Will Gilead, “The Best Antivirals Company,” Find a Remedy for COVID-19

(Note: companies that

could be impacted by the content of this article are listed at the base of the

story [desktop version]. This article uses third-party references to provide a

bullish, bearish, and balanced point of view; sources are listed after the

Balanced section.)

“The single biggest threat to man’s

continued dominance on the planet is the virus”,

quote by Nobel Prize winner Joshua

Lederberg

The entire biotechnology industry is rushing to find an effective treatment or vaccine to save the lives of those suffering with severe “Coronavirus Disease of 2019” (Covid-19), and curtail spreading of the global pandemic, which has become the largest global health crisis since the Influenza pandemic of 1918. As of April 17, 2020, there are more than 2,227,678 people infected with SARS-CoV-2 worldwide, and more than 150,625 people have died from the disease. The symptoms of Covid-19 vary among infected patients, from asymptomatic disease to pneumonia, acute respiratory distress syndrome, to multisystem organ failure and death. There is no effective treatment for the disease. Patients currently receive supportive care, and those developing acute respiratory distress receive oxygen mechanical ventilation support, but no specific treatment for the disease is available.

Would Gilead find a solution for those

with severe illness?

In today’s trading session, shares of Gilead Sciences (Nasdaq:GILD) were up 15% earlier, and currently exchange hands around 8% above the opening price. Investors are anticipating a positive outcome from Gilead’s ongoing remdesivir clinical trials. Gilead Sciences, the global leader in antivirals, is repurposing remdesivir for the treatment of patients suffering from Covid-19. The Company is currently conducting various clinical trials on the use of remdesivir for the treatment of Covid-19. On April 10, 2020, Gilead announced results from 53 patients hospitalized with severe complications of Covid-19 infection, who were treated with remdesivir. Gilead’s remdesivir is an experimental broad-spectrum antiviral drug, initially developed for the treatment of infections by Ebola, Marburg, MERS-CoV and SARS-CoV viruses. In in vitro experimental models, Gilead demonstrated that remdesivir is efficacious against SARS-CoV-2. Remdesivir inhibits an enzyme known as RNA polymerase, which is critical for the replication of these viruses, including SARS-CoV-2.

Figure 1 – Structure of the new coronavirus, “Severe Acute Respiratory Coronavirus 2”, SARS-CoV-2, images by transmission electron microscopy. The virus resembles an sphere with spikes. The S-protein or Spike protein is critical for virus entry into human cells.

Source – Science 2020, 367 (6483)

p1260-1263

Gilead’s candidate drug provided a

potential clinical benefit in 68% of treated patients

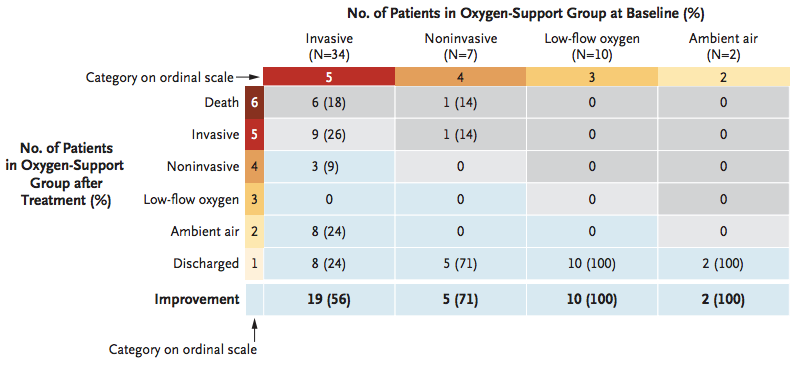

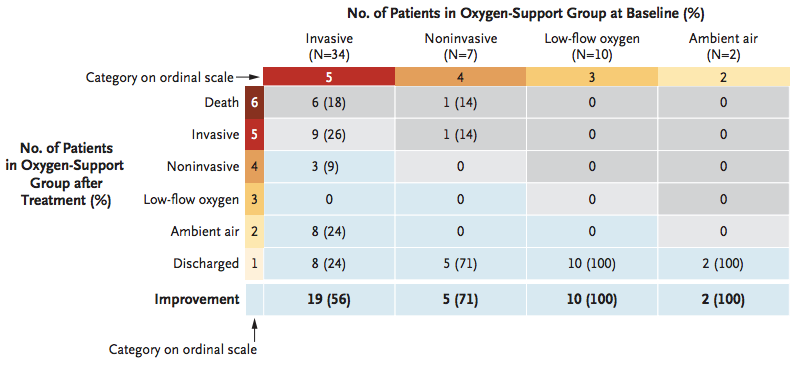

Gilead released data from 53 treated patients treated with remdesivir under a compassionate use program in United States, Europe, Canada and Japan. The treatment resulted in a clinical benefit for 68% of the patients. The results were published in the prestigious “New England Journal of Medicine” (N Engl J Med 2020, April 10, DOI: 10.1056/NEJMoa2007016). However, these type of studies, performed under “compassionate use”, have several limitations which hinder any interpretation of the final results. Among the limitations, a key hindrance is the lack of a control patient group, relative small size and relative short duration of patient follow up in these studies. In the Gilead trial, 34 out of the fifty three patients who participated, were on mechanical ventilation at the time of treatment. Four patients were also on “extracorporeal membrane oxygenation” (ECMO). The intended course of treatment (only 75% of patients completed it) was 10 daily doses (200 milligrams on day 1, followed by 100 milligrams of remdesivir

for 9 consecutive days) administered intravenously.

Eighteen days after receiving the first dose of remdesivir, 68 percent of patients (36 out of fifty three patients) showed a clinical improvement (ameliorating oxygen support class), with 17 out of thirty patients (57%) being extubated (released from mechanical ventilation), and 25 out of fifty three patients (47%) being discharge from the hospital. Although not a conclusive study, Gilead is hopeful that ongoing well-controlled clinical trials will prove the effectiveness of remdesivir for the treatment of Covid-19. At present, Gilead is conducting two Phase III clinical trials in the U.S. and Europe, the SIMPLE studies, on the use of the drug in severe (first data readout due this month) and moderate disease (data due in May). The clinical trials on Gilead’s remdesivir which were being conducted in China have been halted (announced on April 15, 2020).

Figure 2. Treatment with remdesivir improved “Oxygen-Support Class”. The data shows number of patients per category and percentage in parenthesis from total of patients treated with the drug. Number of patients who improved (36/53 or 68%) are shown in blue cells, no change (beige), and worsening of oxygen support class (gray). Invasive ventilation includes “mechanical ventilation” and “extracorporeal membrane oxygenation” (ECMO), whereas noninvasive ventilation includes “nasal high-flow oxygen therapy” and “noninvasive positive pressure ventilation” (NIPPV). In the Invasive ventilation class (category 5 at baseline (before treatment)), 19 out of 34 patients or 56% improved after receiving remdesivir.

Source – N Engl J Med 2020, April 10,

DOI: 10.1056/NEJMoa2007016

The Art of Repositioning Old Drugs for

New Indication, Covid-19

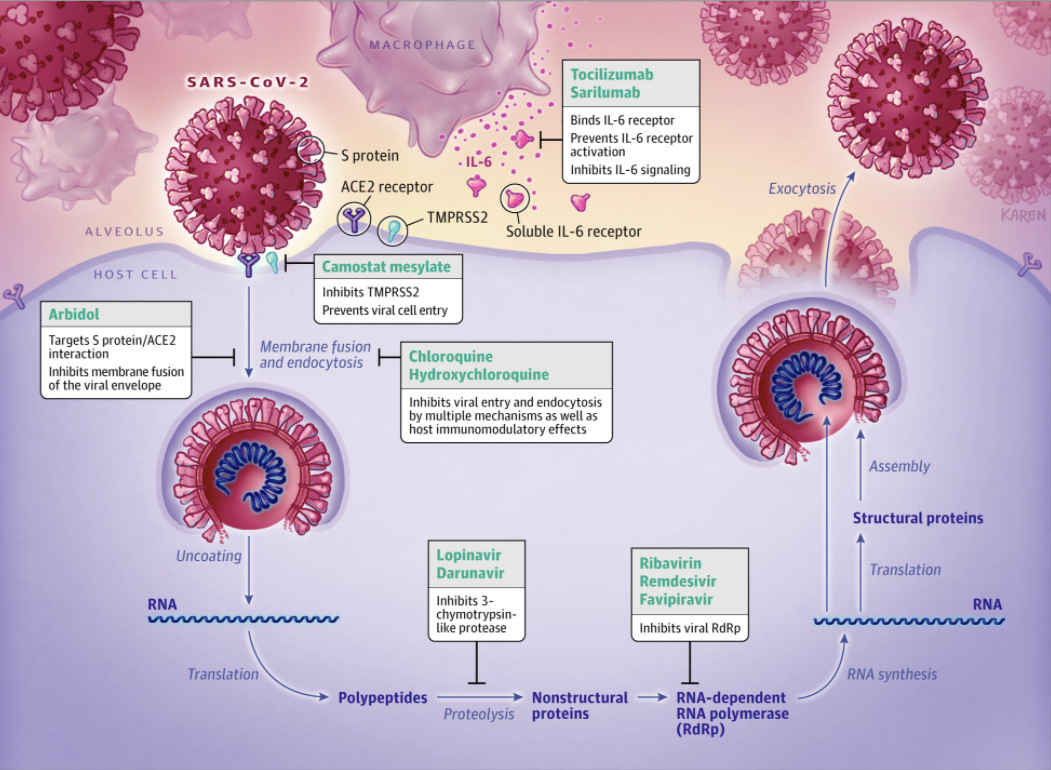

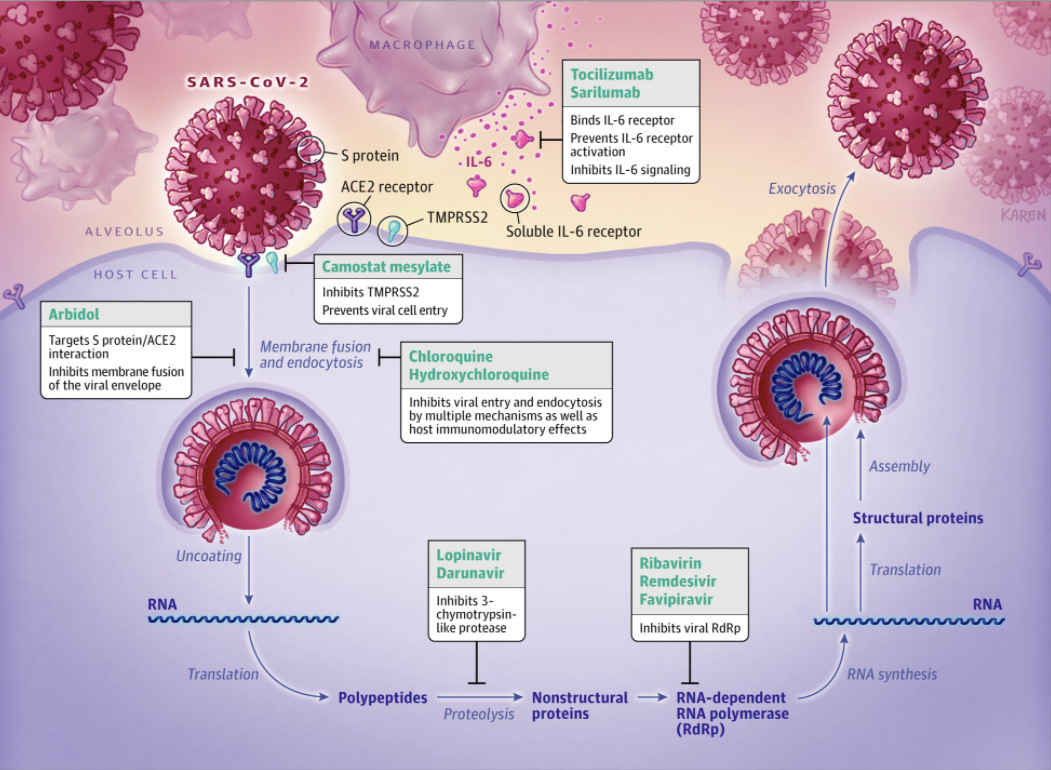

In a recent article published on the “Journal of the American Medical Association” (JAMA), medical scientists from the University of Texas Southwestern Medical Center reviewed recent attempts to repositioning existing drugs for the treatment of Covid-19 patients (JAMA. Published online April 13, 2020. doi:10.1001/jama.2020.6019). According to the authors, there are currently more than 300 clinical trials on the use of candidate drugs for the treatment of Covid-19, the majority of which consisting of repositioning of existing drugs. Promising drug targets include (Figure 3):

- SARS-CoV-2 nonstructural viral proteins such as “3-chymotrypsin-like protease”, “papain-like protease”, and “RNA-dependent RNA polymerase”.

- Viral entry mechanisms

- Immune regulatory pathways

Besides Gilead’s remdesivir (reviewed above), chloroquine and hydroxychloroquine are two known drugs, which are being repurposed for the treatment of Covid-19 (as the two drugs appear to block viral entry into human cells) (Figure 3). Chloroquine and hydroxychloroquine are known drugs approved for the treatment of malaria (an infectious disease) and two autoimmune diseases (lupus erythematosus and rheumatoid arthritis). In in vitro experimental models, hydroxychloroquine seems to be more potent than chloroquine. Existing data from studies on these two drugs for the treatment of Covid-19 is not conclusive, coupled with the fact of potential cardiotoxicity when used in combination with other medicines, raises concerns about the risk-benefit ratio on potential use.

The drug combination of lopinavir and ritonavir, known as anti-HIV-1 antiviral drugs, is being reposition for the treatment of Covid-19. Lopinavir/ritonavir inhibit “3-chymotrysin-like protease”, but thus far there is no demonstration of an antiviral effect on SARS-CoV-2. Like Gilead’s remdesivir, favipiravir and ribavirin are inhibitors of RNA polymerase (Figure 3). Favipiravir was developed for the treatment of influenza and Ebola viral infections. Ribavirin, was developed as an inhibitor of RNA polymerase, but in experimental models of SARS-CoV (the virus which caused SARS outbreak of 2002-2003) was only effective at high concentrations. In this drug class, Gilead’s remdesivir is the most promising candidate.

Figure 3 – There are several candidate drugs in clinical trials for the treatment of SARS-CoV-2 infection. Gilead’s remdesivir, an RNA polymerase inhibitor, is the most promising candidate at present. Ribavirin and favipiravir are also candidates in the RNA polymerase inhibitor class. Chloroquine, hydroxychloroquine, camostat mesylate and arbidol are drug candidates which could potentially block viral entry. Lopinavir and darunavir inhibit 3-chymotrypsin-like protease, and tocilizumab/sarilumab inhibit interleukin-6 (IL-6) signaling preventing cytokine storms.

Source – JAMA. Published online

April 13, 2020. doi:10.1001/jama.2020.6019

Arbidol, also known as umifenovir, is a promising repurposed candidate drug for the treatment of Covid-19. Arbidol blocks the binding of SARS-CoV-2 Spike protein to the cellular receptor ACE2, inhibiting membrane fusion of the viral envelope and viral entry (Figure 3). A drug approved in Japan for the treatment of pancreatitis (inflammation of the pancreas) is being repurposed for the treatment of Covid-19. The drug, known as camostat mesylate might block viral entry by inhibition of TMPRSS2, a serine protease enzyme. Historically, repurposing an existing drug for a different indication has not always been successful. Given the large number of ongoing clinical trials, we will find out over the next few months if any or several of these candidate drugs will be effective for the treatment of Covid-19.

Natural Evolution of a Pandemic, What

could happen next with Covid-19 pandemic?

As the biotechnology/pharmaceutical industry collaborates with medical academic institutions in the search for a treatment/vaccine or cure for Covid-19, it is difficult to predict the evolution of the current pandemic and virus behavior in coming weeks, months. As the world waits for the outcome of ongoing clinical trials evaluating potential treatments for Covid-19, it is important keeping aware of what medical science has taught us from previous epidemics such as SARS in 2002, middle east respiratory outbreak (MERS) in 2012 and Spanish flu (1918). Despite of the relatively short history of Covid-19, which started in China in December 2019, knowledge of the biology of the new coronavirus, SARSCoV-2, have grown very quickly.

At present, experts ponder on the probability that nature might help mankind by slowing down the virus spread. Among many potential mechanisms and strategies, there are three primary events which could curtail viral spreading:

- Natural Mutations of SARS-CoV-2

- Increasing Population Immunity

- Potential anti-viral treatments and Vaccines

The development of a drug treatment and/or effective vaccine will be a medical breakthrough which could save many lives worldwide. However, most experts believe testing of these candidate therapies will take time. As the SARS-CoV-2 virus continues to infect people across the globe, the number of patients with partial immunity could rise, which could eventually curtail viral spreading. However, the virus will probably has to infect many people worldwide before population immunity changes.

Could a Mutation Reduce SARS-CoV-2

virulence?

The answer to this very important question is not that simple. Experts opinions are divided on this subject. According to Dr. Michael Farzan, a biologist from the Scripps Research Institute in Jupiter, Florida, who identified the structure of the Spike protein of SARS-CoV (Science 2005, 309(5742) p1864-8), SARS-CoV-2 will probably mutate to lose rather than gain virulence. There is the possibility that SARS-CoV-2 could become a seasonal endemic virus such as the influenza virus. Some scientists, including Dr. Farzan, believe the natural evolution of a virus selects for less virulent variants as they will transmit more efficiently. Their belief is that very sick patients are not very good at transmitting the disease, and dead people cannot do it at all. Thus a virus which kills quickly does not transmit infection very efficiently, and does not get naturally selected. In contrast, less virulent viruses transmit very well, as less sick patients act as a very efficient source of infection. In colloquial terms, “the virus wants to live, last longer in the infected population”.

Origin of SARS-CoV-2, Critical Mutations,

Virus Chimera – It is hypothesized that SARS-CoV-2 evolved through a mutation in the Spike protein allowing the virus to jump from bats to humans causing a zoonotic infection known as Covid-19. The Spike (S) protein of SARS-CoV-2 contains a “variable receptor-binding domain” (RBD), which binds to ACE-2 receptor in human cells facilitating viral cell entry. Using genomic DNA sequencing, scientists have identified a related virus, RaTG13, from bats (http://virological.org/t.the-proximal-origin-of-sars-cov-2/398). The hypothesis is that SARS-CoV-2 originated from bats, mutated, becoming able to infect human cells. A critical mutation of the virus allows human proteases to cut and activate the Spike protein of the virus, which facilitates viral entry and infection of human cells. A more recent hypothesis claims SARS-CoV-2 is a human creation. Experimental work at a laboratory in Wuhan, China, the site where the pandemic started, did extensive work on bat coronavirus. Although there is no proof of it yet, it has been proposed that SARS-CoV-2 is a chimeric virus resulting from experiments performed at Wuhan’s laboratory.

Mutations Might Decrease Virulence – Some experts believe that in the same fashion the virus experienced a gain of function mutation, allowing cut and activation of Spike protein, increasing virulence, SARS-CoV-2 could also incur mutations causing a decrease in virulence. This was the case for the Spanish flu influenza virus, and for the coronavirus SARS-CoV which caused severe acute respiratory syndrome (SARS) in 2002 (Scientific Reports 2018, volume 8, article number: 15177). Mutated viruses became less virulent, viral spreading stopped, and the epidemics were halted as the viruses fizzle out. In theory, this could happen again with the virus causing Covid-19. Although infection with SARS-CoV-2 has shown a lower fatality rate than SARS-CoV, the new coronavirus SARS-CoV-2 is significantly more contagious. Differences aside, it is theoretically possible that the evolution of the current SARS-CoV-2 pandemic might end up in the same fashion as the SARS epidemic of 2002. In 2018, Dr. Christian Drosten, currently at German Center for Infectious Research in Berlin, published scientific work demonstrating that a variant of SARS-CoV lost part of its genome (29 nucleotides) during the SARS outbreak of 2002-2003, which made the SARS-CoV virus less virulent. The authors demonstrated this hypothesis by testing the SARS-CoV variant in cellular models in the laboratory (Scientific Reports 2018, volume 8, article number: 15177).

Monitoring SARS-CoV-2 Evolution

Monitoring the evolution of SARS-CoV-2 for mutations which could increase or decrease virulence is important (Pathogens 2020, 9, 186; doi:10.3390/pathogens9030186). Mutations in the gene encoding the Spike (S) protein do affect the virulence of SARS-CoV (New England Journal

of Medicine 2003, 348 (20) p1948-1951). A very important statistic to monitor during the SARS-CoV-2 pandemic will be the “Basic Reproduction Number”, or “R0”, which measures the average number of people who will catch the disease from one infected person in a population who has never before being exposed to the disease (Emerg Infect Dis 2019, 25, 1-4). Thus far, the R0 for SARS-CoV-2 is estimated between 2 to 3 (Int J Infect Dis 2020, 92, p214-217; New England Journal of Medicine 2020, doi:10.1056/NEJMoa2001316;

Lancet 2020, doi:10.1016/S0140-6736(20)30260-9), which is relatively high. The goal is to reduce R0 to a number below 1.

Racing to Develop a Vaccine

Moderna (Nasdaq:MRNA) yesterday announced that the U.S. federal government has agreed to give the Company $483 million from “Biomedical Advanced Research and Development Authority” (BARDA) to accelerate development of mRNA-1273 vaccine for Covid-19. On April 15, 2020, Moderna (Nasdaq:MRNA) announced that it has started dosing Covid-19 patients with the highest dose of its candidate vaccine. Moderna, in collaboration with the National Institute of Allergy and Infectious Diseases (NIH, NIAID), is developing mRNA-1273, a candidate vaccine targeting SARS-CoV-2. mRNA-1273 is designed to target the Spike (S) protein of the virus. mRNA vaccines function by encoding proteins, which once made by the cell stimulate the immune system to destroy infected cells. Development of mRNA vaccines is much faster than with traditional vaccines. mRNA-1273 encodes the “prefusion-stabilized” (Science 2020, 367 (6483) p1260-1263, DOI:10.1126/science.abb2507) form of Spike (S) protein of SARS-CoV-2. The candidate vaccine is currently in Phase I human clinical trials, which means it will take months before the effectiveness of this vaccine is known. Repurposing of existing anti-viral medicines is not an ideal strategy, but it could be a short term solution before an effective vaccine becomes available. For a full review of the pipeline of candidate medicines being developed by the biotechnology/pharmaceutical industry for SARS-CoV-2, see the journal Nature

Biotechnology published on March 20, 2020.

Suggested Reading:

Could

a Natural Mutation Slow Down Covid-19

Michael

Burry Says Covid-19 Cure Worse than Disease

https://www.channelchek.com/news-channel/Will_the_Stock_Market_Survive_COVID_19

Channelchek Community:

Unlimited,

no cost subscription to company research and premium features