Is it Better to Shadow Trade Insiders Rather than Congress Members or Fund Managers?

As tricky as the overall market has been, a new crop of investors that had been primarily index investors have spent the past 11 months gravitating more toward creating their own diversified mix of above-average probability stocks. One proven way to put the odds more on your side as a self-directed investor is to watch trends in insider buying. It was Peter Lynch of Magellan Fund fame who said, “Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.” To be sure, management only has so much control over performance, but they are likely to have greater clarity than anyone else evaluating their company.

Why Shadow Insiders?

Following insiders into stocks you otherwise are positive about is a form of shadow investing. Shadowing successful investors is a growing trend. There are websites dedicated to highlighting the transactions of investors like Paul Pelosi, Warren Buffett, Michael Burry, Cathie Wood, and others. But shadowing directors or key executives of publicly traded companies provides investors with much more current information – SEC Form 4 is used to disclose a transaction in company stock within two days of the purchase or sale. Compare the two-day reporting to institutional funds managing over $100 million that report 45 or more days after quarter-end on quarter-end holdings using SEC Form 13F. Or Congress-persons that can wait 45 days after a transaction to report it. Moreover, the insider is generally restricted to trading windows, so their holding time tends to be longer term. So their commitment level may be much higher than say a hedge fund manager like Michael Burry that may have purchased a security just before his 13F statement date, and then sold it a week later.

And the performance is above average. University of Michigan finance professor Nejat Seyhun, the author of “Investment Intelligence from Insider Trading” wrote stock prices rise more after insiders’ net purchases than after net sales. On the whole, insiders do earn profits from their legal trading activities, and their returns are greater than those of the overall market.

Current Example

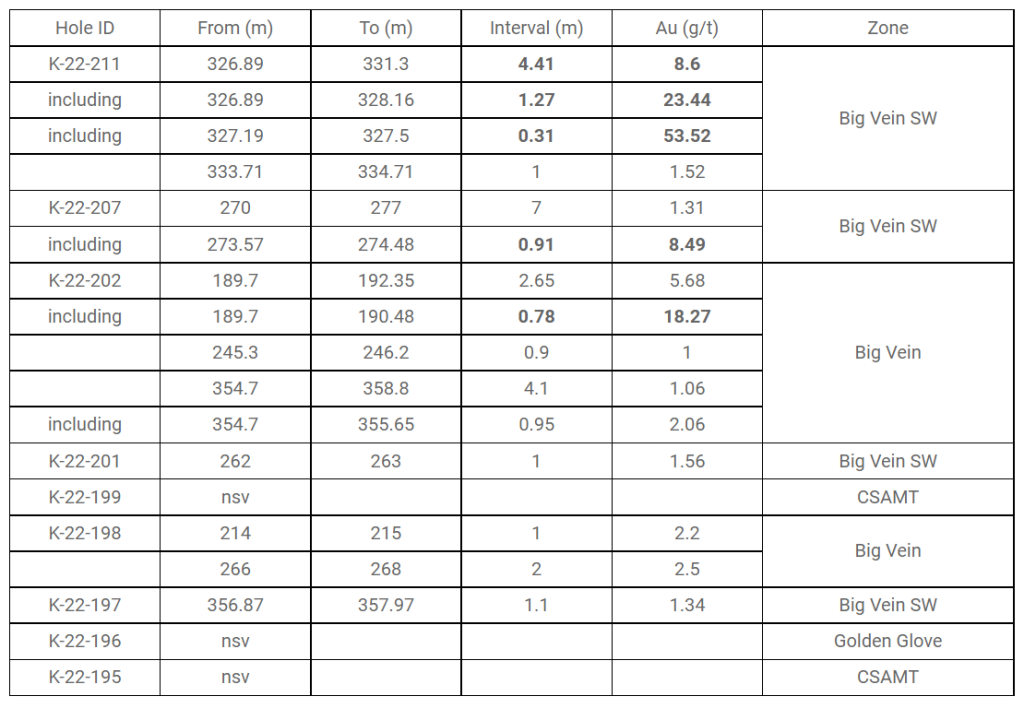

I thought to write about following legal insider buying of stocks on your watch list after a link to a research note posted on Channelchek appeared in my inbox. It was on a company I follow and it highlighted legal insider trading by an executive. The report, available here, reported that the CEO of an expanding company in the cannabis sector name Schwazze (Medicine Man Technologies), was adding substantially to his ownership of the company he runs. The note by Noble Capital Markets Sr. Research Analyst, Joe Gomes, said:

“In a series of Form 4 filings, between November 14th and November 23rd Schwazze CEO Justin Dye purchased 1,325,852 SHWZ shares at a cost of $2.36 million, or a per share average of $1.78. According to the most recent Form 4 filed on November 25th, Mr. Dye directly currently owns 1,368,062 SHWZ common shares and indirectly owns 9,287,500 SHWZ common shares through Dye Capital & Company.”

Schwazze (SHWZ) is up 42% over the past month.

How Do You Screen and Watch for Insider Buying Activity?

There are websites such as SECForm4.com and InsiderMonkey.com that aggregate SEC Form 4 filings and post them in a searchable, fully filterable online environment so you may search for characteristics you may prefer in your stock selections. While using insider activity, whether it be raw from the SEC or served up on online screening tools, here are four things to keep in mind to help hone your skills.

Some insiders are better than others. As a rule, directors tend to know less about a company’s outlook than top executives. Key executives are the CEO and CFO. The people day-to-day running the company are better able to assess risk of an investment in their company.

More insiders are better than a few. If one insider is buying in unusual amounts, it is a green flag to dig deeper. If several have begun adding to their holdings, it can be seen as a stronger signal.

People at small companies may have more insight. At smaller companies, a higher percentage of insiders are privy to company plans, changes in strategy, and financials. At big corporations, information is more dispersed, and typically only the core management team has the big picture.

Stay the course. Insiders tend to act far in advance of expected news. This is in part because of trading windows and also to avoid the appearance of illegal insider trading. A study by academics at Pennsylvania State and Michigan State contends that insider activity precedes specific company news by as long as two years before the eventual disclosure of the news.

Take Away

Insider tracking takes some work, but the resources to monitor a list of stocks you are interested in do exist to make it easier. Investors that would prefer to build their own diversified portfolio rather than own an index fund may find that watching insider buys helps point the way toward stocks more likely to beat a particular index. Another Peter Lynch quote says, “Know what you own, and why you own it.” Following insider buying allows you to have a methodology where you do know exactly why you are in a position. And although I have no hard data, I’d guess over the past five years it has paid better to follow insiders’ reported trades rather than social media influencers’ suggestions for a trade.

Managing Editor, Channelchek

Sources

https://www.secform4.com/insider-trading/1622879.htm

https://www.channelchek.com/research-reports/25422

http://mitpress.mit.edu/9780262194112/investment-intelligence-from-insider-trading/