Thursday, October 2, 2020

Energy Industry Report

Exploration and Production: 2020-3Q Review and Outlook

Michael Heim, CFA, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to end of report for Analyst Certification & Disclosures

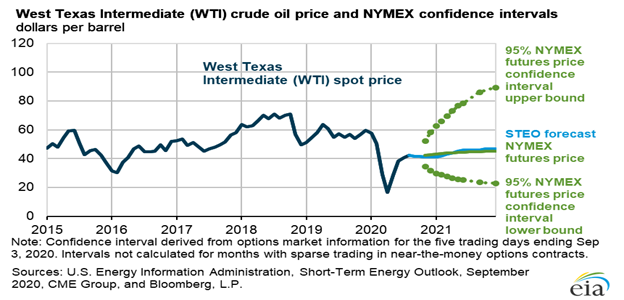

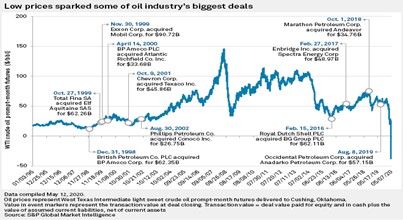

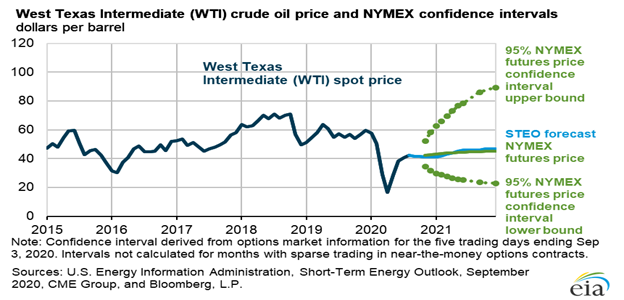

- Oil prices rebounded faster than expected but have stalled out at $40/BBL. The dismal days of the second quarter and the crash in oil prices are behind us. Still, few people in the energy industry are rejoicing about a return in oil prices to the $40 level. At current levels, thoughts have shifted from trying to survive to making sure operations are cash flow positive.

- Natural gas prices rose sharply despite a rise in inventories. Normally, the summer months are quiet for natural gas prices given the seasonal nature of gas demand. Not this year. Surprisingly, the rise in natural gas prices comes despite an increase in gas inventories. Rising gas prices most likely reflect early predictions for a cold winter for most of the country. This is especially true for the highly populated eastern half of the country.

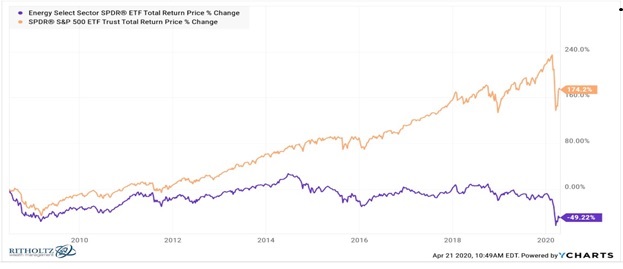

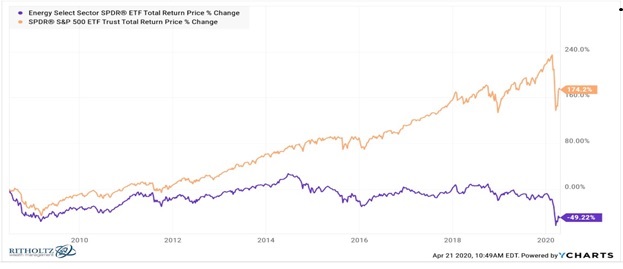

- Energy stocks continue to fall. They have underperformed the overall index for ten consecutive quarters. Energy stocks, as measured by the XLE Energy Index, fell 20% in the second quarter compared to a 7% rise in the S&P 500 Composite Index. The September quarter marks the tenth consecutive quarter in which the XLE has underperformed the overall market. Over the last ten years, the XLE has declined 50% versus a 175% increase in the S&P Index.

- Investors should focus on low-cost producers with good balance sheets. Investors would be wise to focus energy investment on companies with little to no debt and liquidity to continue to drill. A large hedge position may provide a lifeline. Low lifting costs per barrel remain important. A supportive ownership group with a long investment timeframe is also important.

Oil Prices

The dismal days of the second quarter and the crash in oil prices are behind us. Still, few people in the energy industry are rejoicing about a return in oil prices to the $40 level. At current levels, thoughts have shifted from trying to survive to making sure operations are cash flow positive. Managements are less focused on shutting in production or getting out of drilling contracts, but they are still concerned about cutting costs and focusing on the most profitable wells. And throughout it all is a general feeling that $40 per barrel could vanish quickly if anything else negative happened. Could the global economy shut down again if COVID cases accelerate as we enter the winter heating season? Will OPEC Plus members tire of output restrictions and raise production levels? Does the shift towards electric vehicles threaten a key component of oil demand? Will domestic production cost cutting continue to drive down oil prices regardless of supply and demand changes?

On the other hand, domestic oil production has declined to the reduced drilling. The EIA reports that U.S. crude oil production fell 21% between March and May before gaining half the decline back. Domestic producers have clearly shown an ability to respond quickly to oil price changes and that should dampen any impact that external events might have on oil prices.

Gas Prices

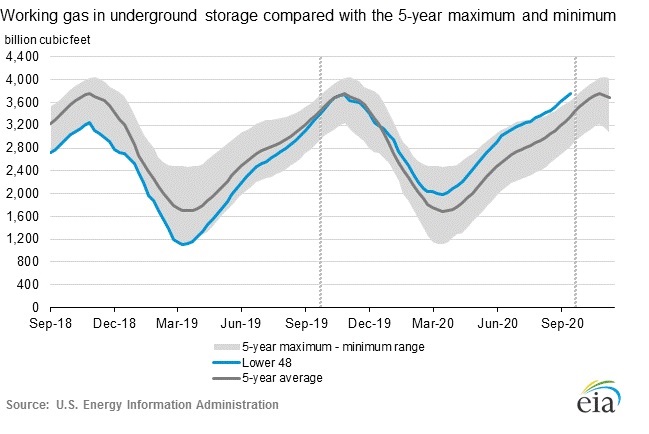

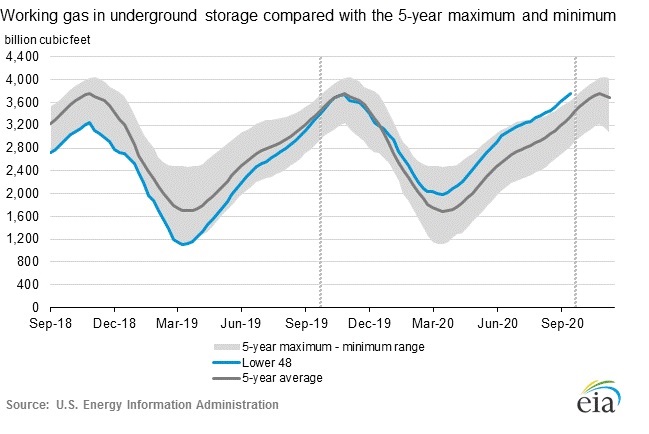

Natural Gas prices followed the trend of oil prices in the spring dropping from a price near $2 per mcf at the beginning of the year to a price under $1.50 by late June. Since then, natural gas prices have started to climb. The current futures price for next month deliveries is a robust $2.47 per mcf. Normally, the summer months are quiet for natural gas prices given the seasonal nature of gas demand. Not this year. Surprisingly, the rise in natural gas prices comes despite an increase in gas inventories. The chart below shows that gas inventories are the highest they have been in the last five years for this time of year. Rising inventories reflect a bounce-back in production and a decrease in liquified natural gas exports.

Rising gas prices most likely reflect early predictions for a cold winter for most of the country. This is especially true for the highly populated eastern half of the country. La Nina forecasts call for wetter-than-normal conditions in the northern half of the country that could mean heavy snowfall. The hope is that cold weather will result in increased heating demand for natural gas and will drive down inventory levels this winter.

Energy Stocks

Energy stocks, as measured by the XLE Energy Index, fell 20% in the second quarter compared to a 7% rise in the S&P 500 Composite Index. The September quarter marks the tenth consecutive quarter in which the XLE has underperformed the overall market. Over the last ten years, the XLE has declined 50% versus a 175% increase in the S&P Index.

The cause of the underperformance is, of course, lower energy prices. The underperformance also reflects the bull market. Although energy stocks benefit from growing demand associated with strong economic conditions, they also have characteristics of defensive stocks. They generally pay a high dividend yield. In fact, several energy companies such as Exxon Mobile now offer a dividend yield above 10%.

Outlook

The rebound in oil prices came faster than expected but seems to have stalled out at current price levels. A higher oil price was welcome news to leveraged energy companies facing negative cash flow and an inability to meet financial obligations. At prices in the forties, companies with a low-cost basis should generate positive cash flow. That said, marginal wells will most likely not be drilled, and production growth will be difficult. Companies must work to lower costs to adjust to $40 pricing, which is beginning to feel like the new normal for the foreseeable future. However, technology gains that came from applying hydraulic fracking and horizontal drilling to nonconventional formations will be hard to come by. Improvements are still being made by adjusting fracking intervals, viscosity, etc. However, these fine-tuning improvements yield small cost reductions, not the type that lower lifting costs by $10 per barrel.

We believe investors should continue to be wary regarding energy stocks. Investors would be wise to focus energy investment on companies with little to no debt and liquidity to continue to drill. A large hedge position may provide a lifeline. Low lifting costs per barrel remain important. A supportive ownership group with a long investment timeframe is also important. That said, there are compelling values within the group now that individual stock prices have fallen. We continue to believe energy prices will eventually return to higher levels with a return to more normal economic conditions and a supply response by domestic producers. We have adjusted our long-term oil and gas price assumption to $50/bbl and $2.50/mcf respectively, although we believe it may be a year or two before we reach those levels. Our individual stock net asset values and price targets are based off of our long-term energy price assumptions.

GENERAL DISCLAIMERS

All statements or opinions contained herein that include the words “we”, “us”, or “our” are solely the responsibility of Noble Capital Markets, Inc.(“Noble”) and do not necessarily reflect statements or opinions expressed by any person or party affiliated with the company mentioned in this report. Any opinions expressed herein are subject to change without notice. All information provided herein is based on public and non-public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed. No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio. The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on its own appraisal of the implications and risks of such decision.

This publication is intended for information purposes only and shall not constitute an offer to buy/sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile. This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice. Past performance is not indicative of future results. Noble accepts no liability for loss arising from the use of the material in this report, except that this exclusion of liability does not apply to the extent that such liability arises under specific statutes or regulations applicable to Noble. This report is not to be relied upon as a substitute for the exercising of independent judgement. Noble may have published, and may in the future publish, other research reports that are inconsistent with, and reach different conclusions from, the information provided in this report. Noble is under no obligation to bring to the attention of any recipient of this report, any past or future reports. Investors should only consider this report as single factor in making an investment decision.

IMPORTANT DISCLOSURES

This publication is confidential for the information of the addressee only and may not be reproduced in whole or in part, copies circulated, or discussed to another party, without the written consent of Noble Capital Markets, Inc. (“Noble”). Noble seeks to update its research as appropriate, but may be unable to do so based upon various regulatory constraints. Research reports are not published at regular intervals; publication times and dates are based upon the analyst’s judgement. Noble professionals including traders, salespeople and investment bankers may provide written or oral market commentary, or discuss trading strategies to Noble clients and the Noble proprietary trading desk that reflect opinions that are contrary to the opinions expressed in this research report.

The majority of companies that Noble follows are emerging growth companies. Securities in these companies involve a higher degree of risk and more volatility than the securities of more established companies. The securities discussed in Noble research reports may not be suitable for some investors and as such, investors must take extra care and make their own determination of the appropriateness of an investment based upon risk tolerance, investment objectives and financial status.

Company Specific Disclosures

The following disclosures relate to relationships between Noble and the company (the “Company”) covered by the Noble Research Division and referred to in this research report.

Noble is not a market maker in any of the companies mentioned in this report. Noble intends to seek compensation for investment banking services and non-investment banking services (securities and non-securities related) with any or all of the companies mentioned in this report within the next 3 months

ANALYST CREDENTIALS, PROFESSIONAL DESIGNATIONS, AND EXPERIENCE

Senior Equity Analyst focusing on Basic Materials & Mining. 20 years of experience in equity research. BA in Business Administration from Westminster College. MBA with a Finance concentration from the University of Missouri. MA in International Affairs from Washington University in St. Louis.

Named WSJ ‘Best on the Street’ Analyst and Forbes/StarMine’s “Best Brokerage Analyst.”

FINRA licenses 7, 24, 63, 87

WARNING

This report is intended to provide general securities advice, and does not purport to make any recommendation that any securities transaction is appropriate for any recipient particular investment objectives, financial situation or particular needs. Prior to making any investment decision, recipients should assess, or seek advice from their advisors, on whether any relevant part of this report is appropriate to their individual circumstances. If a recipient was referred to Noble Capital Markets, Inc. by an investment advisor, that advisor may receive a benefit in respect of transactions effected on the recipients behalf, details of which will be available on request in regard to a transaction that involves a personalized securities recommendation. Additional risks associated with the security mentioned in this report that might impede achievement of the target can be found in its initial report issued by Noble Capital Markets, Inc.. This report may not be reproduced, distributed or published for any purpose unless authorized by Noble Capital Markets, Inc.

RESEARCH ANALYST CERTIFICATION

Independence Of View

All views expressed in this report accurately reflect my personal views about the subject securities or issuers.

Receipt of Compensation

No part of my compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed in the public appearance and/or research report.

Ownership and Material Conflicts of Interest

Neither I nor anybody in my household has a financial interest in the securities of the subject company or any other company mentioned in this report.

| NOBLE RATINGS DEFINITIONS |

% OF SECURITIES COVERED |

% IB CLIENTS |

| Outperform: potential return is >15% above the current price |

88% |

41% |

| Market Perform: potential return is -15% to 15% of the current price |

12% |

5% |

| Underperform: potential return is >15% below the current price |

0% |

0% |

NOTE: On August 20, 2018, Noble Capital Markets, Inc. changed the terminology of its ratings (as shown above) from “Buy” to “Outperform”, from “Hold” to “Market Perform” and from “Sell” to “Underperform.” The percentage relationships, as compared to current price (definitions), have remained the same. Additional information is available upon request. Any recipient of this report that wishes further information regarding the subject company or the disclosure information mentioned herein, should contact Noble Capital Markets, Inc. by mail or phone.

Noble Capital Markets, Inc.

225 NE Mizner Blvd. Suite 150

Boca Raton, FL 33432

561-994-1191

Noble Capital Markets, Inc. is a FINRA (Financial Industry Regulatory Authority) registered broker/dealer.

Noble Capital Markets, Inc. is an MSRB (Municipal Securities Rulemaking Board) registered broker/dealer.

Member – SIPC (Securities Investor Protection Corporation)

Report ID: 11365

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you

Each event in our popular Virtual Road Shows Series has maximum capacity of 100 investors online. To take part, listen to and perhaps get your questions answered, see which virtual investor meeting intrigues you