|

|

|

Noble Capital Markets Senior Research Analyst Michael Heim sits down with Alovpetro Energy President & CEO Corey Ruttan Research, News, and Advanced Market Data on ALVOFView all C-Suite InterviewsThe 2022 C-Suite Interview series is now available on major podcast platforms

Alvopetro Energy Ltd.’s vision is to become a leading independent upstream and midstream operator in Brazil. Our strategy is to unlock the on-shore natural gas potential in the state of Bahia in Brazil, building off the development of our Caburé natural gas field and our strategic midstream infrastructure. |

Category:

Release – Seanergy Announces Additional Share Buybacks and Open-Market Stock Purchase Plan by the CEO

June 28, 2022 – Glyfada, Greece – Seanergy Maritime Holdings Corp. (the “Company” or “Seanergy”) (NASDAQ: SHIP) announced today that the Board of Directors has authorized an additional share repurchase plan (the “Plan”), under which the Company may repurchase up to $5 million of its outstanding common shares, convertible notes or warrants. Moreover, the Company’s CEO, Mr. Stamatis Tsantanis, intends to purchase an additional aggregate of up to 500,000 common shares of the Company in the open market. Within the last 7 months, the Company has already completed two repurchase plans totalling $26.7 million that were utilised for buybacks of its common shares, convertible notes and warrants.

Stamatis Tsantanis, the Company’s Chairman & Chief Executive Officer, stated: “Our management and board of directors believe that our current share price is significantly undervalued. Considering this, we feel that authorizing a share buyback is now a well-timed capital allocation decision. “In addition, I intend to buy an additional 500,000 of Seanergy’s common shares in the open market on top of my previous open-market purchases, which reflects my strong confidence in the Company, its fundamentals and the Capesize market. “Over the last 18 months, we have concluded a series of significant transactions, resulting in a great fleet of high-quality Capesize vessels and a solid balance sheet position. The Company is optimally positioned to capitalise on the strong outlook of our sector.”

The Plan The Company may repurchase common shares in open-market transactions pursuant to Rule 10b18 of the Securities Exchange Act of 1934, as amended, or pursuant to a trading plan adopted in accordance with Rule 10b5?1 of the Securities Exchange Act of 1934. Any repurchases pursuant to the Plan will be made at management’s discretion at prices considered to be attractive and in the best interests of both the Company and its shareholders, subject to the availability of stock, general market conditions, the trading price of the stock, alternative uses for capital, applicable securities laws and the Company’s financial performance. The Plan may be suspended, terminated, or modified at any time for any reason, including market conditions, the cost of repurchasing shares, the availability of alternative investment opportunities, liquidity, and other factors deemed appropriate. These factors may also affect the timing and amount of share repurchases. The Plan does not obligate the Company to purchase any of its shares, and the Company may repurchase other outstanding securities of the Company, including its outstanding convertible notes or warrants, under the Plan. The Board of Directors’ authorization of the Plan is effective immediately and expires on December 31, 2023.

About Seanergy Maritime Holdings Corp. Seanergy Maritime Holdings Corp. is the only pure-play Capesize ship-owner publicly listed in the US. Seanergy provides marine dry bulk transportation services through a modern fleet of Capesize vessels. Upon completion of the previously-announced spin-off and vessel acquisition, the Company’s operating fleet will consist of 17 Capesize vessels with an average age of approximately 12 years and aggregate cargo carrying capacity of approximately 3,020,012 dwt. The Company is incorporated in the Marshall Islands and has executive offices in Glyfada, Greece. The Company’s common shares trade on the Nasdaq Capital Market under the symbol “SHIP”. Please visit our company website at: www.seanergymaritime.com.

Forward-Looking Statements This press release contains forward-looking statements (as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended) concerning future events, including statements regarding the anticipated spin-off of United. Words such as “may”, “should”, “expects”, “intends”, “plans”, “believes”, “anticipates”, “hopes”, “estimates” and variations of such words and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks and are based upon a number of assumptions and estimates, which are inherently subject to significant uncertainties and contingencies, many of which are beyond the control of the Company. Actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, the impact of regulatory requirements or other factors on the Company’s ability to consummate the proposed spin-off; the Company’s operating or financial results; the Company’s liquidity, including its ability to service its indebtedness; competitive factors in the market in which the Company operates; shipping industry trends, including charter rates, vessel values and factors affecting vessel supply and demand; future, pending or recent acquisitions and dispositions, business strategy, areas of possible expansion or contraction, and expected capital spending or operating expenses; risks associated with operations outside the United States; broader market impacts arising from war (or threatened war) or international hostilities, such as between Russia and Ukraine; risks associated with the length and severity of the ongoing novel coronavirus (COVID-19) outbreak, including its effects on demand for dry bulk products and the transportation thereof; and other factors listed from time to time in the Company’s filings with the SEC, including its most recent annual report on Form 20-F. The Company’s filings can be obtained free of charge on the SEC’s website at www.sec.gov. Except to the extent required by law, the Company expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based.

For further information please contact: Seanergy Investor Relations Tel: +30 213 0181 522 E-mail: ir@seanergy.gr

Capital Link, Inc. Paul Lampoutis 230 Park Avenue Suite 1540 New York, NY 10169 Tel: (212) 661-7566 E-mail: seanergy@capitallink.com

Robinhood, Bear Markets, and Acquirers

Image Credit: Toby Bradbury (Flickr)

Is Robinhood a Prime Target for Acquisition During Weak Markets?

Whether or not Robinhood ($HOOD) is acquired by FTX, (the crypto exchange owned by billionaire Sam Bankman-Fried), or it attracts another suitor or remains a publicly-traded company, there are some things investors should know. Yesterday, a Bloomberg article suggested FTX is exploring whether it might be able to acquire Robinhood Markets, Inc. (June 27); they already own 7.6% of the company. Sam Bankman-Fried denied having interest. But, there is still some surprising data that investors in the company and users of the brokerage app should be aware of, as it could impact future price moves.

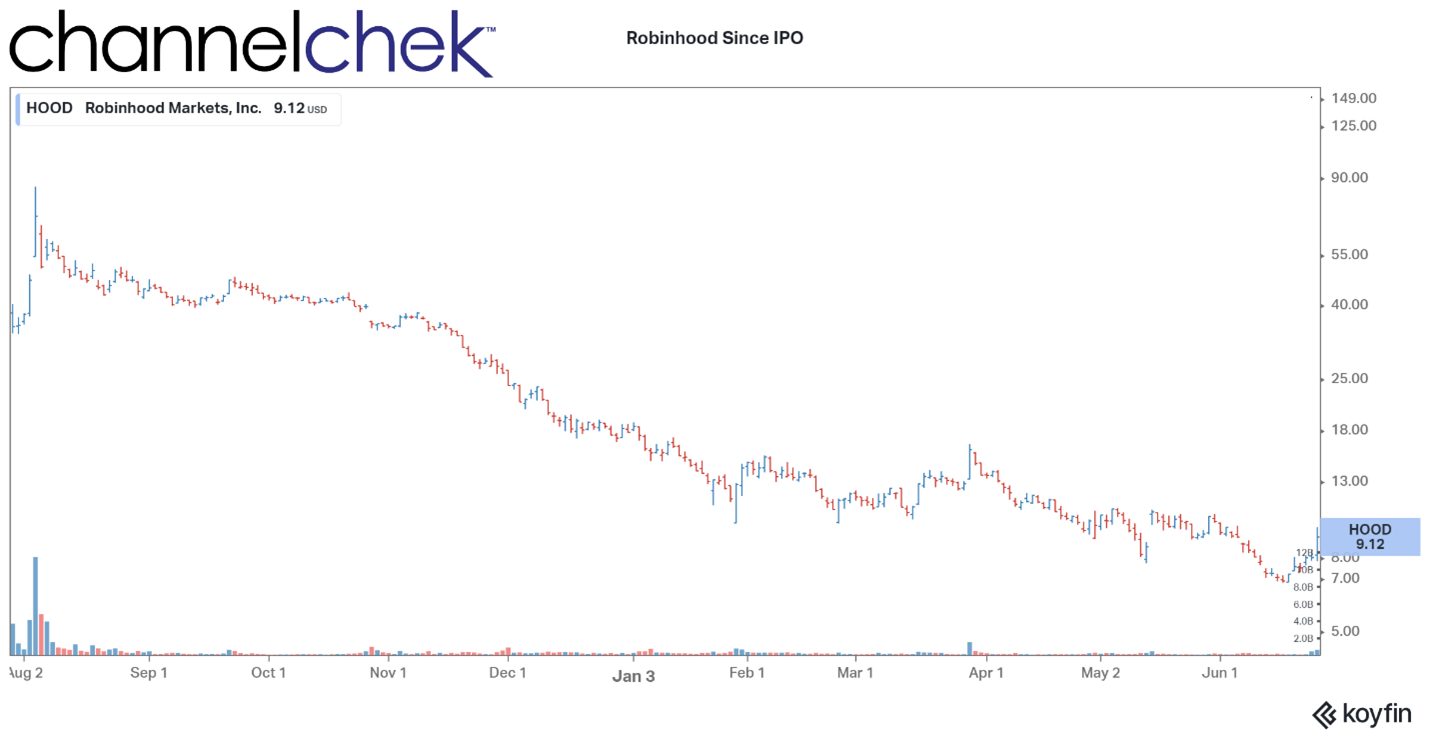

The investing app paved the way for free online trading, it then became a public company almost a year ago. At the time, there was still a strong wave of new investors eager to profit from the bull market in stocks and cryptocurrencies. The share price for the initial public offering came out at $38. By year-end, HOOD sank to about $18 per share. It is now trading near half the level it was at the beginning of 2022.

The company went public with a market value of $32 billion; it now has a total market cap of $7.8 billion.

Source: Koyfin

Robinhood Markets’ decline in price has been dramatic. The brand is well recognized, and the userbase, though shrinking, is more loyal than others. If it has lost customers, they were primarily the recreational investors and lower value users. Regardless, client trading is down; revenue for the most recent quarter was $299 million, or near half of what it was when Robinhood went public. Stimulus checks that in many cases were used to initially fund retail trading accounts are no longer being sent by the government; in fact inflation, in part caused by stimulus programs, may be the reason many are closing their accounts to reallocate the funds to necessities.

Many of the employees that found motivation in their own equity stake after the public offering have seen their valuations plummet. They might welcome a buyout. Using Morgan Stanley’s (MS) 2020 purchase of E*Trade Financial as a rule of thumb, Robinhood could be worth five times revenue, or $8 billion. One key employee that may wish to cash out as earnings have been trending down is Robinhood’s founder Vlad Tenev. His incentive package is tied to the price per share. To reach his maximum payout of $4.7 billion, HOOD shares would have to go from the current $9 range to $300 per share. As this seems unlikely, the founder may wish to cash out as high as possible and move on.

Other companies, if they served Robinhood’s customers, may be able to capitalize on synergies. According to Bloomberg’s story on FTX, a cryptocurrency exchange founded by Sam Bankman-Fried is considering how to make a bid. Today, an email by SamBankman-Fried, says he is not. But this does not mean the app isn’t attractive to suitors. Two other firms that could make good use of Robinhood’s retail traders (according to Reuter’s) are Goldman Sachs (GS) and JPMorgan (JPM), to complement and distribute their various savings and wealth products.

A buyer would still need optimism and confidence. Robinhood’s revenue mostly comes from paid-order

flow. The Securities and Exchange Commission suggested this source of revenue has potential conflicts of interest. Still, only 12% of the company’s top line comes from selling trade orders. Another activity that has recently slowed is trading in cryptocurrency. When added, it was expected to be a source of growth.

Take Away

Robinhood benefited from the upward momentum of the markets and went public at a great time to capture a very good price for the company. The markets have weakened, and the value of the company may have reached a point where a stronger company with enough synergies may target it to make the acquisition worthwhile. Despite the denial by FTX, acquiring companies is a cat-and-mouse game, don’t count anyone out.

Managing Editor, Channelchek

Suggested Content

Robinhood Will Be Adopting More Traditional Investment Programs

|

How Rising Rates Could Make Brokers Like Robinhood More Profitable

|

The Better Reason to Pay Attention to Paid Order Flow

|

How Last Year’s Retail Traders Have Transformed

|

Sources

https://www.sec.gov/Archives/edgar/data/1783879/000162828021013318/robinhoods-1.htm

https://www.reuters.com/breakingviews/robinhood-0-would-start-look-cheap-2022-06-27/

Stay up to date. Follow us:

|

E.W. Scripps (SSP) – Likely To Grow Faster Than Its Peers

Tuesday, June 28, 2022

E.W. Scripps (SSP)

Likely To Grow Faster Than Its Peers

The E.W. Scripps Company (NASDAQ: SSP) is a diversified media company focused on creating a better-informed world. As one of the nation’s largest local TV broadcasters, Scripps serves communities with quality, objective local journalism and operates a portfolio of 61 stations in 41 markets. The Scripps Networks reach nearly every American through the national news outlets Court TV and Newsy and popular entertainment brands ION, Bounce, Defy TV, Grit, ION Mystery, Laff and TrueReal. Scripps is the nation’s largest holder of broadcast spectrum. Scripps runs an award-winning investigative reporting newsroom in Washington, D.C., and is the longtime steward of the Scripps National Spelling Bee. Founded in 1878, Scripps has held for decades to the motto, “Give light and the people will find their own way.”

Michael Kupinski, Director of Research, Noble Capital Markets, Inc.

Patrick McCann, Research Associate, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Highlights from NDR. This report provides highlights from a recent Non Deal Road Show with investors in St. Louis last week. Jason Combs, the CFO, provided a compelling growth outlook for the company given its anticipated strong Political advertising outlook, strong Retransmission revenue growth in 2023 and favorable trends for its National Networks.

Retransmission contract renewals. Management expects a significant revenue boost in 2023 from retransmission contract renewals. The revenue opportunity will result from roughly 75% of the company’s cable contracts being set for renewal in the first half of 2023 along with rising retransmission rates.

…

This Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Aurania Resources (AUIAF) – Technical Report Planned for Core Concessions Renewed in Peru

Monday, June 27, 2022

Aurania Resources (AUIAF)

Technical Report Planned for Core Concessions Renewed in Peru

Mark Reichman, Senior Research Analyst, Natural Resources, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Renewal of concessions in Peru. In aggregate, 130 concessions were renewed covering an area of 128,700 hectares. Thirty of these concessions did not require payment in 2022 and the total cost for the other 100 concessions was US$296,000. The concessions renewed represent a majority of those that had been previously granted to Aurania and are those identified with the most significant geological potential.

Initial technical report. Management contemplates a modest amount of field work in the coming months to prepare an initial technical report to support further work and/or a possible corporate transaction. A technical report would be required in advance of any potential corporate transaction….

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Release – Information Services Group Named to the Russell 2000® Index

Strong business momentum earns firm a place on leading U.S. small-cap benchmark

STAMFORD, Conn.–(BUSINESS WIRE)– Information Services Group (ISG) (Nasdaq: III), a leading global technology research and advisory firm, said today it has been named to the Russell 2000® Index, the leading U.S. barometer of small-cap stocks, on the strength of its business momentum and resulting increase in its market capitalization.

ISG officially was added to Russell 2000 Index as part of the annual reconstitution of the entire family of Russell indexes that took place after the close of trading on Friday, June 24.

“ISG is a business with strong momentum,” said Michael P. Connors, chairman and CEO. “Our record first-quarter revenues and profits are the latest in a string of increasingly strong operating results our firm has produced over the last two years. Clients continue to seek our advice and support to digitally transform their businesses for operational excellence and faster growth.”

Connors called the firm’s addition to the Russell 2000 “a significant milestone.”

“We are delighted the market has recognized our performance and has valued us among the top small-cap stocks in America,” he said. “As part of the Russell 2000, our shares will enjoy a higher profile and we will have further opportunities to expand our shareholder base with institutional and index investors.”

Connors said ISG is committed to long-term value creation for its clients, employees and shareholders. “We continue to focus on sustainable, long-term growth, margin expansion, and free cash flow generation as a means of delivering attractive returns to our shareholders.”

On May 9, ISG announced a 33 percent increase in its quarterly dividend, to $0.04 per common share, part of a capital allocation strategy that also includes share repurchases, debt repayment and strategic acquisitions.

Russell indexes are widely used by investment managers and institutional investors for index funds and as benchmarks for active investment strategies. Approximately $12 trillion in assets are benchmarked against Russell’s U.S. indexes. Russell indexes are part of FTSE Russell, a leading global index provider wholly owned by London Stock Exchange Group.

About ISG

ISG (Information Services Group) (Nasdaq: III) is a leading global technology research and advisory firm. A trusted business partner to more than 800 clients, including 75 of the world’s top 100 enterprises, ISG is committed to helping corporations, public sector organizations, and service and technology providers achieve operational excellence and faster growth. The firm specializes in digital transformation services, including automation, cloud and data analytics; sourcing advisory; managed governance and risk services; network carrier services; strategy and operations design; change management; market intelligence and technology research and analysis. Founded in 2006, and based in Stamford, Conn., ISG employs more than 1,300 digital-ready professionals operating in more than 20 countries—a global team known for its innovative thinking, market influence, deep industry and technology expertise, and world-class research and analytical capabilities based on the industry’s most comprehensive marketplace data. For more information, visit www.isg-one.com.

Source: Information Services Group, Inc.

What Users of Artificial Intelligence Language Need to Keep in Mind

Image Credit: Alex Knight (Pexels)

Google’s Powerful AI Spotlights a Human Cognitive Glitch: Mistaking Fluent Speech for Fluent Thought

When you read a sentence like this one, your past experience tells you that it’s written by a thinking, feeling human. And, in this case, there is indeed a human typing these words: [Hi, there!] But these days, some sentences that appear remarkably humanlike are actually generated by artificial intelligence systems trained on massive amounts of human text.

People are so accustomed to assuming that fluent language comes from a thinking, feeling human that evidence to the contrary can be difficult to wrap your head around. How are people likely to navigate this relatively uncharted territory? Because of a persistent tendency to associate fluent expression with fluent thought, it is natural – but potentially misleading – to think that if an AI model can express itself fluently, that means it thinks and feels just like humans do.

Thus, it is perhaps unsurprising that a former Google engineer recently claimed that Google’s AI system LaMDA has a sense of self because it can eloquently generate text about its purported feelings. This event and the subsequent media coverage led to a number of rightly skeptical articles and posts about the claim that computational models of human language are sentient, meaning capable of thinking and feeling and experiencing.

| This article was republished with permission from The Conversation, a news site dedicated to sharing ideas from academic experts. It was written by and represents the research-based opinions of Kyle Mahowald, Assistant Professor of Linguistics, The University of Texas at Austin College of Liberal Arts and Anna A. Ivanova, PhD Candidate in Brain and Cognitive Sciences, Massachusetts Institute of Technology (MIT).. |

The question of what it would mean for an AI model to be sentient is complicated (see, for instance, our colleague’s take), and our goal here is not to settle it. But as language researchers, we can use our work in cognitive science and linguistics to explain why it is all too easy for humans to fall into the cognitive trap of thinking that an entity that can use language fluently is sentient, conscious or intelligent.

Using AI to Generate Humanlike Language

Text generated by models like Google’s LaMDA can be hard to distinguish from text written by humans. This impressive achievement is a result of a decades long program to build models that generate grammatical, meaningful language.

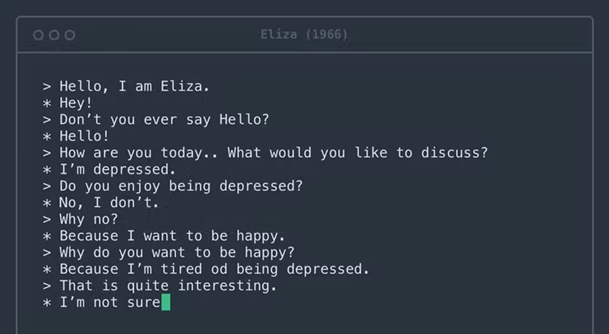

Image: The first computer system to engage people in dialogue was psychotherapy software called Eliza, built more than half a century ago. Rosenfeld Media (Flickr)

Early versions dating back to at least the 1950s, known as n-gram models, simply counted up occurrences of specific phrases and used them to guess what words were likely to occur in particular contexts. For instance, it’s easy to know that “peanut butter and jelly” is a more likely phrase than “peanut butter and pineapples.” If you have enough English text, you will see the phrase “peanut butter and jelly” again and again but might never see the phrase “peanut butter and pineapples.”

Today’s models, sets of data and rules that approximate human language, differ from these early attempts in several important ways. First, they are trained on essentially the entire internet. Second, they can learn relationships between words that are far apart, not just words that are neighbors. Third, they are tuned by a huge number of internal “knobs” – so many that it is hard for even the engineers who design them to understand why they generate one sequence of words rather than another.

The models’ task, however, remains the same as in the 1950s: determine which word is likely to come next. Today, they are so good at this task that almost all sentences they generate seem fluid and grammatical.

Peanut Butter and Pineapples?

We asked a large language model, GPT-3, to complete the sentence “Peanut butter and pineapples___”. It said: “Peanut butter and pineapples are a great combination. The sweet and savory flavors of peanut butter and pineapple complement each other perfectly.” If a person said this, one might infer that they had tried peanut butter and pineapple together, formed an opinion and shared it with the reader.

But how did GPT-3 come up with this paragraph? By generating a word that fit the context we provided. And then another one. And then another one. The model never saw, touched or tasted pineapples – it just processed all the texts on the internet that mention them. And yet reading this paragraph can lead the human mind – even that of a Google engineer – to imagine GPT-3 as an intelligent being that can reason about peanut butter and pineapple dishes.

The human brain is hardwired to infer intentions behind words. Every time you engage in conversation, your mind automatically constructs a mental model of your conversation partner. You then use the words they say to fill in the model with that person’s goals, feelings and beliefs.

The process of jumping from words to the mental model is seamless, getting triggered every time you receive a fully-fledged sentence. This cognitive process saves you a lot of time and effort in everyday life, greatly facilitating your social interactions.

However, in the case of AI systems, it misfires – building a mental model out of thin air.

A little more probing can reveal the severity of this misfire. Consider the following prompt: “Peanut butter and feathers taste great together because___”. GPT-3 continued: “Peanut butter and feathers taste great together because they both have a nutty flavor. Peanut butter is also smooth and creamy, which helps to offset the feather’s texture.”

The text in this case is as fluent as our example with pineapples, but this time the model is saying something decidedly less sensible. One begins to suspect that GPT-3 has never actually tried peanut butter and feathers.

Ascribing Intelligence to Machines, Denying it to Humans

A sad irony is that the same cognitive bias that makes people ascribe humanity to GPT-3 can cause them to treat actual humans in inhumane ways. Sociocultural linguistics – the study of language in its social and cultural context – shows that assuming an overly tight link between fluent expression and fluent thinking can lead to bias against people who speak differently.

For instance, people with a foreign accent are often perceived as less intelligent and are less likely to get the jobs they are qualified for. Similar biases exist against speakers of dialects that are not considered prestigious, such as Southern English in the U.S., against deaf people using sign languages and against people with speech impediments such as stuttering.

These biases are deeply harmful, often lead to racist and sexist assumptions, and have been shown again and again to be unfounded.

Fluent Language Alone Does Not Imply Humanity

Will AI ever become sentient? This question requires deep consideration, and indeed philosophers have pondered it for decades. What researchers have determined, however, is that you cannot simply trust a language model when it tells you how it feels. Words can be misleading, and it is all too easy to mistake fluent speech for fluent thought.

Suggested Content

Insulating Your Portfolio from Cryptocurrency Scams

|

Improving Drug Formulations for Maximum Efficacy

|

Will Bankrupt Revlon Get a Makeover from a Self-Directed Investor Frenzy?

|

Cowboys and Cryptocurrency

|

Stay up to date. Follow us:

|

Third Fed Mandate Would Increase Level of Monetary Policy Difficulty

Image: FOMC participants gather for a two-day meeting held on June 14-15, 2022. (Fed Reserve)

Will a Third Mandate be Added to the Fed’s Challenges?

The House of Representatives just passed a bill that would add to the Federal Reserve’s monetary policy mandates. Currently, the Fed’s dual mandate is to seek maximum employment and maintain stable prices. If H.R. 2543 passes the Senate, the Fed mandate would also include “exercise all duties and functions in a manner that fosters the elimination of disparities across racial and ethnic groups with respect to employment, income, wealth, and access to affordable credit.”

With the current mandates, the central bank is thought to be able to act independently to achieve stable prices and maximum employment. However, the Federal Reserve is always accountable to Congress. As we saw in late June, The Fed Chair testifies and reports to Congress on how the Federal Reserve is managing policy. They can be quite critical at these hearings, and there is often significant disagreement about how the economy should be handled.

The House bill passed last week 215-207 with little media notice. But it deserves attention because it may add a new layer of difficulty in implementing monetary policy.

Among those in the House that voted the amendment down is Congresswoman Stephanie Murphy of Florida. In her statement, she wrote, “The Federal Reserve’s dual mandate for monetary policy is to pursue price stability and maximum employment. At a time when Americans are facing the highest rate of inflation in four decades, the Federal Reserve’s priority should be to combat inflation without causing undue harm to economic growth and employment. By giving the Fed a new mandate, the bill could divert the Fed from its main mission and therefore cause harm to the very people it seeks to help. Those who stand to benefit the most from successful Federal Reserve action—and to lose the most from unsuccessful Fed action—are working families, including communities of color, struggling to afford gas, groceries, and other necessities.”

Supporters of the effort look at the broader implications beyond monetary policy, “I was proud to support the Financial Services Committee’s legislation today and thank Chairwoman Waters for her leadership. As we address inflation and work to bring costs down for American families and small businesses, Congress must ensure that Americans aren’t losing money as a result of discrimination in lending, ” said House Majority Leader Steny Hoyer.

The White House, which does not always comment on legislation, has thrown its support behind the bill. “The Administration strongly supports efforts to promote equity for underserved communities and increase access to safe and affordable financial services, wealth, and economic opportunity for all

Americans.” Earlier this month the President met with the Fed Chairman Powell, promising not to interfere with Fed policy and leaving the Federal

reserve responsible for Fed policy and outcomes. The rare meeting between a Fed Open Market Committee (FOMC) chairman and a sitting President seemed to highlight the autonomy under which the Fed works to achieve its mandates. Biden openly told Powell prior to the closed-door meeting that addressing inflation was his “top priority” and added that his plan “starts with a simple proposition: respect the Fed.”

If passed by the Senate and signed into law H.R. 2543, would raise some challenges for the Federal Reserve. An example of the challenges could be that by stimulating to promote employment, asset prices rise, which makes them less affordable; by not stimulating, employment can be lackluster.

We can see how the Fed is in a box now. If they fight inflation, they could weaken an economy to the point of causing a recession. If they don’t, inflation may continue to be a problem. If a third mandate is introduced, they would find themselves even further constrained by competing priorities. The Bill is now moving to the Senate. Sign up for Channelchek emails to stay updated on this and other important market-related information.

Managing Editor, Channelchek

Suggested Content

Inflation Sticker Shock to be on Powell Says President

|

The Fed, The President, and The Consumer

|

Investors Always Have to Play the Cards They’re Dealt

|

What Investors Haven’t Yet Noticed About the Value in Some Biotechs

|

Sources

https://www.federalreserve.gov/aboutthefed/files/the-fed-explained.pdf

https://murphy.house.gov/news/documentsingle.aspx?DocumentID=2032

https://www.whitehouse.gov/wp-content/uploads/2022/06/HR-2543SAP.docx.pdf

Stay up to date. Follow us:

|

Release – Seanergy Maritime Announces Approval of Listing on the Nasdaq Capital Market and Ex-Distribution Date of June 27, 2022 for Spin-Off of United Maritime Corporation

Seanergy Maritime Announces Approval of Listing on the Nasdaq Capital Market and Ex-Distribution Date of June 27, 2022 for Spin-Off of United Maritime Corporation June 27, 2022 – Glyfada, Greece – Seanergy Maritime Holdings Corp. (the “Company” or “Seanergy”) (NASDAQ: SHIP) announced today that the application of United Maritime Corporation (“United”) to list its common shares on the Nasdaq Capital Market has been approved. In addition, the registration statement on Form 20-F filed by United in connection with its spin-off from Seanergy has been declared effective by the U.S. Securities and Exchange Commission (the “SEC”).

Through United, Seanergy intends to effect a spin-off of the Company’s oldest Capesize vessel, the M/V Gloriuship. United is expected to adopt a diversified business model, with investments across various maritime sectors.

Seanergy shareholders do not need to take any action to receive United shares to which they are entitled, and do not need to pay any consideration or surrender or exchange Seanergy common shares. Seanergy common shareholders will receive one United common share for every 118 Seanergy common shares held at the close of business on June 28, 2022, the record date for the distribution which coincides with the previously-announced record date for Seanergy’s cash dividend of $0.025 per share for the first quarter of 2022. The distribution of United common shares is expected to be made on or around July 5, 2022. United common shares are expected to commence trading on a standalone basis on the Nasdaq Capital Market on the first trading day after the date of distribution, under the ticker “USEA”.

Nasdaq has established an ex-distribution date for the distribution of United common shares of June 27, 2022. Beginning on that date, Seanergy shares will trade without an entitlement by the purchaser of such shares to United common shares distributed in connection with the spin-off. A “when-issued” trading market in United common shares will not be established, and United common shares will not begin trading on a standalone basis until the trading day following the date of distribution.

Fractional common shares of United will not be distributed. Instead, the distribution agent will aggregate fractional common shares into whole shares, sell such whole shares in the open market at prevailing rates promptly after United’s common shares commence trading on the Nasdaq Capital Market, and distribute the net cash proceeds from the sales pro rata to each holder who would otherwise have been entitled to receive fractional common shares in the distribution.

United has filed a registration statement on Form 20-F pursuant to the Securities Exchange Act of 1934 with the SEC, which includes a more detailed description of the terms of the spin-off. A copy of the registration statement on Form 20-F is available at www.sec.gov.

About Seanergy Maritime Holdings Corp. Seanergy Maritime Holdings Corp. is the only pure-play Capesize ship-owner publicly listed in the US. Seanergy provides marine dry bulk transportation services through a modern fleet of Capesize vessels. Upon completion of the spin-off and the delivery of the previously announced vessel acquisition, the Company’s operating fleet will consist of 17 Capesize vessels with an average age of approximately 12 years and aggregate cargo carrying capacity of approximately 3,020,012 dwt.

The Company is incorporated in the Marshall Islands and has executive offices in Glyfada, Greece. The Company’s common shares trade on the Nasdaq Capital Market under the symbol “SHIP”.

Please visit our company website at: www.seanergymaritime.com.

Forward-Looking Statements This press release contains forward-looking statements (as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended) concerning future events, including statements regarding the anticipated spin-off of United, includinecurities Exchange Act of 1934, as amended) concerning future events, including statements regarding the anticipated spin-off of United, including transaction timing and certainty, the planned record and distribution dates, our and United’s anticipated competitive positioning and positioning for future success following the spin-off, and our intention to acquire an additional Capesize vessel. Words such as “may”, “should”, “expects”, “intends”, “plans”, “believes”, “anticipates”, “hopes”, “estimates” and variations of such words and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks and are based upon a number of assumptions and estimates, which are inherently subject to significant uncertainties and contingencies, many of which are beyond the control of the Company. Actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, the impact of regulatory requirements or other factors on the Company’s ability to consummate the proposed spin-off; the Company’s operating or financial results; the Company’s liquidity, including its ability to service its indebtedness; competitive factors in the market in which the Company og transaction timing and certainty, the planned record and distribution dates, our and United’s anticipated competitive positioning and positioning for future success following the spin-off, and our intention to acquire an additional Capesize vessel. Words such as “may”, “should”, “expects”, “intends”, “plans”, “believes”, “anticipates”, “hopes”, “estimates” and variations of such words and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks and are based upon a number of assumptions and estimates, which are inherently subject to significant uncertainties and contingencies, many of which are beyond the control of the Company. Actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, the impact of regulatory requirements or other factors on the Company’s ability to consummate the proposed spin-off; the Company’s operating or financial results; the Company’s liquidity, including its ability to service its indebtedness; competitive factors in the market in which the Company operates; shipping industry trends, including charter rates, vessel values and factors affecting vessel supply and demand; future, pending or recent acquisitions and dispositions, including the consummation of the Capesize vessel identified for acquisition; business strategy, areas of possible expansion or contraction, and expected capital spending or operating expenses; risks associated with operations outside the United States; broader market impacts arising from war (or threatened war) or international hostilities, such as between Russia and Ukraine; risks associated with the length and severity of the ongoing novel coronavirus (COVID-19) outbreak, including its effects on demand for dry bulk products and the transportation thereof; and other factors listed from time to time in the Company’s filings with the SEC, including its most recent annual report on Form 20-F. The Company’s filings can be obtained free of charge on the SEC’s website at www.sec.gov. Except to the extent required by law, the Company expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based. For further information please contact: Seanergy Investor Relations Tel: +30 213 0181 522 E-mail: ir@seanergy.gr Capital Link, Inc. Paul Lampoutis 230 Park Avenue Suite 1540 New York, NY 10169 Tel: (212) 661-7566 E-mail: seanergy@capitallink.com

Release – Maple Gold Announces Voting Results of Annual General and Special Meeting

Maple Gold Announces Voting Results of Annual General and Special Meeting

Research, News, and Market Data on Maple Gold Mines

Vancouver, British Columbia–(Newsfile Corp. – June 24, 2022) – Maple Gold Mines Ltd. (TSXV: MGM) (OTCQB: MGMLF)

(FSE: M3G) (“Maple Gold” or the “Company“) is pleased to announce the voting results at its Annual General and Special Meeting of shareholders held on Friday, June 24, 2022 (the “Meeting“).

The Company’s shareholders voted in favour of all matters brought before the Meeting, at which a total of 157,067,753 common shares were represented in person or by proxy, representing 46.8% of the Company’s issued and outstanding common shares. All director nominees set out in the Management Information Circular dated May 16, 2022 were elected as directors to serve until the next meeting of shareholders of the Company. Details of voting are as follows:

|

Nominee |

Votes For |

% Votes For |

Votes Withheld |

% Votes Withheld |

|

Michelle Roth |

110,433,268 |

81.77% |

24,624,291 |

18.23% |

|

B. Matthew Hornor |

120,380,290 |

89.13% |

14,577,269 |

10.87% |

|

Sean Charland |

103,012,749 |

76.27% |

32,044,810 |

23.73% |

|

Dr. Gérald Riverin |

110,252,342 |

81.62% |

24,805,217 |

18.37% |

|

Maurice A. Tagami |

105,145,793 |

77.85% |

29,911,767 |

22.15% |

At the Meeting, the shareholders of the Company also approved:

- The re-appointment of Deloitte LLP as the auditor of the Company for the ensuing year and authorized the directors to fix their remuneration; and

- The Company’s Amended and Restated Equity Incentive Plan as described in the information circular dated May 16, 2022.

Details of votes on all matters of business considered at the Meeting are available in the Company’s report of voting results on SEDAR (www.sedar.com).

About Maple Gold

Maple Gold Mines Ltd. is a Canadian advanced exploration company in a 50/50 joint venture with Agnico Eagle Mines Limited to jointly advance the district-scale Douay and Joutel gold projects located in Quebec’s prolific Abitibi Greenstone Gold Belt. The projects benefit from exceptional infrastructure access and boast ~400 km2 of highly prospective ground including an established gold resource at Douay (SLR 2022) that holds significant expansion potential as well as the past-producing Eagle, Telbel and Eagle West mines at Joutel. In addition, the Company holds an exclusive option to acquire 100% of the Eagle Mine Property.

The district-scale property package also hosts a significant number of regional exploration targets along a 55 km strike length of the Casa Berardi Deformation Zone that have yet to be tested through drilling, making the project ripe for new gold and polymetallic discoveries. The Company is well capitalized and is currently focused on carrying out exploration and drill programs to grow resources and make new discoveries to establish an exciting new gold district in the heart of the Abitibi. For more information, please visit

www.maplegoldmines.com.

ON BEHALF OF

MAPLE GOLD MINES LTD.

“Matthew Hornor”

B. Matthew Hornor, President & CEO

For

Further Information Please Contact:

Mr. Joness Lang

Executive Vice-President

Cell: 778.686.6836

Email:

jlang@maplegoldmines.com

Mr. Kiran Patankar

SVP, Growth Strategy

Cell: 604.935.9577

Email:

kpatankar@maplegoldmines.com

NEITHER THE TSX

VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED

IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE

ADEQUACY OR ACCURACY OF THIS PRESS RELEASE.

Forward

Looking Statements:

This press release contains “forward-looking information” and “forward-looking statements” (collectively referred to as “forward-looking statements”) within the meaning of applicable Canadian securities legislation in Canada, including statements about exploration work and results from current and future work programs. Forward-looking statements are based on assumptions, uncertainties and management’s best estimate of future events. Actual events or results could differ materially from the Company’s expectations and projections. Investors are cautioned that forward-looking statements involve risks and uncertainties. Accordingly, readers should not place undue reliance on forward-looking statements. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Maple Gold Mines Ltd.’s filings with Canadian securities regulators available on www.sedar.com or the Company’s website at www.maplegoldmines.com. The Company does not intend, and expressly

disclaims any intention or obligation to, update or revise any forward-looking

statements whether as a result of new information, future events or otherwise,

except as required by law.

Release – Great Lakes Announces Participation in Noble Capital Markets C-Suite Interview Series

Great Lakes Announces Participation in Noble Capital Markets C-Suite Interview Series

Research, News, and Market Data on Great Lakes Dredge & Dock

HOUSTON, June 27, 2022 (GLOBE NEWSWIRE) — Great Lakes Dredge & Dock Corporation (“Great Lakes” or the “Company”) (NASDAQ:GLDD), the largest provider of dredging services in the United States today announced their participation in Noble Capital Markets’ C-Suite Interview Series, presented by Channelchek.

Great Lakes’ President & CEO, Lasse Petterson, and SVP, US Offshore Wind, Eleni Beyko, sat down with Noble Capital Markets Senior Research Analyst, Joe Gomes, for this exclusive interview. Topics covered include:

- An introduction to Great Lakes’ new offshore wind division; market size and opportunities.

- Why is offshore wind such an exciting opportunity for the company?

- Update on the rock installation vessel currently under construction.

- The Jones Act – Impacts on competition in the dredging and wind divisions.

- What is driving growth in the dredging market?

- What are Great Lakes’ biggest challenges going forward?

The interview was recorded on June 16, 2022 and is available now on Channelchek.

About Great Lakes Dredge & Dock Corporation

Great Lakes Dredge & Dock Corporation (“Great Lakes” or the “Company”) is the largest provider of dredging services in the United States. In addition, Great Lakes is fully engaged in expanding its core business into the rapidly developing offshore wind energy industry. The Company has a long history of performing significant international projects. The Company employs experienced civil, ocean and mechanical engineering staff in its estimating, production and project management functions. In its over 132-year history, the Company has never failed to complete a marine project. Great Lakes owns and operates the largest and most diverse fleet in the U.S. dredging industry, comprised of approximately 200 specialized vessels. Great Lakes has a disciplined training program for engineers that ensures experienced-based performance as they advance through Company operations. The Company’s Incident-and Injury-Free® (IIF®) safety management program is integrated into all aspects of the Company’s culture. The Company’s commitment to the IIF® culture promotes a work environment where employee safety is paramount.

About Noble Capital Markets

Noble Capital Markets, Inc. was incorporated in 1984 as a full-service SEC / FINRA registered broker-dealer, dedicated exclusively to serving underfollowed small / microcap companies through investment banking, wealth management, trading & execution, and equity research activities. Over the past 37 years, Noble has raised billions of dollars for these companies and published more than 45,000 equity research reports. www.noblecapitalmarkets.com email: contact@noblecapitalmarkets.com

About Channelchek

Channelchek (.com) is a comprehensive investor-centric portal – featuring more than 6,000 emerging growth companies – that provides advanced market data, independent research, balanced news, video webcasts, exclusive c-suite interviews, and access to virtual road shows. The site is available to the public at every level without cost or obligation. Research on Channelchek is provided by Noble Capital Markets, Inc., an SEC/FINRA registered broker-dealer since 1984. www.channelchek.com email: contact@channelchek.com

For

further information contact:

Tina

Baginskis

Director,

Investor Relations

630-574-3024

Release – Tonix Pharmaceuticals Announces Trial Design of New Phase 2 Clinical Study of TNX-1300 for Cocaine Intoxication

Tonix Pharmaceuticals Announces Trial Design of New Phase 2 Clinical Study of TNX-1300 for Cocaine Intoxication

New Trial Design is Single-Blind, Placebo-Controlled, Potential Pivotal Study, Pending FDA Agreement

Expected to Include Women Based on Reproductive Toxicology Studies, Pending FDA Agreement

Planning to Include Patients Who Have Received Naloxone to Increase Enrollment

CHATHAM, N.J., June 27, 2022 (GLOBE NEWSWIRE) — Tonix Pharmaceuticals Holding Corp. (Nasdaq: TNXP) (Tonix or the Company), a clinical-stage biopharmaceutical company, today announced the design of a new Phase 2 clinical trial of TNX-1300 (T172R/G173Q double-mutant cocaine esterase 200 mg, i.v. solution) for the treatment of cocaine intoxication. This new protocol has the potential to serve as a pivotal trial. TNX-1300 is a recombinant enzyme that efficiently degrades and metabolizes cocaine in cocaine users, as demonstrated in a prior Phase 2a randomized, double-blind, placebo-controlled clinical study, providing support of the use of TNX-1300 as a treatment for cocaine intoxication.1 The Company plans to submit the new protocol to the U.S. Food and Drug Administration (FDA).

A positive Phase 2a study of volunteer cocaine users in a controlled laboratory setting has been previously completed. TNX-1300 has been granted Breakthrough Therapy designation by the FDA. As a biologic and new molecular entity, TNX-1300 is eligible for 12 years of U.S. market exclusivity upon approval by the FDA, in addition to expected patent protection through 2029.

“The design of the new Phase 2 trial has the potential to serve as a pivotal trial,” said Seth Lederman, M.D., Chief Executive Officer of Tonix Pharmaceuticals. “There are approximately 505,000 emergency room visits annually involving cocaine use, with approximately 61,000 of the visits involving detox services to treat cocaine overdose. In 2020, about 19,447 overdose deaths involving cocaine occurred in the U.S.2 We believe that TNX-1300 has the potential to be a new treatment option for the substantial morbidity and mortality caused by cocaine intoxication.”

“The new study replaces the Phase 2 open-label trial with TNX-1300 for cocaine intoxication originally expected to start in the second quarter of 2022, which was designed to evaluate feasibility of enrollment,” said Gregory Sullivan, M.D., Chief Medical Officer of Tonix Pharmaceuticals. “We expect to be able to include women in this study, pending FDA agreement, since we have now completed the required reproductive toxicology studies in which no incidents of toxicity were observed. Additionally, we will now admit patients into the study who might have received naloxone due to the intoxication symptoms they are presenting. Based on our learnings from the feasibility study, excluding patients who had received naloxone at the time of intoxication was a hindrance to enrollment. Both of these changes in the new protocol should improve our ability to enroll appropriate patients in a more timely manner.”

Currently there is no specific pharmacotherapy indicated for cocaine intoxication, a state characterized by acute agitation, hyperthermia, tachycardia, arrhythmias and hypertension, with the potential life-threatening sequalae of myocardial infarction, cerebrovascular accident, rhabdomyolysis, respiratory failure and seizures. Patients are currently managed only by supportive care for the adverse effects of cocaine overdose on the cardiovascular and central nervous systems. By targeting the cause rather than the symptoms of cocaine intoxication, the Company believes TNX-1300 may offer significant advantages to the current standard of care for cocaine overdose.

The Phase 2 trial is a single-blind, open-label, placebo-controlled, randomized study comparing the safety of a single 200 mg dose of TNX-1300 to standard of care alone for the treatment of signs and symptoms of acute cocaine intoxication in approximately 60 emergency department patients presenting with cocaine intoxication. During the treatment period, subjects assigned to receive TNX-1300 will receive a single IV injection of TNX-1300 administered over 2 minutes or less; whereas subjects assigned to receive standard of care alone will receive a single IV saline injection over 2 minutes or less. Both groups will be observed according to the site’s emergency department protocol. For both study arms, signs and symptoms of cocaine intoxication will be assessed at pre-determined time points after treatment (30 minutes and then at 60, 90, 120, 180, and 240 minutes). After randomization, blood samples will be drawn at specific time points. The primary endpoint of the study is reduction of systolic blood pressure associated with acute cocaine intoxication identified at study baseline comparing TNX-1300 and standard of care after 60 minutes. A variety of secondary endpoints will be measured, including reduction of circulating cocaine, cocaethylene and ecgonine methyl ester levels after at multiple post-baseline timepoints. Safety assessments will consist of incidence and severity of treatment-emergent adverse events, adverse events of special interest, 12-lead ECGs, and vital signs.

About TNX-1300

TNX-1300 (T172R/G173Q double-mutant cocaine esterase 200 mg, i.v. solution) is being developed under an Investigational New Drug application (IND) for the treatment of cocaine intoxication. TNX-1300 is a recombinant protein enzyme produced through rDNA technology in a non-disease-producing strain of E. coli bacteria. Cocaine esterase (CocE) was identified in bacteria (Rhodococcus) that uses cocaine as its sole source of carbon and nitrogen and that grows in soil surrounding coca plants.3 The gene encoding CocE was identified and the protein was extensively characterized.3-6 CocE catalyzes the breakdown of cocaine into metabolite ecgonine methyl ester and benzoic acid. Wild-type CocE is unstable at body temperature, so targeted mutations were introduced in the CocE gene and resulted in the T172R/G173Q double-mutant CocE, which is active for approximately 6 hours at body temperature7. In a Phase 2 study, TNX-1300, at 100 mg or 200 mg i.v. doses, was well tolerated and rapidly reduced cocaine effects after cocaine 50 mg i.v. challenge.1

About Cocaine Intoxication and Overdose

Cocaine is an illegal recreational drug which is taken for its pleasurable effects and associated euphoria. Pharmacologically, cocaine blocks the reuptake of the neurotransmitter dopamine from central nervous system synapses, resulting in the accumulation of dopamine within the synapse and an amplification of dopamine signaling and its role in creating positive feeling. With the continued use of cocaine, however, intense cocaine cravings occur resulting in a high potential for abuse and addiction (dependence), as well as the risk of cocaine intoxication. Cocaine intoxication refers to the deleterious effects on several body systems, especially those involving the cardiovascular system. Common symptoms of cocaine intoxication include tachyarrhythmias and elevated blood pressure, either of which can be life-threatening. As a result, individuals with known or suspected cocaine intoxication are sent immediately to the emergency department, preferably by ambulance in case cardiac arrest occurs during transit. There are approximately 505,000 emergency room visits for cocaine abuse each year in the U.S., of which 61,000 require detoxification services. According to the National Institute on Drug Abuse, in 2020 the number of overdose death involving cocaine reached 19,447 individuals.2 According to a recent report by the U.S. Centers for Disease Control and Prevention,7 among all 2019 U.S. drug overdose deaths, approximately nearly 1 in 5 involved cocaine. In 2019, Black Americans experienced the highest death rate for overdoses involving cocaine, at 10.7 per 100,000.8

References

1 Nasser AF, Fudala PJ, Zheng B, Liu Y, Heidbreder C. A randomized, double-blind, placebo-controlled trial of RBP-8000 in cocaine abusers: pharmacokinetic profile of rbp-8000 and cocaine and effects of RBP-8000 on cocaine-induced physiological effects. J Addict Dis. 2014;33(4):289-302.

2 National Institute on Drug Abuse (NIDA) National Institute on Drug Abuse – https://www.drugabuse.gov/related-topics/trends-statistics/overdose-death-rates; accessed June 19, 2022

3 Bresler MM, Rosser SJ, Basran A, Bruce NC. Gene cloning and nucleotide sequencing and properties of a cocaine esterase from Rhodococcus sp. strain MB1. Appl Environ Microbiol. 2000. 66(3):904-8.

4 Larsen NA, Turner JM, Stevens J, Rosser SJ, Basran A, Lerner RA, Bruce NC, Wilson IA. Crystal structure of a bacterial cocaine esterase. Nat Struct Biol. 2002. 9(1):17-21.

5 Turner JM, Larsen NA, Basran A, Barbas CF 3rd, Bruce NC, Wilson IA, Lerner RA. Biochemical characterization and structural analysis of a highly proficient cocaine esterase. Biochemistry. 2002. 41(41):12297-307.

6 Gao D, Narasimhan DL, Macdonald J, Brim R, Ko MC, Landry DW, Woods JH, Sunahara RK, Zhan CG. Thermostable variants of cocaine esterase for long-time protection against cocaine toxicity. Mol Pharmacol. 2009. 75(2):318-23.

7 https://www.cdc.gov/drugoverdose/deaths/other-drugs.html; accessed June 19, 2022

8 Kariisa M, Seth P, Scholl L, Wilson N, Davis NL. Drug overdose deaths involving cocaine and psychostimulants with abuse potential among racial and ethnic groups – United States, 2004-2019. Drug Alcohol Depend. 2021 Oct 1;227:109001. doi: 10.1016/j.drugalcdep.2021.109001. Epub 2021 Aug 28. PMID: 34492555.

Tonix Pharmaceuticals Holding Corp. *

Tonix is a clinical-stage biopharmaceutical company focused on discovering, licensing, acquiring and developing therapeutics to treat and prevent human disease and alleviate suffering. Tonix’s portfolio is composed of central nervous system (CNS), rare disease, immunology and infectious disease product candidates. Tonix’s CNS portfolio includes both small molecules and biologics to treat pain, neurologic, psychiatric and addiction conditions. Tonix’s lead CNS candidate, TNX-102 SL (cyclobenzaprine HCl sublingual tablet), is in mid-Phase 3 development for the management of fibromyalgia with a new Phase 3 study launched in the second quarter of 2022 and interim data expected in the first quarter of 2023. TNX-102 SL is also being developed to treat Long COVID, a chronic post-acute COVID-19 condition. Tonix expects to initiate a Phase 2 study in Long COVID in the third quarter of 2022. TNX-1300 (cocaine esterase) is a biologic designed to treat cocaine intoxication that is Phase 2 ready and has been granted Breakthrough Therapy Designation by the FDA. TNX-1900 (intranasal potentiated oxytocin), a small molecule in development for chronic migraine, is expected to enter the clinic with a Phase 2 study in the second half of 2022. Tonix’s rare disease portfolio includes TNX-2900 (intranasal potentiated oxytocin) for the treatment of Prader-Willi syndrome. TNX-2900 has been granted Orphan-Drug Designation by the FDA. Tonix’s immunology portfolio includes biologics to address organ transplant rejection, autoimmunity and cancer, including TNX-1500, which is a humanized monoclonal antibody targeting CD40-ligand being developed for the prevention of allograft and xenograft rejection and for the treatment of autoimmune diseases. A Phase 1 study of TNX-1500 is expected to be initiated in the second half of 2022. Tonix’s infectious disease pipeline consists of a vaccine in development to prevent smallpox and monkeypox called TNX-801, next-generation vaccines to prevent COVID-19, and a platform to make fully human monoclonal antibodies to treat COVID-19. Tonix’s lead vaccine candidates for COVID-19 are TNX-1840 and TNX-1850, which are live virus vaccines based on Tonix’s recombinant pox live virus vector vaccine platform.

*All of Tonix’s product candidates are investigational new drugs or biologics and have not been approved for any indication.

This press release and further information about Tonix can be found at www.tonixpharma.com.

Forward Looking Statements

Certain statements in this press release are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may be identified by the use of forward-looking words such as “anticipate,” “believe,” “forecast,” “estimate,” “expect,” and “intend,” among others. These forward-looking statements are based on Tonix’s current expectations and actual results could differ materially. There are a number of factors that could cause actual events to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, risks related to the failure to obtain FDA clearances or approvals and noncompliance with FDA regulations; delays and uncertainties caused by the global COVID-19 pandemic; risks related to the timing and progress of clinical development of our product candidates; our need for additional financing; uncertainties of patent protection and litigation; uncertainties of government or third party payor reimbursement; limited research and development efforts and dependence upon third parties; and substantial competition. As with any pharmaceutical under development, there are significant risks in the development, regulatory approval and commercialization of new products. Tonix does not undertake an obligation to update or revise any forward-looking statement. Investors should read the risk factors set forth in the Annual Report on Form 10-K for the year ended December 31, 2021, as filed with the Securities and Exchange Commission (the “SEC”) on March 14, 2022, and periodic reports filed with the SEC on or after the date thereof. All of Tonix’s forward-looking statements are expressly qualified by all such risk factors and other cautionary statements. The information set forth herein speaks only as of the date thereof.

Contacts

Jessica Morris (corporate)

Tonix Pharmaceuticals

investor.relations@tonixpharma.com

(862) 904-8182

Olipriya Das, Ph.D. (media)

Russo Partners

Olipriya.Das@russopartnersllc.com

(646) 942-5588

Peter Vozzo (investors)

Westwicke/ICR

peter.vozzo@westwicke.com

(443) 213-0505

Release – Aurania Completes Renewal of Select Concessions in Peru

Aurania Completes Renewal of Select Concessions in Peru

Toronto, Ontario, June 27, 2022 – Aurania Resources Ltd. (TSXV: ARU) (OTCQB: AUIAF) (Frankfurt: 20Q) (“Aurania” or the “Company”) announces that it has completed the process of renewing certain annual mineral concession applications in Peru. The concessions selected are part of the blocks with higher geological potential, where the application process has been completed and most of the concessions granted. Minor field work is contemplated for these concessions in the coming months as a precursor to generating the initial technical report to support further work and/or a possible corporate transaction.

In total, 130 concessions were renewed covering an area of 128,700 hectares. Thirty of these concessions did not require payment in 2022 and the total cost for the other 100 concessions was US$296,000.

The Company did not renew a total of 145 concessions, most of which still remain in the Peruvian application process, thereby focusing its resources on those concessions that can be advanced and/or transacted upon with clear ownership confirmation. Although the Company believes that many of these concessions remain prospective, management determined that the additional annual costs and the continuing uncertainty of when the remaining concessions would be granted, were not appropriate for a non-core asset.

The renewed concessions noted above, represent the majority of those that had been previously granted to the Company over the last two years (see press release dated May 22, 2020). In January 2020, the Company had applied for 419 mineral concessions covering 413,200 Hectares (“Ha”) in northern Peru based on a potential opportunity for additional copper and gold exploration as a result of the possible extension of a mineral belt from Aurania’s project in Ecuador (see press release dated Jan 17, 2020).

In connection with the renewal of the Peruvian concessions, Dr. Keith Barron (the “Lender”) completed a loan of C$1,000,000 to the Company. The loan is unsecured, bears interest at 2% per annum and matures upon notice of twelve months and one day from the Lender. Up to US$300,000 of the loan was allocated to making annual concession payments in Peru, the balance funding working capital and ongoing exploration activities.

Dr. Keith Barron is a related party of the Company by virtue of the fact that he is the Chairman, the President and Chief Executive Officer, a promoter and a principal shareholder of the Company, and as a result, each of the Loan constitutes a “related party transaction” for the purposes of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The Company is relying upon an exemption from the formal valuation and minority shareholder approval requirements under MI 61-101 in respect of the Related Party Transactions, in reliance on Sections 5.5(a) and 5.7(1) of MI 61-101, respectively, as the fair market value of the Related Party Transaction, collectively, does not exceed 25% of the Company’s market capitalization, as determined in accordance with MI 61-101. The Company did not file a material change report related to the Loan more than 21 days before the expected closing of the Loan as required by MI 61-101, as the Company required the funds from closing on an expedited basis for sound business reasons.

The Loan and the Insider Participation were approved by the members of the board of directors of the Company who are independent for purposes of the Related Party Transactions, being all directors other than Dr. Barron. No special committee was established in connection with the Loan and the Insider Participation, and no materially contrary view or abstention was expressed or made by any director of the Company in relation thereto.

Qualified Person

The geological information contained in this news release has been verified and approved by Jean-Paul Pallier, MSc. Mr. Pallier is a designated EurGeol by the European Federation of Geologists and a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators.

About Aurania

Aurania is a mineral exploration company engaged in the identification, evaluation, acquisition and exploration of mineral property interests, with a focus on precious metals and copper in South America. Its flagship asset, The Lost Cities – Cutucu Project, is located in the Jurassic Metallogenic Belt in the eastern foothills of the Andes mountain range of southeastern Ecuador.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain forward-looking information that involves substantial known and unknown risks and uncertainties, most of which are beyond the control of Aurania. Forward-looking statements include estimates and statements that describe Aurania’s future plans, objectives or goals, including words to the effect that Aurania or its management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to Aurania, Aurania provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to Aurania’s objectives, goals or future plans, statements, exploration results, potential mineralization, the corporation’s portfolio, treasury, management team and enhanced capital markets profile, the estimation of mineral resources, exploration, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, regulatory, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, the effects of COVID-19 on the business of the Company including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restrictions on labour and international travel and supply chains, and those risks set out in Aurania’s public documents filed on SEDAR. Although Aurania believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Aurania disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Aurania Resources Ltd.

36 Toronto St, Suite 1050

Toronto, ON, Canada, M5C 2C5

Phone: (416) 367-3200

Email: ir@aurania.com