | |

| Total Indicated | $1,400 | 1.54 | 35.2 | 0.62 | 0.22 | 0.07 | 0.91 | 0.13 | 0.11 | 65.2 |

| $1,600 | 1.51 | 37.3 | 0.61 | 0.22 | 0.07 | 0.90 | 0.13 | 0.11 | 64.8 | |

| $1,700 | 1.50 | 38.2 | 0.61 | 0.22 | 0.07 | 0.89 | 0.13 | 0.11 | 64.6 | |

| $1,800 | 1.48 | 39.1 | 0.60 | 0.21 | 0.07 | 0.88 | 0.13 | 0.11 | 64.4 | |

| $2,000 | 1.54 | 46.5 | 0.58 | 0.21 | 0.06 | 0.85 | 0.12 | 0.11 | 65.6 | |

| $2,500 | 1.44 | 55.3 | 0.55 | 0.19 | 0.06 | 0.80 | 0.12 | 0.11 | 66.4 | |

| Total Inferred | $ 900 | 1.39 | 31.2 | 0.47 | 0.18 | 0.10 | 0.75 | 0.18 | 0.15 | 75.2 |

| $1,400 | 1.29 | 43.8 | 0.44 | 0.17 | 0.09 | 0.70 | 0.16 | 0.14 | 74.4 | |

| $1,600 | 1.27 | 47.7 | 0.43 | 0.17 | 0.09 | 0.69 | 0.16 | 0.14 | 74.0 | |

| $1,700 | 1.26 | 49.7 | 0.43 | 0.17 | 0.09 | 0.68 | 0.16 | 0.14 | 74.0 | |

| $1,800 | 1.24 | 51.2 | 0.42 | 0.16 | 0.09 | 0.67 | 0.16 | 0.14 | 73.5 | |

| $2,000 | 1.30 | 56.6 | 0.42 | 0.16 | 0.08 | 0.67 | 0.15 | 0.14 | 73.7 | |

| $2,500 | 1.23 | 68.1 | 0.40 | 0.15 | 0.08 | 0.64 | 0.15 | 0.13 | 73.2 | |

Notes:

- Total Precious Metals (TPM) equals palladium plus platinum plus gold.

- Only the Palladium Price is varied, all other commodity prices remained fixed at the 2022 MRE price deck.

- Each Palladium price point is tabulated using a conceptual pit specific to that price point.

Table 2b: 2020 LK MRE Sensitivity to Palladium Price – contained metals

| RESOURCE SENSITIVITY TO PALLADIUM PRICE (US$ / OZ) | |||||||||

| IN-SITU CONTAINED METAL- Mineral Resource Estimate – March 2022 | |||||||||

| Pd Price | Strip | Pd | Pt | Au | TPM | Cu | Ni | Co | |

| (US$/oz) | Ratio | (M oz) | (M oz) | (M oz) | (M oz) | (M lbs) | (M lbs) | (M lbs) | |

| Total Indicated | $ 900 | 1.69 | 0.58 | 0.21 | 0.07 | 0.85 | 83.3 | 67.9 | 4.0 |

| $1,400 | 1.54 | 0.70 | 0.25 | 0.08 | 1.03 | 104.4 | 85.6 | 5.1 | |

| $1,600 | 1.51 | 0.73 | 0.26 | 0.08 | 1.07 | 108.8 | 89.9 | 5.3 | |

| $1,700 | 1.50 | 0.74 | 0.26 | 0.08 | 1.09 | 110.7 | 91.6 | 5.4 | |

| $1,800 | 1.48 | 0.75 | 0.27 | 0.08 | 1.11 | 112.5 | 93.4 | 5.5 | |

| $2,000 | 1.54 | 0.87 | 0.31 | 0.09 | 1.27 | 127.0 | 112.1 | 6.7 | |

| $2,500 | 1.44 | 0.97 | 0.34 | 0.11 | 1.42 | 143.8 | 133.6 | 8.1 | |

| Total Inferred | $ 900 | 1.39 | 0.47 | 0.19 | 0.10 | 0.75 | 120.6 | 102.8 | 5.2 |

| $1,400 | 1.29 | 0.62 | 0.24 | 0.13 | 0.99 | 158.9 | 137.4 | 7.2 | |

| $1,600 | 1.27 | 0.66 | 0.26 | 0.13 | 1.06 | 169.7 | 147.4 | 7.8 | |

| $1,700 | 1.26 | 0.68 | 0.26 | 0.14 | 1.08 | 172.9 | 151.5 | 8.1 | |

| $1,800 | 1.24 | 0.70 | 0.27 | 0.14 | 1.11 | 179.1 | 156.2 | 8.3 | |

| $2,000 | 1.30 | 0.77 | 0.30 | 0.15 | 1.21 | 192.6 | 170.9 | 9.2 | |

| $2,500 | 1.23 | 0.88 | 0.34 | 0.17 | 1.39 | 220.8 | 200.6 | 11.0 | |

Notes:

- Total Precious Metals (TPM) equals palladium plus platinum plus gold.

- Only the Palladium Price is varied, all other commodity prices remained fixed at the 2022 MRE price deck.

- Each Palladium price point is tabulated using a conceptual pit specific to that price point.

Table 3: 2022 LK Target Potential

| LK Target Potential – April 2022 | ||||||||

| Target Potential | ||||||||

| Tonnes Low (Mt) | Tonnes High (Mt) | TPM Low | TPM High | Cu Low | Cu High | Ni Low | Ni High | |

| (g/t) | (g/t) | (%) | (%) | (%) | (%) | |||

| Kaukua Far East | 8.1 | 13.5 | 0.6 | 0.9 | 0.09 | 0.13 | 0.08 | 0.12 |

| Haukiaho East | 13.5 | 22.5 | 0.4 | 0.6 | 0.12 | 0.19 | 0.09 | 0.15 |

| Total | 21.6 | 36.0 | 0.5 | 0.7 | 0.11 | 0.17 | 0.09 | 0.14 |

Table 4: Commodity Price Assumptions used in the MRE

| COMMODITY PRICES – Mineral Resource Estimate – April 2022 | ||||||

| Unit of Measure | 3-Year Trailing Average (1) | 2-Year Trailing Average (1) | Spot Price (2) | Prices Used in Mineral Resource Estimation | Percentage of Spot Price | |

| Palladium | US$/oz | $ 2,132 | $ 2,305 | $ 2,358 | $ 1,700 | 72% |

| Platinum | US$/oz | $ 964 | $ 1,007 | $ 1,011 | $ 1,100 | 109% |

| Gold | US$/oz | $ 1,713 | $ 1,829 | $ 1,947 | $ 1,800 | 92% |

| Copper | US$/lbs | $ 3.42 | $ 3.82 | $ 4.67 | $ 4.25 | 91% |

| Nickel | US$/lbs | $ 7.73 | $ 8.43 | $ 15.04 | $ 8.50 | 57% |

| Cobalt | US$/lbs | $ 19.39 | $ 21.71 | $ 37.11 | $ 25 | 67% |

(1) Source: As of April 19, 2022. As quoted on the LBMA & LME for precious & base metals, respectively.

(2) Source: S&P Capital IQ. 2026 estimates used as a proxy.

Metallurgical testing (2022 Phase II program) results:

- Variability testing for five main lithologies and a Master Composite of similar grade to the Kaukua resource area was conducted.

- Results:

- Concentration by conventional floatation produces a saleable bulk concentrate with no deleterious elements, irrespective of lithology.

- A clean, high value saleable Copper Concentrate can be produced.

- A clean, high value saleable Nickel-PGE Concentrate can be produced.

A detailed floatation metallurgical program was conducted by the Company on the Kaukua & Kaukua South deposits. Both deposits posses very similar geology and mineralization, and bulk sample of approximately 1 metric tonne from 22 holes comprising both Upper and Lower Zone mineralization was shipped to SGS Lakefield in Canada in summer of 2021. This sample was blended to produce a representative composite sample of the Lower Zone mineralization with grade of 1.66 g/t PdEq (0.63 g/t Pd, 0.22 g/t Pt, 0.10 g/t Au, 0.13% Cu, 0.14% Ni, 88 g/t Co) (Table 5). In additional, ten individual samples (five high and five low grade) consisting of the four dominant rock types that comprise the Lower zone plus a fifth for the Upper zone were analysed for variability testing.

Results from the current metallurgical program have highlighted very consistently reproducible recovery rates form the Kaukua/Kaukua South mineralization. Copper and PGE recovery being only slightly affected by changes in grade, only nickel recovery is significantly affected by grade, as the percentage of silicate nickel increases as grade decreases.

Historical test work in 2011 on the Kaukua deposit was also performed by SGS Lakefield. This earlier composite sample had a similar bulk composition to the current metallurgical sample but was higher grade 2.38 g/t PdEq (0.94 g/t Pd, 0.31 g/t Pt, 0.08 g/t Au, 0.22% Cu, and 0.20% Ni). Results from this earlier test were consistent with result from the current test and further confirm the consistency of the floatation recovery.

In addition to a Bulk Con, a split copper and nickel con were produced. Both of which are highly saleable (Table 6). The Copper Con is particularly high-grade with 30% Cu and high PGEs. The Copper Con represents 30% by weight of the Bulk Con with the Nickel Con comprising 70%. In addition, the Bulk Con had a low 1.2% mass pull, and low deleterious elements including <6% MgO in the nickel concentrate.

The LK project is located 160 north east of the Port City of Oulu, thereby significantly decreasing potential shipping costs. In addition, Finland has domestic copper and nickel smelting capacity further potentially reducing shipping costs.

Table 5: Locked Cycle Test Results for Lower Zone Composite Sample.

| LOCKED CYCLE METALLURGICAL TEST RESULTS – April 2022 | |||||||||||||

| Products | Mass | Assay | % Distribution/Recovery | ||||||||||

| Pull % |

Pd g/t | Pt g/t | Au g/t | Cu % | Ni % | Co % | Pd | Pt | Au | Cu | Ni | Co | |

| Cu Cleaner Con | 0.35 | 38.3 | 13.1 | 11.2 | 30.0 | 1.43 | 0.1 | 21.0 | 18.8 | 45.2 | 67.9 | 3.4 | 2.0 |

| Ni 3rd Cleaner Con | 0.82 | 40.8 | 11.0 | 2.9 | 3.9 | 4.85 | 0.2 | 52.5 | 37.3 | 27.8 | 20.7 | 27.0 | 16.6 |

| Calc. Bulk Con | 1.17 | 40.1 | 11.6 | 5.4 | 11.7 | 3.83 | 0.2 | 73.5 | 56.1 | 73.0 | 88.6 | 30.3 | 18.6 |

| Rougher Con (1) | 13.1 | 3.85 | 1.11 | 0.57 | 1.08 | 0.46 | – | 81.6 | 64.7 | 79.8 | 94.0 | 39.8 | — |

| Sample Head |

100 | 0.63 | 0.24 | 0.09 | 0.15 | 0.15 | 0.01 | 100 | 100 | 100 | 100 | 100 | 100 |

(1) The Rougher Con is from an Open Circuit test for comparison purposes, as Rougher Con results are not available from the Locked Cycle test as it is continuously recirculated.

(2) The Nickel recovery is lower than previous test work in 2011 which used a higher grade (2.38 g/t PdEq) composite sample due to a higher percentage of silicate nickel present in the current more representative lower grade (1.66 g/t PdEq) composite sample.

Concentrate Grades from Locked-Cycle Testwork:

Table 6: Concentrate Grades and Value from Locked Cycle Test

| CONCENTRATE GRADES – April 2022 | |||||||

| Unit of Measure | Bulk Concentrate Grade (1) | Copper Concentrate Grade (2) | Nickel Concentrate Grade (3) | Bulk Concentrate Value (1) | Copper Concentrate Value (2) | Nickel Concentrate Value (3) | |

| Palladium | g/t | 40.1 | 38.3 | 40.8 | $2,189 | $2,093 | $2,230 |

| Platinum | g/t | 11.6 | 13.1 | 11.0 | $411 | $463 | $389 |

| Gold | g/t | 5.4 | 11.2 | 2.9 | $312 | $648 | $170 |

| Copper | % | 11.7 | 30.0 | 3.9 | $1,095 | $2,811 | $365 |

| Nickel | % | 3.83 | 1.43 | 4.85 | $718 | $268 | $909 |

| Cobalt | g/t | 0.2 | 0.1 | 0.2 | $94 | $55 | $110 |

| Rhodium (4) | g/t | 1.5 | 1.0 | 1.7 | $479 | $322 | $547 |

| PdEq (5) | g/t | 88.2 | 116.0 | 76.4 | |||

| $ Value (5) | US$/t | $4,819 | $6,339 | $4,173 | |||

(1) Represents aggregate concentrate produced.

(2) Represents preferential copper segregation form the Bulk Concentrate.

(3) Represents the remaining Bulk concentrate less the Copper Concentrate extracted.

(4) Rhodium was not consistently analyzed for; these values represent select analysis of nickel and copper concentrates; a price of $10,000/oz was used for purpose of this table for information purposes only.

(5) PdEq and Concentrate Value is calculated using metal price only for information purposes, it does not include Rhodium and is calculated using the current resource price deck of $1,700 US oz Pd, $1,100 US oz Pt, $1,800 US oz Au, $4.25 US lb Cu, $8.50 US lb Ni, and $25 US lb Co.

Methodology:

A resource average master composite was created with representative samples from the four lithologies containing both high- and low-grade samples. The flowsheet developed produced separate Cu and Ni concentrates and the results were confirmed in a locked cycle test which simulates plant conditions. The results of the locked cycle test are presented in Table 1.

Indicative quotations were obtained from smelters for the concentrates produced. Using those terms, the overall smelter returns which include payable metal in addition to treatment and refining charges for metal recovered to the concentrates using a split Nickel and Copper Cons were, Cu 80.3%, Ni 41.8%, Pd 85.3%, Pt 77.3% and Au 79.6%.

In addition to the locked cycle test on the master composite, open circuit tests of 10 variability samples representing the four lithologies of the master composite plus a composite for the Upper Zone were conducted utilizing the flowsheet developed. The results from all tests produced quality concentrates with a very consistent rougher recovery relationship of each metal to its feed grade. The relationships established were used to estimate the rougher recovery from the resource. The rougher recovery relationship combined with the locked cycle test cleaner recovery was used to determine the overall metal recovery. The smelter return for each metal was applied to the overall recovery to determine revenue.

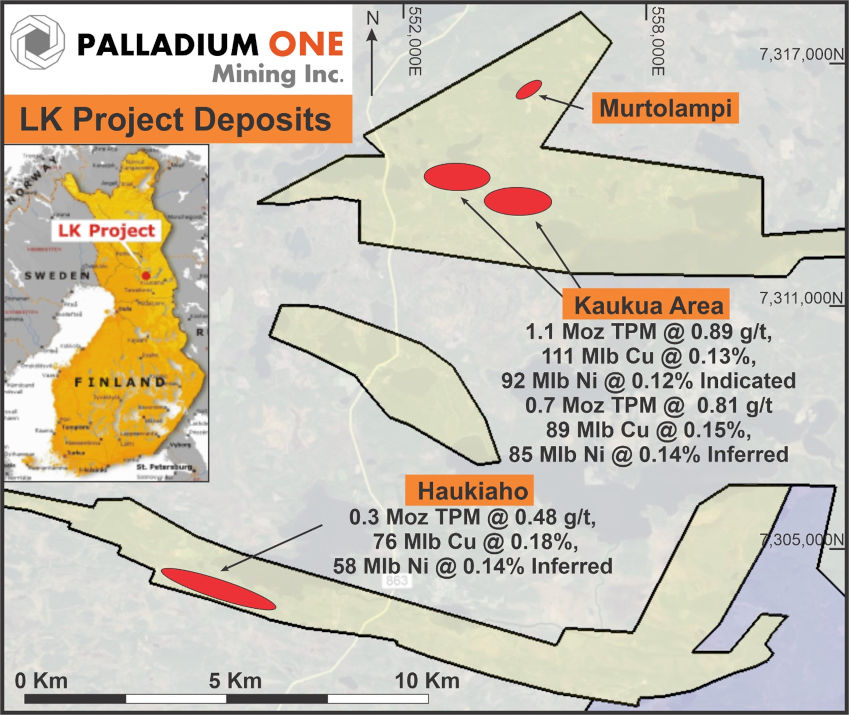

Figure 1 – Location map of LK Project and Open Pit Mineral Resources (red ellipses). The yellow shaded area represents the outer property boundary of the LK Project, and include both Exploration Permits and Permit Applications. The Blue shaded area represents the Company’s adjoining KS Project. TPM represents in-situ Total Precious Metals (Pd + Pt + Au). UTM grid datum is ETRS 35Fin, Zone 35W.

>

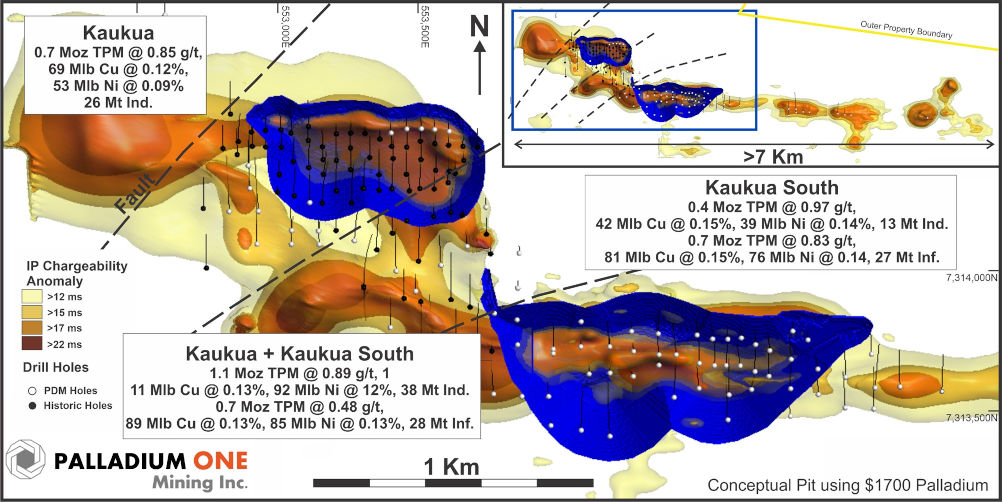

Figure 2 – Kaukua Area showing conceptual open pits superimposed on IP chargeability with both historical and Palladium One drill holes. TPM represents in-situ Total Precious Metals (Pd + Pt + Au).

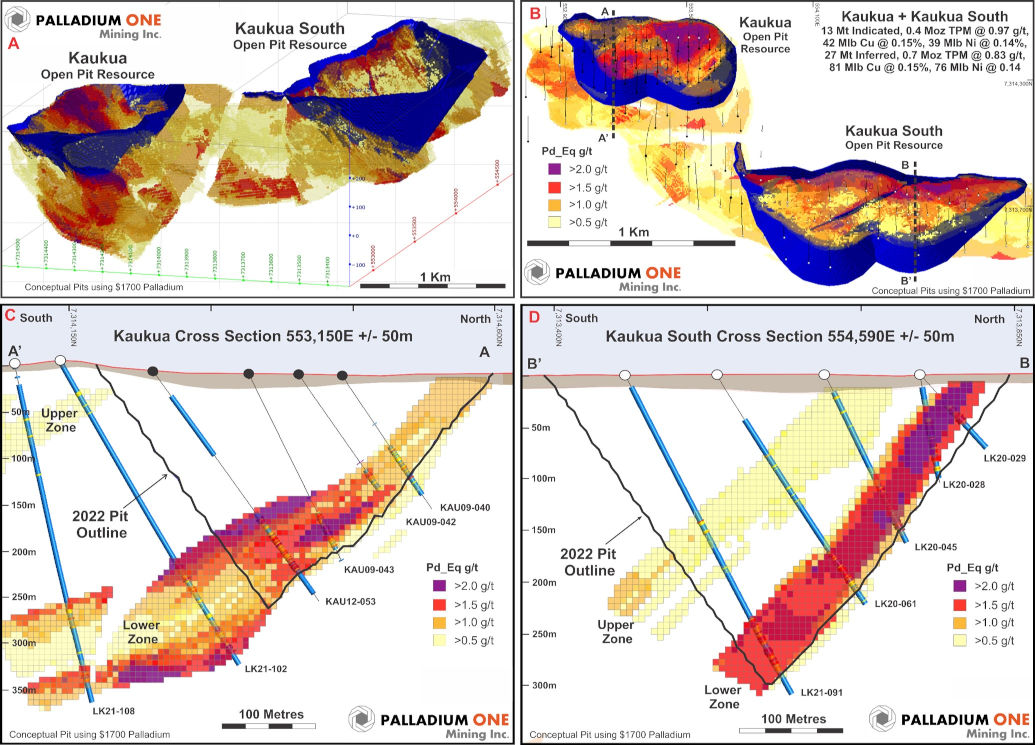

Figure 3 – A Isometric view looking to the northeast, Kaukua Area pits superimposed on the block model. B Plan view of the Kuakua Area pits superimposed on the block model and showing cross section locations. TPM represents in-situ Total Precious Metals (Pd + Pt + Au). C Cross section A-A’ looking west of the Kaukua pit showing drilling and the block model. D Cross section B-B’ looking west of the Kaukua South pit showing drilling and the block model.

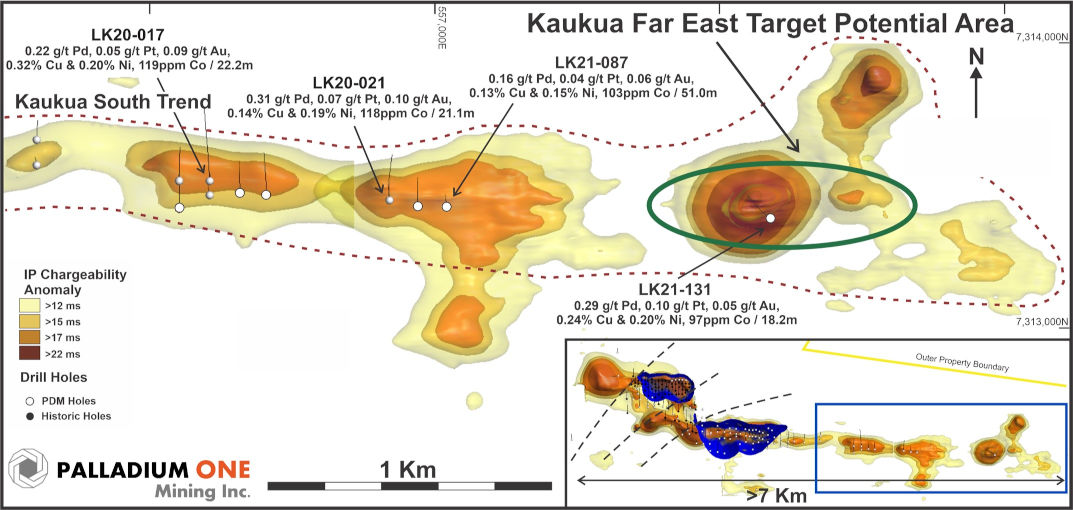

Figure 4. Kaukua Area showing eastern extension of the Kaukua South trend with Target Potential areas outlined in green.

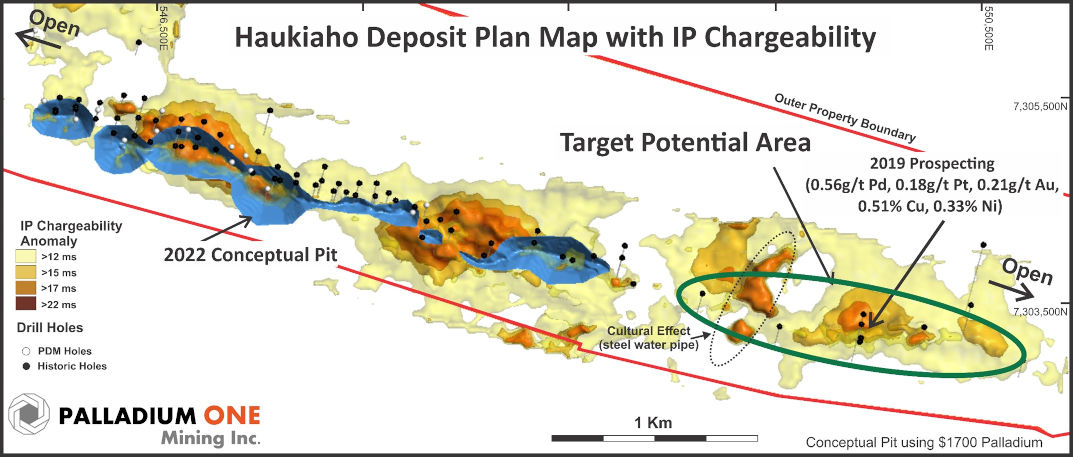

Figure 5. Huakiaho area with current conceptual open pit (blue) and Target Potential areas outlined in green.

Qualified Person

The Mineral Resource Estimate was prepared by the Company under the supervision of Mr. Sean Horan, P.Geo., Technical Manager of Geology at SLR Consulting Ltd., based in Toronto, Ontario, Canada. Mr. Horan is an Independent Qualified Person as defined by NI 43-101. The Mineral Resource Estimate in this news release has been classified in accordance with CIM Definition Standards on Mineral Resources and Mineral Reserves (May 14, 2014). Mr. Horan has read and approved the contents of this news release, as it relates to the disclosed Mineral Resource Estimate.

For the purposes of this news release, Mr. Neil Pettigrew, M.Sc., P. Geo., Vice President of Exploration and a director of the Company is the designated non-Independent Qualified Person and has reviewed and approved the scientific and technical information in this news release.

About Palladium One

Palladium One Mining Inc. (TSXV: PDM) is focused on discovering environmentally and socially conscious Metals for Green Transportation. A Canadian mineral exploration and development company, Palladium One is targeting district scale, platinum-group-element (PGE)-copper-nickel deposits in leading mining jurisdictions. Its flagship project is the Läntinen Koillismaa (LK) Project in north-central Finland, which is ranked by the Fraser Institute as one of the world’s top countries for mineral exploration and development. LK is a PGE-copper-nickel project that has existing Mineral Resources. PDM’s second project is the 2020 Discovery of the Year Award winning Tyko Project, a high-grade sulphide, copper-nickel project located in Canada. Follow Palladium One on LinkedIn, Twitter, and at www.palladiumoneinc.com.

ON BEHALF OF THE BOARD

“Derrick Weyrauch”

President & CEO, Director

For further information contact:

Derrick Weyrauch, President & CEO

Email: info@palladiumoneinc.com

Neither the TSX Venture Exchange nor its Market Regulator (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release is not an offer or a solicitation of an offer of securities for sale in the United States of America. The common shares of Palladium One Mining Inc. have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration.

Information set forth in this press release may contain forward-looking statements. Forward-looking statements are statements that relate to future, not past events. In this context, forward-looking statements often address a company’s expected future business and financial performance, and often contain words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, and “intend”, statements that an action or event “may”, “might”, “could”, “should”, or “will” be taken or occur, or other similar expressions. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; fluctuations in palladium and other commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the absence of dividends; competition; dilution; the volatility of our common share price and volume; and tax consequences to Canadian and U.S. Shareholders. Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Investors are cautioned against attributing undue certainty to forward-looking statements.