Image Credit: Amazon

Big Tech Doing Whatever it Takes to Demonstrate Commitment to Green Solutions

An increasingly digitized world leads to increasing demand for data centers and concomitant electricity. As large data center companies like Google, Microsoft, Amazon, and Facebook try to appease investors by maintaining above-average ESG scores, some have committed to using only renewable energy in the coming years. The challenge in the magnitude of growth in energy usage isn’t whether they can buy “clean” electrons, it’s whether the increased electric demand they cause is forcing electric production from non-renewables to be used at higher amounts elsewhere. Net/net, the added emitted carbon would indirectly be caused by them.

The Challenge

Data-intensive technologies include everything from social media giants, video streaming providers, artificial intelligence, smart and connected energy systems, distributed manufacturing systems, and even new technologies such as autonomous vehicles. These all promise to increase demand for energy, they are all energy-intensive. Data centers today are estimated to account for around 1% of worldwide electricity use.

The companies that have the largest data centers have corporate commitments related to clean energy. This has led the large tech companies to compete to secure electricity deals with renewable sources to continue operations while also moving toward more green corporations. If these moves don’t reduce emissions but instead cause a ramp-up of a fossil fuel plant in another part of town to go out to residential consumers, the companies have failed at their goal; they could actually increase total emissions.

Surprising Solution

On Wednesday (June 23) Amazon.com announced commitments to buy electric green electric generating capacity in the amount of 1.5 gigawatts. The purchases are from 14 new solar and wind plants in different parts of the world. Amazon is pushing to purchase enough renewable generating capacity to cover all of the company’s activities by 2025.

Public, non-utility companies are stepping in to finance the transition to a more sustainable economy to at least make sure they are not creating a dirty KWh shell game with their energy usage. In some countries, tech companies’ ability and willingness to sign commitments to buy energy at a certain price for long periods and pay upfront has placed capitalism as more impactful than government subsidies as the main driver of renewable improvements.

Amazon is the largest renewable energy purchaser worldwide, with the rest of the top six being French oil company Total Energies, AT&T, Google, Facebook, and Microsoft. According to BloombergNEF, these companies account for 30% of the 25.7 gigawatts of the cumulative total capacity purchased from corporations.

The challenge now is showing if these green power purchases are replacing power that would be generated from carbon-emitting plants or simply increasing power generation to feed their own growing energy consumption. This is important because the companies want to express to the world that they are reducing total carbon output. It’s great to not be part of the problem, but your corporate halo shines even brighter if you can show you are part of the solution.

According to the Wall

Street Journal, Nat Sahlstrom, director of energy at Amazon Web Services, said the company looks for projects where it can be first to set up a commercial template other companies can follow to help jump-start demand. And, that Amazon only selects projects based on whether its purchasing commitments are pivotal to the projects’ viability. “If not for our investments in these projects, they would not have gone forward,” the Amazon director of energy said.

Changing Roles

You read the last paragraph correctly, Amazon has a director of energy in their web services division. Big tech companies have built up in-house teams with former deal makers at electrical utilities who are outsourcing deals directly with providers. These deals are big enough they aren’t brokered; there’s no need to be introduced by a middleman when you’re Amazon or Google, they’re given high priority.

One advantage these dealmakers have is there need not be any kind of financing in many of the arrangements. If there is bank financing, the power purchase agreements (PPA) are so strong, they are given favorable terms.

Take-Away

If the pool of available electricity is X% renewables, and Y% fossil, just because your company is buying only from the renewables doesn’t mean you’re any better of a corporate citizen than those who are buying from the overall pool, which then consists of more fossil fuel-generated energy. What data centers are doing to quench their ever-growing appetite is proactively working with renewable energy providers to build more output onto the grid that meets or even exceeds their current and future demands.

Channelchek, Managing Editor

Suggested Reading:

|

|

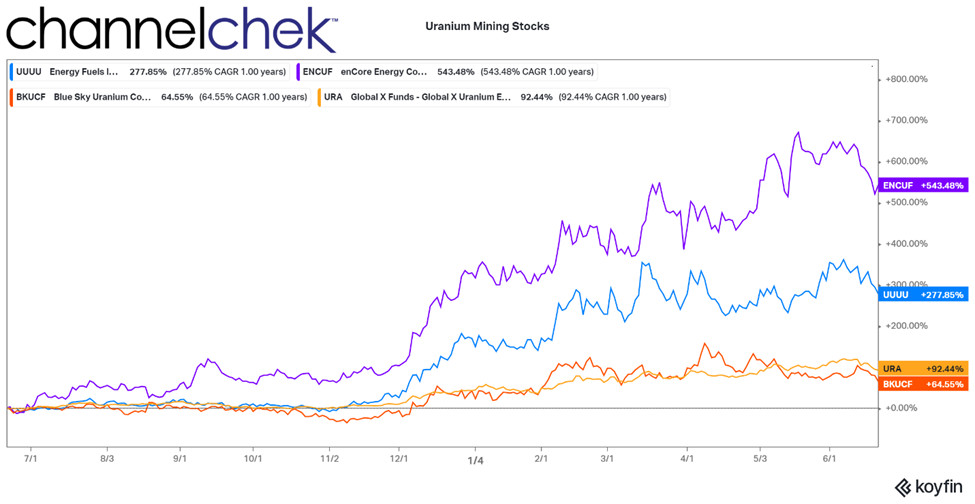

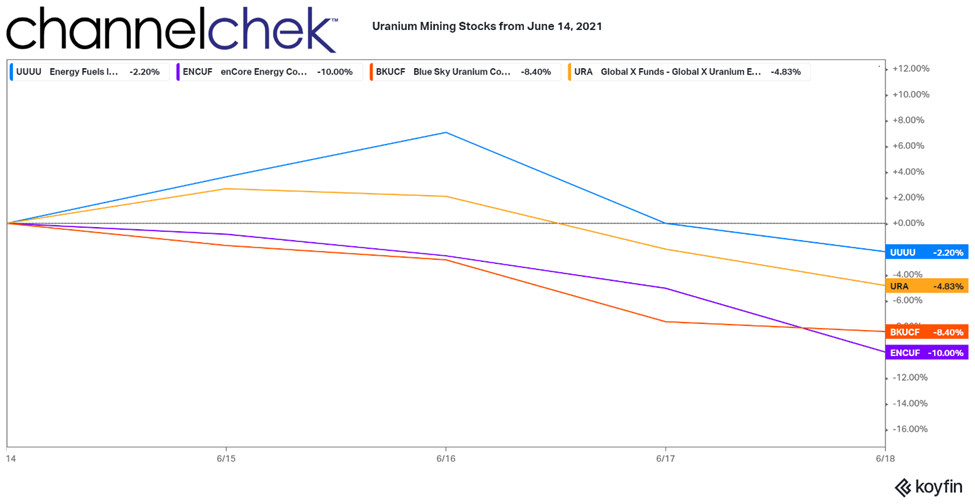

The Increasing Popularity of Uranium Investments

|

Advanced Battery Storage Goals of the US Dept. of Energy

|

|

|

The PCE Deflator and the Trimmed PCE Inflation Rate Tell Different Stories

|

Most Watched Channelchek C-Suite Interviews from 2020

|

Sources:

https://www.sustainalytics.com/esg-rating/facebook-inc/1028643709/

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|