|

|

|

enCore Energy (ENCUF) CEO Paul Goranson and Executive Chairman William Sheriff at NobleCon17 – Noble Capital Markets 17th Annual Small & Microcap Investor Conference – January 2021. Following the formal presentation, Noble Capital Markets Senior Research Analyst Michael Heim joins Paul to moderate a Q&A session. NobleCon 17 Complete Rebroadcast

|

Category: Energy

NobleCon17 Energy Panel Replay

|

|

|

A panel of distinguished experts discuss a number of topics including managing the transition to a greener energy environment. Moderated by Noble Senior Research Analyst Michael Heim. NobleCon 17 Complete Rebroadcast

|

Capstone Turbine (CPST) NobleCon17 Presentation Replay

|

|

|

Capstone Turbine (CPST) CEO Darren Jamison and CFO Eric Hencken at NobleCon17 – Noble Capital Markets 17th Annual Small & Microcap Investor Conference – January 2021. Following the formal presentation, Noble Capital Markets Senior Research Analyst Michael Heim joins Darren and Eric to moderate a Q&A session. NobleCon 17 Complete Rebroadcast

|

Gevo, Inc. (GEVO) – Conference Presentation Should Highlight Significant Progress

Monday, January 18, 2021

Gevo, Inc. (GEVO)

Conference Presentation Should Highlight Significant Progress

Gevo Inc is a renewable chemicals and biofuels company engaged in the development and commercialization of alternatives to petroleum-based products based on isobutanol produced from renewable feedstocks. Its operating segments are the Gevo segment and the Gevo Development/Agri-Energy segment. By its segments, it is involved in research and development activities related to the future production of isobutanol, including the development of its biocatalysts, the production and sale of biojet fuel, its Retrofit process and the next generation of chemicals and biofuels that will be based on its isobutanol technology. Gevo Development/Agri-Energy is the key revenue generating segment which involves the operation of the Luverne Facility and production of ethanol, isobutanol and related products.

Poe Fratt, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Tune into Noble Capital Markets Seventeenth Annual Small & Microcap Investor Conference for a GEVO update. Management will present live at our annual conference tomorrow (January 19th) at 11:15am EST. GEVO will also participate on a energy panel on Wednesday (January 20th) at 5:15pm EST. Go to channelchek.vercel.app for free registration details and www.nobleconference.com/seventeen#agenda for a conference agenda.

Branding first project as Net-Zero 1 to reinforce low/neutral carbon footprint. Greenfield plant at Lake Preston will integrate proprietary technology with renewable energy inputs. The Net-Zero concept involves converting renewable energy into high-density liquid fuels, which are fungible with current supply infrastructure, that enable conventional combustion engines to lower carbon emissions and …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Release – Energy Fuels (UUUU) – To Present at NobleCon17

Energy Fuels to Present at NobleCon17 on Tuesday, January 19, 2021

LAKEWOOD, Colo., Jan. 14, 2021 /CNW/ – Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) (“Energy Fuels” or the “Company”), a leading producer of uranium and critical minerals in the United States, is pleased to announce that the Company’s President and CEO Mark S. Chalmers will present at NobleCon17 – Noble Capital Markets’ Seventeenth Annual Investor Conference on Tuesday, January 19, 2021 at 10:30 AM (EST). The conference is virtual, with no cost, obligation or restrictions to attend: www.nobleconference.com.

Mr. Chalmers will provide an update on Energy Fuels’ various uranium and critical mineral initiatives, with particular emphasis on the Company’s progress on producing rare earth elements.

A high-definition, video webcast of the presentation will be available the following day on the Company’s website at www.energyfuels.com, and as a part of a complete catalog of presentations to be rebroadcast on Channelcheck (channelchek.vercel.app) next month.

About Energy Fuels: Energy Fuels is a leading U.S.-based uranium mining company, supplying U3O8 to major nuclear utilities. The Company also produces vanadium from certain of its projects, as market conditions warrant, and anticipates commencing commercial production of rare earth element (“REE”) carbonate in 2021. Its corporate offices are in Lakewood, Colorado, near Denver, and all of its assets and employees are in the United States. Energy Fuels holds three of America’s key uranium production centers: the White Mesa Mill in Utah, the Nichols Ranch in-situ recovery (“ISR”) Project in Wyoming, and the Alta Mesa ISR Project in Texas. The White Mesa Mill is the only conventional uranium mill operating in the U.S. today, has a licensed capacity of over 8 million pounds of U3O8 per year, has the ability to produce vanadium when market conditions warrant, and is completing final test-work for the production of REE carbonate from various uranium-bearing ores. The Nichols Ranch ISR Project is on standby and has a licensed capacity of 2 million pounds of U3O8 per year. The Alta Mesa ISR Project is also on standby and has a licensed capacity of 1.5 million pounds of U3O8 per year. In addition to the above production facilities, Energy Fuels also has one of the largest NI 43-101 compliant uranium resource portfolios in the U.S. and several uranium and uranium/vanadium mining projects on standby and in various stages of permitting and development. The primary trading market for Energy Fuels’ common shares is the NYSE American under the trading symbol “UUUU,” and the Company’s common shares are also listed on the Toronto Stock Exchange under the trading symbol “EFR.” Energy Fuels’ website is www.energyfuels.com.

About Noble Capital Markets: Noble Capital Markets (“Noble”) is a research driven boutique investment bank that has supported small & micro-cap companies since 1984. As a FINRA and SEC licensed and registered broker-dealer, Noble provides institutional-quality equity research, merchant and investment banking, wealth management and order execution services. In 2005, Noble established NobleCon, an investor conference that has grown substantially over the last decade+. In 2018, Noble launched channelchek.vercel.app – an investment community dedicated exclusively to small and micro-cap companies and their industries. Channelcheck is tailored to meet the needs of self-directed investors and financial professionals and is the first service to offer institutional-quality research to the public, for FREE at every level without a subscription. More than 6,000 emerging growth companies are listed in the site, with growing content including webcasts, industry sector reports, advanced market data and balanced news.

Cautionary Note Regarding Forward-Looking Statements: This news release contains certain “Forward Looking Information” and “Forward Looking Statements” within the meaning of applicable securities legislation, which may include, but is not limited to, statements with respect to: the Company being a leading producer of uranium in the U.S.; any expectation that the Company is able to produce REE carbonate from uranium-bearing ores or that the Company will commence commercial production of REE carbonate in 2021 or at all; any expectation that the Company’s REE project may, in time, result in among the lowest cost REE production in the western world; any expectation that the Company will be successful in acquiring additional supplies of monazite, or will be successful in processing other types of REE- and uranium bearing ores at the White Mesa Mill; any expectation that the Company will be successful in achieving its goal of processing 15,000+ tons of monazite and other sources of ore per year; any expectation that the Company will be able to sell some or all of its REE carbonate to buyers in Europe and/or Asia until a REE separation facility is established in the United States; any expectation that the Company may potentially perform separation, and other downstream REE activities including metal-making and alloying, in the future at the White Mesa Mill or elsewhere in the United States; any expectation that the Company will be successful in helping the EPA and Navajo Nation address historic abandoned uranium mines; any expectation that the Company will significantly increase the number of green jobs it is providing at the White Mesa Mill; and any other statements regarding Energy Fuels’ future expectations, beliefs, goals or prospects; constitute forward-looking information within the meaning of applicable securities legislation (collectively, “forward-looking statements”). All statements in this news release that are not statements of historical fact (including statements containing the words “expects,” “does not expect,” “plans,” “anticipates,” “does not anticipate,” “believes,” “intends,” “estimates,” “projects,” “potential,” “scheduled,” “forecast,” “budget” and similar expressions) should be considered forward-looking statements. All such forward-looking statements are subject to important risk factors and uncertainties, many of which are beyond Energy Fuels’ ability to control or predict. A number of important factors could cause actual results or events to differ materially from those indicated or implied by such forward-looking statements, including without limitation factors relating to: the Company being a leading producer of uranium in the U.S.; any expectation that the Company is able to produce REE carbonate from uranium-bearing ores or that the Company will commence commercial production of REE carbonate in 2021 or at all; any expectation that the Company’s REE project may, in time, result in among the lowest cost REE production in the western world; any expectation that the Company will be successful in acquiring additional supplies of monazite, or will be successful in processing other types of REE- and uranium bearing ores at the White Mesa Mill; any expectation that the Company will be successful in achieving its goal of processing 15,000+ tons of monazite and other sources of ore per year; any expectation that the Company will be able to sell some or all of its REE carbonate to buyers in Europe and/or Asia until a REE separation facility is established in the United States; any expectation that the Company may potentially perform separation, and other downstream REE activities including metal-making and alloying, in the future at the White Mesa Mill or elsewhere in the United States; any expectation that the Company will be successful in helping the EPA and Navajo Nation address historic abandoned uranium mines; any expectation that the Company will significantly increase the number of green jobs it is providing at the White Mesa Mill; and the other risk factors as described in Energy Fuels’ most recent annual report on Form 10-K and quarterly financial reports. Energy Fuels assumes no obligation to update the information in this communication, except as otherwise required by law. Additional information identifying risks and uncertainties is contained in Energy Fuels’ filings with the various securities commissions, which are available online at www.sec.gov and www.sedar.com. Forward-looking statements are provided for the purpose of providing information about the current expectations, beliefs and plans of the management of Energy Fuels relating to the future. Readers are cautioned that such statements may not be appropriate for other purposes. Readers are also cautioned not to place undue reliance on these forward-looking statements, that speak only as of the date hereof.

SOURCE Energy Fuels Inc.

For further information: Investor Inquiries: Energy Fuels Inc.: Curtis Moore, VP – Marketing and Corporate Development, (303) 974-2140 or Toll free: (888) 864-2125, investorinfo@energyfuels.com; www.energyfuels.com

InPlay Oil (IPOOF)(IPO:CA) – Capital Budget and Guidance In Line With Expectations

Thursday, January 14, 2021

InPlay Oil (IPOOF)(IPO:CA)

Capital Budget and Guidance In Line With Expectations

As of April 24, 2020, Noble Capital Markets research on InPlay Oil is published under ticker symbols (IPOOF and IPO:CA). The price target is in USD and based on ticker symbol IPOOF. Research reports dated prior to April 24, 2020 may not follow these guidelines and could account for a variance in the price target. InPlay Oil is a junior oil and gas exploration and production company with operations in Alberta focused on light oil production. The company operates long-lived, low-decline properties with drilling development and enhanced oil recovery potential as well as undeveloped lands with exploration possibilities. The common shares of InPlay trade on the Toronto Stock Exchange under the symbol IPO and the OTCQZ Exchange under the symbol IPOOF.

Michael Heim, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Last week, IPO management set a 2021 capital budget of $23 million to drill 8 wells and projected average production of 5,100-5,400 boe/d. Our models assumed $25 million to drill 8 wells and production levels at the upper end of management’s range with an exit rate of 5,600 at yearend. The company drilled three wells in the fourth quarter all under 9 days each versus previous times of 9.0-9.5 days which explains lower-than-expected capital expenditures per well.

Management projects adjusted funds flow of $30.5-$33.5 million in 2021. This is above our model’s estimate of $29 million and reflects corporate and operating cost reductions of $8 million compared to the original January 2020 budget. The cost reductions come, in part, due to the securing of a $25 million second lien four-year loan facility with the Business Development Bank of Canada at a very …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Will the US Continue to Subsidize Renewable Energy Projects?

Renewable Projects Surge Following Subsidy Extension

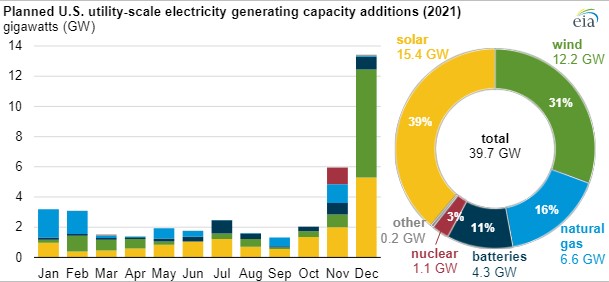

Every month, the U.S. Energy Information Administration (EIA) surveys electric utilities to monitor planned generation projects. Over the last two months, there has been a surge in generation project announcements, with most of the projects being renewable energy. It is not unusual to see an uptick in the announcement of renewable projects at year-end, and the graph below had a similar look to the one twelve months ago. The year-end increase may represent management’s window dressing their generation plans. It is worth noting, however, that the announcements were accompanied by a renewal of tax subsidiaries for both wind and solar power last month. Wind production tax credits (PTCs) were extended twelve months for projects where construction has begun by December 31, 2021, and a new 30% investment tax credit has been created for offshore wind projects that start construction through 2025. A two-year extension for solar power PTCs was also passed at the same time. The shift towards renewable generation projects may also reflect rising natural gas and oil prices in recent months making traditional fossil fuel plant investments less attractive.

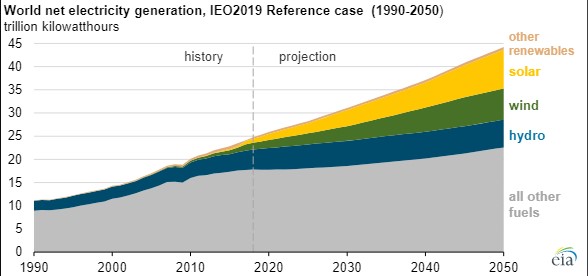

Renewable generation is growing in importance

Renewable generation represents only 11% of the nation’s generation load. However, that percent is growing rapidly, with renewable generation accounting for 70% of all new generation. The EIA projects that renewable energy will double to 22% of generation by 2030 and represent half of the nation’s generation load by 2050. The growth of renewable generations comes despite an expected sunsetting of subsidies.

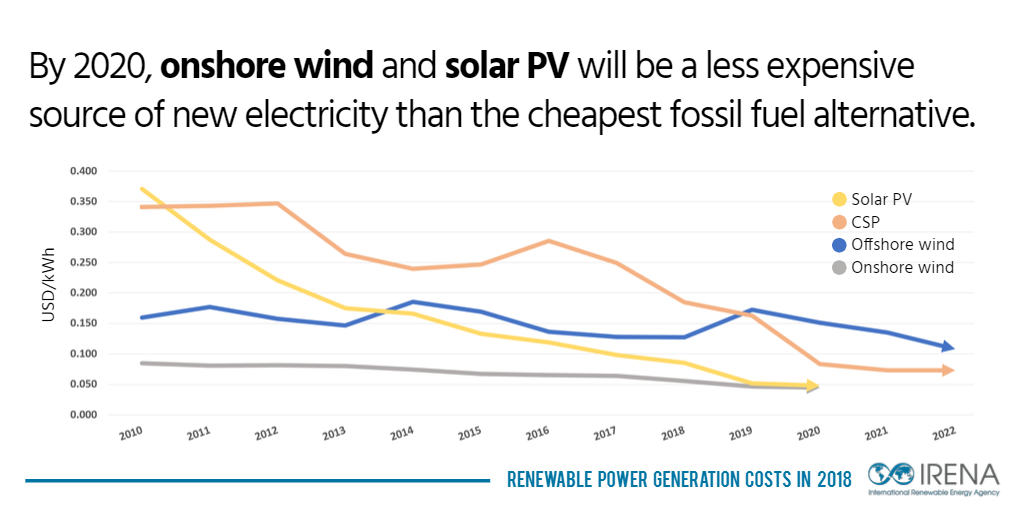

Renewable generation costs are declining rapidly and are competitive without subsidies

The shift towards renewable generation follows a trend that we have seen in recent years as renewable generation costs declined. The International Renewable Energy Agency (IRENA) notes that solar photovoltaic prices have fallen 82% since 2010, while concentrated solar power has dropped 47%. Wind power costs have also decreased, albeit not as much. Onshore wind costs have fallen 39%, while offshore wind costs have fallen 29%. The cost declines mean that wind and solar power have become a cheaper form of power generation than traditional fossil fuels.

Take-Away:

A debate regarding the government’s role in subsidizing production is a subject that can be debated. However, it is beyond the scope of this report. However, the result is the same – the subsidies given to renewable energy have allowed them to achieve the economies of scale needed to compete with fossil fuels. This will be true even if subsidies are removed.

Suggested Reading:

Energy 2020-4Q Review and Outlook -Dtd January 5, 2021

Is the Price for Uranium Rising?

Mergers Within the energy Industry are Heating Up

Sources:

https://www.greentechmedia.com/articles/read/solar-and-wind-tax-credit-extensions-energy-rd-package-in-spending-bill-before-congress#:~:text=The%20U.S.%20Congress%20on%20Monday,through%202025%20for%20offshore%20wind, Jeff St. John, GTM, December 22, 2020

https://www.windpowerengineering.com/ptc-extended-by-one-year-new-offshore-wind-tax-credit-inserted-in-congress-bill/#:~:text=The%20wind%20production%20tax%20credit,of%20its%20investment%20tax%20credit., WPED Staff, WPED, December 22, 2020

https://www.irena.org/newsroom/pressreleases/2019/May/Falling-Renewable-Power-Costs-Open-Door-to-Greater-Climate-Ambition, International Renewable Energy Agency, May 29, 2019

|

Indonesia Energy (INDO) Scheduled To Present at NobleCon17

|

|

|

|

|

Join Indonesia Energy (INDO) President Frank Ingriselli at NobleCon17 – Noble Capital Markets 17th Annual Small & Microcap Investor Conference – January 19&20, 2021. Following a formal presentation, a seasoned Wall Street research analyst will join Frank to moderate a LIVE Q&A session. If you want to be added to the roster of presenters… or if you would like to join the virtual audience of investors, at no cost, go to nobleconference.com. NobleCon 17 Complete Presenting Company Schedule

|

enCore Energy Corp. (ENCUF)(EU:CA) – enCore Closes Westwater Resources Asset Acquisition

Wednesday, January 06, 2021

enCore Energy Corp. (ENCUF)(EU:CA)

enCore Closes Westwater Resources Asset Acquisition

enCore Energy Corp together with its subsidiary, is engaged in the acquisition and exploration of resource properties. The company holds the Marquez project in New Mexico as well as the dominant land position in Arizona with additional other properties in Utah and Wyoming. The firm also owns or has access to North American and global uranium data including the Union Carbide, US Smelting and Refining, UV Industries, and Rancher’s Exploration databases in addition to a collection of geophysical data for the high-grade Northern Arizona Breccia Pipe District.

Michael Heim, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

ENCUF announced that it has closed the acquisition of the uranium assets of Westwater Resources effective December 31, 2020. The acquisition includes two in-situ recover uranium production facilities and mineral exploration leases and rights in New Mexico and Texas. In exchange for the property, ENCUF will pay Westwater US$1.45 million in stock and grant it a 2.5% interest and 2% net smelter return royalty on mineral rights in New Mexico. Our models had assumed the transactions close and we have factored the higher share count.

The deal was expected but is still an important catalyst for the stock to move higher. The terms of the agreement match a previous Letter of Intent and the timing matches management’s guidance for a close by yearend. As such, the transaction was expected. Nevertheless, closing the transaction is a key catalyst for the company to begin producing uranium. We look for the company to now start signing …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Industry Report – Energy – 2020-4Q Review and Outlook

Tuesday, January 5, 2021

Energy Industry Report

Energy 2020-4Q Review and Outlook

Michael Heim, CFA, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to end of report for Analyst Certification & Disclosures

- Oil prices rose sharply beginning in November but are still well below levels at the start of the year. Oil prices continued to rebound from the sharp drop seen in the first quarter as investor enthusiasm about a Coronavirus vaccine pushed prices higher. WTI oil prices began the quarter in the mid thirties and finished the quarter near $47.50/BBL. Near-month oil futures prices are locked in a narrow range near current spot prices. Prices are still well below beginning-of-the-year prices near $60 per barrel.

- Natural gas prices had risen but have fallen in recent weeks due to warm weather. Natural Gas prices also rose during the quarter although they have slipped in recent weeks. Recent weakness reflects significantly warmer-than-normal weather. Population-weighted heating degree days were 21% warmer than the 10-year trailing average in the month of November and similar to historical averages in December. As a result of warm weather, natural gas in storage ended the year at all-time high levels for this time of year and 2.6% above the trailing five-year average.

- Energy stocks climbed 27% in the quarter mirroring the performance of oil prices. Energy stocks, as measured by the XLE Energy Index, rose alongside oil prices climbing 27% during the quarter. The rise began in November when oil prices rose. Even with the strong performance in the fourth quarter, however, the energy index was down 38% in 2020. This compares to a 14% rise in the overall market.

- The near-term outlook for energy stocks has improved but we still have long-term concerns. The rebound in oil prices came faster than expected. We have been adjusting our models to reflect higher prices but are maintaining our long-term oil price forecast of $50 per barrel and $2.50 per mcf. Our near-term outlook for energy stocks has improved. We expect companies to report favorable results for the next few quarters unless rising production pushes energy prices lower. Longer-term, we have concern that oil demand will be constrained by power generation competition from renewable energy and decreased demand for gasoline and diesel due to a growth in electric vehicles. At the same time, supply pressure from an increasingly active OPEC and continued drilling productivity will mean lower energy prices.

Oil Prices

Oil prices continued to rebound from the sharp drop seen in the first quarter as investor enthusiasm about a Coronavirus vaccine pushed prices higher. WTI prices began the quarter in the mid thirties and finished the quarter near $47.50/BBL. Near-month oil futures prices are locked in a narrow range near current spot prices. Prices are still well below beginning-of-the-year prices near $60 per barrel. Interestingly, drilling had not resumed by the end of the year. Baker Hughes reported 351 active rigs in the United States as of December 31, less than half the number from a year ago. Consequently, domestic production has not changed. The U.S. Energy Information Administration (EIA) reports that domestic oil production rose a modest 2.7% between September and November (the last month available) and attributes the increase largely to hurricane-disrupted wells coming back online. We would expect to see production expand in upcoming months with increased drilling.

Natural Gas Prices

Natural Gas prices also rose during the quarter although they have slipped in recent weeks. Recent weakness reflects significantly warmer-than-normal weather. Population-weighted heating degree days were 21% warmer than the 10-year trailing average in the month of November and similar to historical averages in December. As a result of warm weather, natural gas in storage ended the year at all-time high levels for this time of year and 2.6% above the trailing five-year average. Natural gas futures prices show prices rising modestly as the futures curve extends into the spring.

Energy Stocks

Energy stocks, as measured by the XLE Energy Index, rose alongside oil prices climbing 27% during the quarter. The chart below shows that the strength in energy stocks began in November, the exact time that oil prices began to rise. The performance in the quarter far outpaced the overall market. Even with the strong performance in the fourth quarter, however, the energy index was down 38% in 2020. This compares to a 14% rise in the overall market.

Outlook

The rebound in oil prices came faster than expected. We have been adjusting our models to reflect higher prices but are maintaining our long-term oil price forecast of $50 per barrel and $2.50 per mcf. Energy companies should start reporting positive cash flow at these prices and increasing drilling budgets. That said, marginal wells will most likely not be drilled, and production growth will be difficult unless we see prices rise back to a level near $60/bbl. and $3.00/mcf. Companies must continue to work to lower costs to adjust to current prices by finetuning drilling techniques.

Our near-term outlook for energy stocks has improved. We expect companies to report favorable results for the next few quarters unless rising production pushes energy prices lower. Longer-term, we have concern that oil demand will be constrained by power generation competition from renewable energy and decreased demand for gasoline and diesel due to a growth in electric vehicles. At the same time, supply pressure from an increasingly active OPEC and continued drilling productivity will mean lower energy prices. We recommend investors stay focused on energy companies with solid balance sheets, low operating costs and protected prices.

GENERAL DISCLAIMERS

All statements or opinions contained herein that include the words “we”, “us”, or “our” are solely the responsibility of Noble Capital Markets, Inc. (“Noble”) and do not necessarily reflect statements or opinions expressed by any person or party affiliated with the company mentioned in this report. Any opinions expressed herein are subject to change without notice. All information provided herein is based on public and non-public information believed to be accurate and reliable, but is not necessarily complete and cannot be guaranteed. No judgment is hereby expressed or should be implied as to the suitability of any security described herein for any specific investor or any specific investment portfolio. The decision to undertake any investment regarding the security mentioned herein should be made by each reader of this publication based on its own appraisal of the implications and risks of such decision.

This publication is intended for information purposes only and shall not constitute an offer to buy/sell or the solicitation of an offer to buy/sell any security mentioned in this report, nor shall there be any sale of the security herein in any state or domicile in which said offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or domicile. This publication and all information, comments, statements or opinions contained or expressed herein are applicable only as of the date of this publication and subject to change without prior notice. Past performance is not indicative of future results.

Noble accepts no liability for loss arising from the use of the material in this report, except that this exclusion of liability does not apply to the extent that such liability arises under specific statutes or regulations applicable to Noble. This report is not to be relied upon as a substitute for the exercising of independent judgement. Noble may have published, and may in the future publish, other research reports that are inconsistent with, and reach different conclusions from, the information provided in this report. Noble is under no obligation to bring to the attention of any recipient of this report, any past or future reports. Investors should only consider this report as single factor in making an investment decision.

IMPORTANT DISCLOSURES

This publication is confidential for the information of the addressee only and may not be reproduced in whole or in part, copies circulated, or discussed to another party, without the written consent of Noble Capital Markets, Inc. (“Noble”). Noble seeks to update its research as appropriate, but may be unable to do so based upon various regulatory constraints. Research reports are not published at regular intervals; publication times and dates are based upon the analyst’s judgement. Noble professionals including traders, salespeople and investment bankers may provide written or oral market commentary, or discuss trading strategies to Noble clients and the Noble proprietary trading desk that reflect opinions that are contrary to the opinions expressed in this research report.

The majority of companies that Noble follows are emerging growth companies. Securities in these companies involve a higher degree of risk and more volatility than the securities of more established companies. The securities discussed in Noble research reports may not be suitable for some investors and as such, investors must take extra care and make their own determination of the appropriateness of an investment based upon risk tolerance, investment objectives and financial status.

Company Specific Disclosures

The following disclosures relate to relationships between Noble and the company (the “Company”) covered by the Noble Research Division and referred to in this research report.

Noble is not a market maker in any of the companies mentioned in this report. Noble intends to seek compensation for investment banking services and noninvestment banking services (securities and non-securities related) with any or all of the companies mentioned in this report within the next 3 months.

ANALYST CREDENTIALS, PROFESSIONAL DESIGNATIONS, AND EXPERIENCE

Senior Equity Analyst focusing on energy and utility stocks. 24 years of experience as an analyst. Chartered Financial Analyst©. MBA from Washington University in St. Louis and BA in Economics from Carleton College in Minnesota. Named WSJ ‘Best on the Street’ Analyst four times. Named Forbes/StarMine’s “Best Brokerage Analyst” three times. FINRA licenses 7, 63, 86, 87.

WARNING

This report is intended to provide general securities advice, and does not purport to make any recommendation that any securities transaction is appropriate for any recipient particular investment objectives, financial situation or particular needs. Prior to making any investment decision, recipients should assess, or seek advice from their advisors, on whether any relevant part of this report is appropriate to their individual circumstances. If a recipient was referred to by an investment advisor, that advisor may receive a benefit in respect of transactions effected on the recipients behalf, details of which will be available on request in regard to a transaction that involves a personalized securities recommendation. Additional risks associated with the security mentioned in this report that might impede achievement of the target can be found in its initial report issued by . This report may not be reproduced, distributed or published for any purpose unless authorized by.

RESEARCH ANALYST CERTIFICATION

Independence Of View

All views expressed in this report accurately reflect my personal views about the subject securities or issuers.

Receipt of Compensation

No part of my compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed in the public appearance and/or research report.

Ownership and Material Conflicts of Interest

Neither I nor anybody in my household has a financial interest in the securities of the subject company or any other company mentioned in this report.

| NOBLE RATINGS DEFINITIONS | % OF SECURITIES COVERED | % IB CLIENTS |

| Outperform: potential return is >15% above the current price | 78% | 34% |

| Market Perform: potential return is -15% to 15% of the current price | 5% | 1% |

| Underperform: potential return is >15% below the current price | 0% | 0% |

NOTE: On August 20, 2018, Noble Capital Markets, Inc. changed the terminology of its ratings (as shown above) from “Buy” to “Outperform”, from “Hold” to “Market Perform” and from “Sell” to “Underperform.” The percentage relationships, as compared to current price (definitions), have remained the same.

Additional information is available upon request. Any recipient of this report that wishes further information regarding the subject company or the disclosure information mentioned herein, should contact Noble Capital Markets, Inc. by mail or phone.

Noble Capital Markets, Inc.

225 NE Mizner Blvd. Suite 150

Boca Raton, FL 33432

561-994-1191

Noble Capital Markets, Inc. is a FINRA (Financial Industry Regulatory Authority) registered broker/dealer.

Noble Capital Markets, Inc. is an MSRB (Municipal Securities Rulemaking Board) registered broker/dealer.

Member – SIPC (Securities Investor Protection Corporation)

Report ID: 11924

Gevo, Inc. (GEVO) – Two milestones in a week – FEED Engineering firm identified

Tuesday, January 05, 2021

Gevo, Inc. (GEVO)

Two milestones in a week – FEED Engineering firm identified

Gevo Inc is a renewable chemicals and biofuels company engaged in the development and commercialization of alternatives to petroleum-based products based on isobutanol produced from renewable feedstocks. Its operating segments are the Gevo segment and the Gevo Development/Agri-Energy segment. By its segments, it is involved in research and development activities related to the future production of isobutanol, including the development of its biocatalysts, the production and sale of biojet fuel, its Retrofit process and the next generation of chemicals and biofuels that will be based on its isobutanol technology. Gevo Development/Agri-Energy is the key revenue generating segment which involves the operation of the Luverne Facility and production of ethanol, isobutanol and related products.

Poe Fratt, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

Another milestone hit with identification of FEED firm. Koch Project Solutions, LLC is performing front end engineering, design and project execution management services (FEED) for the renewable fuel expansion projects. Koch Project Solutions is part of a subsidiary of Koch Industries. Like Trafigura, the new relationship could open up collaboration opportunities on other fronts. While there is no indication that other subs are involved, establishing a relationship with a major energy industry player should be viewed as a positive development.

Debt free milestone hit. Strong December stock price performance was catalyst for debt conversion into equity. Last week, we learned from an ATM equity prospectus update that all of the convert debt was converted into equity. A total of 5.67 million shares were issued to Whitebox, and ~$14 million of cash was preserved to keep current cash near $79 million …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Capstone Turbine Corporation (CPST) Scheduled To Present at NobleCon17

|

|

|

|

|

Join Capstone Turbine (CPST) CEO Darren Jamison & CFO Eric Hencken at NobleCon17 – Noble Capital Markets 17th Annual Small & Microcap Investor Conference – January 19&20, 2021. Following a formal presentation, a seasoned Wall Street research analyst will join Darren and Eric to moderate a LIVE Q&A session. If you want to be added to the roster of presenters… or if you would like to join the virtual audience of investors, at no cost, go to nobleconference.com. NobleCon 17 Complete Presenting Company Schedule

|

InPlay Oil (IPOOF)(IPO:CA) Scheduled To Present at NobleCon17

|

|

|

|

|

Join InPlay Oil (IPOOF)(IPO:CA) CEO Doug Bartole at NobleCon17 – Noble Capital Markets 17th Annual Small & Microcap Investor Conference – January 19&20, 2021. Following a formal presentation, a seasoned Wall Street research analyst will join Doug to moderate a LIVE Q&A session. If you want to be added to the roster of presenters… or if you would like to join the virtual audience of investors, at no cost, go to nobleconference.com. NobleCon 17 Complete Presenting Company Schedule

|