Image Credit: Navy Sea News

US Inflation is a Big Ship to Steer

Inflation has proven itself to be persistent, not transitory. This means the Fed is off-course with its 2% inflation target and will have to steer sharply into rough seas to regain its bearings. The CPI report for June confirms that the forces taking the economy in the wrong direction are still overpowering the largest economy in the world. Federal Reserve Chairman Powell continues to assure us he is at the helm and promises to get on course before we lose more ground. But the U.S. economy is a big ship to steer. Big ships don’t react immediately and take a while to turn. This delayed reaction has in the past caused the Fed to wait and see the response before taking further steps or risk oversteering. Powell’s statements suggest he believes the Fed began the adjustments to course very late, and therefore the greater risk is not doing enough to come-about quickly.

Consumer Prices (CPI) and the Fed

Compared to last year, at this time, the inflation experienced by consumers, as measured by the June update to the Consumer Price Index (CPI), rose to a new four-decade high with an annual rate of 9.1%. This release indicates that for a year and a half, the U.S. has been experiencing worsening prices each time it takes a new read. The rate of inflation year-over-year in May was 8.6%, the expectations were for the 12-month period to uptick to 8.8% – over 9% indicates a worsening, the Fed and the U.S. economy are still being overwhelmed by inflationary forces.

Core prices, which exclude volatile food and energy did decline somewhat. In June the increase for the year measured 5.9%, the May report indicated 5.9%. n, the Labor Department said.

When the FOMC met in May to set monetary policy, all earlier talk from them indicated a 50bp (0.50%) increase in overnight rates. Then, strong economic numbers just before the meeting caused the Fed to take a more aggressive stance and move 75bp.

This new look at inflation is likely to keep the Fed aggressive in its moving the economy toward the Fed’s preferred direction. This would mean the odds of a 75bp increase after the FOMC meeting on July 27 have increased. The odds are even further enhanced as Bureau of Labor Statistics (BLS) reports show the economy is still supplying plenty of jobs.

The markets are like passengers on an off-course ship, and the voyage is far from over. Based on market action before and following the number, the markets are uncertain if they should rejoice and have faith in the “captain” that is finally taking strong action, be concerned that corrective action wasn’t taken sooner, or look at how far off course their portfolios are now and vomit (not to mention the thought of their expected cost of heating fuel next winter).

CPI and the Markets

Stock futures were trading higher before the CPI report. This may be in part a response to Joe Biden who earlier in the week assured those he serves as the 46th President that the headline number would look bad, but this is because these numbers look back at data that has already improved. This gives hope that next month’s inflation numbers may come off a bit. After the economic release, interest rates on bonds rose (+0.08% on US Treasury 10-Year) and Stocks traded higher (+.05% on S&P 500). They then reversed with bond yields dropping below the open and stock indexes rising.

The market volatility indicates that players in both markets don’t know if they should be comforted by the “bad” number and the Fed’s resolve to react, or concerned about the Fed’s potential to overreact and cause an extended decline in economic growth (recession).

CPI and Consumers

The Fed and seemingly the White House is trying to prevent consumer expectations of higher inflation becoming entrenched. Expectations can be self-fulfilling. Fed Chairman Jerome Powell has said the central bank wants to see clear evidence that price pressures are diminishing before slowing or suspending rate increases. This gives the consumer confidence that the Fed has the tools and is resolved to bring down prices. If this sets expectations it will go a long way in becoming self-fulfilling.

Take Away

The U.S. economy is the largest in the world. In order to impact its components, such as inflation, big steps need to be taken. If they are not taken early, and with enough force, very little happens. The Fed did not attack inflation early for various reasons. After being reaffirmed for a second term, Fed Chair Powell told the markets inflation is more persistent than expected and that he would move to bring it down.

The CPI numbers have been getting worse, this tells the markets the Fed will react with more force. There are fears that this force will cause a recession, the recessionary fears are keeping rates below where they would ordinarily trade with such high inflation and a hawkish Fed. It may be that the fixed income markets are looking too far out into the future, or they just don’t expect a very hawkish response from the Fed.

There is a saying among investors, “don’t fight the Fed.” Based on interest rate moves the bond market does not believe the Fed is resolved, or perhaps they are prematurely pricing in oversteering. The stock market has been moving up since mid-June. This could indicate participants believe the markets were priced for a worse scenario than is currently unfolding for corporate America.

Managing Editor, Channelchek

Suggested Content

Powell’s Need for Speed Attacking Inflationary Pressures

|

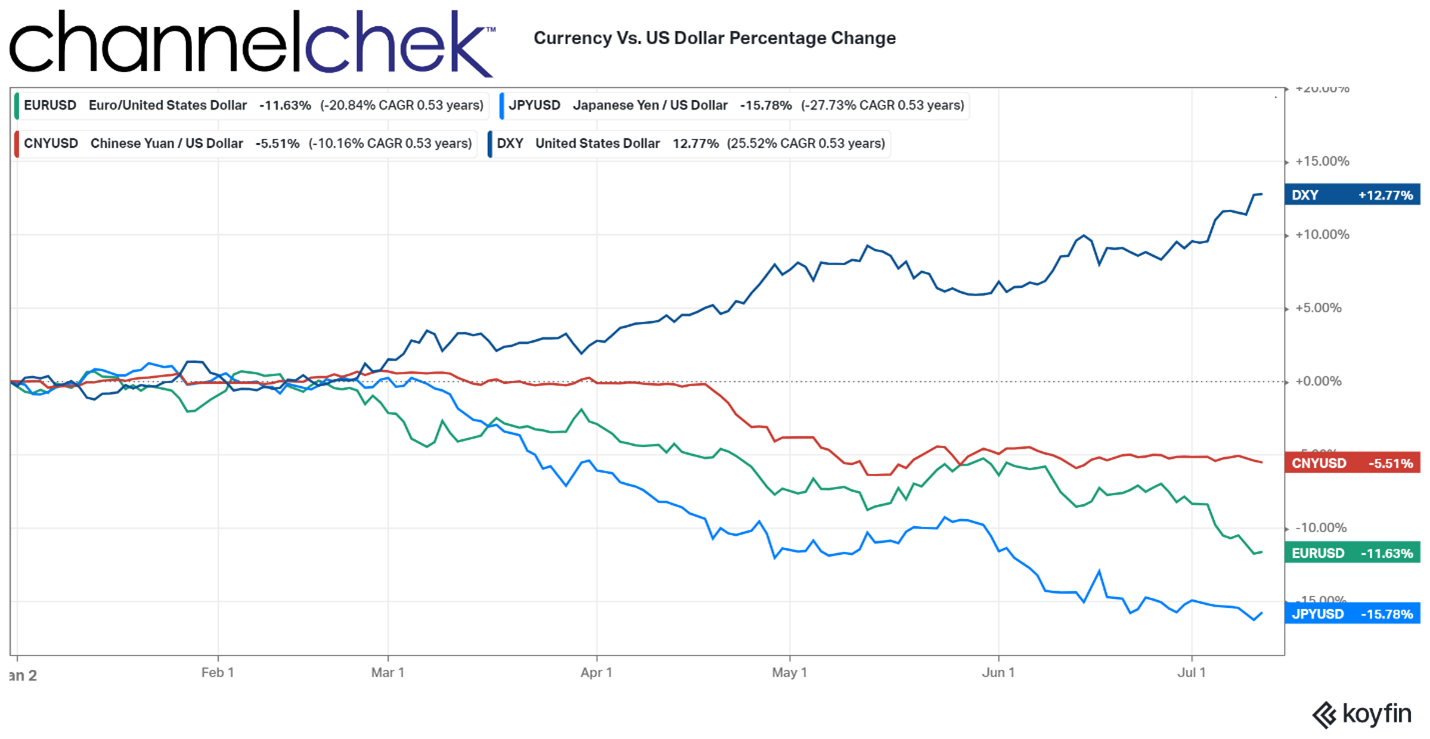

Michael Burry Tweets About the Weak Dollar While Mainstream News Discusses Dollar Strength

|

Inflation Seems Persistent, What Now?

|

Using Current Dollar Strength to Refine Your Watch List

|

Stay up to date. Follow us:

|

Image Courtesy of Alvopetro Energy

Image Courtesy of Alvopetro Energy