Gevo Reports Fourth Quarter 2020 Financial Results

Gevo to Host Conference Call Today at 4:30 p.m. EDT/2:30 p.m. MDT

ENGLEWOOD,

Colo. – March 17, 2021 – Gevo, Inc. (NASDAQ: GEVO) today announced financial results for the fourth quarter of 2020 and recent corporate highlights.

Recent Corporate Highlights

- In January 2021, Gevo announced the plans for its Net-Zero 1 Project (“Net-Zero 1”) to be located in Lake Preston, South Dakota. Net-Zero 1 is expected to produce about 45 MGPY of energy dense liquid hydrocarbons that, when burned as transportation fuels, should have a net-zero greenhouse gas footprint across the whole of the life cycle based on Argonne National Laboratories’ GREET model. Net-Zero 1 is being designed to eliminate the fossil based energy footprint to run the production facility. Importantly, Net-Zero 1 is expected to produce ~400 million pounds per year of protein rich animal feed, and about 30 million pounds per year of corn oil. The 45 MGPY of hydrocarbons would be sold into the gasoline and jet fuel markets under existing take-or-pay contracts. Net-Zero 1 is expected to produce its own biogas. The biogas would be used to heat the production facility and provide approximately 30% of the electricity needed to power the production facility. In addition, wind power is being developed and is expected to supply the other 70% of electricity needed to run the production facility. Green hydrogen will also be produced from the renewable electricity as part of the productions processes at Net-Zero 1. Net-Zero 1 is also expected to have its own water treatment plant to further improve the environmental footprint.

- In February 2021, Gevo signed an amendment to its Fuel Sales Agreement with Scandinavian Airlines System (“SAS”) for sustainable aviation fuel. The volume in the amendment is 5 million gallons per year, and is a “take-or-pay” contract worth ~$100 of revenue across the life of the contract. This volume for the SAS contract is expected to be supplied by Gevo’s second Net-Zero Project beginning in 2024.

- As of February 26, 2021, Gevo had approximately $530.6 million in cash and no significant debt.

- Gevo believes it has the cash on the balance sheet needed to fund the project equity required for Net-Zero 1. A tax-exempt private activity bond debt structure has been developed and vetted by Citigroup which Gevo currently expects to utilize. In order to close the financing for Net-Zero 1, the engineering design and costs first need to be delivered in suitable form for project style financing, and the EPC firm needs to be selected prior to the bond offering. The financial close for Net-Zero 1 is targeted for the first half of 2022.

- In January 2021, Gevo announced that it had selected Koch Process Solutions to provide the Front End Engineering and Design services (FEED) for Net-Zero 1. FEED is expected to be completed in December of 2021. The completion of the FEED work is necessary before the financing of Net-Zero 1 can be completed with Citigroup Global Markets, Inc.

- In January 2021, Gevo completed a registered direct offering of 43.7 million shares of common stock (or common stock equivalents) at $8.0 per share. Total proceeds were $321.7 million, net of closing costs.

- In January 2021, Gevo raised $135.8 million, net of fees, by issuing 24.4 million shares of common stock through its At-the-Market (“ATM”) offering program.

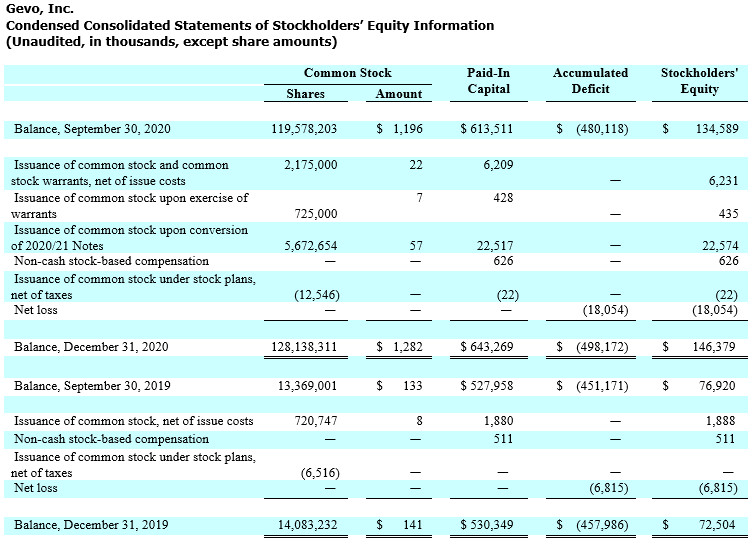

- In December 2020, the holders of Gevo’s 12.0% Convertible Senior Secured Notes due 2020/2021 (the “2020/21 Notes”) converted $12.7 million in aggregate outstanding principal amount of 2020/21 Notes (including the applicable make-whole payment) into an aggregate of 5,672,654 shares of common stock. As a result, as of December 31, 2020, all obligations under the 2020/2021 Notes had been fully paid and satisfied.

- In December 2020, Gevo entered into an option agreement for the right to purchase approximately 240 acres of land near Lake Preston, SD. Gevo expects to construct its Net-Zero 1 Project on this land.

2020 Fourth Quarter Financial Highlights

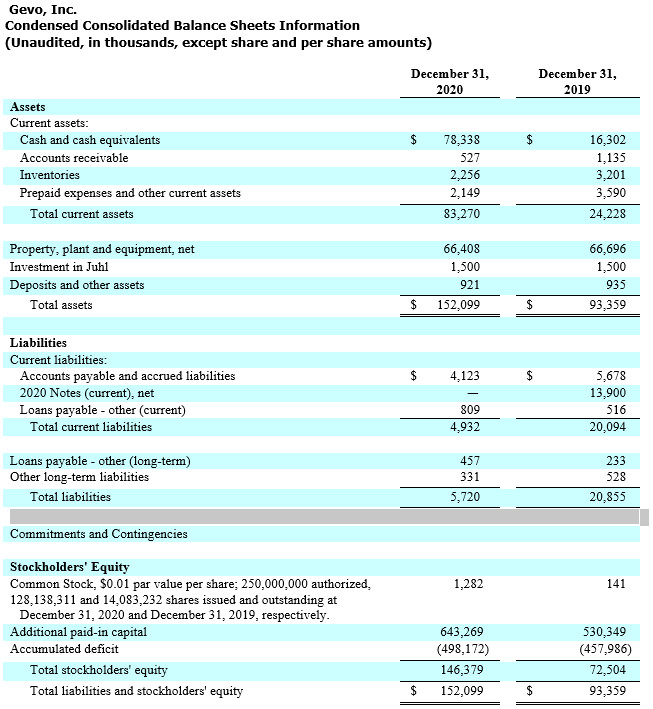

- Ended the quarter with cash and cash equivalents of $78.3 million.

- Revenue totaled $0.5 million for the quarter compared to $6.9 million in Q4 2019.

- Hydrocarbon revenue totaled $0.4 million for the quarter compared to $1.0 million in Q4 2019.

- Loss from operations of ($7.0) million for the quarter compared to ($6.2) million in Q4 2019.

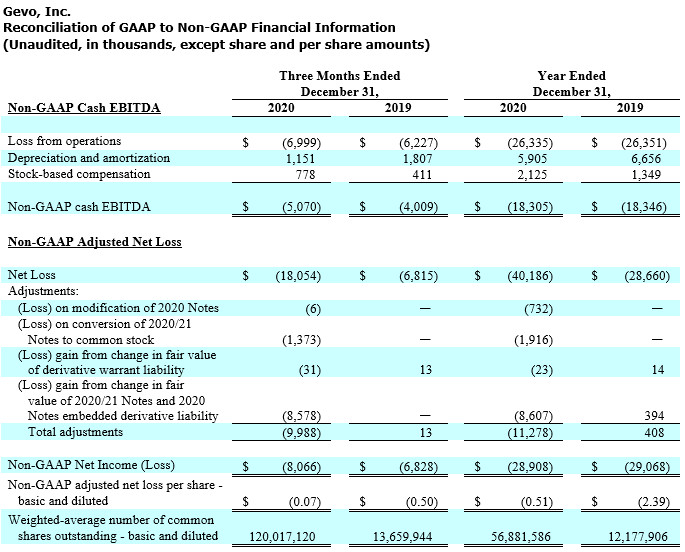

- Non-GAAP cash EBITDA loss[1] of ($5.1) million for the quarter compared to ($4.0) million in Q4 2019.

- Net loss per share of ($0.15) based on 120,017,120 weighted average shares outstanding for the quarter compared to ($0.50) based on 13,659,944 weighted average shares outstanding for the quarter in Q4 2019.

- Non-GAAP adjusted net loss per share[2] of ($0.07) based on 120,017,120 weighted average shares outstanding for the quarter compared to ($0.50) based on 13,659,944 weighted average shares outstanding for the quarter in Q4 2019.

Commenting on the fourth quarter of 2020 and recent corporate events, Dr. Patrick R. Gruber, Gevo’s Chief Executive Officer, said “Net-Zero 1 is a first of a kind, off-the-grid type of plant where we are putting great effort into making Net-Zero 1 the most sustainable plant it can be. I’m glad we have the customers secured, Citigroup to help us with the debt financing, and that the economics of Net-Zero 1 are attractive at this stage. I’m also pleased that we are making progress on filling up production capacity at Net-Zero 2 as evidenced by the recent SAS contract. We are making great progress, fast.”

Fourth Quarter 2020 Financial Results

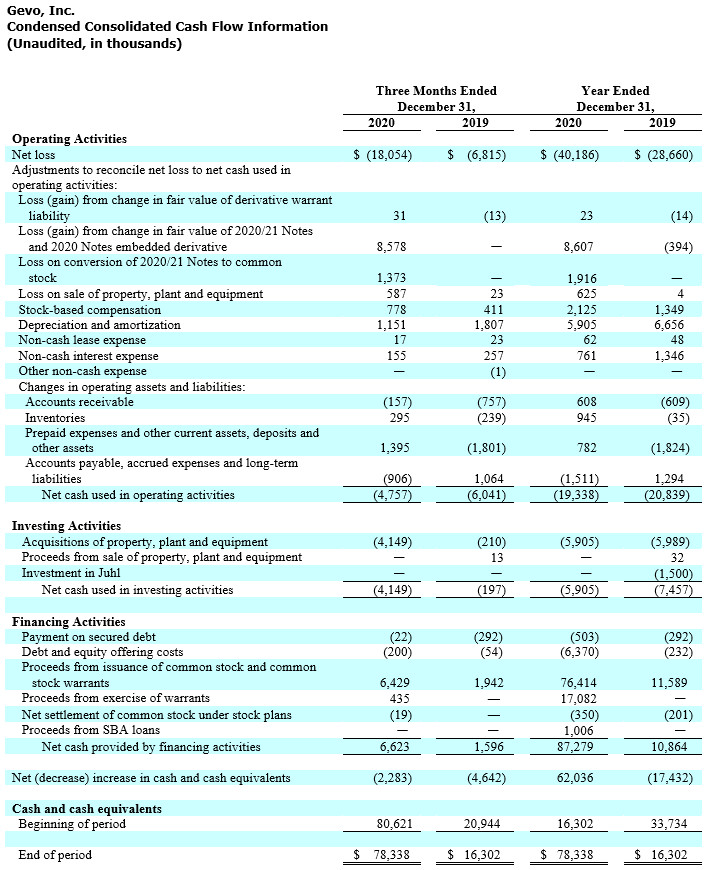

Revenue for the three months ended December 31, 2020 was $0.5 million compared with $6.9 million in the same period in 2019.

Revenue

derived at our production facility located in Luverne, Minnesota (the “Luverne Facility”) related to ethanol sales and related products was nil compared to $5.9 million for the fourth quarter of 2020. As a result of COVID-19 and in response to an unfavorable commodity environment, Gevo terminated its production of ethanol and distiller grains at the Luverne Facility in March 2020. The Luverne Facility is currently shut down until further notice. Currently, the South Hampton Facility is not producing renewable premium gasoline or jet fuel. Gevo expects to produce isobutanol in intermittent campaigns during 2021 to supply the demonstration plant at the South Hampton Resources, Inc. facility in Silsbee, Texas (the “South Hampton Facility”) so that renewable premium gasoline or jet fuel can be produced in 2021.

During the three months ended December 31, 2020, hydrocarbon revenue was $0.4 million compared with $1.0 million in the same period in 2019 as a result of decreased shipments of finished products from our demonstration plant at the South Hampton Facility. Gevo’s hydrocarbon revenue is comprised of sales of alcohol-to-jet fuel, isooctane and isooctene.

Cost of goods sold was $2.0 million for the three months ended December 31, 2020, compared with $9.4 million in the same period in 2019, primarily as a result of terminating ethanol production at the Luverne Facility as discussed above. Cost of goods sold included approximately $0.9 million associated with the production of isobutanol and related products and maintenance of the Luverne Facility and approximately $1.1 million in depreciation expense for the three months ended December 31, 2020.

Gross loss was $1.4 million for the three months ended December 31, 2020, versus a $2.5 million gross loss in the same period in 2019.

Research and development expense increased by $1.7 million during the three months ended December 31, 2020 compared with the same period in 2019, due primarily to an increase in consultant and personnel expenses.

Selling, general and administrative expense increased by $0.2 million during the three months ended December 31, 2020, compared with the same period in 2019, due primarily to an increase in consulting and personnel costs offset by a decrease in investor relations and marketing costs.

Loss from operations in the three months ended December 31, 2020 was $(7.0) million, compared with a ($6.2) million loss from operations in the same period in 2019.

Non-GAAP cash EBITDA loss[3] in the three months ended December 31, 2020 was ($5.1) million, compared with a ($4.0) million non-GAAP cash EBITDA loss in the same period in 2019.

Interest expense in the three months ended December 31, 2020 was $0.5 million, a decrease of $0.1 million as compared to the same period in 2019, primarily due to a decline in amortization of original issue discounts and debt issuance costs compared to the same period last year and the conversion of $2.0 million of 2020/21 Notes in July 2020.

In the three months ended December 31, 2020, Gevo recognized net non-cash loss totaling $1.4 million due to the conversion of $12.7 million of 2020/21 Notes during December 2020.

During the three months ended December 31, 2020, Gevo recognized net non-cash loss totaling $8.6

million due to changes in the fair value of our 2020/21 Notes embedded derivative liability resulting from the increase in the price of our common stock prior to the conversion of the $12.7 million of 2020/21 Notes.

Gevo incurred a net loss for the three months ended December 31, 2020 of ($18.1) million, compared with a net loss of ($6.8) million during the same period in 2019. Non-GAAP adjusted net loss[4] for the three months ended December 31, 2020 was ($8.1) million, compared with a non-GAAP adjusted net loss of ($6.8) million during the same period in 2019.

Cash at December 31, 2020 was $78.3 million, and the total principal face value of 2020/21 Notes was $0.

Webcast

and Conference Call Information

Hosting today’s conference call at 4:30 p.m. EDT (2:30 p.m. MDT) will be Dr. Patrick R. Gruber, Chief Executive Officer, L. Lynn Smull, Chief Financial Officer, Carolyn M. Romero, Chief Accounting Officer, and Geoffrey T. Williams, Jr., Vice President – General Counsel & Secretary. They will review Gevo’s financial results and provide an update on recent corporate highlights.

To participate in the conference call, please dial (833) 729-4776 (inside the U.S.) or (830) 213-7701 and reference the access code 3178466#, or through the event weblink: https://edge.media-server.com/mmc/p/xhvdnuqd.

A replay of the call and webcast will be available two hours after the conference call ends on March 17, 2021. To access the replay, please visit https://edge.media-server.com/mmc/p/xhvdnuqd. The archived webcast will be available in the Investor Relations section of Gevo’s website at www.gevo.com.

About Gevo

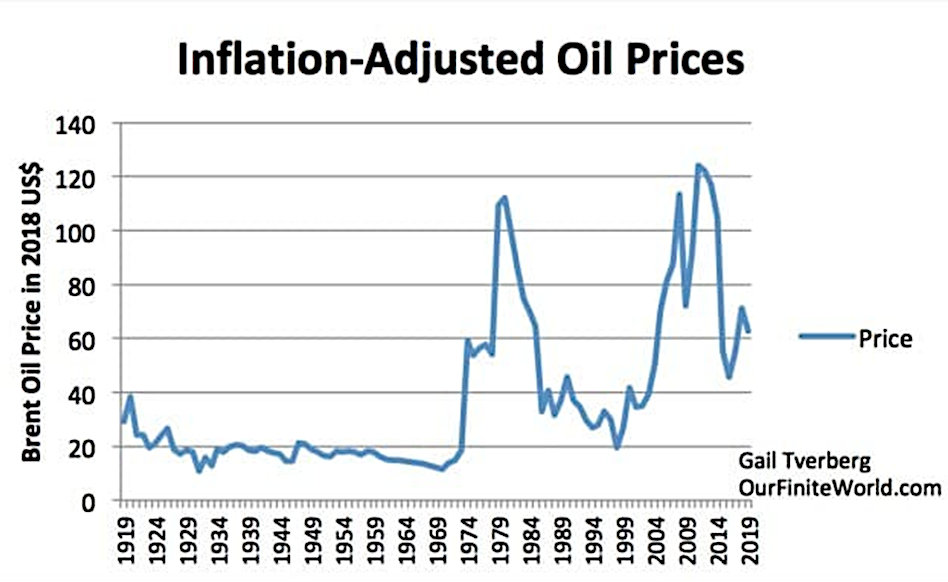

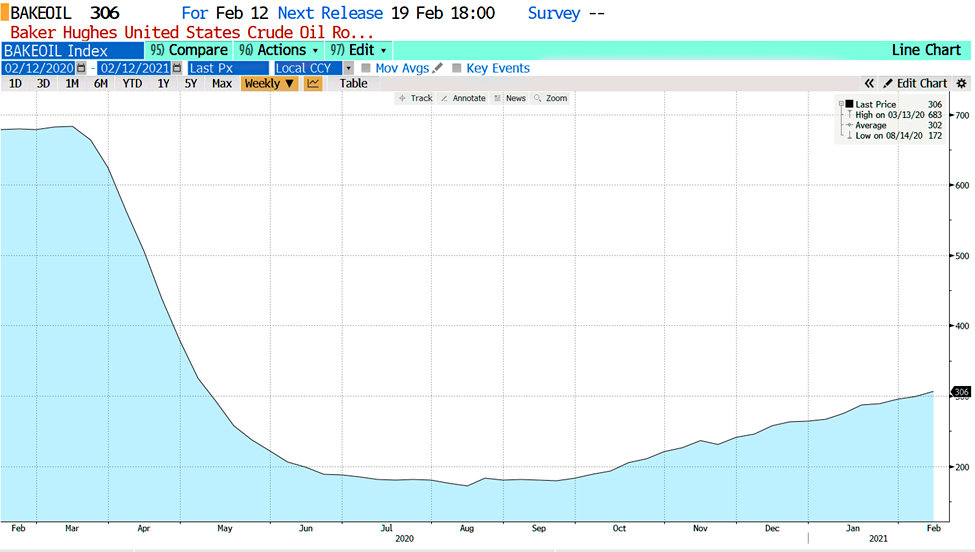

Gevo’s mission is to transform renewable energy and carbon into energy-dense liquid hydrocarbons. These liquid hydrocarbons can be used for drop-in transportation fuels such as gasoline, jet fuel, and diesel fuel, that when burned have potential to yield net-zero greenhouse gas emissions when measured across the full lifecycle of the products. Gevo uses low-carbon renewable resource-based carbohydrates as raw materials, and is in an advanced state of developing renewable electricity and renewable natural gas for use in production processes, resulting in low-carbon fuels with substantially reduced carbon intensity (the level of greenhouse gas emissions compared to standard petroleum fossil-based fuels across their lifecycle). Gevo’s products perform as well or better than traditional fossil-based fuels in infrastructure and engines, but with substantially reduced greenhouse gas emissions. In addition to addressing the problems of fuels, Gevo’s technology also enables certain plastics, such as polyester, to be made with more sustainable ingredients. Gevo’s ability to penetrate the growing low-carbon fuels market depends on the price of oil and the value of abating carbon emissions that would otherwise increase greenhouse gas emissions. Gevo believes that its proven, patented, technology enabling the use of a variety of low-carbon sustainable feedstocks to produce price-competitive low carbon products such as gasoline components, jet fuel, and diesel fuel yields the potential to generate project and corporate returns that justify the build-out of a multi-billion-dollar business.

Gevo believes that Argonne National Laboratory GREET model is the best available standard of scientific based measurement for life cycle inventory or LCI.

Learn more at Gevo’s website: www.gevo.com

Forward-Looking Statements

Certain statements in this press release may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to a variety of matters, including, without limitation, Gevo’s business development activities, Gevo’s Net-Zero Projects, Gevo’s offtake agreements, Gevo’s plans to develop its business, Gevo’s ability to successfully construct and finance its operations and growth projects, Gevo’s ability to achieve cash flow from its planned projects, the ability of Gevo’s products to contribute to lower greenhouse gas emissions, particulate and sulfur pollution and other statements that are not purely statements of historical fact. These forward-looking statements are made based on the current beliefs, expectations and assumptions of the management of Gevo and are subject to significant risks and uncertainty. Investors are cautioned not to place undue reliance on any such forward-looking statements. All such forward-looking statements speak only as of the date they are made, and Gevo undertakes no obligation to update or revise these statements, whether as a result of new information, future events or otherwise. Although Gevo believes that the expectations reflected in these forward-looking statements are reasonable, these statements involve many risks and uncertainties that may cause actual results to differ materially from what may be expressed or implied in these forward-looking statements. For a further discussion of risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to the business of Gevo in general, see the risk disclosures in the Annual Report on Form 10-K of Gevo for the year ended December 31, 2020 and in subsequent reports on Forms 10-Q and 8-K and other filings made with the U.S. Securities and Exchange Commission by Gevo.

Non-GAAP Financial Information

This press release contains financial measures that do not comply with U.S. generally accepted accounting principles (GAAP), including non-GAAP cash EBITDA loss, non-GAAP adjusted net loss and non-GAAP adjusted net loss per share. Non-GAAP cash EBITDA excludes depreciation and non-cash stock-based compensation. Non-GAAP adjusted net loss and adjusted net loss per share excludes non-cash gains and/or losses recognized in the quarter due to the changes in the fair value of certain of Gevo’s financial instruments, such as warrants, convertible debt and embedded derivatives. Management believes these measures are useful to supplement its GAAP financial statements with this non-GAAP information because management uses such information internally for its operating, budgeting and financial planning purposes. These non-GAAP financial measures also facilitate management’s internal comparisons to Gevo’s historical performance as well as comparisons to the operating results of other companies. In addition, Gevo believes these non-GAAP financial measures are useful to investors because they allow for greater transparency into the indicators used by management as a basis for its financial and operational decision making. Non-GAAP information is not prepared under a comprehensive set of accounting rules and therefore, should only be read in conjunction with financial information reported under U.S. GAAP when understanding Gevo’s operating performance. A reconciliation between GAAP and non-GAAP financial information is provided in the financial statement tables below.

[1] Cash EBITDA loss is a non-GAAP

measure calculated by adding back depreciation and non-cash stock compensation

to GAAP loss from operations. A reconciliation of cash EBITDA loss to GAAP loss

from operations is provided in the financial statement tables following this

release.

[2] Adjusted net loss per share is a

non-GAAP measure calculated by adding back non-cash gains and/or losses

recognized in the quarter due to the changes in the fair value of certain of

our financial instruments, such as warrants, convertible debt and embedded

derivatives, to GAAP net loss per share. A reconciliation of adjusted net loss

per share to GAAP net loss per share is provided in the financial statement

tables following this release.

[3] Cash EBITDA loss is a non-GAAP

measure calculated by adding back depreciation and non-cash stock compensation

to GAAP loss from operations. A reconciliation of cash EBITDA loss to GAAP loss

from operations is provided in the financial statement tables following this

release.

[4] Adjusted net loss is a non-GAAP

measure calculated by adding back non-cash gains and/or losses recognized in

the quarter due to the changes in the fair value of certain of our financial

instruments, such as warrants, convertible debt and embedded derivatives, to

GAAP net loss. A reconciliation of adjusted net loss to GAAP net loss is

provided in the financial statement tables following this release.

Gevo,

Inc.

Investor and Media Contact

+1 720-647-9605

IR@gevo.com