Image Credit: Pixabay (Pexels)

Better Your Risk Management Investing Strategy with Protective Puts

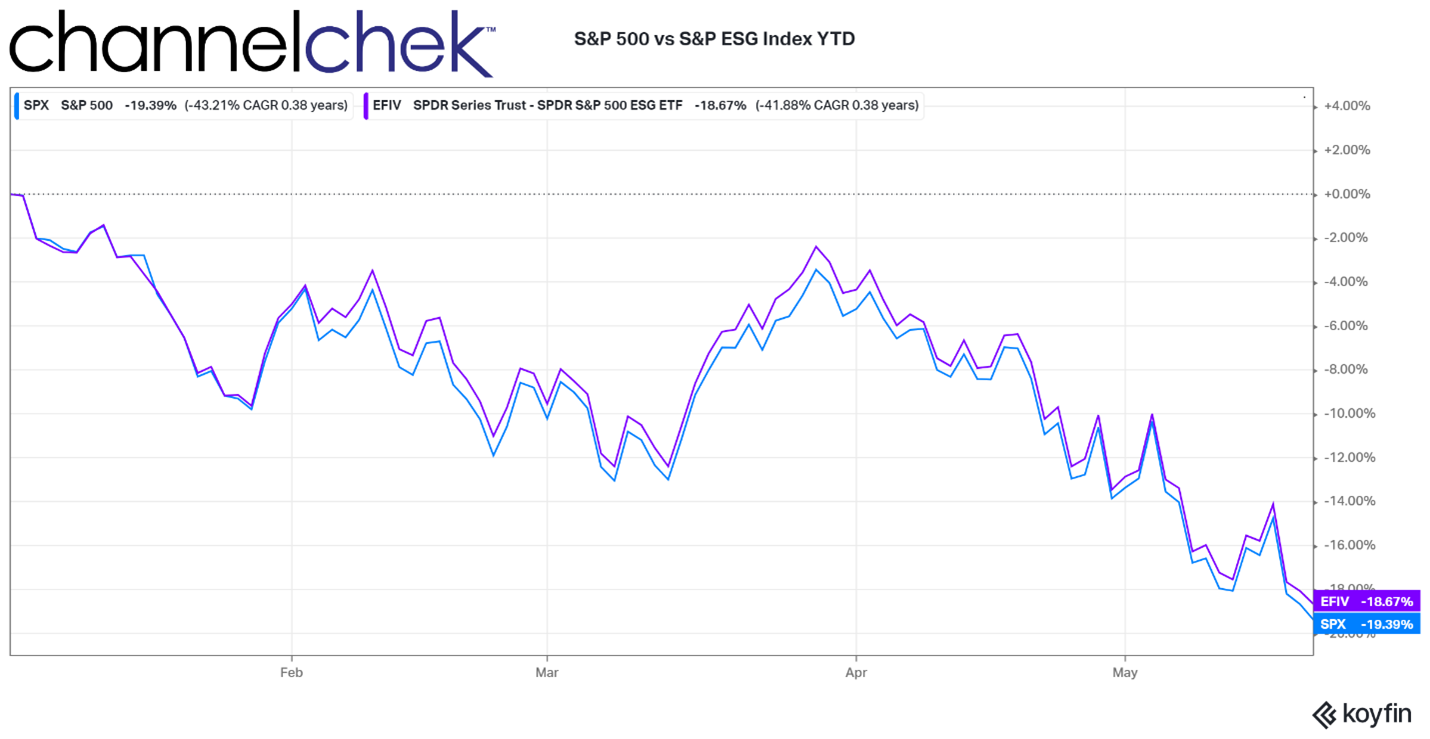

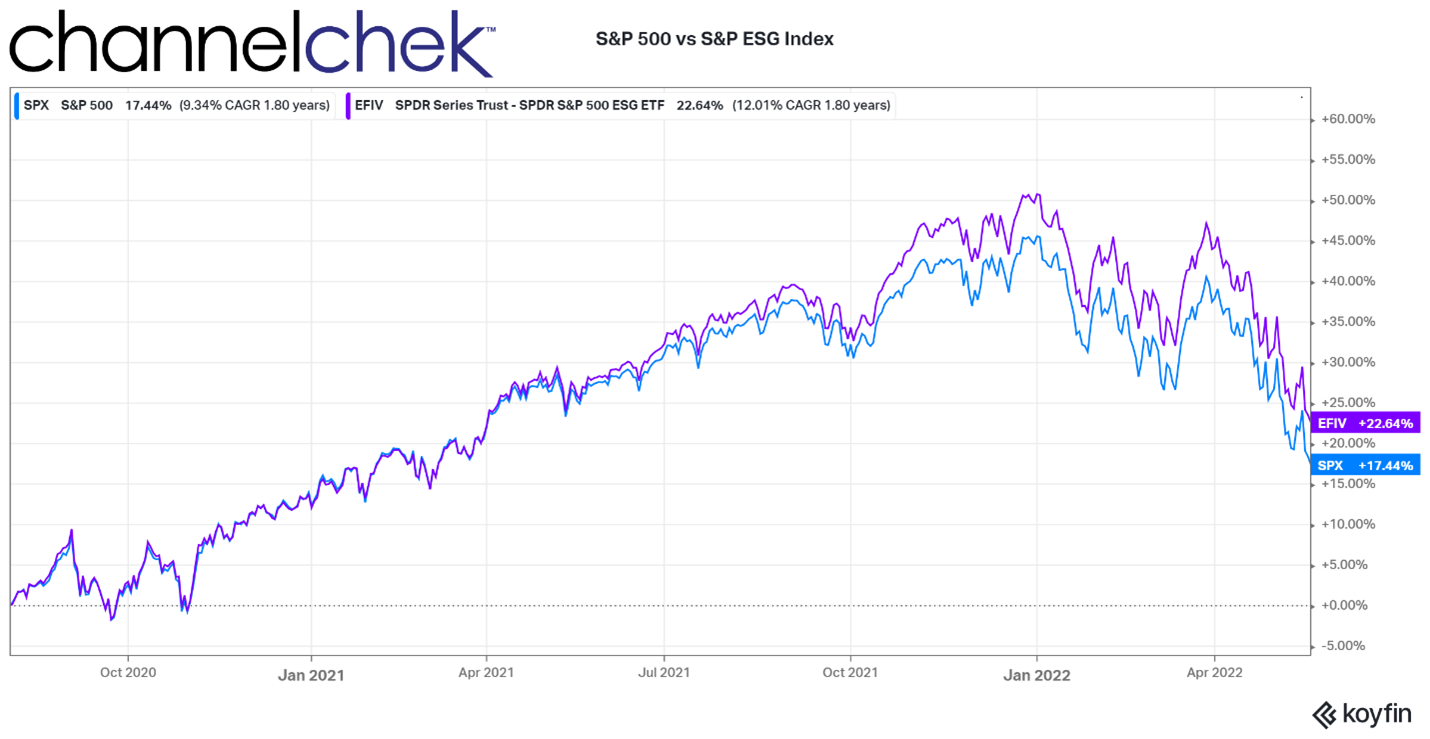

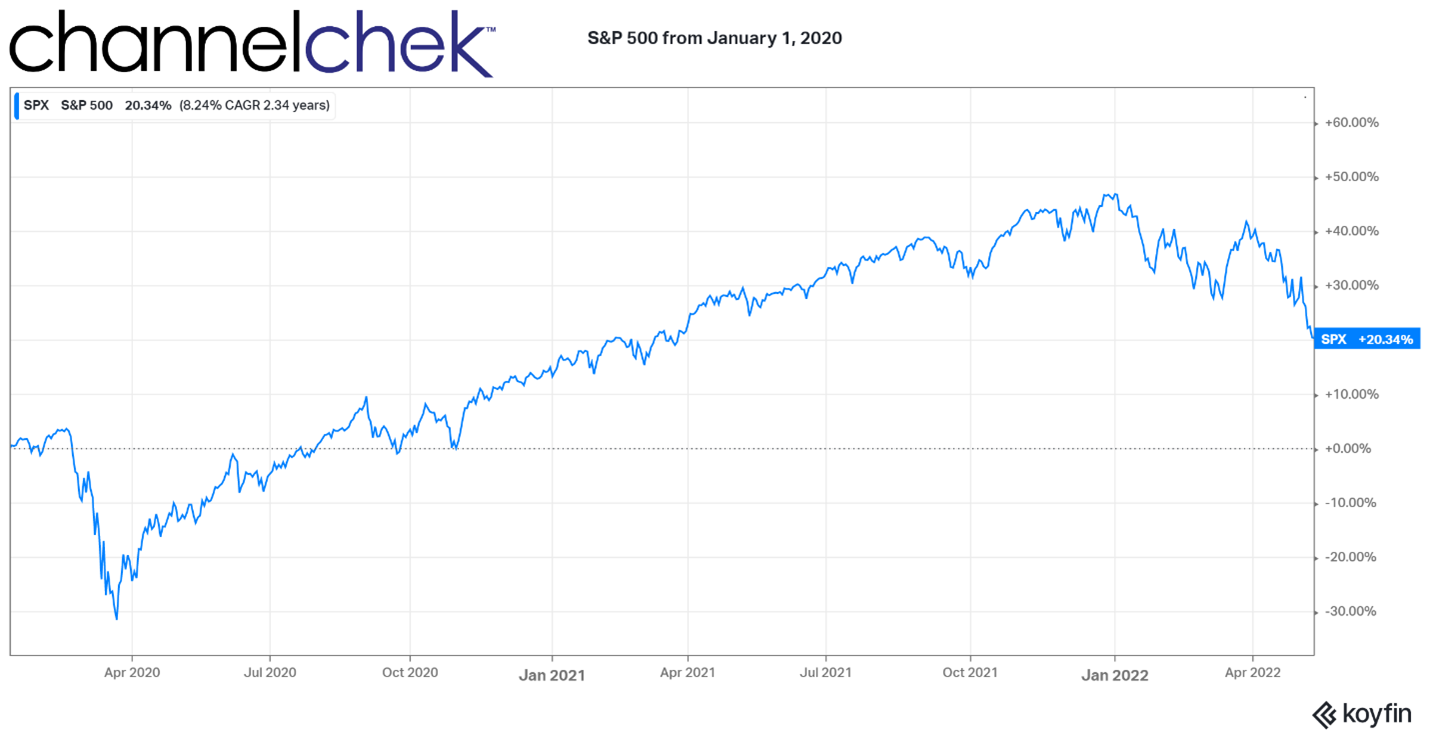

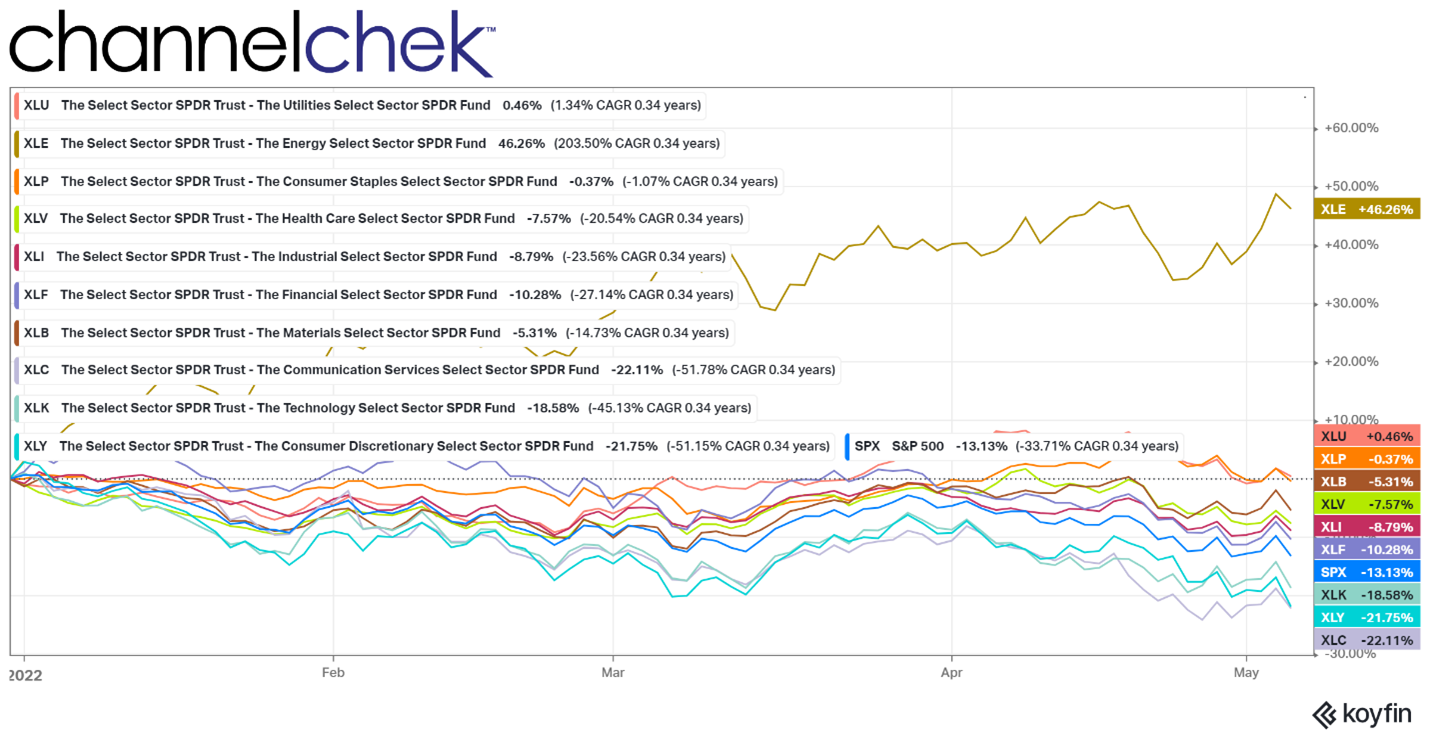

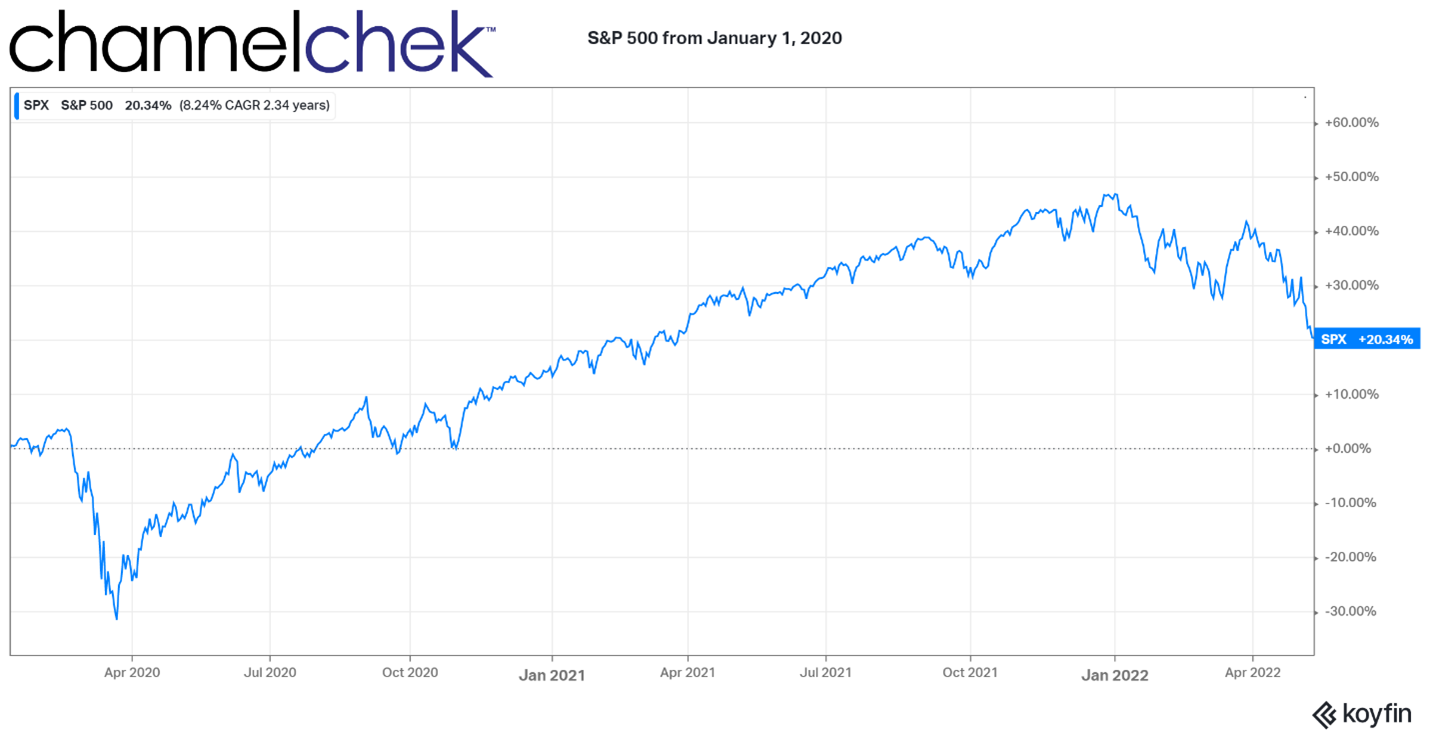

The year 2020 and 2021, despite the coronavirus-related selloff, left most stock market investors with outsized gains. From January 1, 2020, through today (May 13), the S&P is up 20%. So while this year’s moves may be negative, many investors still have gains to either realize or protect. Realizing gains is easy; you pick your spot and sell out of your position. But what may not be easy is the taxes that may accompany those gains or parting with a position that you believe over the long term will excel. If you are confident the best place for your assets is your current position, protecting it with an options strategy may be the best way to protect against your downside, and only curtail your upside potential by the price of the protective options used as insurance.

Hedging Against Downward Moves

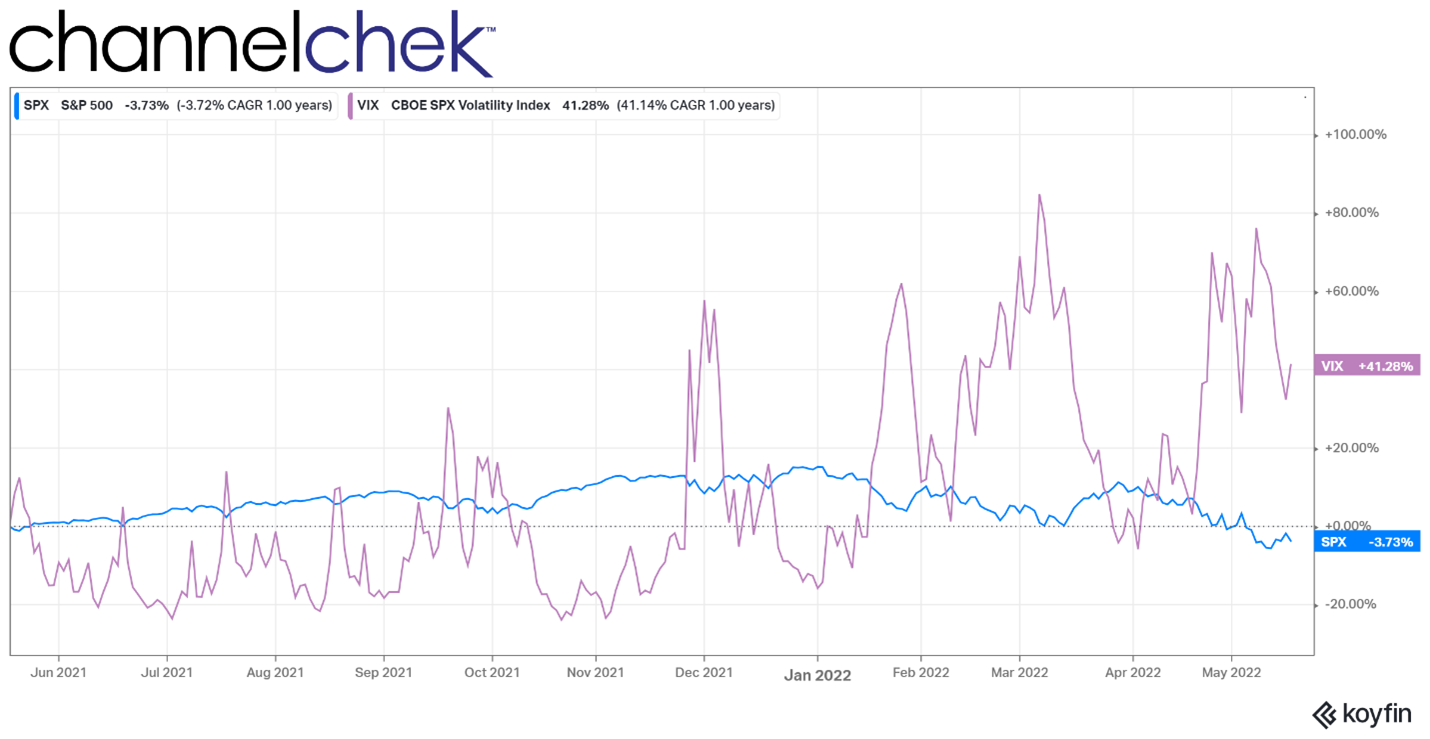

If you have unrealized capital gains, you are probably glad but may be an anxious trader or investor. Volatility, as measured by the VIX is at a level that is considered negative for stocks. Yet, if you believe stocks you own still have upside once we get through this period where covid, crypto, low unemployment, higher interest rates, and war can cause the prices on your holdings to swing in an unpredictable fashion, an options strategy may make sense for you.

One method experienced investors employ is the protective put.

Image: Koyfin

What is a Protective Put?

There are two main types of options: put and call options. The buyer of a call has the right to buy a stock at a set price until the options contract expires. The buyer of a put has the right to sell a stock at a set price until the contract expires.

If you own a stock, a protective put position is created by purchasing put options on the name or something highly correlated to the stock. And, at a quantity that will roughly trade one to one with your position. The put allows the owner to sell the underlying stock at the price predefined in the options contract. This is the mirror trade to a covered call which involves selling the right to buy a stock owned. Investors that are more comfortable with covered call options can think of purchasing a put to protect a long stock position, much like a synthetic long call.

The benefit of a protective put strategy is it helps protect against losses during a price decline in the assets name, while still benefitting from capital appreciation if the stock increases in value. Of course, there is a cost to any insurance against big losses: in the case of a protective put, it is the price of the option. Essentially, if the stock goes up, you have unlimited profit potential (less the cost of the put options), and if the stock goes down, the put goes up in value to offset losses on the stock.

Removing the Mystery

Assume you own 100 shares of ABC Company at $50 per share from April 2020. The cost of this trade was $5,000.

The stock is now trading at $65 per share, and you think it might go to $70 or more. However, you are concerned about stablecoin problems and the Fed putting the kibosh on growth.

A protective put reduces risk if you maintain your position in the stock so you benefit if it reaches your $70 price target. At the same time, the put offers protection in case the market weakens or there is an unforeseen event with the company you own.

Example

Let’s say the stock is trading at $65, and suppose you’re tired of seeing your gains erode so you decide to purchase the 62 ABC Company October put option contract (the underlying asset is ABC Company stock, the exercise price is $62, and the expiration month is November) at $3 per contract (option price) for a total cost of $300 ($3 per contract multiplied by 100 contract shares).

If ABC continues to go up in value, your underlying stock position increases as normal and the put option falls “out of the money” (it can’t be exercised). For instance, if, at the expiration of the put contract, the stock reaches your $70 price target, you might then choose to sell the stock for a pretax profit of $1,700 ($2,000 profit on the underlying stock less the $300 cost of the option) and the option would expire worthless. It the stock went to $74, your overall net would be $2100. And you could realize it without having concerns about a sinking price.

But what if the price did get beaten up? If your fears about the market were realized and the stock was negatively impacted, your capital gains would be protected against a decline by the put.

Here’s how:

Assume ABC Corp. common shares declined from $65 to $55 prior to the option’s expiration. Without owning the put, if you sold the stock at $55, your pretax profit would be just $500 ($5,500 less $5,000). If you purchased the 62 ABC October put, and then sold the stock by exercising the option, your pretax profit would be $900. You could then sell the stock at the (put) exercise price of $62. As a result the profit from the put position would be $900. To calculate, use the $500 profit on the underlying stock, plus the $700 from the in-the-money put profit, less the $300 cost of that option. Compare this with a profit of $500 without the option contract.

The cost of the option doesn’t take much away from upside potential, by it protects against downside losses. If you think your stock price will not move in either direction, a put option may not benefit your strategy.

Circumstances to Consider Put Protection

Protective puts can be a useful strategy for traders and investors that expect a short- or intermediate-term decline in the price of a stock they own and have reasons not to sell. The reasons could be tax related, you may be somehow restricted from selling the shares, fierce volatility in the share price, it is exposure to the company you work for and selling is not yet permitted, building the position in thinly traded shares took time, etc.

Any one of these reasons might make it prudent to consider a protective put. Additionally there may be an event such as an earnings report that you expect will drive the price in ne direction or another, and you want to protect against the downside risk of that report.

Take -Away

Option protection in the form of puts comes at a cost that the investor needs to factor into their overall strategy. However, in volatile markets, knowing you’ll capture a large part of the upside if your stock moves up, and are protected from profit erosion if the stock declines allow for more overall comfort with the limited risk in the position.

Paul Hoffman

Managing Editor, Channelchek

Suggested Content

Sources

https://www.nerdwallet.com/article/investing/put-options

Stay up to date. Follow us: