|

|

|

NNoble Capital Markets Senior Research Analyst Michael Heim sits down with Indonesia Energy President Frank Ingriselli for this exclusive interview. Research, News, and Advanced Market Data on INDOView all C-Suite Interviews

About Indonesia Energy Corporation Limited Indonesia Energy Corporation Limited (NYSE American:INDO) is a publicly traded energy company engaged in the acquisition and development of strategic, high growth energy projects in Indonesia. IEC’s principal assets are its Kruh Block (63,000 acres) located onshore on the Island of Sumatra in Indonesia and its Citarum Block (1,000,000 acres) located onshore on the Island of Java in Indonesia. IEC is headquartered in Jakarta, Indonesia and has a representative office in Danville, California. For more information on IEC, please visit www.indo-energy.com. |

Category: Energy

Release – Capstone Green Energy (Nasdaq CGRN) To Announce Fourth Quarter and Full Fiscal Year 2021 Results On Thursday June 10 2021

Capstone Green Energy (Nasdaq:CGRN) To Announce Fourth Quarter & Full Fiscal Year 2021 Results On Thursday, June 10, 2021

Is Oil Demand Stronger than Estimated?

Image Credit: Kim Woodbridge (Flickr)

Are the Markets Underestimating Oil Demand?

Introduction

What COVID-19 did to oil demand, the rollout of the COVID-19 vaccine has been quickly undoing. As employees return to work and travel is increased both near and far, the sudden demand coupled with the reduced output from last year could be a recipe for even higher prices. The U.S. economy has not even reached its expected peak, yet underestimated oil demand is now showing up in prices. This is why Goldman Sachs predicts Brent crude oil will cross above the $80 per barrel mark. The bank prediction is on the high side of forecasts as others expect oil prices to hover around $70 per barrel until Q3 of 2021.

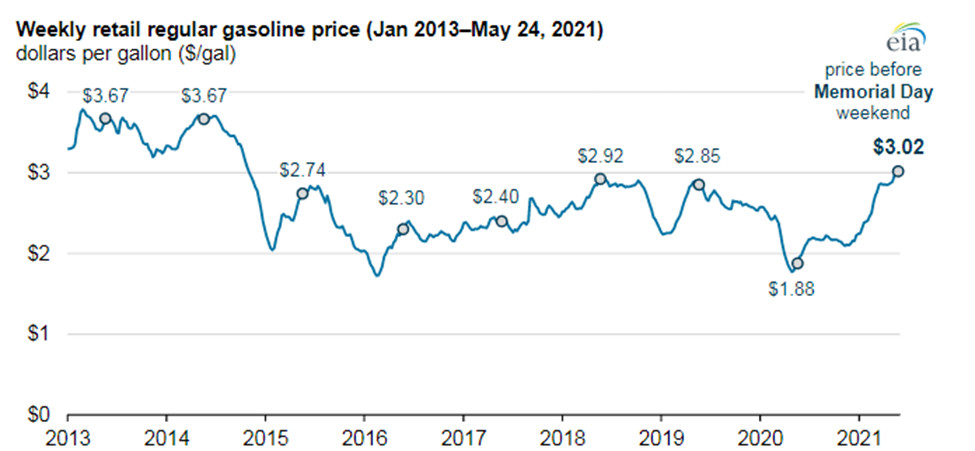

Higher Demand for Gasoline

One place consumers are witnessing the impact of higher crude prices higher is at the gas pump. With more cars coming out of their driveway, pump prices have spiked to $3 and more a gallon. This is almost twice gasoline’s lowest level during 2020. This increase is the record-high increase (percentage) in prices since 2014.

The EIA (Energy Information Administration) affirms that it is expecting the average consumption of 9 million barrels a day (BPD) in the summer season alone in the U.S. In comparison, this pace would surpass the threshold of 2020’s summer consumption by approximately 15% or 1.2 million barrels per day.

Source: EIA.gov

How Accurate Will Predictions Be?

The all-time-high for a barrel of oil was $147.02 reached on July 11, 2008. Although the expectations, even on the high side, are well below that ($80 range). when you consider that Brent crude prices are already up 66% in less than a year and the dynamics driving the price are still in place, the potential for even greater increases is real. The U.S. is ahead of many other large oil-consuming nations, as they lift restrictions and international travel resumes demand could potentially exceed even the more extreme predictions. Over the past year, Brent Crude oil prices have climbed 85 percent to their current price per barrel. Now, as the reopening, the pent-up demand, and the empowered vaccinated and COVID-19 survivors all come together during the summer travel season its could be like a perfect storm, even the more accurate forecasters are faced with variables they have never had to model before. They may be spot on, but if there is deviation, they may be far too conservative with their expectations.

Who Benefits:

This coming Saturday is the United Nations World Environmental Day. The push to reduce fossil fuel use is high across the globe. Yet, there are some true beneficiaries of increasing crude in the short and long term. In a press release dated May 6, 2021, InPlay Oil (IPOOF,

IPO:CA) had this to say about their prospects. “The commodity price recovery in the past year has been remarkable and occurred quicker than InPlay and most in the industry expected. We are pleased to report that InPlay is ahead of schedule on our road to recovery, already reaching our goal of quickly returning to 2019 pre-COVID production levels.” InPlay is a small driller which means every additional penny that a barrel taken from the ground is sold for, has a larger impact on their bottom line. Indonesia Energy (INDO) is an oil and gas exploration and production company focused on Indonesia. They began drilling a first well on April 21st. Next Tuesday (June 8) INDO is hosting an investor conference call in order to provide an update (including initial results) on the drilling and completion of IEC’s first new producing well. INDO is also a small company where small price changes can have a magnified impact. GEVO Inc. (GEVO) is a small biofuels manufacturer that is a favorite among many ESG investors. They also benefit from an increase in fuel prices while having the global regulatory bodies solidly behind the reduction in high carbon-emitting fuels. Any expected increase in the value of a barrel of oil could also impact the bio-alternatives.

Take Away

In their report on oil, Goldman Sachs wrote, “Investors should be aware of the fact that the world market at the moment is underestimating oil demand as a chance to open up economies for enterprise.” If there is the expected increased travel across the globe and economic activity continues its upward spike, it’s conceivable that estimates like this may fall short of what occurs through Summer 2021.

Even the slightest rise in oil prices can impact small companies that either compete with oil with alternative fuels or extract oil at a cost to the company that doesn’t change much with the price of oil.

Suggested Content:

|

|

InPlay Oil Virtual Roadshow (Video)

|

Indonesia Energy Virtual Roadshow (Video)

|

|

|

GEVO, Inc. Virtual Roadshow (Video)

|

FAT Brands Virtual Roadshow (Video)

|

REFERENCES:

- https://www.business-standard.com/article/markets/markets-underestimating-oil-demand-see-brent-at-80-goldman-sachs-121052400224_1.html

- https://www.hellenicshippingnews.com/physical-oil-market-witnesses-strong-buying-ahead-of-summer/

- https://oilprice.com/Energy/Energy-General/Oil-Prices-Rebound-As-Demand-Optimism-Returns.html

- https://www.magzter.com/news/395/2630/052021/mdmdi

- https://www.inplayoil.com/sites/2/files/documents/press_release_q1_2021_final.pdf

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|

Energy Fuels Announces Election of Directors

Energy Fuels Announces Election of Directors

LAKEWOOD, Colo., May 27, 2021 /CNW/ – Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) (“Energy Fuels” or the “Company”), the leading uranium producer in the United States, announces the results of the election of directors at its annual and special meeting of shareholders (the “Meeting“) held virtually on May 26, 2021.

The eight (8) nominees proposed by management for election as directors were elected by the shareholders of the Company, through a combination of votes by proxy and electronic poll, as follows:

|

Nominee |

Votes For |

% For |

Votes Withheld |

% Withheld |

|

J. Birks Bovaird |

16,494,553 |

85.70% |

2,753,377 |

14.30% |

|

Mark S. Chalmers |

18,494,309 |

96.08% |

753,621 |

3.92% |

|

Benjamin Eshleman III |

14,978,861 |

77.82% |

4,269,069 |

22.18% |

|

Barbara A. Filas |

18,358,186 |

95.38% |

889,744 |

4.62% |

|

Bruce D. Hansen |

16,600,408 |

86.25% |

2,647,522 |

13.75% |

|

Dennis L. Higgs |

18,275,526 |

94.95% |

972,404 |

5.05% |

|

Robert W. Kirkwood |

15,876,006 |

82.48% |

3,371,924 |

17.52% |

|

Alexander Morrison |

16,631,280 |

86.41% |

2,616,650 |

13.59% |

About Energy Fuels: Energy Fuels is a leading U.S.-based uranium mining company, supplying U3O8 to major nuclear utilities. The Company also produces vanadium from certain of its projects, as market conditions warrant, and expects to commence commercial production of REE carbonate in 2021. Its corporate offices are in Lakewood, Colorado near Denver, and all of its assets and employees are in the United States. Energy Fuels holds three of America’s key uranium production centers: the White Mesa Mill in Utah, the Nichols Ranch in-situ recovery (“ISR”) Project in Wyoming, and the Alta Mesa ISR Project in Texas. The White Mesa Mill is the only conventional uranium mill operating in the U.S. today, has a licensed capacity of over 8 million pounds of U3O8 per year, and has the ability to produce vanadium when market conditions warrant, as well as REE carbonate from various uranium-bearing ores. The Nichols Ranch ISR Project is currently on standby and has a licensed capacity of 2 million pounds of U3O8 per year. The Alta Mesa ISR Project is also currently on standby. In addition to the above production facilities, Energy Fuels also has one of the largest NI 43-101 compliant uranium resource portfolios in the U.S. and several uranium and uranium/vanadium mining projects on standby and in various stages of permitting and development. The primary trading market for Energy Fuels’ common shares is the NYSE American under the trading symbol “UUUU,” and the Company’s common shares are also listed on the Toronto Stock Exchange under the trading symbol “EFR.” Energy Fuels’ website is www.energyfuels.com.

SOURCE Energy Fuels Inc.

Release – Energy Fuels Announces Election of Directors

Energy Fuels Announces Election of Directors

LAKEWOOD, Colo., May 27, 2021 /CNW/ – Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) (“Energy Fuels” or the “Company”), the leading uranium producer in the United States, announces the results of the election of directors at its annual and special meeting of shareholders (the “Meeting“) held virtually on May 26, 2021.

The eight (8) nominees proposed by management for election as directors were elected by the shareholders of the Company, through a combination of votes by proxy and electronic poll, as follows:

|

Nominee |

Votes For |

% For |

Votes Withheld |

% Withheld |

|

J. Birks Bovaird |

16,494,553 |

85.70% |

2,753,377 |

14.30% |

|

Mark S. Chalmers |

18,494,309 |

96.08% |

753,621 |

3.92% |

|

Benjamin Eshleman III |

14,978,861 |

77.82% |

4,269,069 |

22.18% |

|

Barbara A. Filas |

18,358,186 |

95.38% |

889,744 |

4.62% |

|

Bruce D. Hansen |

16,600,408 |

86.25% |

2,647,522 |

13.75% |

|

Dennis L. Higgs |

18,275,526 |

94.95% |

972,404 |

5.05% |

|

Robert W. Kirkwood |

15,876,006 |

82.48% |

3,371,924 |

17.52% |

|

Alexander Morrison |

16,631,280 |

86.41% |

2,616,650 |

13.59% |

About Energy Fuels: Energy Fuels is a leading U.S.-based uranium mining company, supplying U3O8 to major nuclear utilities. The Company also produces vanadium from certain of its projects, as market conditions warrant, and expects to commence commercial production of REE carbonate in 2021. Its corporate offices are in Lakewood, Colorado near Denver, and all of its assets and employees are in the United States. Energy Fuels holds three of America’s key uranium production centers: the White Mesa Mill in Utah, the Nichols Ranch in-situ recovery (“ISR”) Project in Wyoming, and the Alta Mesa ISR Project in Texas. The White Mesa Mill is the only conventional uranium mill operating in the U.S. today, has a licensed capacity of over 8 million pounds of U3O8 per year, and has the ability to produce vanadium when market conditions warrant, as well as REE carbonate from various uranium-bearing ores. The Nichols Ranch ISR Project is currently on standby and has a licensed capacity of 2 million pounds of U3O8 per year. The Alta Mesa ISR Project is also currently on standby. In addition to the above production facilities, Energy Fuels also has one of the largest NI 43-101 compliant uranium resource portfolios in the U.S. and several uranium and uranium/vanadium mining projects on standby and in various stages of permitting and development. The primary trading market for Energy Fuels’ common shares is the NYSE American under the trading symbol “UUUU,” and the Company’s common shares are also listed on the Toronto Stock Exchange under the trading symbol “EFR.” Energy Fuels’ website is www.energyfuels.com.

SOURCE Energy Fuels Inc.

Finding Replacements for Petroleum Based Chemicals

image credit: Repsol (Flickr)

Oil Companies are Going All-In on Petrochemicals – Where Will That Leave Biochemicals?

Global oil consumption declined by roughly 9% in 2020 as the pandemic reduced business and pleasure travel, factory production and transportation of goods. This abrupt drop accelerated an ongoing shift from fossil fuels to renewable energy.

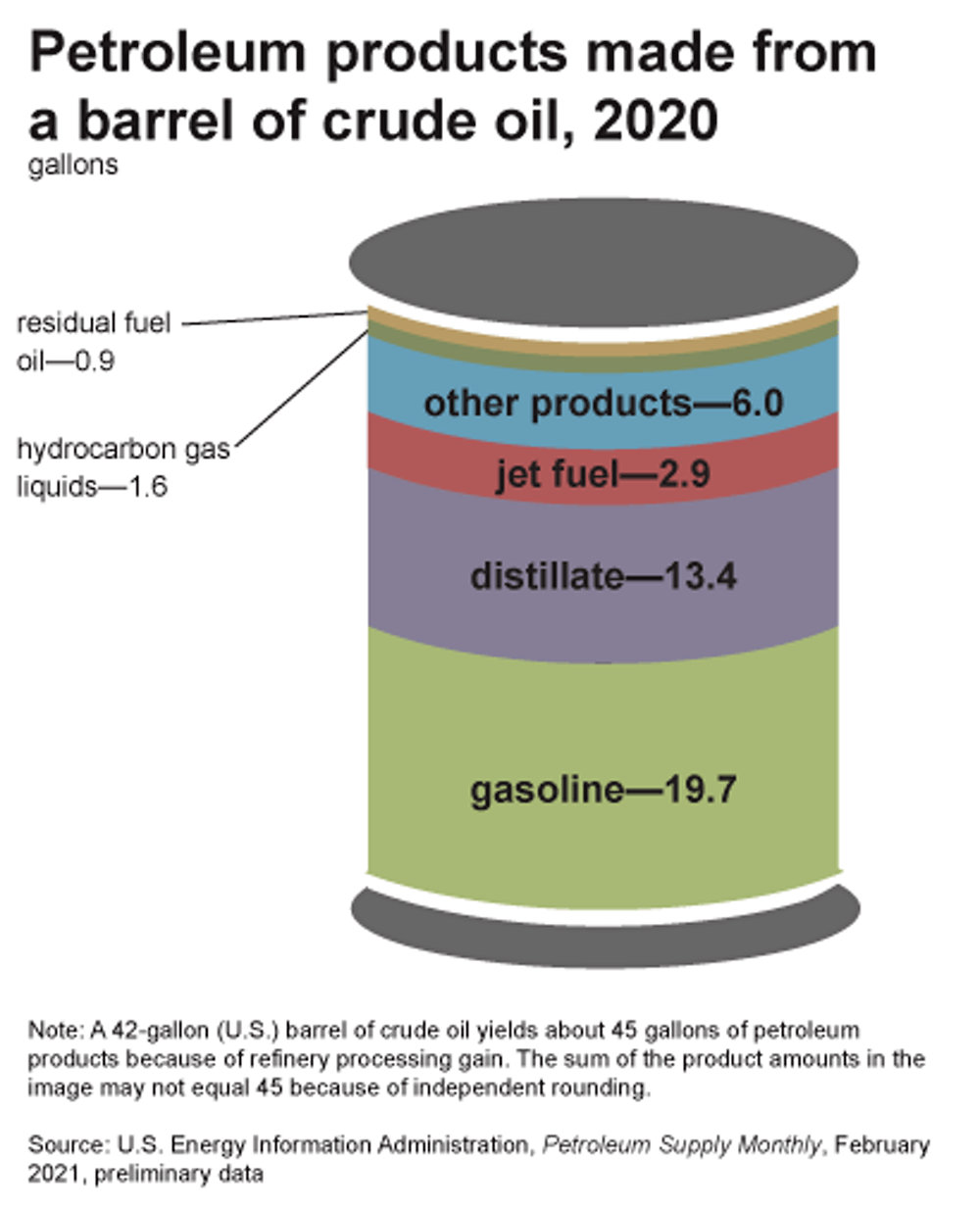

U.S. government forecasts show that oil use for transportation, industry, construction, heating and electricity is declining and will continue to drop in the coming years. This trend has enormous implications for the oil industry: As the International Energy Agency observed in 2020, “No oil and gas company will be unaffected by clean energy transitions.” Many of these companies are trying to make up losses by boosting production of petrochemicals derived from oil and natural gas. Today roughly 80% of every barrel of oil is used to make gasoline, diesel and jet fuel, with the rest going into petrochemical products. As demand for petroleum fuels gradually declines, the amount of oil used for that “other” share will grow.

U.S. government forecasts show that oil use for transportation, industry, construction, heating and electricity is declining and will continue to drop in the coming years. This trend has enormous implications for the oil industry: As the International Energy Agency observed in 2020, “No oil and gas company will be unaffected by clean energy transitions.” Many of these companies are trying to make up losses by boosting production of petrochemicals derived from oil and natural gas. Today roughly 80% of every barrel of oil is used to make gasoline, diesel and jet fuel, with the rest going into petrochemical products. As demand for petroleum fuels gradually declines, the amount of oil used for that “other” share will grow.

This makes sense as a business strategy, but here’s the problem: Researchers are working to develop more sustainable replacements for petrochemical products, including bio-based plastics and specialty chemicals. However, petrochemicals can be manufactured at a fraction of the cost. As a biochemist working to develop environmentally benign versions of valuable chemicals, I’m concerned that without adequate support, pioneering green chemistry research will struggle to compete with fossil-based products.

Pivoting Toward Petrochemicals

Petrochemicals are used in millions of products, from plastics, detergents, shampoos and makeup to industrial solvents, lubricants, pharmaceuticals, fertilizer and carpeting. Over the next 20 years, oil company BP projects that this market will grow by 16% to 20%.

Oil companies are ramping up to increase petrochemical production. In the Saudi Arabian town of Yanbu, for example, two state-owned companies, Saudi Aramco and Sabic, are planning a new complex that will produce 9 million metric tons of petrochemicals each year, transforming Arabian light crude oil into lubricants, solvents and other products.

These changes are happening across the global industry. Several Chinese companies are constructing factories that will convert about 40% of their oil into chemicals such as p-Xylene, a building block for industrial chemicals. Exxon-Mobil began expanding research and development on petrochemicals as far back as 2014.

The Promise of Green Chemistry

At the same time, in the U.S. and other industrialized countries, health, environmental and security issues are driving a quest to produce sustainable alternatives for petroleum-based chemicals. Drilling for oil and natural gas, using petrochemicals and burning fossil fuels have widespread environmental and human health impacts. High oil consumption also raises national security concerns.

The Department of Energy has led basic research on bioproducts through its national laboratories and funding for university BioEnergy Research Centers. These labs are developing plant-based, sustainable domestic biofuels and bioproducts, including petrochemical replacements, through a process called “metabolic engineering.”

Researchers like me are using enzymes to transform leafy waste matter from crops and other sources into sugars that can be consumed by microorganisms – typically, bacteria and fungi such as yeast. These microorganisms then transform the sugars into molecules, similar to the way that yeast converts sugar to ethanol, fermenting it into beer.

In the creation of bioproducts, instead of creating ethanol the sugar is transformed into other molecules. We can design these metabolic pathways to create solvents; components in widely used polymers like nylon; perfumes; and many other products.

My laboratory is exploring ways to engineer enzymes – catalysts produced by living cells that cause or speed up biochemical reactions. We want to produce enzymes that can be put into engineered bacteria, in order to make structurally complex natural products.

The overall goal is to put carbon and oxygen together in a predictable fashion, similar to the chemical structures created through petroleum-based chemistry. But the green approach uses natural substances instead of oil or natural gas as building blocks.

This isn’t a new concept. Enzymes in bacteria are used to make an important antibiotic, erythromycin, which was first discovered in 1952.

All of this takes place in a biorefinery – a facility that takes natural inputs like algae, crop waste or specially grown energy crops like switchgrass and converts them into commercially valuable substances, as oil refineries do with petroleum. After fermenting sugars with engineered microorganisms, a biorefinery separates and purifies microbial cells to produce a spectrum of bio-based products, including food additives, animal feed, fragrances, chemicals and plastics.

In response to the global plastic pollution crisis, one research priority is “polymer upcycling.” Using bio-based feedstocks can transform single-use water bottles into materials that are more recyclable than petroleum-based versions because they are easier to heat and remold.

Promoting bio-based products is compatible with President Biden’s all-of-government approach to climate change. Biomanufacturing investments could also help bring modern manufacturing jobs to rural areas, a goal of Biden’s American Jobs Plan.

But oil company investments in the design of novel chemicals are growing, and the chasm between the cost of petroleum-based products and those produced through emerging green technologies continues to widen. More efficient technologies could eventually flood existing petrochemical markets, further driving down the cost of petrochemicals and making it even harder to compete.

In my view, the growing climate crisis and increasing plastic pollution make it urgent to wean the global economy from petroleum. I believe that finding replacements for petroleum-based chemicals in many products we use daily can help move the world toward that goal.

This article

was republished with permission from The

Conversation, a news

site dedicated to sharing ideas from academic experts. Written by, Constance B. Bailey Assistant Professor of Chemistry, University of Tennessee

Suggested Reading:

|

|

Repurposing Power Plants for Crypto Mining

|

Rare Earth Elements Demand is Still Growing

|

|

|

Can Mining be Green and Sustainable?

|

The Increasing Popularity of Uranium Investments

|

Energy Fuels (UUUU)(EFR:CA) – Rating Upgraded and New Price Target Established

Wednesday, May 26, 2021

Energy Fuels (UUUU)(EFR:CA)

Rating Upgraded, New Price Target

As of April 24, 2020, Noble Capital Markets research on Energy Fuels is published under ticker symbols (UUUU and EFR:CA). The price target is in USD and based on ticker symbol UUUU. Research reports dated prior to April 24, 2020 may not follow these guidelines and could account for a variance in the price target.

Energy Fuels is the largest uranium producer in the U.S. and holds more production capacity and uranium resources than any other U.S. producer. The Company also produces vanadium. Headquartered in Colorado, Energy Fuels holds three of America’s key uranium production centers: the White Mesa Mill in Utah, the Nichols Ranch ISR Facility in Wyoming, and the Alta Mesa ISR Facility in Texas. The producing White Mesa Mill is the only conventional uranium mill in the U.S. and has a licensed capacity of 8 million pounds of U3O8 per year. Nichols Ranch is in production and has a licensed capacity of 2 million pounds of U3O8 per year. Alta Mesa is currently on standby. Energy Fuels also owns several licensed and developed uranium and vanadium mines on standby and other projects in development.

Michael Heim, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

We are upgrading our rating on the shares of Energy Fuels and establishing a new price target. The upgrade reflects an increased recognition of the value of Energy Fuel’s Rate Earth Element (REE) strategy as well as a belief that the company is well positioned to take advantage of an expected increase in uranium prices.

The success of Energy Fuels and its stock price is largely tied to the success of the domestic uranium industry. If uranium prices return to historical levels above $50 per pound, all domestic uranium companies including Energy Fuels will do well. We believe such a move will occur in the next few years in response to rising demand and decreasing international supply of uranium. We believe Energy …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

CanAlaska Promotes Cory Belyk to CEO & Executive Vice President

CanAlaska Promotes Cory Belyk to CEO & Executive Vice President

Vancouver, Canada, May 25, 2021 – CanAlaska Uranium Ltd. (TSX-V: CVV; OTCQB: CVVUF; Frankfurt: DH7N) (“CanAlaska” or the “Company”) is pleased to announce the promotion of Cory Belyk to Chief Executive Officer and Executive Vice President of the Company effective June 1, 2021. Peter Dasler will continue as President of CanAlaska, working closely with Cory Belyk to grow the Company. The rapid resurgence of interest in the uranium market has accelerated the Company’s activities including the addition of new exploration geologists. Cory Belyk now heads CanAlaska’s exploration and management teams, based from the Company’s office in Saskatoon, Saskatchewan.

Cory Belyk is a professional geologist with nearly 30 years of experience working for major and junior mining companies in the Athabasca Basin and worldwide. Prior to joining CanAlaska in 2019 as Chief Operating Officer, he was Director of Exploration for Cameco’s international operations including Mongolia and Australia. Mr. Belyk was also a member of Cameco’s exploration management team during the Fox Lake and West McArthur uranium discoveries in Saskatchewan. Mr. Belyk holds a Bachelor’s (1994) degree in Geology from the University of Saskatchewan and a Certificate in Negotiation from Harvard Law School (2014). He is a registered member of the Association of Professional Engineers and Geoscientists of Saskatchewan.

Cory Belyk, Chief Executive Officer, comments: “It is a privilege and honor to be asked to lead CanAlaska into the future. CanAlaska is a very well-structured Company with a portfolio of uranium and nickel projects that are truly world-class and ripe for additional major discoveries. This is at a time when the world is waking up to nuclear power generation as a carbon-free source of baseload energy. Through deliberate and diligent leadership and management, CanAlaska has preserved its vast portfolio of under-explored Athabasca Basin assets and made a significant new uranium discovery next door to the world’s richest uranium mine. In addition, new uranium and sulphide nickel projects have been added to build value for shareholders. CanAlaska’s project pipeline offers our shareholders multiple opportunities for discovery and I believe whole-heartedly further discovery is just around the corner. I commend Peter, the Board of Directors, and the CanAlaska team for their effort to build this Company to what it is today, ready for the energy needs of the present and future. I am humbled to be entrusted with the reins.”

CanAlaska President, Peter Dasler, comments; “Cory and I have worked shoulder to shoulder with our team for the past 3 years and it is a pleasure to see the significant increase in the Company’s value for our shareholders. I am very excited about CanAlaska’s opportunities for discovery at a time when we see recognition from the market of the value of uranium for carbon-free energy supply. Recent family events are now affecting the amount of time that I can spend on Company affairs and my best role will be in management support of Cory and our expanding exploration team at a time when we expect to see rapid further growth. Our new Saskatoon office is allowing us to grow to suit the market and position us for new discoveries. Cory and I look forward to new discoveries and continuing our Prospect Generator/Joint Venture strategy.”

About CanAlaska Uranium

CanAlaska Uranium Ltd. (TSX-V: CVV; OTCQB: CVVUF; Frankfurt: DH7N) holds interests in approximately 214,000 hectares (530,000 acres), in Canada’s Athabasca Basin – the “Saudi Arabia of Uranium.” CanAlaska’s strategic holdings have attracted major international mining companies. CanAlaska is currently working with Cameco and Denison at two of the Company’s properties in the Eastern Athabasca Basin. CanAlaska is a project generator positioned for discovery success in the world’s richest uranium district. The Company also holds properties prospective for nickel, copper, gold and diamonds.

For further information visit www.canalaska.com.

On behalf of the Board of Directors

“Peter Dasler”

Peter Dasler, M.Sc., P.Geo.

President & CEO

CanAlaska Uranium Ltd.

Contacts:

Peter Dasler, President

Tel: +1.604.688.3211 x 138

Email: info@canalaska.com

Cory Belyk, CEO and Executive Vice President

Tel: +1.604.688.3211 x 138

Email: cbelyk@canalaska.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

All statements included in this press release that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. These forward-looking statements involve numerous assumptions made by the Company based on its experience, perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances. In addition, these statements involve substantial known and unknown risks and uncertainties that contribute to the possibility that the predictions, forecasts, projections and other forward-looking statements will prove inaccurate, certain of which are beyond the Company’s control. Readers should not place undue reliance on forward-looking statements. Except as required by law, the Company does not intend to revise or update these forward-looking statements after the date hereof or revise them to reflect the occurrence of future unanticipated events.

Release – CanAlaska Promotes Cory Belyk to CEO and Executive Vice President

CanAlaska Promotes Cory Belyk to CEO & Executive Vice President

Vancouver, Canada, May 25, 2021 – CanAlaska Uranium Ltd. (TSX-V: CVV; OTCQB: CVVUF; Frankfurt: DH7N) (“CanAlaska” or the “Company”) is pleased to announce the promotion of Cory Belyk to Chief Executive Officer and Executive Vice President of the Company effective June 1, 2021. Peter Dasler will continue as President of CanAlaska, working closely with Cory Belyk to grow the Company. The rapid resurgence of interest in the uranium market has accelerated the Company’s activities including the addition of new exploration geologists. Cory Belyk now heads CanAlaska’s exploration and management teams, based from the Company’s office in Saskatoon, Saskatchewan.

Cory Belyk is a professional geologist with nearly 30 years of experience working for major and junior mining companies in the Athabasca Basin and worldwide. Prior to joining CanAlaska in 2019 as Chief Operating Officer, he was Director of Exploration for Cameco’s international operations including Mongolia and Australia. Mr. Belyk was also a member of Cameco’s exploration management team during the Fox Lake and West McArthur uranium discoveries in Saskatchewan. Mr. Belyk holds a Bachelor’s (1994) degree in Geology from the University of Saskatchewan and a Certificate in Negotiation from Harvard Law School (2014). He is a registered member of the Association of Professional Engineers and Geoscientists of Saskatchewan.

Cory Belyk, Chief Executive Officer, comments: “It is a privilege and honor to be asked to lead CanAlaska into the future. CanAlaska is a very well-structured Company with a portfolio of uranium and nickel projects that are truly world-class and ripe for additional major discoveries. This is at a time when the world is waking up to nuclear power generation as a carbon-free source of baseload energy. Through deliberate and diligent leadership and management, CanAlaska has preserved its vast portfolio of under-explored Athabasca Basin assets and made a significant new uranium discovery next door to the world’s richest uranium mine. In addition, new uranium and sulphide nickel projects have been added to build value for shareholders. CanAlaska’s project pipeline offers our shareholders multiple opportunities for discovery and I believe whole-heartedly further discovery is just around the corner. I commend Peter, the Board of Directors, and the CanAlaska team for their effort to build this Company to what it is today, ready for the energy needs of the present and future. I am humbled to be entrusted with the reins.”

CanAlaska President, Peter Dasler, comments; “Cory and I have worked shoulder to shoulder with our team for the past 3 years and it is a pleasure to see the significant increase in the Company’s value for our shareholders. I am very excited about CanAlaska’s opportunities for discovery at a time when we see recognition from the market of the value of uranium for carbon-free energy supply. Recent family events are now affecting the amount of time that I can spend on Company affairs and my best role will be in management support of Cory and our expanding exploration team at a time when we expect to see rapid further growth. Our new Saskatoon office is allowing us to grow to suit the market and position us for new discoveries. Cory and I look forward to new discoveries and continuing our Prospect Generator/Joint Venture strategy.”

About CanAlaska Uranium

CanAlaska Uranium Ltd. (TSX-V: CVV; OTCQB: CVVUF; Frankfurt: DH7N) holds interests in approximately 214,000 hectares (530,000 acres), in Canada’s Athabasca Basin – the “Saudi Arabia of Uranium.” CanAlaska’s strategic holdings have attracted major international mining companies. CanAlaska is currently working with Cameco and Denison at two of the Company’s properties in the Eastern Athabasca Basin. CanAlaska is a project generator positioned for discovery success in the world’s richest uranium district. The Company also holds properties prospective for nickel, copper, gold and diamonds.

For further information visit www.canalaska.com.

On behalf of the Board of Directors

“Peter Dasler”

Peter Dasler, M.Sc., P.Geo.

President & CEO

CanAlaska Uranium Ltd.

Contacts:

Peter Dasler, President

Tel: +1.604.688.3211 x 138

Email: info@canalaska.com

Cory Belyk, CEO and Executive Vice President

Tel: +1.604.688.3211 x 138

Email: cbelyk@canalaska.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking information

All statements included in this press release that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. These forward-looking statements involve numerous assumptions made by the Company based on its experience, perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances. In addition, these statements involve substantial known and unknown risks and uncertainties that contribute to the possibility that the predictions, forecasts, projections and other forward-looking statements will prove inaccurate, certain of which are beyond the Company’s control. Readers should not place undue reliance on forward-looking statements. Except as required by law, the Company does not intend to revise or update these forward-looking statements after the date hereof or revise them to reflect the occurrence of future unanticipated events.

Repurposing Power Plants for Crypto Mining

image credit: ep_Jhu (Flickr)

Crypto Mining Gives Mothballed Fossil Fuel Plants New Life

As renewable energy has been replacing the fossil-fuel generated electricity powering communities, bitcoin miners and investors are stepping in to repurpose the older plants. The demand for electricity required to mine bitcoin and other cryptocurrencies and the high return at current prices makes it attractive for miners to restart mothballed plants.

Where?

The heat given off by the computers used in mining currencies like Bitcoin makes it logical to set up shop in the higher latitudes where it is naturally cooler. In upstate New York, two idled coal-fired plants are now been converted to natural gas generation and restarted to supply power to Bitcoin mining. Another coal plant in Montana is revamping, now fueled by natural gas, to mine cryptocurrency.

Why?

Cryptocurrency profitability is driving the move. Bitcoin mining relies on powerful computers solving puzzles; when the puzzle is solved, the reward is a newly minted Bitcoin; as the price of Bitcoin has escalated, the attractiveness of mining has grown. Mining, however, consumes massive amounts of electricity. As mining competition increases, the puzzles get harder. The higher the bitcoin price, the more competition; the more competition, the more power that is needed.

The University of Cambridge Centre for Alternative Finance hosts a website that indexes power consumption for mining Bitcoin. It estimates that the annual power consumption used for mining is 130 terawatt-hours. This is three times higher than their estimates in early 2019. To put it easier to visualize terms, it is a little more power than consumed by Argentina.

How?

In Montana, the coal-fired plant, Hardin Generating Station, had been operating well below capacity for a while. Late last year, a miner called

Marathon Digital Holdings Inc. (MARA) partnered with Hardin’s owner to transform the power plant into a hub for mining bitcoin. Marathon Digital’s CEO said, “We were able to get access to a large amount of power at a very attractive price.”

Marathon has plans to scale up to more than 100 megawatts of electricity. The company said that its break-even costs to produce a bitcoin would fall to $4,600, 38% less than current costs by tapping the Montana coal plant. The company aims to produce at least 55 bitcoins daily by the first quarter of next year, up from an average of two a day in 2020. MARA holds nearly $300 million worth of Bitcoin on its balance sheet (subject to price fluctuations), making it interesting to investors looking for crypto exposure but unable to invest directly.

One New York project involves the Greenidge coal-fired power station in the town of Dresden. The inactive plant was purchased in 2014 by a Greenwich, Connecticut private equity company Atlas Holdings. Atlas has since converted the plant to natural gas. Last year, it launched a data center for mining bitcoin using power generated by the plant. The company said it currently has 19 megawatts of mining capacity and plans to raise it to 85 megawatts by the end of 2022.

In March, plans were announced to merge Greenidge with Support.com (SPRT). The deal allows Support.com shareholders to get 8% of the combined company’s shares. Greenidge said it would use the cash on Support.com’s balance sheet to fund its expansion.

Digihost Technology Inc. (HSSHF) began mining in upstate N.Y. in 2015 to take advantage of hydro-generated power from Niagara Falls. The company produces more than 30 bitcoins each month and gets more than 90% of its electricity from hydropower. The price surge in 2021 has prompted Digihost to buy a 60-megawatt natural-gas plant north of Buffalo, N.Y. The initial plans are to direct 35 megawatts toward bitcoin mining while also sending power to the grid when able. Michel Amar, CEO of the company, said they would partly fuel the plant with natural gas derived from animal manure and other sources.

Take-Away

Electricity is critical in solving puzzles to mine Bitcoins. Several companies are finding the solution to their expanding appetite for electricity is to operate their own powerplant. Older plants are being converted to gas-powered and are able to supply the needed power and, at the same time, reduce their costs.

Public companies engaged in Bitcoin mining provide investors with a “back door” way of gaining exposure to price changes of the currency without actually converting dollars to Bitcoin. One creative company has plans to use manure when they can as part of their “greener” method of mining.

Suggested Reading:

|

|

Small-cap Names in a Big Crypto Market

|

Making Sense of Non-Fungible Tokens

|

|

|

What’s the Timeline for a U.S. Digital Currency?

|

Cryptocurrency Gaining Bank’s Acceptance

|

Sources:

https://digihost.ca/what-we-do/

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|

Indonesia Energy Corp (INDO) – 2020 Results in Line, Company May Need To Access Financial Market in 2021

Wednesday, May 19, 2021

Indonesia Energy Corp (INDO)

2020 Results in Line, Company May Need To Access Financial Market in 2021

Indonesia Energy Corp Ltd is an oil and gas exploration and production company focused on Indonesia. It holds two oil and gas assets through its subsidiaries in Indonesia: one producing block (the Kruh Block) and one exploration block (the Citarum Block). The Kruh Block is located to the northwest of Pendopo, Pali, South Sumatra. The Citarum Block is located to the south of Jakarta.

Michael Heim, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

INDO reported 2020 financial results in line with expectations. Revenues of $2.0 million (versus $4.2 million) were in line with our $1.7 million estimate. EBITDA loss of $6.6 million was also in line. EPS was ($0.94) versus our ($0.83) estimate. Negative cash flow was expected given covid-related delays in drilling and should turn positive over the next two years if the company maintains its drilling schedule.

INDO’s cash position has decreased and auditors have added “on going concern” language. INDO’s cash position, which was $16 million after the company’s initial IPO, has decreased to $9.3 million. With 5 wells planned in 2021 at $1.5 million each and an annual cash drain of $6 million or so to support licenses, G&A and other costs, it is possible that the company will need to seek external financing …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

enCore Energy Corp. (ENCUF)(EU:CA) – Price Objective Raised. 2022 Estimates Initiated

Wednesday, May 19, 2021

enCore Energy Corp. (ENCUF)(EU:CA)

Price Objective Raised. 2022 Estimates Initiated

enCore Energy Corp together with its subsidiary, is engaged in the acquisition and exploration of resource properties. The company holds the Marquez project in New Mexico as well as the dominant land position in Arizona with additional other properties in Utah and Wyoming. The firm also owns or has access to North American and global uranium data including the Union Carbide, US Smelting and Refining, UV Industries, and Rancher’s Exploration databases in addition to a collection of geophysical data for the high-grade Northern Arizona Breccia Pipe District.

Michael Heim, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

We are raising our price objective on the shares of ENCUF. The increase reflects continued optimism in a rise in uranium prices, a slight increase in uranium spot pricing in recent weeks, and our introduction of 2022 estimates. We continue to believe uranium prices will soon break out as a confluence of rising demand and decreasing supply will force buyers to begin to sign long-term contracts at higher prices. In recent weeks, spot uranium prices have risen above $30/lb. after a slump in late April. And while past upward movements have proven to be mere head fakes, we believe an eventual breakthrough above $40/lb. is coming within the next 12-18 months.

We are providing initial 2022 annual estimates. We expect the company to report C$9.1 million in revenues with the startup of the Rosalita plant in 2022. We expect EBITDA and EPS to be negative (C$2.5 million and C$0.02 respectively) in response to startup costs and limited production. Our models assume realized uranium prices of $35/lb. in 2022 reflecting a blend of contracted and spot price …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.

Indonesia Energy Corp (INDO) – 2020 Results in Line Company May Need To Access Financial Market in 2021

Wednesday, May 19, 2021

Indonesia Energy Corp (INDO)

2020 Results in Line, Company May Need To Access Financial Market in 2021

Indonesia Energy Corp Ltd is an oil and gas exploration and production company focused on Indonesia. It holds two oil and gas assets through its subsidiaries in Indonesia: one producing block (the Kruh Block) and one exploration block (the Citarum Block). The Kruh Block is located to the northwest of Pendopo, Pali, South Sumatra. The Citarum Block is located to the south of Jakarta.

Michael Heim, Senior Research Analyst, Noble Capital Markets, Inc.

Refer to the full report for the price target, fundamental analysis, and rating.

INDO reported 2020 financial results in line with expectations. Revenues of $2.0 million (versus $4.2 million) were in line with our $1.7 million estimate. EBITDA loss of $6.6 million was also in line. EPS was ($0.94) versus our ($0.83) estimate. Negative cash flow was expected given covid-related delays in drilling and should turn positive over the next two years if the company maintains its drilling schedule.

INDO’s cash position has decreased and auditors have added “on going concern” language. INDO’s cash position, which was $16 million after the company’s initial IPO, has decreased to $9.3 million. With 5 wells planned in 2021 at $1.5 million each and an annual cash drain of $6 million or so to support licenses, G&A and other costs, it is possible that the company will need to seek external financing …

This Company Sponsored Research is provided by Noble Capital Markets, Inc., a FINRA and S.E.C. registered broker-dealer (B/D).

*Analyst certification and important disclosures included in the full report. NOTE: investment decisions should not be based upon the content of this research summary. Proper due diligence is required before making any investment decision.