Further Optimism on Digital Currency Based on White House Order

Crypto participants believe a better-defined market is positive news for the asset class.

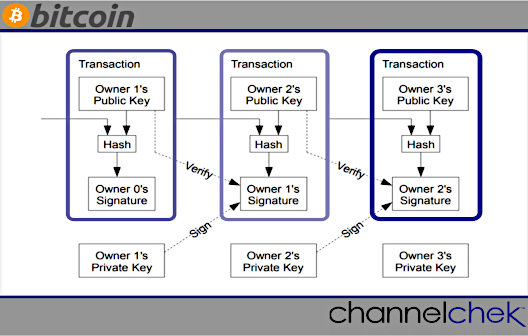

Digital assets’ potential benefits and the related technology usage are to get a “whole-of-government approach” according to an Executive Order signed by President Biden today (March 9). The Order outlines the U.S. policy for digital assets across six key priorities. The crypto market has reacted extremely positively with bitcoin (BTC) up over 20% since news of the order began circulating on Tuesday. Other cryptocurrencies like ethereum (ETH), and dogecoin (DOGE) have pushed higher as well.

The President’s six key priorities are: consumer and investor protection; financial stability; illicit finance; U.S. leadership in the global financial system and economic competitiveness; financial inclusion; and responsible innovation. Specific to each of these priorities, the order:

- Explore a U.S. Central Bank

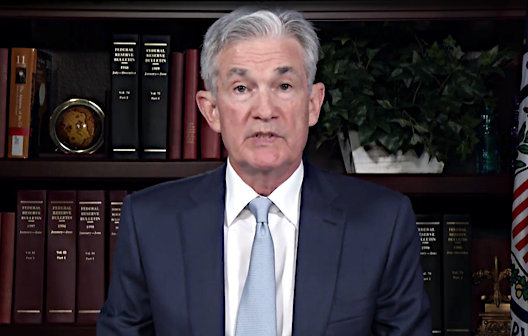

Digital Currency (CBDC) by placing urgency on research and development of a potential United States CBDC, should issuance be deemed in the national interest. The Order directs the U.S. Government to assess the technological infrastructure and capacity needs for a potential U.S. CBDC in a manner that protects Americans’ interests. The Order also encourages the Federal Reserve to continue its research, development, and assessment efforts for a U.S. CBDC, including development of a plan for broader U.S. Government action in support of their work. This effort prioritizes U.S. participation in multi-country experimentation and ensures U.S. leadership internationally to promote CBDC development that is consistent with U.S. priorities and democratic values. - Protect U.S. Consumers, Investors, and Businesses by directing the Department of the Treasury and other agency partners to assess and develop policy recommendations to address the implications of the growing digital asset sector and changes in financial markets for consumers, investors, businesses, and equitable economic growth. The Order also encourages regulators to ensure sufficient oversight and safeguard against any systemic financial risks posed by digital assets.

- Protect U.S. and Global Financial Stability and Mitigate Systemic Risk by encouraging the Financial Stability Oversight Council to identify and mitigate economy-wide (i.e., systemic) financial risks posed by digital assets and to develop appropriate policy recommendations to address any regulatory gaps.

- Mitigate the Illicit Finance

and National Security Risks Posed by the Illicit Use of Digital Assets by directing an unprecedented focus of coordinated action across all relevant U.S. Government agencies to mitigate these risks. It also directs agencies to work with our allies and partners to ensure international frameworks, capabilities, and partnerships are aligned and responsive to risks. - Promote U.S. Leadership in

Technology and Economic Competitiveness to Reinforce U.S. Leadership in

the Global Financial System by directing the Department of Commerce to work across the U.S. Government in establishing a framework to drive U.S. competitiveness and leadership in, and leveraging of digital asset technologies. This framework will serve as a foundation for agencies and integrate this as a priority into their policy, research and development, and operational approaches to digital assets. - Promote Equitable Access to Safe

and Affordable Financial Services by affirming the critical need for safe, affordable, and accessible financial services as a U.S. national interest that must inform our approach to digital asset innovation, including disparate impact risk. Such safe access is especially important for communities that have long had insufficient access to financial services. The Secretary of the Treasury, working with all relevant agencies, will produce a report on the future of money and payment systems, to include implications for economic growth, financial growth and inclusion, national security, and the extent to which technological innovation may influence that future. - Support Technological Advances

and Ensure Responsible Development and Use of Digital Assets by directing the U.S. Government to take concrete steps to study and support technological advances in the responsible development, design, and implementation of digital asset systems while prioritizing privacy, security, combating illicit exploitation, and reducing negative climate impacts.

Biden’s order asks the Justice Department to look at whether a new law is needed to create a new currency, with the Treasury, Securities and Exchange Commission, Federal Trade Commission, Consumer Financial Protection Commission and other agencies to study the impact on consumers. Although the Order uses words like ‘explore” and “potential” and provides financial market regulators a higher ability to place restrictions and reporting requirements on the asset class, it is a move forward that speculators in the crypto market have shown they believe further legitimizes current crypto.

Digital assets, including cryptocurrencies, have seen explosive growth in recent years, surpassing $3 trillion in circulation last November, up from $14 billion just five years prior. Around 16 percent of adult Americans – approximately 40 million people – have invested in, traded, or used cryptocurrencies. Over 100 countries are exploring or piloting Central Bank Digital Currencies (CBDCs) – digital forms of the country’s sovereign currency.

Suggested Reading

Elon Musk Weighs in on Unrealized Capital Gains Tax Idea

|

The Era of Flying Cars May Have Just Dawned

|

Investing in the Businesses in and Around Crypto

|

What is the Feds position on Crypto, Stablecoin, and CBDCs?

|

Sources

https://home.treasury.gov/news/press-releases/jy0644

Stay up to date. Follow us:

|

WallStreetBets users calling themselves “Diamond Hands History” have launched a Kickstarter fund to publish an archive of the fun memes from the era of self-deprecation and intentional misspelling STONKS (stocks), and HODL (hold).

WallStreetBets users calling themselves “Diamond Hands History” have launched a Kickstarter fund to publish an archive of the fun memes from the era of self-deprecation and intentional misspelling STONKS (stocks), and HODL (hold).