Friday, October 25, 2019

Biotechnology Industry Overview

Ahu Demir, Ph.D, Biotechnology Research Analyst, Noble Capital Markets, Inc.

Cosme Ordonez, MD, Ph.D., Senior Life Sciences Analyst, Noble Capital Markets, Inc.

Refer to end of report for Analyst Certification & Disclosures

- Bears got a grip on biotech stocks this year:

The biotechnology sector has underperformed the broader markets thus far in 2019. The biotech bear market might be due to a slowdown in FDA approvals, negative outcome from several high-profile clinical trials, as well as the recent industry focus on smaller indications and orphan diseases.

- Turnaround in investor sentiment might be near: In our view, a reversal of fortunes might be possible by year end. The biotechnology sector got a boost from Biogen this week. On October 23rd, Biogen announced that it plans to file for FDA approval of aducanumab for the treatment of Alzheimer’s disease early next year. On the heel of the news, biotech stocks rallied lifting the BTK and NBI indices by 2.3% and 2.9%, respectively.

- Robust financing environment:

The biotechnology sector has experienced an uptick in total capital raised thus far in 2019, already surpassing the total amount of money raised by the sector in 2018, and establishing records not seen in recent years.

- Sector overview.

Despite the recent underperformance, we expect the sector to rebound driven by steady earnings growth from industry bellwethers and an uptick in M&A activity. Over the first three quarters of 2019, biotechnology companies have strengthened their balance sheets, which bodes well for future drug innovation. Going forward, we expect clinical trial readouts to be the major catalysts for the sector in Q4 2019-H1 2020.

Click ‘view previous report’ for company specific disclosures on Noble covered companies.

Performance of Biotechnology Sector in 2019

Index Performances: S&P 500 (SP50, +19.5%) and Russell 3000 (RUA, +19.1%) benchmark indices have outperformed the NYSE Arca Biotechnology (BTK, +3.3%) and NASDAQ Biotechnology (NBI, +8.8%) indices in YTD-2019 (as of 10/23/2019, Exhibit 1). The stock markets recovered following a plunge at the end of Q3 and the beginning of Q4 2019. When the biotechnology sector was the strongest by middle of this decade, medical breakthroughs took place on large commercial indications such as hepatitis C and lung cancer. In recent years, the industry has focused mainly on orphan indications, which are lucrative for individual companies, but have a lesser impact on return on invested capital (ROIC) for the industry overall. This may have put a dent of investors’ current appetite for biotech stocks. However, recent news from Biogen might change this trend.

Reversal of fortunes at Biogen bodes well for sector rebound: The biotechnology sector got a boost from Biogen this week. On October 23rd, Biogen announced that it plans to file for FDA approval of aducanumab for the treatment of Alzheimer’s disease early next year. Alzheimer’s disease might be the largest commercial opportunity in the sector’s history. Recall that back in March 2019, Biogen announced the discontinuation of Phase 3 clinical trials on the use of aducanumab. Biogen’s stock lost 29% of its value that day, sending ripples through the entire biotech sector, which was negatively impacted by the news. Biogen reversal of fortunes this week triggered a rally lifting the BTK and NBI indices by 2.3% and 2.9%, respectively, on the heels of the news.

Biotech companies strengthen their balance sheets: The biotechnology sector has experienced an uptick in total capital raised thus far in 2019, already surpassing the total amount of money raised by the sector in 2018 ($546 million (mm) raised in YTD-2019 compared to only $526 mm for the full year of 2018) (Exhibit 5). The median capital raised by initial public offerings (IPO) in Q1 and Q3 2019 represented the highest numbers since 2011 ($166 mm and $150 mm, respectively) (Exhibit 5). In YTD-2019, M&A activity has also increased as total private and public transaction volume (+6%) and deal count (+2%) in the 9-months of 2019 have already surpassed the totals for full year 2018 (Exhibit 7).

FDA Approvals Slowdown: Thus far, U.S. Food and Drug Administration (FDA) has approved 33 drugs in YTD-2019 after a record high number of 59 in 2018 (Exhibit 12 and 13). Although the pace for 2019 is not far off from industry norm, it has certainly slowdown relatively to 2018. We believe this has had a negative impact on biotech investors sentiment this year.

What shall we expect over the next six months? In our opinion, a potential approval by FDA regulators of Biogen’s aducanumab early next year could be a significant catalyst for the sector. Alzheimer’s disease has been a very difficult indication for biotech and big pharma companies. However, there is no doubt of the tremendous commercial opportunity the Alzheimer’s market represent. The introduction of a disease modifying drug could certainly have a significant impact on future earnings, generate economic value and improve return on invested capital (ROIC) for the industry overall. We believe data readouts from late stage human clinical trials from several biotech companies will key catalysts for the sector in Q4 2019/H1 2020.

Recent Sector News

- ProQR Therapeutics (PRQR) received Rare Pediatric Disease (RPD) designation from the U.S. Food and Drug Administration (FDA) for sepofarsen for the treatment of Leber’s congenital amaurosis 10 (LCA10), the most common cause of blindness due to genetic disease in children. (October 15, 2019)

- BridgeBio Pharma (BBIO) terminated a merger to acquire the remaining outstanding common stock (33.4%) of its subsidiary Eidos. BridgeBio currently holds 66.6% of Eidos shares and was unable to agree with the Special Committee formed by its subsidiary. (October 14, 2019)

- Eli Lilly (LLY)’s Reyvow lasmiditan received approval from the FDA to treat acute migraine with or without aura. It is the first agonist of serotonin (5-HT1F) approved for migraine. Lasmiditan’s rights were gained through its $960 million acquisition of CoLucid Pharmaceuticals in 2017. (October 11, 2019)

- Novartis AG (NVS)’s Beovu received FDA approval to treat wet age-related macular degeneration. Beovu is a vascular endothelial growth factor (VEGF) inhibitor, that demonstrated non-inferior vision improvements and superior retinal fluid and thickness compared to Regeneron Pharmaceutical (REGN)’s VEGF inhibitor Eylea. (October 8, 2019)

- 4D pharma plc (LSE: DDDD) and Merck (MRK) inked a deal on discovery and development of live biotherapeutic vaccines using 4D’s microbiome based MicroRx platform. 4D will receive an undisclosed upfront cash payment and is eligible for $347.5 million in milestones plus royalty payments. (October 8, 2019)

- Ardelyx (ARDX)’s Ibsrela tenapanor gained FDA approval to treat irritable bowel syndrome (IBS) associated with constipation. Tenapanor (the solute carrier “family 9 sodium hydrogen exchanger member 3” (SLC9A3; NHE3) inhibitor) became the second approved product for IBS. This news came one week after positive data readout from Phase 3 study of tenapanor in hyperphosphatemia. (September 12, 2019)

Important upcoming catalysts in our selected coverage universe

Dyadic International (DYAI), Outperform rating, $9 Price Target (PT, view previous report by Ahu Demir, Ph.D.)

- Accomplishment of C1 glyco-engineering (human-like glycosylation) in Q1 2020

- Bio-comparability data from certolizumab biosimilar program in 2020

Genprex (PMN), Outperform rating, $5.00 Price Target (PT, view previous report by Cosme Ordonez, MD, Ph.D.)

- Extension of human clinical trials on the use of lead drug Oncoprex in combination with erlotinib for the treatment of non-small cell lung cancer in 2020

- Commencement of human clinical trials evaluating Oncoprex in combination with Merck’s Keytruda for the treatment of lung cancer in 2020

Onconova (ONTX), Outperform rating, $12 Price Target (PT, view previous report by Ahu Demir, Ph.D.)

- Completion of enrollment in INSPIRE study assessing rigosertib in 2nd line high-risk myelodysplastic syndrome (HR-MDS) in Q1 2020

- Submission of IND for ON 123300 (novel CDK 4/6 and ARK 5 dual inhibitor) in Q1 2020

- Top-line data readout from INSPIRE in H1 2020

- Commencement of Phase 2 clinical study evaluating rigosertib with azacitidine in first line treatment of MDS in 2020

ProMIS Neurosciences (PMN), Outperform rating, $1.00 Price Target (PT, view previous report by Cosme Ordonez, MD, Ph.D.)

- Initiation of human clinical trials on the use of lead drug PMN310 for the treatment of Alzheimer’s disease in 2020

- Potential signing of high value partnership with big pharma to complete development and commercialize antibody platform technology in 2020/2021 timeframe

Trovagene (TROV), Outperform rating, $23 Price Target (PT, view previous report by Ahu Demir, Ph.D.)

- Clinical data update from Phase 1b/2 acute myeloid leukemia (AML) study of onvansertib in combination with standard-of-care chemotherapy (Phase 2 study enrolling patients on onvansertib in combination with decitabine) at the American Society of Hematology (ASH) annual meeting on December 7-10, 2019

- Clinical data update from Phase 1b/2 KRAS-mutated metastatic colorectal cancer (mCRC) study of onvansertib in combination with FOLFIRI and Avastin at the Gastrointestinal Cancers Symposium (ASCO-GI) on January 23-25, 2020

- Clinical data update from Phase 2 metastatic castration-resistant prostate cancer (mCRPC) study of onvansertib in combination with Zytiga at the Genitourinary Cancers Symposium (ASCO-GU) on February 13-15, 2020

INDUSTRY ARTICLES BY NOBLE LIFE SCIENCE PARTNERS

A. Gene Therapy Bloom – Innovative drugs and technologies in the area

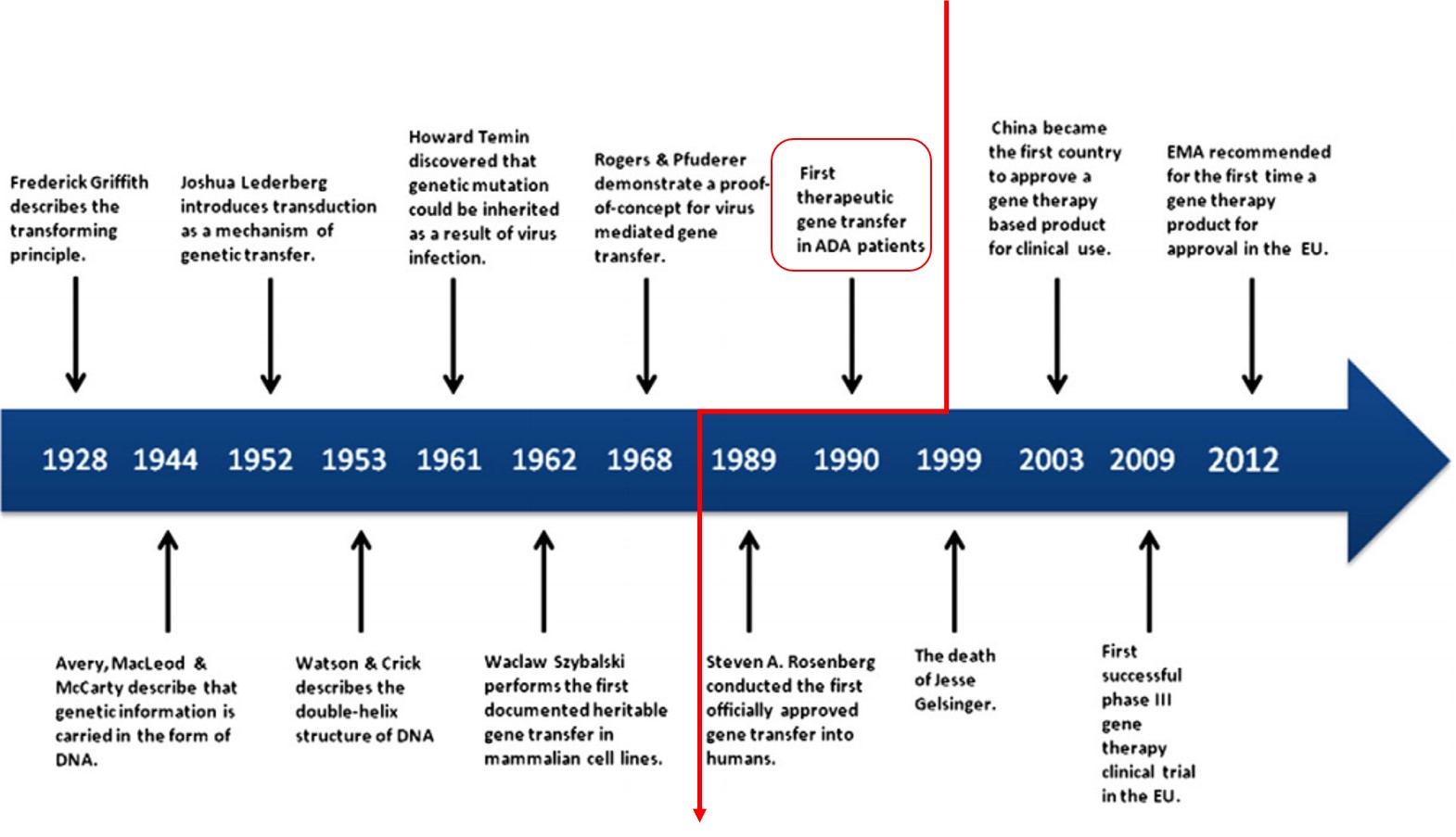

2019 has been a strong year for gene therapy companies. An increase in activity on merger and acquisition (M&A) front, combined with several positive data readouts, have acted as key catalysts for the sector.

- Spark (ONCE, Not covered)’s Luxturna became the first FDA-approved gene therapy for the treatment of a rare form of inherited blindness (approved in 2017) with a listed price of $850,000 per course of therapy. Roche (RHHBY, Not covered) announced a deal to acquire Spark for $4.8 billion in February 2019. However, the deal closing has been delayed until at least April 2020 due to an extended antitrust review by regulators.

- The second M&A deal was Biogen (BIIB, Not covered)’s acquisition of Nightstar Therapeutics (NITE, Not covered). Biogen acquired Nightstar for $800 million, the deal was closed in July 2019. Nightstar Therapeutics has a clinical pipeline of gene therapy candidates in ophthalmology. The lead asset NSR-REP1 is being assessed for the treatment of choroideremia (CHM), a rare, degenerative, X-linked inherited retinal disorder, which leads to blindness.

Table 1. Selected Gene Therapy Companies with Clinical Programs

Source: BioMedtracker, Noble Research

- Two initial public offerings (IPO) took place in gene therapy;

- Prevail Therapeutics ($125 million IPO, June 2019) is developing AAV-based gene therapies to treat neurodegenerative disorders. The New York based company’s lead program, PR001, is targeting Parkinson’s disease patients carrying a particular genetic mutation.

- 4D Molecular Therapeutics ($100 million IPO, September 2019) is developing AAV-based targeted gene therapies for multiple diseases involving target tissues in the areas of retina, heart, liver, brain, skeletal muscle, and lung.

- Sarepta (SRPT, Not covered), BioMarin (BMRN, Not covered), Spark (ONCE, Not covered) and Nightstar (NITE, Not covered) stand out as leaders in gene therapy across various indications.

- Sarepta announced interim data from a Phase 1/2 study of SRP-9003 to treat a form of limb-girdle muscular dystrophy on October 4, 2019. SRP-9003 treatment led to functional improvements in all three patients in a low-dose cohort after nine months of therapy. The company intends to give guidance next year on a timeline and design of the pivotal study.

- BioMarin plans to seek approval of valoctocogene roxaparvovec in the U.S. and Europe to treat severe hemophilia A in Q4 2019. SB-525 from Sangamo, Pfizer and Spark’s SPK-8011 are in Phase 1/2 testing for the same indication.

- bluebird and Orchard Therapeutics (ORTX, Not covered) are developing lentiviral gene therapies for ex vivo delivery of beta-globin gene (HBB) to hematopoietic stem cells (HSCs) from patients with hemoglobin disorders.

- bluebird’s Zynteglo (LentiGlobin, BB305) gained approval in Europe for the treatment of beta-thalassemia. Zynteglo is priced at €1.575 million ($1.77 million) spread over five years. After the first payment, only patients who benefit from Zynteglo will continue to pay. The FDA decision on U.S. approval is expected by early 2020.

- Orchard is preparing for a registrational trial evaluating OTL-300 for the treatment of beta-thalassemia in 2020.

- bluebird and Novo Nordisk (NVO, Not Covered) inked a partnering deal to develop a gene therapy for hemophilia A on October 9, 2019.

Key catalysts in gene therapies are highlighted on page 31.

B. Impact of FDA’s Expedited Drug Approval Programs on Biotech Industry

Food and Drug Administration (FDA) approval is mandatory for marketing drugs in the United States. Drug development is a scrutinizing and costly process for biopharmaceutical companies. It starts with the drug discovery/preclinical phase, which consists of screening compound libraries for a drug with positive activity. It could take up to 6 years to identify a lead drug. To start human clinical trials, the sponsor or the drug development company requires to file an “Investigational New Drug (IND)” application with the FDA. Only after the green light is given by regulators, human clinical trials with the drug can start. The clinical programs consist of three phases: Phase I, II and III human clinical trials. This extensive and costly process can last up to 7 years to complete, depending upon chosen indication (targeted disease) and other factors. Once the trials are finished, a “New Drug Application (NDA)” for drug commercialization is submitted for FDA review. It could take up to 2 years until a verdict is delivered. Hence, introducing a promising treatment into the marketplace is a laborious, expensive and time-consuming process (Figure 1).

Figure 1. Drug Discovery and Development Timeline

Source: https://www.focr.org/fda-regulatory-policy

FDA introduced the PRIORITY REVIEW and ACCELERATED APPROVAL programs in 1992 to expedite the availability of drugs for the treatment of serious conditions. In 1997 (in the wake of the AIDS crisis), the FAST TRACK program was introduced to quicken NDA filing for drugs targeting a life-threatening illness. In 2012, the FDA launched the BREAKTHROUGH THERAPY program for investigational drugs targeting life-threatening illness and showing an improvement over available treatments. This improvement is measured using a clinically significant endpoint or endpoints, which are indicators of patients’ morbidity, mortality or severe symptoms of the targeted disease.

Priority Review (PR)

Following submission of an NDA application for approval of a drug as a treatment for neglected or rare pediatric diseases, the company or sponsor could apply for Priority Review (PR). The novel drug therapy must demonstrate a significant improvement in the effectiveness of the treatment, showing superior safety and efficacy. There has to be a significant improvement in the prevention, treatment, and/or diagnosis of the targeted disease.

For a sponsor to secure PR, the readout from early clinical trials must demonstrate significant improvement in safety and efficacy compared to standard available treatment. Once the PR voucher is obtained, the sponsor has the right to use it for the targeted disease, or alternatively, it could use it for another drug filing. The company could also monetize the PR voucher by selling it to another sponsor. The FDA aims to render a decision in 6 months instead of 10 months of standard review process with PR designation. In 2018, FDA has granted 60 PR designation, which represents 35% of total number of drugs approved in that year.

Accelerated Approval (AA)

Accelerated Approval (AA) allows the use of surrogate endpoints for a faster drug approval process for serious conditions that fill an unmet medical need. Clinical trial endpoints measure the outcomes (improvement in symptoms) in the trial, while surrogate endpoints measure the effect of a specific treatment that may correlate with real clinical endpoints. Surrogate endpoints do not represent direct clinical benefit, instead predict clinical benefit (e.g. tumor shrinkage can be used as a surrogate endpoint, where the endpoint is longer survival in clinical trials). Surrogate endpoints can be laboratory results, radiographic images, or physical signs to predict clinical benefit. AA does not necessarily shorten the standard 10-month review process, however, it allows FDA to start deliberating NDA much earlier within the drug’s development cycle, as early as Phase 2 stage (Figure 2). Within the past 5 years (Exhibit 2), FDA has steadily increased AA designations to bring new drugs faster into the market. In 2018, 18 drugs (11% of total drug approvals compared to 5% in 2013) with AA designation were approved.

Fast Track (FT)

Fast Track (FT) designation works only for drugs that treat serious conditions filling the unmet medical need. FT can be granted if the drug shows significant advantage (efficacy or safety) over available options or if there is no available treatment for the target condition. To expedite development, companies with FT designated drug meet more frequently with FDA to discuss and coordinate clinical trial design, use of appropriate biomarkers (biological marker refers to a broad subcategory of medical signs – that is, objective indications of medical state observed from outside the patient). Drugs with FT designations can be eligible for AA or PR if relevant criteria are met (Exhibit 2). In 2018, the FDA has granted 33 FT which represented 19% of total drug approvals compared to 4% in 2013 (Exhibit 2).

Breakthrough Therapy (BT)

Breakthrough Therapy (BT) designations allow expedition of drug development to treat serious illnesses. BT is granted based on preliminary evidence of target drug demonstrating substantial improvement over available treatment. Advantages can be established from safety profile, surrogate endpoint, intermediate clinical endpoint, or changes in critical biomarkers. Drugs with BT designation are eligible for FT features and FDA guidance on efficient clinical development beginning as early as Phase 1 stage (Figure 2). FDA has dramatically increased drug approvals with BT designation from 3 in 2013 to 38 in 2018, which represents 3% and 22% of total drug approvals, respectively.

Figure 2. Summary of FDA’s Expedited Drug Approval Programs

Source: www.fda.gov, Noble Research

The use of 4 mentioned expedited programs has steadily increased over the years. In 2018, these programs were responsible for 149 approvals, representing 88% of total drug which entered into the US market. Research programs have been rejuvenated in hope of capturing FDA designation and this is especially highlighted in companies that develop therapies for rare diseases (diseases affecting fewer than 200,000 people).

Figure 3. Drugs Approved by Expedited Programs in the Last 5 years

Source: www.fda.gov and Noble Research

To date, FDA’s expedited programs have been successful at speeding up the drug approval process. In a study that considered oncology approvals from 1992 to 2017, FDA reported that 55% of 93 drugs were validated for clinical benefit in post-approval trials, while 40% were still under post-approval evaluation and 5% were withdrawn. Based on statistics, these designations have helped patients with serious illnesses to receive effective treatment earlier than the regular path. Favorable success rates show that these programs have been valuable in the biotechnology sector.

Market Dynamics

Exhibit 1: Biotechnology Relative Price Performance, YTD 2019 (as of 10/23/2019)

Source: Noble Life Science Research, Capital IQ

S&P 500 (SP50, +19.5%) and Russell 3000 (RUA, +19.1%) benchmark indices have outperformed the NYSE Arca Biotechnology (BTK, +3.3%) and NASDAQ Biotechnology (NBI, +8.8%) indices in YTD- 2019 (as of 10/23/2019). Notable stock price outperformance in the BTK index (in alphabetical order) include Acadia, (ACAD, +158.6%), Seattle Genetics (SGEN, +76.4%), Celgene (CELG, +63.8%), Bio-Techne (TECH, +39.9), Exact Sciences (EXAS, + 38.7%).

Exhibit 1-2: Biotechnology Relative Price Performance, Q1/Q2/Q3 2019 (9 months, as of 9/30/2019)

Source: Noble Life Science Research, Capital IQ

NYSE Arca Biotechnology (BTK, -0.1%) and NASDAQ Biotechnology (NBI, +2.8%) indices have underperformed benchmark indices S&P 500 (SP50, +18.7%) and Russell 3000 (RUA, +18.4%) in the three quarters of 2019.

Exhibit 2: Top/Bottom 5 Small Cap Stock Performance, YTD (as of 10/23/2019)

Source: Noble Life Science Research, Capital IQ

Top stock performers of NBI index include Achillion Pharmaceuticals (ACHN, +259.8%), Reata Pharmaceuticals (RETA, +230.1%), Dova Pharmaceuticals (DOVA, +223.2%), ArQule (ARQL, +208.3%), The Medicines Company (MDCO, +205.8%); bottom performers include Clovis Oncology (CLVS, -83.5%), Zafgen (ZFGN,-85.5%), Savara (SVRA, -88.7%), Novavax (NVAX, -89.1%) and Tocagen (TOCA, -92.9%).

Exhibit 3: Biotechnology Short Interest % of Float, as of 10/21/19

Source: Noble Life Science Research, Capital IQ

Stocks with highest short interest are Opko Health Inc. (OPK), Therapeutics MD (TXMD) and Geron Corporation (GERN).

Exhibit 4: Biotech Financing YTD-2019 (between $50-$200mm)

Source: Noble Life Science Research, Capital IQ

The largest transactions include Intercept Pharmaceuticals (ICTP, $200mm), Zai Lab (ZLAB, $200mm) and Alector (ALEC, $176mm).

Exhibit 5: Biotech Financings—IPO and Follow-on Capital Raised by Quarter

Source: Noble Life Science Research, Capital IQ

Biotech financings in YTD-2019 has exceeded the full year of 2018 numbers ($546mm vs. $526mm, respectively). This was a result of large transactions, initial public offering (IPO) in Q3 2019, including IGM Biosciences (IGMS, $175mm), SpringWorks Therapeutics (SWTX, $162mm) and Viela Bio (VIE, $150mm).

Exhibit 6: Biotech Licensing Deals

Source: Noble Life Science Research, Bloomberg

The licensing deal transactions in the 9 months of 2019 showed a modest increase (1%, total licensing deals of 321 versus 318) compared to the 9-months in 2018.

Exhibit 7: Biotech M&A Deals

Source: Noble Life Science Research, Bloomberg

The total M&A deals in the three quarters of 2019 showed an uptick exceeding the full year 2018 transaction volume and deal count. The transaction volume reached $250 billion with 1,105 deals in Q1-Q3 2019 compared to $236 billion with 1,080 deals in full year of 2018.

Exhibit 8: IPO and Follow-On Lock-Up Expiration Data for 2019-Q1 2020

Source: Noble Life Science Research, CapIQ

Exhibit 9: Medical, Scientific and Industry Conferences in 2019-H1 2020

Source: Noble Life Science Research, Biomed Tracker

Exhibit 9: Medical, Scientific and Industry Conferences in 2019-H1 2020 Cont.

Source: Noble Life Science Research, Biomed Tracker

Exhibit 10: Selected Pending Approvals of New Molecule Entities (NMEs) and Biologics

Source: Biomed Tracker, FDA

Exhibit 11: Upcoming Advisory Committee Meeting Dates

Source: Noble Life Science Research, FDA

Exhibit 12: Selected Recently Approved Drugs and Biologics, YTD

Source: Noble Life Science Research, Biomed Tracker, FDA

In total, 33 medicines were approved in YTD-2019.

Exhibit 13: New FDA Drug Approvals

Source: Noble Life Science Research, Bloomberg

33 drug approvals in 2019 (YTD) demonstrated a low productive year following all-time record of 59 approvals in 2018.

Exhibit 14: Number of Drugs in the Pipeline

Source: Noble Life Science Research, Global Data Intelligence

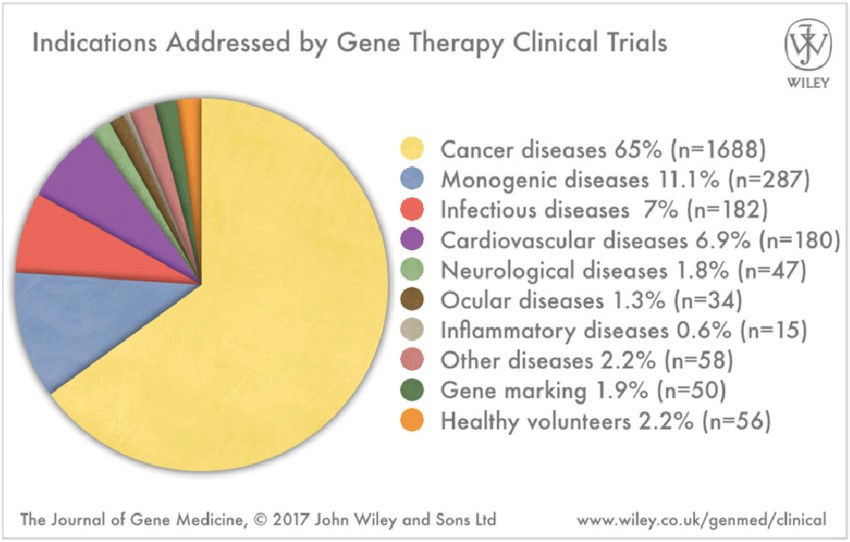

Oncology continues to be the dominant development category, which we think has also been fueled of late by the 1000+ immuno-oncology clinical drug trials.

Exhibit 15: Cash Analysis, sorted by E/P (as of 10/18/2019)

Note: Market cap as of 10/18/2019, Cash value for 2Q19

Source: Noble Life Science Research, Capital IQ

Exhibit 15: Cash Analysis, sorted by E/P Cont.

Note: Market cap as of 10/18/2019, Cash value for 2Q19

Source: Noble Life Science Research, Capital IQ

Exhibit 15: Cash Analysis, sorted by E/P Cont.

Note: Market cap as of 10/18/2019, Cash value for 2Q19

Source: Noble Life Science Research, Capital IQ

Exhibit 15: Cash Analysis, sorted by E/P Cont.

Note: Market cap as of 10/18/2019, Cash value for 2Q19

Source: Noble Life Science Research, Capital IQ

Exhibit 16: Catalyst Calendar for Gene Therapy Companies

Source: Noble Life Science Research, Biomed Tracker

Ahu Demir, Ph.D.

Biotechnology Research Analyst

E: ademir@noblelsp.com

T: 561-994-5730

Dr. Ahu Demir, Ph.D. covers the small cap biotechnology sector. She joined Noble Capital Markets as a Biotechnology Research Analyst in 2018. Prior to that, she worked at Roth Capital as an Associate Biotechnology Analyst. Dr. Demir started her Wall Street and sell-side equity research career in biotechnology at Cantor Fitzgerald Research Division, where she served as Associate Biotechnology Analyst and followed a range of publicly traded biotechnology companies focused on the development of therapeutics in oncology, infectious disease and central nervous system diseases. Prior to joining Wall Street, Dr. Demir was a Post-Doctoral Fellow at Columbia University and New York University. During her fellowship, she has also worked as a scientific consultant for the industry and as Marketing and Patentability Agent at the Technology Transfer Office of New York University. She holds a Ph.D. in Chemistry from University of Florida.

Cosme Ordonez, MD, Ph.D.

Senior Life Sciences Analyst

E: cordonez@noblelsp.com

T: (561) 998-5487

Dr Ordoñez joined NOBLE Capital Markets in 2016. He has nineteen years of experience in various segments of the healthcare capital markets including equity research and investment banking. During his career, he has worked on various roles in Buy-side and Sell-Side Institutions, including Difference Capital Financial Inc., and GMP Securities Inc. in Canada, where he was highly ranked by Brendan Woods International and Starmine for quality of equity research. Dr Ordoñez has advised and helped raise funds for North American companies in drug development, medical device, specialty pharma and healthcare services areas. He is a Medical Doctor and obtained a Ph.D. in Experimental Medicine and Biochemistry from McGill University in Montreal, Canada. He also completed post-doctoral training at the Karolinska Institute/Hospital in Stockholm, Sweden.

GENERAL DISCLAIMERS

All statements or opinions contained herein that include the words “we”, “us”, or “our” are solely the responsibility of Noble Capital Markets, Inc.(“Noble”) and do not necessarily reflect statements or opinions expressed by any person or party affiliated with the company mentioned in this report. Any opinions expressed herein are subject to change without notice. All information provided herein is based on public and non-public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed. No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio. The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on its own appraisal of the implications and risks of such decision.

This publication is intended for information purposes only and shall not constitute an offer to buy/sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile. This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice. Past performance is not indicative of future results. Noble accepts no liability for loss arising from the use of the material in this report, except that this exclusion of liability does not apply to the extent that such liability arises under specific statutes or regulations applicable to Noble. This report is not to be relied upon as a substitute for the exercising of independent judgement. Noble may have published, and may in the future publish, other research reports that are inconsistent with, and reach different conclusions from, the information provided in this report. Noble is under no obligation to bring to the attention of any recipient of this report, any past or future reports. Investors should only consider this report as single factor in making an investment decision.

IMPORTANT DISCLOSURES

This publication is confidential for the information of the addressee only and may not be reproduced in whole or in part, copies circulated, or discussed to another party, without the written consent of Noble Capital Markets, Inc. (“Noble”). Noble seeks to update its research as appropriate, but may be unable to do so based upon various regulatory constraints. Research reports are not published at regular intervals; publication times and dates are based upon the analyst’s judgement. Noble professionals including traders, salespeople and investment bankers may provide written or oral market commentary, or discuss trading strategies to Noble clients and the Noble proprietary trading desk that reflect opinions that are contrary to the opinions expressed in this research report.

The majority of companies that Noble follows are emerging growth companies. Securities in these companies involve a higher degree of risk and more volatility than the securities of more established companies. The securities discussed in Noble research reports may not be suitable for some investors and as such, investors must take extra care and make their own determination of the appropriateness of an investment based upon risk tolerance, investment objectives and financial status.

Company Specific Disclosures

The following disclosures relate to relationships between Noble and the company (the “Company”) covered by the Noble Research Division and referred to in this research report.

Noble is not a market maker in any of the companies mentioned in this report. Noble intends to seek compensation for investment banking services and non-investment banking services (securities and non-securities related) with any or all of the companies mentioned in this report within the next 3 months

ANALYST CREDENTIALS, PROFESSIONAL DESIGNATIONS, AND EXPERIENCE

Ahu Demir

Equity Research Analyst focusing on the Life Sciences sector. 5 years of industry experience. PhD in Chemistry from University of Florida.Post-Doctoral training at Columbia University and New York University. Her scientific training focused on antiviral therapy, oncology and immuno-oncology.

FINRA licenses 7, 63, 86, 87.

Cosme Ordonez

Senior Equity Analyst focusing on Life Sciences. More than 16 years of experience in his field. Former President and co-founder of Ciclofilin Pharmaceuticals. Held various roles in Buy-side and Sell-Side specializing in drug development, medical device, specialty pharma and healthcare services areas. Medical Doctor with a Ph.D. in Experimental Medicine and Biochemistry from McGill University in Montreal, Canada. Completed post-doctoral training at the Karolinska Institute/Hospital in Stockholm, Sweden.

Holds FINRA licenses 7, 79, 86, 87.

WARNING

This report is intended to provide general securities advice, and does not purport to make any recommendation that any securities transaction is appropriate for any recipient particular investment objectives, financial situation or particular needs. Prior to making any investment decision, recipients should assess, or seek advice from their advisors, on whether any relevant part of this report is appropriate to their individual circumstances. If a recipient was referred to Noble Capital Markets, Inc. by an investment advisor, that advisor may receive a benefit in respect of

transactions effected on the recipients behalf, details of which will be available on request in regard to a transaction that involves a personalized securities recommendation. Additional risks associated with the security mentioned in this report that might impede achievement of the target can be found in its initial report issued by Noble Capital Markets, Inc.. This report may not be reproduced, distributed or published for any purpose unless authorized by Noble Capital Markets, Inc..

RESEARCH ANALYST CERTIFICATION

Independence Of View

All views expressed in this report accurately reflect my personal views about the subject securities or issuers.

Receipt of Compensation

No part of my compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed in the public

appearance and/or research report.

Ownership and Material Conflicts of Interest

Neither I nor anybody in my household has a financial interest in the securities of the subject company or any other company mentioned in this report.

| NOBLE RATINGS DEFINITIONS |

% OF SECURITIES COVERED |

% IB CLIENTS |

| Outperform: potential return is >15% above the current price |

86% |

25% |

| Market Perform: potential return is -15% to 15% of the current price |

14% |

2% |

| Underperform: potential return is >15% below the current price |

0% |

0% |

NOTE: On August 20, 2018, Noble Capital Markets, Inc. changed the terminology of its ratings (as shown above) from “Buy” to “Outperform”, from “Hold” to “Market Perform” and from “Sell” to “Underperform.” The percentage relationships, as compared to current price (definitions), have remained the same. Additional information is available upon request. Any recipient of this report that wishes further information regarding the subject company or the disclosure information mentioned herein, should contact Noble Capital Markets, Inc. by mail or phone.

Noble Capital Markets, Inc.

225 NE Mizner Blvd. Suite 150

Boca Raton, FL 33432

561-994-1191

Noble Capital Markets, Inc. is a FINRA (Financial Industry Regulatory Authority) registered broker/dealer.

Noble Capital Markets, Inc. is an MSRB (Municipal Securities Rulemaking Board) registered broker/dealer.

Member – SIPC (Securities Investor Protection Corporation)

Report ID: 11091