Gevo and Scandinavian Airlines System Amend Agreement to Increase Off-Take of Sustainable Aviation Fuel, valued at over $100 Million

ENGLEWOOD, Colo., Feb. 22, 2021 (GLOBE NEWSWIRE) — Gevo, Inc. (NASDAQ: GEVO), announced today that it and Scandinavian Airlines System (“SAS”) have signed an amendment to increase SAS’s minimum purchase obligation to purchase sustainable aviation fuel (“SAF”) to 5,000,000 gallons per year. Gevo and SAS signed the original fuel sales agreement in October 2019 (the “Fuel Sales Agreement”).

With the finalization of this this amendment to the Fuel Sales Agreement (the “Amendment”), Gevo expects to supply SAS with SAF beginning in 2024 from Gevo’s Net-Zero 2 Project for use and distribution in low carbon fuel regions of the United States. The value of the Fuel Sales Agreement, as amended, is estimated at over $100 million over the entire term of the agreement inclusive of the related SAF and environmental credits.

“With this amendment, SAS has significantly increased the amount of SAF that it is willing to purchase from Gevo. This amendment is evidence of the strong and growing demand for Gevo’s renewable hydrocarbon products. We expect to ink additional offtake agreements later this year,” said Patrick R. Gruber, Chief Executive Officer of Gevo. “SAS have a vision and plan that they are executing, even in spite of the global pandemic. This additional volume will help Gevo grow its business and hopefully accelerate making real Gevo’s Net-Zero 2 plant,” added Mr. Gruber.

“SAS has an ambitious goal in reducing its’ absolute climate affecting emissions by 25 percent from 2005 levels by 2025. This increase of Gevo SAF will help us to reach at least 20% of the SAF needed to reach our emission reductions goal. SAS chooses partners like Gevo that have the vision and ambition to support the aviation industry’s transition to net zero emission,” says Lars Andersen Resare, Head of Sustainability, SAS.

Beyond Net-Zero 1

Gevo has introduced the concept of Net Zero Projects. Announced in early 2021, these production facilities are being designed to produce energy-dense liquid hydrocarbons using renewable energy and Gevo’s proprietary technology. The first Net-Zero project, Net-Zero 1, is expected to be built in Lake Preston, South Dakota.

The Net-Zero Projects are being designed to produce liquid hydrocarbons in the form of sustainable aviation fuel and renewable gasoline. These fuels, when used for transportation, should have a net-zero greenhouse-gas footprint as measured across the entire lifecycle, based on the Argonne National Laboratory’s GREET model.

Gevo expects that each Net-Zero Project will have the capability to produce approximately 45MGPY of liquid hydrocarbons (jet fuel and renewable gasoline) and are also expected to produce at least 350,000,000 lbs/yr of high protein animal feed. To reduce and eliminate the fossil fuel resources used in the production facilities, each Net Zero Project is expected to have an anaerobic digestion wastewater treatment plant that is capable of generating enough biogas to run the plant and supply a combined heat and power unit, capable of meeting approximately 30% of the plant’s electricity needs. The remaining 70% of electricity to run the plant is expected to come from wind power. Net-Zero 1 may also obtain renewable natural gas (“RNG”) using manure from dairy or beef cows. These efforts should make this Net-Zero 1 self-sufficient and help ensure it will be off a fossil-based grid. Gevo also believes in transparency and is setting up sustainability tracking methods to work alongside our farmers.

The Fuel Sales Agreement, as amended, is subject to certain conditions precedent. A copy of the Fuel Sales Agreement and the Amendment have been filed with the U.S. Securities and Exchange Commission on Form 8-K.

About Gevo

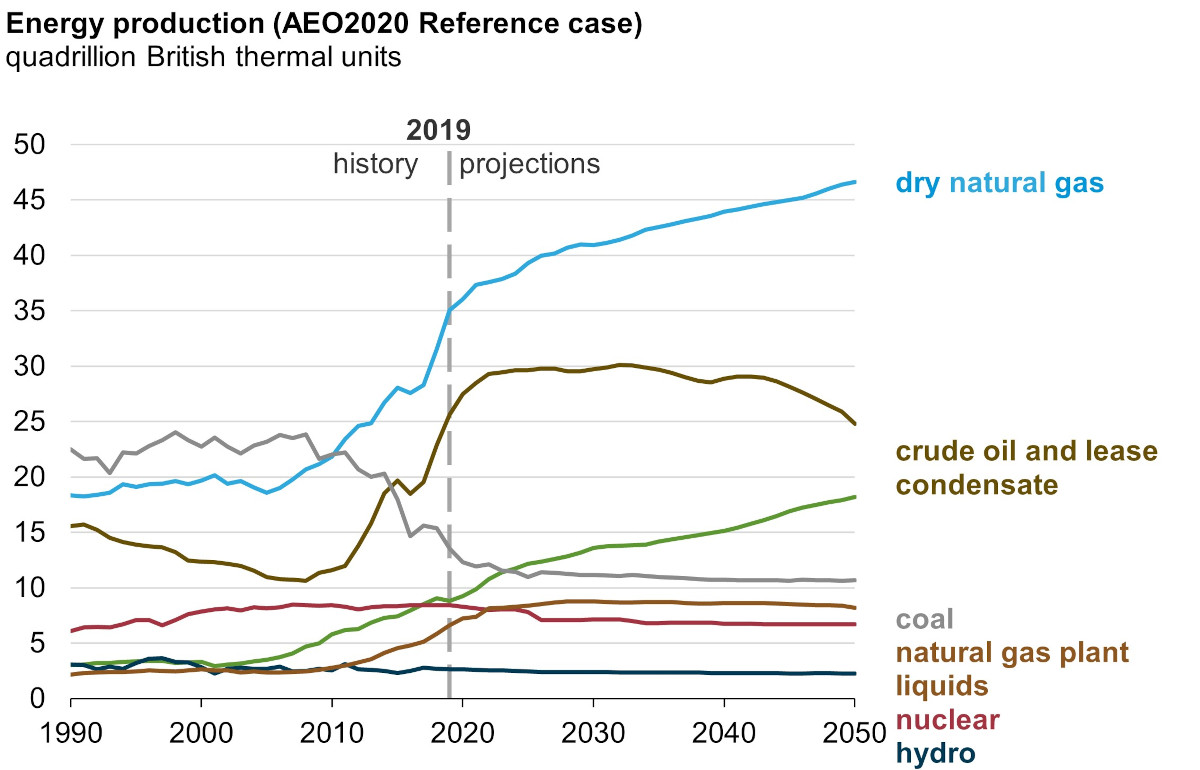

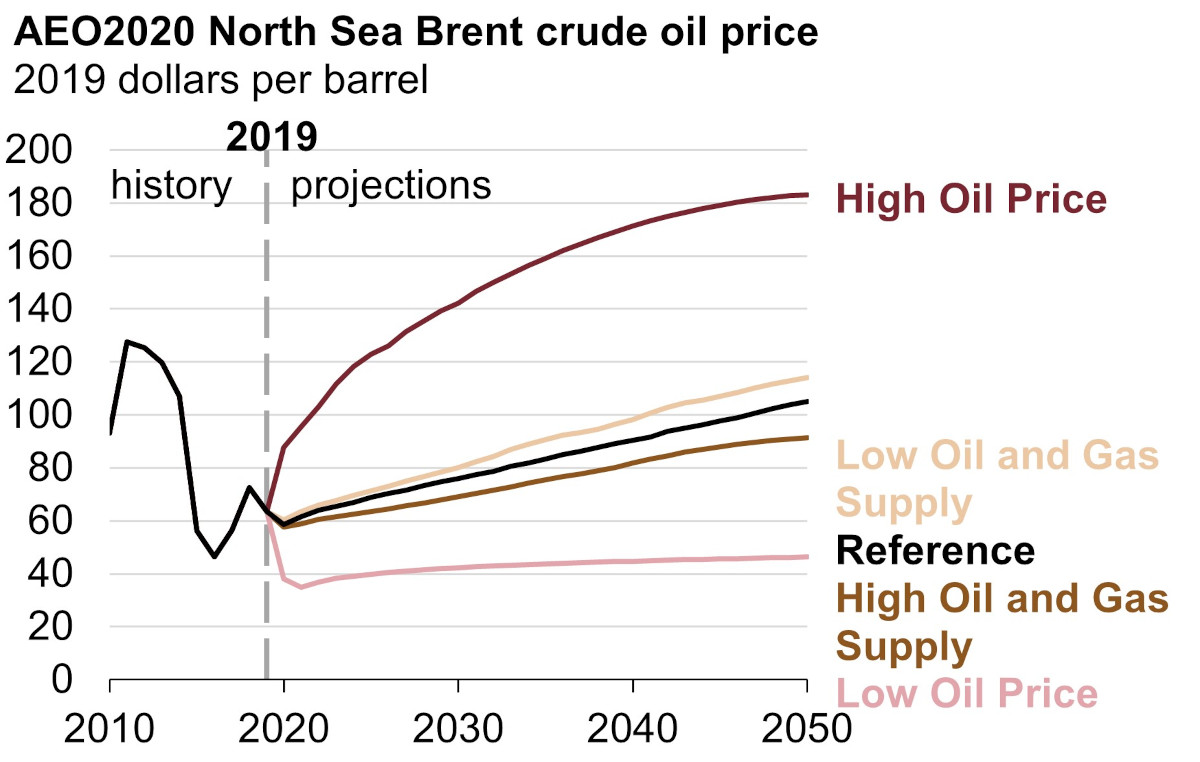

Gevo’s mission is to transform renewable energy and carbon into energy-dense liquid hydrocarbons. These liquid hydrocarbons can be used for drop-in transportation fuels such as gasoline, jet fuel, and diesel fuel, that have the potential to yield net-zero greenhouse gas emissions when measured across the full lifecycle of the products. Gevo uses low-carbon renewable resource-based carbohydrates as raw materials from residues and slurries, and is in an advanced state of developing renewable electricity and renewable natural gas for use in production processes, resulting in low-carbon fuels with substantially reduced carbon intensity (the level of greenhouse gas emissions compared to standard petroleum fossil-based fuels across their lifecycle) and GHG scores. Gevo’s products perform as well or better than traditional fossil-based fuels in infrastructure and engines, but with substantially reduced greenhouse gas emissions. In addition to addressing the problems of fuels, Gevo’s technology also enables certain plastics, such as polyester, to be made with more sustainable ingredients. Gevo’s ability to penetrate the growing low-carbon fuels market depends on the price of oil and the value of abating carbon emissions that would otherwise increase greenhouse gas emissions. Gevo believes that its proven and patented technology, which enables the use of a variety of low-carbon sustainable feedstocks to produce price-competitive low carbon products such as gasoline components, jet fuel, and diesel fuel, yields the potential to generate project and corporate returns that justify the build-out of a multi-billion-dollar business.

Learn more at Gevo’s website: www.gevo.com

About SAS

SAS, Scandinavia’s leading airline, with main hubs in Copenhagen, Oslo and Stockholm, flies to destinations in Europe, USA and Asia. Spurred by a Scandinavian heritage and sustainability values, SAS aims to be the global leader in sustainable aviation. We will reduce total carbon emissions by 25 percent by 2025, by using more sustainable aviation fuel and our modern fleet with fuel-efficient aircraft. In addition to flight operations, SAS offers ground handling services, technical maintenance and air cargo services. SAS is a founding member of the Star Alliance™, and together with its partner airlines offers a wide network worldwide.

Learn more at https://www.sasgroup.net

Forward-Looking Statements

Certain statements in this press release may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to a variety of matters, including, without limitation, statements related to the Agreement and the Amendment, Gevo’s SAF, Gevo’s ability to produce the SAF, Gevo’s ability to realize revenue from the Agreement and Amendment, Gevo’s ability to enter into additional offtake agreements for its products, Gevo’s Net-Zero Projects, including Net-Zero 2, Gevo’s ability to produce products that have a “net-zero” greenhouse gas footprint, Gevo’s plans and strategy, the NW Iowa Project, Gevo’s ability to finance its projects, and other statements that are not purely statements of historical fact. These forward-looking statements are made on the basis of the current beliefs, expectations and assumptions of the management of Gevo and are subject to significant risks and uncertainty. Investors are cautioned not to place undue reliance on any such forward-looking statements. All such forward-looking statements speak only as of the date they are made, and Gevo undertakes no obligation to update or revise these statements, whether as a result of new information, future events or otherwise. Although Gevo believes that the expectations reflected in these forward-looking statements are reasonable, these statements involve many risks and uncertainties that may cause actual results to differ materially from what may be expressed or implied in these forward-looking statements. For a further discussion of risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of Gevo in general, see the risk disclosures in the Annual Report on Form 10-K of Gevo for the year ended December 31, 2019, and in subsequent reports on Forms 10-Q and 8-K and other filings made with the U.S. Securities and Exchange Commission by Gevo.

Investor and Media Contact

IR@gevo.com

+1 720-647-9605

SOURCE: Gevo