Ocugen, Inc. to Present at Upcoming Citi and H.C. Wainwright Investment Conferences

MALVERN, Pa., Sept. 07, 2021 (GLOBE NEWSWIRE) — Ocugen, Inc. (NASDAQ: OCGN), a biopharmaceutical company focused on discovering, developing, and commercializing gene therapies to cure blindness diseases and developing a vaccine to fight COVID-19, today announced that it will be participating in Citi’s 16th Annual BioPharma Virtual Conference being held on September 8-10, 2021 and at the H.C. Wainwright Global Investment Conference being held on September 13-15, 2021.

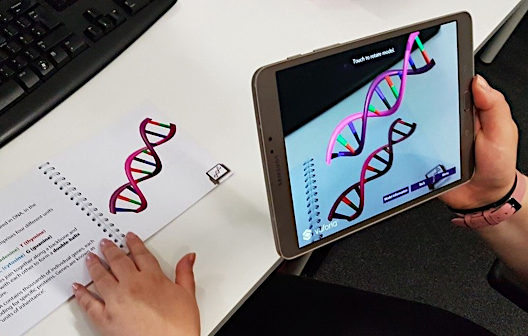

Dr. Shankar Musunuri, Chairman, CEO, and Co-Founder will present virtually at Citi’s conference and Sanjay Subramanian, CFO and Head of Corporate Development will present virtually at H.C. Wainwright. Both will provide updates on COVAXIN™, the investigational COVID-19 vaccine which the company is co-developing with Bharat Biotech for the U.S. and Canadian markets. They will also present information about Ocugen’s breakthrough modifier gene therapy platform, which has generated product candidates that are expected to enter Phase 1/2a clinical trials in ophthalmic disease states over the next 18 months.

Citi/Ocugen Fireside Chat

Date/Time: Wednesday, September 8, 2021, from 3:15PM-4:00PM Eastern Time

Registration link: https://kvgo.com/citi-16th-annual-biopharma-vc/ocugen-inc-sept-2021

H.C. Wainwright Global Investment Conference

Date/Time: Presentation available on-demand starting at 7:00AM Eastern Time on September 13, 2021

Registration link: https://journey.ct.events/view/705764c5-88a7-4a4c-afff-d1688de5a5d9

About Ocugen, Inc.

Ocugen, Inc. is a biopharmaceutical company focused on discovering, developing, and commercializing gene therapies to cure blindness diseases and developing a vaccine to save lives from COVID-19. Our breakthrough modifier gene therapy platform has the potential to treat multiple retinal diseases with one drug — “one to many,” and our novel biologic product candidate aims to offer better therapy to patients with underserved diseases such as wet age-related macular degeneration, diabetic macular edema, and diabetic retinopathy. We are co-developing Bharat Biotech’s COVAXIN™ vaccine candidate for COVID-19 in the U.S. and Canadian markets. For more information, please visit www.ocugen.com.

Cautionary Note on Forward-Looking Statements

This press release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995, which are subject to risks and uncertainties. We may, in some cases, use terms such as “predicts,” “believes,” “potential,” “proposed,” “continue,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,” “might,” “will,” “should” or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Such statements are subject to numerous important factors, risks and uncertainties that may cause actual events or results to differ materially from our current expectations, such as risks and uncertainties regarding market and other conditions and the timing of our planned clinical trials. These and other risks and uncertainties are more fully described in our periodic filings with the Securities and Exchange Commission (the “SEC”), including the risk factors described in the section entitled “Risk Factors” in the quarterly and annual reports that we file with the SEC. Any forward-looking statements that we make in this press release speak only as of the date of this press release. Except as required by law, we assume no obligation to update forward-looking statements contained in this press release whether as a result of new information, future events or otherwise, after the date of this press release.

Ocugen Contact:

Ken Inchausti

Head, Investor Relations & Communications

IR@Ocugen.com